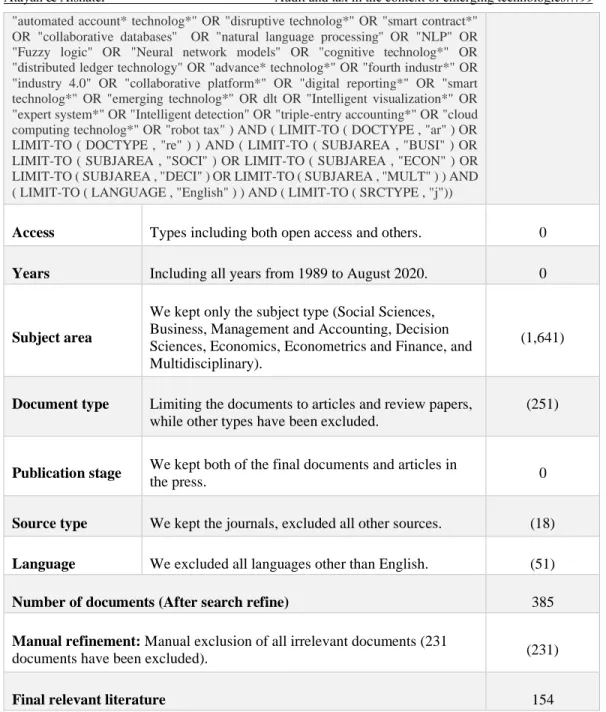

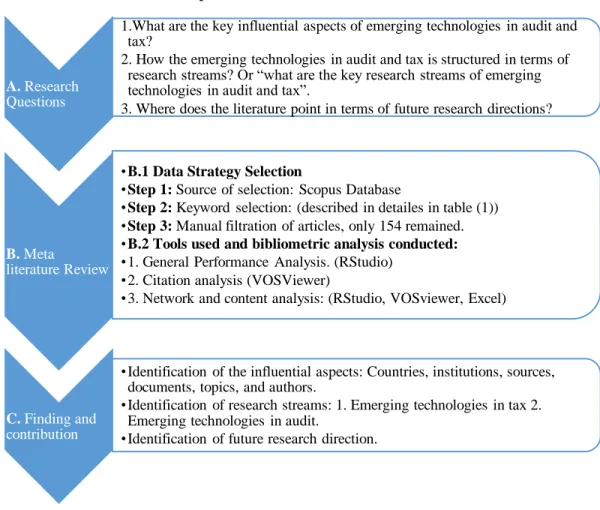

The financial reports are the main output of the accounting process, as they form the basis for the economic decisions of internal and external users, and their reliability is essential for developing adequate and correct decisions (Kolsi & Attayah, 2018). Thus, this study will shed light on examining the available literature on audit and taxation only in emerging technologies. Second, the bibliometric analysis provides a clear understanding of the past and current research trends and provides a reliable understanding of this particular area of intellectual structure.

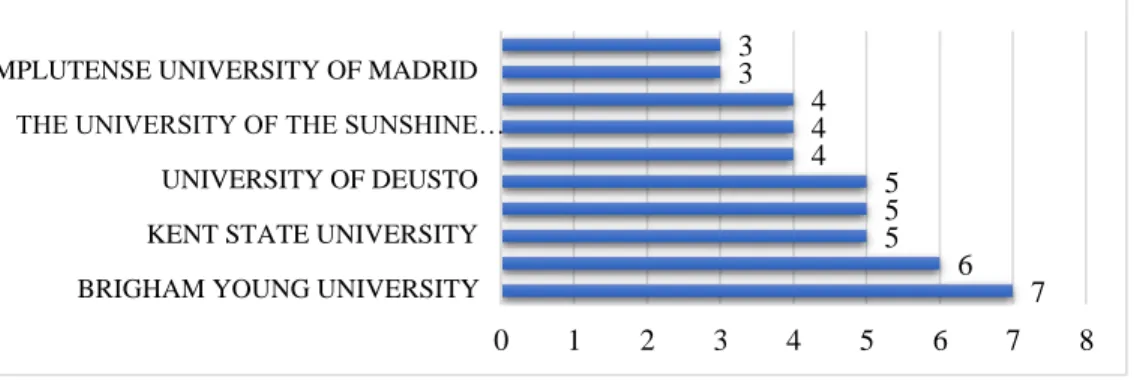

The remainder of the study is structured as follows: the second section discusses the methodology, the third section discusses the results of the bibliometric analysis and content analysis, the fourth section presents future research opportunities, and the last section presents the conclusions. How new technologies in auditing and taxation are structured in terms of research streams. It has been demonstrated that there is no central institution that focuses on this type of research as most of the research is done by different institutions around the world.

