First of all, we would like to express our gratitude to our research project supervisor, Mr. Lim Chong Heng, for his valuable time, guidance and comments on our research project until the completion of the study. Throughout this project, he directly gives his wise professional information, valuable opinion and his motivation to improve our research project.

Undergraduate Research Project against the Faculty of Business and Finance Last but not least, we are very grateful to have a diverse background of group members. First and foremost, we would like to thank the members of our group consisting of Ang Jia Xuan, Ch'ng Jia Ann, Tan Pei Wen and Wong Suet Yee for their efforts in carrying out the research project. The Undergraduate Research Project (UBFZ3026) is a compulsory course for all final undergraduate students to complete their studies towards the Bachelor of Finance (Hons).

RESEARCH OVERVIEW

- Research Background

- How Liquidity Risk Led to Bank Failure

- Basel Committee on Bank Supervison

- Research Problem

- General Objective

- Specific Objectives

- Specific Questions

- Research Significance

Undergraduate Research Project Page 2 of 58 Faculty of Business and Finance of the bank such as liquidity ratio, financial leverage and profitability. One of the reasons causing the bank's failure is its poor liquidity risk management. After the crisis, the banks realized the importance of liquidity risk management for their survival in the banking sector.

Therefore, this study is crucial to assess the understanding of liquidity risk levels and liquidity risk management in banks.

LITERATURE REVIEW

Introduction

Review of Variables

- How the banks determine and identify Liquidity Risk?

- What is the relationship between Debtor Collection Period and

- What is the relationship between Credit Payment Period and Liquidity

- What is the relationship between Liquidity Buffer and liquidity risk? . 18

- Cash Conversion Cycle (Debtor Collection Period)

- Cash Conversion Cycle (Credit Payment Period)

- Inventory theory of capital and liquidity buffer (Liquidity Buffer)

Kimani, James, Nyangáu, Benson, Karungu and Kirui (2014) stated that there is a significant relationship between the average credit payment period and the bank's liquidity risk. The liquidity buffer of the banks can be calculated by using the ratio between liquid assets and deposits. Undergraduate Research Project Page 19 of 58 Faculty of Business Administration and Finance There is a significant relationship between the liquidity buffer and the liquidity risk of the banking institutions which is supported by the inventory theory of capital and liquidity buffer.

Based on Bindseil and Lamoot (2011), the liquidity buffer is negatively associated with the liquidity risk. This is because the liquidity buffer prevents the banks from suffering the fire sale situation. In addition, the negative correlation between liquidity buffer and liquidity risk is also supported by Centralny (2012).

In short, there is a negative relationship between the liquidity buffer and the liquidity risks. Meanwhile, the stock theory of capital and liquidity buffer will present the relationship between liquidity risk and liquidity buffer. Undergraduate Research Project Page 22 of 58 Faculty of Business Administration and Finance In short, the creditor period had a negative impact on the liquidity risk of the company under study.

Thus, the theory of capital inventory and liquidity buffer specified that there is a strong relationship between liquidity buffer and liquidity risk. Based on Mugenyah (2015), the relationship between liquidity buffer and bank liquidity risk is proven by capital inventory and liquidity buffer theory.

