There is also nothing in the introduction about the state of the art and the novelty of this research. Based on the reviewer's valuable comments, the introductory part of the study has been revised and the contributions have been discussed more efficiently. Reviewer comment 5: This study did not discuss the results of the study.

The findings should alert corporate management to improve their financial performance and focus on IC. This is one of the few studies that provides empirical evidence on the impact of IC on firm financial performance using the MVAIC instead of the VAIC model in the Pakistani and Indian contexts. The importance of IC has grown rapidly due to the growing importance of the knowledge economy (Cabrita & Vas, 2009).

An overview of the literature is presented in section two, followed by the development of hypotheses in section three. A summary of the results is presented in section four, and a discussion of these results is presented in section five.

Theoretical Foundation

Finally, this study helps the management of listed companies improve their financial performance and provides crucial insights for policymakers in achieving their objectives.

Measuring IC –MVAIC

Human Capital

Structural Capital

Relational Capital

Capital Employed

Developing companies mainly focus on physical capital. 2019) found the significant positive effect of CEE on the financial performance of companies.

IC and Firm Financial Performance in Pakistan

Chinese bank's profitability is driven by SCE, while HCE drives the profitability of the bank in Pakistan. They found that IC and its components, HCE, CEE and SCE, positively affect companies' financial performance.

IC and Firm Financial Performance in India

Pal K and Soriya (2012) analyzed the relationship between ICE and company financial performance for one hundred and five pharmaceutical and one hundred and two textile companies from 2009 to 2010. They used VAIC (OLS) regression and found a positive relationship between IC and profitability measured in terms of ROA.

