The introductory section contains a literature review on the legal origin theory and an overview of the scope and location of the study. The new approach of classifying legal origins in terms of English, French, French sub-Saharan countries, Portuguese and North African countries provides an exhaustive and thorough insight into an African view of the legal origins debate. For clarity and organization, the literature will be classified into two main strands: why legal origins matter for financial performance and the extent of the law-finance nexus.

Mulligan and Shleifer (2005a, 2005b) assess one of the ultimate forms of government intervention in private military conscription. The second strand assesses the effects of legal origin on the characteristics of the judiciary and other government organs on the one hand and its effects (characteristics of the judiciary) on the security of property rights and contract enforcement on the other. The motivation for and positioning of the current study is derived from the literature on the law-finance nexus, which is classified into four strands below.

In line with Asongu (2012), the rule of law channel argues that legal traditions differ in their emphasis on law vis-à-vis the rights of the state and those of private property. According to the World Bank, regulatory quality reflects the perception of the government's ability to formulate and implement good regulations and policies that promote private sector development. Testing the difference in means between samples from the population shows whether differentiating different indicators according to legal origin is really worthwhile.

Finally, the validity of the instruments will be tested with an over-identifying restrictions (OIR) test.

Cross-country Regressions

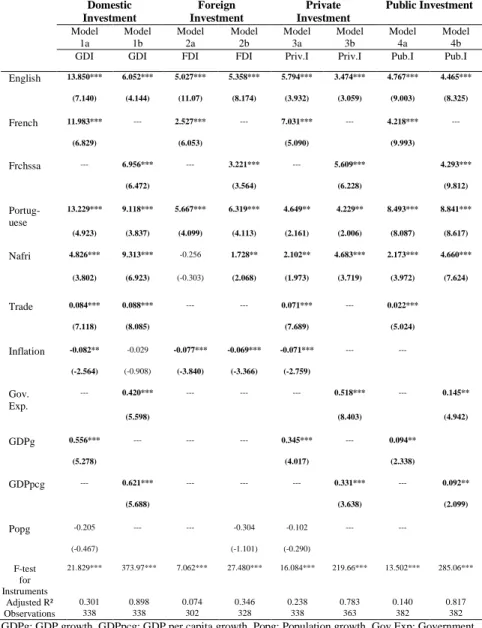

The findings of the control variables are broadly consistent with the relevance of trade, inflation, government expenditure, GDP growth, and GDP per capita growth in the investment growth literature. However, some of these initial findings are inconsistent with the legal finance literature (La Porta et al., 1998b; Beck et al., 2003), which would see English common law countries championing private property rights over those of the state should inherently reflect higher levels of private investment than French civil law countries that emphasize state power. The measures of regulatory quality and the rule of law with respect to the legal origin dummy variables are regressed.

Also, the significance of the F-test at the 1% level illustrates that legal origins taken together significantly explain legal origins across countries. The results also show that English common law countries have the highest levels of regulatory quality and rule of law. North African countries compared to French (sub-Saharan) countries have lower (higher) levels of law.

Consistent with law and growth theory, Table 4 broadly shows that British common law countries have significantly higher levels of law indicators. OIR) test whose null hypothesis is the position that the instruments are not correlated with the error term of the interest equation (Eq. Therefore, a rejection of the null hypothesis of the OIR test is a rejection of the position that explain legal origins. investment only through channels of the law.

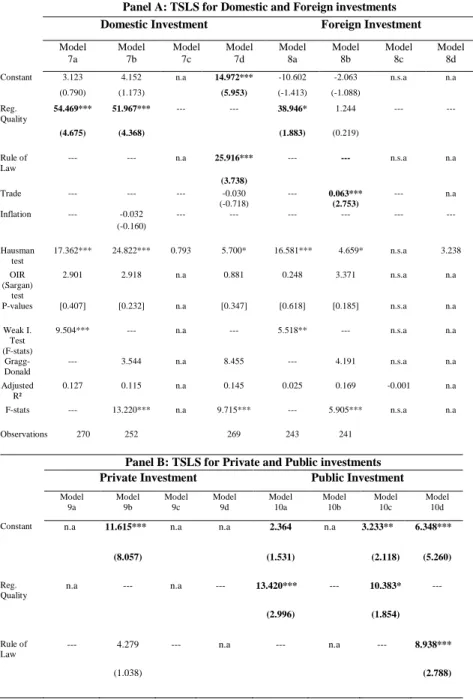

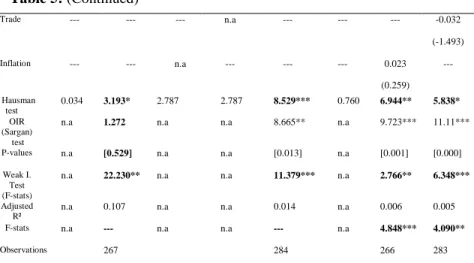

The study also reports weak instrument test statistics of first-stage regressions in Fisher (without control variables) or Cragg-Donald (with control variables) statistics depending on the nature of the identification (difference between instruments and endogenous regressors). This also applies to the rule of law in the presence of a control variable (Model 7d). The null hypothesis of OIR is not rejected in all regressions (but for Model 7c), implying that the instruments are valid and legal origin explains domestic investment through no other mechanism than law channels.

