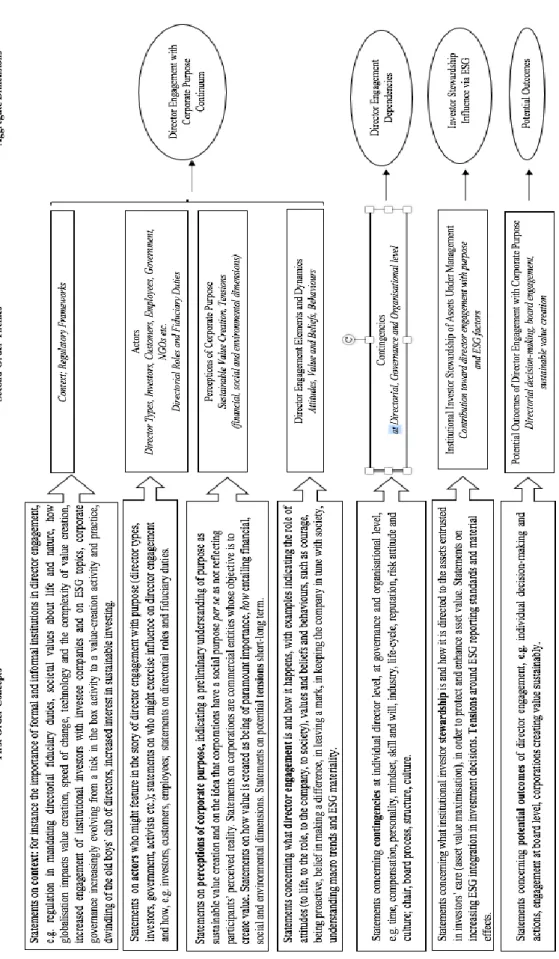

Perspectives that define ESG factors as 'non-financial', the lack of globally accepted ESG standards, and the debate on integrated reporting emerge as potentially detrimental to engagement beyond compliance and compliance, as ESG factors are seen as strategic in nature can have an impact on the bottom line and ability to create value, and is financially relevant and important. My second acknowledgment goes to my 'support network': the individuals who helped me address the access limitations of this thesis and navigate stormy waters; the participants in this study, who shared their insights, time and hospitality with me; and the scholars whose work has informed, inspired and challenged this journey in the field of corporate governance.

List of Abbreviations

Introduction

Research Background

Externalities are all around us in the form of environmental, social and governance (ESG) factors, which represent a key aspect of the modern corporate context (Adler 2016). Institutional investors are increasingly involved in corporate governance through the exercise of their fiduciary duties through a form of activism known as 'collaboration' on environmental, social and corporate governance (ESG) topics with the boards and/or individual directors of the companies in which they invest (Esphabodi et 2019;

