Disclosure of the Declaration of Integrity Pact, Code of Ethics and Anti-corruption commitments by the Board of Commissioners and the Board of Directors on the Bank's website. Public the profiles of candidate members of the Board of Commissioners and Board of Directors.

SELF-ASSESSMENT

Governance Structure

CIMB Niaga consistently strives to improve the quality of GCG implementation as evidenced by the annual increase in board results, including operational and financial performance demonstrating sustained growth as a result of GCG implementation. To maintain consistency, the Bank always measures the quality of the GCG implementation, either conducted through self-assessment or in conjunction with an external reviewer to obtain a more independent assessment result.

Governance Process

Governance Outcome

GCG IMPLEMENTATION ASSESSMENT

Results of the subsidiary self-assessment are then consolidated using an internal methodology based on materiality and significance. In 2020, the self-assessment of CIMB Niaga's management, for bank only and on a consolidated basis, achieved an overall rating of 2 (Good).

EXTERNAL ASSESSMENT

Commissioners of the Bank must have a term of office of a maximum of 2 (two) periods and not exceed 9 (nine) consecutive years. The assessment criteria consists of 5 (five) aspects, namely Rights of Shareholders, Fair Treatment of Shareholders, Role of Stakeholders, Disclosure and Transparency, and Responsibilities of the Board of Directors.

GENERAL MEETING OF SHAREHOLDERS

SHAREHOLDERS

RIGHTS, AUTHORITY AND RESPONSIBILITY OF THE SHAREHOLDERS

GMS OF CIMB NIAGA IN 2020

APRIL 2020

2nd agenda Determination of the appropriation of the profit of the company for the financial year that ended on December 31, 2019. Therefore, no members of the Supervisory Board (including independent Supervisory Board members) and SSB received a bonus/tanti.

SEPTEMBER 2020

Proofs of the publications were submitted to OJK and IDX on the same day (hardcopy and e-reporting via SPE-OJK & IDXNet). Agenda Change in the composition of the company's Supervisory Board Result of the vote.

RESOLUTIONS AND REALIZATIONS OF THE RESULTS OF THE PREVIOUS YEAR GMS

The 2nd determination of the agenda for the use of the company's profits for the financial year ended on December 31, 2018. Therefore, the composition of the Company's Board of Directors remains the same.

BOARD OF COMMISSIONERS

LEGAL BASIS

BOARD OF COMMISSIONERS’ CHARTER

MECHANISM OF NOMINATION,

APPOINTMENT, DISMISSAL, REPLACEMENT AND/OR RESIGNATION OF MEMBERS OF THE

The Bank may use the services of independent and reputable search firms when selecting candidates for the Board of Commissioners. Members of the Board of Commissioners have the right to resign from their position by resignation.

STRUCTURE, NUMBER, AND COMPOSITION OF THE BOARD OF COMMISSIONERS IN 2020

1 (one) female member of the Board of Commissioners is an Independent Commissioner, namely Sri Widowati. 50% (fifty percent) of the members of the Board of Commissioners are Independent Commissioners, namely 3 (three) Independent Commissioners out of a total of 6 (six) members of the Board of Commissioners.

TERM OF OFFICE OF THE BOARD OF COMMISSIONERS

On the professional side, most members of the Board of Commissioners have work experience in banking. Appointed Senior Independent Commissioner by CIMB Niaga Board of Commissioners District Resolution No.

FIT AND PROPER TEST

DUTIES, RESPONSIBILITIES, AND AUTHORITIES OF THE BOARD OF COMMISSIONERS

A member of the Board of Commissioners appointed by the Board of Commissioners shall chair the GMS. Ensuring that the responsibilities of the Board of Commissioners are carried out in accordance with the procedures.

INDEPENDENCY OF THE BOARD OF COMMISSIONERS

CONCURRENT POSITIONS OF THE BOARD OF COMMISSIONERS

Each Commissioner receives the relevant information at the right time, including the right information about the issues that arise in the Board. A member of the Board of Commissioners, Board of Directors or Executive Officer who performs supervisory functions in 1 (one) non-bank subsidiary controlled by the Bank;.

CONFLICT OF INTEREST OF THE BOARD OF COMMISSIONERS

A member of the Committee up to 5 (five) committees in the Bank or Public Company where the person in question also serves as a member of the Board of Directors or the Board of Commissioners.

POLICY ON LOANS PROVISION TO THE BOARD OF COMMISSIONERS

BOARD OF COMMISSIONERS SUPERVISION FOCUS IN 2020

In accordance with the applicable regulations, supervision of risk management is the focus of the Executive Board.

RECOMMENDATIONS OF THE BOARD OF COMMISSIONERS

Provided data on the Bank's financial objectives, including Net Interest Margin, NPL and watch list account, loan to deposit ratio, asset quality, productivity and market competitiveness. Periodically discussed macroeconomic and industrial conditions as well as new banking regulations, and their impacts on the Bank's business and subsequent actions.

DEVELOPMENT PROGRAMS OF THE BOARD OF COMMISSIONERS

Provided input on increasing the bank's low-cost funds (CASA) and fee-based revenues by expanding the bank's services to facilitate convenient transactions through transaction banking, value chain and improvements to sharia banking operations through through dual banking leverage, as well as the continued development of branchless banking facilities offered by the Bank to enhance the customer experience in transactions. In 2020, induction programs were given to 2 (two) new members of the Supervisory Board, namely Glenn M.

PERFORMANCE ASSESSMENT OF COMMITTEES UNDER THE BOARD OF

Collegial Performance Assessment for the Committees under the Board of Commissioners

To improve the quality and efficiency of induction programs, the bank has developed a digital induction program (e-Learning) through the Learning on the Go (LoG) application, which is accessible to commissioner candidates anywhere and at any time.

Individual Performance Assessment for Each Members of the Committees under the Board of

Performance Assessment for the Chairman of the Committees under the Board of Commissioners

INDEPENDENT COMMISSIONERS

NUMBER AND COMPOSITION OF INDEPENDENT COMMISSIONERS

CRITERIA OF THE INDEPENDENT COMMISSIONER

Audit Committee, then they can be reappointed to the Audit Committee for 1 (one) further term only. An Independent Commissioner who serves as Committee Chair may serve concurrently as Committee Chair on only one other committee.

STATEMENTS OF INDEPENDENCE OF THE RESPECTIVE INDEPENDENT COMMISSIONER

BOARD OF DIRECTORS

BOARD OF DIRECTORS’ CHARTER

The shareholders who can propose a candidate for the board members are 1 (one) or more shareholders representing 1/20 (one twenty) or more of the total voting shares. Proposals for dismissal and/or replacement of board members that are submitted to the general meeting must be recommended by the bank's nomination and remuneration committee.

STRUCTURE, NUMBER, AND COMPOSITION OF THE BOARD DIRECTORS IN 2020

Members of the Board of Directors, Board of Commissioners and/or Shareholders of the Bank may propose candidates for members of the Board of Directors to the Bank. The members of the Board of Directors can be dismissed at any time by decision of GMS indicating the reason for dismissal.

TERM OF OFFICE OF THE BOARD OF DIRECTORS

DUTIES, RESPONSIBILITIES, AND

AUTHORITIES OF THE BOARD OF DIRECTORS

SCOPE OF WORK AND RESPOSIBILITIES OF EACH MEMBER OF THE BOARD OF DIRECTORS

- LEE KAI KWONG – STRATEGY, FINANCE &

- JOHN SIMON –TREASURY & CAPITAL MARKET DIRECTOR

- VERA HANDAJANI – RISK MANAGEMENT DIRECTOR

- LANI DARMAWAN – CONSUMER BANKING DIRECTOR

- PANDJI P. DJAJANEGARA – SHARIA BANKING DIRECTOR

- FRANSISKA OEI – COMPLIANCE, CORPORATE AFFAIRS & LEGAL DIRECTOR

- TJIOE MEI TJUEN – OPERATIONS &

- VACANT – BUSINESS BANKING DIRECTOR a. Establish the business strategy and provide

Ensure that all bank internal rules (policies, systems and procedures) are in compliance with all relevant external laws and regulations (Bank Indonesia, OJK and other institutions/authorities), including Capital Market regulations. Responsible for corporate social responsibility activities and the implementation of sustainability, including the sustainable financing of the bank.

