Operation refers to the provision of some or all of the services related to the use of the asset. Traditionally, the private party has been a special purpose created specifically for the purpose of the project.

INTRODUCTION

For example, the Victorian government in Australia took back its Deer Park women's prison following poor performance by the private operator. One of the main aims of this volume is to analyze what makes a successful partnership and develop a framework that will help achieve this outcome.

THE NATURE OF A PPP

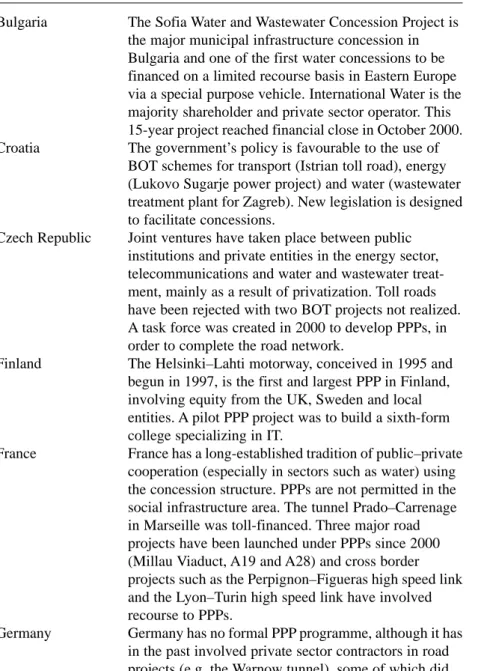

Germany Germany has no formal PPP programme, although in the past it has involved private sector contractors in road projects (eg the Warnow Tunnel), some of which involved risk transfer to the private sector under a. All this is a consequence of the incentives built into the payment for services mechanism and the risk transfer in the PPP model.

TYPES OF PPPS

Several of the former French colonies in Africa (Francophone African countries) have adopted the affermage system, where a municipality builds a water plant and then contracts with a private company to operate and maintain the plant (Rondinelli, 2002). Additionally, in terms of the 'alphabet soup' of acronyms, there are also BLT (Build, Lease, Transfer), BLTM (Build, Lease, Transfer, Maintain), BTO (Build, Transfer, Operate), BOOR (Build, Own, Operate, Remove ), BOOT (Build, Own, Operate, Transfer), LROT (Lease, Renovate, Operate, Transfer), DBFO (Design, Build, Finance, Operate), DCMF (Design, Construct, Manage, Finance) and DBFOM (Design, Build, Finance, Operate, Manage).

GENERAL CHARACTERISTICS OF PPPS

In short, what are the characteristics that can give us the right to say that any arrangement is part of the PPP family. Underpinning the partnership will be a framework contract, which sets out the 'rules of the game' and offers the partners some certainty.

SPECIFIC CHARACTERISTICS

QUESTIONS ABOUT PPPS

In the second half of the nineteenth century, France made extensive use of concessions to finance the development of its infrastructure. Changing attitudes towards infrastructure have also played a role, raising another question: what is the role of the private sector in infrastructure.

NOTES

THE NATURE OF INFRASTRUCTURE

Soft social infrastructure takes the form of the social security system, a range of community services and environmental protection agencies. Economic infrastructure also represents about 70 percent of the infrastructure stock in Australia by value.

THE EFFECTS OF INFRASTRUCTURE

In effect, the investment lowers the 'price' and this reduction in the price of infrastructure services will have two effects in the short term. As in the short run, the change in transportation costs must be significant to matter.

PUBLIC CHARACTER OF INFRASTRUCTURE

Two of the characteristics, natural monopoly and the dominance of sunk costs, simply indicate that competitive supply is unlikely to arise. Finally, the strategic importance of the service to the economy means that governments have traditionally been unwilling to rely on provision by the competing private sector.

THE COMMERCIALISM OF INFRASTRUCTURE

Tolls can be based on the likely damage to the roads by charging a higher toll on heavy trucks. To reduce congestion, tolls could be adjusted according to the time of day or week.

