I thank them, as well as other faculty members, including Roger Noll and David Grether, for their time, patience, and fair evaluation of my work. Formal models of such "incentive signaling" have been found to make a strong implicit assumption about the outcome of the information transfer process; weakening this assumption has been shown to disrupt the ability of a wide class of incentive mechanisms to support equilibrium outcomes.

INTRODUCTION

By announcing the financial structure for the company (for example, entering into an agreement for a certain level of debt financing), management creates an idea among investors about the expected return of the company. Managers who know the state of the firm at time 0 issue a signal that is observed by investors.

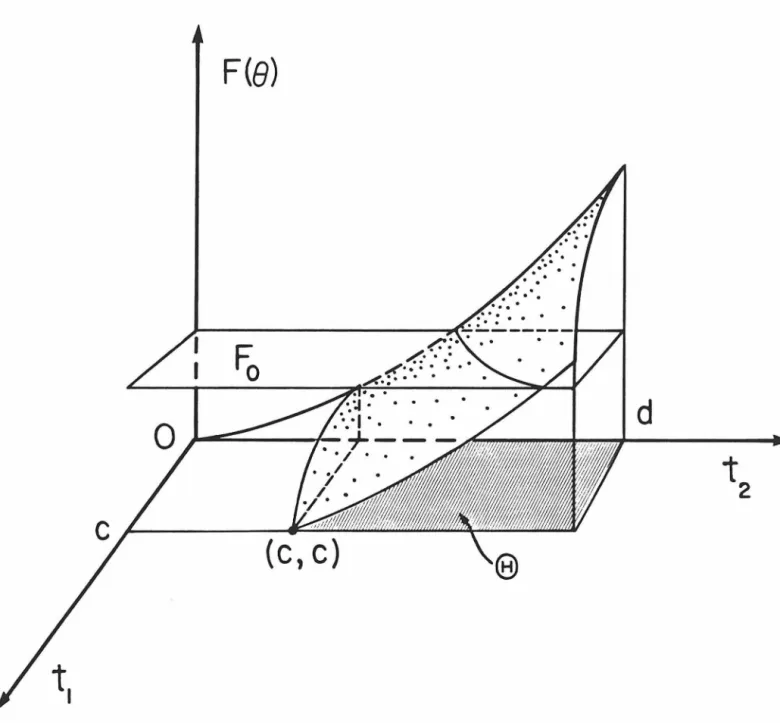

But by the definition of the state space, this condition holds only at a point in 9. The nature of the failure of equilibrium characterized by the theorem is best visualized with a specific example.

CONCLUSIONS

If a particular type of incentive contract is not stable in the presence of condensed information, others may be, and these equilibrium-supporting contracts may turn out to be testable. Therefore, the emphasis of the investigation turns to the problem of characterizing the properties of candidate condensed information signaling mechanisms. However, before the mid-nineteenth century, this form of organization was almost never seen in other areas of commerce.

34; • • For centuries, choosing a broker was one of the most important decisions a trader had to make. The institutions of fully alienable rights to residuals, limited liability, and the perpetual life of the underlying organization define the corporation. The evidence made three critical assumptions, from which the implication was that if any of the three were sufficiently weakened, a positive role for 'pure' finance might emerge.

The characteristic alluded to is the monotonic likelihood ratio property, which in the one-parameter incentive signal models helps ensure the monotonicity of the equilibrium signal in the firm's state parameter. Scott [1980], particularly Section I, is a compelling summary of the controversy in the regulation of disclosure. Bhattacharya [1980] notes that because shareholders are not subject to the same cost structure as managers in Ross's model, negative incentives may exist for shareholders to attempt to influence the signaling process.

