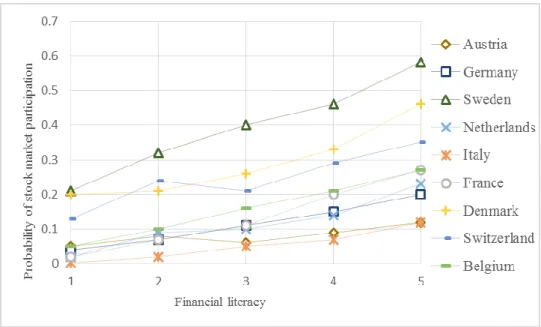

Several studies have also attempted to uncover the precise channels through which financial literacy affects the decision to participate in the stock market. The figure clearly shows that stock market participation increases significantly with financial literacy: in fact, stock market participation is. Regarding country-level institutional variables, we assess the role of the effectiveness of the education system in influencing stock market participation.

More specifically, we argue that the effect of stock market attractiveness on the decision to join is twofold. First, actual financial incentives such as the leverage ratio may influence the actual decision to invest in the stock market. In addition, the effect of the current level of the acute ratio should be disentangled from the country-level effect, which may also affect the decision to participate in the stock market.

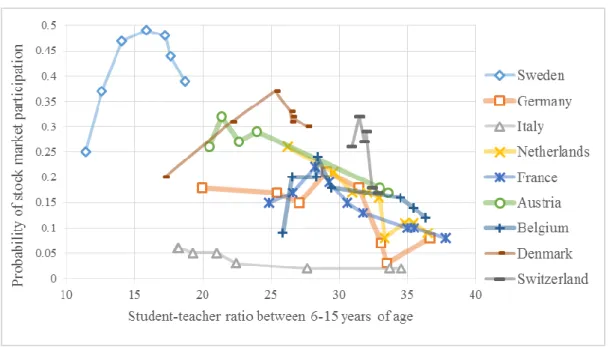

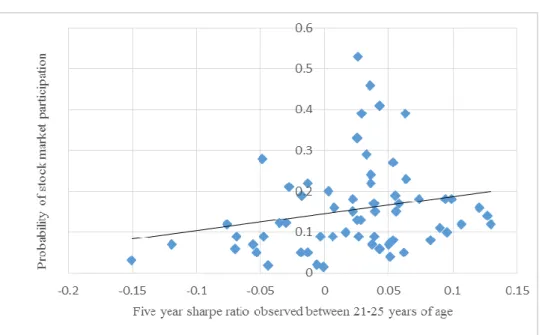

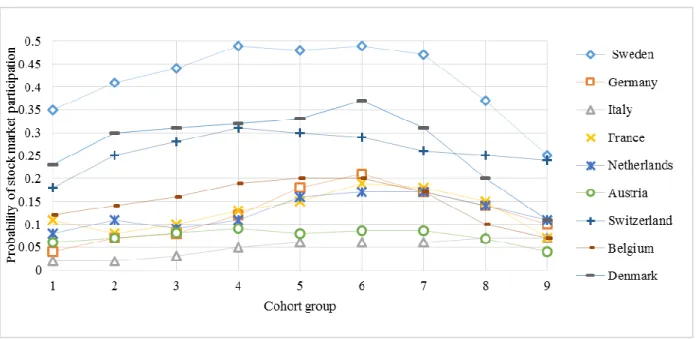

From both figures, it appears that the probability of participating in the stock market for each cohort tends to increase as the steep ratio increases.

Identification strategy

One of the striking features of the empirical data on financial literacy is the large and persistent gender gap, and this is also reflected in the financial decision to participate in the stock market. As already mentioned, previous studies have shown that women are less likely to enter the stock market (Halaisonos and Bertaunt, 1995, Croson and Gneezy 2009, Fonseca et al. 2012). In line with the existing studies, we expect a negative correlation between female individuals and stock market participation.

