No part of this publication may be reproduced in any material form (including photocopying or storing in any medium by electronic means and whether or not incidentally or incidentally to any other use of this publication) without the written permission of the right holder copyright, except in accordance with the provisions of the Copyright, Designs and Patents Act 1988 or under the terms of a license issued by the Copyright Licensing Agency Ltd, 90 Tottenham Court Road, London, England W1T 4LP. 265 11.6 Too Often, Analysts' Picks Are Mediocre 267 11.7 Buy-Side Asymmetries in Expert Advice 270 12 Volatility, Liquidity, Leverage, and Their Impact on Investments 274 .

Preface

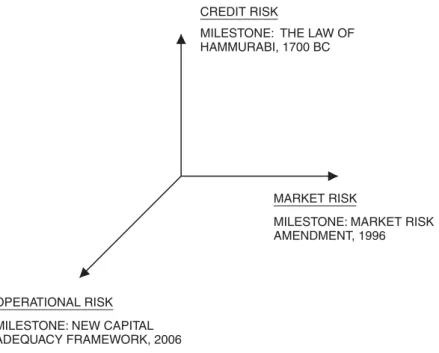

Price/earnings, return on equity, and the treatment of equity as an option are among the topics of the chapter. This is the subject of Chapter 12, which also focuses on liquidity and solvency, and the consequences of leverage on the investor and his savings—a concept that leads to rethinking return on equity.

The art of investing

1 Golden rules of investing

Introduction

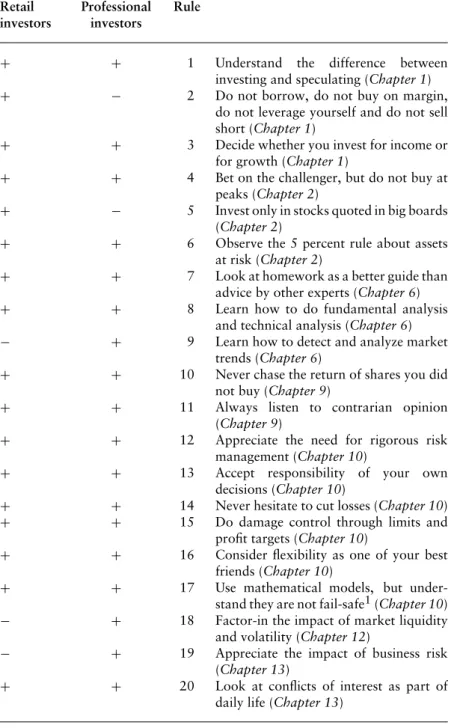

For example, the first and third golden rules of investing in Table 1.1, as well as many others, appeal to both professional investment managers and individual investors. As individual investors use the services of institutional investors, they themselves must always be aware of how the latter work, which rules govern them and on which criteria or conditions their decision-making process is based.

