On the Effects of Income Volatility on Income Distribution: Asymmetric Evidence from State-Level Data in the US A previous study that attempted to estimate the impact of income volatility on income inequality in the US, while we reveal the effects short-run asymmetric effects of income volatility on a measure of inequality in most countries, they translate into long-run asymmetric effects in only 16 countries.

Hausmann and Gavin (1997) is perhaps the first study to allude us to the negative effects of income volatility on income distribution by arguing that poor members of society are not well equipped to absorb economic shocks or uncertainties compared to wealthier members. Let GINI denote the measure of income inequality in each state and VOL the measure of income volatility in the same state. However, the estimate of β, which reflects the long-run effects of income volatility on the GINI, will only be valid if the two variables are cointegrated.

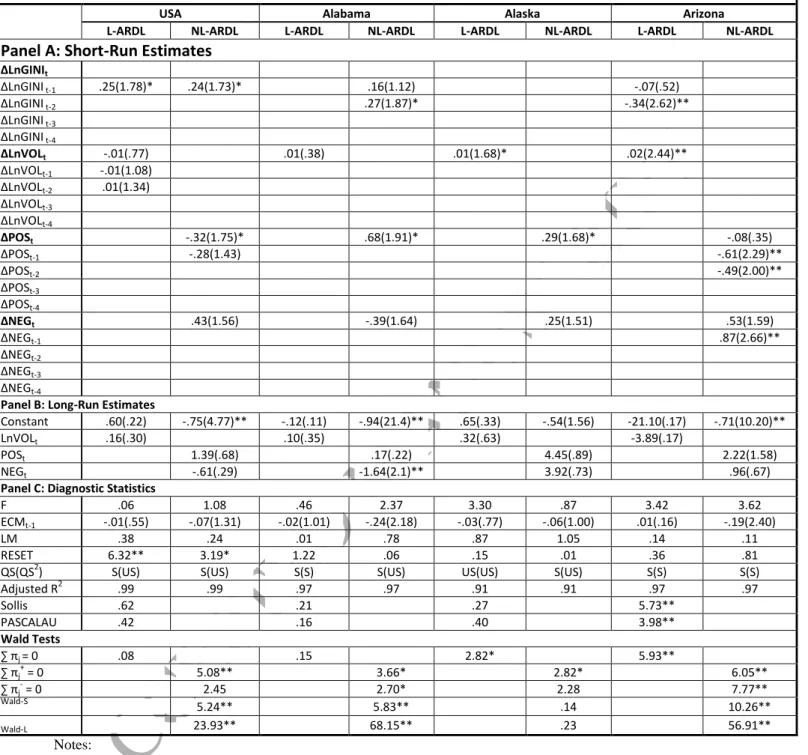

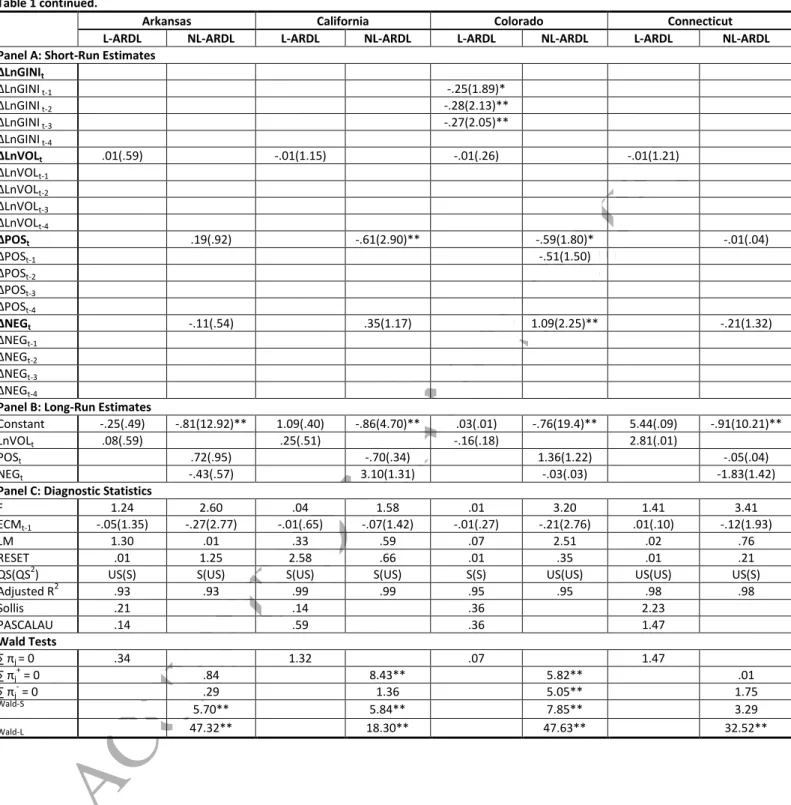

