Despite several studies that have previously examined the impact of the pandemic on SMEs in Indonesia, there are still gaps in the existing literature that need to be filled and which also highlight the contributions of this study. In dealing with the global financial crisis, not all SME sectors bore the brunt of the crisis. Meanwhile, in developing Asia, SMEs suffered from a decline in sales revenue and a reduction in the number of workers during the first few months of the pandemic (Sonobe et al. 2021).

Many Indonesian workers were laid off, especially in the first year of the pandemic. A joint study by UNDP & LPEM FEB UI (2020) found that more than 45% of MSMEs surveyed had difficulties in sourcing raw materials and distributing their products due to the pandemic. Regarding the response of MSMEs to government programs, 40% of respondents indicated that they received government support and claimed that the support was beneficial to their business (UNIDO 2021).

This shows that it facilitates MSMEs in receiving incentives from the government, increasing the quality of service provided by the government program. An incomplete database of existing MSMEs is also becoming a problem in the disbursement of the incentives in Indonesia. MSMEs' internal strategy to cope with the impact of the pandemic may differ depending on the country, business sector and region in which they operate.

This is due to their greater flexibility in adapting their business models to changing consumer demand compared to larger companies.

Data Analysis Methods

Result and Discussion

MSMEs’ Initiatives to Cope with the Pandemic

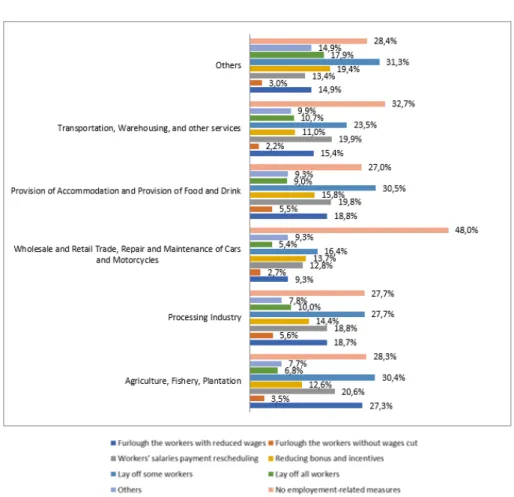

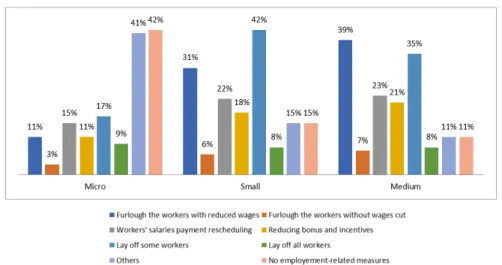

- Employment-related Strategy

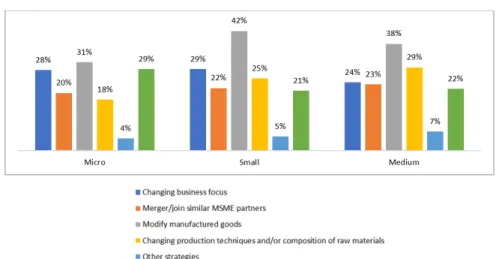

- Production Strategy

- Financial Strategy

- Marketing Strategy

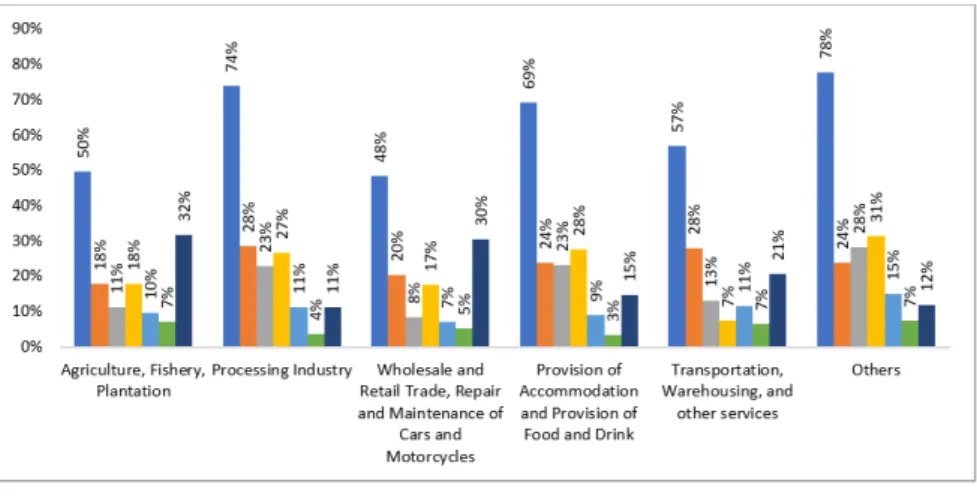

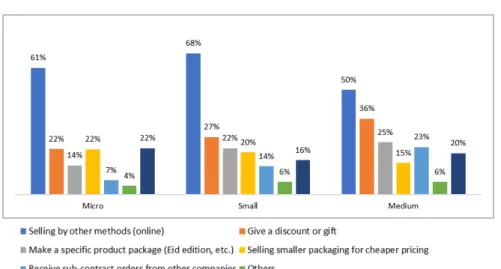

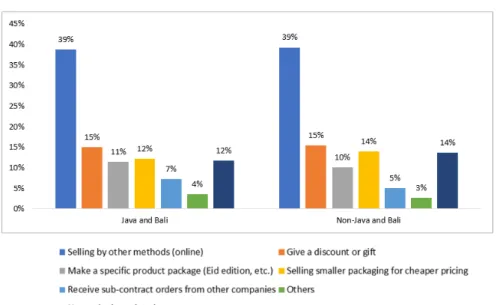

Regardless of firm size, the three most dominant strategies were reported, including reducing the costs of utilities such as electricity, gas, water and communication, followed by reducing transport costs and seeking new loans, respectively (Figure 4a) . These three strategies were also the most chosen by MSMEs across business sectors (Figure 4b), gender of owners (Figure 4c) and location (Java-Bali and rest of Indonesia). However, the third coping strategy for SMEs was to create a specific package for a particular occasion (eg, a national holiday).

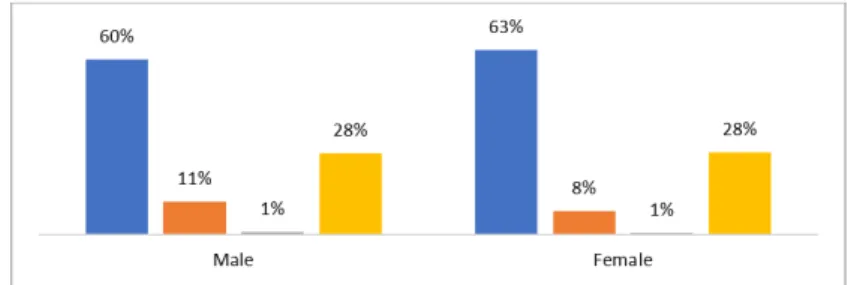

In the eyes of the business community, using information technology to sell the product was also the main strategy to face MSMEs. The second strategy reported was to provide discounts or gifts, except for those in the lodging and food supply who chose instead to repackage. However, marketing-related coping strategy did not differ significantly by region and gender of owners.