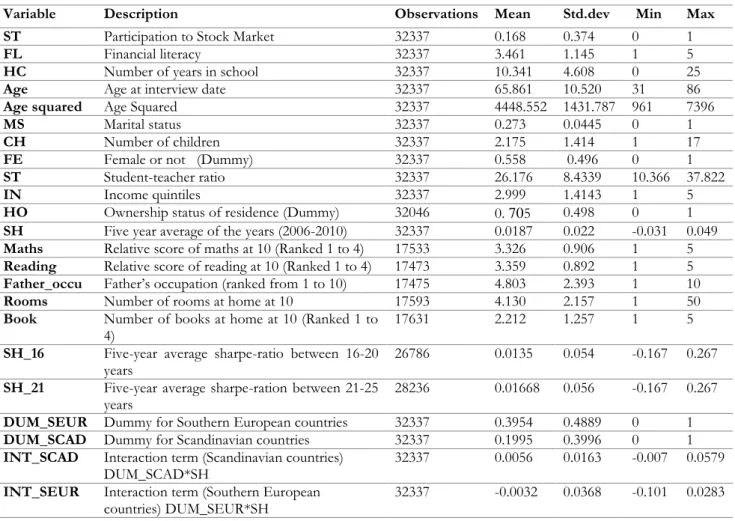

Demographic variables such as age, age squared10 number of children in the family, marital status, gender, house ownership are also included in the model and used as controls in regressions11. In the case of homeownership, Vestman (2010) argues that homeowners, in both the US and Sweden, are about twice as likely to participate in the stock market as renters. We therefore include home ownership as a dummy variable in the model with 1 as home owner and 0 otherwise.

In addition, we add a dummy for respondents who are retired to account for the fact that some households may be in the run-down phase of their life cycle. As pointed out by Griliches (1977) and Lam and Schoeni (1993), an omitted variable, such as employee individual ability/talent, associated with training in the wage equation could not reflect the true effect of training on wages. overestimate because it is part of the wage effect of ability. In other words, differences in the individual's initial endowments at a younger age can also lead to unnoticed compensatory behavior among employees in their economic and financial decisions, and therefore the likelihood of participating in the stock market based on perceived investment alone in human capital certainly lead to biased results.

Charles and Hurst (2003) find that parent-to-child investment behavior explains a significant portion of wealth correlation across generations. Using information provided in Wave 3 SHARELIFE, financial knowledge and human capital investment are instrumented with exogenous instruments, such as own talent, supported by the individual's math and reading skills at age 10, and initial conditions, identified by father's profession. and the number of rooms in the house when he is 10 years old and the number of books on the shelf when he is 10 years old. In Table 1, we report the sample statistics of the main variables included in the study.

Empirical Model

Empirical results

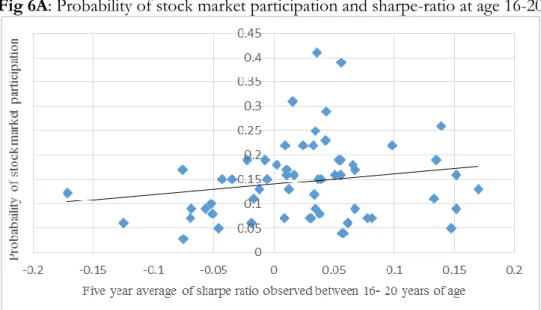

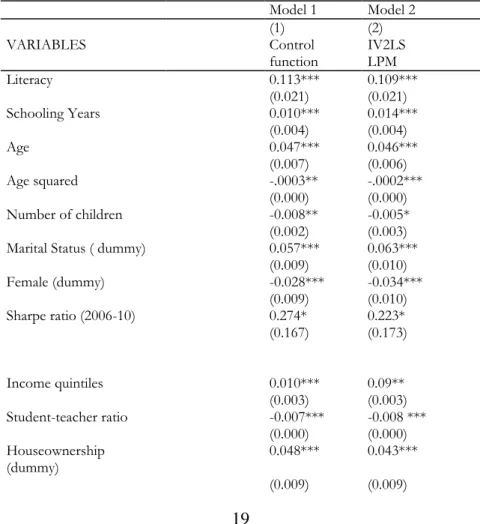

The empirical results show that all the variables we used in this study, except the dummy for retired individuals, are significant across all specifications and with the expected signs. Therefore, the hypothesis that all parameters are equal to zero can be rejected at 1% level of significance. The measure sharp ratio, the sharp ratio of Scandinavia and Southern Europe is significant at 1% level.

Demographic variables including age, dummy for women, number of children, home ownership, and dummy for unmarried workers are significant at the 1% level. Country opinions for Scandinavian and southern European countries are also significant at the 1% level. The reference ratio Sharpe-Ratio shows a negative sign, which means that the Sharpe-Ratio in continental European countries has a negative effect on the probability of participation in the stock market.

The probability of investing in the stock market increases by 5.4% if the dummy variable homeownership is 1. Regarding the gender effect, if the dummy for female changes from 0 to 1, the probability of participating in the stock market decreases by 3.2%. If the dummy variable for single (unmarried) changes from 0 to 1, the probability of holding shares increases by 3.6%.

