Served Kumpulan FIMA Berhad in various capacities as Vice President for Agro-based Group and Business Development and as Executive Director and Chief Executive Officer, Percetakan Keselamatan Nasional and Security Printers, FIMA Berhad.

BOARD COMMITTEES

DR. BADRULHISHAM BIN MOHD GHAZALI

PROFILE OF SENIOR MANAGEMENT

AZMAN BIN ABDULLAH

DR. CHARLES CHOW KOK CHENG

5-YEAR GROUP FINANCIAL HIGHLIGHTS

ECONOMIC VALUE FOR SHAREHOLDERS

KUB IN THE NEWS

While we have certainly not been immune from the negative impacts of the pandemic, this year's report theme "Building Resilience" reflects our belief that the actions we have taken over the past eighteen (18) months, particularly in eliminating our non-strategic products and assets non-core and building balance sheet strength will pay dividends in the long term. In addition to the continued improvement of our cost structure, we now benefit from improved financial space to invest in our core businesses and execute our strategic plans to their full potential, thus standing us in good stead for a period long term.

THE GROUP MANAGING DIRECTOR’S

I welcome you to read the following analysis to gain greater insight into how our respective business divisions have evolved amid the pandemic-related setbacks and the strategies we have put in place to recover in the near future. Group-wide profit after zakat and tax ('PAT') for FP2021 stands at RM158.6 million and is boosted by exceptional gains from the disposal of our plantation properties in Kluang, Johor under our Agro division totaling RM122.5 million and the disposal of to our associate company KUB Berjaya Enviro Sdn Bhd for RM30.5 million.

STATEMENT AND MANAGEMENT DISCUSSION

The COVID-19 pandemic, among many other challenges, has cast a long shadow over the world, threatening lives and livelihoods and causing major disruptions in global supply chains. This breakdown of revenue contribution is in line with that of previous fiscal years, with a notable decline in the relative revenue contribution of our LPG division driven by various pandemic and market-related headwinds, which are analyzed in detail in the division report below.

In Malaysia, the ongoing uncertainty this has brought has resulted in depressed demand from both consumer and commercial markets, ongoing logistical challenges and significant delays in the initiation and execution of projects across the business community.

Revenue

THE GROUP MANAGING DIRECTOR’S STATEMENT AND MANAGEMENT DISCUSSION & ANALYSIS

During the period under review, our Agro division underwent a significant evolution with the disposal of our properties in Kluang, Johor, for RM158.0 million, which contributed to a segmented PAT of RM142.7 million. Looking at our Agro division, we can expect reduced revenues and profits in the coming years as a result of the disposal of our properties in Kluang, Johor and Malua, Sabah.