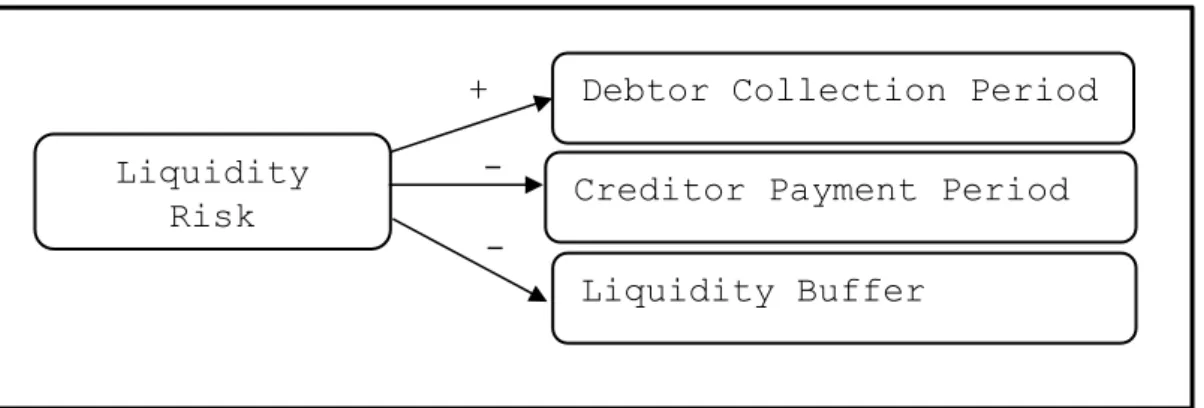

Conceptual Framework

Undergraduate Research Project Page 24 of 58 Faculty of Business and Finance When banks have adequate liquidity buffers, they can achieve two important goals, namely increasing profits and reducing liquidity risks. It is critical for banks to manage their balance sheet structure well and have a liquidity buffer to mitigate liquidity risk by reducing assets and liabilities. This is because banks will always convert liquid assets into illiquid liabilities in the short term, such as investing in illiquid loans with deposits.

Even so, it is a challenge for banks to sell off loans in a short period of time if there are large sudden deposits withdrawals. If banks do not have an adequate liquidity buffer to insure against liquidity risk, they can and do suffer greater losses. These include the types of data, the periods of the year and the countries included in the survey.

In addition, the study explains the measurement of variables and the data collection method for each variable that falls within the scope of the studies. This study is crucial for assessing the understanding of the level of liquidity risk and liquidity risk management in banks and indicates the main direction for bank risk management and its improvement. The research will focus on examining the relationship between working capital management and the banks' liquidity buffer and liquidity risk.

To conduct the study, panel data will be collected, as they are combined with both cross-sectional and temporal data. Panel data can reveal dynamic changes of variables over time and have more informative data.

Scope of Study

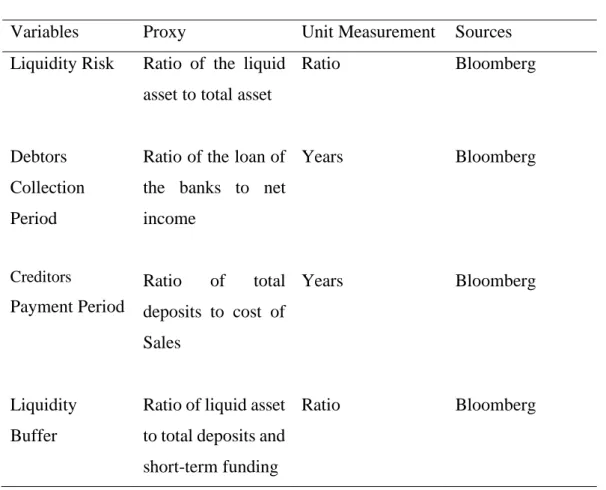

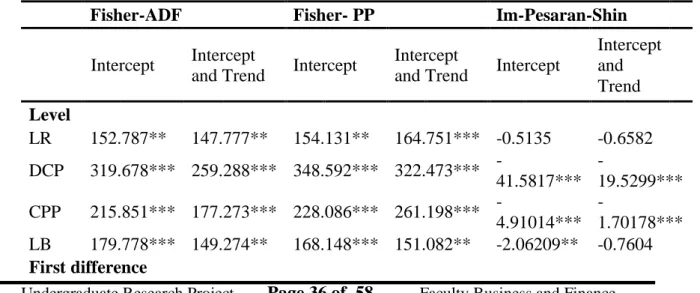

- Unit Root Test

- Lag Order Selection

- PVAR Estimation

- Granger Causality

- PVAR Impulse Response-Functions

- Panel Variance Decomposition

Since the PVAR coefficient is difficult to interpret, a variance decomposition and an impulse response function will therefore be generated to determine the response and effect of the variables. The ratio of liquid assets to total assets is an efficient and quick way to determine the liquidity status of a bank. Fisher's PP test can be called a modified version of the ADF test, as it requires more attention.

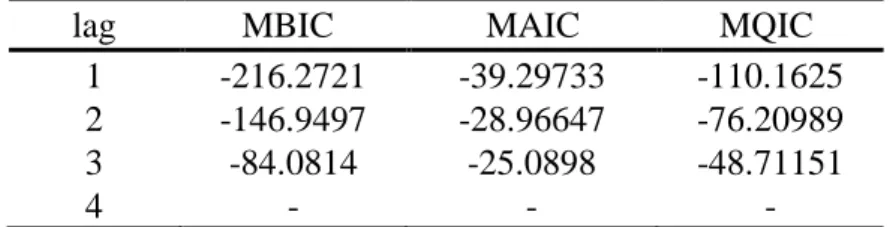

The results show that the first-order values are the smallest among all the statistical values of the criteria. The characteristics of this test can take into account all the interaction between variables in the unit observation of the period and it can also show a clear overview regarding the causal chain of the variables (Oluwapelumi & Olaride, 2017). In equation (4), the exogenous variables are in the autoregressive structure of the panel VAR to preserve generality.

