The impact of the GFC was so destructive that it caused the collapse of conventional banking (Banna et al., 2020) and the world is still suffering the consequences and trying to overcome it. However, we analyzed Islamic banks based on the availability of data in the Orbis BankFocus database (formerly known as BankScope) to estimate the actual performance of their smooth financial operations in the aftermath of the GFC. First, the study measures the non-bias and bias-adjusted efficiency of Islamic banks of 32 countries over the period 2011-2017 using the most recently available data to see the efficiency trend of Islamic banks in the aftermath of the GFC, in contrary to previous studies.

Second, it intends to examine the relationship between FI and the efficiency of Islamic banks, as this association helps to determine how FI plays a crucial role in promoting the efficiency of the Islamic banking sector. Greater access to financial services increases the level of efficiency in the banking sector and brings progress for both banking stability and social stability. Thus, the current study fills the gap in the literature by highlighting the relationship between FI and the efficiency of Islamic banks as well as the effect of the interaction between FI and GDP in achieving inclusive sustainable growth.

The Financial Access Survey (FAS) of the International Monetary Fund (IMF) and the World Development Indicators (WDI) of the World Bank provide FI and macroeconomic data respectively. DEA efficiency results are linearly correlated with an additional source of endogeneity, which is the result of measurement error in efficiency estimates (Daraio et al., 2018; Simar & Wilson, 2011). Therefore, the double-boot method by Simar-Wilson (2007) is considered during the second stage analysis to explore the main determinants of the technical efficiency of Islamic banks and, in particular, how FI helps to achieve sustainable inclusive growth. improving the efficiency of this banking sector.

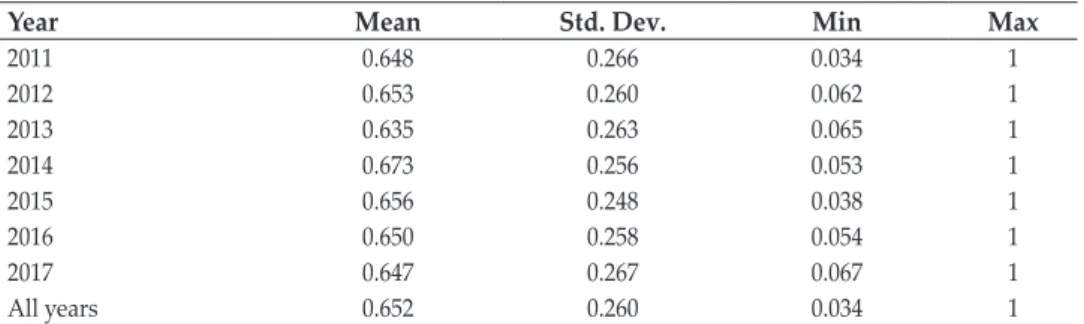

This approach helps to limit the problems caused by both the endogeneity of outreach measures related to the efficiency score and autocorrelation of the unobservable efficiency components (Banna et al., 2019b). With these values, we infer that Islamic banks on average suffer from about 35% (i.e. 1–0.652) of the inefficiency during the study period. Furthermore, the GDP growth and inflation rates of the sample countries average around 3.6% and 8.8% respectively.

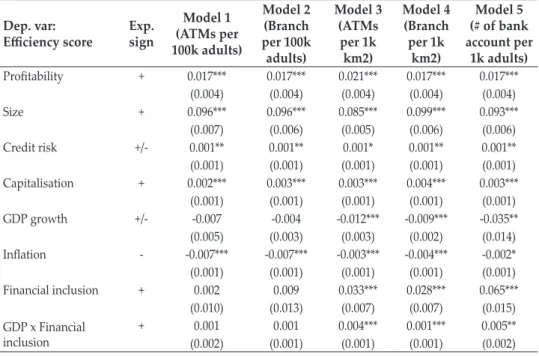

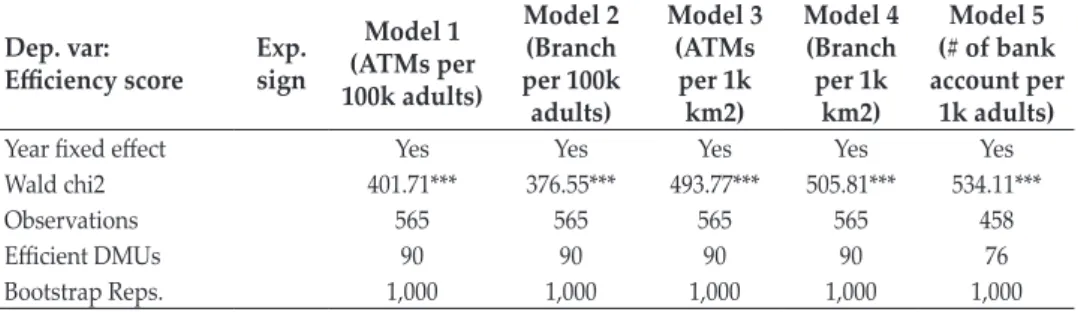

The sum of the positive and negative income streams linked to the profit-loss sharing (PLS) schemes has been defined as the net interest income of Islamic banks (Cihák & Hesse, 2008). To see the relationship between the efficiency of Islamic banks and FI, and the interaction effects of FI and GDP growth on efficiency, we consider the Simar-Wilson (2007) double bootstrap regression (Algorithm 1 and Algorithm 2) as due to the criticism of the Tobit regression. In our analysis, the FI is divided into two main dimensions: financial reach of the financial institutions (ATMs and branches) and customer usage (number of bank accounts).

