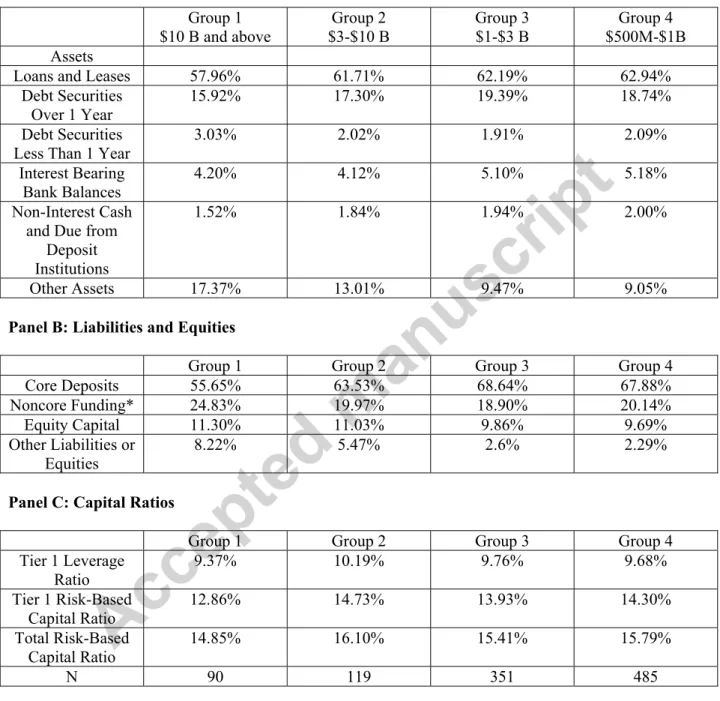

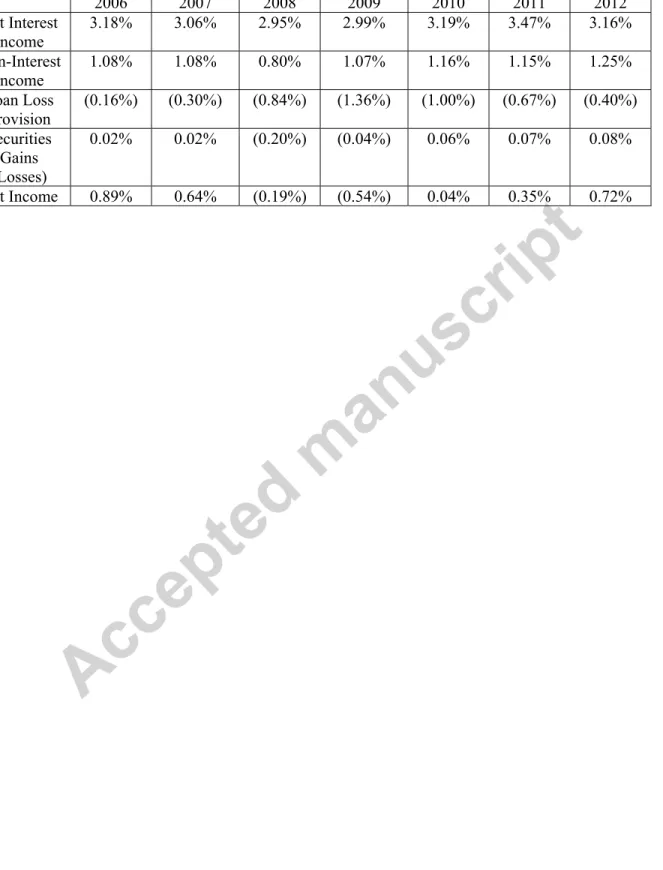

These studies focus on banks' use of loan loss provisions to mitigate information asymmetry, and on the importance and risk relevance of accounting methods such as fair value accounting and securitization. In the third section we provide basic institutional information about regulatory capital requirements and banks' financial statements.

