When you "do the books" you will be at the heart of the business with your hands on the controls. While this is true, there is no need for the business records to contain all of the individual's personal expenses, provided it has no significance to the business. We have already seen that a small business is simply the 'business side' of the owner's personal financial affairs.

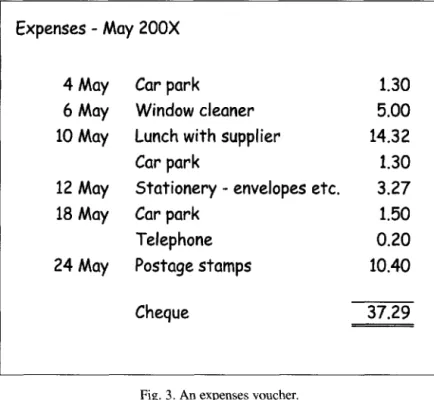

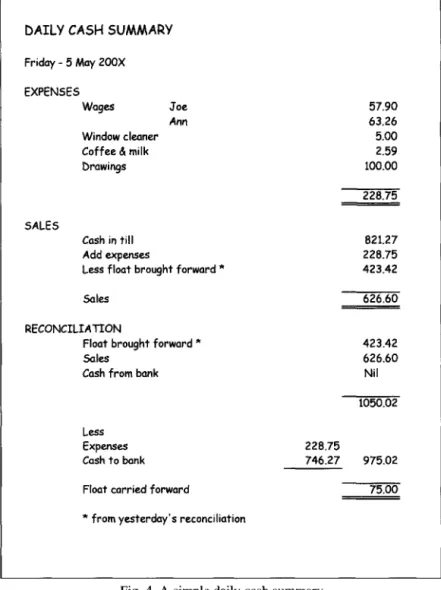

If you take money out of the business for your own use, or pay for a private item from the business bank account, this must be recorded as a drawing. They come in handy when there are questions about the bank account and help your accountant at the end of the year. At the end of the month (or when the total is a reasonable amount), you must write a check to your business bank account, payable to yourself (or in cash) to pay yourself back.

When the customer pays, mark your copy of the invoice in the book with the date and amount paid. You must then usually send the customer a statement of the amount you still owe. In your record of the bank transactions (your cash book) you will record this as a receipt as the money is received in the bank account.

As you can see there has been an increase in the value of the radio at the shop of £20.

Group 2 Group 3 31 March 30 April 31 May

You can also request that the accounting periods be adjusted to your company's accounting year. You must complete the VAT declaration and submit it to the VAT office no later than one month after the end of the VAT quarter. Each time you default, the penalty rate increases to a maximum of 15% of the VAT you owe.

It represents either the VAT due to Customs and Excise (if box 3 exceeds box 4) or the amount you claim from them (if box 4 exceeds box 3). The figures in boxes 6 to 9 are used by the VAT office to prepare statistics and to check the figures declared in the other boxes of the form. Retail schemes provide a method of arriving at the value of taxable retail sales and allow you to determine the percentage of those sales charged at different rates of VAT.

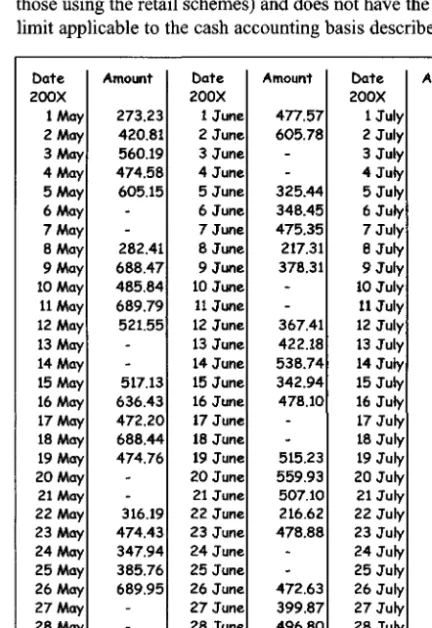

In most schemes you work out the VAT output tax on your sales by applying the VAT fraction (see page 47) to the appropriate proportion of your sales. So if 40% of your purchases are zero-rated, then 40% of your sales are treated as zero-rated.

Point of sale scheme: sales are analyzed between different VAT rates at the time of sale using an electronic table. This is more accurate, but requires an expensive electronic tape and staff who know how to use it.