Citation analysis

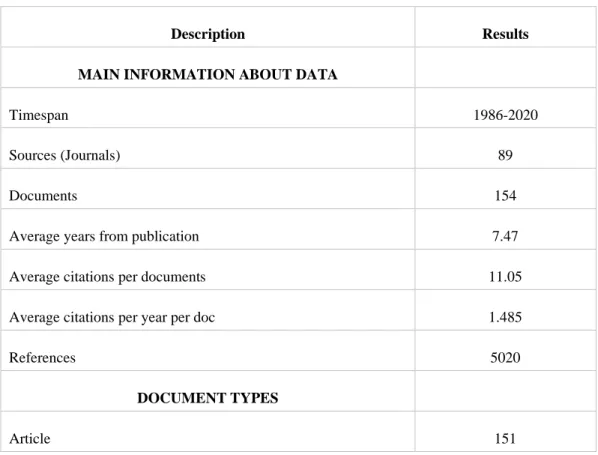

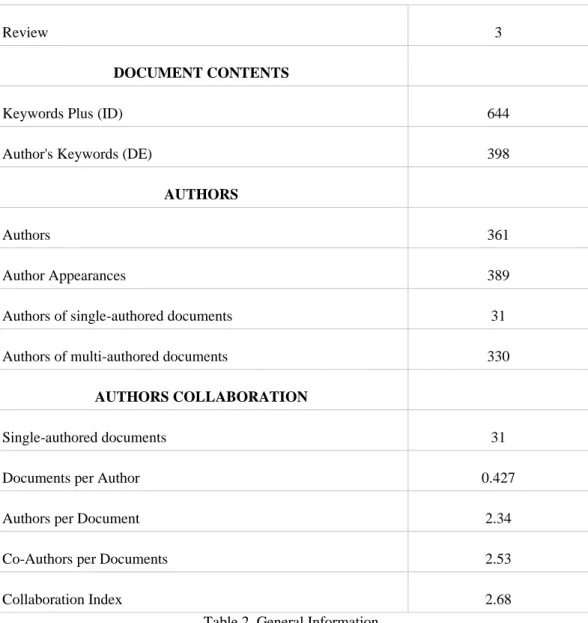

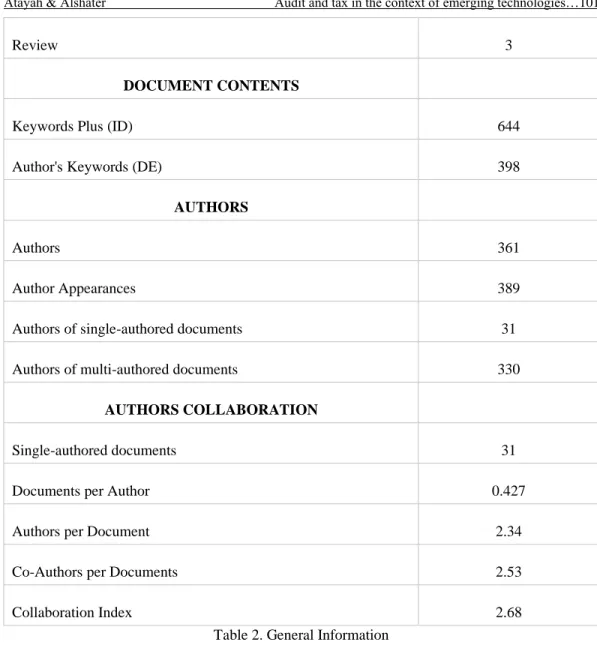

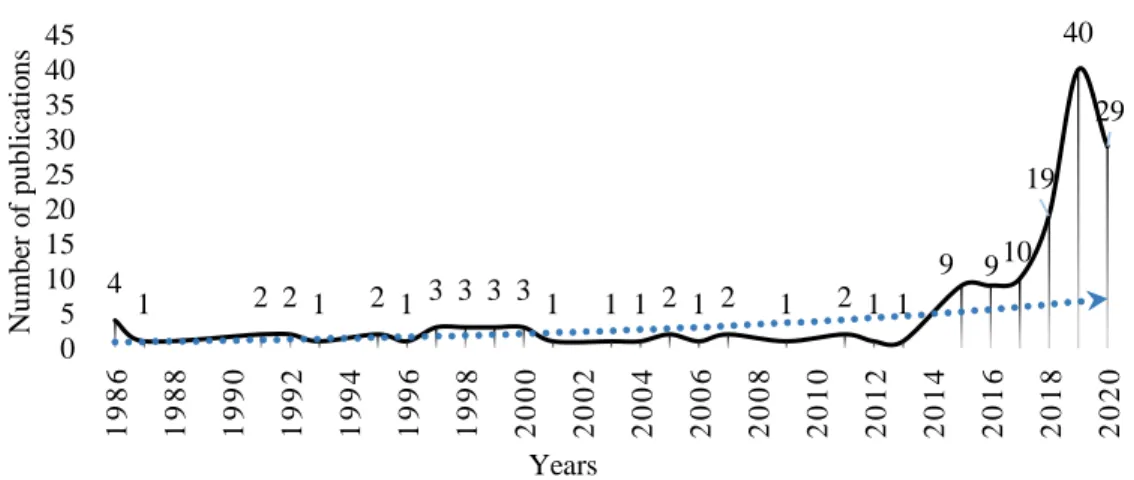

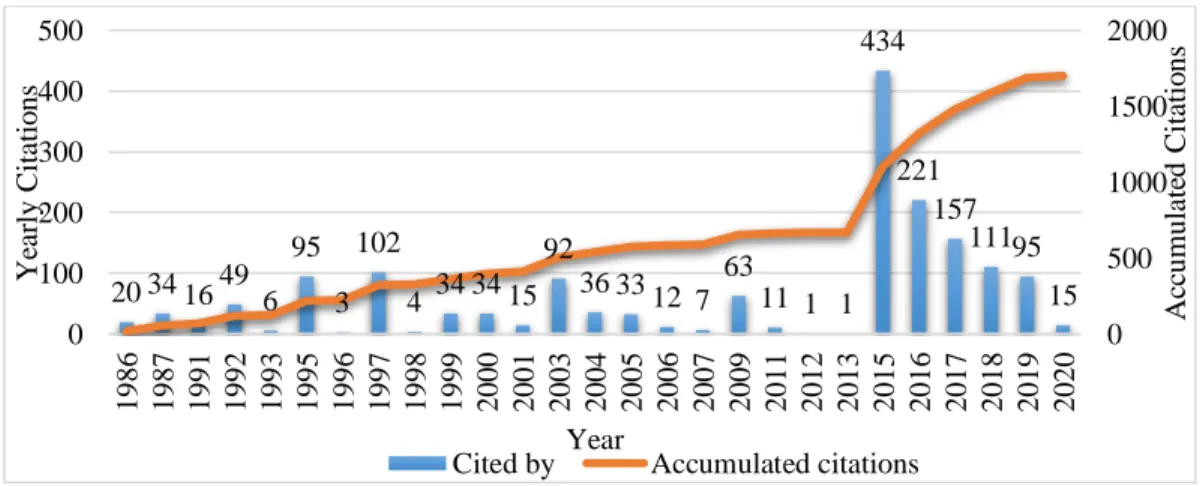

Nevertheless, it is still the best way to measure the influence of certain scientific actors in the scientific field. The total number of citations is 1,701, with the growth of citations in the last five years in percentage (61%). This study expects the topic to attract more attention in the near future; this is evident in the growth in citations and publication volume, as shown in Figure 2.