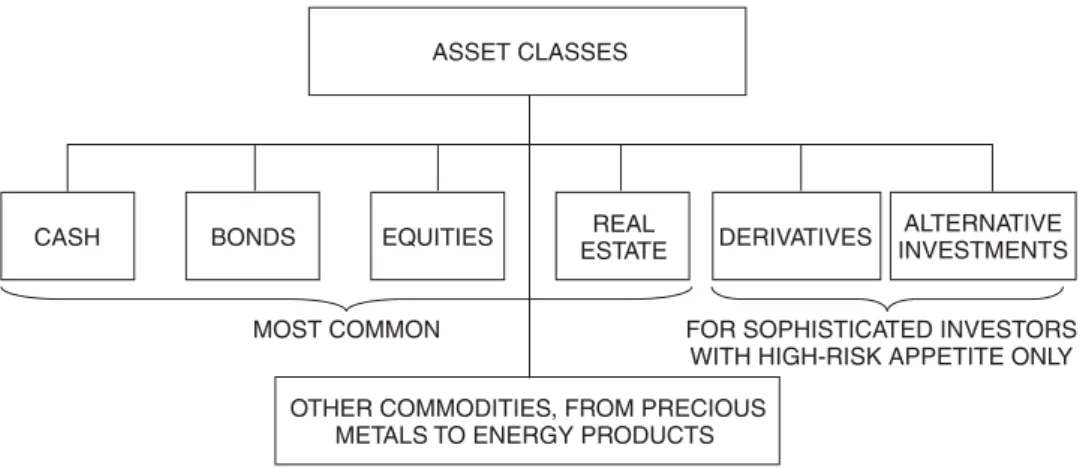

Asset classes of investing

A 25-year-old person is likely to go for growth in investments in the expectation that the right market choices will increase his or her capital. The questions in the previous sections must be asked before deciding on an investment policy.

Investors, speculators, risk and return

The portion of assets subject to exposure beyond prudential limits to maximize anticipated returns. He said the extremely negative US current account balance essentially represents the difference between Americans' savings and investments.

Savings down the drain: the Eurotunnel fiasco

Funding requirements grew to the point that a financial restructuring operation became necessary at the end of 1995. As this reference documents, since 1998 Eurotunnel has carried out a series of financial operations aimed at reducing its debt (achieved in the amount of £1.2 billion), as well as reduce annual interest charges by up to 40 percent.

Understand the difference between investing, trading and speculating

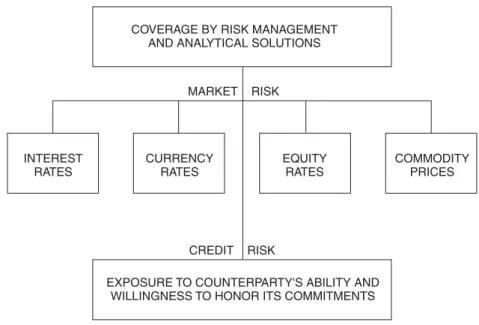

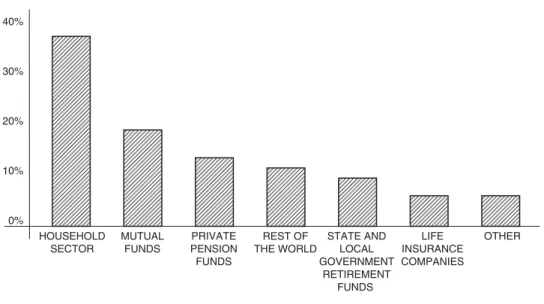

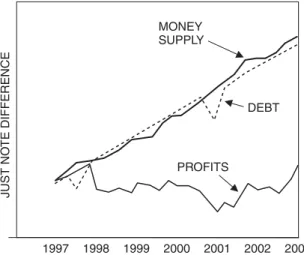

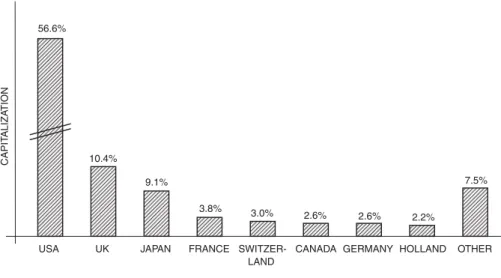

For example, companies hedge their exposure to interest rate risk with options in the event of a major increase in interest rates. Bush recognizes that the investor class is the most important demographic group in the country.”8 Figure 1.3 provides a bird's-eye view of who controls the capital of American companies.

Caveat emptor and human nature

In Belgium, which has four different codes on investment-related topics, there has been evidence that control over corporate governance activities is slowing down.11 Clearly, this is to the detriment of investors. Impartiality refers to the lack of subjective stance by the analyst, who must not favor any of the stocks he or she covers, for any reason.

A golden rule for private investors, but not necessarily for all professionals

One of the experts who participated in the research that led to this book was to suggest that the second golden rule can be valid even for professional investors, depending on the time frame in which they work. To appreciate Giannini's dictum behind the second golden rule of investing, it is necessary to remember that in the late nineteenth and early twentieth centuries, as now, there were many opportunities to make and lose a fortune.