INDEPENDENCY OF THE BOARD OF DIRECTORS

CONCURRENT POSITIONS OF THE BOARD OF DIRECTORS

CONFLICT OF INTEREST OF THE BOARD OF DIRECTORS

PARTICIPATION OF MEMBERS OF THE BOARD OF DIRECTORS IN ASSOCIATIONS/

ORGANIZATIONS

POLICY ON LOANS PROVISION TO THE BOARD OF DIRECTORS

IMPLEMENTATION OF THE DUTIES AND RESPONSIBILITIES OF THE BOARD OF

Enhanced IT security systems for protecting the bank's confidential data, enhanced the Security Operations Center's capabilities for monitoring and countering cybercrime. The transformation program is expected to take the bank's performance to the next level.

DEVELOPMENT PROGRAMS OF THE BOARD OF DIRECTORS

The Bank has increased its vigilance on (i) protecting employees' health and welfare, (ii) maintaining liquidity, (iii) asset quality, (iv) cost management, (v) supporting the government programs to ensure economic and business continuity, and (vi) transformation and digitalisation. To improve the quality and efficiency of the induction programmes, the Bank has developed a digital induction program (e-Learning) through Learning on the Go (LoG) application which can be accessed by the director candidate at any time.

PERFORMANCE ASSESSMENT OF COMMITTEES UNDER THE BOARD OF DIRECTORS

In 2020, the Orientation Program was conducted by CIMB Niaga for 1 (one) new member of the Board of Directors, namely Tjioe Mei Tjuen.

BOARD OF COMMISSIONERS’ (INCLUDING THE PRESIDENT COMMISSIONER)

PERFORMANCE ASSESSMENT

Collegial Performance Assessment of the Board of Commissioners

Individual Performances Assessment of Each Member of the Board of Commissioners

PERFORMANCE ASSESSMENT ON THE BOARD OF COMMISSIONERS AND BOARD OF DIRECTORS

Performance Assessment of the President Commissioner

Individual Performances Assessment of the Board of Commissioners

In line with the bank's commitment to implement the principles of good corporate governance, implementation of GCG was one of the aspects assessed in the collegial performance assessment by the Board of Commissioners. In 2020, the assessment result of the implementation of GCG in the Board of Commissioners was 4.2.

ASSESSMENT OF GCG IMPLEMENTATION ON THE ASPECT OF THE BOARD OF

BOARD OF DIRECTORS’ (INCLUDING THE PRESIDENT DIRECTOR) PERFORMANCE

Collegial Performance Assessment of the Board of Directors

All performance reviews of the Board, both individual and collegial, are carried out at least once a year.

Individual Performances Assessment of the Board of Directors

Overall, the result of the individual performance assessment of the Board of Directors in 2020 was good, as well as the result of the collegial performance assessment of the Board of Directors was also good, with a score of 3.8. In addition, as a form of the Bank's commitment to implement Good Corporate Governance Principles, the GCG implementation was one of the aspects evaluated in the collegial performance assessment of the Board of Directors.

ASSESSMENT OF GCG IMPLEMENTATION ON THE ASPECT OF THE BOARD OF DIRECTORS

In 2020, the assessment result for the implementation of GCG by the Board of Directors was a 4.0.

POLICY ON THE DIVERSITY OF THE BOARD OF COMMISSIONERS AND BOARD OF DIRECTORS

DIVERSITY IN THE COMPOSITION OF THE BOARD OF COMMISSIONERS

Expertise/Experience/Education, shall have at least

Nationalities

Gender

Independence

DIVERSITY IN THE COMPOSITION OF THE BOARD OF DIRECTORS

Board members of national and multinational financial and non-financial institutions. Gender Out of a total of 8 (eight) members of the board of directors, 4 (four) are women.

ACHIEVEMENT OF THE POLICY ON DIVERSITY IN THE COMPOSITION OF THE BOARD OF COMMISSIONERS AND BOARD OF DIRECTORS

There are 3 (three) independent commissioners out of 6 (six) members of the board, or 50%. fifty percent) of the board of commissioners are independent commissioners. ACHIEVING THE POLICY ON DIVERSITY IN THE COMPOSITION OF THE COMMISSION'S BOARD OF DIRECTORS AND BOARD OF DIRECTORS.

OBJECTIVES AND BACKGROUND

The Bank is committed to implementing a competitive, fair, risk-based remuneration system based on applicable laws and regulations, while always ensuring that no person receives compensation below the minimum wage set by the government. The bank's remuneration policy is based on performance, competitiveness, fairness and risk-based in accordance with POJK No.

RISK-BASED REMUNERATION POLICY

40/SEOJK.03/2016 on Implementation of Governance in Providing Remuneration in Commercial Bank and POJK no. 59/POJK.03/2017 on Implementation of Governance in Providing Remuneration in Sharia Bank and Sharia Business Unit.

DETERMINATION OF REMUNERATION BASED ON PERFORMANCE AND RISK

45/POJK.03/2015 on the Implementation of Management in the Provision of Remuneration in Commercial Bank, OJK Circular No.

REVIEW AND INDEPENDENCY OF

REMUNERATION POLICY IMPLEMENTATION

REMUNERATION POLICY

To ensure the independence of rewarding all employees, including employees in control units, the bank ensures that performance evaluation and determination of remuneration is carried out with supervision and review by the appointment and remuneration committee. The bank regularly reviews and publishes its salary structure and scale in accordance with the Decree of the Minister of Manpower no.

DETERMINATION OF MATERIAL RISK TAKER

40/SEOJK.03/2016 regarding the implementation of governance in the awarding of remuneration in the Commercial Bank and Sharia Business Unit.

BOARD OF COMMISSIONERS’ REMUNERATION

Remuneration Packages and Other Facilities Type of Remuneration and Other Facilities

Variable Remuneration for the Board of Commissioners

BOARD OF DIRECTORS’ REMUNERATION

Variable Remuneration for the Board of Directors Variable Remuneration **

Including compensation for the members of the Board of Directors who are no longer in office.

SHARIA SUPERVISORY BOARD’S REMUNERATION

Variable Remuneration for the Sharia Supervisory Board Variable Remuneration *

All members of CIMB Niaga's Shariah Supervisory Board did not receive any variable remuneration (shares or bonuses based on performance or non-performance as well as stock options).

EMPLOYEE/MANAGEMENT SHARE OWNERSHIP PROGRAM

HIGHEST AND LOWEST SALARY RATIO

VARIABLE REMUNERATION FOR EMPLOYEES

FIXED AND VARIABLE REMUNERATION FOR PARTIES CATEGORIZED MATERIAL RISK TAKERS (MRT)

QUANTITATIVE INFORMATION FOR PARTIES CATEGORIZED AS MATERIAL RISK TAKERS (MRT)

TOTAL SEVERANCE GRANTED TO EMPLOYEES AFFECTED BY TERMINATION AND TOTAL AMOUNT PAID

AND BOARD OF DIRECTORS MEETINGS

PROVISIONS FOR BOARD OF

COMMISSIONERS’ MEETING AND JOINT MEETING OF BOARD OF COMMISSIONERS

Minutes of meetings are taken by the Corporate Secretary or other parties appointed by the Supervisory Board and are duly documented. Minutes of meetings are valid evidence for members of the Supervisory Board and third parties regarding the decisions taken during the meeting.

