INTRODUCTION

The Rise of DFI

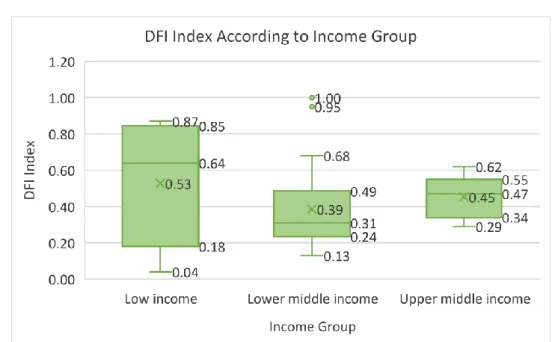

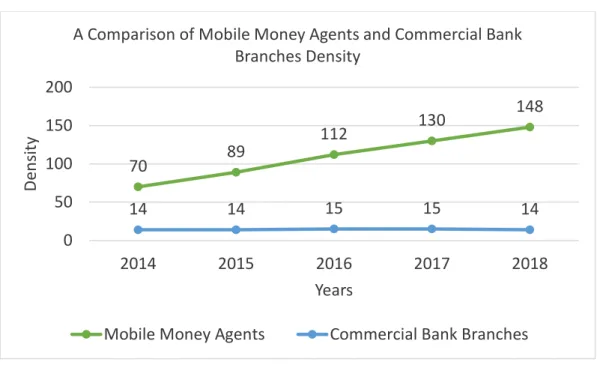

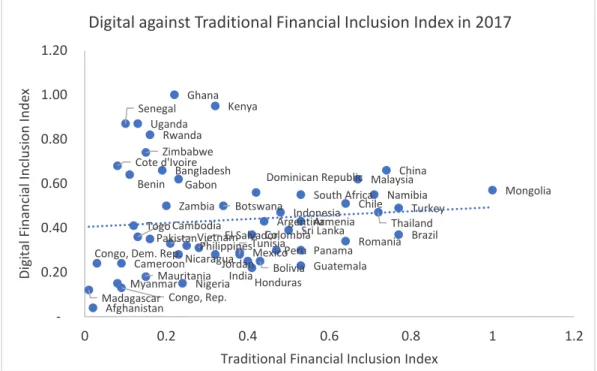

The escalating use of mobile phones and access to the internet has prompted the provision of MFS, which enables individuals to use their mobile money accounts at their leisure. With agents acting as intermediaries for mobile money users, it eases the hassle of searching for expensive financial services. A successful example can be seen in Kenya, which has a high DFI index due to the success of its mobile money application, M-Pesa.

The emergence of mobile money agents in rural areas has influenced increasing financial inclusion.

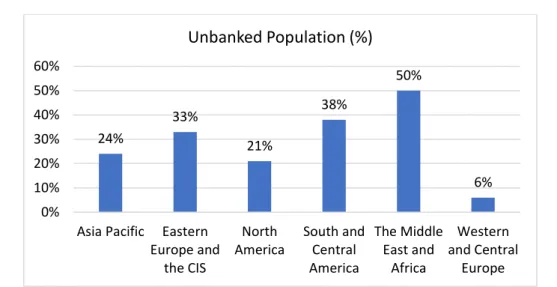

Why Financial Excluded Population Still Exists?

To add, the emergence of digital technology increases the possibility for almost two-thirds of adults in developing countries to access basic financial services that were previously excluded from the system (Pazarbasioglu & Mora, 2020). Although DFI can be the key solution to tackle the issue of banking freedom, as some people who stay in rural areas can imagine to access financial services digitally, this way is only applicable if the households have access to digital infrastructure and internet has. This is because user interfaces (UIs) to access DFS are said to be highly influenced by the type of mobile coverage provided, as DFS is defined as the financial services accessible via mobile.

As the lack of adequate digital infrastructure in some countries is considered one of the main barriers to accessing DFS, a network of mobile money intermediaries could be the secret ingredient in bridging the gap between non-banking and financial services.

