On the contrary, in the long run, such policies may create diminishing effects on capital accumulation and production. Second, the policy of a higher child benefit is always beneficial in the long run for PAYG pension budgets, government handouts for the elderly and a higher birth rate with more newborns.

INTRODUCTION

- Background

- Research questions

- Objectives of the study

- Significance of the study

- Scope and limitation of the study

- Research hypotheses

- Organization of the study

Is the mandatory retirement age really beneficial for the pension system (ie for the pension benefits paid to retirees). 3. To analyze the effect of the adoption of the child allowance policy on macroeconomic variables in Thailand.

REVIEW OF LITERATURE AND RELEVANT POLICY IN THAILAND

Theoretical Literature

- Basic lifecycle model

- Fundamental the two-period OLG model

The key state variable in the Diamond-Samuelson OLG model is the physical capital stock, and it explicitly shows the dynamic path of the economy. There is too much capital in the economy, and welfare would be increased if the capital stock were reduced and consumption increased.

Empirical and theoretical research applying OLG model

- Impact of demographic change on macroeconomic

- PAYG pensions and retirement age

- Fertility incentives

- Review of research applying OLG model in Thailand

This study found that an increase in the fertility rate can increase pensions when the output elasticity of capital is low. This study found that the compulsory public pension system produces the highest economic growth, savings, output per effective labor and capital per effective labor in the balanced growth path.

METHODOLOGY

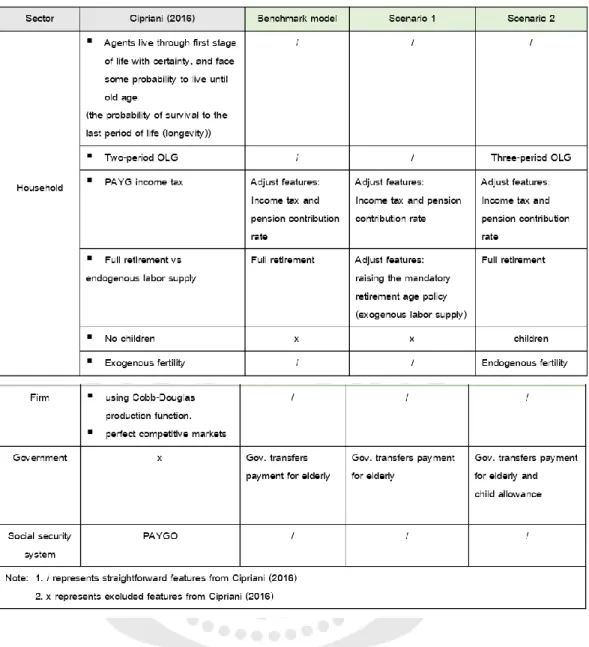

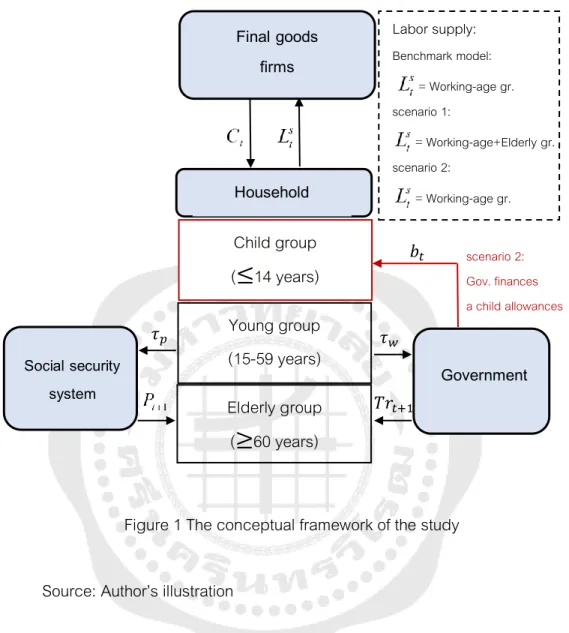

The model

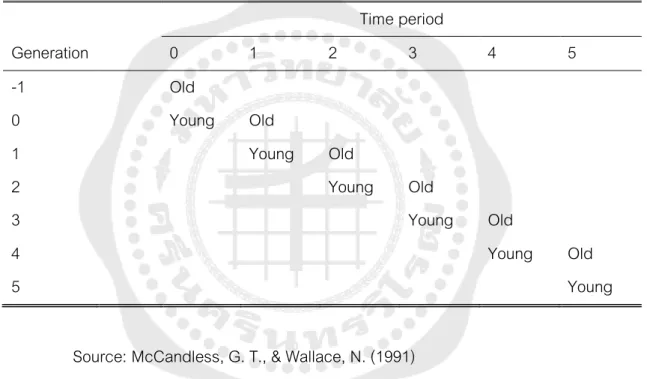

- Population aging in overlapping generation model (benchmark model)

