If you borrowed this book from a library or a friend, I commend you for being thrifty. If you are inconsistent, unmotivated, or mistakenly believe that success will come to you automatically, forget about this book.

WANT TO MAKE MORE MONEY?

DO THESE THINGS FIRST

You don't need a good real estate agent to make money in the real estate market. You don't need to spend hours of research to make money in stocks.

WHO AM I?

In doing so, I discovered that most people living in the northern suburbs of Chicago either inherited their money or earned it in the stock market. This is a book that I encourage everyone to read, regardless of whether they are interested in the stock market or not.

A FEW OF THE THINGS I LEARNED AND WHY I WANT TO SHARE THEM WITH YOU

The modern day way of saying this is "Think outside the box." In other words, you'll want to go against the grain most of the time. You will find that their thinking is mostly very standard, very average and very wrong.

BEGINNINGS, DANGERS, AND DIRECTIONS

Are you willing to accept the emotional stress, anxiety and pressure that occurs when you cannot pay the rent on time. You can either accept these losses, or you can take the risk of a financial loss as a way to avoid other types of losses.

OF COURSE YOU WANT TO TAKE IMMEDIATE ACTION!

Either you accept one type of risk to avoid another, or you accept the losses that may arise from not having enough money to support yourself and your family. Learning how to grow your money is not like learning to play Monopoly.

THE DANGERS OF MOVING TOO SLOWLY

DO IT ALONE OR GET A PARTNER?

Remember, however, that sometimes getting too involved with your partner outside of your investment relationship can lead to problems.

A CHECKLIST FOR SUCCESSFUL PREPARATION

- Are You Willing to Make the Commitment?

- Is the Money You Plan to Invest Risk Capital or Vital to Your Financial Survival?

- Determine Where You Stand in Terms of Your Individual Needs and Goals

- Do You Have the Time to Follow Through on Your Commitment?

- Be Consistent, Organized, and Thorough in All You Do

- Out with the Old and in with the New

- Be Prepared to Play Your Own Game

- Don’t Fool Yourself into Thinking You Need Expensive Computers or Programs

- Don’t Feel Pressured at Any Time, for Any Reason

- Be Prepared to Diversify

If you don't have what it takes to be consistent and organized, then I urge you to find a partner who possesses these skills. If you feel a great urgency to make an investment, then you are likely being influenced by someone else, either a friend or a sibling.

MARRIAGE, MONEY, AND FAMILY

INVESTING AND MARRIAGE ISSUES

If you fail to adequately prepare for the challenges and opportunities that marriage can present, you may well fall victim to its limitations on your success. The power of a two-income family can be harnessed to produce very large financial gains, or it can be a drag on your path to success and wealth and early retirement.

HARNESSING THE SYNERGISM OF A TWO-INCOME FAMILY

LIFE INSURANCE ON BOTH PARTNERS

Term, Convertible Term, or Other

But term insurance will only benefit you if you can take the money you saved by not buying whole life insurance and invest it wisely. If you have whole life insurance now, ditch it and switch to term insurance as you become a more successful investor.

TAX CONSIDERATIONS AND STRATEGIES

By starting whole life for kids when they are very young, you can buy a good amount of coverage and by the time your kids are ready for college, they will be able to put away a nice little nest egg. If you have a special situation involving dependents, we advise you to consult your tax advisor for information and strategies.

PLANNING FOR THE FINANCIAL BURDEN OF HAVING CHILDREN

Encourage your children to take an active role in their investments and let them open stock trading accounts as soon as they are legally allowed to do so. Educate your children about the risks of gambling versus the benefits of investing.

PROTECTING YOUR ASSETS FROM LEGAL RAMIFICATIONS

Blind faith. This is a trust in which the beneficiaries do not know what is in the trust and in which a nominated and financially trusted third party has full management discretion. Before entering this very gray area, you may want to consult with a tax advisor and/or a tax attorney.

YOU AND YOUR SPOUSE AS INVESTMENT PARTNERS

Your burden as a parent will be reduced, and you will also know that you have given your children a start in the world of capitalism. If your children learn about the various aspects of investing in their early teens, they will be way ahead of their peers.

SELF-KNOWLEDGE

INVESTOR BEHAVIOR

Obviously, the best choice is the train that is about to leave the station or, better yet, the train that is just pulling out of the station. However, despite the fact that the rules are broken, the investment turns out to be profitable.