PRIVATE INVOLVEMENT IN INFRASTRUCTURE

Agency problems, which arise from the divergence between ownership and control of assets, are easier to deal with in the private sector through managerial incentives and market disciplines. Transferring risk to the private sector gives private entities an incentive to maximize efficiency.

TWO PRIVATE TOLL ROADS

City Link is one of the first urban toll roads developed as a BOOT (build-own-operate-transfer) project. It is this recent resurgence of private sector involvement in infrastructure that is the subject of the remainder of this chapter.

HISTORY

By the late 1880s, most of the British road system had been taken back into public ownership. A similar pattern of enthusiastic growth followed by competitive pressure is evident in the history of the London Underground.

FRENCH CONCESSION APPROACH 7

In the second half of the nineteenth century, France made extensive use of concession schemes to finance its infrastructure networks. Most of these projects were realized in the form of long-term concession contracts, whereby the infrastructure properties had to return to the public bodies at the end of the contract.

RECENT DEVELOPMENTS

The efficiency of the infrastructure can be affected by the time it takes to launch new programs. One is to refine the private finance model and develop project finance techniques to 'engineer' finance to fit PPP structures.

CHANGING MARKET FOR PUBLIC SERVICES

Except in the case of a BOO where ownership remains with the private sector practically forever, at the end of a concession the public body usually assumes (or resumes) responsibility for the ownership, operation and management of the asset. The first, broader definition includes all reductions in regulatory and spending activity of the state.

THE PRIVATE FINANCING MODEL

Shadow fees involve payment per vehicle using one kilometer of the project road in accordance with a price structure. After this period, the ownership of the facility is transferred free of charge to the sponsoring government (under the BOT scenario) or the transfer can be made right after the completion of construction (under the BTO scenario).

PARTNERING

But for this to happen, an appropriate framework is needed to initiate and implement changes within the organizational structure of the partnership. Also, those on the lower rungs of the public sector ladder may not share the enthusiasm for it.

CONCLUDING REMARKS

Thus, the lines were built to follow underground the course of the streets and roads above. Four of the seven companies failed to raise capital at the first attempt and were either taken over by other interests or needed financial support from others.

WHAT’S WRONG WITH CONVENTIONAL PROCUREMENT?

An earlier study by Mackie and Preston (1998) into the transport sector identified no fewer than 21 sources of error and bias in transport projects. In the Mott MacDonald report, by far the most important factor identified was the inadequacy of the business case.

ARE PPPS THE ANSWER?

In contrast, 11 of the 50 projects examined by Mott MacDonald were implemented under the UK PPP/PFI models. These results are attributed in the report to the better risk allocation in PPP/PFI projects and the high level of care required to establish the business case.

