Think of customer loyalty as the air that successful brands must breathe to survive. The techniques and approaches in this book represent the pinnacle of customer loyalty measurement – making it a must-read.” Predicting Marketing Success : New Ways to Measure Customer Loyalty and Attract Consumers to Your Brand / Robert Passikoff.

Robert Passikoff pioneered a method to help marketers create an effective differentiation strategy based on customer loyalty research. This requires building customer loyalty metrics into any research and capturing real emotional perceptions and deep brand insights—techniques pioneered by Robert and described in this book. Understanding and applying a new generation of customer loyalty metrics will help you successfully differentiate your brand.

Our loyal customers, whose faith and trust have given us a light leap in the development of the postmodern model of customer loyalty engagement and its applications. My goal is to show that modern customer loyalty metrics are the most effective way to predict success, customer engagement, and profitability.

And that brings us to the last word of the new marketing triumvirate: customer loyalty. There are 181 locations within a five-mile radius of Brand Keys' New York City offices. Lambertville Retail Company: Implemented a customer loyalty program, increased customer engagement and increased category sales by 25 percent.

And the success stories of companies that rely on customer loyalty and higher levels of engagement go on and on. Customer loyalty has always been desired, but in the past it was not as critical as it is today. Modern customer loyalty measurement techniques—those discussed in this book—provide predictive measures of category direction and velocity and customer value.

Most people understand the need to solve these problems, but we have done something about it, and that is the reason for this book. You just have to keep your eyes on the real ball – in this case, customer loyalty.

Two books have recently received a lot of attention in the marketing world (and elsewhere): The Tipping Point and Blink, both by Malcolm Gladwell (New York: Little Brown and Company, 2005). What if you knew what information about a product, service or brand consumers should keep. I mean, if you had answers to these questions, you would really have an edge over the competition.

The category changed – reached a tipping point, if you will – and customer values and expectations changed, and the company has responded admirably. You can't quite say when it happened or articulate it, but the change is there. There is the temptation to feel, perhaps even convey, a hint of conceit when you know you have the answer to what fails a fluttering brand when loyalty is in crisis.

When you have the numbers in front of you, when you know the direction and speed of customer loyalty with near 100% accuracy, it's hard not to feel like the smartest person in the room, or at least the one with the information that will have the biggest positive impact on business strategy. It's a nice feeling to be in that position, to have the kind of confidence that comes with really valuable and reliable information to guide your brand.

High levels of general awareness and consumers' ability to remember your name, combined with low levels of loyalty, make you a "category holder," a classification just steps away from being a commodity—the Acme machine of the century. twenty one . And instead of doing the kind of research that could identify values and expectations that GM could engage consumers on and profitably capitalize on, they relied on the "same old, same old" approach of the last century. . Here's a test of the effectiveness of promotion: Call 10 of your friends and ask, "Do you remember when Oprah gave everyone in the audience a car?".

All of this was oblivious to the fact that consumers didn't think badly of GM cars in the first place. The information allows you to reverse-engineer the valuable loyalty metrics you need by starting with a checklist of the questions you want answered about your brand and your customers. But, even done well, they still only provide 30 percent of the insights and direction you need to succeed in today's market.

This is because some of the most interesting, progressive and challenging questions I get come not only from clients, but also from journalists and analysts who do. Introduction 13The time (and the obligation) to ask what is if and report fearlessly.

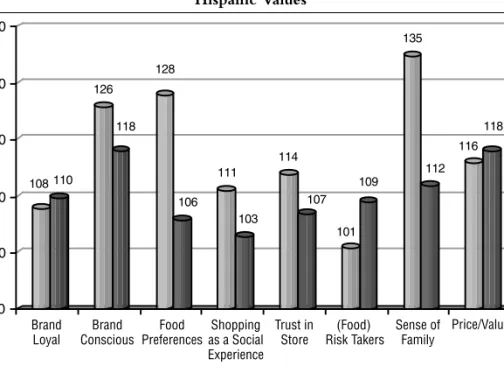

The height of the bars—the indices—indicate the level of expectation that consumers have for each of the drivers (see Figure 1.1). A higher index for your brand is better than a lower index (some things in research never change), and a brand's equity (ie, its strength in the category) is judged by its ability to meet or exceed the expectations that consumers hold for drivers that define the "Ideal" category (ie, the theoretical criterion against which all offers are ultimately evaluated). Come and join us in the quest for the Holy Grail.” The soldier leans over the edge and shouts: "Go away, we already have one!".

Researchers take their particular observational data and, to use their popular and comforting phrase, "paint a picture of what's really going on." The problem here is that results inevitably vary from observer to observer. We also need to understand that identifying the target group, developing a new product, creating advertisements and finally getting the consumer to buy the product depends not only on the content of the product itself, but also on the placement of the product. in the consumer's life - the meaning it has for the consumer. We hypothesize that customer connection (i.e., the theoretical framework for customer loyalty and commitment) is key to a successful new product launch and brand success, in general.

The order of importance of the category drivers (read from left to right) and customer expectations (expressed as a driver index or height of the bars) appears in Figure 2.1. If it resonated with any e-values at all, it was found in the “Good Prices/Value Added” driver—the one driver where Barnesandnoble.com was actually competitive with Amazon.com—which was only the third most important driver. .

If you make that last statement to a marketing or brand team, most people in the room will nod in agreement. From the analysis of brand keys or the result of traditional statistical analysis, you can now name the drivers. The first is understanding the expectations consumers have for each of the category leaders.

According to findings from the Brand Keys Customer Loyalty Index, Hispanics are more likely to purchase brands that make them feel valued as customers. But if you include customer loyalty metrics in the vetting process, you can actually configure your groups with people who really and truly see the category or brand the same way. Brand ratings on eight category attribute statements on a seven-point rating scale (averaged to give a total brand rating).

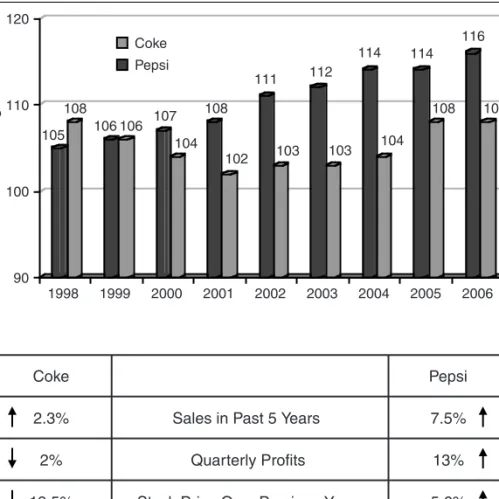

In 1997, Interbrand rated IBM as one of the five most valuable brands in the world. They selected 10 of the 35 categories we include in the Brand Keys Customer Loyalty Index (their choice, not ours) and ran correlations with our loyalty scale. KeySpan's brand strength, based on a weighted average of the four loyalty driver categories, was 112.

Each component of the interaction must be subjected to the litmus of loyalty to see if there is harmony between the brand and the show. Further complicating the issue is that in many categories, the order of importance of brand loyalty drivers is changing over time. Over the two-year period (from 2004 to 2006), in 7 out of 29 product and service categories (24 percent) there were no changes in the order of importance of the four main drivers of loyalty.

Proven drivers of customer loyalty 169 figures on the state of the economy, growth, jobs and inflation. The fact that you have been around for a long time or that many people recognize your name does not make you a brand – in the twenty-first century sense of the word. Goods: products and services that are so basic that they are indistinguishable in the minds of consumers.