In most cases, the significance and sign of the variables do not change in Algorithm 2. However, the bias-corrected efficiency results improve the estimated confidence intervals and coefficients, as well as the significance of the models (based on the highest Wald chi2 value). Profitability is positively and significantly related to the efficiency of Islamic banks at the 1% level, independent of the financial extent penetration and usage dimensions.

However, using the bias-corrected efficiency score, it is clear that a smooth and inclusive financial sector is positively associated with higher Islamic banking efficiency, regardless of the penetrations and dimensions of FI.

Robustness Test

We have not reported the results in this manuscript; however, results are available upon request.

Analysis

In Table 6, the findings also suggest that FI is significantly related to the efficiency of Islamic banking by providing a positive link between them and the interaction of FI and GDP growth has a positive relationship with the efficiency of Islamic banking. Islamic banks in Bangladesh, Malaysia, Mauritania, Qatar, Tunisia and Sudan perform as efficiently as the others. Interestingly, Islamic banks in Iraq and Palestine, despite being affected by war, are performing efficiently.

However, FI has a negative impact on the financial system due to excessive financial innovations (Mani, 2016). The study further shows a negative effect of GDP growth on the efficiency of Islamic banking. We expected a positive relationship between GDP growth and banking efficiency, as growth could promote the efficiency of the banking sector, but a negative relationship was determined.

Interestingly, the interaction of FI with GDP growth creates a positive relationship between the interaction effect (FI and GDP growth) and the efficiency of Islamic banks, which suggests that FI has an important role in sustainable growth. We consider the interaction effects between FI and GDP growth because when we talk about the real or sustainable growth of any country, GDP seems to be the main determinant. In their empirical study that determined the economic growth of different countries around the world, Gould and Ruffin (1993) consider GDP as the main determinant of the economic growth of countries.

Since both inclusive finance and GDP growth promote the economic progress of any country, both their interaction effects bring sustainable economic growth in an increased manner. The size of banks has a positive effect on Islamic banks' technical efficiency, which is also supported by Hassan (2006). Larger Islamic banks that have skilled management teams can produce more efficient outputs from their limited inputs.

However, the result is similar for Rosman et al. 2014) who observed a positive association after researching Islamic banks in Asia and the Middle East. As expected, this confirms the adverse effects of economic instability on the efficiency of the banking sector. It is clear from the different dimensions of analysis that the efficiency of Islamic banks is greatly influenced by efficient and productive FI.

CONCLUSION 5.1. Conclusion

Recommendation

This paper measures the performance of Islamic banks post-GFC and explores how this performance contributes to inclusive sustainable growth; policy makers, regulators, practitioners, financial analysts and others involved in financial matters are expected to have good insight into FI, Islamic banking effectiveness and inclusive economic growth. Islamic scholars should participate in spreading the importance of Islamic finance and financial investment in achieving inclusive sustainable growth. Therefore, Islamic banks should focus more on how to bank the unbanked, especially those who are marginalized and live in rural areas.

Then, with the passage of time, innovative, eco-friendly and Shari'a compliant financial services/products should be launched which will attract more customers, mitigate the time requirement and remove finance related constraints from the Islamic banking industry. Islamic banks should properly implement digital financial services (the adoption of Fintech solutions eg e-wallet/mobile banking) to keep pace with this competitive age where their counterpart conventional banks are moving forward. Finally, research depicting the role of FI in terms of bank efficiency and financial stability is an ongoing process; therefore, the results of this paper can be extended by future studies in many ways, such as a comparative study between conventional and Islamic banks to measure efficiency through FI, and comparison of efficiency between different branches of Islamic banks in the same country or with other countries.

Financial Inclusion for Financial Stability: Access to Bank Deposits and Deposit Growth in the Global Financial Crisis. The role of Islamic finance in enhancing financial inclusion in Organization of Islamic Cooperation (OIC) countries. Assessing the cost-effectiveness of the Italian banking system: what can be learned from the combined use of parametric and non-parametric techniques.

Efficiency of Islamic banks during the financial crisis: an analysis of Middle Eastern and Asian countries. The Determinants of Islamic Banks' Efficiency Changes: Empirical Evidence from MENA and Asian Banking Sectors.