Research Objectives & Research Questions

Significancy of the Research

Therefore, our research includes Internet bandwidth as a new indicator to identify its importance to DFI to fill the gap of previous studies. In addition to digital connectivity, numerous past studies by Mas and Morawczynski (2009) and Unnikrishnan and Larson (2019) have portrayed how the network of mobile money agents plays its key role in promoting DFI. This fact is believed to be the recipe for bKash's success as the agent network is one of the main pillars of MFS.

Accordingly, our study aims to examine how important the agent network is in explaining DFI, especially in emerging countries.

LITERATURE REVIEW

- Conceptual Framework: Understanding DFI

- The Roles of DFI.…

- Digital-Focused Determinants: Influencer of DFI

- Conclusion

In the literature, most studies have been conducted in a conventional way by adopting banking determinants as a measure of financial inclusion. Some research has highlighted digital factors that have a positive impact on financial inclusion; however, it is less inclusive when considering access and use dimensions as the only single factor. Many journals have offered their assessments of the importance of financial inclusion, in which it has contributed to financial stability, economic growth and the reduction of income inequality (Sahay et al., 2015; Khera et al., 2021; Ratnawati, 2020). .

In Brazil, studies have applied the Delphi method to find that Fintech promotes financial inclusion as it can provide services to the unbanked, reduce the costs of Fintech users, and provide financial services to people in the distant geographies ( Joia & Cordeiro, 2021). On a macroeconomic scale, improving financial inclusion helps households weather unforeseen shocks as people access savings services that plan for seamless consumption. Subsequently, improving financial inclusion will most likely boost GDP growth by 2 to 3 percentage points.

This is also supported by Rizzo and CGAP (2014), where they mentioned a positive link between the basic theory of digital finance and financial inclusion. Similarly, research conducted in Zimbabwe with a sample of 262,493 rural households found that mobile money storage improved financial accessibility and the use of remittances at lower costs, suggesting a positive effect on financial inclusion in the rural region of the country (Thulani et al. , 2014). In addition, there is a significant result that shows that mobile phone and Internet penetration led to financial inclusion in the South Asian Association for Regional Cooperation (SAARC) countries from 2004 to 2014 (Lenka & Barik, 2018).

Based on the research conducted in seven developing regions in Africa during the period from 2013 to 2017 claiming that financial inclusion is driven by the introduction of mobile money where indicated by the registered subscriber ratio and active subscriber ratio (Mahmoud, 2019). For example, Indian banks in both the private and public sectors have established a heavy reliance on the agent model, while at the same time complying with government policies on financial inclusion (Unnikrishnan & Larson, 2019).

METHODOLOGY

Research Design.…

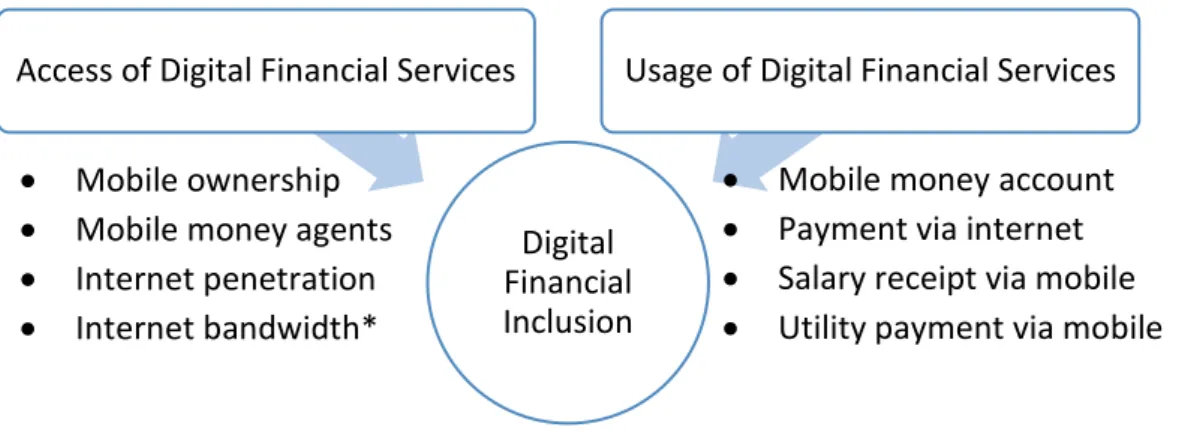

Theoretical Framework of DFI

According to a study published by Perlman and Wechsler (2019), DFS can equip the underserved and unbanked with basic financial services. As allowed by regulatory innovations, even non-banks can now offer financial services to fill these gaps.

