The theme “Forward Your Dreams, Shape the Future” is CIMB Niaga's commitment to continuously inspire every generation to achieve their dreams. Safari Ramadhan became a media communication between CIMB Niaga management and all employees in all areas.

Corporate Social Responsibility

CIMB Niaga prioritized relevant sustainability topics to be delivered in the 2018 Sustainability Report through focus group discussions (FGDs). To ensure stakeholder involvement, this four-stage process for determining report content has become the CIMB Niaga reporting cycle.

MATERIAL TOPIC PRIORITY

Material Topic Matrix

Process(es) for improving the competence of staff for the implementation of environmental and social policies and procedures in banking business activities. Coverage and frequency of audits to assess the implementation of environmental and social policies and risk assessment procedures.

Para Pemangku Kepentingan

In 2018, we started the previous preparation of our SFAP and started some implementations related to sustainable financing. 51/2017 and the results of the Conference on Climate Change, agree that our business processes must support the principles of sustainable financing.

Reaching Aspiration for the Future

Following the previous Indonesian Sustainable Finance Roadmap issued by the Financial Services Authority (OJK), in 2017 the OJK issued Regulation No. 51/POJK.03/2017 (POJK No. 51/2017) regarding the implementation of sustainable finance for financial institutions, issuers and listed companies, and has also taken into account the results of the climate conference in Katowice, Poland, which took place between 2 and 14 December 2018.

Dear Respected Stakeholders,

We are aware that climate change is the responsibility of all of us and requires real active contributions to reduce the negative impact of banking activities. As an initial step, a project group for sustainable finance was formed, which is responsible for assisting the board of directors in monitoring and ensuring the process of introducing sustainable finance in the bank.

CIMB Niaga is continuing its aspiration to grow and to realize sustainable finance by integrating

The SFAP will be our guide to conducting the bank's business activities related to environmental, social and governance (ESG) aspects and supporting the achievement of Sustainable Development Goals (SDG). In addition, the Bank is committed to a proactive approach in integrating economic, environmental and social risk assessments into its main activities, such as financing, investments and others.

Achieving Performance as Our Aspiration

Establishing Sustainable Social Performance

Establishing Environmental Performance

To finance palm oil plantations, the Bank will consider the Indonesian Sustainable Palm Oil (ISPO) or Roundtable on Sustainable Palm Oil (RSPO) certifications owned by the debtors. With this in mind, CIMB Niaga is preparing to begin identifying and opening up green financing opportunities to potential debtors who meet the financing requirements.

Establishing Sustainable Governance

In addition, along with increasing public awareness about the importance of minimizing the effects of climate change, the opportunities to finance clean energy and renewable energy projects are expected to increase. Internally, CIMB Niaga has started implementing a green office policy that adopts an environmentally friendly lifestyle and work culture through smart spending policies for all CIMB Niaga people.

Challenges and Expectations in Reaching our Aspiration

VISION

VISION FOR SUSTAINABLE

MISSION

MISSION FOR SUSTAINABLE

3 CRITICAL BEHAVIOURS

Customer-centric

High Performance

Enabling People

Strength in Diversity

Integrity

Branch addresses can be found in the Branch List section of the CIMB Niaga Annual Report 2018. Detailed information on products, services and sectors served can be found in the CIMB Niaga Annual Report 2018.

The Company’s reputation plays an important role in the success of the business and is one

Sustainable Governance

By following good corporate governance, CIMB Niaga has transformed into a professional and highly competitive company that adds maximum value for stakeholders.

Company Reputation

Corporate Governance

A full description and disclosure of information regarding the duties, responsibilities and authorities of GMS, the Board of Directors and the Board of Commissioners can be found in the CIMB Niaga 2018 Annual Report, which is supplementary to, but prepared separately from, this Report.

Governance Practices and Governance

Stakeholder Approach

At least once a year • Development of collaboration with CIMB Niaga business partners on procurement of goods and services for the company. The trade union leadership's input and proposals to the management regarding the rights and duties of the employees and the company.

CIMB Niaga is the second largest private bank in Indonesia in term of total assets

CIMB Niaga provides banking services, both to individual and corporate customers, and

Creating Sustainable Banking

Supply Chain and Procurement Practices

CIMB Niaga practices sustainable banking and applies the principles of sustainable finance as contained in the CIMB Niaga Sustainability Policy. CIMB Niaga's commitment to supporting the achievement of the Sustainable Development Goals (SDGs) is outlined in its Sustainable Finance Action Plan (SFAP).

SUSTAINABLE FINANCE CHALLENGES

1 To raise awareness at every level of CIMB Niaga to lead a culture that supports sustainability. Through the economic performance improvement strategy, CIMB Niaga supports the national non-cash movement agenda launched by the government.

Economic Value Received and Distributed

As a BUKU 4 bank, the Bank has an important role to play in the national banking sector, which in turn will affect the sustainability of the community's economic system. The achievement of the Bank's economic performance will be a benchmark for the confidence of stakeholders and form the basis for investors to make investment decisions.