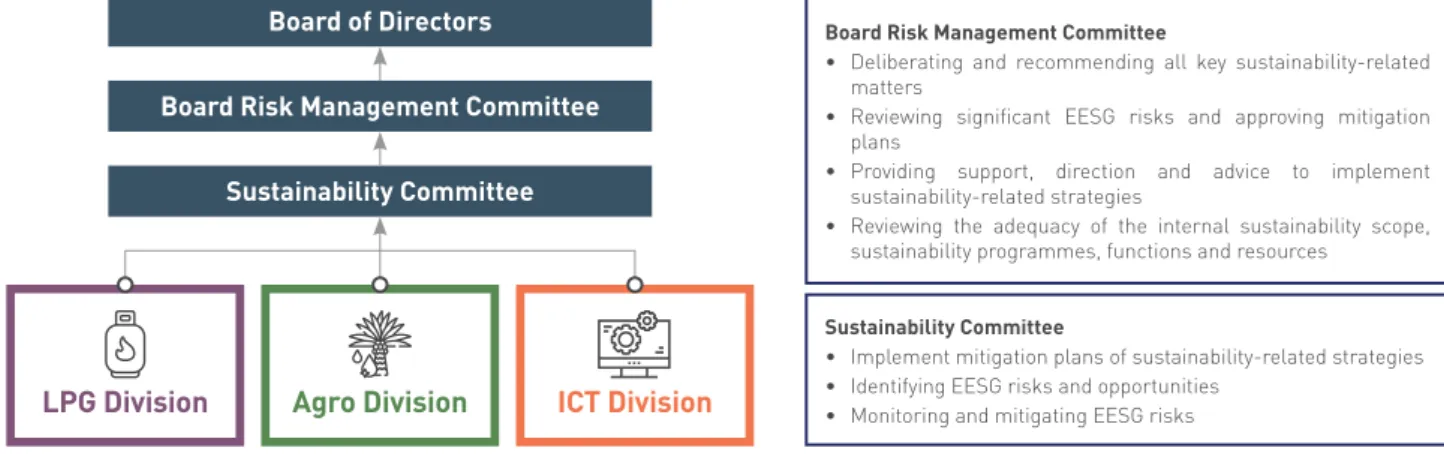

SUSTAINABILITY STATEMENT

ABOUT THIS STATEMENT

Periodic medical check-up review As needed Introduction, training and skills development As needed. Meetings with management and board of directors As required Feedback from respective shareholders As required.

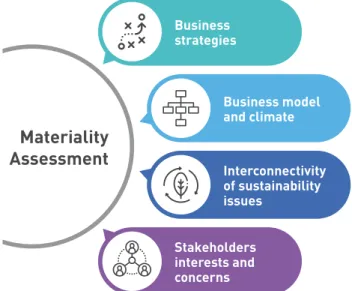

Materiality Assessment

The Group pursues its environmental sustainability with continuous monitoring of performance against key indicators such as energy, fuel and water consumption and implements corresponding resource and conservation initiatives. The group continues with energy efficiency to ensure minimal energy consumption, including replacing conventional lighting with LED alternatives within the LPG bottling plant and the KUB offices.

CORPORATE GOVERNANCE OVERVIEW STATEMENT

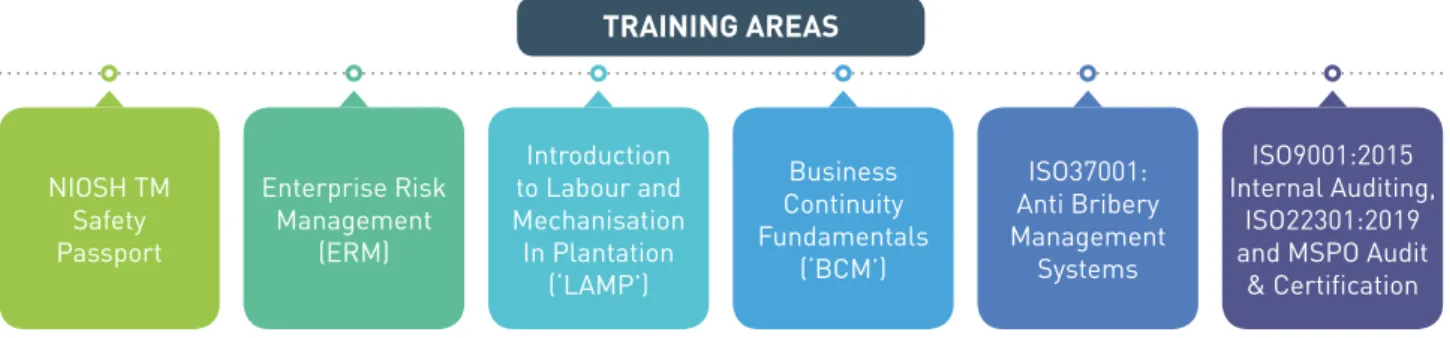

The demarcation of responsibilities between the board, board committee and executive board is set out in the board's charter ('the charter'). Following the recent enforcement of the new Section 17A of the Malaysian Anti-Corruption Commission Act 2019, the Company has revised and introduced the new Anti-Bribery and Corruption Policy, Supplier's Code of Business Ethics Policy and Whistleblowing Policy (collectively known as the "Policies"' ) and has established an integrity committee, governed by its terms of reference.