INTRODUCTION

CHAPTER II

CHARACTERIZATION THEOREMS

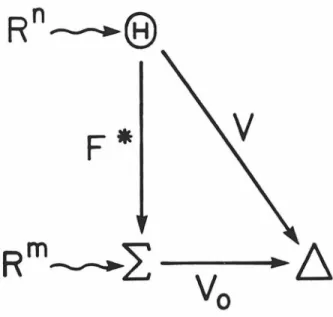

If we follow most of the existing literature, managers will be assumed to be risk-neutral reward maximizers. Necessary condition (11) is derived not to characterize the optimal management signal F • for a given incentive function, but to test for joint constraints on the C, V, and ~ functions necessary to support an equilibrium incentive structure. To derive the necessary conditions for pen-trivial C(a,x), the conditions giving positive or negative values of the term in brackets are derived and jointly negated.

If the state space of firms is specified, satisfying the constraint will in general place a limit on the admissible range of risk preferences of investors (their utility functions are of course already restricted to quadratic form). These constraints should be considered extremely troublesome, given how little they actually guarantee about the existence of a non-trivial function C(a,x).

CONCLUSIONS

However, by the same token, not all internal knowledge possessed by the firm can be disclosed to the market without destroying its proprietary value to the firm. One purpose of the model would be the derivation of the equilibrium bounds on a(c,e), which would scale the efficiency loss of risk bearing in the presence of condensed information transmission and imperfect monitoring. For an equilibrium supportive incentive plan, the investor's trade-off cuts between draining or too much of the firm's equity value in the form of monitoring costs versus giving managers too much leeway to misrepresent the firm's value.

A difficulty with equilibrium signaling-based agency models of the firm is the relative paucity of testable propositions that can be derived. But since the state and signal spaces are equidimensional, investors may be able to invert the equilibrium signaling correspondence and obtain an exhaustive copy of . Rubenstein [1973] provides a compact derivation of the general relationship between the aggregation of individual measurable utility functions and the concept of the "market price of risk."

34;Unproductive" means that here, unlike, for example, labor market signaling models, the signal itself does not contribute to the value of the asset. Consider an initial state value e0 of a firm and a configuration of the share of market residual that gives a) Note that in deriving the expression for Re, the quite reasonable assumption that the manager's incentive compensation is much less than the firm's debt obligation is used.

CHAPTER III

INTRODUCTION

Recently, additional contract terms such as warranties and security interests - which have an influence on the quality dimension of the consumer's purchase decision - have been introduced into the equilibrium search framework (Schwartz and Wilde . [1982b], [1983]). Some of the most far-reaching consumer product legislation is concerned with the provision of warranties. This essay deals with a leading theory on the function of consumer guarantees, the so-called signaling theory (after Spence in consumer product markets where search can be imperfect. guarantees as potential signals of product quality arise from a straightforward but vital observation: such as the intrinsic reliability of a product declines, it becomes relatively more expensive to justify the product against failure.

Therefore, if quality cannot be determined directly by consumers at the time of purchase, companies offering goods of different quality may see an incentive to try to differentiate themselves in the eyes of consumers by providing guarantees with terms that are more generous become as the reliability of the product increases. An important reason offered to explain the undramatic empirical verification of the signaling theory is the presence of imperfect search. In contrast, Schwartz and Wilde (1982b) described cases in which noncompetitive prices coincided with one.

Guarantees can be expected to have a signaling function only in markets for heterogeneous experience goods: goods whose intrinsic reliability or quality cannot be directly assessed by consumers at the time of purchase. Considering that markets for experience goods can be transformed into markets for search goods through regulations designed to require the disclosure of quality. Therefore, if the search function is not perfect, a competitive balance can be more easily achieved in markets where consumers do not know the product quality per product.

WARRANTY SIGNALING WITH PERFECT SEARCH

NH of firms produce high-quality goods (and H-type firms will be marked); NL produce little. Other than changing the firm's production schedule, the warranty program adds no new marginal costs. Each period, consumers enter the market and buy one unit or none of the two types of goods.

The welfare properties of the signal equilibrium arise from what can be determined about the consumer's welfare in the absence of guarantee signals. The resulting equilibrium is the imperfect search analogy to the “lemons” equilibrium (see Akerlof) and is extremely inefficient, as an entire class of consumers (in this case the h-types) gets none of the goods they prefer. Opening up the hardware market is relatively efficient: h-types get H-goods (albeit at the cost of a warranty), and (-types are indifferent to the change.

