I understand that the British University in Dubai may make a digital copy available in an institutional repository. The purpose of this study is to investigate the corporate social responsibility (CSR) disclosure of Islamic banks in the United Arab Emirates.

B ACKGROUND

Many strategic theorists and researchers have made numerous attempts to find a concise definition of CSR that is clear and unbiased. The fact that companies are diverse in the nature of their activities and differ in their degree of exposure to their host societies can complicate efforts to arrive at a single definition of CSR.

CSR IN THE B ANKING I NDUSTRY

CSR IN I SLAMIC B ANKING

According to Haniffa et al, “Islamic banks and financial institutions have additional responsibilities to adopt, implement and publicize CSR as there are extra elements. Islamic banks can therefore be held accountable to their communities under Sharia law, and their communities will have high levels of expectation of the banks' performance at all levels based on the Islamic values they espouse.

C ORPORATE S OCIAL R ESPONSIBILITY D ISCLOSURE (CSRD)

CSR practices in the Islamic banking industry have started relatively recently as this industry itself is relatively new. This reporting usually follows a predetermined framework of disclosure recommended by certain industry bodies.

C ORPORATE S OCIAL R ESPONSIBILITY D ISCLOSURE (CSRD) IN I SLAMIC B ANKS

The factors that influence management's discretion to disclose or not disclose CSR activities have received much research. Several theories in the social reporting literature are already in place with an ongoing effort to address the question of why companies bother to disclose social and environmental data, even though they are not required to do so by law.

The second chapter provides a literature review on existing CSR practices and disclosure in various Islamic banks around the world. A number of studies have examined the CSR practices and disclosures of Islamic banks and financial institutions.

M AALI ET AL (2006)

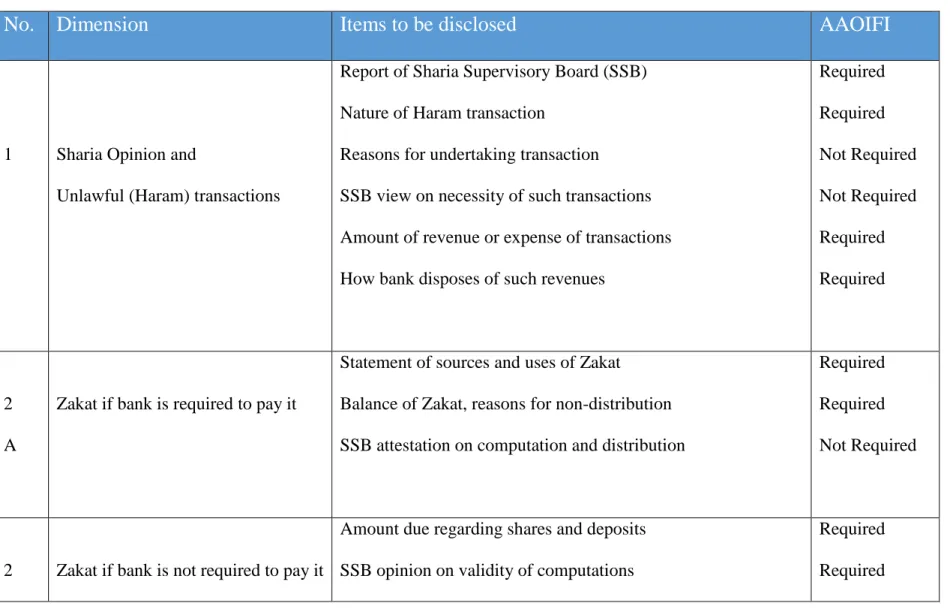

- Sharia Opinion and Unlawful Transactions

- Disclosure of Sharia Supervisory Board Opinion (SSB)

- Qard Hassan (Benevolent loan)

- Charity and Other Social Activities

- Employees

- Late repayments and Insolvent Clients

- The Environment

- Other Community Involvement Aspects

Some Islamic banks are required by law to pay Zakat on behalf of the shareholders, such as in the UAE and Saudi Arabia. The bank is required to disclose the purposes of the charity, the amount given and its sources.