CORPORATE GOVERNANCE OVERVIEW STATEMENT

- UTILISATION OF PROCEEDS RAISED FROM ANY CORPORATE PROPOSAL

- AUDIT AND NON-AUDIT FEES

- MATERIAL CONTRACTS

- EMPLOYEE SHARE OPTION SCHEME (‘ESOS’)

Details of the composition and activities of the BAC are provided in the BAC report. The annual report provides shareholders and stakeholders with a comprehensive overview of financial and non-financial information.

ADDITIONAL COMPLIANCE INFORMATION

The Group's non-audit fees mainly related to the provision of tax compliance and advisory services, transfer pricing documentation and the assessment of the Statement on Risk Management and Internal Control. During the Extraordinary General Meeting of May 23, 2017, the shareholders approved the Company to grant ESOS options to the Directors and eligible employees subject to the articles of association.

STATEMENT ON RISK MANAGEMENT AND INTERNAL CONTROL

The board is fully committed to ensuring effective internal control in the group's business operations, both strategically and operationally. The Board of Directors establishes appropriate policies to ensure that the system operates effectively to manage risks that may impede the achievement of the Group's objectives.

STATEMENT ON RISK MANAGEMENT AND INTERNAL CONTROL

As required by paragraph 15.23 of the listing requirements, Deloitte PLT's external auditors have reviewed this risk management and internal control statement. RPG5 (revised) does not require external auditors to form an opinion on the adequacy and effectiveness of the Group's risk management systems and internal controls.

BOARD AUDIT COMMITTEE REPORT

Financial Results and Corporate Governance

External Audit

Internal Audit

STATEMENT OF DIRECTORS’ RESPONSIBILITY

FINANCIAL STATEMENTS

The Directors hereby submit their report and the audited annual accounts of the Group and the Company for the financial period from January 1, 2020 to June 30, 2021.

CHANGE OF FINANCIAL YEAR END

PRINCIPAL ACTIVITIES

RESULTS OF OPERATIONS

DIVIDENDS

RESERVES AND PROVISIONS

ISSUE OF SHARES AND DEBENTURES

DIRECTORS’ REPORT

SHARE OPTIONS

OTHER STATUTORY INFORMATION

DIRECTORS

DIRECTORS’ INTERESTS

DIRECTORS’ BENEFITS

INDEMNITY AND INSURANCE FOR DIRECTORS, OFFICERS AND AUDITORS

AUDITORS

AUDITORS’ REMUNERATION

REPORT ON THE AUDIT OF THE FINANCIAL STATEMENTS Opinion

INDEPENDENT AUDITORS’ REPORT

TO THE MEMBERS OF KUB MALAYSIA BERHAD (Incorporated in Malaysia)

There are no key audit matters to be communicated in respect of the audit of the financial statements of the Company. The other information consists of the information included in the Annual Report, but does not include the financial statements of the Group and the Company and our auditor's report thereon.

REPORT ON OTHER LEGAL AND REGULATORY REqUIREMENTS

OTHER MATTER

STATEMENTS OF PROFIT OR LOSS

AND OTHER COMPREHENSIVE INCOME

STATEMENTS OF FINANCIAL POSITION

AS AT 30 JUNE 2021

STATEMENTS OF CHANGES IN EqUITY

STATEMENTS OF CASH FLOWS

GENERAL INFORMATION

The financial statements of the company as at and for the financial period from 1 January 2020 to 30 June 2021 do not include other entities. During the financial period, the Group and the Company changed their financial year end from 31 December to 30 June.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES 1 Basis of Preparation of the Financial Statements

The company's consolidated financial statements as of and for the accounting period from 1 January 2020 to 30 June 2021 includes accounts for the Company and its subsidiaries (together referred to as the "Group" and individually referred to as "Group Entities") and the Group's interests in associated companies and joint ventures. The Group's and the Company's accounts for the current accounting period are therefore prepared for a period of eighteen (18) months from 1 January 2020 to 30 June 2021, whereas comparative figures are presented for a period of 12 months from 1 January 2019 to 31 December 2019.