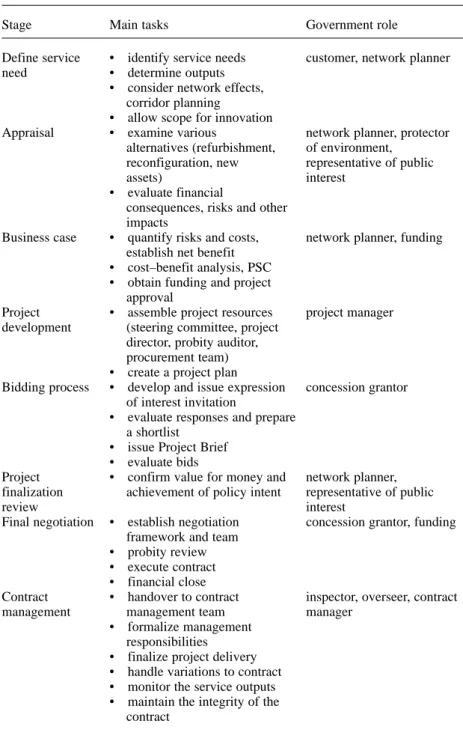

THE CHANGED ROLE OF GOVERNMENT UNDER PPPS

As managers of contractual relationships, public authorities approve contracts (government as grantor), assess infrastructure needs (government as network planner), provide support facilities (e.g. land) and pay for services (government funding), define outcomes and performance standards. (government as client), carry out detailed procurement planning (government as project manager), ensure that facilities are constructed, operated and maintained satisfactorily (government as inspector), require compliance with standards and specifications (government as supervisor), monitor operations and financial viability (government as contract manager), assess environmental impacts (government as guardian of the environment) and ensure community access and achieve social policy goals (government as representative of the public interest). Assessment • examine the various interests of network planners, protectors (renovation, environments, . reconfiguration, new representative of public . resources).

ADVANTAGES OF PPPS

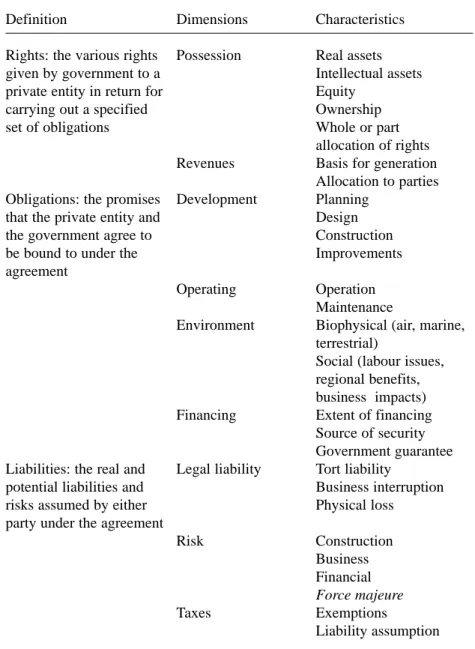

As a consequence of the 'discipline' on the private capital markets, there is pressure to make construction and operation more efficient and to complete projects at the lowest possible cost and in the shortest possible time. The second right refers to revenues when the public entity gives the private body access to revenues during the operational phase of the contract.

THE SCOPE OF PPPS

Using this framework, Abdel-Aziz and Russell examine a number of projects in Britain, Canada and the United States. These issues are discussed in the next chapter, where we examine both the 'traditional' approach to structuring PPPs and the newer 'financial institution-led' model.

WHEN SHOULD PPPS BE USED?

For all other aspects of the service and supporting physical infrastructure, what is the project model that provides the best value for money. the value for money question); and. Nevertheless, one merit of a partnership agenda is to bring two dimensions of the core service issue into focus.

WHAT IS A CORE GOVERNMENT SERVICE?

Furthermore, core services are usually provided in a context that does not exclude the participation of private parties. All of these features, including the courthouse itself, can be designed and executed by private operators.

THE CASE OF HOSPITALS

Sale of public hospital as Purchasing facility and continue to operate it as Pays operator for clinical services and. A case study is provided later in this chapter of the design, construction, finance and facilities management of a new public hospital in Victoria.

THE CASE OF PRISONS

The hallmark of this approach is the transfer of all prison services to the private sector and the management of prison operations by a private company. The specific prison services to be provided by the private sector included industry, education, catering (including staff facilities), medicine, maintenance, work and vocational training and transport.

PPP DELIVERY MODELS

Above all, in all cases, land and property are required to provide a PPP service, and a private individual can often gain value through imaginative land development that integrates with and complements the project. Underwriting means a deliberate decision by the government to assume or share a risk that would otherwise lie at the doorstep of a private party.