MASTERING THE PSYCHOLOGICAL ASPECTS OF INVESTING

But without a doubt, they are all useless in the hands of a trader who is psychological. Realistic pose. Investors must maintain a realistic attitude in order to succeed in the game of high expectations.

THE MAJORITY IS USUALLY WRONG—

The fact of the matter is that you are much better off catching smaller wins that have a higher degree of accuracy than waiting for big wins that are unlikely to happen or take so long that you have at least 100 chances. to make mistakes.

DON’T FORGET THAT!

If there is only one thing you learn in this book, it is to have discipline. You will never succeed without discipline. Now that you've survived the boring stuff, let's move on to Chapter 5, where the real fun begins.

SETTING FINANCIAL GOALS

The good news is that Larry and his wife have quite a few home businesses to choose from. On a less aggressive level than as a stock trader, Larry and his wife could become investors.

MANY INVESTORS HAVE BEEN LOSERS

This problem alone is one of the most serious offenses committed by the average investor. These are some of the reasons why investors tend to lose money in the stock market.

VICTIMS OF THE SYSTEM

Can the average person learn how to invest and make money in the stock market. This book will teach you some of the strategies you will need to know, but more than that, it will introduce you to other strategies and earning opportunities to help you, regardless of your age or how much money you have to invest.

A FEW GENERAL RULES TO GET YOU STARTED

If you fall victim to these promotions, you are likely to lose money in the long run. The best way to make money in the stock market is to rely on your own efforts and using the tools you will learn in this book.

THE “BORING” PART OF SETTING FINANCIAL GOALS

Fourth Year - After three years of learning the methods suggested in this book, you can start on your own. And if you've done well with one or more of these vehicles, consider options strategies.

THE GENERAL

INVESTMENT MODEL

AN OVERVIEW OF THE

GENERAL INVESTMENT MODEL (GIM)

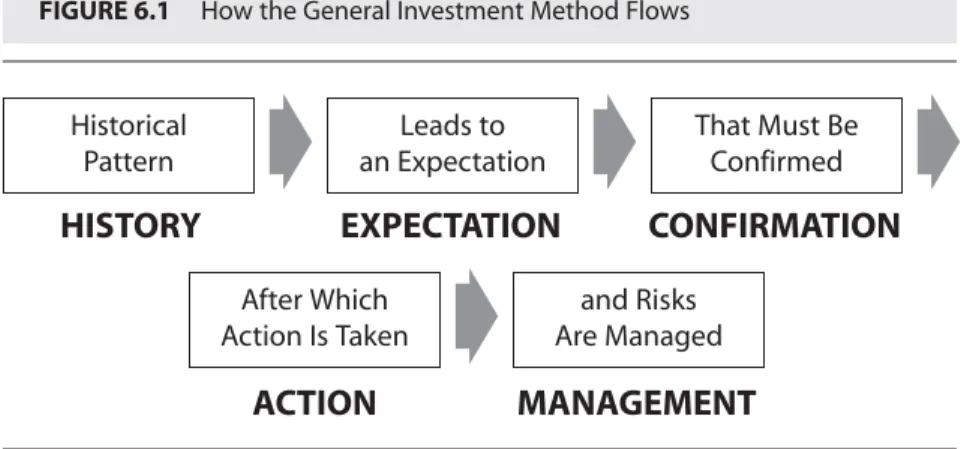

Each step in the gym depends on the successful completion of the previous step. Learn the general investment model and examine some hypothetical investments in the context of GIM.

THE SETUP, TRIGGER, AND

FOLLOW-THROUGH METHOD (STF)

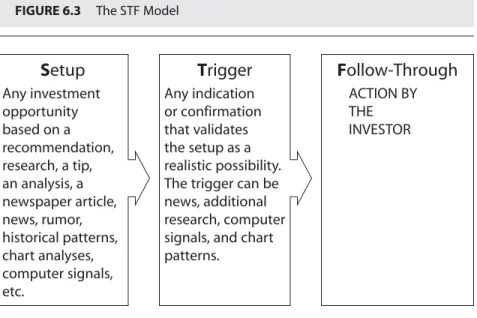

From the tone of the e-mail and the brevity of the message, one can conclude that it is headed for trouble. There are many other possibilities, but you won't even consider them because you've already moved beyond the reality of email.

THE STF IN DETAIL

Naturally, you are excited by the prospect of such a move, and you buy the stock. Then you hear that the news is false or exaggerated, the stock goes down, and you either take your losses or you hold the stock indefinitely, expecting it to eventually go up.

