I would also like to thank Ajarn Vasan Siraprapasiri for helping me learn and understand relative valuation and discounted cash flow methods, which actually contributed greatly to the completion of my topic paper. This topic paper showed how to evaluate the stock price of Ichitan Group Public Company Limited (ICHI), applied the concept of discounted cash flows to the company model, created a forecast and calculated a reasonable valuation of the company's stock price, and finally made a decision. or buy/hold/sell shares of a company.

VALUATION

Highlights

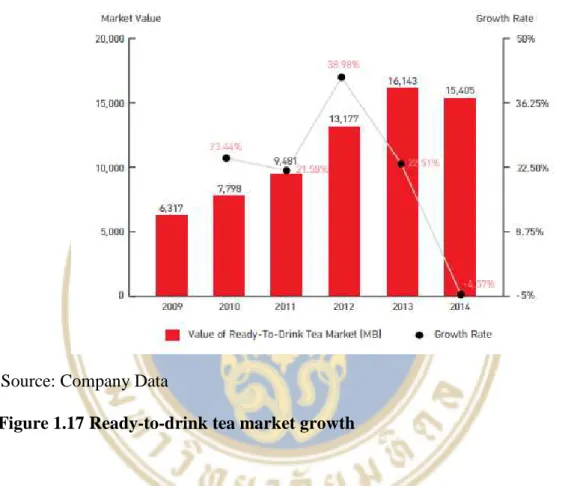

Slowdown of ready-to-drink tea market: Over the past 5 months, the RTD tea market has seen an impressive growth of 14.6%. High competition leads to high cost: ICHI should increase marketing, advertising; promotion and spending heavily on champagne to maintain its market share due to high competition in the ready-to-drink tea market.

Financial Summary

Business Description

- ICHI’s brands

- Production capacity

- Distribution channels

- Business strategies

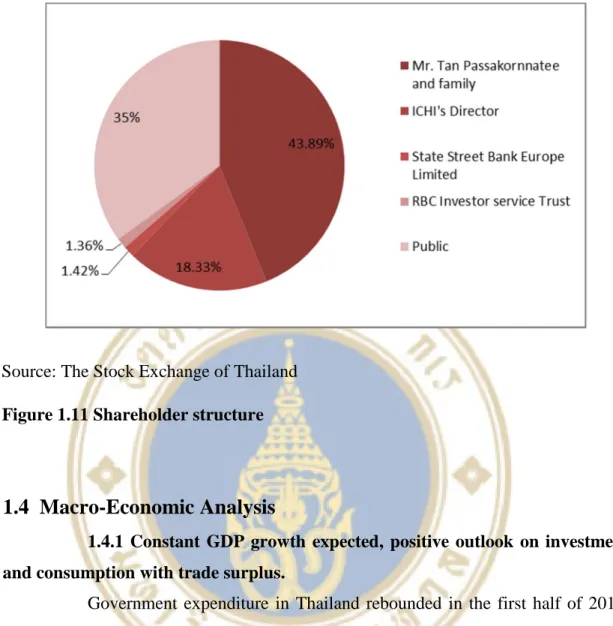

- Shareholder structure

The company's revenue is primarily from the sale of ready-to-drink tea drinks, which amounted to Baht 6,179.1 million. in 2014, which is 99.5% of total sales. The company strives to be a leader in quality beverage business and innovation and grow sustainably with the quality community.

Macro-Economic Analysis

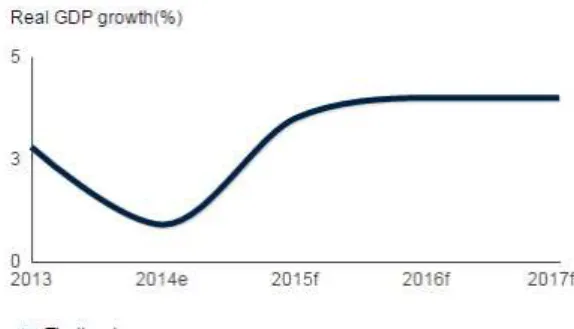

- Constant GDP growth expected, positive outlook on investment and consumption with trade surplus

- Economy glance and outlook

- Impact from Asean Economic Community (AEC)