AGENDA OF THE MEETINGS OF THE BOARD OF COMMISSIONERS IN 2020

The member of the board of commissioners who is prevented from participating in the meeting must notify the chairman of the commissioner of the reason for his absence. AGENDA FOR JOINT MEETINGS OF THE COMMISSION'S BOARD OF DIRECTORS WITH THE BOARD OF DIRECTORS in 2020.

AGENDA OF JOINT MEETINGS OF THE BOARD OF COMMISSIONERS WITH THE BOARD OF DIRECTORS IN 2020

Appointed as President Commissioner at GM on April 9, 2020 and effective from July 7, 2020. Appointed as Vice President Commissioner (Independent) at GM on April 9, 2020 and effective from September 16, 2020.

FREQUENCY AND ATTENDANCE AT THE BOARD OF COMMISSIONERS’ MEETING IN 2020

PROVISIONS FOR BOARD OF DIRECTORS’

MEETING AND JOINT MEETING OF BOARD OF DIRECTORS WITH BOARD OF

AGENDA OF JOINT MEETINGS OF THE BOARD OF DIRECTORS WITH THE BOARD OF COMMISSIONERS IN 2020. Meetings of the Board of Directors Joint Meetings of the Board of Directors with the Board of Commissioners.

ULTIMATE AND CONTROLLING SHAREHOLDER

AFFILIATION AMONG MEMBERS OF THE BOARD OF COMMISSIONERS, BOARD OF DIRECTORS AND THE

RELATIONSHIPS WITH MEMBERS OF THE BOARD OF DIRECTORS, ASSOCIATE MEMBERS OF THE BOARD OF DIRECTORS AND CONTROLLING SHAREHOLDERS. All committees within the Board of Commissioners are chaired by an independent commissioner who has.

COMMITTEES UNDER

THE BOARD OF COMMISSIONERS

AUDIT COMMITTEE

AUDIT COMMITTEE CHARTER

TERM OF OFFICE

AUDIT COMMITTEE MEMBERSHIP NUMBER, STRUCTURE AND COMPOSITION

PROFILES OF AUDIT COMMITTEE MEMBERS

No affiliate relationships with fellow Committee members, members of the Supervisory Board, members of the Executive Board or the Ultimate and Controlling Shareholders. Head of the Financial Institutions Ratings Department at PT Pemeringkat Efek Indonesia (PEFINDO) – Jakarta, Indonesia Concurrent positions Principal Advisor at PT Advance Intelligence Indonesia – Jakarta, Indonesia (2019 - present).

TRAINING FOR AUDIT COMMITTEE MEMBERS

AUDIT COMMITTEE INDEPENDENCY

DUTIES, RESPONSIBILITIES AND AUTHORITIES

Provide recommendations to the Board of Commissioners regarding the audit plan preparation, scope and budget for the Internal Audit. Provision of recommendations to the Board of Commissioners on the overall annual remuneration of the Internal Audit as well as performance appraisal.

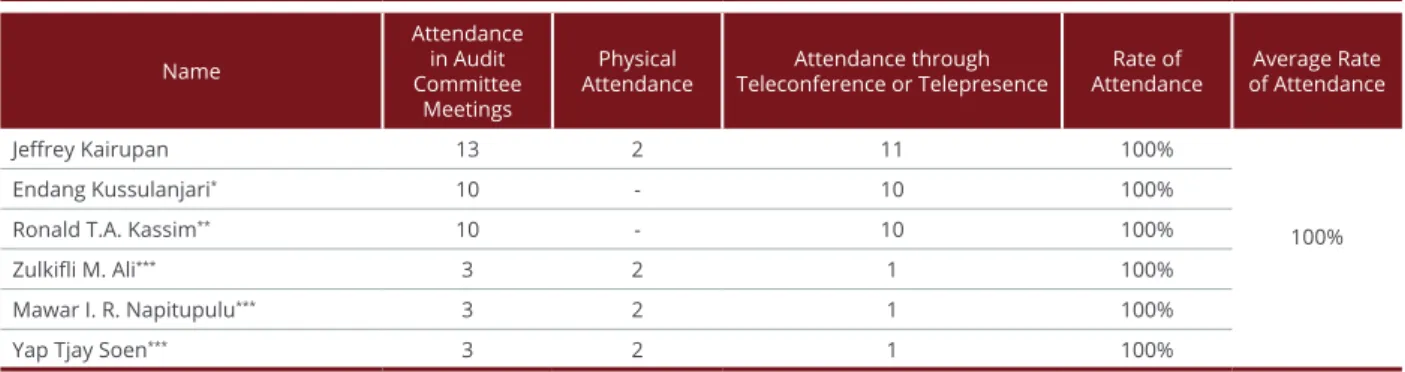

AUDIT COMMITTEE MEETINGS AND ATTENDANCE

Officers and parties performing the functions of Internal Audit, Risk Management and accountants related to the duties and responsibilities of the Audit Committee. To engage independent parties outside the Audit Committee to assist in the performance of their duties (if necessary).

REPORT OF AUDIT COMMITTEE DUTIES IMPLEMENTATION IN 2020

Meetings with Anti-Fraud Management (AFM) to discuss the implementation of anti-fraud strategies across the four interrelated anti-fraud pillars of prevention, detection, investigation and monitoring. Several anti-fraud programs implemented, including anti-fraud campaign weeks, anti-fraud awareness training and socialization and e-learning and certification through applications, conducting fraud case investigations and monitoring sanctions against fraudsters and corrective actions taken by the bank so that fraud does not happen again in the future.

AUDIT COMMITTEE STATEMENT ON THE EFFECTIVENESS OF INTERNAL CONTROL AND

Meetings with the accountant to discuss the audit plan, scope of the audit, audit findings, recommendations on the audit results and the submitted letter to management. Meetings with directors and related work units to ensure the adequacy of the internal control system, including NPL management, cyber security review and Sharia banking and the status of key projects in 2020.

WORK PLANS IN 2021

Discussion on the recommendations and progress of monitoring the audit results of OJK, Bank Indonesia and Bank Negara Malaysia.

REMUNERATION FOR AUDIT COMMITTEE MEMBERS 1. REMUNERATION PACKAGE AND OTHER FACILITIES RECEIVED

VARIABLE REMUNERATION FOR AUDIT COMMITTEE MEMBERS

The Nomination and Remuneration Committee (NRC) has been established to assist the Supervisory Board in fulfilling its oversight responsibilities in relation to the implementation of the Bank's policy on the appointment and remuneration of Supervisory Board members and the Executive Board, the Sharia Supervisory Board, members of the committees under the Supervisory Board and all employees of the bank in accordance with applicable legal requirements. CIMB Niaga's articles of association regarding the duties and powers of the Supervisory Board.

NOMINATION AND REMUNERATION COMMITTEE CHARTER

OJK Regulation and OJK Circular regarding the implementation and bodies of Corporate Governance, the Committee of Nomination and Remuneration, the Management of Remuneration, and the Principles of Prudence for Commercial Banks that outsource part of their operations to other parties.

NOMINATION AND REMUNERATION COMMITTEE MEMBERSHIP NUMBER,

NOMINATION AND REMUNERATION COMMITTEE

PROFILE OF THE NOMINATION AND REMUNERATION COMMITTEE MEMBERS

Structure, policy and amount of remuneration for members of the Board of Commissioners, the Sharia Supervisory Board, the Board of Directors and members of the committees under the Board of Commissioners; and ii. Directors and employees of the bank who have been approved by the board.

TRAINING OF THE NOMINATION AND REMUNERATION COMMITTEE MEMBERS

Provide recommendations on independent parties who will serve as members of the audit committee, risk review committee and integrated governance committee. In the event that a Committee Member has a conflict of interest with the proposed recommendation, the proposal will disclose the conflict of interest and the considerations underlying the proposal.

