The main objectives of the regulation on the share ownership quota in listed public companies, which was introduced in 1971 through the NEP, are as follows:-. Prior to the 1971 NEP policy, the general ratio on the capital ownership structure of listed public companies was Malay Bumiputeras: Other Malaysians: . Foreigners). Through the stability of the political situation, the progress of the nation is likely to increase further.

Types of Costs Involved.- 1) Direct costs

Direct Costs

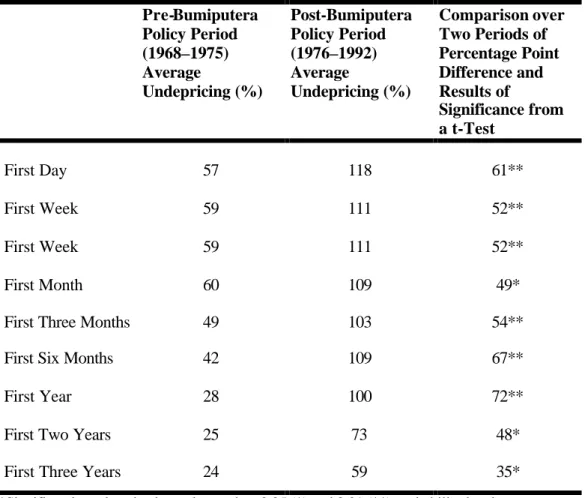

In the following discussion, it will be demonstrated that the costs involved are not purely administrative, but also direct costs, such as their negative impact on foreign and domestic investment. In addition to this, the indirect costs such as transaction costs in the form of negotiation, search and opportunity costs of meeting the quota requirement are also identified. On top of this, social costs in the form of inefficient net seeking are unavoidable due to the nature of the quota itself, whereby a 'network of intermediaries' is established to profit from the transfer of the shares.

There is a general trend in the decline of listed companies owned by the foreign owners13. Singapore companies were excluded due to complications associated with the way Singapore (and Malaysian) companies were cross-listed in the early years in both Singapore and Kuala Lumpur. In addition to this, in the current years up to 2008, after facing the economic problem due to the 1997 Asian financial crisis and worldwide inflation, the government has also opened up a special region in the state of Johore (which is adjacent to Singapore), known as the Iskandar Economic Zone, whereby.

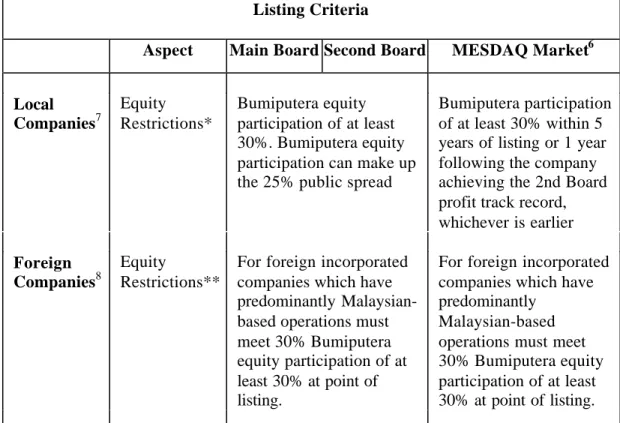

Many local companies have chosen to list their companies on foreign stock exchanges such as Hong Kong and Singapore, as the listing requirements in these countries are not as strict regarding the quota of local bumiputeras ownership. Some domestic investors have also chosen to invest in China and India, which have lower production costs and greater flexibility in the ownership structure of foreign companies investing in these two giant economic dynamos in Asia.