- The lengthening mandatory retirement age model

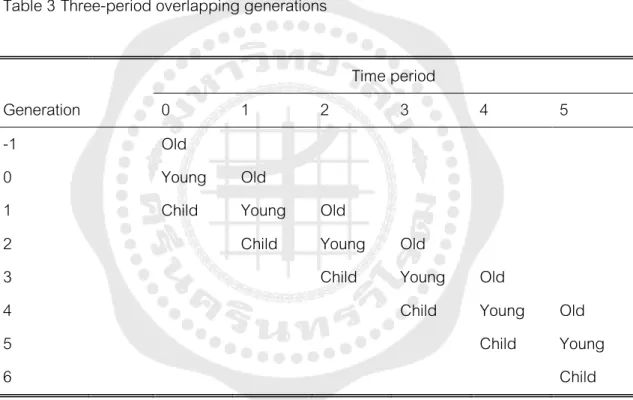

- The raising child allowance model

- Exogenous process

Equation (3.13) shows that the government transfer payment to the elderly is equal to the tax receipts. Equation (3.18) shows that the pension system is such that the total pension contribution received from period t 1 is equal to the pension benefit payments of the current periods (period t). 5) Equilibrium solution and model. Equation (3.59) shows that the capital stock always decreases as the mandatory retirement age increases.

Equation (3.60) implies from equation (3.59), kl* 0 that an increase in the retirement age can reduce steady-state output. Equation (3.62) reveals that the effect of raising the retirement age on pension payments is steady state. The value of state transfers in a steady state can be obtained from equation (3.43) as or it can be written as 3.64) Equation (3.64) shows that the effect of raising the retirement age on government transfers in the steady state depends on the length of the retirement period.

The right-hand side of equation (3.66) is the wage income (less contributions paid to the income tax rate ( w) and social security tax rate ( p)). Equation (3.106) shows that the share capital is always reduced by raising the child benefit policy. Equation (3.107), recalled from equation (3.106), shows that an increase in the child benefit policy can reduce output in the steady state.

Equation (3.108) shows that the demand for children (newborn) is increased by increasing the child benefit policy. The steady state value of government transfers from equation (3.78) as. or it can be written as. 3.112) Equation (3.112) shows that the government transfers for the elderly are increased by increasing the child benefit policy.

Solution method of solve this model

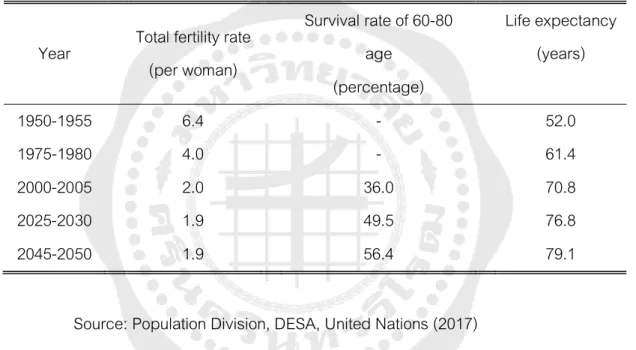

Calibration and data description

Fourth, for the public sector, the parameter wor labor income tax rate is set equal to 0.10, which is the rate for middle-class taxpayers in Thailand. In this study, it is set equal to 0.066 to raise the retirement age to 3 years according to the Office of Civil Service Commission (2018). In addition, the parameter for the child benefit rate is assumed to be a fixed proportion of b= 0.1 as in the child benefit policy (Ministry of Social Development and Human Security, 2016).

Finally, the social security system (p) provides a pension contribution rate equal to 6 percent, so that the employer and the employee each pay equal contributions of 3 percent of the worker's salary in accordance with the Social Security Act, B.E.