NOMINATION AND REMUNERATION COMMITTEE INDEPENDENCY

DUTIES, RESPONSIBILITIES, AND AUTHORITIES

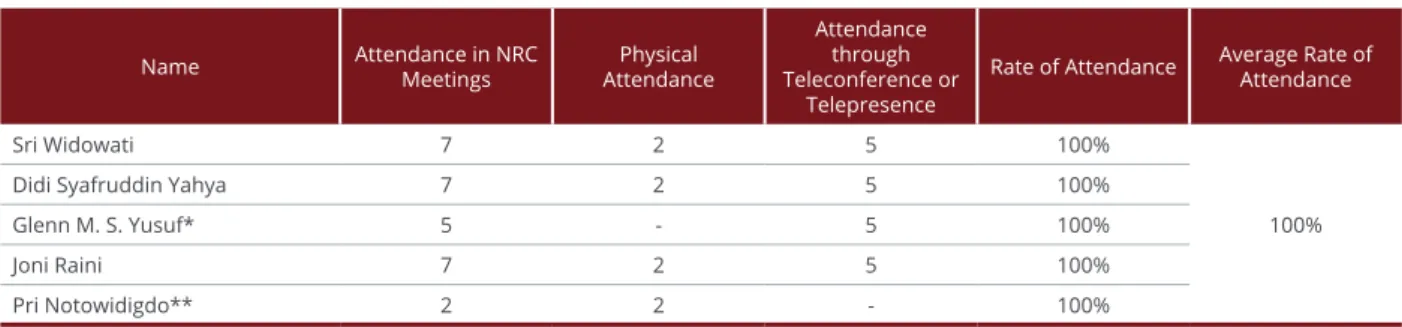

NOMINATION AND REMUNERATION COMMITTEE MEETINGS AND ATTENDANCE

REPORT OF NOMINATION AND REMUNERATION COMMITTEE DUTIES

Provided evaluation and direction for Board of Directors KPI performance, and input for units that performed below targets to improve their performance. ASSESSMENT OF THE NOMINATION AND REMUNERATION COMMITTEE ON THE IMPLEMENTATION OF THE BANK'S NOMINATION AND COMMUNICATION POLICIES.

EVALUATION OF THE NOMINATION AND REMUNERATION COMMITTEE ON THE IMPLEMENTATION OF THE BANK’S NOMINATION AND REMUNERATION POLICIES

Discussed and provided data on the assessments of the collective performance of the Board of Directors and the Board of Commissioners, the individual performances of each Commissioner and the performance of the Commissioner Presidents and the Chairman of the Committees of the Board of Commissioners. Assessing the required competencies of the Board of Commissioners and the Board of Directors to minimize the skill level gap between the current members of the Board of Commissioners and the Board of Directors.

REMUNERATION FOR NOMINATION AND REMUNERATION COMMITTEE MEMBERS

REMUNERATION PACKAGE AND OTHER FACILITIES RECEIVED Types of Remuneration and Other Facilities

Implement the framework for Talent Management which consists of the identification, development and evaluation of talents that form part of the obligations of the Bank to succession planning especially for Senior Management.

VARIABLE REMUNERATION FOR NOMINATION AND REMUNERATION COMMITTEE MEMBERS Variable Remuneration

BOARD OF DIRECTORS’ SUCCESSION POLICY

RISK OVERSIGHT COMMITTEE

RISK OVERSIGHT COMMITTEE CHARTER

RISK OVERSIGHT COMMITTEE MEMBERSHIP NUMBER, STRUCTURE AND COMPOSITION

PROFILE OF THE RISK OVERSIGHT COMMITTEE MEMBERS

Secretary of the Department of Management Science, Faculty of Economics and Business, University of Indonesia. Consultant and researcher at the Institute of Management of the Faculty of Economics and Business (LM-FEB) of the University of Indonesia.

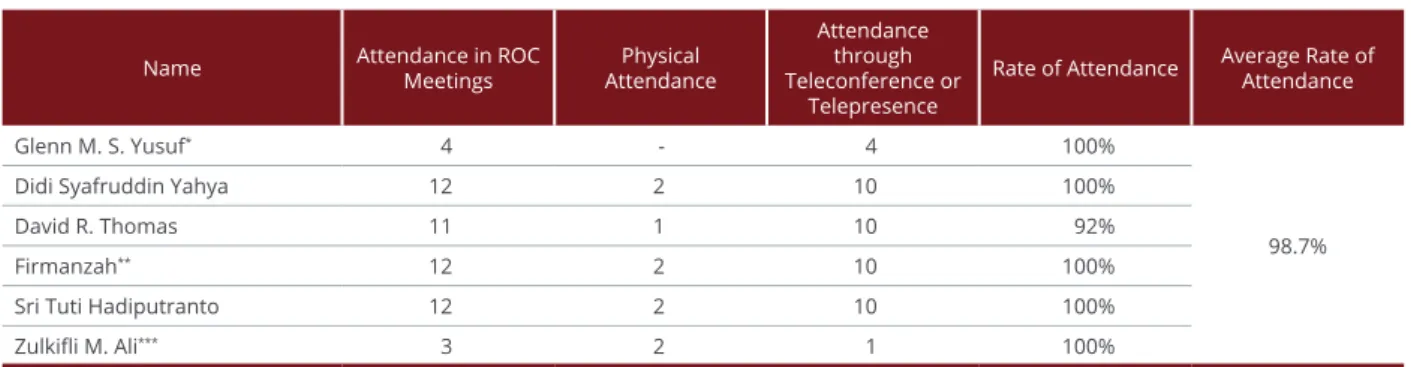

RISK OVERSIGHT COMMITTEE MEETINGS AND ATTENDANCE

No affiliate relationship with other members of the Committee, members of the Supervisory Board, the Board of Directors or the Ultimate and Controlling Shareholders. Monitoring and evaluating the performance of the Risk Management Committee and the Risk Management Cell.

TRAINING FOR RISK OVERSIGHT COMMITTEE MEMBERS

Co-founder of Hadiputranto, Hadinoto & Partners, the largest law firm in Indonesia, member of Baker & McKenzie International Law Firm. Evaluating the alignment between the policy and the implementation of risk management in the bank; and 2.

RISK OVERSIGHT COMMITTEE INDEPENDENCY

The term of office as a ROC member effectively ended with the closing of the AGM 9 April 2020. Monitor monthly risk management reports (Risk Appetite Statement/Risk Report) covering various aspects of risk management (Credit, Market, Liquidity, Operations and others).

REPORT OF THE RISK OVERSIGHT

Monitoring and evaluation of the realization of the 2019 work plan and the 2020 work plan (Risk Management Committee - RMC). Assess capital risk management, including conducting stress tests (at group, management and coronavirus level) and ICAAP.

COMMITTEES DUTIES IMPLEMENTATION IN 2020

Internal reports that include the monitoring results of material and emerging risk, macroeconomic conditions, the Bank's financial performance and risk indicators to ensure compliance with the Bank's risk appetite. Mandatory reports submitted to the Bank's supervisor consisting of the Risk Profile Report, the Risk-Based Bank Rating Report and other reports to ensure that the information transmitted to the Bank Supervisor accurately reflects the actual risks faced by the Bank.

RISK OVERSIGHT COMMITTEE ASSESSMENT ON THE IMPLEMENTATION OF RISK

Risk management related to capital, including the internal capital adequacy assessment process and the implementation of stress tests. Asset quality status for each loan segment to ensure that each business unit has taken the necessary measures to maintain and improve the Bank's asset quality in accordance with the established risk posture and risk appetite.

MANAGEMENT BY THE BANK

Risk management strategies and policies for different aspects of risk, not only credit risk, operational risk, liquidity risk and market risk, but also legal risk, compliance risk, reputational risk and information technology risk. The results of the Credit Underwriting Test evaluation are presented every 3 months in an effort to improve the underwriting process.