Empirical Model

- Model Estimation

- Quantile Regression

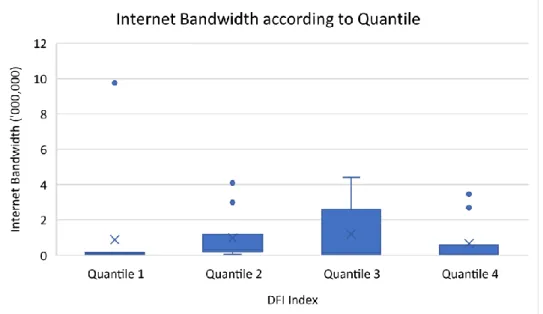

Also, the interaction term between Internet penetration and Internet bandwidth, 𝐼𝑁𝑇𝐼𝑁𝑇𝐵𝑖 and an additional control variable that is a dummy variable for the country of the low income group, 𝐷𝑈𝑀𝐿𝑂 are included in the model. The heteroscedasticity test (Breusch-Pagan test) is used to test whether the error term is normally distributed in the data set. The autocorrelation test (Breusch-Godfrey Serial Correlation .. LM Test) is defined as a test for autocorrelation in the errors of a regression model.

The occurrence of outliers in the data distribution could affect the accuracy of the estimation result due to the extreme change in the value of the outliers. In addition, OLS assumes homoscedasticity where all error terms have constant variance from the mean (Gujarati, 2019); however, it is suspected to have behavioral differences in the DFI quantile. Therefore, in the case of heteroscedasticity, the OLS estimation is less suitable for determining the relationship between the determinant variables and the DFI index.

By overcoming the limitations, the quantile regression model is extended for greater flexibility in research as less assumption is exercised compared to the linear regression model (Petscher, & Logan, 2013). Instead of estimating the conditional mean, quantile regression estimates the conditional mean which increased the reliability of the result in investigating a more specified effect of the explanatory variables on the DFI index at different scale levels (quantiles) (Wenz, 2018). Furthermore, it is less sensitive to outliers, which clearly shows the effect of explanatory variables on the DFI index in different quantiles (Huang et al., 2017).

Supported by the data obtained for the DFI index is in continuous figures, the model is applicable in this research to identify the scale of the DFI index in different quantiles. 𝑀𝑂𝐵𝑖 is mobile phone ownership (per 100 people); 𝐼𝑁𝑇𝑖 is internet penetration (internet user % of population); 𝐼𝑁𝑇𝐵𝑖 is the Internet bandwidth (Mbit/s); 𝑀𝑀𝐴𝐺𝑁𝑖 is mobile money agent (per 100,000 adults); 𝑀𝑀𝐴𝐶𝐶𝑖 is mobile money account ownership (% aged 15 and over); 𝐼𝑁𝑇𝑃𝐴𝑌𝑖 is online payment (% age 15 and over); 𝑀𝑂𝐵𝑅𝐸𝐶𝑖 is receiving salary via mobile phone (% of age 15 and over); 𝑀𝑂𝐵𝑃𝐴𝑌𝑖 is the payment of municipal services via mobile phone (% of age 15 and over); 𝐼𝑁𝑇𝐼𝑁𝑇𝐵𝑖 is.

Data Collection

DFI Index Digital financial services delivered through digital means, including mobile money operators, fintech companies, other new entrants to the financial industry, as well as internet and mobile banking offered by traditional banks. The sum of the country's internet traffic exchanged capacity, measured in megabits per second (Mbit/s). The percentage of people aged 15 and older who personally used mobile money services in the last 12 months.