LOAN PORTFOLIO AND QUALITY

Based on the business segment, the business segment's loan portfolio holds the largest share at 37.15% of the bank's total loan portfolio in 2018. As at end-December 2018, all CIMB Niaga business segment's NPL ratios showed improvement, with Consumer Banking at 2.48%; MSME banking at 3.0%, Commercial banking at 7.9%, and Corporate banking at 1.3%.

IMPACT OF INDIRECT ECONOMIC VALUE

CIMB Niaga is committed to applying the principles of sustainable financing when lending to borrowers and in compliance with applicable ESG provisions. As stated in the Sustainable Finance Action Plan 2019-2023, CIMB Niaga has established priority lending sectors from a social and environmental perspective, which include: [FS8].

Banking SME

Mikro Linkage

The Bank's AML and PTF program refers to the applicable provisions and legislation and is based on international best practices. Third Line of Defense, a monitoring function of the AML and CFT program carried out by the first and second lines of defense.

Anti Fraud Strategy

The implementation of the AML and PTF program is a commitment of the Board of Commissioners and the Board of Directors of CIMB Niaga to build an adequate risk culture at all levels of the organization and to prevent the use of its products, services and electronic channels as a medium for money laundering and terrorist financing. The bank has also implemented the Know Your Employee (KYE) concept as part of its efforts to prevent AML and CFT and fraud.

Total Anti Fraud Training

In addition, the bank has also held mandatory Anti Fraud Awareness training for all employees with the aim of increasing employees' knowledge of the prevention and consequences of fraud. As a concrete manifestation of its internal control efforts, CIMB Niaga has drawn up and implemented policies and a whistleblowing system (WBS) since 2011.

Violation Reporting Mechanism

Since 2017, CIMB Niaga has appointed an independent and professional third party to manage whistleblowing, whereby whistleblowers can more conveniently and openly report violations or signs of fraud. The WBS policy refers to Bank Indonesia (PBI) Regulation no. 5/8/PBI/2003, amended by PBI no.

Complaint Handling Mechanism

The bank has also improved this reporting system in stages, both in the reporting mechanism and the socialization of the reporting media. In addition to the investigated WB reports, WB reports have also been received which cannot be investigated due to lack of indication of violation, insufficient evidence, etc.

Sustainable Finance

Digital Banking Services

Go Mobile

ATM and SST

To ensure the quality of the loan and mitigate the loan risk, CIMB Niaga monitors and periodically reviews the loan facilities provided by the bank to the debtors. The results of the credit assessment are submitted to the credit approval authority on the basis of the limits of authority set by the Bank.

Change, dreams and aspirations to become real, so that CIMB Niaga helps build and