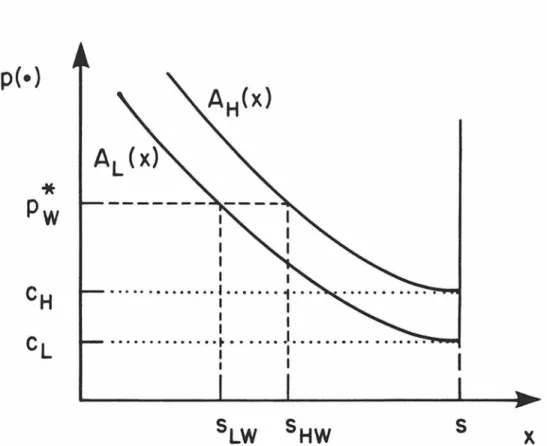

Proof Under the perfect purchase assumption, the zero-profit equilibrium will form at competitive prices for both types of goods. Before the entry of the L-type firm, the consumer-firm ratio in the H market was (Ah/NH) c sHW; after input the number of consumers of type h becomes Ah • c sHWNH + sLw· Note. To summarize this opening section: an analysis of the informative role of consumer guarantees requires little.

EQUILIBRIA WITH IMPERFECT SEARCH: COMPETITIVE

A key aspect of market equilibrium lies in the fact that the markets for both types of goods are interactive. If companies in a certain market try to take advantage of the presence of non-buyers and raise prices. The presence of these exchange prices8 is a limitation to the upward movement of prices; note that although some consumers buy.

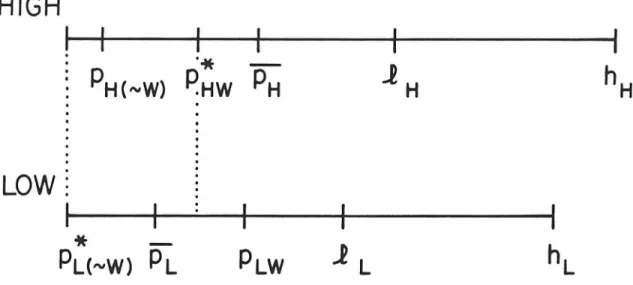

9 The hypothesized, derived, and defined characteristics of the two markets can best be summarized in a "map" such as Figure 3.2. The market price relationships follow from the definitions of the previous section and conditions (2a) and (2b) of Theorem 1. Note that although only two markets (high and low quality with consistent signals) are shown in Figure 3.2, there are actually two other initial markets ( where low quality goods are offered with warranties and high quality goods without). derived so that the market for consistent signals is dominated by competitive pricing while firms are locked out of markets for switching signals.

Three types of competitive market equilibria are possible:. i) a price PHW in the H market with the L market non-existent; (ii). Free entry markets such as those studied here cannot exist if so few consumers prefer a product of a given type that firms offering the good cannot break even.

HIGH

Now notice that the zero-profit equilibrium in the H market deters the entry of signal-switching entrants, even with the . The cost functions, capacity and prices of the firms in the two markets are identical to the. The same applies to prices up to !H<-w> in the H(-W) market condition (7) is reproduced.

Thus, the expected welfare of consumers of a given type in both worlds was the same. The common necessary and sufficient conditions for two-price competitive equilibria in both worlds are now just those. Se(hfL) = Ss(hfL), and the expression in parentheses is larger in the world of research than in the world of good experience under Assumption 1', it is found that Ws(h,1) - We(h,1) > 0, h-type nonbuyers are clearly better or in the search world.

In a world of good search, this happens with probability (n~)2• So the probability that a buyer encounters at least one company of type H is 1-(n~)2•. To see this, examine the necessary and sufficient conditions for a single-price equilibrium (H-good) in the search/equilibrium world settings. This means that closing the L(-w) market to enter the world of good experience requires a new constraint.

This is the only new constraint generated in the L(-w) market in the transition to an experience good environment. Therefore, the necessary balancing condition in the experience good market will not translate to the analogous condition in the search market.