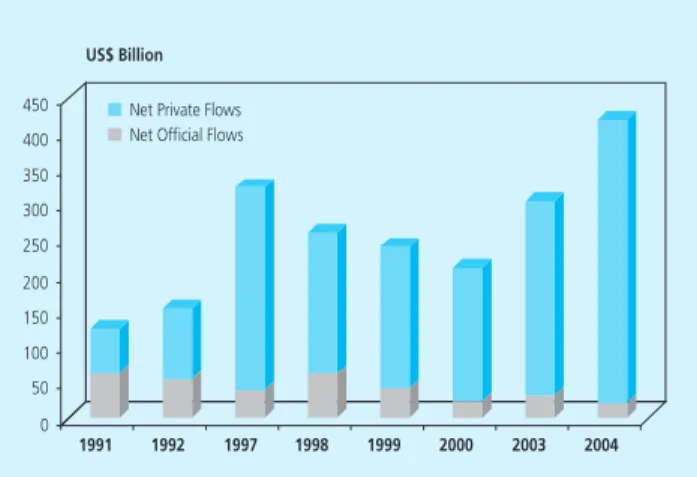

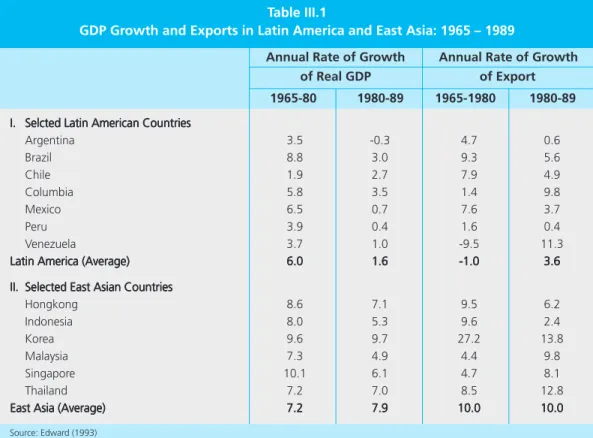

Therefore, the positive impact of openness on the economic growth of a country can be done through international trade as well as the inflow of capital from one country to another. The openness in these aspects will be very useful for accelerating the economic growth of a country. The positive relationship between openness and economic growth can be explained by modern growth theory, such as endogenous growth theory.

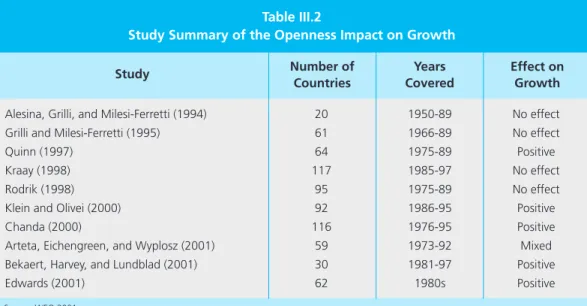

Amidst the high optimism about the advantage of openness to a country's economic growth, controversy still remains regarding some aspects of trade or openness policies. Because of this limitation, there is doubt about the positive relationship between openness and economic growth (Edwards, 1998).

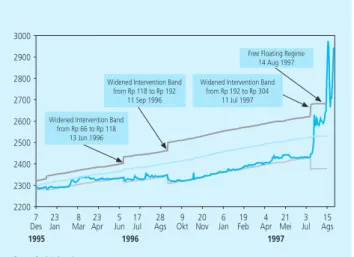

Foreign Exchange and Exchange Rate Policies

There was almost no restriction on foreign exchange transactions, which included: i) no obligations for exporters to submit the foreign reserve; ii) no obligations for the bank to sell the foreign reserve to the central bank; iii) no obligations for individuals to buy/sell foreign reserve; iv) no obligation to report foreign exchange transaction. One of the provisions stipulated that foreign banks were allowed to open branch offices in various major cities in Indonesia. In accordance with the foreign exchange system, the exchange rate can also reflect the openness of a country towards financial globalization, for example, fixed exchange rate system is generally followed by capital controls.