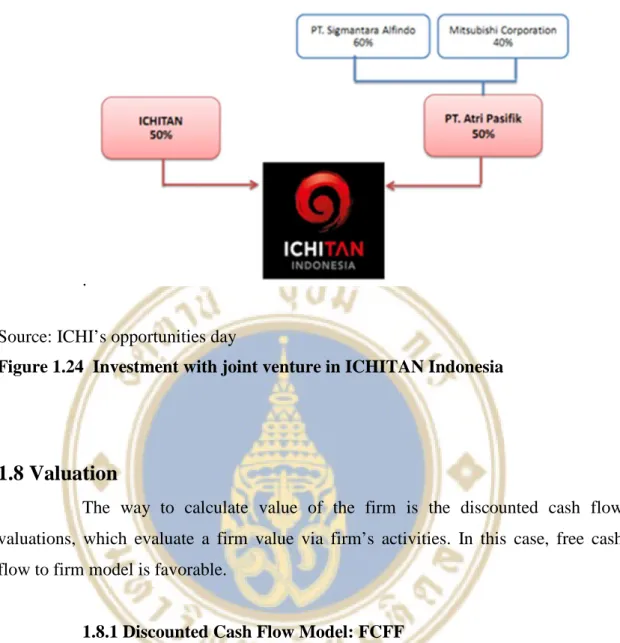

- Indonesia opportunities

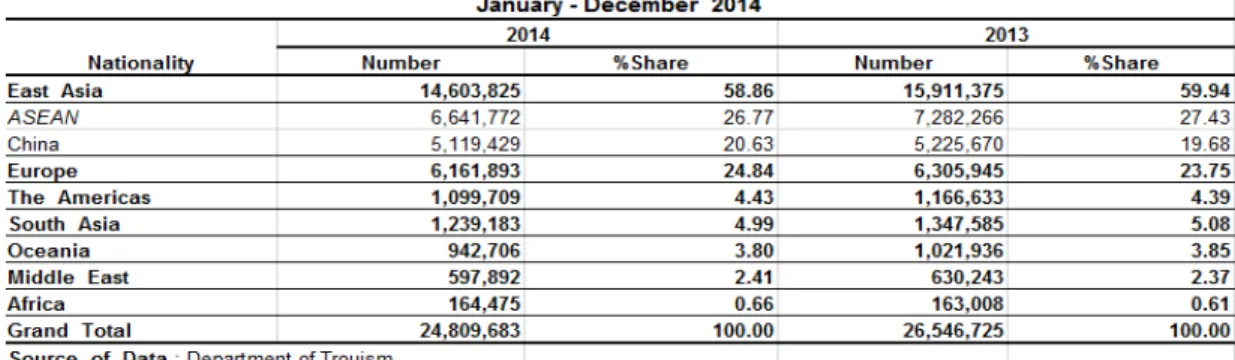

- Tourism sector recovery from regaining confidence in Chinese tourists

In the latter half of 2014, the Thai economy gradually recovered following the easing of political uncertainty. The growth of Chinese tourists not only fueled the recovery of the Thai tourism sector in the latter half of 2014, it also contributed to a promising outlook for tourism sector growth in 2015.

Industry Analysis

- Ready-to-drink tea market in Thailand

- Positive outlook likely to drive by healthier products

It was expected, however, that the market for ready-to-drink tea can expand further on the basis of new market participants. Health and wellness recorded stronger current value growth in 2015 than in 2014 due to rising consumer health awareness and rising commodity costs. Various food scares across the globe, as well as exposure to international health and product trends, also increased consumer awareness of the importance of health and wellness products, including the willingness to invest in them to improve well-being.

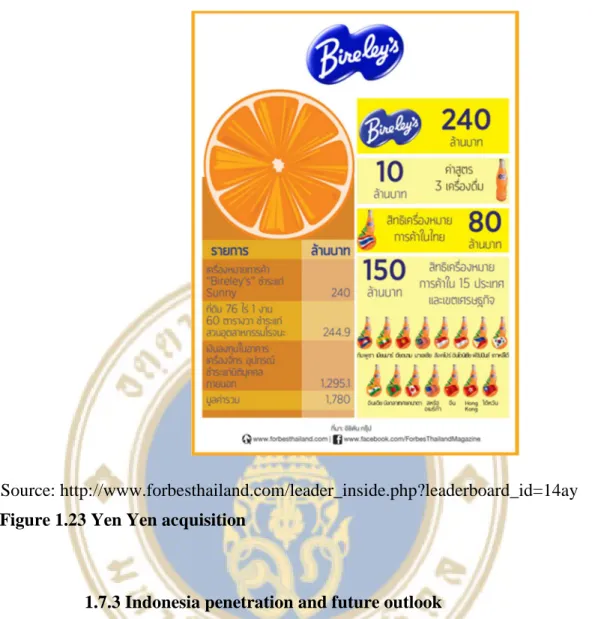

Additionally, increasing consumer sophistication resulted in a shift toward high-quality health and wellness products that offer multiple benefits and high-quality ingredients that can enhance the overall nutritional offering. Due to the increasing need for healthy drinks, the product “YenYen” is classified as a healthy drink. There is a positive outlook for these types of products.