The percentage of individuals over the age of 15 who paid bills via the Internet in the last 12 months. The percentage of individuals over the age of 15 who received salary or wages from a service via mobile phone in the last 12 months. The percentage of individuals over the age of 15 who have personally made regular utility payments via mobile phone in the past 12 months.

Conclusion…

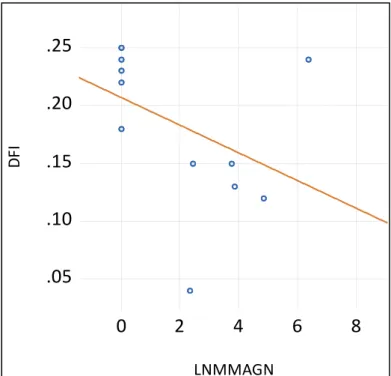

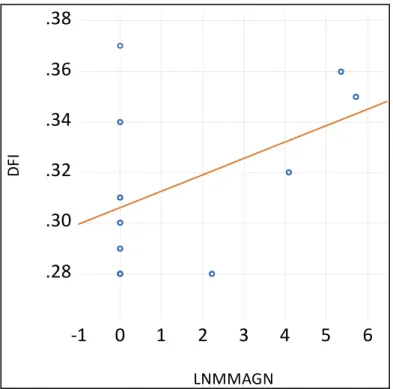

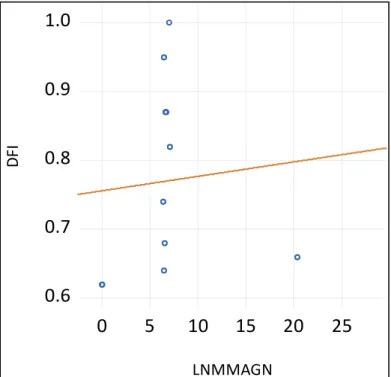

Since Internet bandwidth does not show prominent significance in the countries with the highest DFI, it is therefore suspected that mobile money agent can be the catalyst to achieve high DFI index. As such, we proceed to calculate the average mobile money agent per 100,000 adults for all quantiles to verify our assumption. Average Number of Mobile Money Agents by DFI Quantile Quartile Average Mobile Money Agent.

Moreover, this result confirms our assumption that the mobile money agent is the main determinant of promoting DFI in countries with the highest DFI index. This is explained by those low-income countries making heavy use of mobile money agents instead of traditional ATMs, and it is further supported by the result of the estimate in which the mobile money agent shows 5 percent significant in explaining DFI. Therefore, we focused our attention on the mobile money agent outlet which is significant in the 30th quantile to the 80th quantile (except the 60th quantile), meaning that the DFI index can be explained by the agent network.

Among the 7 variables, our findings suggest that only internet penetration, internet bandwidth, payment via internet, mobile ownership and mobile money agent show a significant relationship in explaining DFI in their respective quantile. Since approaches to TFI are expensive compared to DFI, assistance for internet penetration supported by high internet bandwidth and further topped with the network of mobile money agents are potential boosters of DFI among emerging countries. These key factors include internet penetration, internet bandwidth, internet payment, mobile money agent and mobile money ownership, thereby being significant in explaining the DFI index from the access and usage perspectives.

The mobile money agent variable shows higher significance in the 30th, 40th, 50th, 70th and 80th quantiles. Retrieved July 30, 2022 from https://econofact.org/using-mobile-money-to-help-the-poor-in-developing-countries. Retrieved from https://www.cgap.org/sites/default/files/researches/documents/Brief-Digital-Financial-Inclusion-Feb-2015.pdf.

Retrieved July 30, 2022, from https://www.bcg.com/publications/2019/how-mobile-money-agents-can-expand-financial-inclusion. Retrieved July 25, 2022, from https://www.bcg.com/publications/2019/how-mobile-money-agents-can-expand-financial-inclusion. This is to confirm that Goh Yi Xuan, Mah Sze Hwei and Yunne Chay Yinn Yinn (ID No: 19ABB00341; 19ABB00573; 19ABB00460) have completed this final year project entitled "Mobile Money Agent Network: Key Towards Digital Financial Inclusion" under under the supervision of Eng Yoke Kee from the Economics Department of the Faculty of Business and Finance.