In the case of continuous demographic variable such as number of children, a 1% increase dampens the probability of investing in stocks by 0.06%. Finally, the country dummy for Scandinavian country shows a positive marginal effect of 0.05% indicating that people from Scandinavian countries are 5% more likely to participate in the stock market than our benchmark group. Alternatively, the dummy for Southern European country shows a negative effect implying the fact that individuals from countries are 2% less likely to participate in stock market.

Model II: Multiple endogeneity and estimations based on control function approach

Empirical Results

Looking at Model (1), we find that all the estimated coefficients for the probability of participating in stock market are significant and with the expected signs. The number of children also negatively affects stock market participation and is significant at the 5% level. Regarding marginal effects, it appears from Model (1) that a 1% increase in financial literacy can lead to an approximately 11.3% increase in the probability of participating in the stock market, while human capital has a 1% marginal effect tone.

As mentioned, this variable is intended to capture the effect that a better education system exerts on stock market participation through externalities and peer effects. The marginal effect shows that a 1% increase in the student teacher ratio can reduce the probability of participating in the stock market by 0.07%. Next, the coefficient of financial attractiveness of the country proxied by sharp ratios is positive in all three subgroups, which clearly underlines the effect of the variable in the decision to participate.

Furthermore, the effect of the current Sharpe-Ratio level is significantly greater in the Scandinavian (197%) and Southern European countries (85%) compared to the continental European benchmark countries. This also means that the effect of financial attractiveness is different in different regions of Europe, which may be the result of different views on risk and understanding of how the capital market works. In the control function approach, as mentioned earlier, the effect of this variable is twofold.

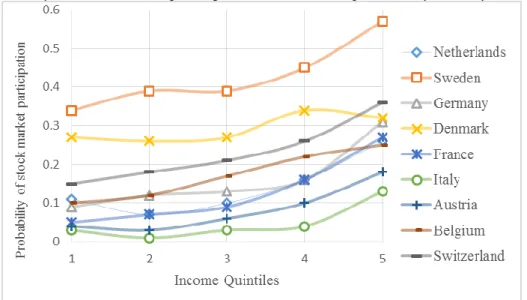

The effect of income remains positive and significant in all the CF approaches as well and, finally, all socio-demographic control variables show significant and expected signs, with the coefficients showing marginal changes compared to the base model (see Table 2, Model 2 ). Finally, the country-level effects in the control function approach show that a person belonging to Scandinavia is 2.9% more likely to enter stock market, while we observe no separate effect of Southern European economies on the probability of entering stock market not. One should conclude that these two subgroups have no significant differences, which may have a different effect on the participation of stock market.

Conclusions

Sociodemographic control variables, also used in previous studies, show the expected sign. Finally, the quality of the education system was found to have a positive effect on the propensity to invest in the stock market due to some external or peer effects. In terms of policy implications, our findings suggest that improving financial literacy and human capital is critical to ensuring better participation in capital markets.

Furthermore, policy makers should put a lot of effort into closing the gender gap and improving institutional factors such as the effectiveness of education and the performance of financial markets (whose attractiveness can be boosted by favoring the presence of institutional investors such as pension funds). Individual's risk preferences are not included in the model due to data limitations. Also, employment sector and field of study are missing due to the lack of information in the SHARE database.

The inclusion of such information in the next waves will greatly improve the quality of the database for future research in the field of financial related decisions at the European level. Subjective Return Expectations, Information and Stock Market Participation: Evidence from France Economics and Econometrics Discussion Paper, University of Southampton. School resources and student outcomes: A review of the literature and new evidence from North and South Carolina.

How to increase the effectiveness of financial education and savings programs University of Chicago Press, Chicago. SH (2006-10) Five-year average of acute report lag from date of interview. Father_occu Father's occupation SHARE Initial_con Rooms in the house at age 10 SHARE Books_10 Books on the shelf when they turn 10 SHARE Sharpe_16 Sharp ratio when getting old.

How much will you have in the account at the end of the second year.

Cohort groups

Possible answers are shown on cards shown by the interviewer who is instructed not to read them to the respondents: 1. Answering (1) correct results in a score of 3, answering (3) correct but not (4 ) results in a score of 4 while answering (4) correctly results in a score of 5. Answering (2) correctly gives her a score of 2, while answering (2) incorrectly gives her a score of 1 gets.

Variables and detailed methodology used to compute sharpe-ratios

Then we calculate the average return by subtracting the return on the risky asset (Rf) from the return on the safe asset (R0). Finally, the average return is divided by the standard deviation of risky assets, calculated annually by multiplying by the respective years.

Mathematical ability and Reading ability in SHARELIFE

Ranking based on skills of occupation of the father provided by SHARE Wave3