NOTES TO THE FINANCIAL STATEMENTS

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d) 1 Basis of Preparation of the Financial Statements (cont’d)

Changes to MFRSs Annual improvement of MFRS standards Changes to MFRS 3 Reference to conceptual framework2. Amendments to MFRS 4 Extension of the temporary exemption from application of MFRS 93 Amendment to MFRS 9, MFRS 139, Interest Rate Benchmark Reform - Phase 21.

SIGNIFICANT ACCOUNTING POLICIES 1 Basis of Accounting

Amendments to IFRS 10 Sale or contribution of assets between an investor and IFRS 128 and its associate or joint venture4. Changes in IFRS 101 Classification of liabilities as current or long-term3 Changes in IFRS 101 Disclosure of accounting policies3.

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 1 Basis of Accounting (cont’d)

- Basis of Consolidation

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 2 Basis of Consolidation (cont’d)

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 3 Transactions with non-controlling interests

- Subsidiaries

- Investments in associates

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 5 Investments in associates (cont’d)

- Revenue

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 6 Revenue (cont’d)

- Employee benefits (a) Short-term benefits

- Zakat

The Group participates in national pension schemes as defined by the laws of the countries in which it operates. Zakat is recognized when the Group has a current zakat liability as a result of a zakat assessment.

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 9 Income taxes

- Foreign currency

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 11 Property, plant and equipment

- Investment properties

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 12 Investment properties (cont’d)

- Biological assets

- Impairment of non-financial assets

- Financial instruments

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 15 Financial instruments (cont’d)

The Group may make an irrevocable election (on an instrument-by-instrument basis) to designate investments in equity instruments as with FVTOCI. However, if the credit risk on the financial instrument has not increased significantly since initial recognition, the Group measures the loss allowance for that financial instrument at an amount equal to 12 months ECL.

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 16 Contract assets and contract liabilities

- Inventories

- Provisions

- Grants

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 20 Borrowing costs

- Leases (a) As lessee

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 21 Leases (cont’d)

- Non-current assets (or disposal groups) held for sale and discontinued operation

- Derivative financial instruments

Amounts owed by tenants under finance lease agreements are recognized as receivables at the amount of the Group's net investment in the lease agreements. Immediately before classification as held for sale, the valuation of the non-current assets (or all assets and liabilities in a disposal group) is updated in accordance with applicable Financial Reporting Guidelines.

SIGNIFICANT ACCOUNTING POLICIES (cont’d) 24 Share capital

- Segment reporting

- Statements of Cash Flows

SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS

- Critical judgements made in applying accounting policies

SIGNIFICANT ACCOUNTING ESTIMATES AND JUDGEMENTS (cont’d) 2 Key sources of estimation uncertainty

REVENUE

REVENUE (cont’d)

COST OF SALES

FINANCE INCOME

FINANCE COSTS

PROFIT BEFORE ZAKAT AND TAXATION

PROFIT BEFORE ZAKAT AND TAXATION (cont’d)

AUDITOR’S REMUNERATION

DIRECTORS’ REMUNERATION

TAXATION

NON-CURRENT ASSETS HELD FOR SALE

EARNINGS PER ORDINARY SHARE

PROPERTY, PLANT AND EqUIPMENT (cont’d)

Assets under construction of the Group include the construction of a liquefied petroleum gas storage tank facility from RM RMNil). The impairment loss of the company for the current period is mainly related to the impairment of office equipment of RM116,000.