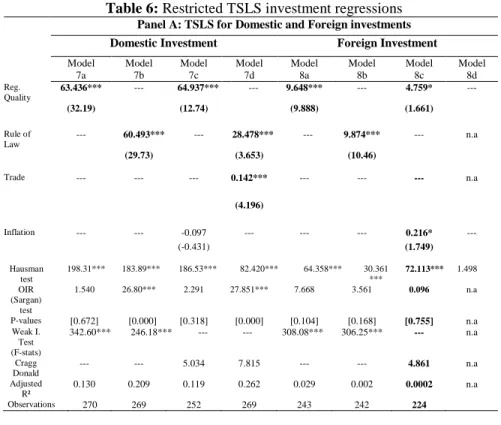

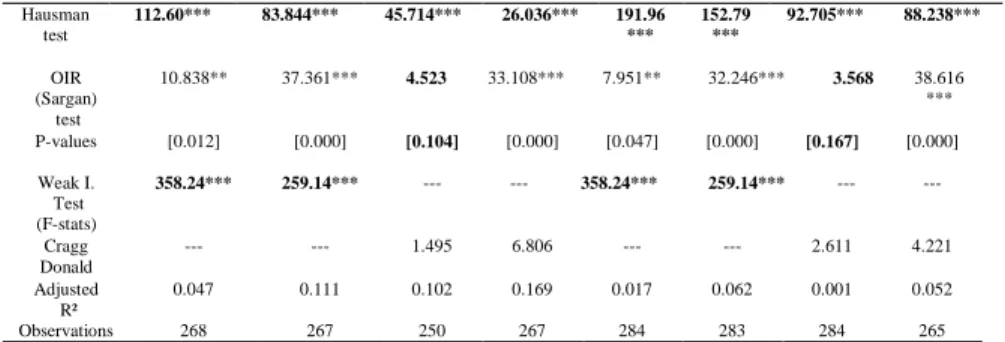

While some models do not reject the null hypothesis of the Hausman test (9a, 9c, 9d and 10a) and thus invalidate the IV procedure, Model 9b (Models 10a, 10c, 10d) validates the second issue but not the first for private investment. (confirming the first issue but not the second for public investment). Consistent with the literature (Beck et al., 2003; Asongu, 2014a), the robustness of the results above is checked with restricted TSLS investment regressions. Rejection of the null hypothesis of the Hausman test in 15 of the 16 regressions justifies the TSLS estimation method.

The first question is resolved by the significance of the estimated coefficients in most regressions. Regarding the second concern, the failure to reject the null hypothesis of the OIR test in at least one of the four regressions relating each investment dynamic provides further evidence of the validity of the instruments.

Conclusion and future research directions

For example, Ecuador, a French civil law country, revised its company law in 1977 to incorporate some common law rules; European Italy is a French civil law country with some German influence; some Japanese laws were Americanized after World War II, Thai laws were based on common law but heavily influenced by French civil law. Accordingly, the paper uses data collected from pioneering works on the nexus between law and finance to assess the hypotheses derived from it in the context of Africa. The French tradition emphasized the passive nature of monetary policy and the importance of exchange stability through convertibility; stability was achieved at the expense of institutional development and monetary experience.

While Agbor (2015) examines channels through which legal origin affects economic performance, Asongu (2011a) proposes four theories to assess why legal origin matters for growth and welfare. Asongu (2011) has debunked the dominance of English common law countries in terms of financial development prospects by providing empirical validity to a theoretical postulation that stable inflation is a strong determinant of the advantage African French civil law countries have in terms of economic allocative efficiency. Agbor (2015) has used trade openness to explain the advantage English common law countries have over French civil law countries in economic performance.

With the exception of Portuguese countries, English commonwealth countries reflect higher levels of trade because they traditionally have legal systems that allow for openness (in trade and capital) and competition: this is in line with Agbor (2015). Conversely, it is not unexpected that countries with a French legal tradition should have the lowest levels of inflation. French colonial monetary legacy is focused on reducing levels of inflation because their former colonies sacrificed financial independence and monetary experience in exchange for stability (Mundell, 1972; Asongu, 2011).

Increasing the Share of Foreign Direct Investment in Sub-Saharan Africa: Public Policy Challenges, Strategies and Implications. The role of investment climate and tax incentives in the foreign direct investment decision: Evidence from South Africa.

Countries selected for the study Colonial

Correlation analysis