Where sales are partly standard rate and partly zero rate, you may be able to use an electronic cash register with multiple totals to analyze your sales at the time of sale. If you can determine the value of the standard-rated sales in this way, you can apply the VAT fraction to the appropriate amount to calculate the output tax. Where sales are partly standard-rated and partly zero-rated, and you cannot record the split at the point of sale, you must use one of the retail schemes set out above to determine the amount of VAT output tax.

For example, using apportionment scheme 1, if 75% of your resale costs are standard rated, then 75% of your revenue is treated as standard rated and the VAT proportion is applied accordingly. The total gross value will thus amount to 117.5% of the net purchase value of the goods without VAT. If you are trying to find the VAT content, this will be the total amount of the goods which includes VAT.

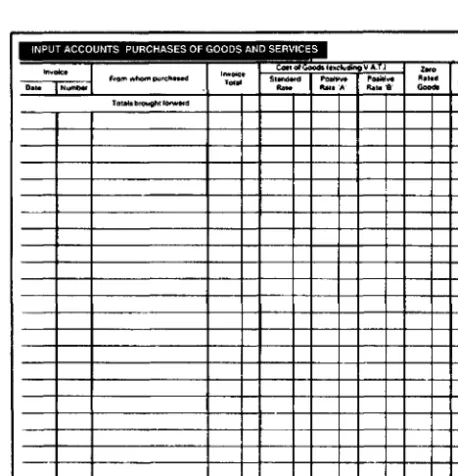

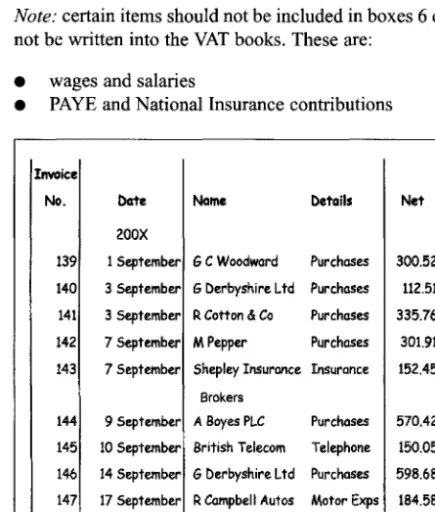

At the end of the VAT period, add up the columns to get the figures for your VAT return. Subject to any adjustments (page 59), the total of the 'Net' column must be entered as the 'Value of Outputs' in box 6 of the VAT return. Again, unless you use one of the retail schemes, the VAT book for Fig.

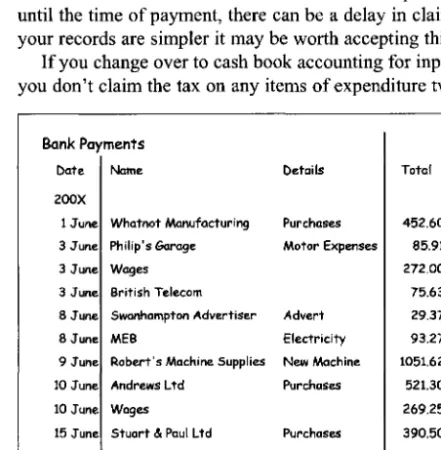

The total of the 'Net' column is used to complete box 7 (Value of the inputs) of the VAT return. The total of the VAT column is then entered in box 4 (VAT deductible) on the form. At the end of the VAT quarter, the total from the VAT column is used to arrive at the output VAT amount.

Details of the information you must show on your sales invoices are discussed on page 48. In these cases, only part of the input tax (the tax on the business part) can be reclaimed. At the end of the month when the book is tallied, it should cross tally.

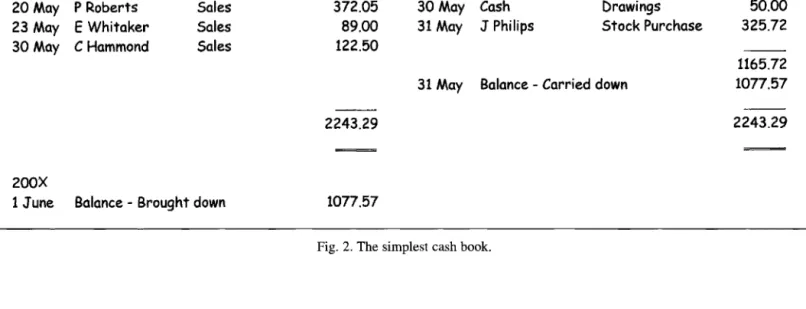

Then, every week or month, post the entries from the sales day book (including VAT) to the (left) debit side of the sales book. Amounts entered on the left (debit) side of the cash book must be recorded on the right (credit) side of the sales ledger. To find out the total amount owed to you by your customers, you 'pull' the list of balances from the sales ledger accounts.