Estimation of the exogenous shocks processes

RESULTS AND DISCUSSION

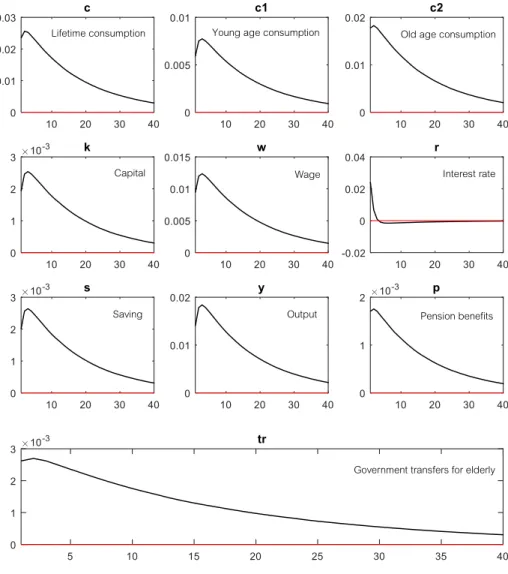

- Effects of population aging

- Effects of the technological shock

- Effects of a lengthening of the mandatory retirement age policy

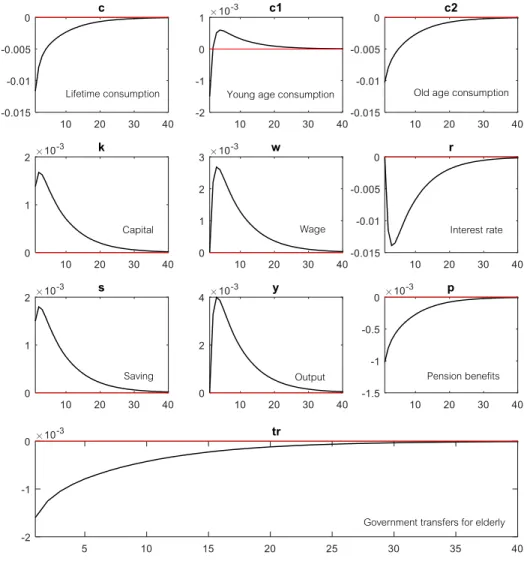

- Effects of raising the child allowance policy

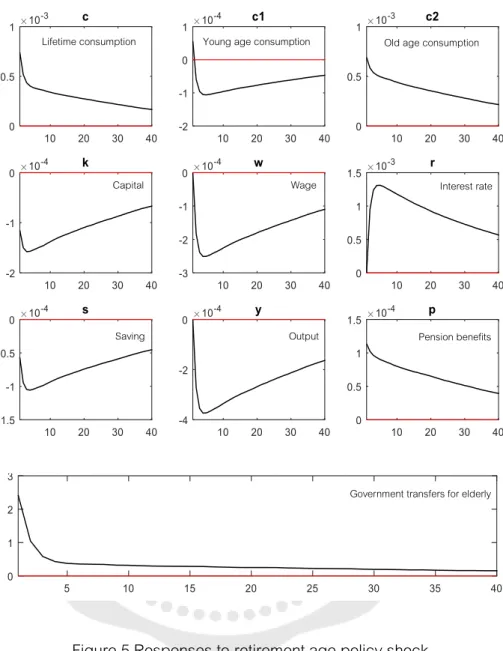

Wages rose sharply to 0.0028% in the third quarter and gradually declined through the 40th quarter. Therefore, when wages increased, it consequently increased young age consumption to 0.005% in the third quarter and then gradually decreased until the 40th quarter. Wages rose sharply to 0.013% in the third quarter and gradually declined until the 40th quarter.

Therefore, wage increases caused youth consumption to increase by 0.007% in the third quarter and then gradually decline until the 40th quarter. Pensions also increased to 0.0018% in the third quarter and then gradually declined until the 40th quarter. The interest rate rises to 0.0013% in the third quarter and gradually decreases until the 40th quarter.

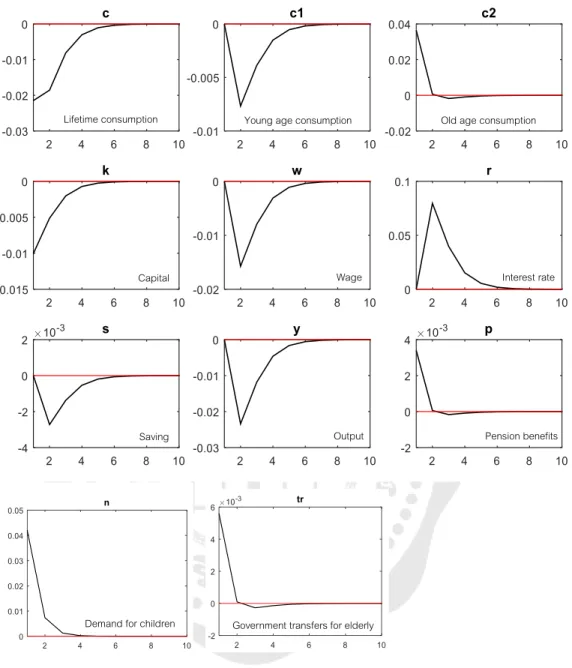

Early childhood consumption is negatively impacted, as consumption immediately after the shock falls to 0.0001% in the third quarter and then rises to the 40th quarter. After the shock, the pension slowly drops to 0.0001% in the third quarter and lasts more than 40 quarters. Output fell to 0.025% in the second quarter and then gradually increased until the 6th quarter.