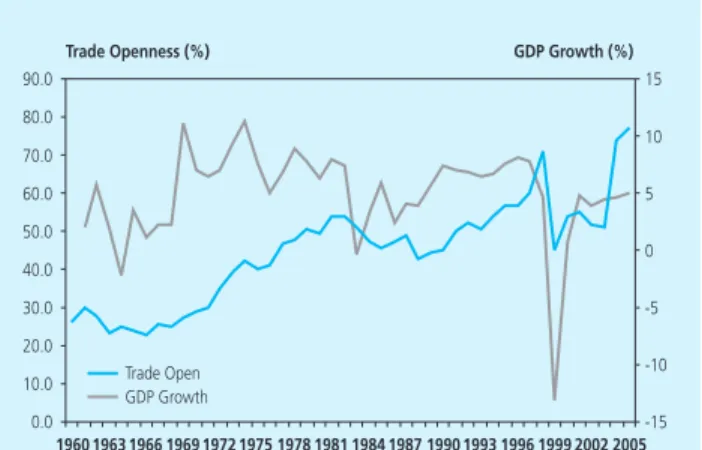

Openness and Economic Development in Indonesia

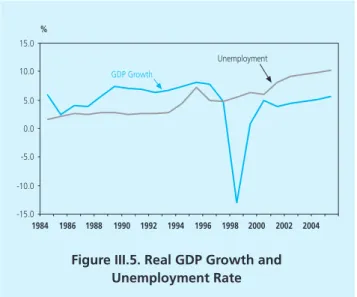

Inflation, on the other hand, increased in the early 1970s, with the highest level recorded at 40.6 percent in 1974. The impact of the world recession and the drop in oil prices in the early 1980s was then felt in the Indonesian economy in 1982. The economy contracted with growth falling to -0.3 percent in 1982 and the balance of payments continued to experience deficits due to the decline in international oil market prices.

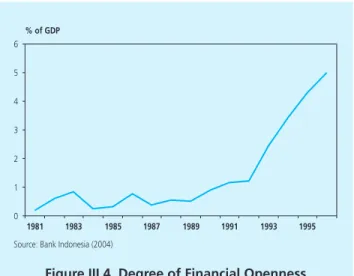

This deregulation was taken in a sequence, began to deregulate the foreign exchange market in 1982, then led by further fundamental deregulation in the money and banking sector in 1983. These deregulations were followed by deregulation in the financial, monetary and banking sector in 1988 and Deregulation of the capital market was taken in and 1990. Deregulation also provided greater openness for foreign banks to open their branches in the major cities of Indonesia.

A fundamental deregulation succeeded in supporting the increase in domestic saving which created a high increase in the financial resources for investment. Economic crisis that occurred in 1997/1998 actually arose from capital reversal in the form of portfolio investment. The monetary crisis prompted Indonesia to seek financial assistance by participating in the IMF's program.

To avoid the possible destruction of the banking sector, the government provided blanket insurance to bank customers by paying all their withdrawals and other bank liabilities, which certainly resulted in an excess money supply.

METHODOLOGY 1. Data

Model

The model that can be used is the structural vector autoregression (SVAR) or the cointegrated SVAR as proposed by Pesaran and Shin (1997) and Pesaran, Shin and Smith (1998). The next step is to create a model of an accounting innovation of impulse response function (IRF) and forecast error variance decomposition (FEVD) using structural vector autoregression (SVAR) to analyze the impact of openness for Indonesian economy. A cointegrating VAR model is that the model incorporated a cointegration matrix into a VAR model, which, according to Pesaran and Pesaran (1997), can be represented as a generalized vector error correction model (VECM) as follows.

With the order of variables in xt as follows, gdpt, rt, ot, exct, cpit, empt, β' can be explicitly written as follows. The resulting vector of residuals (or ≈innovations∆, say εt) is then used for the VAR analysis. Further suppose that et is the error term of the structural model (i.e., an economically meaningful model) corresponding to the cointegrating VAR model.

AΠi = –Ai for i = 1,2,..,k and AΣA» = Ω This leads to the establishment of the following relations: (III.5) Imposing constraints on appropriate elements of the matrices in (2) allows the identity structure shocks. Although it is possible to impose overidentifying restrictions, since our concern with this ANSWER is not for the elements of A and B, but mainly with the subsequent IRF and FEVD analyses, we heuristically use only identifying restrictions as follows. To analyze factors affecting the openness of the Indonesian economy, the impulse response function (IRF) and FEVD (forecast error variance decomposition) analysis will be performed.

Since CPI and exchange rate have no effect on output in the long run, the model constrained the parameter of CPI and EXC to zero.

RESULT AND ANALYSIS

The coefficients of the long-run cointegrating equation

Like trade openness equation, the long-term financial openness equation showed that the sign of direction of interest rate coefficient was still negative and significant, namely -0.055. However, although the coefficient was relatively small, the sign of the direction was still negative and significant. The result implied that as the local financial market in Indonesia became more open, there would be more risk that could endanger the Indonesian economy.