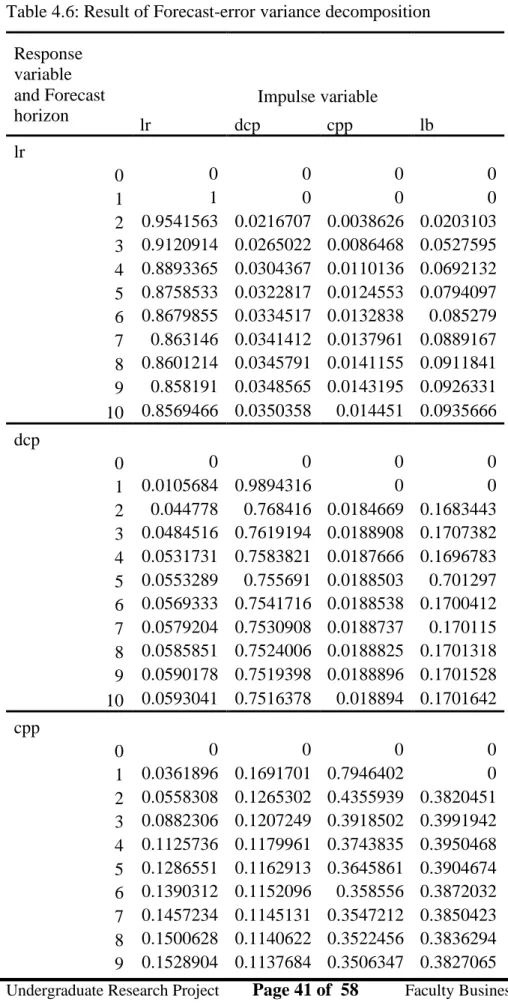

Another shock on variable will be induced by a variable shock due to the correlation between 𝑒𝑖𝑡 occurring at identical instants. In this research study, the variance decomposition is presented to explain the degree of the total effect of a shock, assuming that the movement share of one variable can be explained by the shock to another variable over time. In addition, the stimulation of the standard deviation and confidence interval and the variance decomposition of the prediction error of the impulse response equation should generate the variance analysis result and the impulse response function diagram.

The matrix P can be used to orthogonalize the shocks, thus 𝐼𝑘 can be the covariance matrix of the orthogonalized shocks 𝑒𝑖𝑡𝑃−1. The estimated error variance will have disintegration in the direct way due to the orthogonalization process.

Diagnostic Checking

- Over- Identifying Restriction

- PVAR Stability

PVAR stability test is crucial when performing on the PVAR model because it indicates that the model is reversible and has an infinite order VMA indicator for stimulating impulse response function and variance decomposition which indicates the direction of the overall effect of a liquidity. risk, which indicates the proportion of the movement in one variable that is explained by the liquidity risk, to another variable over time. Furthermore, it could show that the model is stable if all the characteristic roots of the model fall within the unit circle and all the moduli are strictly less than one.