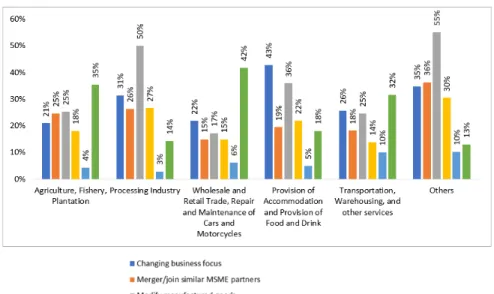

Recovery Path and Business Transformation

- Economic Recovery Sentiment

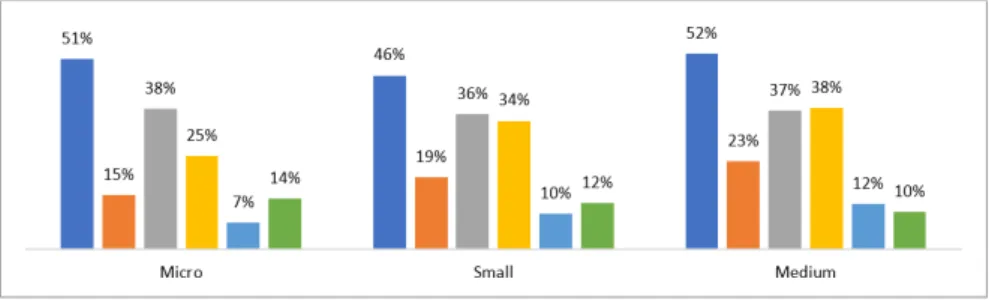

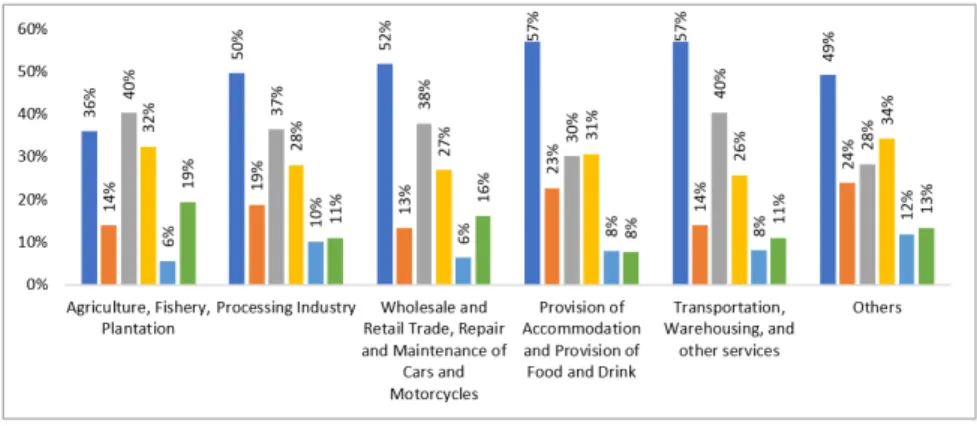

- Production Method Plans during Recovery

- Plans to Access Working Capital during the Recovery Period

- Marketing Plan during Recovery

- Plans to Conduct Other Businesses during the Recovery Period

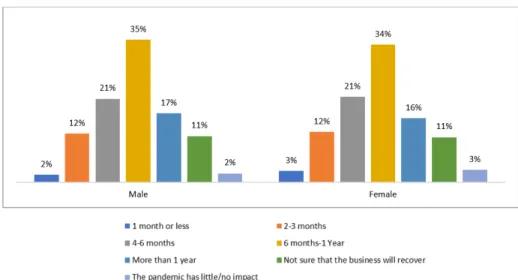

A significant proportion of respondents were more optimistic as they expected the economy to recover within 4-6 months of the survey, and this was evident across genders, regions and business sectors, with the exception of medium-sized companies and companies operating in the primary and logistics sector which showed that a significant proportion of respondents predicted that the recovery would take more than a year. At an enterprise scale, MSMEs generally plan to adapt their products, for example by making smaller sizes or packaging or removing certain features from the products, to adapt to changing input costs and consumer incomes as a result of the pandemic. However, the choice of production strategy did not differ significantly between the sex and location of the owners.

The largest shortfall in working capital was reported by MSMEs in the primary sector, as seen by the corporate sector. On a company scale, the larger the company, the greater the chance that it will gain access to the fund through banks and fellow entrepreneurs. By industry sector and by gender, banks were also the top source of funding planned by.

Regardless of company size, industry, region, and gender of owners, most MSMEs planned to use free social media as the primary means of marketing their products. By company size, the larger the company, the more likely it is to plan to use paid social media or participate in e-commerce programs offered by state-owned enterprises (SoEs) and large private companies. However, it is worth noting that there was still a significant portion of MSMEs across all scale and enterprise sectors that still lacked a plan to revamp their marketing strategy.

Finally, the survey also asked how MSMEs implemented the health protocol in their production facilities and whether they would maintain this practice during the recovery period.