Research Problem

Research Aim

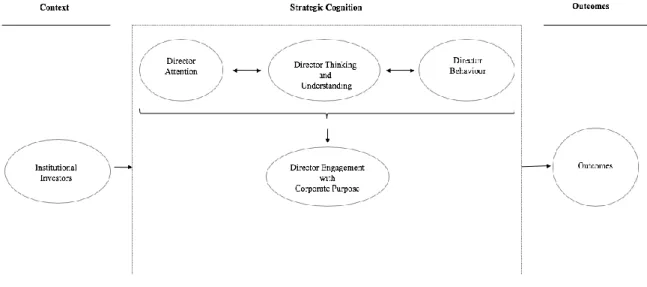

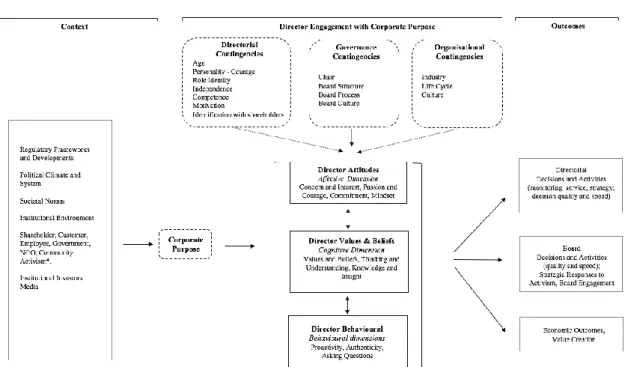

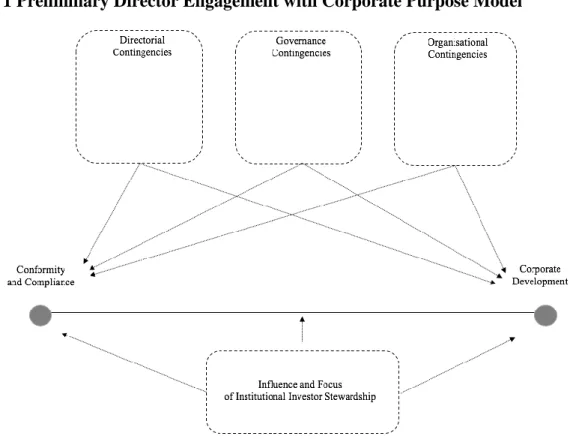

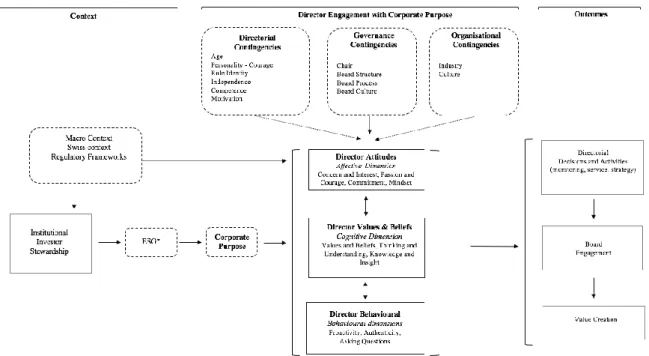

SC is critical to this study and I considered a SC view of board engagement as the link or mediating mechanism between the context of this study (with a focus on investor stewardship) and a number of possible outcomes of board engagement, e.g. board level engagement, trust and reputation or (as I discovered much later in the research process) the institutionalization of corporate goals. I also suggest that the exercise of investor stewardship, through the integration of ESG factors as a cornerstone of investment decisions, particularly through a form of investor activism known as “engagement,” can enhance executive engagement.