Income, growth and control of exposure

Is he closer to the truth about the state of the market (or subject) than I am. Some of the rules underlying effective risk management are fairly simple and can be expressed in one short sentence.

Notes

In theory, having been rattled by uncertainty about corporate finances following the great bankruptcies of the early 21st century, investors should not need reminding of the importance of stable risk controls. Arriving at the home of the richest man in the world, Yamani was shown to a pay phone and told that any visitor who wanted to make a call should use it.

2 The area where professional asset managers and private investors meet

Introduction

In continental Europe, retirees have long relied on elaborate public pension schemes, which are theoretically financed by the working population as an independent entity, but in practice part of the government budget. What is written in this chapter about pension funds and mutual funds is not a criticism of their work, but an alarm.

Investments through private banking

A properly run private banking business will ensure that each client receives advice tailored to his or her investment goals and risk appetite. Ensure that private banking customers receive a consistent, high-quality service, regardless of whether they bank at home or abroad.

Betting on the challenger and learning to diversify

This is a shot in the direction of diversification, which by choice must be part of the fourth golden rule. If the investor doesn't, he or she shouldn't be in the stock market in the first place.

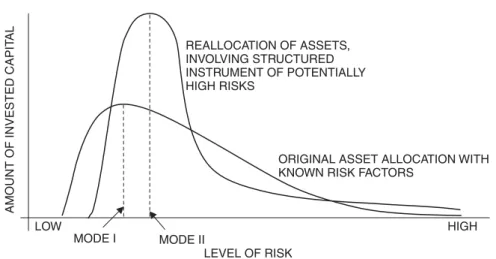

Increasing the visibility of one’s investments

Both alternative investments and discretionary portfolio management reduce the investor's visibility of the risks inherent in the way his or her wealth is managed. Always in theory, the client should feel confident that his or her portfolio and the risks taken with it are continuously monitored.

The 5 percent rule about assets at risk

Traders with significant experience in the stock market have provided another example of the financial application of the Heisenberg Principle. These two points are hypotheses suggested by experience and discussed in the course of the investigation.

Challenges faced by pension funds

One of the misleading slogans of hedge funds and funds of funds is that 'your money is actively managed around the world'. One only has to look at the widely available tables of estimates of age dependency ratios in the most developed countries to get an idea of the magnitude of this issue.

Are mutual funds a good alternative?

The full extent of this elaborate fraud is not yet known,” said Spitzer, “but one thing is clear: the mutual fund industry operates with a double standard. For its part, the SEC joined the growing investigation into the mutual fund trading scandal.

Capital markets and their players

3 Capital markets and the securities industry

- Introduction

- Securities and their legal protection

- Investment banking and underwriting

- Investment bankers and primary dealers

- Correspondent banks

- The globalized securities market

- Risk of global contagion

For example, in the US the Securities Investor Protection Corporation (SIPC) is registered with the SEC under the Securities Act of 1933 (see Chapter 4). Participants in the sales group include some or all of the underwriters as well as additional dealers.

4 The trading of equities

Introduction

Over nearly 200 years, the ships of the United Dutch East Indies made 4,800 voyages, transporting nearly a million people to the colonies. The VOC's biggest rival had been the English East India Company, which sent 2,700 ships, but these carried only 20 percent of the Dutch entity's 2.5 million tons of Asian cargo.

Equities, stock exchanges and over-the-counter operations

Stocks generally provide the holders with a share in the ownership of the corporation while, in the case of debt securities, the holders are creditors. Some of the OTC traders try to avoid taking a position in the instruments they trade, keeping the volume of purchases and sales in balance.

Basic facts about equities: common and preferred stock

They are the connecting link between the floor of the stock exchange and investors and traders. Still other members of the stock exchange are specialists who focus their activity on one or a few stocks on a single trading floor of the stock exchange (see Chapter 5).