WORK PLANS FOR 2021

REMUNERATION FOR RISK OVERSIGHT COMMITTEE MEMBERS 1. REMUNERATION PACKAGE AND OTHER FACILITIES RECEIVED

VARIABLE REMUNERATION FOR RISK OVERSIGHT COMMITTEE MEMBERS

INTEGRATED GOVERNANCE COMMITTEE

INTEGRATED GOVERNANCE COMMITTEE CHARTER

INTEGRATED GOVERNANCE COMMITTEE NUMBER, STRUCTURE, AND COMPOSITION

He also currently serves as a member of the Sharia Supervisory Board of the Bank. Not affiliated with fellow members of the Committee, members of the Board of Commissioners, members of the Board of Directors, or the Ultimate and Controlling Shareholder.

TRAINING FOR INTEGRATED GOVERNANCE COMMITTEE MEMBERS

Chief Audit Executive (Director of Internal Audit and Risk Management) at PT Ithaca Resources (2009 - present) Zero share ownership.

INTEGRATED GOVERNANCE COMMITTEE INDEPENDENCY

Provide recommendations on the adequacy of internal controls and the implementation of the integrated compliance function. To provide recommendations to the Board of ME for the preparation and improvement of the IG guidelines.

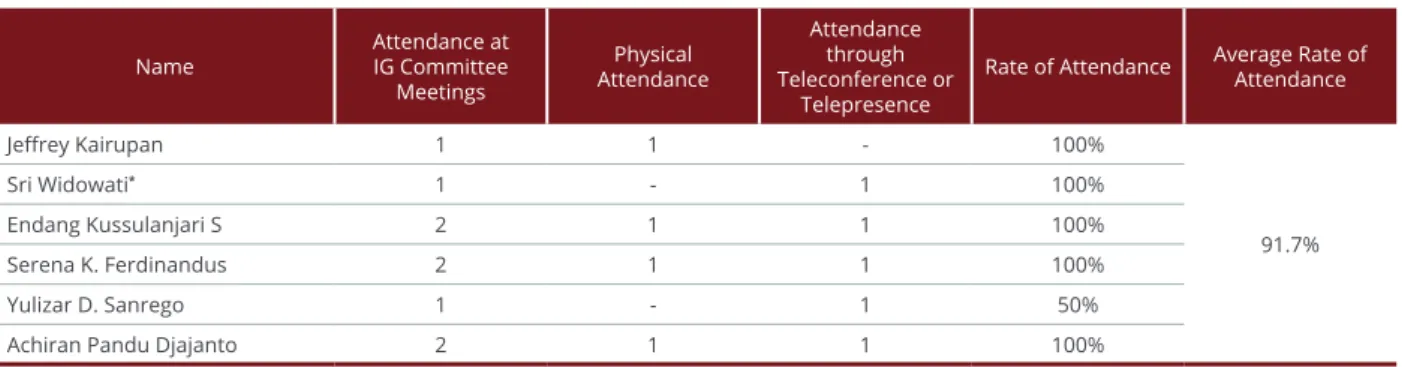

INTEGRATED GOVERNANCE COMMITTEE MEETINGS AND ATTENDANCE

Obtaining input, suggestions and recommendations from professional clients or other parties outside EM, FSI or CIFC in relation to their duties as members of the IG Committee;. Report on the results of monitoring or discussion of issues that were not concluded from the previous meeting of the IG Committee.

REPORT OF INTEGRATED GOVERNANCE

COMMITTEE DUTIES IMPLEMENTATION IN 2020

EVALUATION OF THE INTEGRATED GOVERNANCE COMMITTEE ON THE

REMUNERATION FOR INTEGRATED GOVERNANCE COMMITTEE MEMBERS

Remuneration Package and Other Facilities Received Types of Remuneration and Other Facilities

Variable Remuneration for Integrated Governance Committee Members Variable Remuneration

CIMB Niaga has formed committees that are directly responsible to the Board to assist and support the duties and responsibilities of the Board, namely the Executive Committee. However, the Board is also authorized to form other Executive Committees as required by the Bank.

THE COMMITTEES’ POSITION IN THE BANK STRUCTURE

In accordance with the applicable rules, the bank is required to have 3 (three) business committees, consisting of the risk management committee, the asset and liability committee and the IT steering committee. In line with the development of complexity of companies that required management and quality improvement in the implementation of good corporate governance, the board has therefore formed few other committees.

RISK MANAGEMENT COMMITTEE (RMC) MAIN FUNCTION AND AUTHORITY

THE BOARD OF DIRECTORS

Formulate and recommend risk management policies and framework, including the Bank's risk management strategy and Risk Appetite Statement (RAS). Assessing the risks and the implementation of risk management at the Bank and its subsidiaries, both periodically and incidentally, as a result of changes in the external and internal circumstances of the Bank.

ASSET & LIABILITY COMMITTEE (ALCO) MAIN FUNCTION AND AUTHORITY

The quorum participation in the meeting is at least 2/3 (two thirds) of the number of members of the Director. Ensuring the Bank's liquidity at the optimal level amid uncertainties throughout the period of the COVID-19 pandemic.

INFORMATION TECHNOLOGY STEERING COMMITTEE (ITSC)

Analyze the alignment between the rules and regulations of OJK and Bank Indonesia with the policies and procedures of the Bank. Recommend the alignment of IT with management information system requirements and the business activities of the Bank.

CREDIT POLICY COMMITTEE (CPC) MAIN FUNCTION AND AUTHORITY

Harmonization of credit concentration policy in relation to lending restrictions in accordance with OJK regulation no. Find out the new regulations issued by the regulator and their impact on the bank's internal policies.

FREQUENCY AND ATTENDANCE OF THE DIRECTORS IN THE EXECUTIVE COMMITTEE (EXCO) MEETINGS IN 2020

Throughout 2020, CIMB Niaga undertook several alignments on the Retail Products Policy with external policies issued by the regulator, government regulations and the Bank's business strategy in line with its risk appetite, including forecasting and management of the impact of the COVID-19 pandemic. Monitor the implementation of the credit policy to ensure the Bank's compliance with credit policy management and applicable regulations.

CORPORATE SECRETARY

TERM OF OFFICE & DOMICILE

CORPORATE SECRETARY PROFILE

ORGANIZATION STRUCTURE OF CORPORATE SECRETARY

DUTIES AND RESPONSIBILITIES

Due process for candidates for the Board of Commissioners and/or Board of Directors. Organizing orientation programs for new Directors and/or Commissioners to provide knowledge and understanding about the Bank.

DUTIES IMPLEMENTATION IN 2020

Administration, distribution and follow-up of letters addressed to the Executive Board and/or Supervisory Board. Organizing the introduction program for new members of the Executive Board and Supervisory Board.

COMPETENCY DEVELOPMENT

In 2020, the Bank received a total of 13,665 (thirteen thousand six hundred and sixty-five) letters addressed to the Board of Directors and/or Board of Commissioners, some of which were also received by OJK, Bank Indonesia, the Indonesia . Stock Exchange (IDX), Indonesian Central Securities Depository (KSEI), the Association of Private National Banks (PERBANAS), the State Court of the Republic of Indonesia, the National Police Force of the Republic of Indonesia, the Directorate General of Taxation and others.

INFORMATION DISCLOSURE IN 2020

IA CIMB Niaga provides independent and objective assurance, advice and consultancy that can add value and improve the bank's operations. IA helps the bank achieve its goals by evaluating and increasing the effectiveness of management, internal control processes and risk management.

THE INTERNAL AUDIT CHARTER

As the third line of defense, the main task of the IA is to ensure that the bank's management and operations comply with applicable rules and regulations and to support the bank's interests and objectives. The IA is also responsible for ensuring that internal control processes are adequate and properly implemented.

APPOINTMENT AND DISMISSAL OF THE CHIEF AUDIT EXECUTIVE

The Internal Audit (IA) is responsible for conducting internal audit at CIMB Niaga. Until the end of 2020, the IA will continue to carry out required innovation in the banking industry and the use of methodology and technology that can increase the effectiveness and efficiency of the audit process.