PROPERTY, PLANT AND EqUIPMENT (cont’d) Acquisition of property, plant and equipment

INVESTMENT PROPERTIES

INVESTMENT PROPERTIES (cont’d)

The fair value of the investment properties is obtained by relying on the work of independent appraisal firms, determined using market value based on active market prices involving identical or similar property and location, if necessary adjusted for any differences in nature. the site's facilities, size and shape, accessibility, available infrastructure, site improvements, rental income, occupancy rate, operating costs and the condition of the specific assets.

LEASES (i) As lessee

LEASES (cont’d) (i) As lessee (cont’d)

The held extension options can only be exercised by the group and not by the lessors. The group assesses at the start of the lease whether it is reasonably safe to use the extension options.

LEASES (cont’d) (ii) As lessor (cont’d)

LEASES (cont’d) Operating lease (cont’d)

INVESTMENTS IN SUBSIDIARIES

INVESTMENTS IN SUBSIDIARIES (cont’d)

INVESTMENTS IN SUBSIDIARIES (cont’d) (d) Transactions during the financial period

INVESTMENTS IN SUBSIDIARIES (cont’d) (d) Transactions during the financial period (cont’d)

INVESTMENT IN ASSOCIATES

INVESTMENT IN ASSOCIATES (cont’d)

OTHER INVESTMENTS

INVENTORIES

BIOLOGICAL ASSETS

AMOUNT DUE FROM/(TO) SUBSIDIARIES

TRADE AND OTHER RECEIVABLES AND CONTRACT ASSETS

TRADE AND OTHER RECEIVABLES AND CONTRACT ASSETS (cont’d) (a) Trade receivables (cont’d)

TRADE AND OTHER RECEIVABLES AND CONTRACT ASSETS (cont’d) (c) Contract assets

CASH AND BANK BALANCES

CASH AND BANK BALANCES (cont’d)

TRADE AND OTHER PAYABLES, REFUNDABLE CYLINDER DEPOSITS AND CONTRACT LIABILITIES

TRADE AND OTHER PAYABLES, REFUNDABLE CYLINDER DEPOSITS AND CONTRACT LIABILITIES (cont’d) Included in other payables are amounts owing to property, plant and equipment creditor and accrued expenses

BORROWINGS

BORROWINGS (cont’d) (a) Term loans

BORROWINGS (cont’d)

DEFERRED TAX LIABILITIES

DEFERRED TAX LIABILITIES (cont’d)

Under the Malaysian Finance Act 2018, which was published on 27 December 2018, the Group's and the Company's unused tax losses will be set with a utilization timeline. Starting from assessment year 2018, unused tax losses in an assessment year can only be carried forward for a maximum period of 7 consecutive assessment years.

DERIVATIVE FINANCIAL LIABILITIES

SHARE CAPITAL

RESERVES

RETAINED EARNINGS AND DIVIDENDS

NON-CONTROLLING INTERESTS

NON-CONTROLLING INTERESTS (cont’d)

NON-CONTROLLING INTERESTS (cont’d) (iii) Summarised statement of cash flows (cont’d)

DEFERRED INCOME

COMMITMENTS, CONTINGENT LIABILITIES AND MATERIAL LITIGATION (a) Capital commitments

COMMITMENTS, CONTINGENT LIABILITIES AND MATERIAL LITIGATION (cont’d) (b) Contingent Liabilities

RELATED PARTY DISCLOSURES A related party of the Company refers to

RELATED PARTY DISCLOSURES (cont’d)

FAIR VALUE OF FINANCIAL INSTRUMENTS

Level 2 Level 3 Total

- FAIR VALUE OF FINANCIAL INSTRUMENTS (cont’d) Fair value hierarchy

- FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES

- FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (cont’d) (b) Liquidity risk (cont’d)

- FINANCIAL RISK MANAGEMENT OBJECTIVES AND POLICIES (cont’d) (d) Foreign currency risk

- CAPITAL MANAGEMENT

- SEGMENT INFORMATION

- SEGMENT INFORMATION (cont’d)

- SIGNIFICANT EVENTS

- INVESTMENTS IN SUBSIDIARIES Details of the subsidiaries are as follows

- INVESTMENTS IN SUBSIDIARIES (cont’d) Details of the subsidiaries are as follows: (cont’d)

- INVESTMENTS IN ASSOCIATES Details of associates are as follows

The Group's and the Company's exposure to credit risk arises primarily from trade and other receivables, contract assets and finance lease receivables. The Group's and the Company's exposure to liquidity risk arises primarily from the mismatch between the maturities of financial assets and liabilities.