Theoretical Framework

RESEARCH METHODOLOGY 1 Population and Sample Size

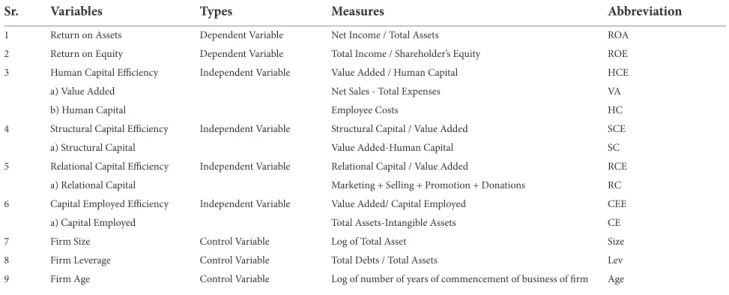

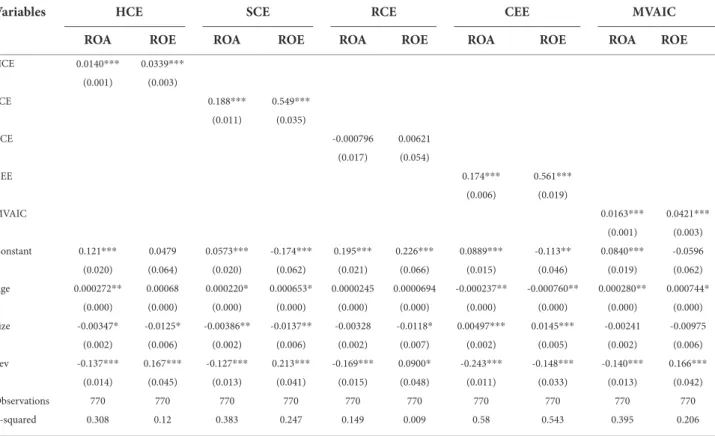

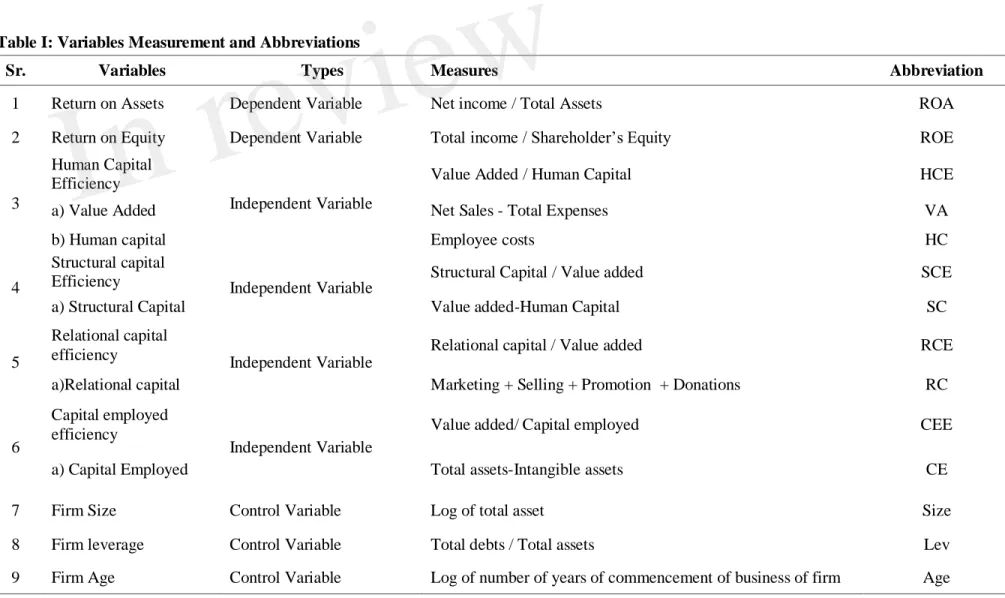

- Variables and their Measurement

- Model Specification

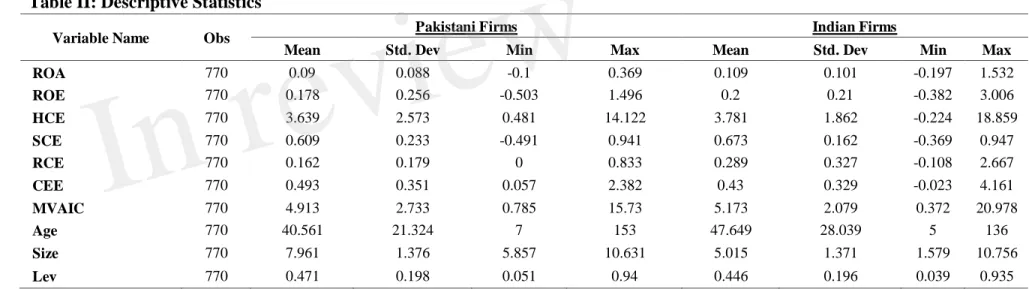

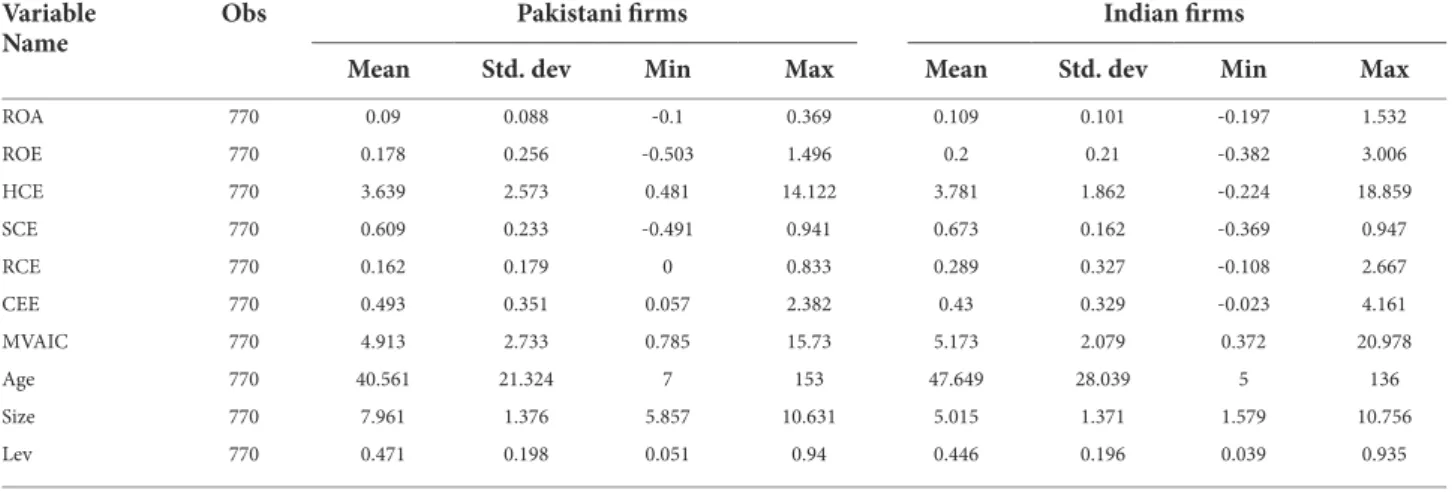

- Descriptive Statistics

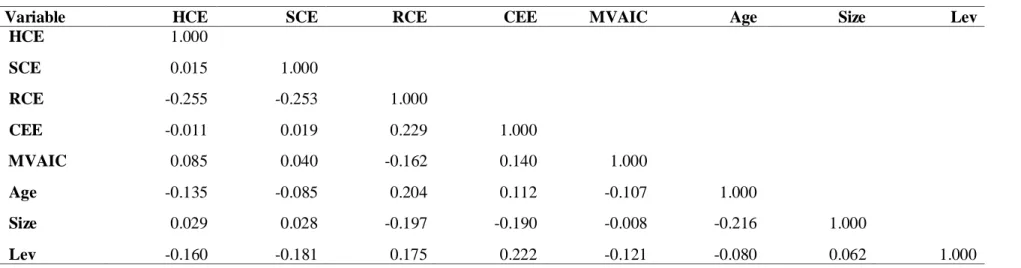

- Correlation Analysis of Pakistani Firms

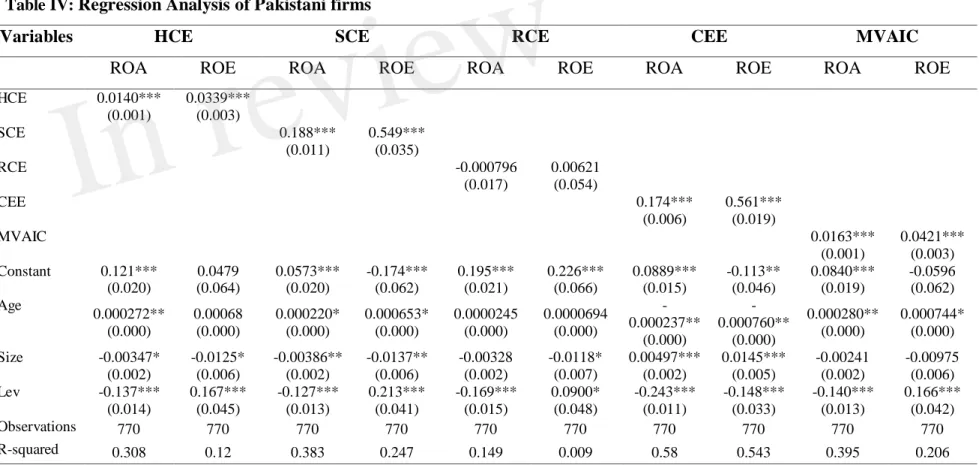

- Regression Analysis of Pakistani Firms

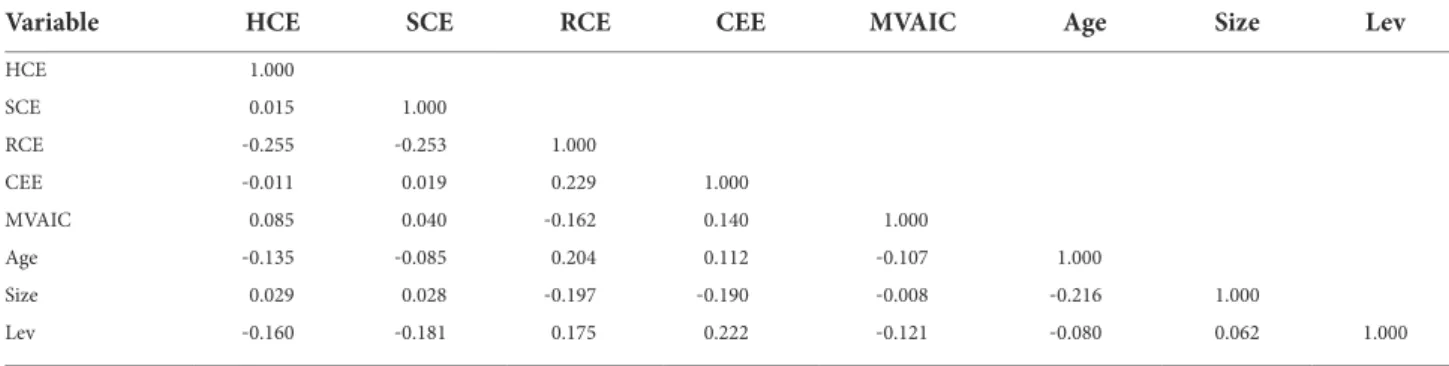

- Correlation Analysis of Indian Firms

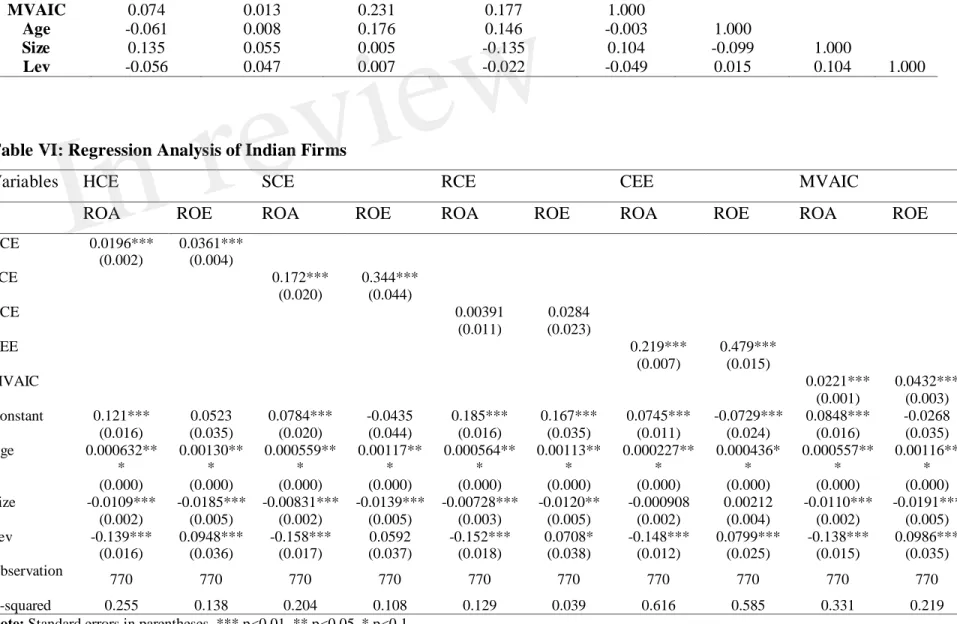

- Regression Analysis of Indian Firms

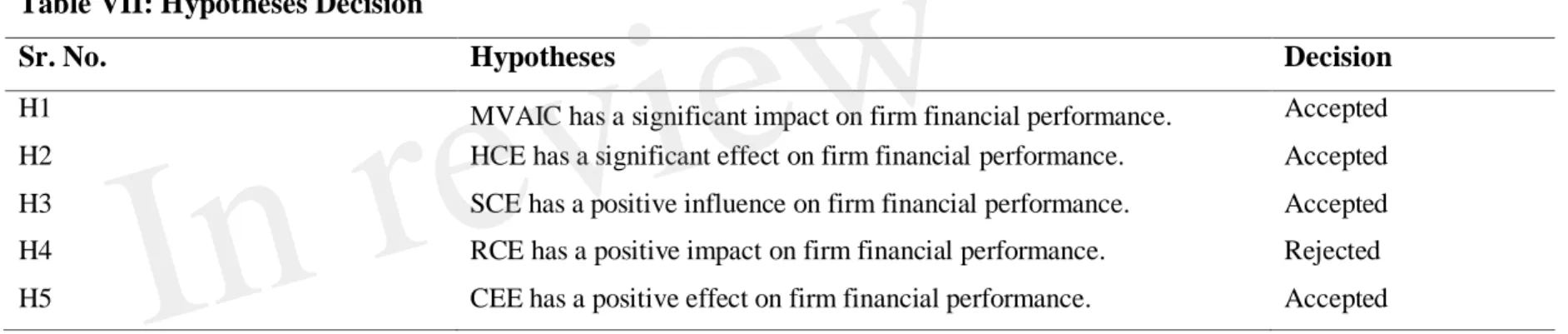

- Hypotheses Summary

Based on the table, Pakistani companies have an average return on assets of 0.09 while Indian companies have an average return on assets of 0.109 which means that the average return on assets of Pakistani companies is 9% while the average return on assets of assets of Indian companies is about 11%. The results also show that the average value of ROE of Pakistani companies is 0.178 and that of Indian companies. In the current study, three control factors have been used to limit the effect of these factors on the financial performance of companies (size, leverage and age).

The predictor variables HCE, SCE, CEE and MVAIC were found to have a significant impact on ROA and ROE. There is a significant positive correlation between ROA and ROE and HCE, SCE, CEE and MVAIC. HCE positively impacts ROA and ROE with R-squared 0.308 and 0.12, respectively, meaning that HCE entails a 30 and 12% change in ROA and ROE, respectively.

HCE is very important for Pakistani firms to achieve their primary objective in the form of ROA and ROE. This implies that Pakistani firms focus more on training, skills and education of employees. SCE also positively affects ROA and ROE with R-square 0.383 and 0.247, respectively. Therefore, companies are advised to focus on maintaining their relationships with stakeholders as stakeholder trust is also an important factor in enhancing the firm's financial performance.