D USUKI (2008)

- Pressure from the Markets

- Power of Communication

- Competition between Corporations

- Regulatory Pressure

- Criticism of Western CSR Driving Forces

- CSR from an Islamic Perspective

- Description of Corporate Social Responsibility Continuum (Dusuki 2008)

Dusuki's study discussed the above driving forces and later contrasted them with what he called the "Islamic perspective of CSR", followed by a discussion of the basis for understanding CSR in Islam from a Shariah point of view. Worship in Islam is not only limited to performing religious obligations such as prayer, fasting, etc.

H ASAN AND H ARAHAP (2010)

- Ethical Behavior, Stakeholder Engagement, and Customer Relations

- Good Governance

- Research and development

- The equator principles

- Strategic Social Investments

They suggest that the top management of Islamic banks should consider showing greater commitment and responsibility and acting justly not only to their companies but also in obedience to Allah (SWT) by following Sharia rules in their CSR activities and disclosure. They argue that such a disclosure would increase the confidence of stakeholders and other parties in the operation of Islamic banks. This can be followed by Islamic banks as a best practice to help decide whether or not to finance certain projects if there is doubt that these projects are harmful to the environment or society.

The authors believe that implementation of these principles by Islamic banks would confirm their commitment to assist in Sharia-compliant financing of the societies.

F AROOK ET AL (2011)

- The Determinants

- The Relevant Publics

- Proportion of investment accounts compared to total assets

- Level of social and political freedom

Another determinant that influenced the level of disclosure according to their study is the share of investment accounts compared to total assets in each of the banks studied. Their findings also suggested that the amount of social and political freedom in the countries in the study affected the level of disclosure across the sample. Farook et al define “Relevant Publics” as the size of the Muslim population in a given society or country and believe that “the relative size of the Muslim population as a proxy for the Islamic society will determine the level of CSR disclosure presented by Islamic banks”.

Farook et al also pointed out that there is a direct relationship between the level of social and political freedom in a community and the extent of bank social responsibility disclosure in that community.

A RIBI ET AL (2012)

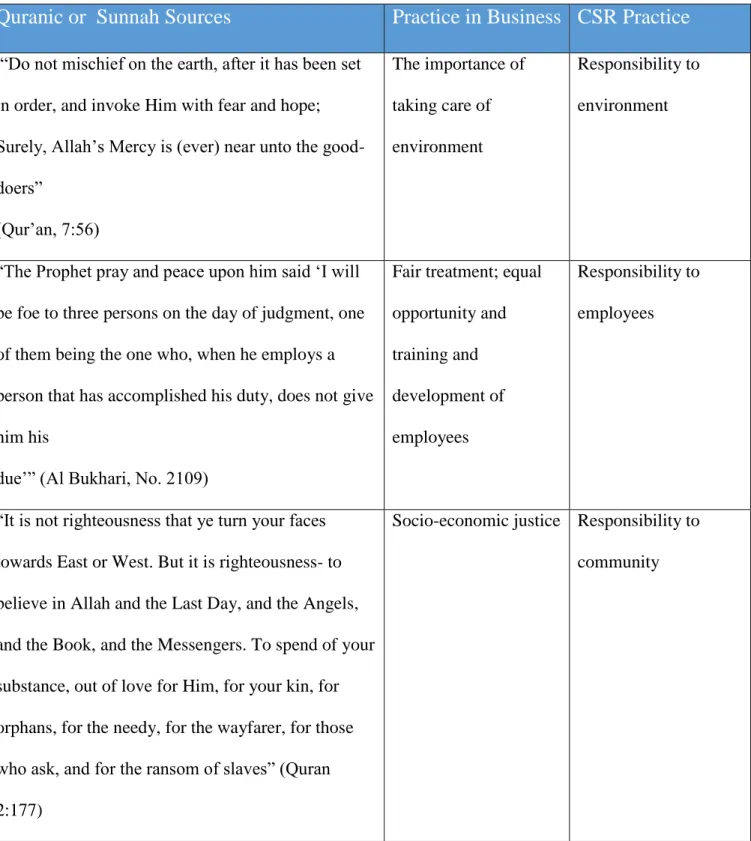

Aribi et al CSR table from Quran and Sunnah

But that is righteousness - believing in Allah and the Last Day, and the angels and the Book and the Messengers. To spend of your possessions, out of love for Him, for your relatives, for orphans, for the needy, for the wayfarer, for those who pray, and for the ransom of slaves” (Quran 2:177). The above examples from Aribi's table specify CSR contributions from an Islamic perspective to the welfare of societies, which include responsibility to the environment, responsibility to employees, responsibility to customers and responsibility to society as a whole as evidenced by the Qur'an and Sunnah.