Background on capital regulation and basic bank balance sheet 1 Capital regulation

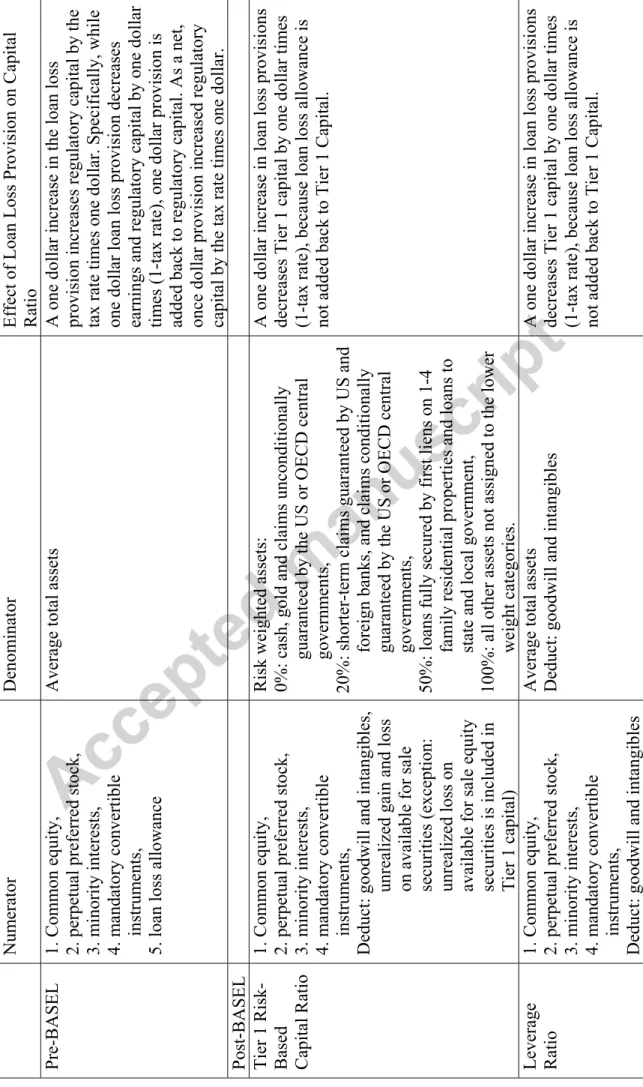

There is also an ongoing debate in the banking theory literature regarding the use of fair value to calculate regulatory capital. The most important change in BASEL's capital regulations that affects the relationship between provisions and regulatory capital is the abolition of provisions for credit losses from Tier 1 capital.

Research examining the valuation and risk relevance of bank accounting information With the backdrop of the theoretical economic models underlying bank accounting research

Recently, the fair value debate has again attracted widespread interest due to the potential effect of fair value accounting in the financial crisis. The importance, reliability and unintended consequences of fair value versus historical cost accounting have been the focus of debate. Nissim and Penman (2008) provide an information retention principle that adds to the fair value versus historical cost debate.

There are several reasons why the banking industry has been a primary focus in the fair value literature. These papers typically implicitly assume that the effect of information asymmetry between managers and equity investors will have the same effect on fair value measurements as random measurement errors in the fair values. Further evidence supporting the importance of information asymmetry in the stock valuation of fair values is provided by studies examining differences in valuation based on different measurement methods taken in the fair value estimates.

For example, Hodder et al. 2006) argue that given the importance of fair value financial instruments for assessing bank performance and risk, it is important to study the relationship between bank risk and fair value accounting. These fair value risk relevance studies share many of the same issues with the value relevance studies. They argue that the finding suggests that fair value accounting does not capture underlying economic risk more than historical cost accounting.