INTERNAL AUDIT (IA)

POSITION OF IA IN THE ORGANIZATION

PROFILE & TRAINING OF THE CHIEF AUDIT EXECUTIVE

DUTIES AND RESPONSIBILTIES OF IA

The annual audit plan and its budget are approved by the board of directors and the board of commissioners, taking into account the recommendation of the audit committee. The QAIP also evaluates the effectiveness and efficiency of the audit process and identifies possible improvements to it.

CODE OF ETHICS OF THE INTERNAL AUDITORS

- Integrity

- Objectivity

- Confidentiality

- Competency

Able to conduct audits of Financial Services Institutions (FSIs) individually, in groups or based on an FSI audit report. Prepare and present a report on the implementation of the duties and responsibilities of the integrated IA to the director responsible for the control of FSI in the financial conglomerate, the director of compliance of the main entity and the board of commissioners of the main entity.

HUMAN RESOURCES AND PROFESSION CERTIFICATION

The internal audit imparts the knowledge, skills and experience necessary to deliver the IA services. QRMP : Qualified Risk Management Professional ERMCP : Enterprise Risk Management Certified Professional CIF : Certified Investment Foundation.

AUDIT MANAGEMENT INFORMATION SYSTEM

AUDIT METHODOLOGY

REPORT ON IA ACTIVITIES IN 2020

Participation of IA CIMB Niaga as keynote speakers in external seminars/online webinars. Continuation of IA's role in providing consultative review and advice to business units and support units.

KEY INITIATIVES IN 2020

- Fulfilling the need for the safety of auditors

- Carrying Out the Audit Plan

- Renewing the Audit Plan

- Monitoring the Impact on the Bank’s Business Operations

- Development of Data Analytics

- Visualisation

- Thematic Audit

- Guest Auditor Program

- Business Monitoring

- Combine Assurance Audit

- Attachment Program

- Demerit Audit Rating

- High Risk Validation

- Competency Framework and Learning Journey As part of the commitment to enhance the quality

Improvements and improvements in data analytics are also implemented in line with the development of the IA organization and the growth of the bank's operations and operations. Improving the auditor's understanding of the business process and risk and control elements of the entity concerned.

EVALUATION OF IA PERFORMANCE

This decrease indicates the significant improvements being made to the control environment and the timely remediation of the audit recommendation. IA has also continued high-risk validation to ensure that all audit recommendations are timely and continuously remediated, ensuring no repeat audit findings in the future.

WORK PLAN 2021

CIMB Niaga has a director responsible for the compliance function and has established an independent Compliance Unit (CU) directly under the Compliance Director. The Head of Compliance Management is in charge of CIMB Niaga's CU, which serves the compliance function as a key element in improving the implementation of Corporate Governance.

APPOINTMENT AND DISMISSAL OF HEAD OF COMPLIANCE MANAGEMENT

The role and function of the Compliance Unit at the Bank represents one of the preventive measures taken to mitigate the compliance risk in the Bank's business activities. The establishment of the Bank's CU refers to the respective POJK and SEOJK on Implementation of Management in Commercial Banks, Integrated Management, Assessment of Bank's Health, and Implementation of Compliance Function in Commercial Banks.

PROFILE & TRAINING OF THE HEAD OF COMPLIANCE MANAGEMENT

The compliance function ensures that all policies, provisions, systems and procedures, as well as the activities of the Bank, are in accordance with the provisions of Otoritas Jasa Keuangan (OJK) and applicable laws and regulations.

COMPLIANCE UNIT

COMPLIANCE PRINCIPLE

COMPLIANCE FUNCTION AT THE BANK

DUTIES AND RESPONSIBILITIES OF THE COMPLIANCE UNIT

ORGANIZATIONAL STRUCTURE OF COMPLIANCE UNIT

HUMAN RESOURCES AND PROFESSIONAL CERTIFICATIONS

COMPLIANCE UNIT WORK PLAN FOR 2020

COMPLIANCE INDICATORS 2020

The minimum statutory reserve for foreign exchange for daily and daily + average positions was 4.05% and 4.05% respectively, which meets the regulatory minimum limit of 3% and 8%. Net open position (on and off balance sheet) was 1.77%, reaching the regulatory maximum limit of 20%.

IMPLEMENTATION OF DUTIES OF THE COMPLIANCE UNIT IN 2020

Monitoring the compliance status of identities in the CIMB Niaga Indonesia Financial Conglomerate (KKCI). Monitoring of compliance implementation through the Regulatory Commitment Monitoring (ReCoM) application, and further development of ReCoM to automate processes in the compliance framework.

COMPLIANCE UNIT WORK PLAN FOR 2021

Carry out periodic Integrated Compliance reporting on the implementation of compliance in KKCI to the Board of Directors and the Board of Directors of the bank as the main unit. In the implementation of the AML & CFT programs, CIMB Niaga has formed the AML unit as a special work unit that reports directly to Compliance in the execution of the AML & CFT programs in the bank.

AML & CFT POLICIES

As such, the Bank is committed to mitigating this risk and undertaking various preventive measures by effectively implementing the Anti-Money Laundering and Counter-Terrorist Financing (AML & CFT) programs. These efforts are carried out using risk-based approach in its implementation, in order to measure the AML and CFT risks at the client level (Client Risk Rating) as well as that of bank-wide (Bank AML Risk Rating).

ANTI MONEY LAUNDERING AND

As a bank with a network that spans all over Indonesia and offers a wide range of products and services, CIMB Niaga can be vulnerable to money laundering and terrorism financing crimes.

PROCEDURE FOR THE APPOINTMENT AND DISMISSAL OF THE HEAD OF AML

PROFILE & TRAINING OF THE HEAD OF AML

Relating to the Reporting of the Personal Savings Guarantee Data (single client view)-PLPS No.05 of 2019.

ORGANIZATION STRUCTURE OF AML & CFT AML UNIT

DUTIES AND RESPONSIBILITIES OF THE AML UNIT

Measure the AML and CFT risks and mitigate those risks through the Risk Control Self-Assessment (RCSA) mechanism, to minimize the potential of money laundering in the business units or branch offices. Raise AML awareness within the Bank's first line of defense in implementing AML & CFT.

IMPLEMENTATION OF AML & CFT PROGRAMS IN 2020

- First Line of Defense

- Second Line of Defense

- Third Line of Defense

- Establishment of a special organization, the Anti Money Laundering (AML) Unit, to implement the

- Risk-based AML & CFT policies and procedures of, in accordance with the complexity of the Bank’s

- Management Information System in the Implementation of AML & CFT

- Screening of the Watch-List

- AML & CFT Risk Assessment

- Internal Control to Evaluate the Adequacy and Effectiveness of the AML & CFT Programs

- Compliance Test and Advisory related to AML &

- Training (Certification) of AML & CFT to Employees Training on AML & CFT are mandatory for all employees

- Reporting and Data Submission to Regulator/Law Enforcement

- Improvements Initiatives in 2020

Alignment of AML & CFT policies as well as SOP in line with applicable regulations. Alignment of the policy and implementation of AML & CFT with those of the CIMB Group.

AML & CFT PLANS IN 2021

Improvement of the AML system that used to generate more added value in the implementation of the bank's AML and CFT programs. Assessment of implementation of AML & CFT at business units/branches as well as subsidiaries that are assessed to have higher risks.

POLICY FOR APPOINTMENT OF PUBLIC ACCOUNTANT

CIMB Niaga performs an external audit function as an independent control over the financial aspects by performing an audit of the financial statements by Public Accountants (PA) and Public Accounting Firm (PAF). PA and PAF, which audit the bank's financial statements for the financial year 2020, were appointed at the annual GSD based on the recommendation of the board of commissioners and the audit commission, in accordance with POJK no.