Aribi's study expected Islamic banks to comply with practicing and disclosing their CSR activities according to Shariah for the sake of informing and updating the stakeholders and the societies.

S UMMARY OF THE L ITERATURE R EVIEWS

Farook et al (2011) identified and measured the determinants of CSR disclosures by 47 Islamic banks from 14 countries and tested four determinants of the disclosure. The authors concluded that the extent of the CSR disclosure varies directly with the size and structure of the SSB and the extent and composition of the stakeholders' networks. They concluded that annual reports of the 21 IFIs operating in the GCC region confirmed that CSR disclosure is consistent with Islamic ethics and principles to a significant extent.

However, their study did not provide details on each of the components of the disclosed information.

M ETHODOLOGY

This study adds to the literature on Corporate Social Responsibility and its disclosure in Islamic banks by examining and comparing the descriptive disclosure published in the 2020 annual reports and sustainability reports of 2 Islamic banks in the UAE with the best practices. The aim is to identify any gaps in CSR practices and disclosure in the two UAE banks for possible future improvements.

O BJECTIVES

The comparison will be made using the benchmark developed by Maali et al (2006) based on the AAOIFI disclosure standards. Maali's benchmark includes eight dimensions of CSR areas that stakeholders expect in the CSR disclosure of Islamic banks. The required elements are those that are AAOIFI standards and represent a minimum level of disclosure.

Maali et al added these elements to the benchmark to give it more depth in identifying Islamic banks willing to practice and disclose more CSR.

S AMPLE

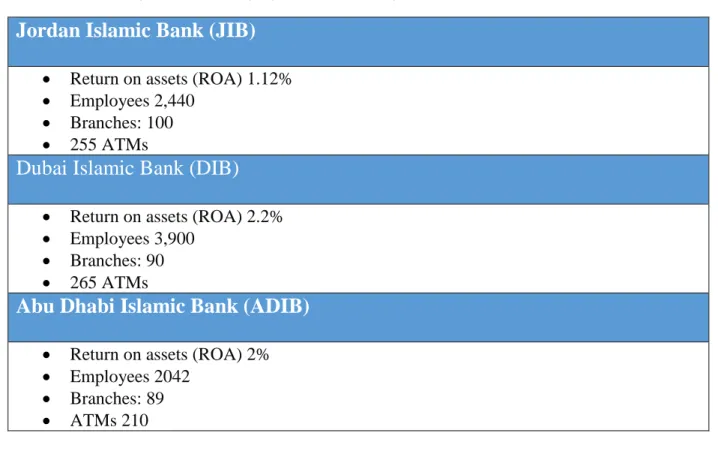

Jordan Islamic Bank (JIB)

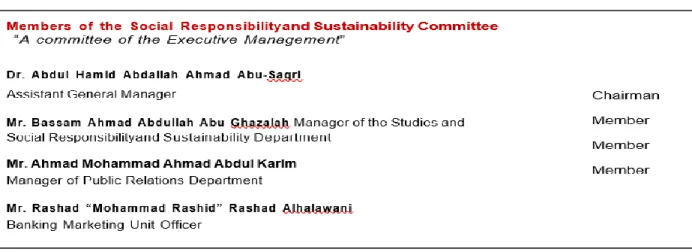

Jordan Islamic Bank (JIB) started operations in September 1979 and now has a ROA of 1.12%, more than 2440 employees and 255 ATMs in more than 100 local branches and offices3. Since 2012, these committees have regularly compiled the report on social responsibility and sustainability and published it annually. The bank obtained ISO 26000 certification in 2015 for the implementation of ISO guidelines for social responsibility projects in the MENA region.