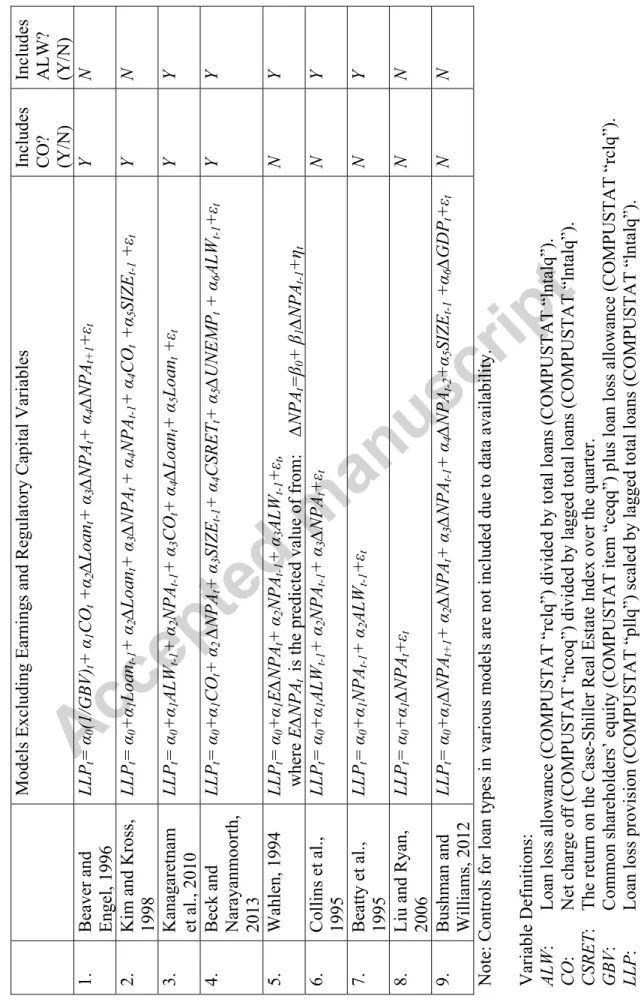

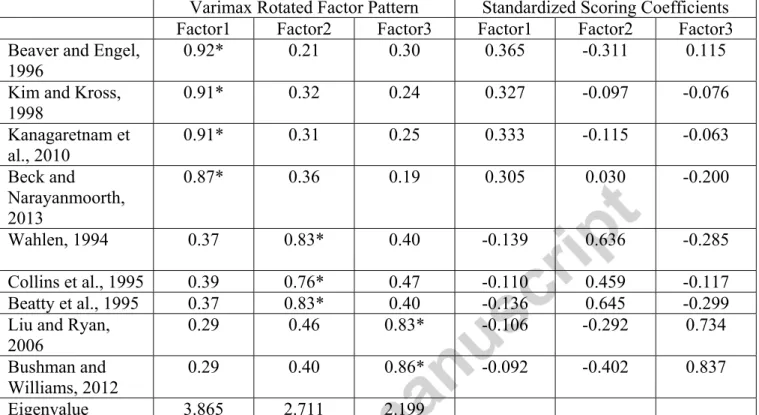

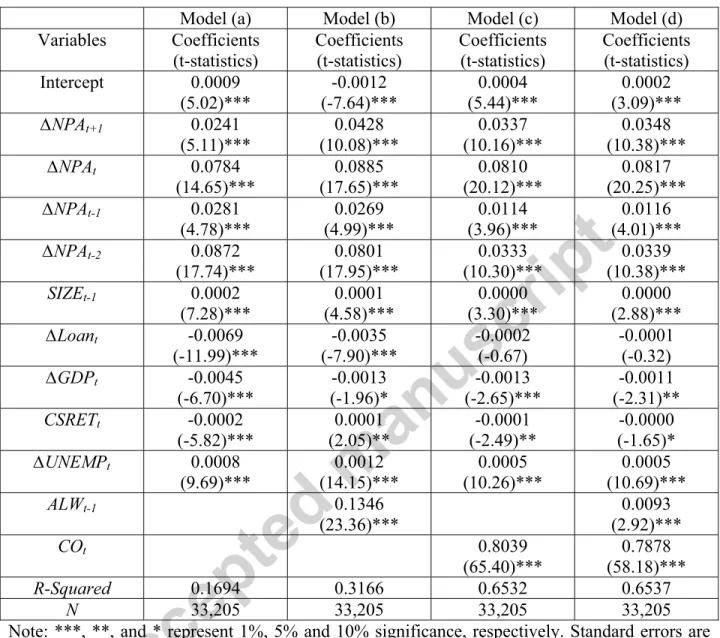

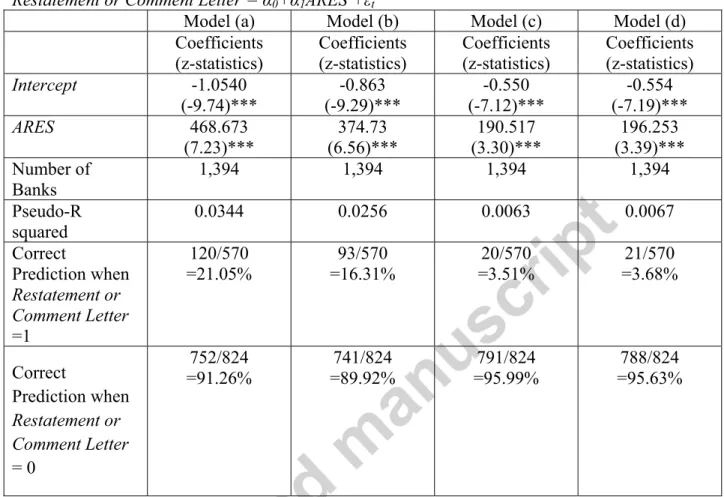

Research examining financial reporting discretion and capital and earnings management A large literature examines whether banks use financial reporting discretion to

The change in the effect of the provision for credit losses on regulatory capital calculations during the pre-BASEL versus BASEL periods influences how accounting research identifies capital management behavior and how we interpret the correlation between the provision and regulatory capital. Taking advantage of this regulatory shift, Kim and Kross (1998) and Ahmed et al. 1999) find evidence consistent with the interpretation of capital management in the pre-BASEL studies. Their sample drawn from the periods before and after the implementation of BASEL shows that public banks use more leeway in providing for credit losses to achieve profit targets than private banks.

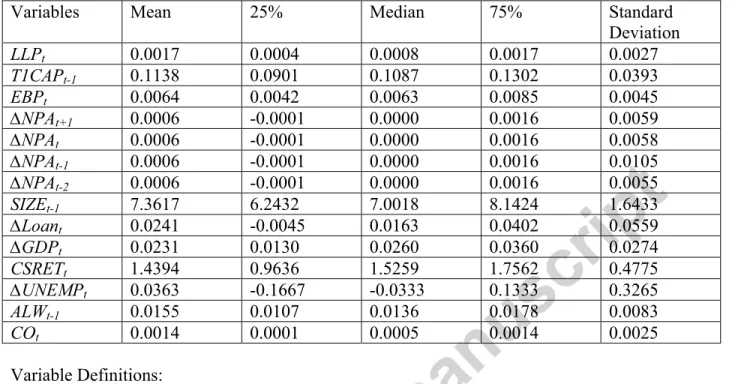

This finding, although somewhat different from earnings smoothing, suggests that discretion in loan loss provision is related to earnings management incentives that are distinct from the effect of earnings on capital management. Although both Kim and Kross (1998) and Ahmed et al. 1999) examine the change in correlations between provisions and regulatory capital, they do not directly examine capital management in the new regime. For the same reason, we do not include the level of bank loans in the models.