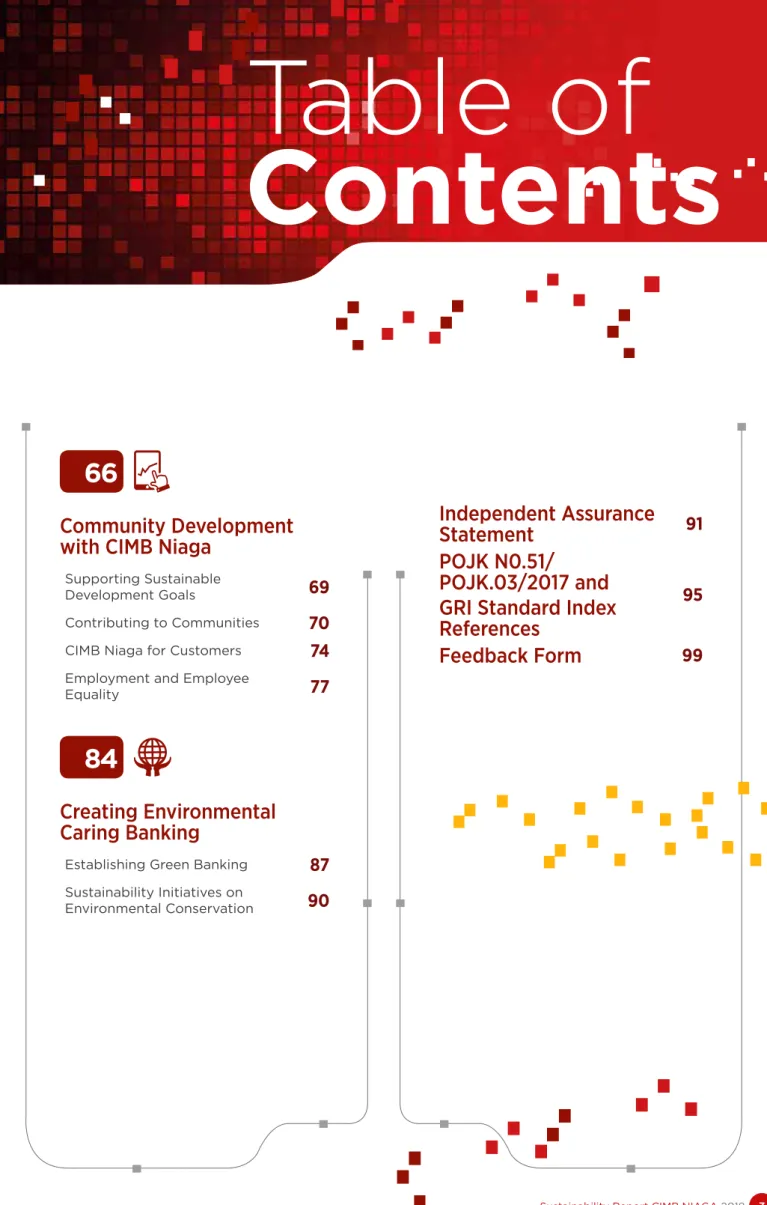

Community Development with CIMB Niaga

Support For SDGs

In conducting its business activities, CIMB Niaga wants to grow with the community and the environment. This unit is responsible for the Bank's CSR strategies and implementation, as well as for ensuring that CSR activities are consistent with applicable policies or regulations.

Social Responsibility Activities (CSR)

The aim of CSR activities is to provide broad benefits to the communities, to preserve the environment and to minimize negative impacts for all stakeholders. The CSR activities carried out by CSR unit at the Head Office, under the Corporate Secretary sub-directorate.

Funds for CSR Activities

CIMB Niaga Employees and Customers Synergy [413-1]

Realizing the Nation’s Generations Dream Through CIMB Niaga Scholarships

CIMB Niaga Peduli

BANKING FINANCIAL LITERACY AND EDUCATION

Empowerment Education

CIMB Niaga is committed to maintaining customer and data privacy in accordance with applicable regulations. As part of its quality of service, CIMB Niaga ensures that it addresses all complaints reported by customers to the bank.

PRODUCT RESPONSIBILITY [FS15]

Indirectly, keeping customer information is a form of trust that affects the Bank's reputation and this is regulated in policy E.04 regarding the Customer Protection Policy. 17/SEOJK.07/2018 regarding the Guidelines for the Implementation of Consumer Complaint Services in the Financial Services Sector, in 2018 CIMB Niaga started reporting the types and number of complaints, as well as their resolution following the guidelines of SEOJK.

Customer Satisfaction on Products

Customers with Disabilities

CIMB Niaga's human resources strategy and management are continuously adapted to the bank's long-term strategy and to current and future market developments. The Bank ensures that all employees have the competence, expertise and commitment, and are agile in line with the Bank's core values and culture.

Employee Recruitment

One of the Bank's main principles for achieving its vision, mission and sustainable business growth is to maintain well-being at work and a harmonious working relationship between the Bank and its employees. The involvement of employees in the creation of a decent and safe work environment is also realized through employee satisfaction surveys, so that the Bank responds to the levels of satisfaction and connection of employees with the Bank.

Funds For Employees’ Competency Development

EMPLOYEE TURNOVER

Guaranteeing Employee Welfare

CIMB Niaga offers all employees equal opportunities to develop in accordance with their potential, expertise and the opportunities available at the bank. During 2018, CIMB Niaga organized education and training programs for 183,675 employees (including participants in training programs and employees who resigned at the end of December 2018), whereby an employee can participate in various training programs.

Increased Sustainable Finance Competence

At the end of CIMB Niaga employees were registered as local employees from the point of employment at the time they were employed. Compliance, Corporate & Legal Affairs (CCAL), Strategy & Investor Relations, Corporate Banking, Commercial Banking, Corporate Banking Office (COBA), Commercial Banking Office (COMBA), Retail/.

EMPLOYEE PERFORMANCE APPRAISAL

CIMB Niaga helps to preserve the environment by carrying out banking

Creating Environmental Caring Banking

As part of CIMB Niaga's efforts to be part of the green banking industry, the Bank applies a green banking concept through environmentally friendly operational activities, and through lending. The Bank has implemented a green office policy that applies environmentally friendly lifestyles as a culture for CIMB Niaga employees.

PAPER SAVING [306-2]

In line with the Green Office policies contained in the Smart Spending Policy, CIMB Niaga is making efforts to save energy, including: [302-4]. CIMB Niaga also holds socialization by distributing energy-saving movement posters and stickers in certain locations, as well as energy-saving movement campaigns.

EMISSION AND WASTE CONTROL

In addition to emissions control, CIMB Niaga also manages the waste generated by the bank's business support activities. During 2018, CIMB Niaga implemented sustainability initiatives through environmental conservation activities and by providing loans to ESG-minded companies in accordance with the principles of sustainable finance.

BAMBOO CONSERVATION TO PRESERVE THE ENVIRONMENT

DISTRIBUTION OF ENVIRONMENTALLY FRIENDLY LOANS [FS8]

An overview of the sustainability aspect of performance 4 5.a Board of Directors and Board of Commissioners duties on sustainability. PT Bank CIMB Niaga Tbk Sustainability Report 2017 provides an overview of financial and sustainability performance.

PT Bank CIMB Niaga Tbk Corporate Secretary

Shaping The Future