SUMMARY

Are you able to do it alone or are you more likely to succeed with a partner or partners.

THE METHOD

In this chapter, I will give you the tools you need to succeed in investing: how to implement the GIM model and the STF method with timing. If you're not completely satisfied, you can return the entire package within 30 days for a full refund (minus shipping and handling).” No, you won't find any of that in this chapter.

SELECTION AND TIMING OF INVESTMENTS

There are only a handful of market timers in the investment world who are consistently good at what they do. Because of the stock-picking scandals that emerged in the early 2000s, and changes made to avoid such problems in the future, many brokerages separated their research departments from their sales departments.

INTRODUCING THE METHOD

If you can find a method that has been profitable 50 percent of the time, and if you manage your losing investments by exiting them quickly while continuing to make winning investments, you will do well in the long run. If you have a method that is both accurate and profitable, you have the best combination.

INTRODUCING MOMENTUM

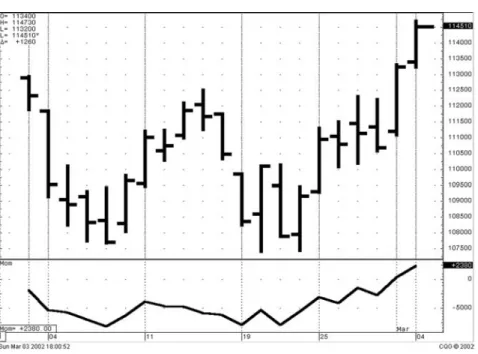

This is also a “normal” pattern where the chance of a further price drop is fairly high.

HOW TO CALCULATE MOMENTUM

Some trading software and charting programs use the Rate of Change (ROC) instead of the MOM. However, in terms of the shape of the momentum indicator when plotted on a chart, the end result is the same.

WHAT DOES MOMENTUM TELL US ABOUT A MARKET?

Momentum is zero if today's price is the same as X days ago. You don't need to know how to calculate MOM unless you don't have access to the internet.

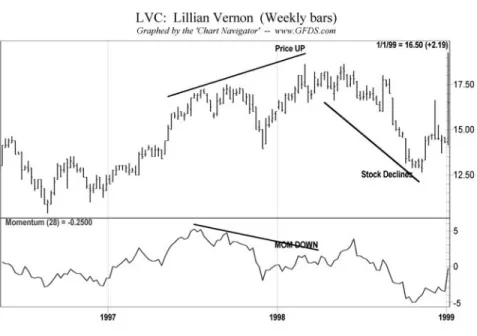

DIVERGENCE AND CHANGES IN TREND

Note that this configuration does not tell you to sell immediately. It only creates a potential peak. It is important to remember that the illustration in Figure 7.3 does not in itself tell us WHEN to buy.

TIMING, TIMING, TIMING

Sell signal. Once a period of bearish divergence has developed for six time frames (ie days if you use daily charts, weeks if you use weekly charts), then you SELL when momentum drops below the lowest level it reached during the period of bearish divergence . It shows how a top forms on bearish divergence and the sell signal is triggered based on penetration of point E, which is the momentum sell point.

WHERE DO I GET THE MOM?

PRACTICE, PRACTICE, PRACTICE!