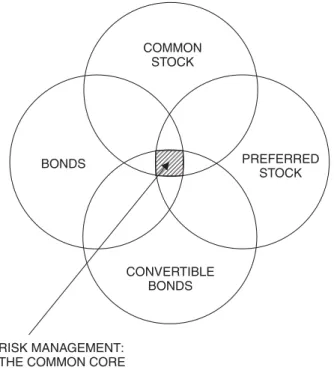

Convertible bonds defined

And at the same time, actual or expected changes in the issuer's credit ratings will generally affect the market value of convertible bonds and debentures. In effect, convertible shares are tradable bearer instruments that give the investor long-term access to the common stock of the company.

The funding competition between capital markets and commercial banks

In the globalized financial environment, on the other hand, external influences can be transmitted to the domestic market in a number of direct and indirect ways. It is inevitable that direct and indirect foreign influences affect the term structure between domestic and foreign capital markets.

Stock markets and equity prices

In contrast, an increase in stock prices may indicate good investment opportunities, as this investment can be financed at a lower cost through new stock issues. All other things being equal, when stock prices rise, the company's market value relative to the replacement cost of its capital stock will generally rise.

Stock market indices: Dow Jones, S&P and NASDAQ

NYSE World Leaders Index Table 4.2 Subdivisions of the Dow Jones Index and other NYSE stocks. The DJIA accounts for nearly 50 percent of the manufacturing industry, while manufacturing accounts for about a quarter of the S&P Composite.

European market indices

FTSE 100 Index FTSE 100 for EuroOpts FTSE 250 Index FTSE 350 Index FTSE 250 for Inv Trst FTSE Fledgling Index FTSE Lower Yield Index FTSE Higher Yield Index FTSE Smallcap Index FTSE Target Index FTSE All Share Index FTSE All Share Index FTSE Index. Bloomberg European 500 Bloomberg Eur New Mkt 50 DJ Euro Stoxx 50 Price Index DJ Stoxx 50 Price Index DJ Euro Stoxx Price Index DJ Stoxx 600 Price IX Euro FTSE Eurotop 100 Index FTSE Eurotop 300 Index FTSE Eurofirst 80 Index FTSE Eurofirst 100 Index FTSE FTSE EuroStars Index MSCI Euro .

Appendix: The Paper Ships Index 11

2 This works in conjunction with the twentieth century socialist dogma that "When companies are nearly bankrupt, we nationalize them, and when they are profitable, we privatize them." Due to the lull in the stock market, regulators have allowed banks to increase their core capital (eligible regulatory Tier 1 capital) with permanent deeply subordinated bonds that can be called after 10 years.

5 Regulation and operation of the exchanges

Introduction

The 1934 Act was intended to ensure a free and open market in which stock and bond prices reflect, at least to some degree, supply and demand based on informed judgment, uninfluenced by artificial manipulation or deceptive practices. The law's 1934 ban didn't bother the many short sellers and hedge funds behind them.

Role of a regulatory authority

For example, groups typically attempt to increase the price of a security through the concerted activity of stock exchange members. The SEC charged the broker with negligence for failing to warn the investor of the risks.

Self-regulation by the exchanges and conflicts of interest

One of the reasons for possible conflicts of interest lies in the fact that brokers not only act as intermediaries, but also operate wealth management services. Weeding out conflicts of interest is most important because investors should be able to believe without reservation in the integrity of free markets.

Role of specialists in a stock exchange

What is the specialist's responsibility towards his book and its content. What role does the specialist and his book play in the activities of the scholarship.

Bid, ask, large blocks and the third market

Brokers and traders receive either a commission or a price concession from the seller for directing large blocks to the market and finding a counterparty. Regardless of whether these transactions are on the stock exchange or on a third market and whether they concern the purchase or sale of large packages of securities.

Cash and margin accounts

The broker can force the sale of securities or other assets in the investor's account(s) without contacting him or her. These will be used by the broker or dealer as part of his or her capital, depending on the risks of the business the broker or dealer is taking.