STATEMENT BY DIRECTORS

DECLARATION BY THE DIRECTOR

PRIMARILY RESPONSIBLE FOR THE FINANCIAL MANAGEMENT OF THE COMPANY

LIST OF PROPERTIES

DIRECT AND INDIRECT INTERESTS OF DIRECTORS

ANALYSIS OF SHAREHOLDINGS

AS AT 15 SEPTEMBER 2021

SUBSTANTIAL SHAREHOLDERS

TOP THIRTY (30) LARGEST SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT the Fifty-sixth ('56th') Annual General Meeting ('AGM') of KUB Malaysia Berhad ('KUB' . or 'the Company') will be held VIRTUALLY via live broadcast from the Boardroom, KUB Malaysia Berhad, Suite A-22-1, Level 22, Hampshire Place Office, 157 Hampshire, No.

AGENDA

Resolution 2

Resolution 5

Please refer to Note 6

Please refer to Note 7

- Appointment of Proxy

- Audited Financial Statements for the Financial Period Ended 30 June 2021

- Re-election of Directors who retire in accordance with Clause 100 of the Constitution of the Company

- Re-election of Directors who retire in accordance with Clause 94 of the Constitution of the Company

- Declaration of a First and Final Single-Tier Dividend

- Directors’ Remuneration

- Re-appointment of Deloitte PLT as Auditors of the Company

- Statement Accompanying Notice of Annual General Meeting of the Company

- election of board members who resign in accordance with section 100 of the company's articles of association. The payment of the director's benefits will be made by the company as and when they are incurred.

Benefits up to RM350,000 ('the proposed amount') to the NEDs by the Company for the relevant period. The General Mandate, unless revoked or amended by the Company in general meeting, will expire at the next Annual General Meeting of the Company.

ADMINISTRATIVE DETAILS

- FULLY VIRTUAL AGM

- REMOTE PARTICIPATION AND ELECTRONIC VOTING (‘RPEV’)

- Register Online with Boardroom Smart Investor Portal (for first time registration)

- Submit Request for Remote Participation User ID and Password for the AGM

- PROXY

- Register Online with Boardroom Smart Investor Portal (for first time registration) [Note: Please refer to Item 2, above for the procedures]

- e-Proxy Lodgement

- VOTING PROCEDURES

- PROCEDURES OF THE AGM

- NO DOOR GIFTS OR FOOD VOUCHER

- ENqUIRY

It is your responsibility to ensure that connectivity is not interrupted for the duration of the meeting. iv). If you wish to appoint another person(s) as your proxy(s), kindly delete the phrase 'Presiding at the meeting' and enter the name(s) of the person(s) desired.

PROXY FORM

Approval of directors' fees of RM600,000 for non-executive directors for the period from 28 October 2021 until the conclusion of the 57th AGM. See the 56th General Assembly's administrative details on remote participation and voting options for the virtual meeting. you).

KUB MALAYSIA BERHAD (196501000205 (6022-D)) c/o THE REGISTRAR

The document appointing a power of attorney must be in writing under the hand of the appointor or his duly authorized attorney, or if the appointor is a corporation, either under its common seal or signed by the hand of its attorney or by an officer authorized on behalf of the corporation. A proxy may, but need not, be a member of the Company and a member may, without limitation, appoint any person to be his/her proxy. iv) The proxy forms must be deposited at the office of the Company's share registrar, Boardroom Share Registrars Sdn Bhd (Company Reg.

GROUP DIRECTORY