Indirect Costs

The late Lim Goh Tong, Malaysia's third-richest businessman, built his fortune largely from the Genting Highland casino business and has controlling stakes in publicly listed Genting, Resorts World and Asiatic Developments, has also listed Star Cruises Plc in Hong Kong. , in which he holds a 20% stake 20. In the absence of ownership quota regulation, research and negotiation costs are saved and used for a more productive or value-enhancing activity. A brief look at the following capital policies in ASEAN (Association of Southeast Asian Nations) countries in Appendix I 21 shows that Malaysia has the most complicated and inconsistent foreign capital policy, with numerous exceptions and deadlines. uncertainty, which means higher costs in its review and reduced competitiveness in the eyes of foreign investors. b) Increased costs due to strategic behaviors in the transfer of shares.

In addition, the problem of strategic behavior could further lead to an increase in transaction costs when transferring shares. For example, if the last Bumiputera or Malaysian is not willing to accept the same interest rate as offered by the previous shareholders, the company has no choice but to adhere to the threat of the last acquirer, as the company has invested heavily in the previous transactions. . However, these shares are likely to be immediately sold to third parties at a higher market price, creating a rent-seeking market in the distribution of shares within the community of Malay Bumiputeras and other Malaysians.

In relation to futile rent-seeking activities, many Bumiputera companies were floated in the 1980s and listed on Bursa Malaysia to take advantage of the soft and subsidized government loans given to these types of companies. A number of these businessmen were hit hard by the currency crisis of 1997, leading to the loss of firms under their control27.