Research Objectives

Research Questions

Research Strategy

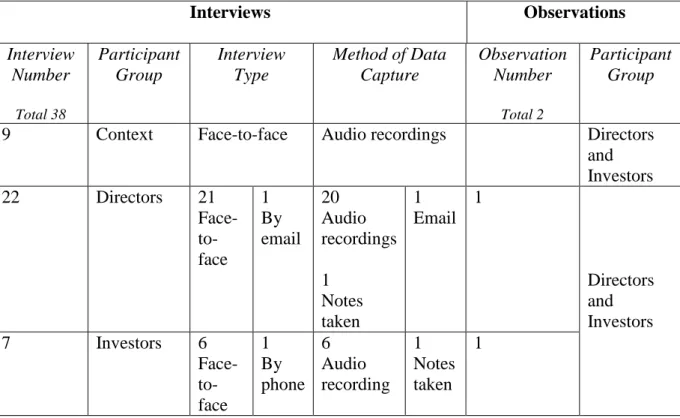

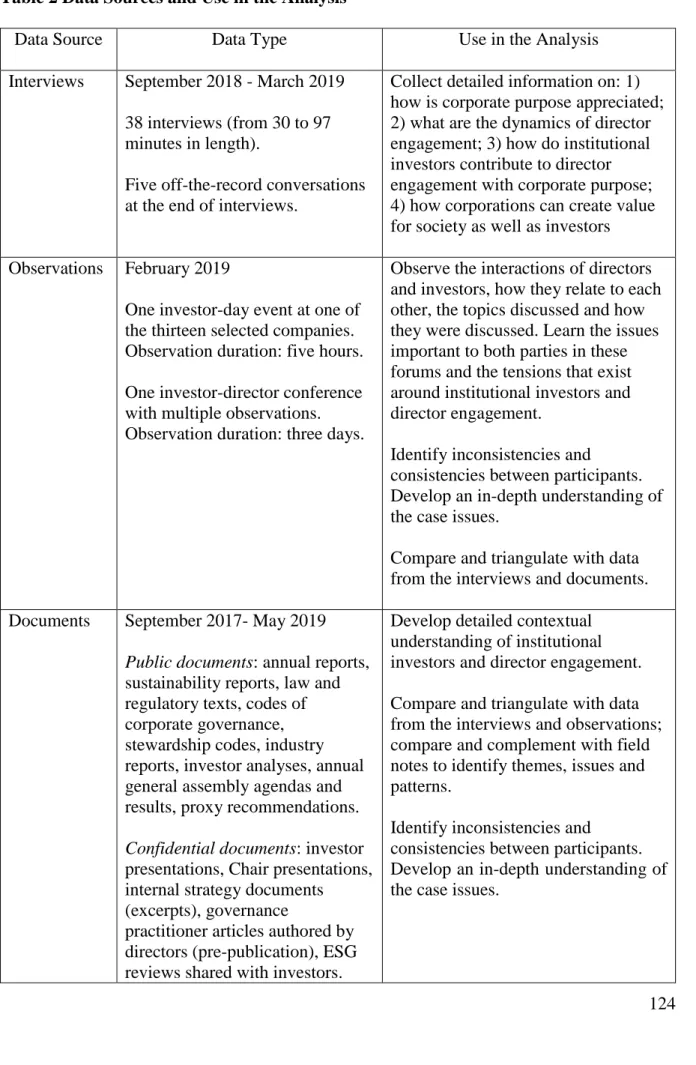

It places my role as researcher at the forefront of this study, making my reflections on the actions I took and what I observed in the field a central part of the knowledge I aim to produce. Through these interviews, I collected data on the study's main constructs, namely individual director engagement with purpose and institutional investors.

Research Significance and Contribution to Knowledge

In terms of implications for practice, they include the role of the chairman, talent pipeline and education for directors, and board structure. Having elaborated on my original contribution to knowledge, I now present the structure of the thesis.

Structure of the Thesis

Literature Review

Introduction

Thus, the origins of commercial companies were rooted in public interests and goals, and also displayed a profit motive (Mayer 2013). The nineteenth century marked the beginning of freedom of incorporation and the origin of the private corporation.

Corporate Purpose

Report to the Committee for the Association for the Relief of Manufacturing and Work. In this regard, it is worth noting one of the most remarkable developments of the last decade (Mayer 2017) in the field of corporate personality and purpose.

Directorial Roles in Corporate Governance

Therefore, it is important to review director roles and how they are positioned within the management area. The concept of corporate governance dates back to the 1970s and was coined in the wake of corporate scandals (Ocasio & Joseph 2005).

Director Engagement with Corporate Purpose

Regarding the different conceptualization of engagement in the social sciences, engagement in psychology implies a high sense of initiative and involvement with a display of motivation and commitment (Achterberg et al. 2003; London, Downey & Mace 2007). Engagement can also use affective, cognitive and physical energy (Mitchell et al. 2019; Rich, LePine & Crawford 2010).

Strategic Cognition

Given the nature and dependencies of involvement, the investigation of how it unfolds under the influence of institutional investors requires a cognitive explanation, which rests on the assumption that directors' perceptions of a variety of factors can shape individual and corporate actions (Crilly & Sloan 2012; Porac, Thomas & Baden-Fuller 1989). Therefore, a review of strategic cognition (SC) theory (Hodgkinson & . Thomas 1997; Kaplan 2011; Narayanan, Zane & Kemmerer 2010; Schwenk 1988; Walsh 1995) seems appropriate to guide the exploration of the nature and dynamics of director involvement. The relevance of board and director research for strategic decisions is a central theme in management research (Golden & Zajac 2001; Hillman & Dalziel 2003), but research on this topic is nonetheless scarce.

Institutional Investors

Stewardship increasingly includes consideration of the wider ESG factors (environmental, social and corporate governance) as a core element of investors' fiduciary duties (Espahbodi et al. 2019; Van Duuren, Platinga & Scholtens 2016). What is different now is the immediacy, scale and global impact of the consequences of such events, giving increased urgency and importance to the response to and anticipation of them, and therefore the increasing inclusion of ESG factors in investment decisions. Most importantly, against the background of a lack of globally accepted standards, ESG factors continue to be considered as non-financial dimensions of stock and company performance (Klasa 2018; van Duuren, Platinga & Scholtens 2016), a view supported by the integrated reporting for recently mandated by the EU and in force since June 2019 (EU 2014; 2017a), and by the US Congress rejection of the adoption of ESG standards (Temple-West 2019).