As mentioned above, the role of corporate governance in banks in the recent financial crisis is widely debated. Related to the importance of the mix of loans in the loan portfolio, Liu and Ryan (1995) also find that information content of terms depends on loan types. Finally, investigating the consequences of accounting quality in the financial crisis, Cohen et al. 2012) argue that more opaque banks that engage in more earnings management are more likely to collapse during the crisis.

Research examining the effect of accounting on banks’ economic behaviors

For financial institutions, the transition to fair value accounting for investment securities with the adoption of SFAS 115 was an important accounting change with the potential to impact their operating decisions. These studies indicate that banks changed their investment behavior to minimize the effect of fair value accounting on regulatory capital, but they do not examine the efficiency losses associated with these changes in behavior or tell us how the behavioral changes affected the usefulness of the regulatory capital ratio in capturing potential solvency problems . Plantin et al.'s (2008) view that fair value accounting accentuates fire sales of bank assets is also currently under debate.

Its fair value reporting measure includes both recognized and disclosed fair values reported in the bank holding company's regulatory filings. He says his findings suggest that fair value accounting is likely to exacerbate the subprime crisis. It is also important to consider the effects of fair value accounting on procyclicality and contagion in the absence of a regulatory capital effect, but the current limited and sparse evidence suggesting that fair value accounting contributes to these problems ignores the incentives through which the feedback takes place. then via assessment capital.

