As customers nowadays want to receive a better customer experience, especially in service quality from insurance agents. The purpose of conducting this research is to distinguish the factors that influence the customers' experience of service quality from insurance agents. Accordingly, the customer experience theory and service quality concept were implemented to investigate customer experience in receiving service from insurance agents.

INTRODUCTION

- Introduction

- Research Background

- Research Problem

- Research Question

- Research Objectives

- Hypothesis of Study

- Significance of Study

Determining the relationship between tangibility and customer experience versus insurance agent service quality. Determining the relationship between competence and customer experience and the quality of service provided by insurance agents. Research into the relationship between communication and customer experience and the quality of service provided by insurance agents.

LITERATURE REVIEW

- Introduction

- Review of Relevant Theoretical

- Theory of Customer Experience (CX)

- Review of Concept

- Service Quality Concept (Servqual)

- Review of Variables

- Customer Experience

- Tangibility

- Reliability

- Responsiveness

- Assurance

- Empathy

- Competence

- Communication

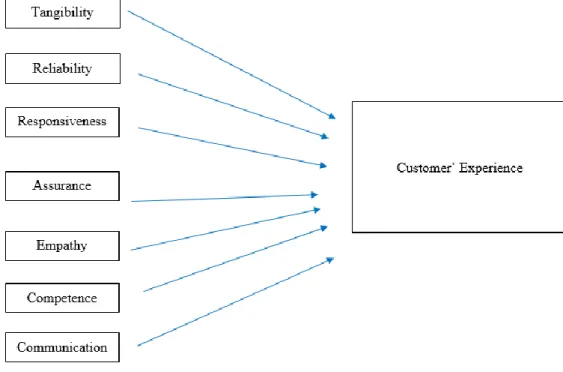

- Conceptual Framework

- Hypothesis Development

- The relationship between tangibility and customer experience

- The relationship between reliability and customer experience towards

- The relationship between responsiveness and customer experience

- The relationship between assurance and customer experience towards

- The relationship between empathy and customer experience towards

- The relationship between competence and customer experience

- The relationship between communication and customer experience

In addition, research conducted by McLean et al. 2018) found that the measurement of the cognitive dimension of customer experience has been focused by some research studies, which are only through analyzing satisfaction with the experience. Furthermore, reliability is one of the most important elements on which customers base their expectations on service quality, as revealed by previous research. To help the customer judge the functional quality of the service encounter, responsiveness would be an important dimension.

The definition of security is the ability of employees and their company to create trust and confidence in their customers and employee courtesy, knowledge (Ramya et al., 2019). The study by Ahmad Al Qudah et al. 2013) indicated that communication is a factor due to the company's highly trained employees in communication and dialogue, and they have high abilities to clarify the particularity of the given service. The customers can roughly know about the quality of the company's service by looking at these tips and the image of the company can be improved with this dimension.

The findings of the study have shown that the tangibility of a service will influence the customer experience. From previous research, the researchers said that reliability is one of the important dimensions on which customers base their expected value of service quality. Besides the dimension of assurance, it also has the responsibility to ensure the safety of the company and the skills, expertise, courtesy and accuracy of the employees (Ahmad Al Qudah et al., 2013).

The previous research conducted by Alawni et al. 2016) stated that the workers working in the firm constitute the assurance factor considered as part of the service quality dimension.

RESEARCH METHODOLOGY

- Introduction

- Research Design

- Quantitative Research

- Descriptive Research

- Data Collection Method

- Primary Data

- Sampling Design

- Target Population

- Sampling Location

- Sampling Element

- Sampling Technique

- Sample Size

- Research Instrument

- Questionnaire Design

- Pilot Testing

- Construct Measurement

- Origins of Construct

- Nominal Scale

- Ordinal Scale

- Interval Scale

- Data Processing

- Editing of Data

- Coding of Data

- Tabulation of Data

- Data Diagrams

- Data Analysis

- Descriptive Analysis

- Scale Measurement

- Inferential Analysis

The insurance agent performs error-free services the first time The company's staff offers. The insurance agent follows specific procedures when a customer submits a request for service until the customer information is submitted. An insurance agent is quick to respond to all customer needs regardless of the level of concern.