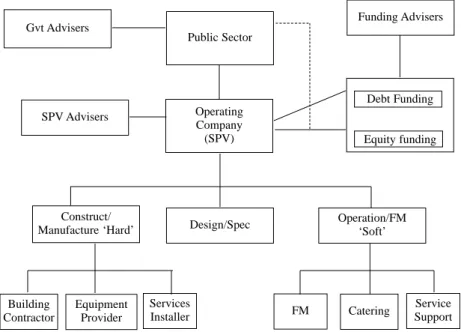

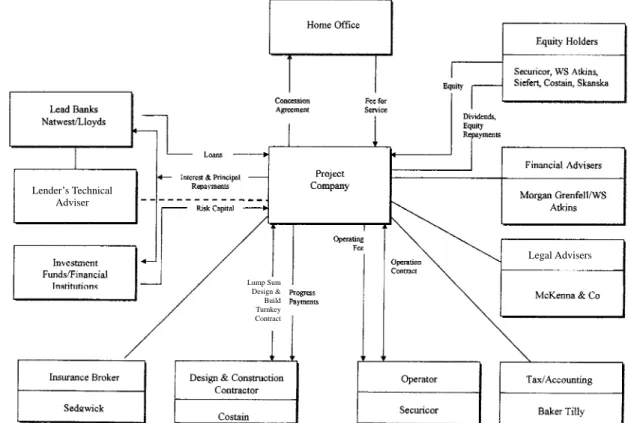

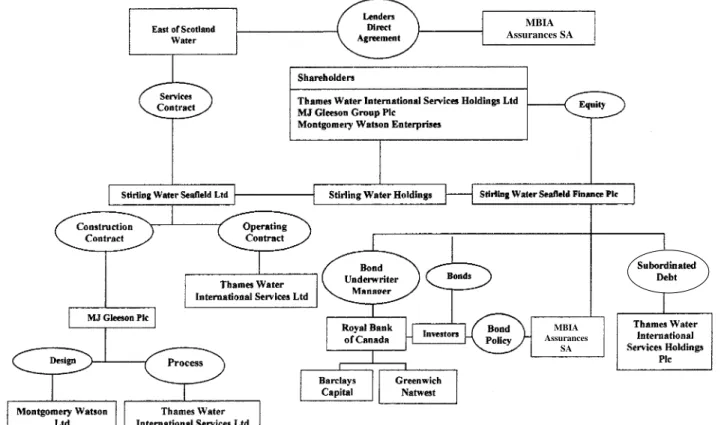

THE ORGANIZATION OF PPPS

However, it is the investment bank that takes 100 percent of its equity in the SPV and guarantees the capital market issues and all other elements of the contract. Meanwhile, given the difference between the two models, we now describe the role of the various participants.5.

THE ROLE OF PARTICIPANTS

Equity participation in the SPV is a way to align the interests of those involved in project delivery with policy objectives and long-term partnership with the government. The obligations and responsibilities of the project company to the public procurer are distributed through specialized subcontractors, who in the traditional model are often equity investors in the SPV.

CASE STUDIES

The efficiency of the design solution for the building also contributed to the project's cost effectiveness. 21 of the institutions, the construction and facility management (accommodation and catering, health, work, vocational training and maintenance) were provided by the private sector.

THE BUSINESS CASE

This chapter examines a number of issues regarding the value for money test and the public interest test for PPPs. Ensuring that taxpayers get value for money from an infrastructure project is of the essence in any procurement policy.

BUNDLING

One is that a public authority must play the role of the concessionaire in BOT projects. In our view, the question of the incentive structure is central to the issue of bundling.

