This disparity in practice, as well as the vast differences in consumer information and opportunities, lead to the potential for welfare-enhancing government measures, particularly activities to protect (and promote) the consumer's financial position. More research is needed to better understand consumer financial behavior and to provide professional help to economically vulnerable consumers. Over the past decade, in the US and other countries, the social movement to promote consumer financial literacy has gradually shifted to promoting consumer financial literacy.

For this reason, this new edition attempts to update research findings and provide newly synthesized information to consumer finance researchers and practitioners that helps consumers better manage their finances and improve their financial well-being. American consumers have faced many financial challenges in recent years for several reasons. These social issues prompted concerted efforts in financial education and research sponsored by governmental and non-governmental organizations.

This book can be used by graduate courses focusing on consumer finance research in departments of business, consumer science, economics, family studies, finance, financial planning, human development, and related fields. He presented his financial research to consumers in China, Japan, Malaysia, South Korea, Taiwan, USA and other countries/areas.

Concept and Theories of Consumer Finance

Consumer Finance in Various Settings

Institut for personlig finansiel planlægning, School of Family Studies and Human Services, Kansas State University, Manhattan, KS, USA. School of Human Ecology og La Follette School of Public Affairs, University of Wisconsin—Madison, Madison, WI, USA of Public Affairs, University of Wisconsin—Madison, Madison, WI, USA Brenda J. Department of Economics, Mike Cottrell College of Business , University of North Georgia, Gainesville, GA, USA.

Department of Humanities, Center for Decision Research, Leeds University Business School, Ohio State University, Columbus, OH, USA. Department of Human Development and Family Studies, University of Rhode Island, Transition Center, Kingston, RI, USA Sara K. Department of Economics, Center for Economic Education, University of Nebraska at Omaha, Omaha, NE, USA.

Concept and Theories of Consumer Finance

It is also possible that a theory of financial risk tolerance could emerge from this work.

Retirement Savings

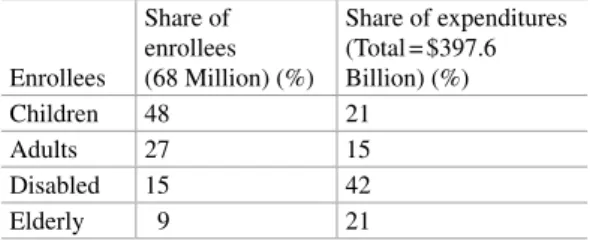

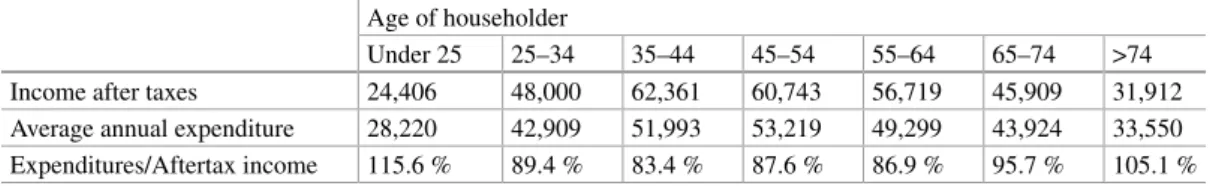

The pattern is consistent with the life cycle savings model discussed in the next section. It may make sense for consumers to plan for somewhat lower retirement spending, especially in the later years of retirement. It provides pensions, disability benefits, and survivor benefits to almost all workers in the United States.

Social Security provides the most important source of income for most elderly households in the US. For those in the lowest income quintile, Social Security would provide 62% of income at age 67. Fears about the future of Social Security are often expressed in the popular press.