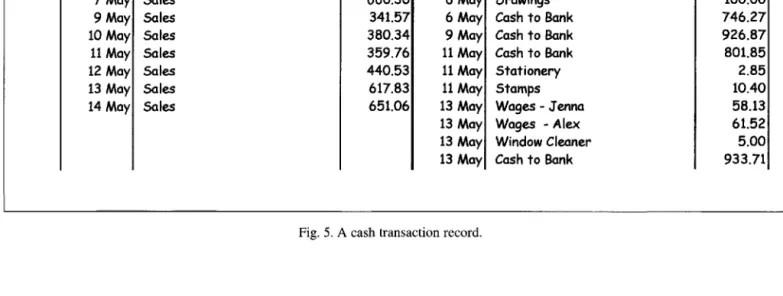

At the end of each month you post the cash total (from the sales ledger column of the cash book) and the receipts total for the month from the sales day book to the memo control account. Sales Ledger Control Account6556. directly) is equal to the net total of the surplus list taken from the sales ledger. Since you will now analyze most of your expenses in the purchase day book, the right (credit) side of the cash book can now be simplified.

Likewise, if at the end of the year £165 was owed on goods, this will not be included in the payments made. The first type is personal accounts - those relating to contacts with customers or suppliers, collected in the form of sales and purchase ledgers respectively.

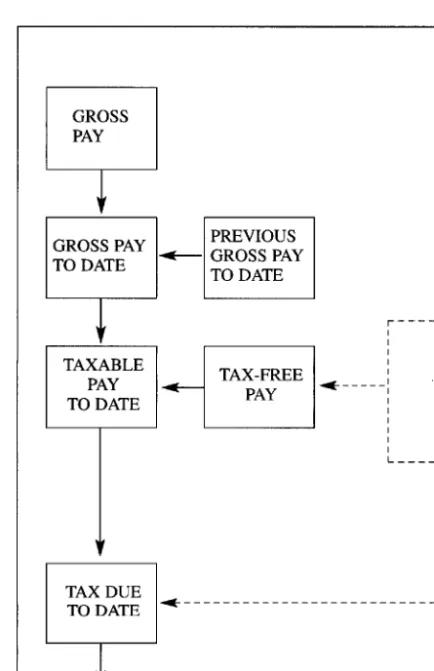

A deduction working sheet (Form PI 1) for each employee

The PAYE Tables. There are two books of tax tables in general use

Tax Code Advice (Form P6) - A notice issued by the Inspector of Schools telling you which tax code number to use for each.

The tax code advice (Form P6) - A notice issued by the Inspector of Taxes telling you which tax code number to use for each

If the business is carried on by a limited company, then the directors of the company are employees. The general ledger where all assets, liabilities, income and expenses of the business are recorded. Often the group remains open for the current month and only at the end of the month the amounts are transferred to the general ledger.

Except for companies, there is no 'legal' order of posting the items on the balance sheet. After accounting for time differences (debtors, creditors and shares), it shows the company's profit and loss. This can be related either to the price of the goods or to the selling price.

After adjusting for non-trading income, you finally arrive at the net business profit for the year. We had to transfer the account balance (£2,800) to the profit and loss account; there we will pay it off with other business expenses. Under this system, a fixed percentage on the declining value of the asset is written off in the profit and loss account every year.

An income statement shows how the change in the company's net worth has occurred since the last accounts were prepared. The way in which accountability is presented will also depend on the nature of the company. In addition to sales revenue, your budget should forecast all of the company's expenses.

It taxes the increase in the asset's value over the period of ownership. In small companies, the owners of the company (shareholders) are often also directors. Depending on the company's financial situation, you may need to raise additional funds.

You can therefore claim capital allowances (see Chapter 10) on the cash value of the asset. Instead, you can deduct the entire amount you pay to the leasing company (excluding VAT) from your business profits.