Since the model included portfolio investment to measure financial openness, the result was realistic for the Indonesian economy. The return of capital from portfolio investments caused a large depreciation of the rupiah exchange rate, which then caused hyperinflation and increased external debt4 in rupiah exchange rate terms.

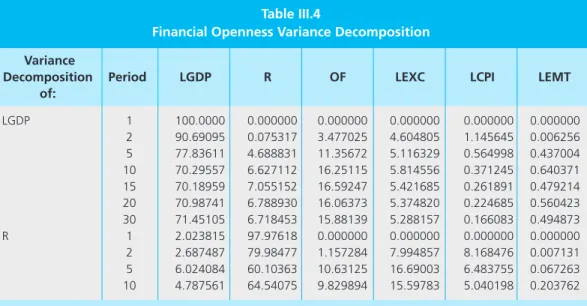

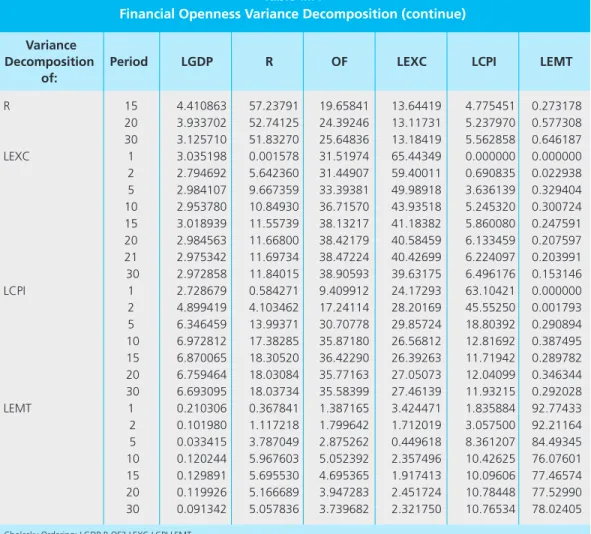

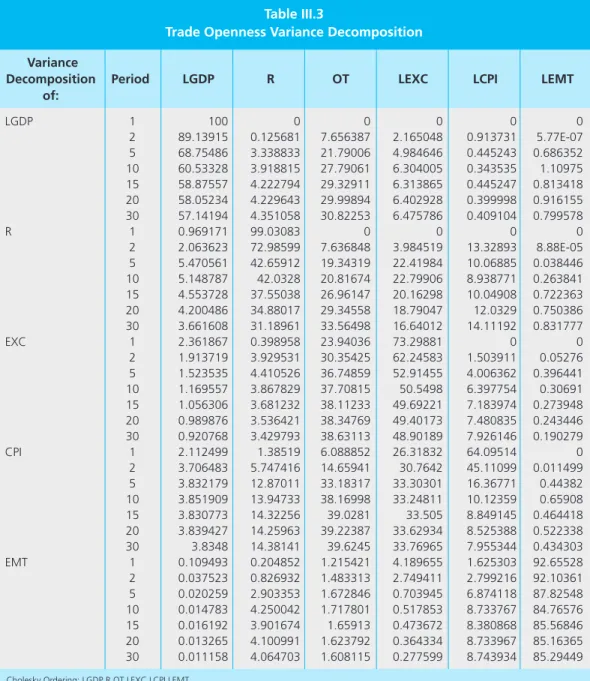

Forecast error variance decomposition analysis

The variability of the exchange rate in the short and long term is mainly related to the exchange rate itself. Shocks to the interest rate and CPI have little effect on triggering long-run exchange rate fluctuations, while GDP and employment have a negligible effect. Fluctuations in the consumer price index are self-explanatory in the short term, but in the long term their effect will decrease.

In the long run, shocks to trade openness can account for mostly 39 percent of consumer price index variability. The variability of the working population in the short and long term is mainly related to the own situation, namely 85 percent in the long term. The shocks affecting trade openness are very small and can cause fluctuations in the labor force.

Interest rate shocks and inflation shocks can explain only 6 percent and 8 percent of the long-term labor force fluctuation. Short-term and long-term fluctuations in production explain mainly themselves, about 90 percent in the short term and 70 percent in the long term. Instead of own output, shocks to financial openness can mostly explain 16 percent of output variability in the long run.

In the long run, financial openness will explain 24 percent of interest rate variability, 38 percent of rupiah exchange rate variability, and 35 percent of inflation variability.