Types of Benefits (aimed to be) Derived:-

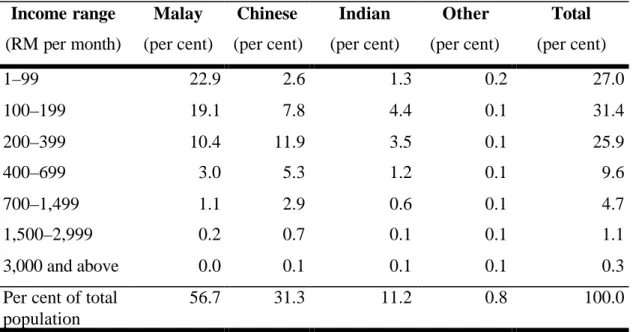

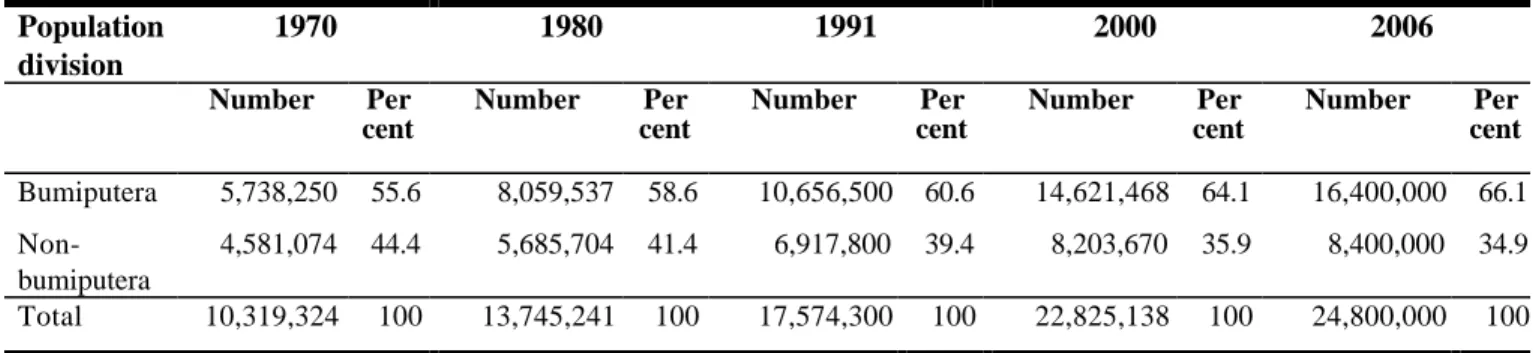

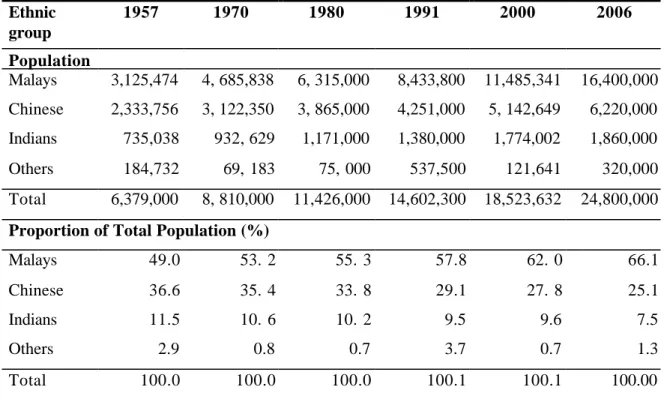

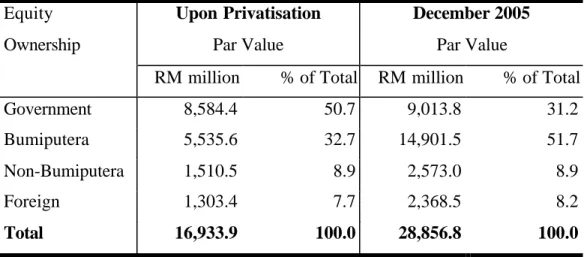

Given the very nature of asymmetric information between the elite group and the general public, the concentration of ownership in the hands of the elite group is not reflected in official statistics. Second, it is claimed that poverty among ethnic groups has also been reduced during the implementation of the regulation. In terms of the ethnic group ratio, according to statistics, the Malay Bumiputeras again recorded the greatest progress.

For example, of the total equity shares held by the general public, Indians and Natives account for less than 2% of the equity shares. Furthermore, based on recent analysis, there is a clear indication that creating Malay Bumiputera entrepreneurs through equity ownership and soft loans are not the right instruments to root entrepreneurship. Based on the above illustration, in the presence of state aid (financial and non-financial), the government (and ultimately the general public), instead of the so-called 'entrepreneurs', becomes the bearer of the residual risk.

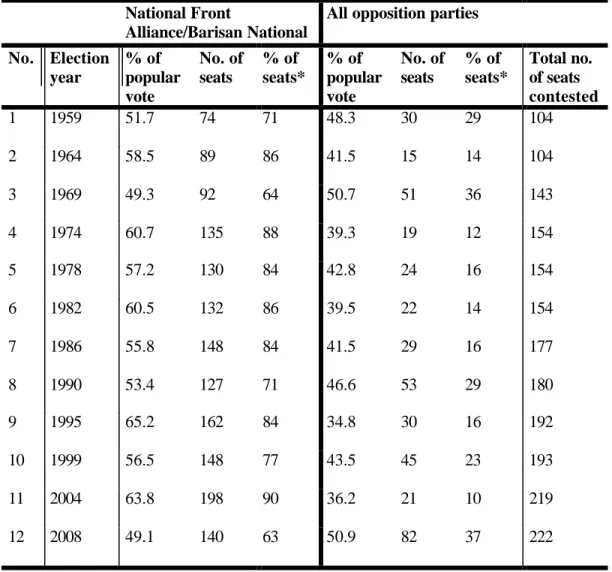

In fact, Malaysia is one of the most advanced countries in the Southeast Asian region, but also the country with the largest gap between the rich and the poor. As shown in the table below, it is the first time in Malaysia's history since 1969 that opposition parties have won more than 1/3 of the total parliamentary seats:-. Neglecting the economic progress of the Indian community at large has led to the stagnation of this group in the mainstream economy.

Consequently, there is a silver lining in the true enlightenment of the Malay Bumiputera electorate in recognizing the difference between a political agenda and what truly increases prosperity for the nation as a whole, regardless of ethnic groups.

