At the heart of value-based management is the recognition of the need to generate a return on the capital committed to the activity commensurate with the risk involved. Establishing a minimum required return is a 'cost of capital' issue - the logic behind this calculation is discussed in Chapter 10. The jargon is explained and the reader is guided to choose the most appropriate financing mix for the company's circumstances.

WHAT IS THE FIRM’S OBJECTIVE?

Good financial management is essential for a company's survival and growth. Long-term maximization of shareholder returns is considered a higher goal. Directors must state in the financial statements how the principles of the Code have been applied.

INVESTING IN PROJECTS

STATE-OF-THE-ART PROJECT APPRAISAL TECHNIQUES

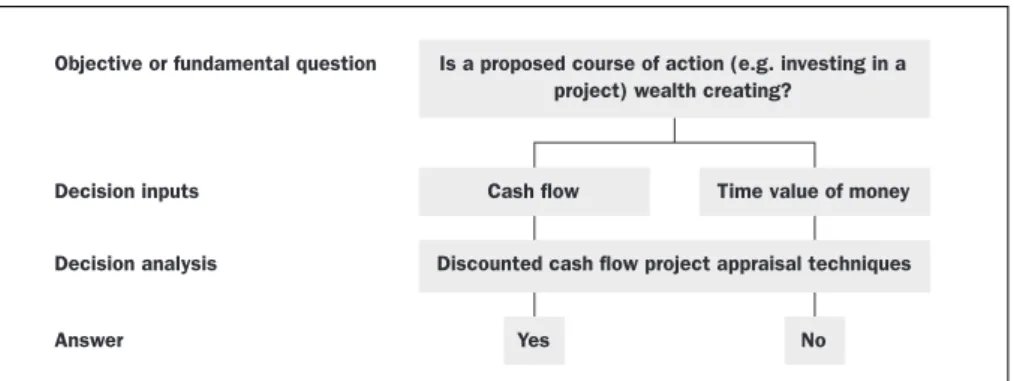

The return is generated by management using the financing provided to invest in real assets. It is essential to the health of the firm and the economic welfare of the financial providers that management use the best techniques available when analyzing which of all the possible investment opportunities will produce the best return.

CADBURY SCHWEPPES

In other words, the current value of the pound (at time zero) depends on when they are received. Another way to look at this problem is to calculate the net present value of the project. The last two calculations tell us that the interest rate equivalent to the present value of the cash flow is somewhere between 9 and 10 percent.

TRADITIONAL APPRAISAL TECHNIQUES

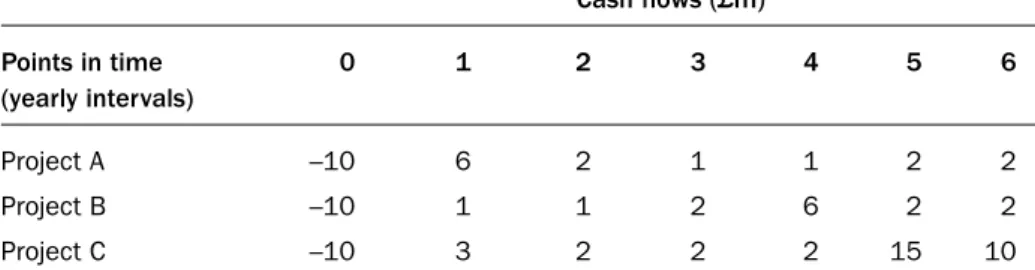

The accounting rate of return continues to lag but is still used in over 50 percent of large firms. Arnold and Hatzopoulos (2000) 'The theory practice gap in capital budgeting: evidence from the United Kingdom' Journal of Business Finance and Accounting, 27(5) and (6), June/July, p. In C's case it takes five years for cash inflows to accumulate to £10m.

In the case of Project B, the discounted cash inflows never reach the level of the cash outflows. In the world beyond the simplifications required in academic exercises, there is much uncertainty about future cash flows. The accounting rate of return (ARR) method may be known to readers by other names, such as return on capital employed (ROCE) or return on investment (ROI).

ARR is the ratio between the accounting profit and the investment in the project, expressed as a percentage. The most important criticism of the accounting rate of return is that it does not take into account the time value of money. IRR can be calculated without knowing the required rate of return. A decision using IRR involves two separate stages.

In contrast, it is not possible to calculate the NPV without knowing the required rate of return.