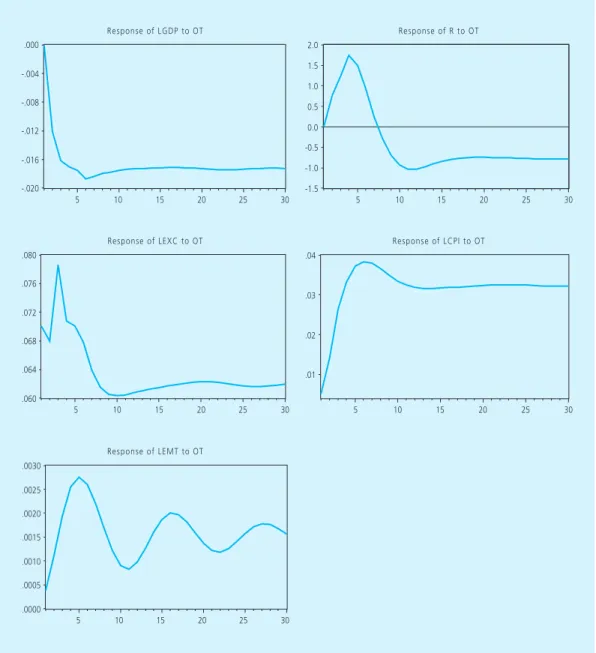

Impulse Response Function Analysis

A one standard error shock to trade openness will lead to a depreciation of rupiah exchange rate. As the Indonesian economy is more open, the use of foreign reserves to cover the current account deficit may lead to the depreciation of the rupiah's exchange rate. Moreover, shock to trade openness will lead to inflation being raised, while a one standard error shock to trade openness has no real effect on labor force.

The movement of each macroeconomic variable due to shocks to financial openness is different (Figure III.7). Regardless of the outcome, a standard error shock to financial openness will lead to an increase in the interest rate in the very short run, but in the long run it will lead to a decrease in the interest rate. This result may be strong as the Indonesian financial market has been integrated into the global financial market, the domestic interest rate will decrease approaching the world interest rate and while in the short term the market needs time to adjust with a high interest rate.

The movement of the exchange rate, inflation and the labor force due to the financial openness shock is relatively diverse; A shock to financial openness leads to an increase in the exchange rate, inflation and the labor force.

Conclusions

Moreover, a shock to financial openness leads to a rise in interest rates in the very short term, but lower interest rates in the long term. The finding may be robust as preparations to implement financial integration lead to a rise in interest rates in the very near term; In the longer term, however, domestic interest rates will approach global interest rates. Beenstock, Michael and Peter Warburton (1983), ≈Long-Term Trends in Economic Openness in the United Kingdom and the United States, ∆ Oxford Economic Papers, New Series, Vol.

Diamond, Douglas and Philip Dybvig (1983), Bank Runs, Deposit Insurance, and Liquidity, ∆ Journal of Political Economy. Edwards, Sebastian (1993), ≈Openness, trade liberalization and growth in developing countries, ∆ Journal of Economic Literature, Vol. Hau, Harald (2002), ≈Real Exchange Rate Volatility and Economic Openness: Theory and Evidence, ∆ Journal of Money, Credit and Banking, Vol. 1999), Asian Contagion: The Causes and Consequences of a Financial Crisis, Westview Press.

Levine, Ross (1997), ≈Financial Development and Economic Growth: Positions and Agenda, ∆ Journal of Economic Literature, Vol. Rabemananjara (1990), ≈From a VAR model to a structural model, with an application to the wage-price spiral, ∆ Journal of Applied Econometrics, Vol. 1998), The Currency Crisis in South East Asia, Institute of South East Asia, Singapore. Working document Center for Central Bank Education and Studies (PPSK), Bank Indonesia. 1998), ≈Openness and Inflation: A New Assessment, ∆ The Quarterly Journal of Economics, Vol.

Rauch (1999), ≈Openness, Specialization, and Productivity Growth in Less Developed Countries, ∆ The Canadian Journal of Economics, Vol. 1969), ≈Gospodarska odprtost in mednarodni finančni tokovi, ∆ Journal of Money, Credit and Banking, Vol.

Unit Root Test

Cointegration Test

Trace test indicates 1 cointegrating equation(s) at the 0.05 level * indicates rejection of the hypothesis at the 0.05 level. **MacKinnon-Haug-Michelis (1999) p-values. Maximum eigenvalue test indicates 1 cointegrating equation(s) at the 0.05 level * indicates rejection of the hypothesis at the 0.05 level.

Vector Error Correction Estimate

Variance Decomposition