Dubai Islamic Banks (DIB) and Abu Dhabi Islamic Banks (ADIB)

The top two Islamic Banks of the above four IBs are Dubai Islamic Bank (DIB) and Abu Dhabi Islamic Bank (ADIB). DIB and ADIB are ranked 4th and 6th respectively on the list of the Top 10 banks in the UAE in terms of return on assets (ROA), number of employees, number of branches and number of ATMs in 2020. DIB and ADIB have a network of branches with a total of 90 and 89 branches, a number of employees with a total of 3,900 and 2,042 employees respectively.

The number of branches, employees and ATMs in (Table 4) is important to this study as it reflects the degree of dispersion of the banks' services and, consequently, the number of customers and the size of the network of stakeholders affected by the banks. CSR activities.

Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)

R ESULTS

F INDINGS

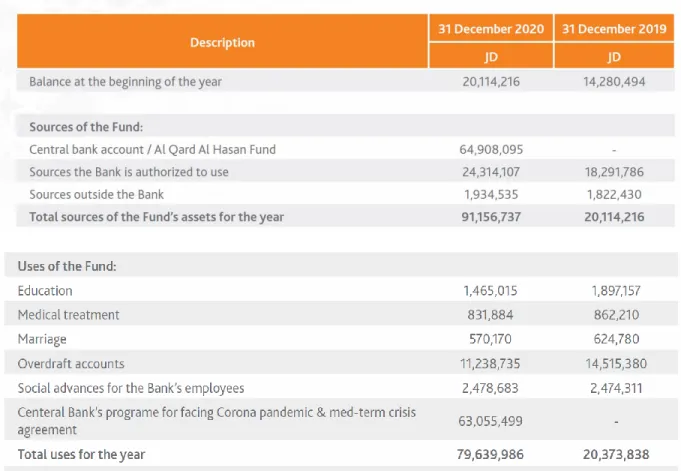

JORDAN ISLAMIC BANK

It is stated in the SSB report on page 89: "The duty to give Zakat rests with shareholders; no authority is given by them to the Bank to issue it directly”. The participants of this fund share in the coverage of any financial damage due to default in payment of debts to the bank. Regarding equal opportunities, JIB's mission statement on page 11 of the report states "the bank equally serves the interests of all stakeholders, including shareholders, investors, borrowers and employees".

This demonstrates the Bank's commitment to CSR and sustainability practices and disclosure thereof.

DUBAI ISLAMIC BANK

The ISSC report on page 2 states that it has continuously provided guidance and direction to all departments in the Bank to rectify every incident noted in every report. The ISSC opinion concluded: "The Bank's activities are in accordance with the Islamic Sharia, except for incidents of non-compliance noted, as noted in the relevant reports." DIB SSB Report p. The TESS program of the Central Bank “Targeted Economic Support Scheme” mentioned in dimension (4) above under Charitable and Social Activities has also been used by the bank to support customers in difficulty during the COVID 19 pandemic during 2020.

The role of the bank in solving social problems, as revealed in the report, is limited to what is shown under dimension 4 "Charitable and social activities".

ABU DHABI ISLAMIC BANK

Other aspects of community involvement Yes (√) or No (X) Bank's role in economic development of the community. The report of this committee was made public on pages 69 and 70 of the annual report for 2020. Total Zakat payable by the bank on shares for 2020 amounted to about 194 million AED as per Note 38 on page 117 of the annual report.

The source of the social contribution funds for charity and social activities was the bank's retained earnings.

D ISCUSSION

- Sharia Opinion Unlawful (Haram) transactions

- Zakat

- Qard Hasan (Benevolent Loan)

