MARY MORGAN GLADNEY: The trajectory of the Argentine economy from 2001 to the present: What comes next. By analyzing the factors that have previously influenced the trajectory of Argentina's economy, I will try to answer this question: What is the trajectory of the Argentine economy in the current political climate. Analyzing the factors that previously influenced the trajectory of Argentina's economy, I will try to answer this question: What is.

The monetary value of the peso was equal to that of the US dollar, but its intrinsic value was not. Because the peso was directly pegged to the dollar, markets assumed that the peso's risk was equal to that of the US dollar. These trends shaped the trajectory of Argentina's economy over the past decade, and their influence is still evident.

With a large population and a dominant influence on South America, the state of the economy matters to many.

Much of the article talks about her likelihood of winning office based on economic success. There is even mention of the fictionalized inflation figures published by the government as they continue to flood the market with pesos (“Flying Solo” 2011). The government responded by suing all private companies that published their own, probably much more accurate, calculations, compromising the accuracy and readiness of statistical information.

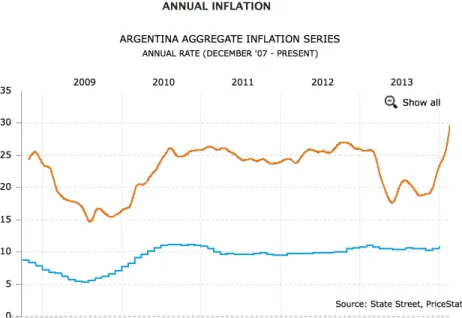

As the government from 2007 until Kirchner's re-election published falsified figures, people turned to private economic analysts. When, in 2011, private economists published an estimated inflation rate of 25% when the government stated that inflation was around 10%, the government investigated and fined the analytical firms (“Lies and Statistics” 2011). The government is paying higher payments to its citizens based on the falsified GDP growth rate published.

The key is to consider the government's motives for publishing false numbers and endangering the well-being of the nation, both economically and politically.

CHAPTER III. Research Data and Methodology

Dependent Variable

Independent Variable

Pedro Pou's article "Argentina's Structural Reforms in the 1990s" for Finance & Development gives a sense of the policies supported by the IMF in Argentina before the crash of 2001. The Inter-American Development Bank's "Fixed Exchange Rates: Lessons from Argentina" on how The convertibility plan hurt the economy This article was written by an expert in international economics at the most depressing moment of Argentina's economic collapse.

Another determining factor in the trajectory of the Argentine economy will be energy profitability. Argentina and YPF” provides a sense of the relationship between the country's YPF oil refinery and the government. The article provides a good understanding of the meaning of the Argentine democratic system on economic prosperity.

Perverse Accountability: A Formal Model of Machine Politics with Evidence from Argentina,” an article written by Stokes, provides further insight into how political machines like the Partido Justicialismo are elected.

The significance of the study’s postulations

On the campaign trail, he assured voters that he would not use "the hunger of the Argentine people" to pay the nation's debt (Stokes 46). It rose to 0.56 to 1, but the Convertibility Act which doubled the value of the peso making the rate 1 to 1 was still drastic (Saxton 5). The initial success of the Menem era was undoubtedly the stabilization of the economy through inflation control and reliable currency (Quiroga 131).

The start of his second four-year term in 1995 was marked by the impact of the "Tequila crisis" in Mexico, a currency crisis resulting from the devaluation of the Mexican peso at the end of 1994, which foreshadowed the Argentine crisis of 2001 ( Peacock 2000). . When the Mexican government introduced a sudden devaluation of the Mexican peso, limited Mexican purchasing power had a significant effect on the South American economy and Argentina in particular. The popularity of the Menem regime began to erode early in his second term as unemployment rates and accusations of corruption rose markedly.

Within a year, however, the country's economy suffered a recession linked to the recessions in Brazil and Russia, exacerbated by Argentina's overvalued currency. Most hired bidders once served as government contractors and often as representatives of the private bidders. Kirchnerismo, a play on the name of the political dynasty, evokes memories of Peronsimo at his height when Juan and Eva Perón ruled together.

He tried to set political limits on the free reign of the market to protect Argentina from the foreign industries that privatized and outsourced a huge percentage of the workforce under Menem's regime. Bush vetoed proposals to create a debt restructuring that would destroy the value of the $550 million owed to American investors (Hornbeck 5). A 2005 article from The Economist describes the relative success of the exchange with an accompanying chart.

This power is significant compared to that of the United States Federal Reserve, and government manipulation can be a dangerous force. This manipulation by the Central Bank also includes other aspects of the economy. The Kirchner regime interprets the role of the Central Bank differently than in the past and has proposed to increase it.

However, the results of Kirchner's policies will most likely negatively affect the trajectory of the economy.

CHAPTER VI. Data Analysis and Suppositions

- Economic trends in the first quarter of 2014

- Economic policy reform: trade, price freezes, devaluation

- Economic theory in the 2001 crisis versus today

- What happens next?