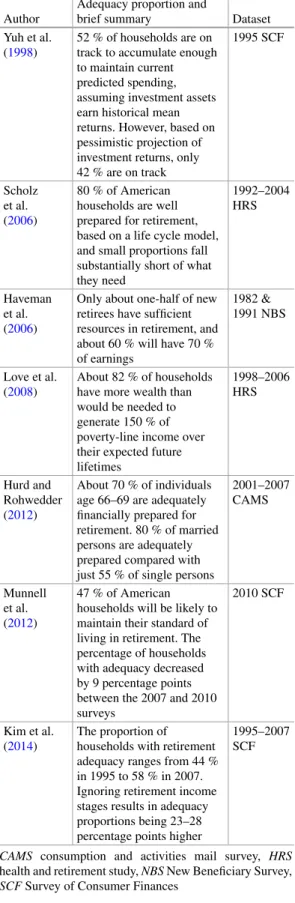

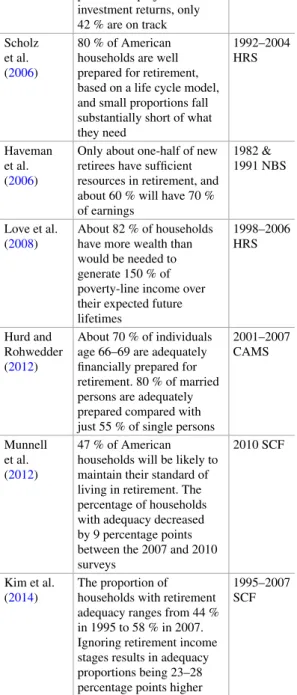

However, for 67-year-old GenX households in the top income quintile, retirement accounts make up a larger portion of income than Social Security. Do newly retired workers in the United States have enough resources to maintain their well-being?

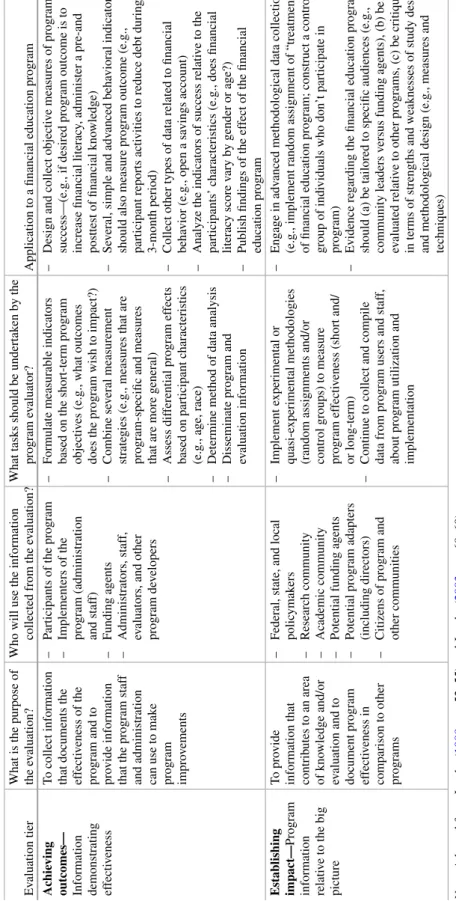

Education Using a Framework for Evaluation

Financial literacy and the effectiveness of financial education and counseling: a literature review (WP, 07-03). The financial returns of low-income homeownership (Joint Center for Housing Studies Working Paper W05-9).

Challenges at the Intersection of Business and Family

Families and businesses depend on each other's survival and success in the family business. Disruptions in the business can adversely affect the stability of the family (Haynes et al., 1999. Other researchers, such as the Family Business Group, have used various criteria to define a family household and family business.

The importance of the family for family business success Family and business economic/sociological/psychological factors merge at the intersection between family and business. Although business financial concerns seem to dominate any discussion of household financial health, it is the interplay between family and business resources that affects family business performance. The intersection of family and business is where relational tensions often exist, and appropriate coping strategies are needed by both the family and the business to prevent these tensions from negatively affecting the family business.

Many family members work in the firm and transport human capital from the family to the firm to promote business productivity. In SFBT, sustainability is the result of the overlap between what the household and the firm achieved during the current year (Danes et al., 2008a). SFBT recognizes that the firm is part of a larger system by placing the family business within its community context (Danes et al., 2008a).

One of the family attitudes that is often passed on in the company through the family employees is responsibility to the community. The success of the family business depends on whether the business is managed in harmony with the culture of the local community (Astrachan, 1988; Niehm, Swinney, & Miller, 2008). The SFBT provides the conceptual guidance for discussing financial intermingling and interpersonal relationships in the family business.

In the previous sections of this chapter, the principles of the SFBT and blending at the interface of the family business have been described. To further elucidate marital property, the definition of family property is used by Danes et al. The full utilization of the SFBT and the analysis of the survival and success of family businesses requires comprehensive information about the health of both the family and Company.