Short sales and reverse/forward splits

In contrast, unregulated lenders decide for themselves what percentage of the loan they want as collateral. The example given in the following paragraphs describes a reverse one-for-thirty stock split followed immediately by a forward thirty-for-one stock split of common stock.

Three

Performance criteria and quoted equities

6 Technical and fundamental analysis

Introduction

Experience teaches us that there is no way out of one's daily homework unless one wants to be beaten by the market. Knowing when to stay out of the market is just as important to an investor as knowing when to be in.

Fundamental analysis defined

According to this expert, part of the downside of technical analysis is that it drives investors to trade frequently. Integrated into the perspective of the references in the previous paragraphs is the eighth golden rule of investing.

Technical analysis defined

Specific indicators can be tested quickly over selected time periods to explore a network of relationships within a stock's price structure. What they are saying is that price patterns have formed and studying them can be revealing.

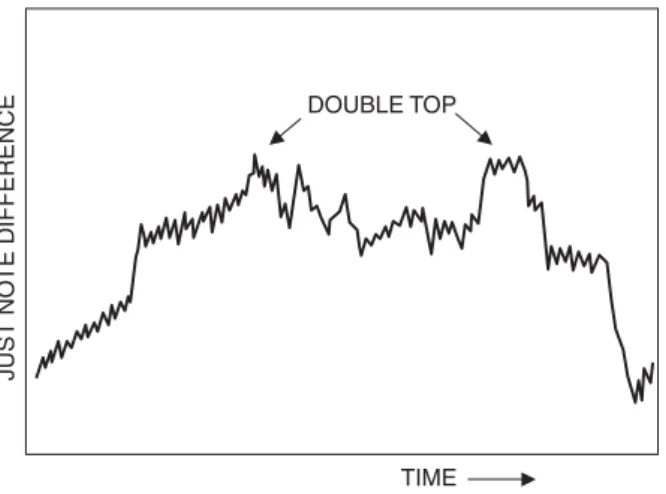

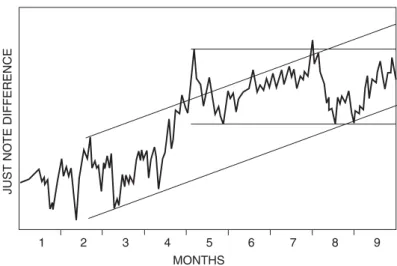

Theory behind the art of charting

By breaking above the top of the resistance zone, the 200-day moving average can command impressive volume, which is the beginning of an uptrend. More or less all of this negative action occurs below the falling moving average of the stock; that is, the exact opposite of a stock's uptrend that we explored earlier in this section.

The bolts and nuts of charting

Resistance exists if the price cannot rise above a certain level after a rise, at least temporarily. Support exists if the price cannot fall below a certain threshold, at least temporarily.

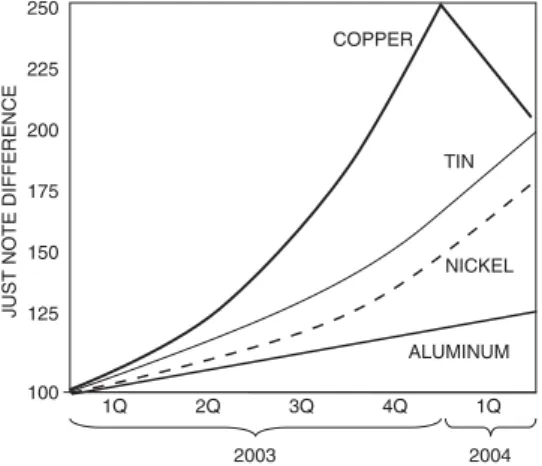

Financial analysis and future price of a commodity

Note that some of the criteria used in the past do not make much sense. In price movement analysis, one tries to gauge what the market is thinking.