PERIOD OF SERVICE OF PUBLIC ACCOUNTANT AND PUBLIC ACCOUNTING FIRM

Audit of the Bank's Financial Statements is carried out to ensure that the financial information referred to is prepared and presented in a quality manner, and to form and express an opinion on the fairness of the Financial Statements. The selection process followed the established mechanism for procurement of goods and services to guarantee the independence and quality of work of the designated PA and PAF.

EFFECTIVENESS OF AUDIT BY PUBLIC ACCOUNTANT

13/POJK.03/2017 of 27 March 2017 regarding procedures for using the services of public accountants and public accounting firms in financial services activities.

SUPERVISION AND COMMUNICATION BETWEEN PUBLIC ACCOUNTANT AND THE

PUBLIC ACCOUNTANT

NAMES, PERIODS AND FEES FOR PUBLIC ACCOUNTING FIRMS AND PUBLIC ACCOUNTANTS PERFORMING THE AUDIT OF THE BANK'S ANNUAL FINANCIAL STATEMENTS IN THE LAST 5.

NAMES, PERIODS AND FEES FOR PUBLIC ACCOUNTING FIRMS AND PUBLIC ACCOUNTANTS CONDUCTING THE AUDIT ON THE BANK’S ANNUAL FINANCIAL STATEMENTS IN THE LAST 5

FEES FOR OTHER SERVICES PROVIDED BY THE PUBLIC ACCOUNTING FIRM AND PUBLIC

ACCOUNTANT OTHER THAN THE AUDIT ON THE LAST ANNUAL FINANCIAL STATEMENTS IN 2020

OVERVIEW OF RISK MANAGEMENT SYSTEM AT CIMB NIAGA

RISK MANAGEMENT

RISK MANAGEMENT UNIT

Risk Management Director Certification is offered in the Board's profiles Koei Hwei Lien. Head of Non-Retail Credit Policy and Insurance Testing Level 4 Risk Management Certification Sandi Maruto.

BOARD OF DIRECTORS’ PERFORMANCE ASSESSMENT OF RISK MANAGEMENT UNIT

RISK MANAGEMENT SYSTEM EFFECTIVENESS STUDY RESULT

The internal control system is a control mechanism that the bank uses continuously. As a process carried out at all levels of the organization, the system of internal controls is inherently used within the strategies of all work units and is designed to identify the possibilities of any event that may affect the bank and mitigate the risks to remain within an acceptable tendency the bank's exposure to risk to provide reasonable assurance that the bank will achieve its objectives.

BASIS OF IMPLEMENTATION

An effective internal control system is a key element and foundation for a safe and sound banking operation, enabling the Board of Commissioners and the Board of Directors to protect the Bank's assets, ensuring reliable management and financial reports, increasing the Bank's compliance with applicable laws. and regulations, as well as reducing the risk of loss, fraud or breach of care aspects, while also increasing organizational effectiveness as well as cost efficiency.

THE PURPOSE OF IMPLEMENTING THE INTERNAL CONTROL SYSTEM

Compliance Objective

INTERNAL CONTROL SYSTEM

Information Objective

Operational Objective

Risk Culture Objective

IMPLEMENTION OF INTERNAL CONTROL SYSTEM, FINANCIAL AND OPERATIONAL

The internal control component based on COSO implementation of the internal control system at CIMB Niaga Control Environment. The Board of Directors, the Bank's management and Internal Audit continuously monitor the effectiveness of all internal control activities.

STATEMENT OF ADEQUATE INTERNAL CONTROL

The internal control component based on COSO implementation of the internal control system at CIMB Niaga Information and Communication. The board of directors, the management of the bank and internal audit constantly monitor the effectiveness of the whole.

EVALUATION ON THE EFFECTIVENESS OF INTERNAL CONTROL

Throughout 2020, the Bank had to deal with a number of important civil and criminal cases. In civil cases, the Bank was the defendant; while in criminal cases the Bank was a reported party, with the details of the cases as follows (excluding Sharia cases, which are disclosed in the Governance Report of the Sharia Business Unit):

IMPORTANT CASES INVOLVING THE BANK

IMPORTANT CASES

The bank has filed a cross-appeal supporting its position and is currently awaiting a ruling. SIGNIFICANT MATTERS REGARDING INCUMBENT MEMBERS OF THE BOARD OF DIRECTORS AND THE COMMISSIONER'S BOARD.

MATERIAL CASES INVOLVING INCUMBENT MEMBERS OF THE BOARD OF DIRECTORS AND THE BOARD OF COMMISSIONERS

MATERIAL CASES INVOLVING SUBSIDIARIES

MATERIAL CASES INVOLVING INCUMBENT MEMBERS OF BOARD OF COMMISSIONERS AND THE BOARD OF DIRECTORS

IMPACT OF LEGAL ISSUES FOR THE BANK AND ITS SUBSIDIARIES

In 2020, there were no significant administrative sanctions that would affect the continuity of the bank's operations, nor were there any administrative sanctions imposed by regulators on members of the board of directors and commissioners.

ADMINISTRATIVE SANCTION FROM RELEVANT AUTHORITIES

PROGRAMS AND PROCEDURES

TRAINING/SOCIALISATION ON ANTI- CORRUPTION

ANTI-CORRUPTION POLICY

The Bank provides convenient access to relevant data and information on the Bank's performance to all interested parties. The bank actively disseminates information in both print and electronic media, including its official website that is accessible in Indonesian and English.

INVESTOR RELATIONS

ACCESS TO

BANK INFORMATION AND DATA

ACTIVITIES OF INVESTOR RELATIONS

The Bank's Annual Public Exhibition for 2020 was held on November 18, 2020, conducted online via video conference using the Webex Event platform. In this public presentation, the Bank's Board of Directors presented the Bank's operational and financial performance as well as its strategy to the general public, the media, securities analysts, investors and potential investors.

SOCIAL MEDIA

INTERNAL COMMUNICATION

PRESS RELEASES

34 Practical and convenient, CIMB Niaga encourages public to use OCTO Mobile for healthy and secure transactions 6. 58 CIMB Niaga earns The Asian Banker's 2020 Liquidity Risk Technology Implementation of the Year Award 8.

BASIC PRINCIPLES OF GOODS AND SERVICES PROCUREMENT

The policy is also supported by Standard Operating Procedures (SOP) for Goods and Services Procurement which was adopted in 2018 and is still valid as a reference. The procurement policy for goods and services and the SOP have become the main reference for everyone.

VENDOR’S CODE OF ETHICS

Legal Compliance

Corruption, Bribery or Illegal Payment

Gifts and Entertainment

Conflict of Interest

Labor and Human Rights, Vendors shall

Confidentiality and Protection of Bank and Customer Data, Vendors shall

Employee Health and Safety

GOODS AND SERVICES PROCUREMENT POLICY

Environmental Protection

Fair Competition

ELECTRONIC PROCUREMENT OF GOODS AND/

OR SERVICES (E-PROCUREMENT)

VENDOR DUE DILIGENCE

The implementation of the Employees' Code of Ethics & Conduct is one of the Bank's obligations under the principles of corporate governance to achieve the Bank's vision and mission. The Code of Ethics and Conduct sets the standard for ethical business and personal behavior and is part of the bank's culture in the implementation of good corporate governance (GCG).

THE CODE OF ETHICS & CONDUCT PURPOSE

The Code of Ethics & Conduct serves as a guideline for all CIMB Niaga employees in performing their daily duties and activities, as well as in dealing with customers, suppliers and colleagues. The CIMB Niaga Code of Ethics and Conduct forms the basis of the attitudes and actions of employees to work professionally and ethically according to the basic principles that refer to the Bank's vision, mission and core values, as well as applicable internal and external regulations.