- Charitable and Social Activities

- Employees

- Late Repayments and Insolvent Clients

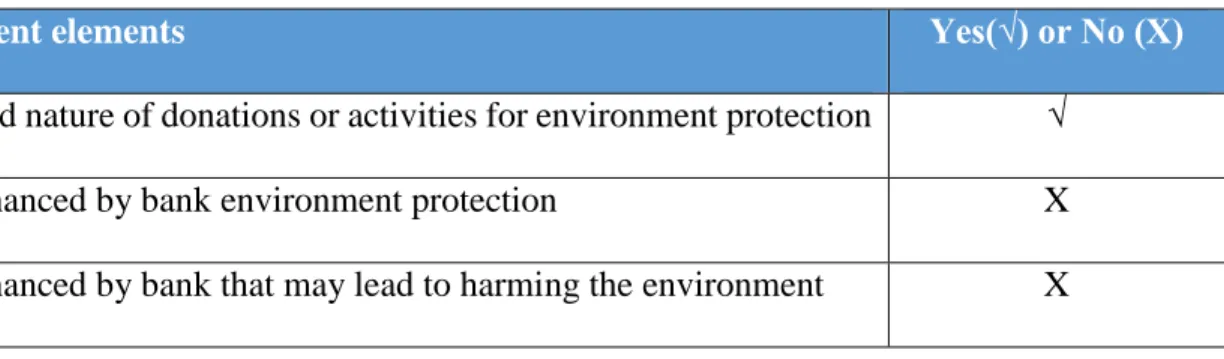

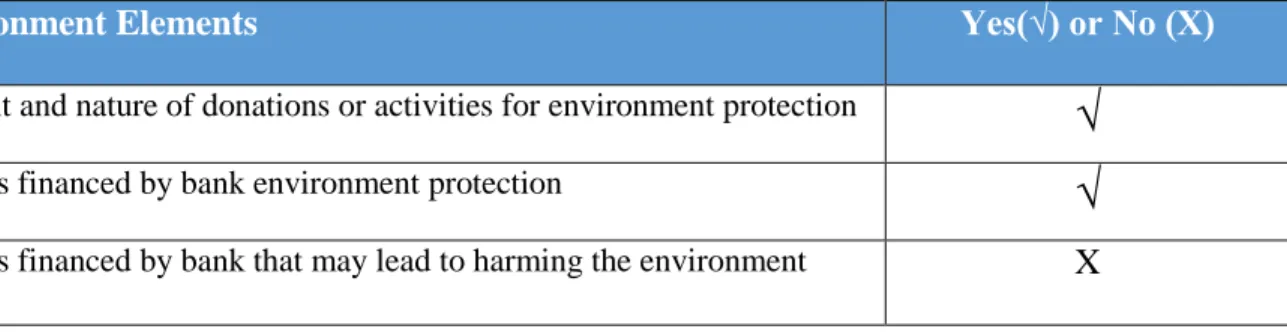

- Environment

- Other aspects of community involvement

However, JIB report provided more details about the members of the SSB committee than DIB and ADIB. None of the three banks disclosed the financing of any projects that could harm the environment. DIB has contributed to the economic development of the community by reducing and simplifying the banking processes and transactions for the customers.

ADIB played a role in the economic development of the community and won many awards for their exceptional contributions to economic development in the UAE and GCC.

C ONCLUSION

DIB and ADIB disclosure of the 31 items are benchmarked against JIB's sales item disclosure. Findings suggest that there are discrepancies between JIB CSR disclosure and DIB and ADIB CSR disclosure in most of the 31 items of the 8 dimensions. In Dimension Seven, JIB and ADIB disclosed two of the three items, while DIB disclosed none.

The study shows that out of a total of 31 items in 8 dimensions of performance measures Jordan.

P OLICY I MPLICATIONS AND R ECOMMENDATIONS

Although the weights of the items are not the same, they do show the extent to which each bank has gone into CSR disclosure with the aim of measuring up to the expectations of their respective stakeholders. Disclosing a profile of the members of the Sharia Supervisory Board (SSB), including their practical experience and academic qualifications, is also a best practice for JIB that can be adopted by Islamic banks in the UAE. A significant finding of the investigation was the non-disclosure of Al Qard Al Hassan by DIB and ADIB as mentioned above.

Neither of the two UAE banks disclosed anything about this recommendable Islamic practice that reflects assuming responsibility towards a sector of their stakeholders.

L IMITATION OF THE S TUDY AND F UTURE R ESEARCH

34; Arsenic contamination of groundwater in Bangladesh: a major environmental and social disaster." International Journal of Environmental Health Research. 34; A New Direction for Corporate Social Responsibility: Shortcomings of Previous Models of Corporate Social Responsibility and Rationale for a New Model.". Corporate Social Responsibility and Stakeholder Theory:. 1991), “Business ethics and stakeholder analysis”, Business Ethics Quarterly, Vol.

Corporate social and environmental reporting: a review of the literature and a longitudinal study of disclosure in the UK.