CEE also significantly affects the firm's financial performance because the R-squared of ROA and ROE are 0.58 and 0.543, respectively. As a result, the conclusion can be formed that overall IC should be prioritized in order to gain a competitive advantage and improve the company's financial performance. Since these variables are related to the predicted variable, they should affect the firm's financial performance.

HCE positively affects ROA and ROE with R-squared of 0.255 and 0.138, respectively, which means that HCE causes a 25% and 13% change in ROA and ROE, respectively. HCE has a positive and significant relationship with ROA and ROE, suggesting that HC can contribute to improving firm performance. Furthermore, CEE significantly affects a firm's financial performance because the R-squared of ROA and ROE are 0.616 and 0.585, respectively.

Conclusions, Policy Implications, and Future Recommendations

Intellectual capital and firm performance of listed firms in Nigeria: Moderating role of corporate governance. Pakistan Journal of Humanities and Social Sciences, Vol Intellectual capital and business performance: the role of dimensions of absorptive capacity," Journal of Intellectual Capital. Intellectual capital efficiency and corporate book value: evidence from Nigerian economy," Journal of Intellectual Capital.

Intellectual Capital and Business Performance: A Comprehensive VAIC Model Improving Parental Leadership by Building Social and Intellectual Capital," The Spanish Journal of Psychology, Vol. Intellectual capital disclosure: A structured literature review," Journal of Intellectual Capital. Intellectual capital and corporate governance : an evaluation of Oman's financial sector companies," Journal of Intellectual Capital.

Intellectual capital performance and profitability of banks: Evidence from Pakistan," Journal of Risk and Financial Management, Vol. International Journal of Learning and Intellectual Capital Defining intellectual capital: a three-dimensional approach," Management Decision. Building small firm performance through intellectual capital development: Exploring innovation as a “black box”, Journal of Business Research, Vol.

The link between corporate governance and intellectual capital in Vietnam," Journal of Asia Business Studies. Croatian Intellectual Capital Center, Zagreb, Vol. 2020), "Determinants of online intellectual capital disclosure by Spanish local governance", Journal of Intellectual Capital. The link between the performance of intellectual capital with corporate performance: a comparative study of the banking sector in Pakistan, "International Journal of Business and Social Science, Vol. Competitive advantage between intellectual capital and financial performance of the banking sector in ASEAN".

The Effects of Intellectual Capital on Firm Financial Performance: Evidence from the ACE Market of Bursa, Malaysia. A panel data analysis of SME hotels," International Journal of Hospitality Management, Vol Intellectual capital and company's performance improvement,". The Impact of Intellectual Capital on Business Performance: A Study of Indian Companies Listed in COSPI," Journal of Intellectual Capital.

The impact of intellectual capital on firm performance: a modified and extended VAIC model," Journal of Competitiveness, Vol.12 No Cross-country comparison of intellectual capital performance of commercial banks in Asian economies,"". The analysis of added value as an indication of intellectual capital and its effects on company performance.

Frontiers: Article Published

The purpose of this study is to determine whether IC performance affects the financial performance of Pakistani and Indian listed companies between 2010 and 2020. Human capital (HC), structural capital (SC) and capital invested (CE) significantly affect Pakistani and Indian companies' financial performance. A rare study has addressed the impact of IC on firm financial performance using the MVAIC model instead of the VAIC model in Pakistan and India.

Singla (2020) investigated the relationship between IC and firm financial performance in the infrastructure and real estate sectors from 2008 to 2017. The added value of a firm's financial performance is measured by the contribution of IC and physical capital. EQL also significantly affects the firm's financial performance because the R-square of ROA and ROE are 0.58 and 0.543, respectively.

Since these variables are related to the predicted variable, they should affect the firm's financial performance. To the best of the researcher's knowledge, this is the first study to compare the impact of IC on firm financial performance in Pakistan and India. The financial performance of companies with strong IC will increase due to their ability to manage.

Furthermore, the study shows that intangible assets can improve the financial performance of firms in Pakistan and India. The relationship between intellectual capital and financial performance: An empirical investigation in an Iranian company. Intellectual capital and financial performance in a developing economy: an empirical investigation of a Nigerian bank.

On the relationship between intellectual capital and financial performance: a panel data analysis on SME hotels. Relationship between Intellectual Capital and Financial Performance of Pakistani Non-Financial Firms and a Comparative Study of the Textile and Chemical Industries.