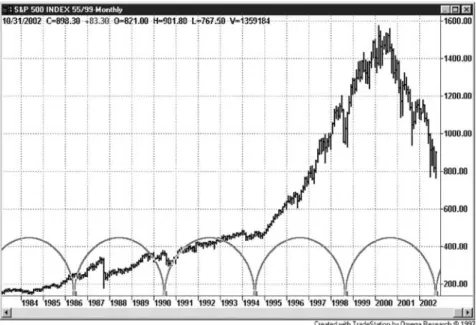

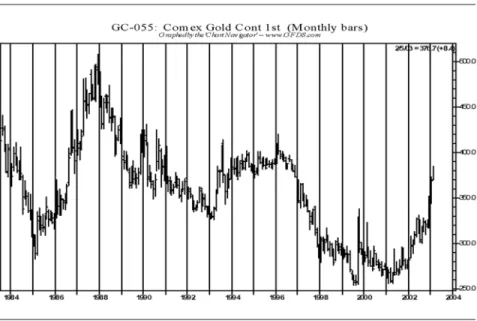

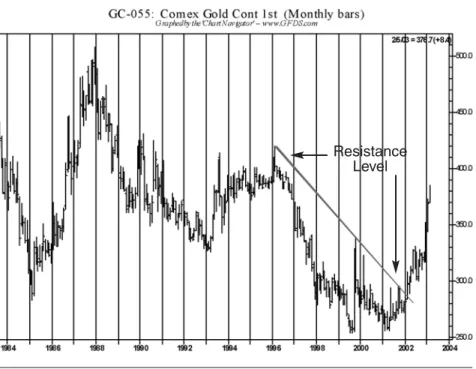

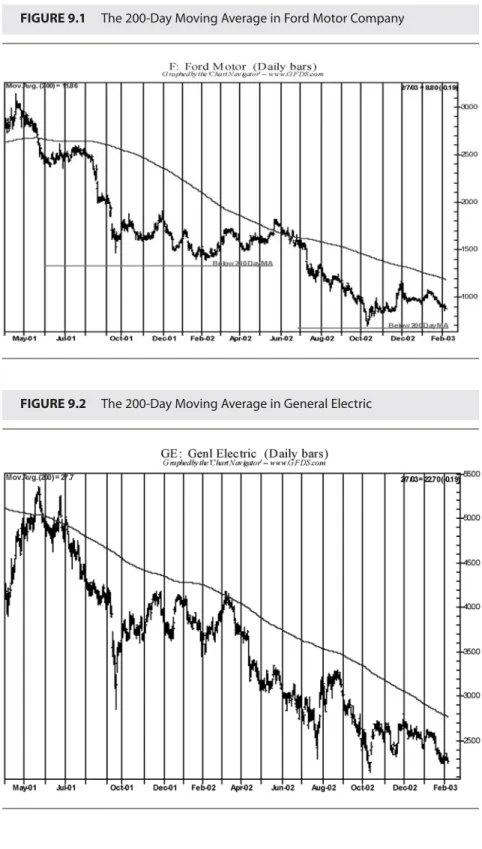

For more information on this aspect of the MOM method, I refer you to my book, Momentum Stock Selection (McGraw-Hill, 2001), which is available at my online bookstore GAMBLE OR INVEST Once you've made that decision, decide whether you want to be a good gambler or a good investor, rather than a bad gambler or a bad investor. Since it takes just as much effort to be a good investor as it does to be a good gambler, you might as well be a good investor. THE INSTANT AGE And even better, if you're really still tempted by short-term gains, you'll find some resources and rules to fill that need as well. You will be frustrated and lose money if you are inconsistent in applying my rules. You will lose money if you are too eager to exit an investment if it goes against you. Futures trading can be a very effective addition to a stock portfolio; however, it is risky, volatile and only suitable for higher risk investors. You don't want to throw away your hard-earned money playing a game dominated by professionals whose only goal is to take your money. HOW THE STOCK MARKET CAN BE AN INVESTMENT HOW THE STOCK MARKET CAN BE USED FOR TRADING REAL ESTATE AND Remember that the real estate market is selective; a lot depends on the location and the local market. While there may be money to be made in the zero-down real estate game, I believe the chances of success in this game are slim indeed. In the booming real estate market, you can make good money by buying dilapidated residential properties, fixing them up and selling them quickly for a good profit. If you want to make quick money, you must realize that the other side of the coin is quick losses. STRATEGIES FOR This chapter examines strategies and techniques you can use to grow your small seed into a large sum. If you have more than a few hundred dollars but less than big bucks, this chapter will also show you how to invest larger amounts. Don't let your lack of education limit you and don't let friends, relatives or colleagues discourage you or influence you with their negative attitudes. Yes, you can start with a very small amount of money, but what can you do with a few hundred dollars. 5,000 AVAILABLE STARTING CAPITAL This chart shows two time frames where Ford's price fell below its 200-day moving average. Let's say you started a monthly program when the stock price fell below the 200-day moving average. If you had launched your program in July 2001, your average cost would be about $31 per share. If and when GE rises in price to $31 per share, you're even in your investment, with any price above $31 per share being profitable. If you don't want to invest in mutual funds because they move too slowly for you, then you can invest in individual stocks. As you can see, you will have to start at a relatively slow pace if you have a small amount of capital. You can use the DCA moving average and/or momentum methods with mutual funds to time your entry. You can expand your base of operations when you have profits to show for your efforts. GETTING SERIOUS The main difference between stocks and individual stock futures is that you invest 20 percent of the purchase amount. With individual stock futures, you pay 20 percent of the total value and no interest charges. This is a riskier procedure and you will need to know about futures and the specifics of single stock futures. I highly recommend two of my books as a prerequisite to expanding into this field: Profiting in the Futures Markets (Bloomberg Press, 2002) and How to Trade the New Single Stock Futures (Dearborn Trading, 2003) . MORE THAN $25,000 BUT LESS THAN $50,000 MORE THAN $50,000 If you have understood what I have explained in this book, and if you agree with my concerns, then you will have a very good idea of how to protect yourself