DATA ANALYSIS

- Introduction

- Panel Unit Root Test

- Lag Order Selection

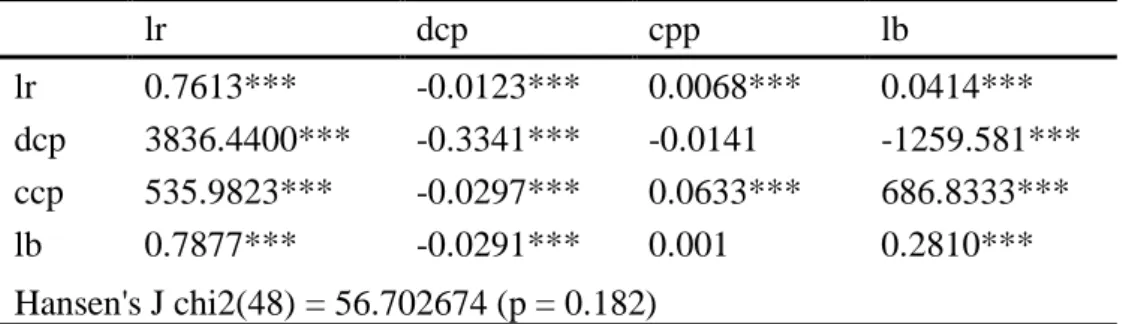

- Panel VAR results

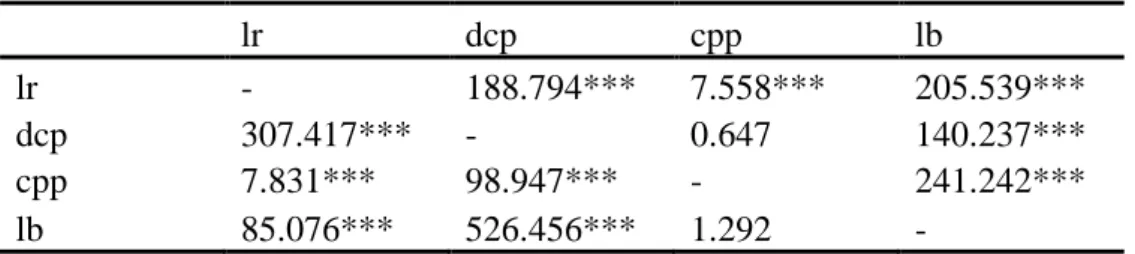

- Granger Causality Test

- Impulse-Response Functions

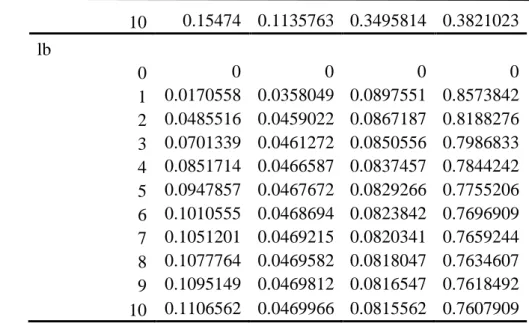

- Panel Variance Decomposition

- PVAR Stability Test

- Interpretation of Major Findings

The debtor's collection period has a positive effect on liquidity risk, while the creditor's payment period and the liquidity buffer have a negative effect on liquidity risk. Meanwhile, the result shows that liquidity risk negatively affects the debtor's recovery period in the long run. In addition, the PVAR result shows that the debtor's recovery period significantly affects the liquidity buffer in a negative direction.

Also, the creditor's payment period negatively affects liquidity risk because when the creditor's payment period increases, liquidity increases. First of all, the debtor's collection period will significantly affect the liquidity risk in a positive direction. In addition, liquidity risk will be negatively affected by the creditor's payment period and liquidity reserves.

Undergraduate Research Project Page 44 of 58 Faculty of Business and Finance Wieczorek-Kosmala, Doś, Błach and Gorczyńska (2016) who said that the better the working capital management, the lower the liquidity risk. Apart from that, long-term liquidity risk can reversely affect the collection period of the debtor is supported by few researchers. Based on the impulse response functions, the independent variables, namely the payment term of the creditor and the liquidity buffer, have a significant impact on the dependent variable's short-term liquidity risk.

The bank with more liquidity buffer is generally more liquid; therefore, it has a lower liquidity risk. This means that the bank with a higher cash reserve will have higher liquidity and lower liquidity risk.

CONCLUSION AND IMPLICATIONS

- Summary

- Implications of the Study

- Limitations of the Study

- Recommendations for Future Research

The results indicated that the receivables collection period will positively influence the long-term bank liquidity risk for the oil exporting countries' banks. Therefore, it can be concluded that the bank liquidity risk can be managed by maintaining a low receivables collection period. The results showed that there is a negative relationship between the creditor payment period and bank liquidity risk in both long-term and short-term effect for the oil exporting countries' banks.

This is similar to the objective in which it was mentioned that the higher the creditor payment period, the lower the liquidity risk. So it can be summarized that the bank liquidity risk can be managed by maintaining a longer creditor payment period. Undergraduate Research Project Page 49 of 58 Faculty of Business and Finance As shown in the results, there is an inverse relationship between the liquidity buffer and bank liquidity risk in both long-term and short-term effect for the oil exporting countries' banks.

This is also consistent with the objective in this study, which mentioned that the higher the liquidity buffer, the lower the liquidity risk. Therefore, it can be concluded that the bank's liquidity risk can be managed with an appropriate liquidity buffer. The examples of bank drive, as mentioned in Chapter 1, show that the bank's liquidity risk will trigger a financial crisis and the economic development of the country.

They will have a better understanding of the liquidity ratio and risk while realizing the impact of liquidity risk. The proposed methods to manage bank liquidity risk in this study are solely from the micro perspective and more focus on internal control of banks.