Learning how to detect and analyze market trends

It is not yet one of the key variables of financial analysis and this is a disadvantage. A trending market is the main thing that ultimately gets us into the trade," said one expert.

The role of rocket scientists

To a significant extent, this explains some of the conceptual qualities that a product planner, financial analyst or risk manager needs, beyond those traditionally considered 'analytical'. This is not true of the process of analysis whose end result, which is insight, is highly correlated with the twists and turns of the process – the two feed on each other.

Appendix: Microsoft’s 2004 Huge Dividend

For example, there is a difference in the views of equity analysts and debt analysts expressed by the way they view ROE (see Chapter 7). The dividend Microsoft pays its shareholders is worth more than the entire market capitalization of all but the largest 71 companies in the S&P 500.

7 Quantitative criteria for equity performance

Introduction

Another popular measure, which is also an input to the P/E ratio, is earnings per share (see section 7.4). Typically, in the ROE algorithm, return refers to the trailing twelve-month earnings per share as a percentage of the most recent book value per share.

An equity’s valuation and need for stress tests

One of the interesting metrics is Tobin's Q ratio, which the reader will find in the appendix of this chapter. Positive or negative swings in a stock market disconnect the share price from the real value of the company.

Equity as an option and dividend discount model

The simulation based on Merton's approach takes advantage of the information contained in the capital market price taken as a proxy for its assets. All these observations provide a sound basis for investment decisions and they should be reflected in the creation of a model.

Earnings per share and creative accounting solutions

At the same time, rising inflation is bad for capital and in the bond market it is not always offset by the expected inflation component. In practice, this is not easy because standards are set by different bodies such as the FASB in the US, the Accounting Standards Board (ASB) in the UK and the IASB.

Earnings before interest, taxes, depreciation, and amortization

One of the main reasons for Vodafone's long decline in 2001 was the market's loss of confidence in pro forma reporting. Do you really have to be so tough on EBITDA?” asked one of the reviewers.

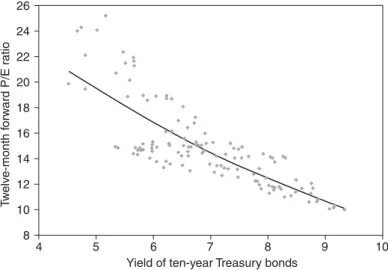

Price to earnings ratio and its challenges

A shift to positive ERR value is significant because it comes in the wake of net EPS upgrades. If the time frame of the example you were given was 1987 to 1992, then, in the typical case, management's assumption that 'next year's earnings'.

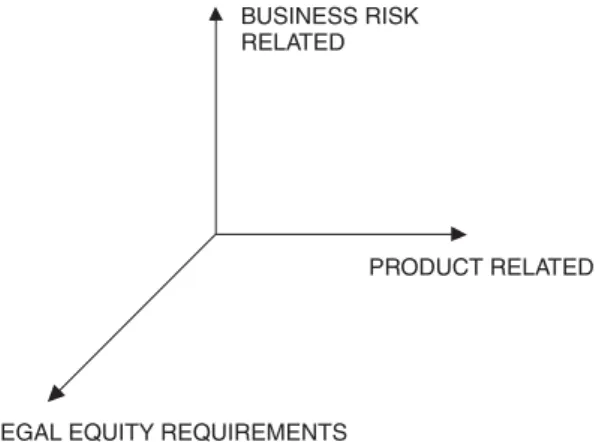

Using return on equity as a guide

In the same frame of reference, the product-related contribution to ROE should be allocated to the products on the basis of both expected risk and income volatility. In principle, the greater the fluctuations in income, the higher the long-term contribution of a product to ROE should be.

Appendix: the Tobin Q-ratio

8 Transparency in financial statements and reputational risk

Introduction

Experienced investors can detect when certain types of trades start to become fraudulent and they withdraw from the market. Fueled by legislation and regulation, the capital market in the G-10 countries is well established and has the expertise necessary to underwrite a wide range of risks.

Goals of transparent financial reporting