Competition Analysis

Fashionable packaging with a variety of serving sizes to maximize customer satisfaction and meet the needs of each target group. However, ICHI's main product is ready-to-drink tea, so OISHI is the company's direct competitor. There are various products in the ready-to-drink green tea market, offering many choices to the customer.

According to the concentrate on the quality of raw materials such as tea leaves, cane sugar and water to ensure that all ingredients meet high quality standards. The barrier to entry to the ready-to-drink market is not high due to the low cost of start-up and no high-level technology required. However, the volume of the Thai market is not expected to grow at a high rate each year due to the economic slowdown and market saturation.

In addition, the intensity of competitive rivalry is high because the competitor of ICHI is not only OISHI Company in Thailand, but there are many import ready to tea products available in different markets. The company becomes price taker in the market due to the high level of rivalry.

Investment Summary

- Reduce cost and increasing capacity from expansion

- Indonesia penetration and future outlook

The company believes that the more they lose, the more they will gain in the future, this is because all products sold there were imported from Thailand, so there will be a huge amount of costs. When sales reach the target for ICHI, they plan to build production line in Indonesia to reduce costs. According to the company's date and group analysis, we believe that the company has a high chance to expand its business in Indonesia due to the increasing "loss" which suggests that the demand for the market is increasing.

If the company decides to build its own production line, we expect to have at least 2 lines that will cost about 750 million baht.

Valuation

- Discounted Cash Flow Model: FCFF

- Key assumptions

- Three-year forecasted cash flow

- Terminal value, TV, discounted at 9.39%

- Change in net working capital

- Weighted average cost of capital

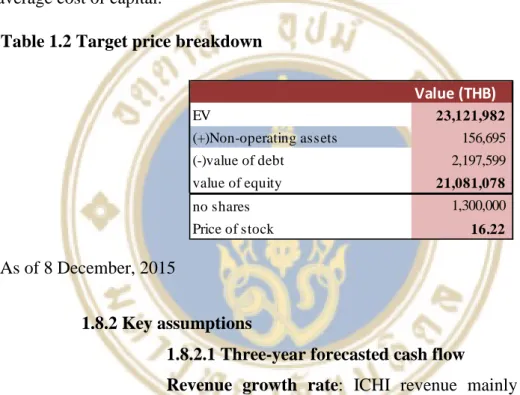

The key elements in the free cash flow model are the three-year forecasted cash flow, terminal value, capital expenditures, change in net working capital and weighted average cost of capital. However, growth for the year 2015 will only be 5.3% as of the announcement of the third quarter financial statement, due to economic conditions that have still not recovered. Proportioned Cost of Sales: The company's cost of goods sold varies due to the increase in OEM, where the company outsources purchasing for operations.

In 2015, production line 6 was started, so the cost of goods sold decreased from 67.02% to 64.6% of total sales (data from the third quarter financial statement announcement). For the period beyond 2019, we expected the lifetime sales growth rate with Thailand's expected annual real GDP at 3.57%. The cost of debt was determined by comparing the current percentage of interest expenses with interest-bearing debts, which is about 4.14%.

Kd before tax, with a weighted average cost of debt mainly from long-term loans. For the cost of equity, we use a risk-free rate of 2.7% from the 10-year Treasury bond, yielding at 11.5% based on Bloomberg, resulting in a market risk premium of 8.81% adjusted beta of 1.03 from SETSMART.

Financial Statement Analysis

- Summary figures from financial statements (Size analysis)