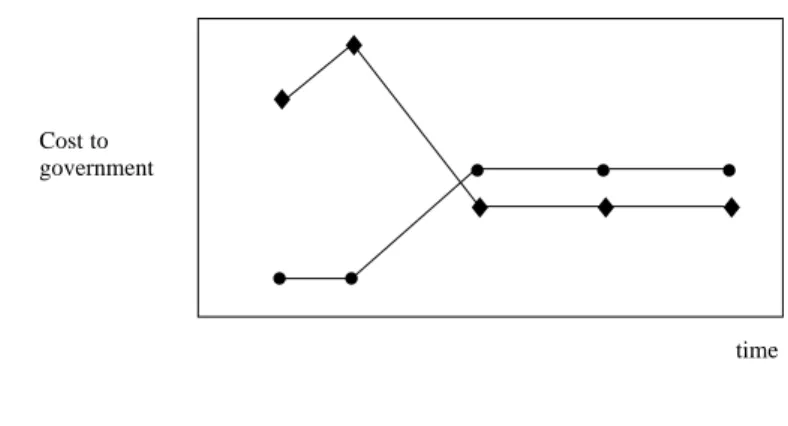

COSTS OF FINANCE

What differs is that the private provision of financing; that is, under the PFI/PPP route, risk is explicitly built into the cost of funds. If this were to happen, the real cost of government borrowing would be the same as that of the private sector if the underlying risk of the projects were the same.

VALUE FOR MONEY

The basic or raw cost is the cost of providing the services required by the public sector. The cost of retained risks is usually the same for a PSC and a private supplier.

THE DISCOUNT RATE ISSUE

On the other hand, if the risk-free discount rate method is used, it is necessary for risks in the cash flow forecasts to be adjusted using the certainty-equivalence method (or "the cost of variability in outcomes" as defined in the Green Book). This cash flow represents the cost of building the facility if it is done in the public sector.

EVIDENCE OF VALUE FOR MONEY

By comparison, the average weighted average cost of capital is estimated at 5.3 percent per year. The 'spread', the amount by which the average internal rate of return of a project exceeds the cost of capital, is therefore 2.4 percent per year.

RISK AND UNCERTAINTY

Second, under the PFI's 25-30 year contracts, bidders can price their target yields above a fixed rate, such as the swap rate, rather than the government bond rate, as assumed in the conventional CAPM. Sensitivity analysis and Monte Carlo analysis are discussed in the next chapter, and both are standard tools for dealing with risk (rather than 'real' uncertainty).

ACCOUNTABILITY

Whether a party has 'an asset of structure or property' will depend on whether it has access to the benefits and exposure to risks normally associated with ownership of that property. The more integral the asset is to the provision of the service, the more likely the asset is not separable.

THE PUBLIC INTEREST

All bidders must be treated fairly and decisions must be made in a transparent manner so that they can be understood and justified later. People must be treated fairly and equitably, and the government has a special duty to care for those citizens who are disadvantaged by personal and economic circumstances.

CONDITIONS FOR SUCCESSFUL PPPS

Arrangements must provide incentives for the private sector to take risks, and the contract must spell out responsibilities and roles in a clear and transparent manner if it is to be properly managed. Interaction is essential during the bidding process, and negotiations to complete the contract must be conducted with cooperation and patience.

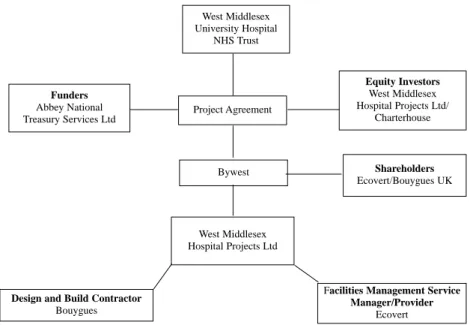

THE WEST MIDDLESEX UNIVERSITY HOSPITAL PROJECT 17

The pre-risk adjusted NPV of unitary payments for the project over 35 years is £123.8 million. Indeed, as the NAO noted, the attention paid by the Trust to dealing with

RISKS OF PPPS

Straight equity participation is generally low, only 5 per cent of the total funding (£4.95m out of £99m funding) in the case of the AV&S project. Knight believed that the main function of the 'entrepreneur' is to bear the brunt of uncertainty.

RISK ALLOCATION STRATEGIES

In the case of information technology services, the number of transactions can reflect the speed of service, which in turn is related to performance. If neither party is in a position of complete control, the allocation of risk must reflect how the private party 'prices' the risk and whether it is reasonable for the government to pay that price, given the likelihood of the risk occurring, the cost to of the government if it retains that risk and the ability of the government to mitigate any consequences if the risk materializes.

RISK ANALYSIS IN PRACTICE – A CASE STUDY