An insurance agent provides individual attention to clients. Competencies (Ahmad Al. Qudah et al., 2013). The insurance agent is sufficiently informed about the information communication of the customers (Ahmad Al. Qudah et al., 2013). In constructing the measurement scale of this research, a nominal scale was used in Section A (Demographic Profile) of the survey questionnaire form.

Based on 3.5, in this research, in addition to ratio scales, construct measurements, ordinal, interval, and nominal scales are applied in data categorization. Thus, the scales mentioned above can be considered as the measurement level and the reliability of the data collected in this research will be continuously improved. The definition of inferential analysis is the conclusion about a target population from the research sample size can be drawn using this method (Byrne, 2007).

In the meantime, the level of linear relationship between the dependent variable and each independent variable can be analyzed.

DATA ANALYSIS

- Introduction

- Descriptive Analysis

- Respondents Demographic Profile

- Central Tendencies Measurement of Constructs

- Reliability Test

- Inferential Analysis

- Pearson’s Correlation Analysis

- Multiple Regression Correlation Analysis

- Hypothesis Testing

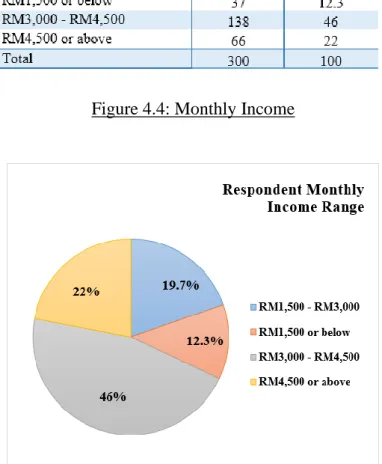

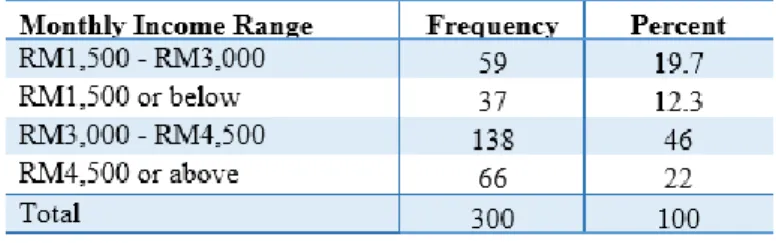

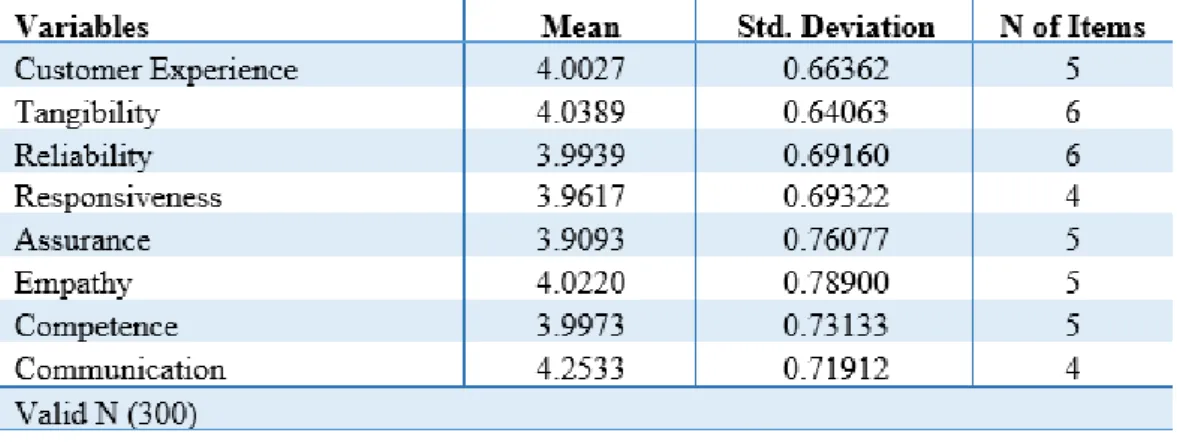

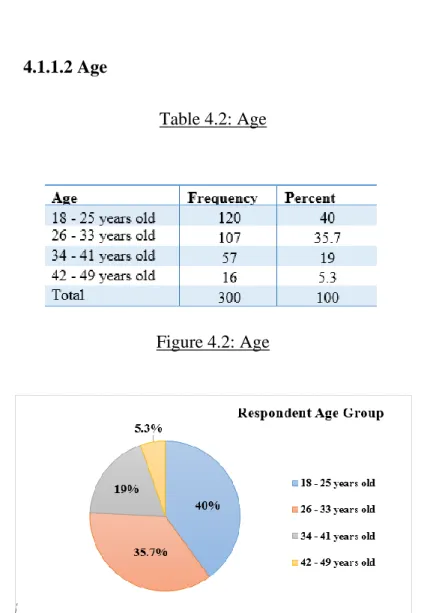

The income group of the respondents is classified into 4 groups which are presented in table 4.4 and graph 4.4. In table 4.5, the mean and standard deviation for the variables are obtained from the descriptive statistics of this research. The majority of the respondents agreed with the communication statements which show the highest mean value of 4.2533, while safety has the lowest mean value of 3.9093, which results that the respondents planned to disagree or neutralize the statements .

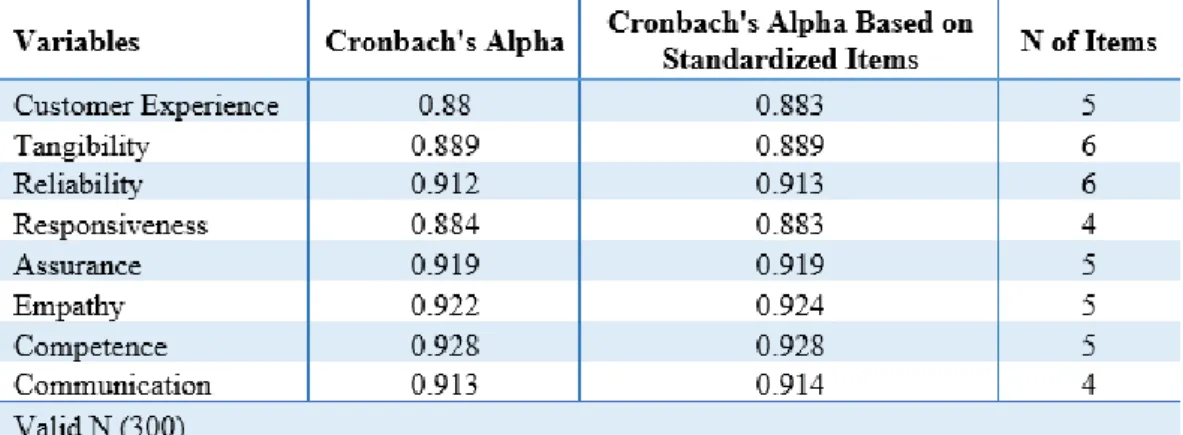

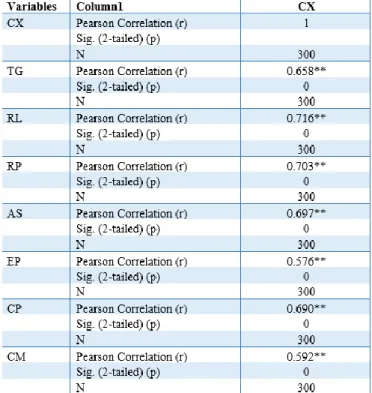

Apart from that, the standard deviation of empathy is the highest out of all variables while tangibility has the lowest standard deviation value of 0.64063. Based on Table 4.6 shown above, all variables have a Cronbach's Alpha that is more than 0.6, which meant that all variables have sufficient reliability. Thus, the results of Pearson's correlation coefficient for this research had been portrayed in Table 4.8.