INVESTMENT DECISION-MAKING IN COMPANIES

That is, both the project appraisal techniques and the entire process of creating and selecting proposals lead to the achievement of the organization's goals. The application of project assessment techniques should be seen only as one of the phases in the process of allocating resources in a company. Any capital allocation system must be seen in the light of the complexity of organizational life.

And over the next few years there will be a review of the entire project. The relationship between the proposed project and the company's strategic direction is very important. An examination of the quantifiable elements in isolation will lead to a rejection of the project to purchase the Z200.

The loss elsewhere in the organization becomes a relevant cash flow in the assessment of the new project, i.e. the new store. In the soft drink business, the introduction of a new brand can reduce the sales of the older brands. These are costs that are not directly related to any part of the firm or one project.

Many of the general overhead costs can be incurred whether or not the project takes place.

ALLOWING FOR RISK IN PROJECT APPRAISAL

Multiply the number generated in stage 2 by the probability of that outcome occurring. In the case of the first outcome of Project 3 we

The next stage is to obtain the standard deviation, σ, by taking the square root of the variance. However, others in the class say that for the sake of slightly greater risk, Project 3 yields a significantly higher NPV and thus should be accepted. The Pentagon's board of directors must weigh the risk preferences of the company's owners and choose one project or the other.

In doing so, they may want to consider how this new project fits in with the rest of the company's projects. At the very least, probability analysis forces the decision maker to explicitly identify the type of outcomes and the basis on which they are estimated, and to express the level of confidence in the estimates. The business context can be an important variable in determining whether a particular project is too risky to take on, so a project should never be considered in isolation.

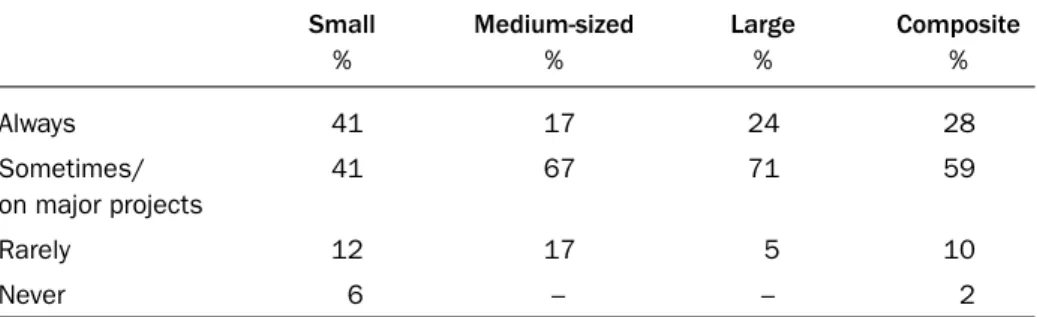

This trend has been encouraged by a greater awareness of the techniques and aided by the availability. Probability analysis is used more now than in the past, but few smaller firms use it on a regular basis. Greater realism and more information removes some of the fog that shrouds many capital investment decision-making processes.

However, this chapter has primarily focused on the technical/mathematical aspects of the assessment phase of the investment process sequence.

SHAREHOLDER VALUE

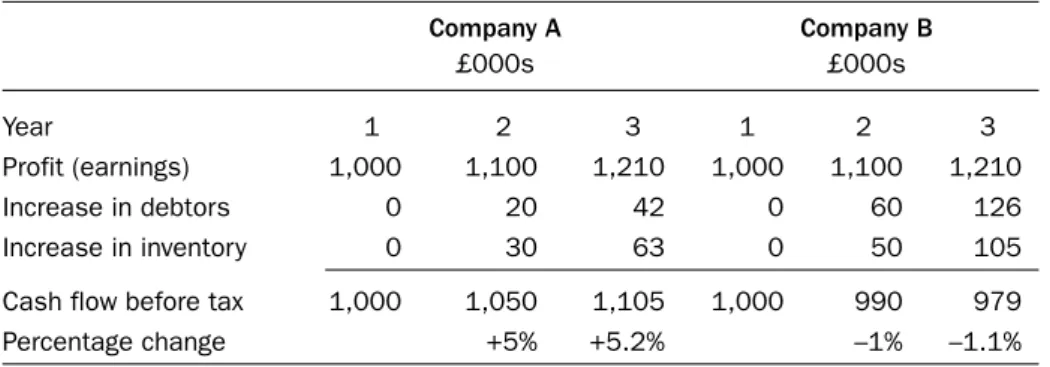

VALUE MANAGED VS EARNINGS MANAGED COMPANIES

In human resources, it is accepted that all organizations need an engaged workforce. It has been more difficult to make the same demands in light of increasing shareholder pressure. It is only in the past year that they have started to take shareholder value really seriously, says Mr Berger.