West and Bhattacharya (2016), who came in the top position among other contributors, conducted a comprehensive review of intelligent financial fraud detection. In the second position comes Lin et al. 2003), who conducted a paper to evaluate the utility of integrated fuzzy neural network (FNN) for fraud detection. In the third position, Lenard et al. 1995) stated that the neural network model improves the auditor's prediction accuracy and assessment of clients' going concern, especially under uncertain circumstances.

Behavioral implications of the impact of big data on audit judgment and decision making and future research directions. He is the most influential author on audit and tax research in the context of emerging technology. The top ten cited authors have collected 22% of the total number of citations in the field.

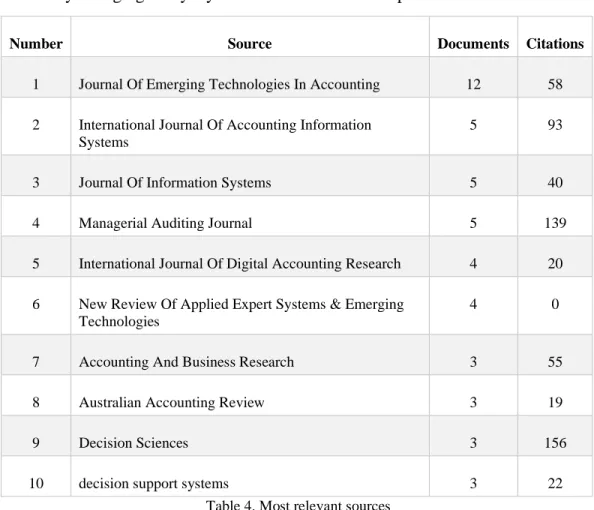

The study used the VOSviewer to generate the list below, which presents the most cited sources in the latter scientific domains. The table illustrates that the Decision Sciences Journal followed by the Managerial Auditing Journal and Auditing Journal are the most cited in the existing literature.

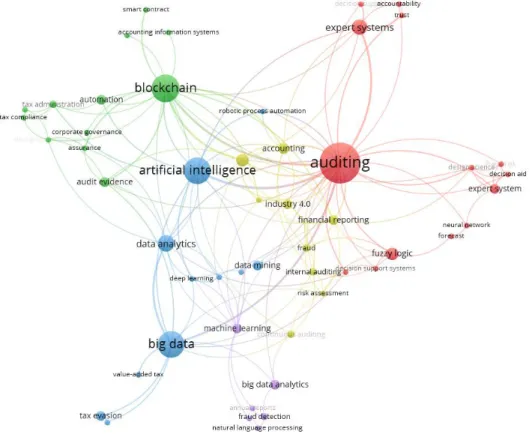

Network analysis

From a tax perspective, big data is linked to value added tax and tax evasion. However, this study finds that blockchain is linked to tax compliance, while artificial intelligence is indirectly linked to tax administration. Figure 9 below provides more elaboration on the context and development of the critical keywords used in the literature.

The figure illustrates that the darker links and nodes are older discussed, while the lighter nodes and links are the more recent topic discussed. From a technological perspective, both the expert systems and decision support system were discussed early on. Recently, the scientific community has focused more on trending topics (i.e. artificial intelligence and big data) and the blockchain area.

The figure shows that the most important changes in the intellectual structure of audit and tax have occurred over the past ten years. Over these years, discussions have emerged about big data, artificial intelligence and blockchain applications, opportunities and challenges that arise in audit and tax. The figure shows that fuzzy logic and technological themes of expert systems are related to decline or stable trends.

Content analysis

Because the benefits of using big data in the audit process can vary based on the precise time spent, the use of big data interpretation, as has been documented, provides better benefits if used after evaluating the traditional audit evidence (Rose et al., 2017) ). There are 68 studies that have discussed the undercurrent of AI in the audit field so far. In the initial stages of the 1980s, expert systems and decision support systems were among the first truly successful forms of AI.