Understanding the link between procyclicality and contagion and the effects of fair value accounting more broadly could provide a more compelling argument for the importance of accounting in the recent financial crisis because most SFAS 115 gains/losses are not included in capital ratio calculations. Whether market mispricing during crises for reasons other than illiquidity alters the effect of fair value accounting on actual firm activities is largely unexplored in the empirical literature. More research in this area would be helpful in understanding broader issues related to how market mispricing alters the effects of fair value accounting on economic behavior.

Future banking and accounting regulation 1 BASEL III

Furthermore, in advanced approaches, banks are also subject to a countercyclical capital buffer if regulators determine that credit growth in the economy is becoming excessive. In the current regime, empirical researchers may be able to take advantage of different capital requirements around the world to partially explore the empirical implications of higher capital requirements. Accounting researchers may be of particular interest to a proposal in the BASEL III reforms that requires comprehensive income arising from unrealized gains/losses on securities to be part of Tier 1 capital.

Finally, BASEL III introduces a global minimum liquidity standard (next to the US rule) to insulate banks from the liquidity squeeze experienced in the crisis. Although DTAs arising from temporary differences are allowed to be part of Common Equity Tier 1 capital up to 10%, there is a total threshold of 15% for three components: DTAs, mortgage servicing assets and investments in institutions unconsolidated financial in the form of ordinary shares. . In addition, for DTAs that are recognized as Tier 1 capital, a 250% risk weight will be applied in the calculation of risk-weighted assets.

Although not included in the new BASEL rule, the FASB and IASB are proposing forward-looking provisioning to replace the incurred loss model. Current accounting research can help us understand the implications of BASEL III's and FASB's and IASB's emphasis on more forward-looking provisioning. However, using the results of these studies to make inferences about future regulatory changes is subject to the criticism discussed above that it is difficult to predict the likely impact of this accounting change in the absence of an economic model of the change in behavior resulting from the change in loan loss allowance accounting.

Summary and conclusions

The implications of banks' credit risk modeling disclosures for their loan loss provision timeliness and loan origination procyclicality. Regulatory capital, tax and earnings management effects on loan loss accrual in the Canadian banking industry. The impact of the 1989 change in bank capital standards on loan loss provisioning and loan write-offs.

1934 As a "temporary measure" the SEC exempted banks from the Securities Act of 1934 reporting and other requirements for securities listed on national exchanges. Add back the loan loss provision to the loan loss capital provision to increase the regulatory capital ratio. Average Total Assets A one dollar increase in the loan loss allowance increases regulatory capital by the tax rate times one dollar.

Specifically, while provision for one dollar of loan loss reduces earnings and regulatory capital by one dollar times (1 tax rate), one dollar of provision is added back to regulatory capital. A one dollar increase in loan loss provisions reduces Tier 1 capital by one dollar times (1 tax rate), because loan loss allowance is not added back to Tier 1 Capital. When loan loss allowance is less than 1.25% of risk-weighted assets, a one dollar increase in the loan loss allowance increases regulatory capital by the tax rate times one dollar.

When the loan loss allowance is greater than 1.25% of risk-adjusted assets, a dollar increase in loan loss provisions reduces total capital by one dollar (1 tax rate). Bank for International Settlements (BIS) – Founded on May 17, 1930, making it the oldest international financial organization in the world, the BIS is a bank for central banks.

NPA: Change in non-performing assets (COMPUSTAT “naptq”) divided by total overdue loans (COMPUSTAT “lntalq”). Asset-backed commercial paper – Asset-backed commercial paper (ABCP) is a short-term investment vehicle with a maturity that is typically between 90 and 180 days. These commercial papers are backed by physical assets such as trade receivables, and are generally used for short-term financing needs.

Its mission is to serve central banks in the pursuit of monetary and financial stability and to promote international cooperation. The BCBS serves as a forum for its members to discuss issues and problems relating to banking regulation. The culmination of the BCBS's efforts led to the promulgation of an agreement entitled "International Convergence of Capital Measurement and Capital Standards", which has since been known as the Basel Capital Accord.

Basel Capital Accord (BASEL) – a set of minimum capital requirements for banks, which was adopted in 1988 by the countries of the Group of Ten (G-10). This agreement updated the original Basel agreement to include alternative methods for calculating risk-weighted assets and.

Capital – capital represents supplementary capital of a bank's capital base that regulators use as a bank financial health indicator. capital includes qualifying subordinated