To our surprise, the management admitted that there are shareholders out there." The company announced a target rate of return on capital of 15 per cent for each of its operating divisions by 1998 and outlined plans to reduce its exposure to bulk shipping and sell £500m of property and dispose of Bovis. The thunderous answer is: it's easy to increase earnings per share just by holding on to ever-increasing amounts of money; what shareholders want is a return greater than the opportunity cost of capital (the time value of money) – the return available elsewhere for the same level of risk. Intelligent shareholders and analysts are primarily interested in the long-term cash flow returns on stocks.

At some point in the future (the planning horizon), each new investment will earn, on average, only a minimum acceptable rate of return. An alternative approach: the value of the company is equal to the initial investment in the company plus the present value of all the values generated annually. Despite the higher rate of return required in the toy division, it creates value (calculation of required rates of return is covered in Chapter 10).

The five actions available to increase value are shown in the value action pentagon (Figure 6.10).

VALUE THROUGH STRATEGY

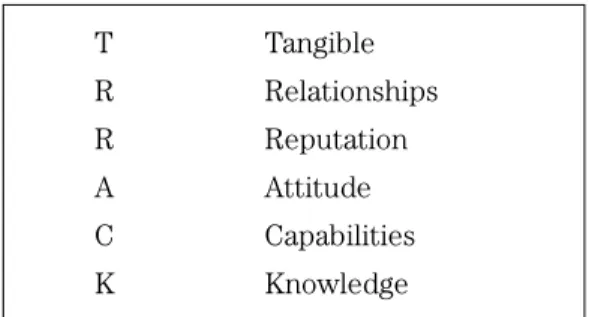

The economics of the market for the product(s) have a huge impact on the profitability of the company. Long-term competitive advantage may depend on the ability of the management team to. Therefore, the compliance, attitude, intelligence, knowledge and drive of managers in the organizational environment are a tremendous resource.

It's very profitable, yet it's been cutting prices every year for the past two decades - the price of beer has literally halved. Their contacts and knowledge of the inner workings of purchasing decisions, with political complications, can be very valuable. Performance is more than the sum of individual processes – the combination and coordination of individual processes can provide an outstanding resource.

Note: The size of the circle represents the proportion of the company's assets allocated to this SBU. A differentiation strategy – the uniqueness of the product/service offering provides the opportunity to charge a premium price. The overall structure of the organization must be appropriate for the market environment and designed to create value.

In terms of the value creation life cycle, this SBU would move from the maturity strategy plan to the growth plan (shown in Figure 7.8).

MEASURES OF VALUE CREATION

In Chapter 2, the value of an investment is described as the sum of the discounted cash flows (NPW). The cash flow figures at the bottom of the columns are sometimes referred to as 'free cash flow'. By examining the discounted cash flows, the SBU management and the firm's managing director can evaluate the value contribution of the SBU.

This is to illustrate how you can use discounted cash flow analysis to analyze the present value of future cash flows (not net present value) of an SBU etc. The market value of these adds to the value of the firm derived from operating free cash flow. The opportunity cost of pursuing the strategy is the value of the best foregone alternative.

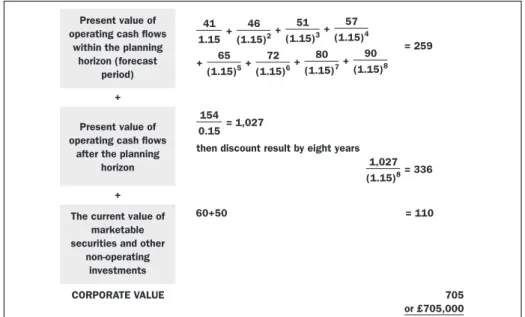

In the Gold plc example (see Table 8.1), the constituent elements of cash flow did not change in a regular pattern. Rappaport's enterprise value consists of three elements because it separates the discounted cash flow value of marketable securities (these are assets that are not needed in the operations of the business to generate the company's cash flows) from the cash flows from operating activities (see Figure 8.2). The free cash flow is the operating cash flow after investments in fixed capital and working capital; that which arises from the activities of the company.

This indicates that the perpetual cash flow of 154 can be produced without expanding the company's physical capacity (no new factories, etc.).