Rent -seekers’ lobbying

Nevertheless, the utility of this political agenda is now under relentless challenge from the Malaysian Bumiputera community itself. Considering that the regulation of equity capital has been in place for more than 30 years, its negative effects in widening the gap between the elite groups and the general public are becoming more and more visible. With the rise of the new Malay Bumiputera middle class, who are more informed and more knowledgeable than their predecessors, they no longer see the share quota as synonymous with Malay Bumiputera privilege.

In 1994, the Malaysian Anti-Corruption Agency investigated the case of share transfers in a public company known as Leader Universal, which is the largest cable manufacturer in Malaysia. Six allocations were made to individuals, namely Fazrin Anwar (son-in-law of Ms. Rafidah Aziz, former Minister of International Trade and Industry), Mirzan Mahathir (son of former Prime Minister, Mr. Mahathir Mohamad) and Marzuki. Ibrahim (brother of the former deputy prime minister, Anwar Ibrahim). However, the investigation led nowhere and then faded from the public eye, as is usually the case.

Path-dependence

Many protectionist approaches favor the ownership of equity quotas, arguing that local Malay Bumiputera businesses are vulnerable to "predation". In addition, due to the accompanying regulation that the employment of these public companies must be at least 30% Bumiputera employees, the removal of this equity restriction may result in further unemployment of Bumiputeras in the private sector. This could have a negative externality in the labor market, leading to greater poverty within the ethnic group.

Although the bitter pill of removing the capital ownership quota may be difficult to swallow at the initial stage, it nevertheless has a long-term positive effect on the overall economic health of the country. Despite this, it is essential to emphasize the evolutionary nature of Malaysia's economic development. In the period from Malaysia's independence to the 1970s, this pattern continued without much change in its course.

However, in recent years, with the relaxation of capital ownership rules, it can be observed that genuine cooperation between ethnic groups is developing well, especially in small and medium-sized enterprises46. The spontaneous and dynamic nature of economic fluctuations across the river of history may indicate that economic restrictions based on ethnicity or nationality are short-lived and ineffective for the nation's wealth.

Endowment Effect

Heng, Pek Khoon, 1997, "The New Economic Policy and the Chinese Community in Peninsular Malaysia" Developing Economies, XXXV-3 (September) Jesudason, James V., 1989, "Ethnicity and the Economy: State, Chinese and Multinational Business in Malaysia .” Oxford University Press. Editors), 2000, “Rent, Rent Seeking and Economic Development: Theory and Evidence in Asia”, Cambridge University Press. Landa, Janet Tai, 1994, “Belief, Ethnicity and Identity: Beyond the Economics of Institutional Networks of Ethnic Trade Networks, Contract Law and Gift Exchange" The University of Michigan Press. Koppl (eds.) The Cognitive Revolution in Economic Science Advances in the Austrian Economy, Elsevier Ltd. Volume.

Rowley, Charles K., Tollison Robert T., Tullock, Gordon (Editors) 1988, "The Political Economy of Rent-Seeking" Kluwer Academic Publishers. B., 1997, "The Economic Dimension of Malay Nationalism: The Socio-Historical Roots of the New Economic Policy and Its Contemporary Implications", The Developing Economies, XXXV-3 (September. Torii, Takashi, "The New Economic Policy And The United Malays National Organization - With special reference to the restructuring of Malaysian society", The Developing Economies, XXXV-3 (September.

LAOS 100% foreign share ownership is permitted in all sectors open to foreign investment, with the exception of the mining, plantation and hydropower sectors where a negotiated level of minority government ownership is required. The burden of proof that the proposed acquisition of assets or any interest, mergers or acquisitions of companies and enterprises is not inconsistent with the objectives of the New Economic Policy rests with the acquiring parties concerned. Any proposed acquisition of 15% or more of the voting power by a foreign interest or associated group, or by foreign interests in the aggregate of 30% or more of the voting power of a Malaysian company or enterprise.

In the case of a joint venture, foreign capital must represent at least 35% of the total equity capital.