from what I believe is inevitable. If you've done your homework, if you've done your research, and if you've studied hard to predict the direction of the next big market change, then don't let others sway your opinion. By the time you read this book, some of my comments may be out of date. When emotions reign supreme, when traders and investors are in a frenzy and when markets seem out of control, precious metals will be the preferred investment. Bullion coins can be bought and sold through thousands of dealers worldwide. The value of these coins is determined by the value of the metal (bullion) and a broker's commission on buying and selling. If you are concerned about this, I suggest that you store your gold coins in a private vault that is not operated by a bank or other financial institution. You can conduct most of your business on the Internet, but follow all the necessary precautions for online financial transactions. Are they bought at auction or are they bought from the company's affiliates or from its directors. If you want to collect coins, do so as part of your numismatic portfolio; however, don't get it mixed up with your gold coin strategy. Unless the market for these specialty items turns sharply higher, you probably won't recoup your original purchase price when you sell, especially if you don't keep these items for a long time. When you see prices go up sharply and when the situation seems incredibly positive, be prepared to liquidate some, if not all, of your holdings, and be prepared to do so quite quickly. If you decide to invest a portion of your funds in precious metals and/or numismatic coins, I strongly recommend that you do additional research in accordance with the guidelines in the previous chapters. Trading high-stakes futures markets. The Do's and Don'ts of the Bullion, Bullion and Bullion Market. Some of the wildest schemes and scams in the markets have involved options trading. STAYING AHEAD OF THE CURVE Companies involved in security and defense are attractive, especially in the area of internet security. He was asked: "Do you have any idea of the technological basis for the next great economic boom?". SUMMARY AND FINAL THOUGHTS Could it be that the losers are just as high in the stock market. The fact that there are still losers in the stock and futures markets tends to negate the value of our alleged great advances in business science and investment analysis. And if none of that happens fast enough for you with a 56K modem, you can connect using a high-speed connection, a super-fast IT line, or a variety of high-speed alternatives. And, of course, you can relax in style while doing all this on new office furniture, with no payments for 12 months and a low, low 3 percent guaranteed rate. On the more pragmatic side of things, you can trade stocks online with instant electronic order entry, check your bank balance, transfer money or donate money to your favorite charity. And you can enjoy all of these on your new incredibly fast computer that has an ultra-fast CD-ROM drive with an internal fast-access hard drive.YOUR WAY TO WEALTH?

CONTRADICTIONS, CONFLICTS, AND CONSISTENCY

NARROWING THE FIELD OF CHOICES

HOW THE STOCK MARKET CAN BE A GAMBLE

THE GENERAL INVESTMENT MODEL

THE GOOD NEWS AND THE BAD NEWS IN FUTURES TRADING

A SHOESTRING BUDGET

THE THREE SHOESTRING-BUDGET STARTING LEVELS

HOW DOLLAR COST AVERAGING WORKS

DRIP YOUR WAY TO SUCCESS

LESS THAN $2,500 AVAILABLE STARTING CAPITAL

A FEW PORTFOLIO SUGGESTIONS

FROM $5,000 TO $20,000

MORE THAN $10,000 BUT LESS THAN $25,000

INVESTING IN PRECIOUS METALS AND COINS

PROTECTING YOURSELF WITH

INVESTMENTS IN RARE COINS (NUMISMATICS)

NUMISMATICS AND NUMISMATIC COIN INVESTMENT PROGRAMS

GUIDELINES FOR INVESTING IN COINS

FAST AND FURIOUS—

THE HOTTEST GAMES IN TOWN

WHAT’S AHEAD IN THE AREA OF TECHNOLOGICAL BREAKTHROUGHS?

A PERSPECTIVE ON INVESTOR PSYCHOLOGY

ECONOMIC YIN AND YANG

CYCLES OF BOOM AND BUST