Elliott (1986) raised the issue of auditing education and thus recommended that accounting students be equipped with the technological skills to utilize the auditing technologies of the 1990s. Overall, 120 studies were conducted to measure and explore auditing in the digital era. These studies have documented that advanced technologies are applicable and can be used in the audit field as these technologies improve accuracy, reliability and audit timing.

The common concern in the literature revolves around the use of advanced technologies in tax administration. Consequently, the Internal Revenue Service (IRS) began using big data from online platforms and social media to determine taxpayer non-compliance with tax rules and regulations (Houser & Sanders, 2018). Politou et al., 2019) consistently confirmed that the tax authorities of European countries used big data and machine learning in tax compliance checks. Teske (2007) investigated the impact of internet sales on tax collection and policy harmonization in the United States of America.

The use of blockchain technology in digital currencies motivates researchers to investigate its possible use in the field of accounting (Coyne & McMickle, 2017). Merkx (2019) stated that blockchain technology, which is still in the development stage, may face some challenges in tax uses, such as identifying reverse charge mechanisms.

Future research questions

The last sub-stream identified future research opportunities around the use of blockchain in the audit profession. The study identified 13 gaps in the second mainstream exploring the relevant technologies (Big data, AI and blockchain). The big data application in tax mainly focuses on utilizing it in accordance with the tax rules and regulations.

No studies have yet explored how big data mitigates data quality risk and how big data influences taxpayer behavior on social media. In addition, no research has yet been done on the role of social media as one of the main sources of big data in developing countries that can use big data in the activities of the tax authorities. The second substream focused on AI used in tax administration, with AI mainly being used for tax agents job stability.

In fact, no studies have yet explored the use of AI in the courts to resolve tax disputes, nor have studies yet investigated the challenges and opportunities in using virtual tax agents. The focal point of the literature was how blockchain would contribute towards greater tax compliance, how current tax regulations should be optimized to adapt to the use of blockchain in tax administration and operation, and what challenges should be faced. The study also attempts to investigate how blockchain accurately identifies different types of income.

How the use of AI increases the accuracy of auditors' conclusions and risk assessment. Does the use of blockchain in client operations affect the auditor's assessment of internal control.

CONCLUSIONS

34;A soft neural network for assessing the risk of fraudulent financial reporting" Lin, Hwang and Becker. The content analysis performed shows that the audit profession has benefited from emerging technologies in many areas. For example, it increases audit efficiency and reliability, reduces audit time and costs , develops a decision-making process and gathers evidence in real time.

At the same time, this study suggests that auditors should be equipped with the appropriate technical skills and tools to efficiently use technologies, interpret structured and unstructured data, and visualize financial information. In the area of taxation, governments usually make special efforts to secure their vital source of revenue, especially taxes. The use of advanced technologies offers promising opportunities to mitigate the risk of tax evasion and increase the abilities of tax authorities to detect suspicious transactions and cases of non-compliance.

This study shows that the use of big data, artificial intelligence and blockchain in taxation and auditing should take into account ethical aspects such as, but not limited to, privacy and data protection of taxpayers, management of technologies. Advanced technologies in accounting could be influenced by the output of higher education institutions, as these technologies are reshaping the accounting profession. This leads higher education to play a key role in equipping students with the necessary skills in the modern marketplace by optimizing accounting curricula and conducting more research on the subject.

This study has detailed past and present intellectual contributions in audit and tax and emerging technologies, in addition to developing a roadmap for further contributions. The study recommends that more studies should be carried out to explore, assess and examine the existing literature in other accounting areas (management accounting, cost accounting, financial accounting, education and accounting) in the context of Industry 4.0 technologies.

Construction and application of multi-regional input-output table of China based on big data from value added tax. The tax administration's use of big data analytics: what tax practitioners need to know. Big data analytics and other emerging technologies: Impact on the Australian audit and assurance profession.

The Fall and Rise of Intellectual Capital Accounting: New Prospects of the Big Data Revolution. Big data and algorithmic trading against periodic and tangible asset reporting: the need for U-XBRL. Next-generation smart, sustainable audit systems using Big Data Analytics: Understanding the interaction of critical barriers.

Financial Fraud Detection and Big Data Analytics – Implications for Auditors' Use of Fraud Brainstorming.