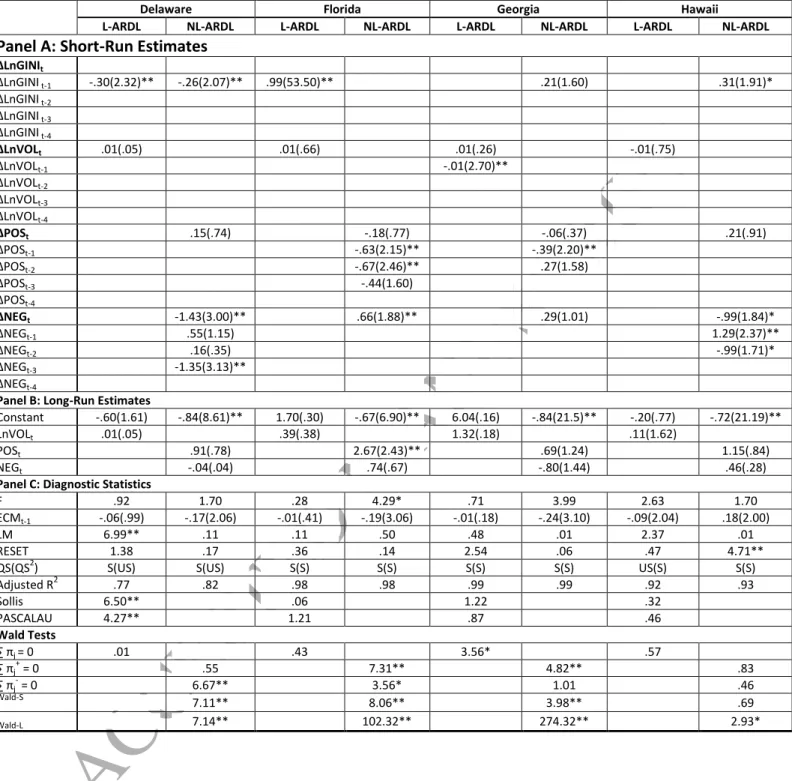

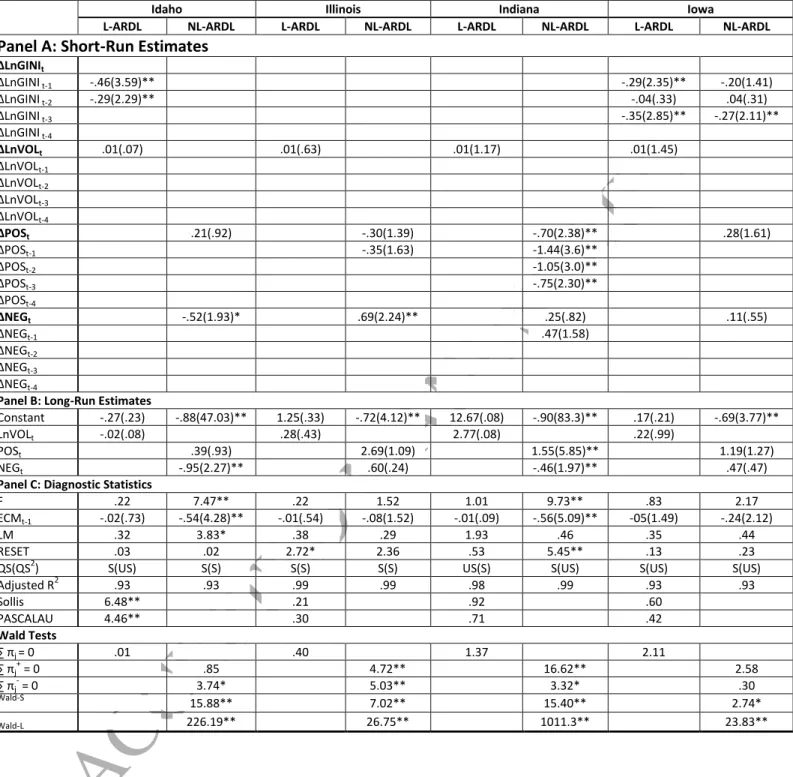

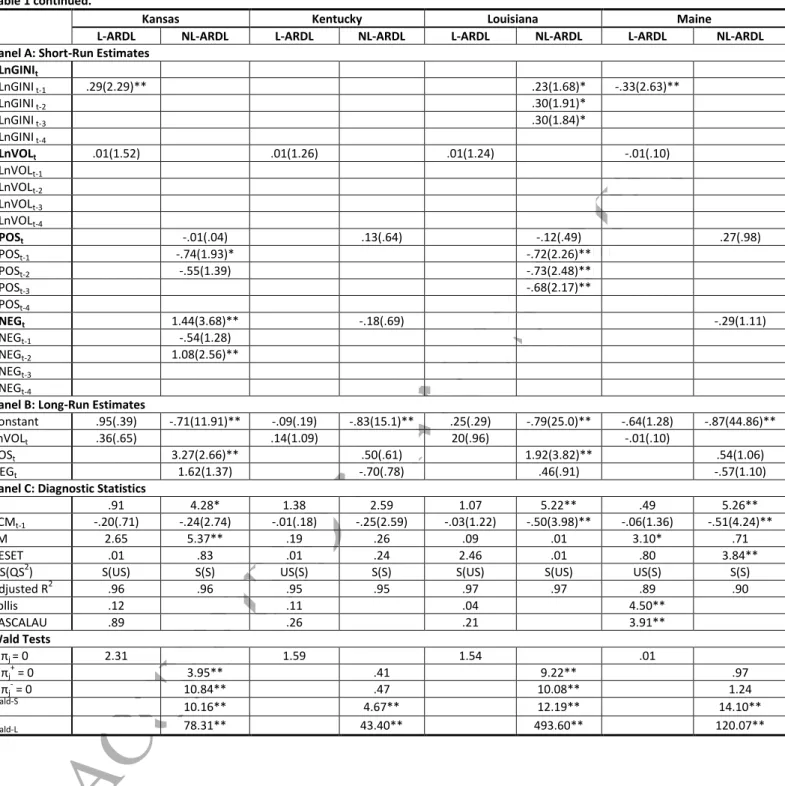

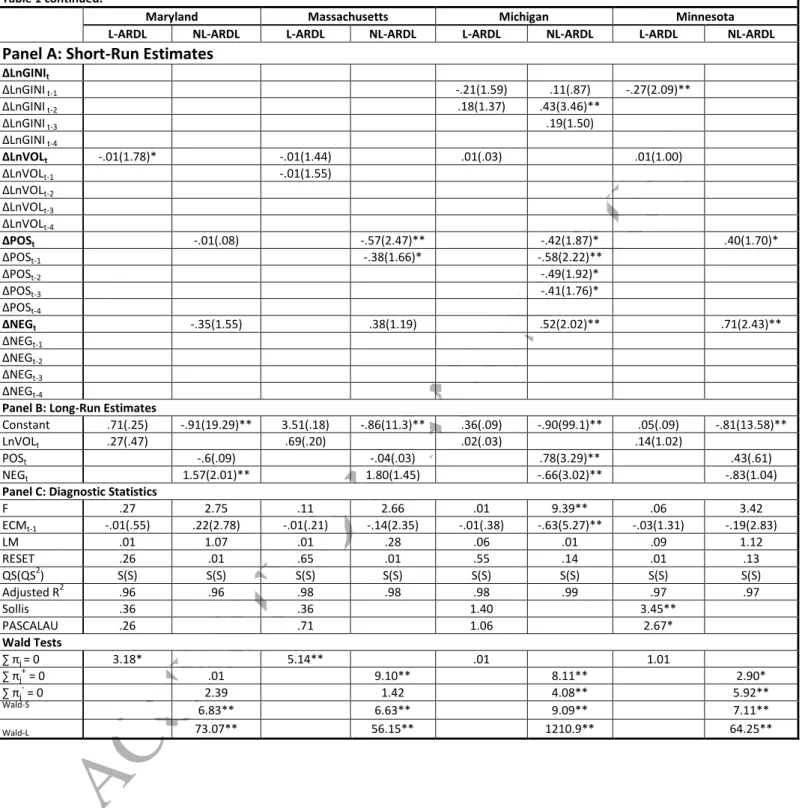

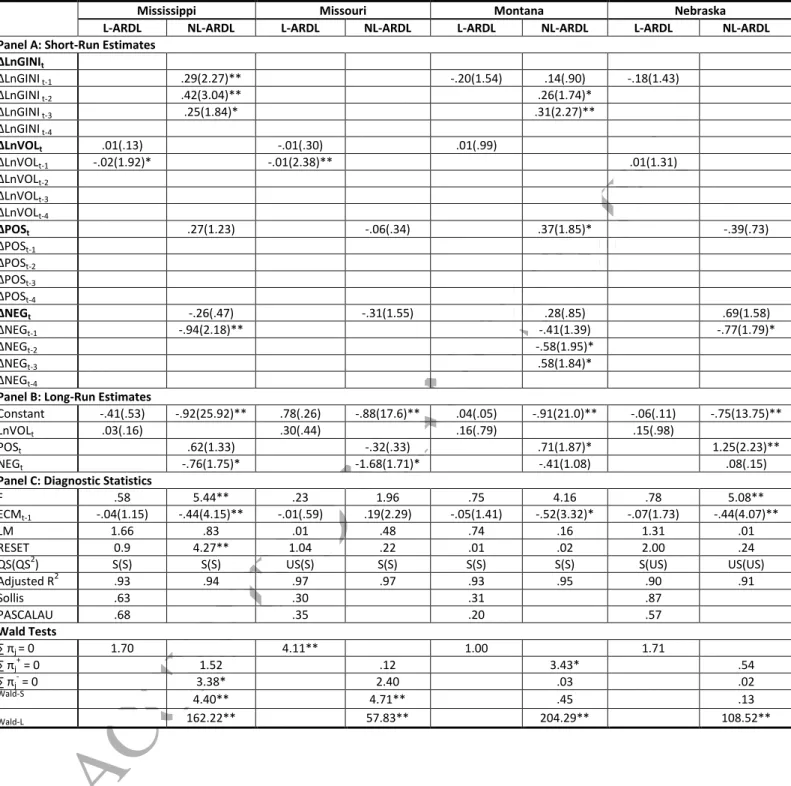

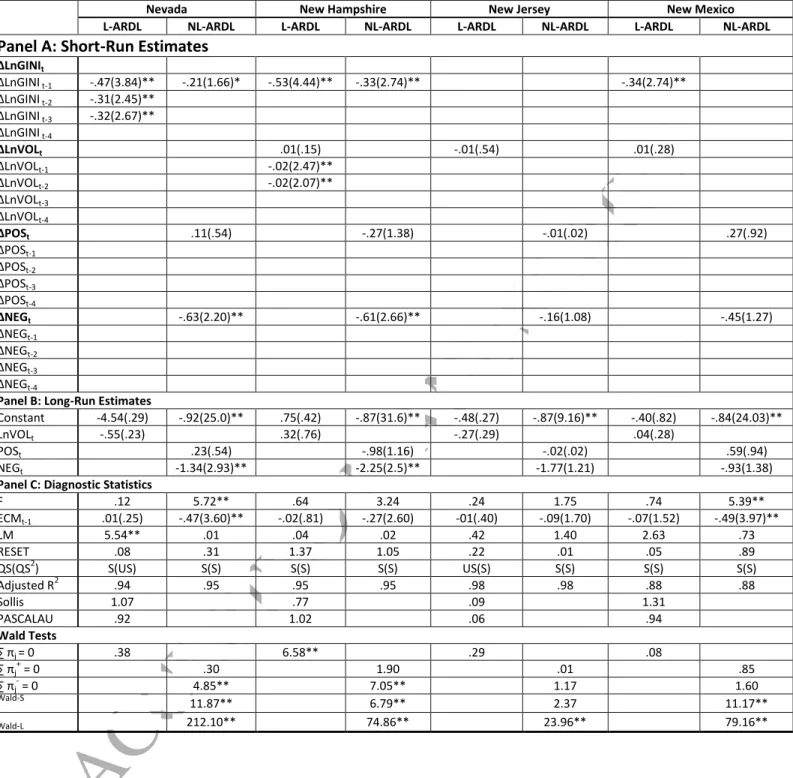

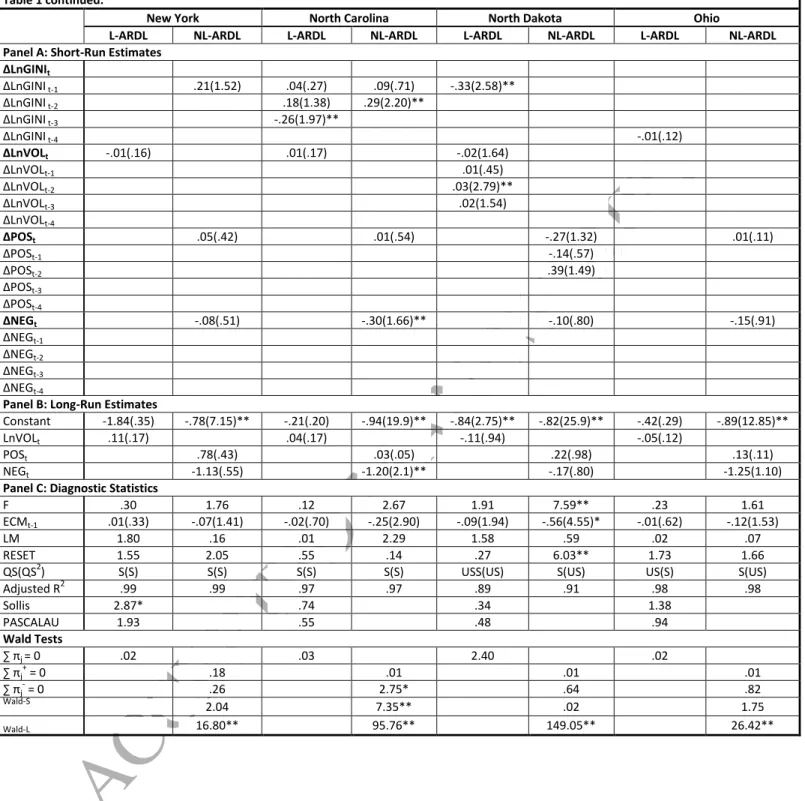

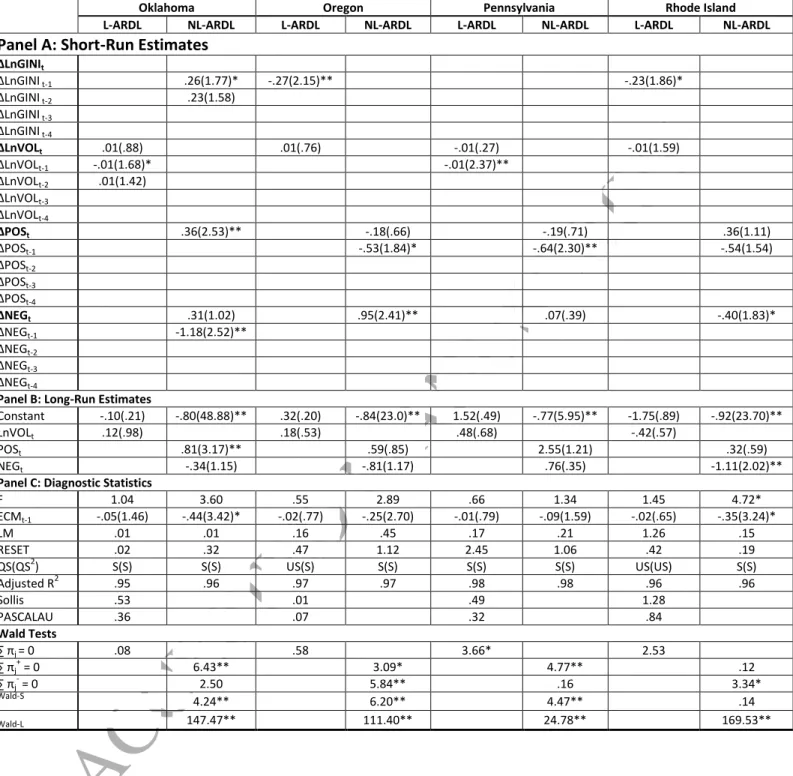

First, short-term effects of income volatility on GINI are assessed through the estimates of ˆj's. While the above two tests provide some preliminary about nonlinear adjustment process to long-run equilibrium, neither of them can shed light on the asymmetric effects of income volatility on GINI. To evaluate the asymmetric effects of income volatility on GINI, we follow Shin et al.