- Common size analysis

- Trend analysis

- Financial ratios - Return

- Financial ratios - Risk

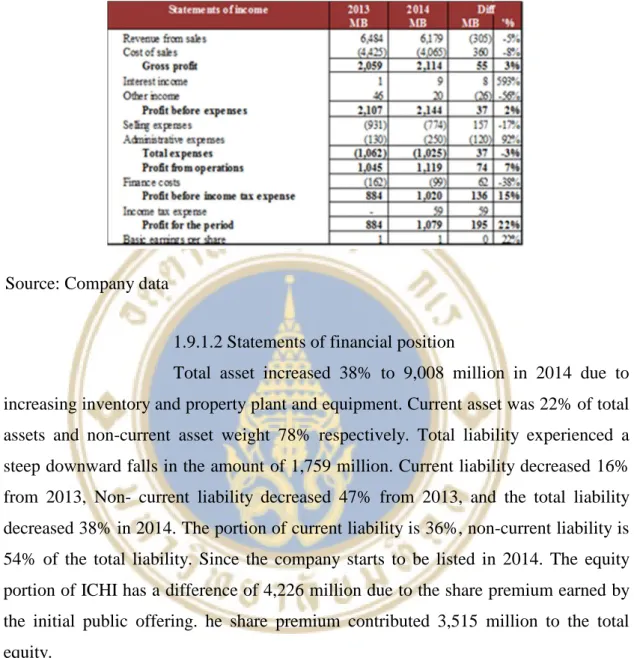

The share portion of ICHI has a difference of 4,226 million due to the premium earned in the initial public offering. ICHI's trade receivables is 10.1% of total assets almost twice the trade receivables than OISHI which is 5.6%, this is a big gap which implies that ICHI has lower ability to negotiate with its customers . Both PP&E are very inelastic, ICHI has a steeper curve due to the strong growth in the last 5 years.

The amount of trade receivables and inventories implies that ICHI has worse net working capital management than OISHI, which we have already discussed in the overall size analysis. The amount of trade receivables and inventories implies that ICHI has worse net working capital management than OISHI, which we have already discussed in the overall size analysis. ICHI suffers a huge loss later in 2010, causing its EBIT margin and net profit margin to be negative in 2011.

ICHI's ROE shows a downward trend due to the issuance of more shares in 2013 and the issuance of shares in SET in 2014. This means that ICHI is better able to meet its long-term obligations every year after 2012.

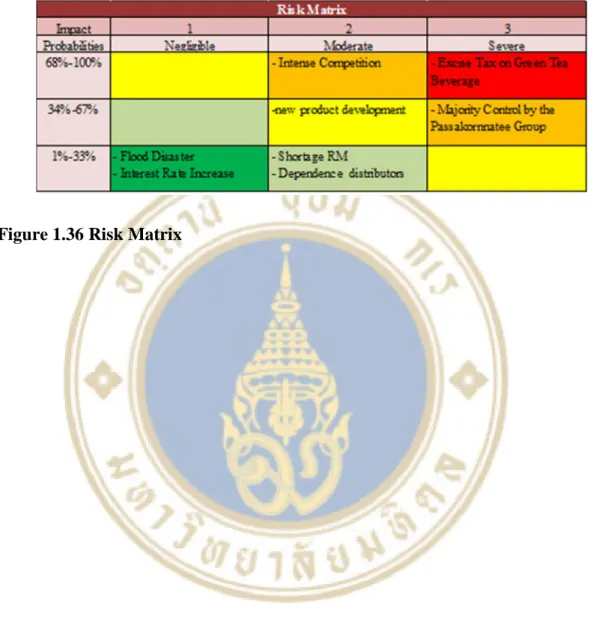

Investment Risks and Downside Possibilities

- Risk from linkage between Ichitan brand and Mr. Tan

- Risk from new product development

- Risk from Shortage and Price Fluctuation of Raw Material Key raw materials are tealeaves, fructose, and cane sugar and flavor

- Risk from Food Safety Hazard

- Risk from Interest Rate Increase

- Risk from Dependence and Major distributors

- Risk from Intense Competition

- Risk from Liability for Excise Tax on Green Tea Beverage The Company has been exempted from excise tax because the contents of

- Risk from Flood Disaster

- Risk from Majority Control by the Passakornnatee Group As of 31 December 2014, the Passakornnatee group (inclusive of Mr. Tan

As of 31 December 2014, the Company charged the loan obligations amounting to Baht 1,963 million at the floating interest rate and is therefore exposed to the risk of interest rate increases which may have an adverse effect on the Company's financial performance. In April 2014, the company launched an IP and successfully raised the capital worth Baht 3,900 million. The decrease of the outstanding loan obligations from banks to Baht 1,963 million as of December 31, 2014, significantly reduced the company's risk related to the interest rate movement.