Discussion and Implications

First, subsidies or delays in payment of utility costs (electricity and clean water) may be provided, as the results show that most MSMEs tried to reduce expenses during the pandemic. This can be done through wage subsidies, preceded by the identification of workers, using cross-institutional data. Second, MSMEs can be helped by relaxing regulations, especially in relation to business licenses and product marketing permits.

Support can be provided, for example, in the form of export financing, insurance and guarantees for companies wishing to expand into the international market. In the medium term and later, when the period of economic recovery will begin, it is still necessary to provide support to MSMEs so that the development of MSMEs returns to or at least close to the expected track in the national medium-term plan (RPJMN). First, for MSMEs, access to financial markets should be increased, one of which is banking services. Familiarity of MSME workers and managers with online training during the pandemic will facilitate a large-scale training process for MSMEs throughout Indonesia.

This can be done by encouraging MSMEs to learn from others who have weathered the pandemic. For micro-scale businesses, support can be focused on the use of social media for marketing, subsidies for internet quotas and subsidies for shipping costs, requirements for access to capital, business licenses and product distribution licenses. The study shows that MSMEs can be found in various economic sectors such as manufacturing, trading, marine, agriculture, forestry, financial services, transport services, etc.

The research shows differences in MSMEs' strategies for dealing with the pandemic across regions in Indonesia; therefore, their growth is also under protection and responsibility. Therefore, capacity building of MSMEs needs to be accelerated to make the use of online marketplaces more widespread and sustainable. Fourth, although marketing and payments can be done digitally, the activities of delivering goods must still be physical.

The survey result shows that product distribution and access to inputs were among the most complex challenges for MSMEs during the pandemic. The synergy between SoEs or collaboration between SoEs and private sectors can be an alternative business model to improve logistics for MSMEs. The synergy between with SoEs can be pursued by utilizing available spaces in public facilities such as airports, rest stops, ports and bus terminals as showrooms for MSME's products.

Conclusion

The Impact of COVID-19 on Small and Medium-Sized Enterprises in Armenia: Evidence from a Labor Force Survey. International Small Business Review, 4 (2), e298. Innovation as a recovery strategy for SMEs in developing economies during the COVID-19 pandemic. Research in International Business and Finance. The impact of strategic competitive innovation on the financial performance of SMEs during the period of the COVID-19 pandemic. Competition Review: An International Business Journal.

How did Tokopedia help MSME economic recovery during the Covid-19 pandemic? Sebelas Maret Business Review. Key findings of the ILO SCORE Indonesia COVID-19 enterprise survey.ILO Research Brief May 2020. European SMEs amid the COVID-19 crisis: assessing the impact and policy responses.Journal of Industrial and Business Economics.

Dukungan dan Bantuan Bisnis Pemerintah Malaysia untuk Usaha Kecil dan Menengah: Kasus Krisis Pandemi COVID-19. Faktor-faktor yang mempengaruhi keputusan UMKM untuk mengikuti relaksasi pajak di masa pandemi Covid-19. Jurnal Akuntansi. Respon kebijakan UKM dan kewirausahaan selama satu tahun terhadap COVID-19: Pembelajaran untuk "membangun kembali dengan lebih baik": respons kebijakan OECD terhadap virus corona (COVID-19).

Penutupan ekonomi makro dan UKM: dampak pandemi COVID-19 di Spanyol. Ekonomi Usaha Kecil. Optimalisasi Sektor Unggulan Pemulihan Ekonomi Kota Surabaya Pasca Pandemi Covid-19 Dinamika Tata Kelola: Jurnal Ilmu Administrasi Negara. Efektivitas kebijakan pemerintah Rusia untuk mendukung usaha kecil dan menengah dalam pandemi COVID-19. Jurnal Inovasi Terbuka: Teknologi, Pasar, dan Kompleksitas, 6(4), 160.

Economic Impact of Covid-19 on the Micro, Small and Medium Enterprise (MSME) Sector in Batticaloa District, Sri Lanka. Ministry of Labor Annual Research Journal 2020 [Covid-19: labor issues and responses] (pp. 27-41) . Impact of the COVID-19 pandemic on micro, small and medium enterprises operating in Pakistan. Globalization Research, 2, 100018. Impacts of the Covid-19 pandemic on micro, small and medium-sized enterprises in Asia and their digitization responses.