Conclusion and Organising Framework

Methodology

From an objectivist point of view (positivism), organizations are seen as an existing reality that can be studied from a distance, with scientists trying to apply the methods used for the study of natural sciences to the realm of man and his affairs. Van de Ven 1989; Weick 1995) and the case for qualitative research, seen as the descendant of the interpretivist paradigm, rather than the positivist tradition (Bluhm et al. 2010; Flick 2014). Thus, I consider an in-depth examination of the phenomenon of executive engagement in a particular context and time most appropriate to answer the research questions, hoping to contribute new interpretations to SC theory and the study and practice of corporate governance.

Autobiographical Notes

As a director, I began to develop the ability to hear fellow board members and shareholders, read between the lines, and recognize the need to dig beneath the surface of issues to understand the context behind decisions that ultimately benefit both society and society. to influence. company. I developed a helicopter view of company operations, advised executives, interacted with institutional investors and society, monitored and controlled company activities, while remaining sensitive to what is happening in and around the board. I vividly recall a board meeting in which the CEO made it clear to the board that the sole purpose of the company was to make a profit, despite shareholders clearly reminding us that the purpose of the company ( according to the founder's intention) was also to contribute to the development of a culture of groups of people discovering the world together, and that the company played a key role in the lives of thousands of customers and represented Switzerland abroad.

Researcher Reflexivity

Auto-reflexivity also came to life in my thesis writing, as I tried to clarify my point of view (Creswell & Poth 2018). An additional aspect of self-reflexivity concerns the "dark matter" (Weiner-Levy & Popper-Giveon 2011, p. 2177) of this type of research. In order to avoid 'dark matter', I have included in this thesis a list of concepts that emerged from the data analysis, but which do not fall within the scope of this thesis (Appendix 9) because they are not directly related to the research questions, and a section on Unexpected Events.

The Case Study Approach

I wanted to design a multiple case study (Creswell & Poth 2018; Stake 1995; Yin 2014) to investigate the phenomenon of executive engagement. The main unit of analysis of this case is the individual directors, as I examine director engagement as an individual-level process. So, in this case, I took individual directors as the unit of analysis and explored how the stewardship of institutional investors, exercised through engagement through dialogue with invested companies and unfolding through individual directors, could enhance the engagement of directors with a purpose. can influence.

Setting the Scene

A key element of the context of this study is the Swiss system of corporate governance, which I present in the next section. In terms of stock market importance, another departure from the Germanic system, the Swiss stock market is reported to have moderate to high importance in. As a result of the adoption of the initiative, two new paragraphs were added to the Swiss Federal Constitution (Federal Council 2019; Ferrarini & Ungureanu 2018).

The Pilot Study

The final choice of the USA and the UAE in addition to Switzerland was driven by literature. In the pilot project, data analysis was inductive and interpretive, which began after the completion of the first interview transcript and. In the third phase, I tried to further condense the second-order themes into aggregate dimensions, which were the basis for the main findings of the pilot study.