CONCLUSIONS AND RECOMMENDATIONS

Conclusions

Third, a higher mandatory retirement age is always beneficial in the long run for PAYG pension budgets, public transfers for the elderly and lifetime consumption. Thus, the policy of raising the compulsory age can be harmful not only in the long run in terms of capital accumulation, but also in terms of output. The mechanisms driving this are twofold: (1) there is a direct positive effect consisting of an increased labor supply and a lower length of the pension period, and (2) there is an indirect effect due to the negative change in wages. .

The Child Benefit is always beneficial in the long run for PAYG pension budgets, government transfers for the elderly and the demand to have more children (newborns). On the contrary, the policy of increasing the child allowance has a negative impact on capital stock, savings and output. Therefore, the policy of increasing the child allowance may not only be harmful in the long term in terms of capital accumulation, but also in terms of output, as the net effect on capital returns remains positive and results in a fall in the wage rate." .

When a policy shock is implemented in the economy, the impulse response to such policies, especially in relation to the extension of the retirement age and the application of technology to increase productivity, will have a long-lasting effect before the economy returns to equilibrium. its original steady state. (adjustments occur for more than 40 quarters). On the other hand, the sudden implementation of the policy to increase child benefits results in a short-term impulse response where the economy will adjust to the initial steady state equilibrium in the 6th quarter. However, caution is required as implementing an extension of the retirement age or an increase in the child benefit will have a long-term negative impact on the capital stock, savings and output, which may inevitably lead to a slowdown in the economy.

Policy implications

There is currently a disparity in the current work life policies in Thailand in the public and private sectors. In the government sector, there is a law that clearly defines the retirement age of 60 years with some exceptions for certain highly skilled jobs. While in the private sector, the retirement age is currently set at 55 years in accordance with the Social Security Act 2010.

In 2018, the government set out a policy to extend the mandatory working age, which is the country's plan to prepare for entering an aging society, extending the mandatory retirement age for civil servants in state and state-owned enterprises from 60 to 63 under a national reform plan that came into force in Thailand and is intended to address problems associated with being an aging society (cited from Office of Civil Service Commission (2018)). Therefore, the research in this study is thus targeted at the policy of extending the retirement age to 63 years. But the government's enforcement of the retirement age extension policy may be limited to full-time working hours, which may prove restrictive for seniors.

In the effort to increase the older workforce, they should therefore have a more flexible work policy, that is, the number of working hours that are more suitable for the elderly in each age group. In addition, the sole application of the employment expansion policy alone is prudent as it adversely affects capital stock, savings and output, which may result in a slowdown in the economy. In addition, caution must be exercised in using the child benefit policy exclusively, as it negatively affects capital stock, savings and productivity (output), which may result in a slowdown in the economy.

Limitations and suggestions for further study

Then, finding a solution to the rational expectation model means finding the policy functions (also known as decision rules) that give the current endogenous variables as a function of the state variables:. by the definition of a deterministic steady state, we have A first-order approximation (1A) around and gives:. where are derivations of the constraints of g with obvious notation. By calculating the expected term, taking into account the properties of the deterministic steady state and reorganizing the terms, we get:

The literature review is based on Office of the Civil Service Commission (2018) and Paitoonpong, Tasee and Waisuriya (2016) as follows. The employer and employee each pay equal contributions of 5% of the worker's salary, while the government contributes an additional 2.75% to make a total contribution of 12.75% of the worker's salary. As a temporary measure to cope with the impact of the 2011 floods, in 2012 the government reduced worker and employer contributions from 5% to 3% in the first six months and from 5% to 4% in the last six months of 2012 (Social Security Office , 2018).

The committee is made up of representation from the employer and elected representatives of the employee, with a fund manager chosen by the committee. In 2008, the government enacted the Private Schools Act in which the PSTWF became a private entity managed by a board of directors chaired by the permanent secretary of the Ministry of Education. Monthly contributions (not more than 3% of the member's salary) are paid by the teacher, the school (equal to the member's contribution) and the Ministry of Education (twice the member's contribution) as studied by Paitoonpong, Tasee and Waisuriya (2016) ).

The intended beneficiaries are citizens aged 15-60, who are not enrolled in other funds that receive contributions from the government and not under the pension systems of the government or the private sector (National Savings Fund, 2018). The Office of the Public Service Commission and the Office of the Public Sector Development Commission are responsible for the implementation of the plan.