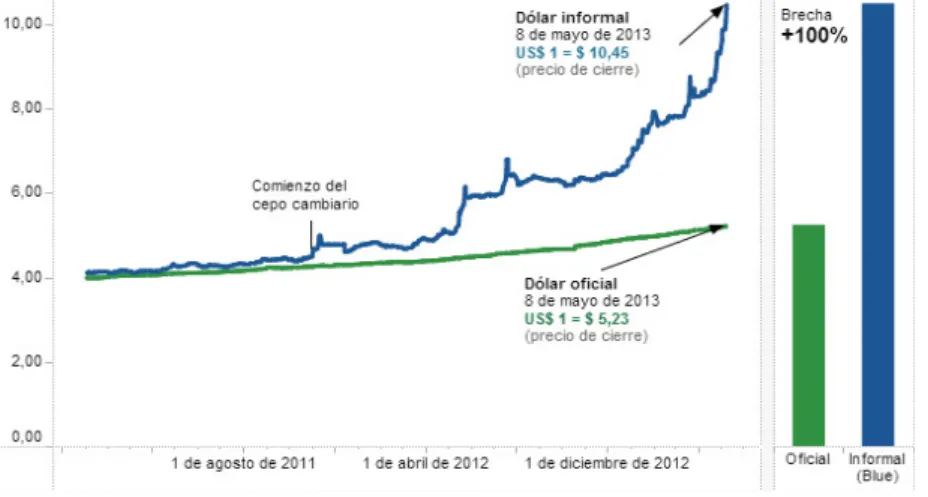

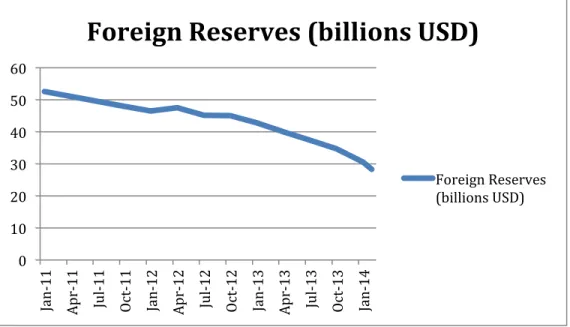

To cover these costs, the Central Bank turned to printing new money, which posed a major threat to the value of the peso. If the devaluation of the Argentine peso during 2014 is as extreme as expected, the government risks social chaos at the hands of social workers. Currently, as foreign currency reserves dwindle, citizens are showing distrust of the peso and the government's ability to support their currency.

Through the central bank, Kirchner has kept a tight grip on the peso's value, and the bank recently defended the currency at around eight pesos to the dollar after letting it fall 15% in early January. Public concern is higher than ever in light of the gap between published and actual statistics. Kirchner's "statistical solipsism" has proved unhelpful in light of the December 2013 police attacks that crippled eleven provinces and resulted in a 30% wage increase ("Still a Lie" 2013).

In April 2012, 40 WTO members, including the United States, denounced Argentina at a WTO meeting for increasing protectionist practices. Kirchner was easily re-elected using such economic policies and she has continued to use the same PBC policies to try to create an artificial boom over the past few years. However, the Argentine government has struggled for credibility in its argument on the independence of the country's central bank after passing seven governors.

The ousting of the previous governor because he refused to transfer funds collected in international reserves to the government to use to pay off the debt does not show much independence (Levy 2013). The current exchange rate is not pegged, providing an autonomy that was absent under Menem's fixed exchange rate regime, but Kirchner has strong control over many other aspects of the economy. Now the value of the Argentine peso is partially determined by currency controls to keep the exchange rate within the range set by Kirchner, and inflation is like that.

This action is most likely prompted by the memory of the 2001 crisis when dollar deposits were exchanged for devalued pesos. Kirchner only continued the problems of the 2001 debt default created by Menem with excessive spending and an overinflated currency. In December 2013, the year-end trade surplus was $272 million, which was $1.5 billion short of the budgeted target.

Argentine citizens feel similarly, and their propensity to withdraw foreign currency held in Argentine banks is indicative of their distrust of the government.

CHAPTER VII. Conclusion

Its attempts to fix the economy by limiting sales in dollars and banning unlimited exports of agricultural products have failed, as evidenced by dwindling foreign exchange reserves and a significant devaluation of the peso in the first quarter of 2014. Now, their apparent distrust and lack of confidence in Argentina's the executive branch could accelerate the rate of deterioration of the country's weak economy. If Argentines start withdrawing and sending their savings out of the country for safekeeping, the banks will not be able to secure credit and will default on citizens' deposits.

This means continuing to restrict agricultural exports in order to stimulate domestic production and stimulate the economy. More than likely, exporters will default on contracts with other countries, and Argentina's debt will grow as GDP per capita and the trade balance continue to decline. But other policies are less likely to stop, and she has chronically shown liberal spending tendencies amid economic strife.

Her success in overtaking the central bank has allowed her to take control of the amount of cash produced and put into the economy. The implications of this are great; Inflation will continue to rise and the Argentine peso will lose significant value. As citizens' mistrust of the government leads to unrest, the economy is doomed to fail again.

Political business cycle theory predicts this outcome based on the behavior of the executive branch, and the trajectory of the Argentine economy appears to follow the pattern provided by PBC theory. It explains the patterns seen in the economic cycle surrounding Kirchner's re-election, and it appears to be accurate in predicting the future. Although the political business cycle appears to be in effect in today's Argentine economy, there may be other explanations for the economy's trajectory.

In the face of an impending economic recession, it is important to ask whether the nature of politics in Argentina will change. Nevertheless, Nestor Kirchner was given the presidency after the economy was destroyed under the Peronist regime.

CHAPTER VII. BIBLIOGRAPHY

State Economic and Social Policy in Global Capitalism.” Handbook of Political Sociology: States, Civil Societies and Globalization. 34; The Political Business Cycle." Readings in Growth Theory: A Selection of Articles from the "Review of Economic Studies,".