It has shown that when it comes to the dependent variable, all the independent variables have the same p-value of 0.000. The F value is 78.118 as shown in Table 4.9, which reveals statistically significant results and is suitable for the information in this research. Therefore, there is an impact between TG, RL, RP, AS, EP, CP & CM and customer experience towards the service quality of insurance agents.

RP has the largest beta value of 0.197, which means that RP has the greatest impact on customer experience towards the service quality of insurance agents.

DISCUSSION AND CONCLUSION

Introduction

Summary of Statistical Analysis

Discussion on Findings

- Tangibility

- Reliability

- Responsiveness

- Assurance

- Empathy

- Competence

- Communication

Referring to Table 4.11, a significant positive relationship had emerged between RP and CX in relation to insurance agents' service quality, as the p-value is 0.000, which is less than 0.05. The previous studies had supported these results, where responsiveness to speed up the service has attributed to the provision of signs in the company and also the complete readiness of the employees to help the customers Ahmad Al Qudah et al. The hypothesis is accepted as Table 4.11 represented that insurance has the p-value of 0.008, which is less than 0.05, where this can be demonstrated that there is a positive correlation between AS and CX in relation to service quality of insurance agents.

These findings can also be supported by the previous studies of Ramya et al. 2019), in various situations, such as insurance service companies, try to form loyalty and trust between the individual customers and key contact persons such as insurance agents. This means that there is no relationship between EP and CX towards service quality of insurance agents. Although most of the customers would like to use the new facilities provided by the company, however, there are still groups of people.

They have no choice but to make private contact with insurance agents every time equipment and machinery breaks down. This could therefore lead to consumers being more interested in products than in the quality of brokers' services. Looking at the results in Table 4.11, CM is positively related to CX for insurance agent service quality as the p-value is 0.011, which is less than 0.05.

These findings can be proven through research. 2019), communication was also considered a key factor, as the lack of systematic data transfer between employees and customers will affect the user experience.

Implications of Study

- Theoretical Findings

- Managerial Implications

- Tangibility

- Reliability

- Responsiveness

- Assurance

- Communication

So the agents must dress decently and use appropriate and modern technology and equipment when meeting with clients. The outcome supported H2, it categorizes reliability as one of the variables influencing customer experience. Therefore, the agents must understand and know the customers well in order to dramatically reduce the opportunities for growth and up-selling, which ultimately lead to growth profits for the company (Cyriac, 2016).

Customers will always give feedback and leave information via comment about a company, way of product reviews, experiences with a brand and other similar data (Newman, 2016). The agents should therefore always ask for feedback from the customers regarding the insurance case and always prepare to help them. The goal of the insurance is configured to maintain a good customer experience while protecting the organization.

To ensure that customers experience a good customer experience, agents are responsible for ensuring the quality function they have provided to customers. Agents can specify the resources needed to accomplish the characterized tasks and ensure that customers experience a high-quality service when the definitions are set (Markgraf, 2016). Therefore, insurance agents should provide risk-free services to customers to let them feel safe in dealing with them.

Good communication not only improves customer trust in the business, but also results in better customer experience (Gilboa et al., 2019).

Limitations and Recommendations

The frequency, quantity and quality of information shared by insurance agents can affect the customer experience. Therefore, insurance agents must ensure that the client understands their requirements each time they meet to avoid future disputes. Therefore, direct interviews are required for future research so that accurate detailed data about the behavior and perspective on the subject can be gathered by the researcher.

The sample size for this study is too limited, the determinations of a group of people do not represent larger populations. There are several types of respondents, some of whom agree with the statements made in the survey and some of whom disagree due to individual matters. Therefore, the researcher should use over-sampling to conduct the research in order to get a more reliable result.

So if this problem arises, the researchers should recognize it and indicate the need to identify the key issue for future research.

Conclusion

Consequences of service quality in the insurance industry: A case study on Saudi Arabia's insurance industry. Assessing the relationship between service quality and customer satisfaction in the Malaysian motor insurance industry. An analysis and assessment of customer satisfaction with service quality in the insurance industry in Ghana.

Service quality delivery and its impact on customer satisfaction in banking sector in Malaysia.