THE CODE OF ETHICS & CONDUCT PRINCIPLES/CONTENTS

Confidentiality

EMPLOYEES CODE OF ETHICS & CONDUCT

Competence

Fairness

Mutual Respect

STATEMENT OF THE CODE OF ETHICS &

CONDUCT APPLIES TO ALL LEVELS OF THE ORGANIZATION

THE CODE OF ETHICS & CONDUCT DISSEMINATION/SOCIALIZATION

THE CODE OF ETHICS & CONDUCT MONITORING

POLICY ON DISCIPLINE ENFORCEMENT AND SANCTIONS IMPOSED FOR VIOLATIONS

DATA ON EMPLOYEE VIOLATIONS IN 2020

Go the extra-mile to delight customers

Respect each other, engage openly and work together

Recognise each other’s efforts and always back each other up

Mental Health

Physical Health

Hobbies

CORPORATE CULTURE

Sharing Session

Competitions and Other Activities

FUNDING FOR SOCIAL AND POLITICAL ACTIVITIES

TRANSPARENCY OF THE BANK’S FINANCIAL CONDITIONS

TRANSPARENCY OF THE BANK’S NON- FINANCIAL CONDITIONS

TRANSPARENCY OF THE BANK’S FINANCIAL AND NON-FINANCIAL CONDITIONS

The Bank complies with the obligation of transparency and publication of its financial and non-financial. The Bank intended to transfer the shares obtained from the share buyback to certain management and personnel personnel who met the criteria of Material Risk Taker (MRT) as determined by the Bank in accordance with the provisions of POJK No.

SHARES AND BONDS BUYBACK OF CIMB NIAGA

CONFLICT MANAGEMENT POLICY (INCLUDING INSIDER TRADING)

DIVIDEND POLICY

This transparent disclosure allows all creditors and business partners of the Bank to In addition, CIMB Niaga also ensures that the creditor's rights are duly executed as stipulated in the agreement signed by the parties involved and strives to timely fulfill the bank's obligation as agreed to avoid delays or default which can lead to financial problems. losses to the parties thereof.

PROTECTION OF CREDITOR’S RIGHTS

In an effort to secure creditor rights and maintain creditor confidence, CIMB Niaga has established Creditor Compliance Policy No. CIMB Niaga uses a transparent and fair information disclosure system based on equal treatment for all creditors without any discrimination to protect creditor's rights.

POLICY

PROCEDURES

DISCLOSURE

PROVISION OF FUNDS TO RELATED PARTIES

18/POJK.07/2018 on the handling of consumer complaints in the financial services sector, and OJK circular no. 17/SEOJK.07/2018 on the guidelines for the implementation of the handling of consumer complaints in the financial services sector, CIMB Niaga continuously strives to protect the interests of customers and provide the best banking services.

CUSTOMER PROTECTION POLICY

To this end, the bank has elevated the role of its Customer Care Unit (CCU), which is responsible for answering customer complaints about the bank's products and services. In addition, the Bank has a Customer Experience Unit as a dedicated work unit that manages the customer experience.

COMPLAINTS HANDLING IN 2020

ANTI-FRAUD POLICY

ANTI-FRAUD AWARENESS TRAINING

INTERNAL FRAUD

Speak Up Culture, where some cases of fraud that occurred in 2020 were a follow-up to reports submitted through the media whistleblowing system and some employees have been subject to sanctions related to cases reported through the whistleblowing system.

DATA OF INTERNAL FRAUD EXCEEDING RP100 MILLION

WHISTLEBLOWING SYSTEM

Confirms with the whistleblower whether his/her identity is to be disclosed to CIMB Niaga or not. Sends the report to CIMB Niaga WITHOUT the whistleblower's identity, UNLESS he/she chooses to disclose the identity to CIMB Niaga.

WHISTLEBLOWING REPORTING CHANNEL

WHISTLEBLOWER PROTECTION

WHISTLEBLOWING REPORT HANDLING

PERSONS IN CHARGE OF WHISTLEBLOWING

The person in charge of Whistleblowing System of CIMB Niaga is the Compliance Director with the main

The Whistleblowing Coordinator of CIMB Niaga is the Anti-Fraud Management unit, in which the

The Whistleblowing Coordinator Unit comprises of D-1 officers in charge of Anti-Fraud Management

The Whistleblowing Officers are employees from the AFM, AML and HR units who has been appointed

The Chief Audit Executive (CAE) undertakes the role of an independent supervisor with respect to the

NUMBER OF WHISTLEBLOWING REPORTS IN 2020 AND 2019

FOLLOW UP SANCTIONS ON VIOLATION

ASEAN CORPORATE GOVERNANCE SCORECARDS IMPLEMENTATION

259 & 627 D.3.2 Does the company disclose the name, relationship, nature and value of each RPT material. Have the non-executive directors/officers of the company met separately at least once during

IMPLEMENTATION OF CORPORATE GOVERNANCE ASPECTS AND PRINCIPLES IN A PUBLIC COMPANY

From December 2020, the bank's board of directors consists of 6 (six) persons, 3 of whom (50%) were independent commissioners. The total number of members of the board does not exceed the total number of members of the board.

INTEGRATED

GOVERNANCE REPORT

STRUCTURE OF THE FINANCIAL CONGLOMERATE

SHAREHOLDING STRUCTURE

MANAGEMENT STRUCTURE

MAIN ENTITY: CIMB NIAGA

MEMBERS

Make recommendations and approve the governance policies established by the board of directors and ensure that the governance policies are in line with the IG charter; Follow the instructions and advice of the supervisory board to improve the governance policy, the IG and the governance implementation based on the recommendations of the IG committee; And.

THE CORPORATE CHARTER

Supervises the implementation of the Board of Directors' duties and responsibilities, and also gives directions or recommendations to the Board of Directors regarding the implementation of Management Policy;. The Board of Commissioners discusses the recommendations of the IG Committee in the Board of Commissioners and Board of Directors meetings to provide direction and advice.

THE INTEGRATED GOVERNANCE (IG) COMMITTEE

Follow up on the IG Committee recommendations related to IG implementation and improvements to Management Policy;. Prepare the necessary policies and procedures for the IG implementation, in line with the Lead Entity procedures.

INTEGRATED INTERNAL AUDIT UNIT (IIA)

In the performance of its duties, CIMB Indonesia Financial Conglomerate's IIA may conduct audits for members of CIMB Indonesia Financial Conglomerate, either through joint audits, or based on internal audit reports from relevant members of CIMB Indonesia Financial Conglomerate. IMPLEMENTATION OF INTEGRATED AUDIT IN 2020 During 2020, IIA monitored and reported the implementation of integrated internal audit to the Head of Internal Audit ME, the Director in charge of the supervision of FSIs in the Financial Conglomerate CIMB Indonesia, the Compliance Director of ME and the Board of Commissioners of the ME on a regular basis.

INTEGRATED COMPLIANCE UNIT (ICU)

Monitoring or evaluating the implementation of Integrated Compliance in each member of the CIMB Indonesia Financial Conglomerate;. Compilation of the results of the implementation of Integrated Compliance by each member of the Financial Conglomerate CIMB Indonesia;.

INTEGRATED RISK MANAGEMENT

CNAF) 2/Low Moderate Considering the business activities carried out by CNAF, the possibility of losses encountered by Compliance Risk is classified as low during a certain period of time in the future. Conglomerates, the possibility of losses encountered from Compliance Risk is low over a certain period of time in the future.

INTEGRATED RISK MANAGEMENT UNIT (IRMU)

Encourage the availability of risk reports, policies and procedures and limits for CIMB Niaga Sekuritas, as the youngest subsidiary, which are consistent with the implementation of risk management in ME. Further information on the implementation of integrated risk management is presented in the Risk Management Report section of this Annual Report.

INTRAGROUP TRANSACTIONS POLICY

In the process of managing the risk of transactions within the group, ME has identified, measured, monitored and controlled the risk of the composition and fairness of transactions among the members of the Financial Conglomerate CIMB Indonesia. Intra-group transaction risk within CIMB Indonesia Financial Conglomerate is identified, managed and reported regularly along with embedded risk.

IG IMPLEMENTATION ASSESSMENT REPORT METHOD OF IG IMPLEMENTATION ASSESSMENT