Fourth, if the Wald test supports j j, changes in income volatility would have cumulative or asymmetric effects on income inequality in the short run.

ACCEPTED MANUSCRIPT

Summary and Conclusion

In 1955 Kuznets (1955) identified the level of income or economic activity as the main determinant of income inequality. Instead, what has been easy to verify in the literature is the non-equalizing effect of income or output volatility. It has been argued that since income volatility brings uncertainty to the economy, it redistributes income from workers to owners of capital or from the poor to the rich.

Previous research has tested and largely verified the uneven effects of income volatility on income distribution by using cross-sectional data or a panel collected from many countries over a period of time. This enables us to introduce the first time series study of the impact of income volatility on income distribution. We use the linear ARDL approach of Pesaran et al. (2001) for error-correction modeling and co-integration to examine the short- and long-term effects of volatility on GINI to show that short-term income volatility affects the distribution of income in the economy causes. nine states (that is, in Alaska, Arizona, Georgia, Maryland, Massachusetts, Missouri, New Hampshire, Pennsylvania, and South Dakota).

Based on the sum of short-term estimates, the cumulative effects of volatility on GINI were unequal in Alaska, Arizona, and South Dakota, but similar in the remaining six states. However, in none of the states do we see short-term effects that translate into significant long-term effects. Since we suspected that the income volatility adjustment might be nonlinear, we also considered Shin et al.'s nonlinear ARDL approach. 2014) that allow us to assess the possibility of asymmetric effects of income volatility.

However, short-term effects translate into long-term significant, significant, and asymmetric effects in 16 countries. Specifically, we found that in nine states Florida, Indiana, Kansas, Louisiana, Michigan, Montana, Nebraska, South Dakota, and Wyoming, increased income volatility worsens income inequality, and in 10 states, viz. Idaho, Indiana, Michigan, Mississippi, Missouri, Nevada, New Hampshire, Rhode Island, West Virginia and. Our interesting asymmetric findings suggest that here in the US, reducing income or output volatility will not help reduce income inequality.

Future research should consider the time series direction we have introduced in this paper, not only to revisit the issue in the US, but also in other countries. VOL = A measure of income volatility defined as the four-year rolling standard deviation of the change in the growth rate of real total income in each country. Again, the data was compiled by Mark W. Frank from data on individual tax returns available from the IRS. http://www.shsu.edu/eco_mwf/inequality.html).

State-level data comes from Piketty and Saez available at Emmanuel Saez's web page: http://eml.berkeley.edu/~saez/. What can new survey data tell us about recent changes in distribution and poverty?" World Bank Economic Review, vol.11, issue 2, p. New Ways of Looking at Old Issues: Inequality and Growth", Journal of Development Economics, 57, pp.

Delatte, Anne-Laure and Antonio Lopez-Villavicencio (2012), "Asymmetry Exchange Rate Pass-Through: Evidence from Major Countries", Journal of Macroeconomics. Growth is Good for the Poor,” Journal of Economic Growth, vol. 2009), “Inequality and Growth in the United States: Evidence from a New State-Level Panel of Income Inequality Measures”, Economic Inquiry, Vol. The effect of growth volatility on income inequality”, Economic Modelling, Vol. 1995), "Income Distribution in the United States: Kuznets".

Joulfaian (1991), "Federal Government Expenditures and Revenues in the Early Years of the American Republic: Evidence from 1792 to 1860", Journal of Macroeconomics, Vol. The effect on income distribution of development, the growth rate and economic strategy,” Journal of Development Economics, vol. Greenwood-Nimmo (2014) "Modelling of asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework" Festschrift in honor of Peter Schmidt:.

A simple unit-root test against asymmetric STAR nonlinearity with an application to real exchange rates in Nordic countries”, Economic Modelling, Vol. 2013), “Interest Rate Pass-Through in the EMU-New Evidence Using Nonlinear ARDL Framework”, Economics Bulletin, Vol. These critical values are also used for Wald tests, because they also have a χ2 distribution with one degree of freedom. . e)-RESET is Ramsey's test for misspecification.