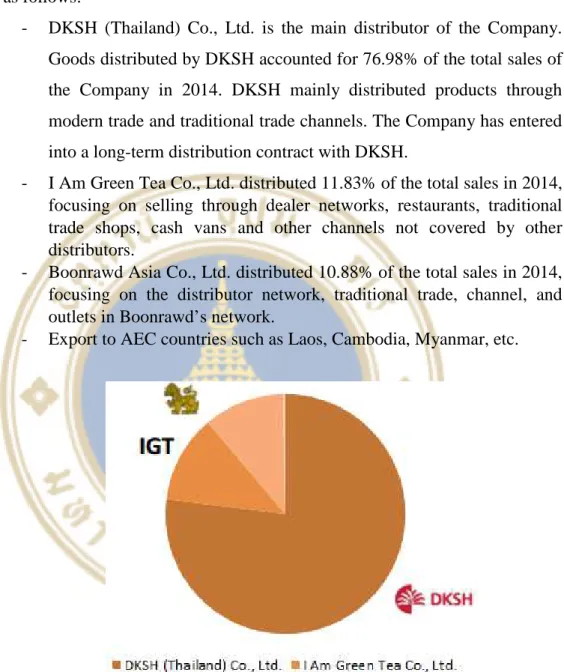

Based on this fact, the Company is exposed to the risk of over-dependence on the large distributors. The involvement of 3 distributors instead of only 1 distributor in the product distribution is a way of risk mitigation and the distribution agreement entered into with DKSH who was the original distributor of the Company allows the Company to involve 2 more distributors. For the green tea products that are difficult to distinguish, the Company intends to make efficient production and logistics management our key strength for greater profit.

In addition, the company has taken out insurance that covers all possible damages and plans to invest in overseas joint ventures and factory construction. Tan As of December 31, 2014, the Passakornnatee group (including the nominees of Mr. Tan Passakornnatee), as the majority shareholder of the Company, owned 60.0% of the total paid-up capital.

DATA

- Business Structure (ICHI)

- Revenue Growth Assumptions

- WACC Assumptions

- Other Assumption

- Major Shareholders and Free Float

- Management and organizational chart

- Corporate Governance (CG)

- SWOT Analysis

- Five Forces Analysis

- Statement of income including Projections

- Statements of financial position including Projections

- Statement of Cash Flow including Projections

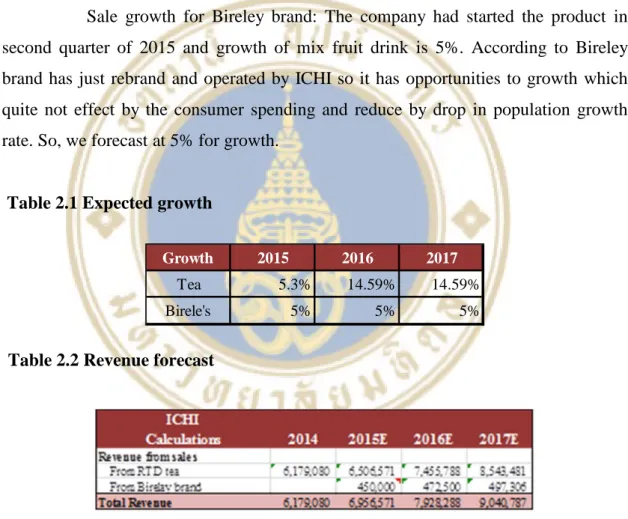

Sales growth for Bireley brand: The company launched the product in the second quarter of 2015 and the growth of mixed fruit drink is 5%. Corporate Governance Objective The Board attached importance to the corporate governance principles and aimed to ensure the Company's proper compliance with the laws and applicable rules, practices and requirements to achieve transparency and fairness in all dimensions of the Company's business operations. The Company shall have at least 3 independent directors or one third of its directors, whichever is higher.

Policy and guidance on the use of inside information by the executive The Company has established the Inside Information Policy to prevent and prohibit the use of inside information, especially the Company's non-public financial information, by limiting the number of employees who have access to such information . The Company has also communicated to all executives their duties in this regard, which include the obligation to report to the Company the holding of the Company's securities by themselves, including their spouse and dependent children. Internal Control System The company has recognized the importance of the internal control system at operational and managerial levels as a major contributor to business excellence.

Therefore, the company has clearly established the authority and duties of operations managers and managers in writing to support effective asset utilization and control, segregation of duties for operations managers, supervisors and controllers. The Audit Committee is also tasked with reviewing the Company's internal control and internal audit systems to ensure the appropriateness and effectiveness of the systems. Power controlled by the major shareholder can harm the interests of minority shareholders. Corporate Governance Objectives The Board has emphasized the principles of corporate governance and aimed to ensure the Company's correct compliance with laws and applicable rules, practices and requirements in order to achieve transparency and fairness in all dimensions of the company's business operations.

The products do not differ much and the price of the products is similar, which is the reason why the company has become a price target in the market due to the high level of rivalry.