Main Study Focus

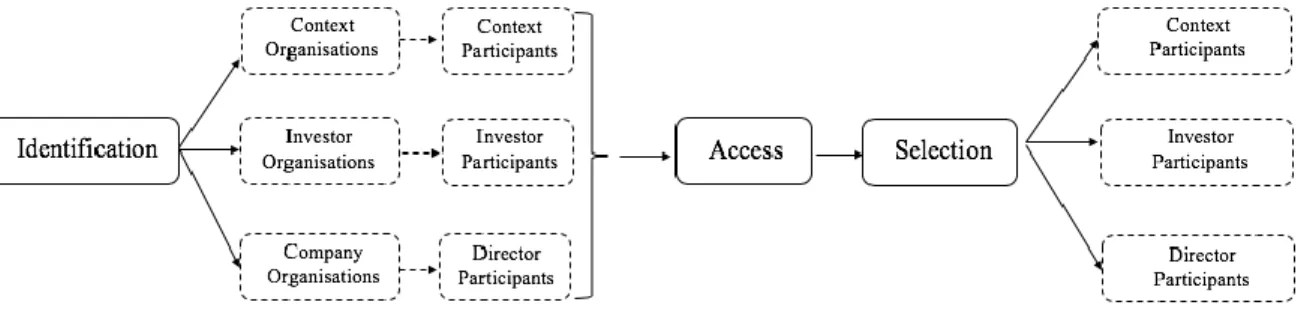

I used the results of the pilot study to focus the research questions and to change the organizing framework for the study of executive engagement and the study design. I reserved the final research question (Question 5) to examine how director engagement can contribute to creating value for society as well as investors. I reflected the choices described above in a more focused framework within which to study director engagement (presented in Figure 5).

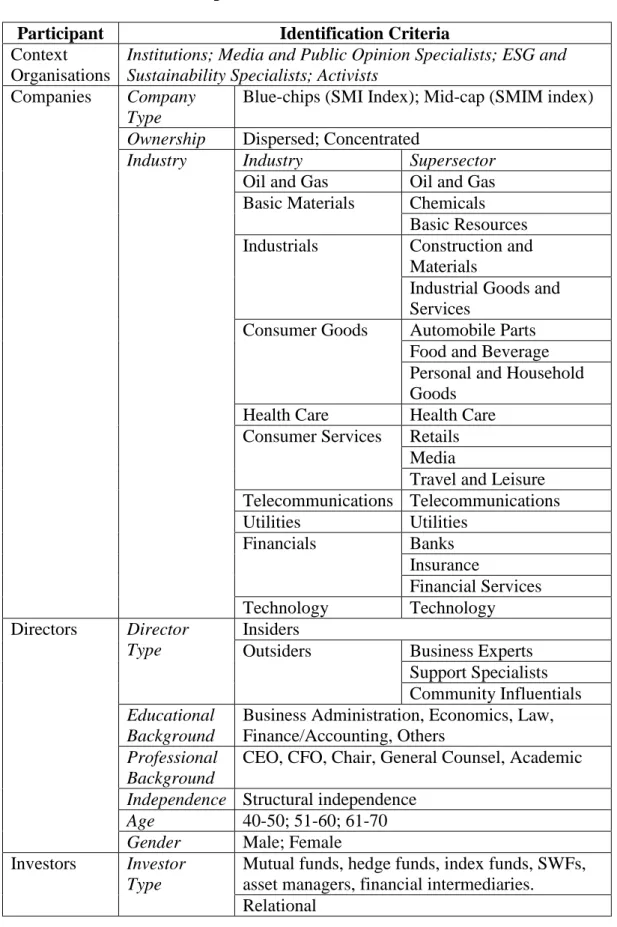

Data Collection

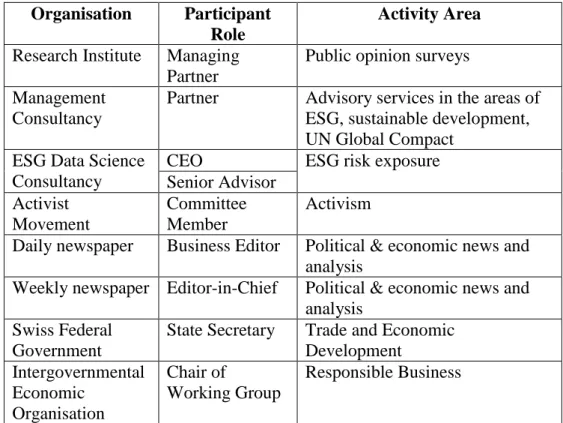

The third criterion, industry, is one of the key contingencies affecting corporate governance (Zahra & Pierce 1989), so industry-level factors must be considered to develop a deeper understanding of corporate governance mechanisms (Judge 2011), such as the director. Insiders Company expertise Current or former executives (employees) External experts Business experts General management of the company. In the era of intermediary finance, these types of investors represent the professionalization of the investment function, or

Investor-lead Organisations

One of its bodies is dedicated to managing affairs in the fields of economy, trade and labor market policy. I adopted some elements of the access strategy (presented in earlier parts of the section titled Primary Data Sources) to enroll context participants in the study. In the following sections, I first introduce each of the twelve selected companies (as shown in Table 12), and then I introduce the selected directors.