Getting Started with Online Day Trading by Kassandra Bentley Getting Started with Asset Allocation by Bill Bresnan and Eric P. Getting Started with Fiscal Investing by Andrew Westham and Don Korn Getting Started with Annuities by Gordon M.

About This Book

How This Book Is Organized

In the chapters of this section, we explore the strengths and weaknesses of both schools. In this section, we expose the trader to the psychology of trading and the stresses that can accompany it.

Disclaimer

This section is optional for the novice trader, although investors with some trading experience will find it informative.

What Is FOREX?

What Is a Spot Market?

Which Currencies Are Traded?

Who Trades on the Foreign Exchange?

If they sign a long-term sales contract with a company in the United States, they may want to buy a certain amount of USD and sell an equal amount of GBP to hedge their margins against a drop in GBP. A hedger has an inside interest in one side of the market or the other.

How Are Currency Prices Determined?

Today, importers and exporters, international portfolio managers, multinational corporations, speculators, day traders, long-term holders and hedge funds all use the FOREX market to pay for goods and services, to trade financial assets or to reduce the risk of currency fluctuations due to their exposure to other markets. to cover. The hedger trades to protect his or her margin on an international sale (for example) against adverse currency movements.

Why Trade Foreign Currencies?

The FOREX market operates in a manner similar to that of the NASDAQ market in the United States; that is why it is also called an over-the-counter (OTC) market. There is only limited government influence through regulation over the FOREX markets, mainly because there is no central location or exchange.

What Tools Do I Need to Trade Currencies?

The FOREX market is so vast and has so many participants that no one entity, not even a central bank, can control the market price for a long period of time. Because of the size of the FOREX market and its decentralized nature, there is virtually no chance of adverse effects caused by insider trading.

What Does It Cost to Trade Currencies?

The FOREX market is a $1.95 trillion-a-day financial market that dwarfs everything else, including stocks and futures. Access to the FOREX markets via the Internet has generated a lot of interest from small traders who were previously shut out of this huge market.

Ancient Times

The Gold Standard, 1816–1933

For example, in 1816 the British pound was defined as 123.27 grains of gold, which was on its way to becoming the leading reserve currency and was at the time the most important component of the international capital market. But eventually the worsening international depression led even the dollar off the gold standard in 1933; this marked the period of collapse of international trade and financial flows before World War II.

The “Fed”

Traditionally, the Chairman of the Board of Governors is also selected as the Chairman of the FOMC. This includes monitoring the system's member banks, international banking facilities in the United States, foreign activities of member banks and the US.

Securities and Exchange Commission, 1933–1934

The voting members of the FOMC are the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and presidents of four other reserve banks, on a year-long rotation. The Fed's primary responsibility is “to promote sustainable growth, high levels of employment, price stability to help preserve the purchasing power of the dollar, and moderate long-term interest rates.”

The Bretton Woods System, 1944–1973

Based on the findings of these hearings, Congress passed the Securities Act of 1933 and the Securities Exchange Act of 1934. 1. Companies that publicly offer securities for investment dollars must tell the public the truth about their business, the securities that they sell them and the risks involved in investing.

The End of Bretton Woods and Floating Exchange Rates

International Monetary Market

Commodity Futures Trading Commission

National Futures Association

Commodity Futures Modernization Act of 2000

As the market opened up to the small speculator, it also opened up the market to less than scrupulous companies and individuals. The non-centralized nature of FOREX makes it unlikely that the level of regulation seen in the futures market will be achieved.

Regulation in Other Countries

The Arrival of the Euro

1972—The European Joint Float is established as the European community tries to move away from its dependence on the US.

Futures Contracts

Currency Futures

Clearing houses (the futures exchange) and introducing brokers are subject to stricter rules from the SEC, CFTC and NFA agencies than the FOREX spot market (see www.cme.com for more details). Additionally, the margin requirements for futures contracts are typically slightly higher than the requirements for the FOREX spot market.

Contract Specifications

It should also be noted that FOREX traders are only charged a transaction fee per trade, which is simply the difference between the current bid and ask prices. Currency futures traders are charged a rollover commission that varies from brokerage house to brokerage house.

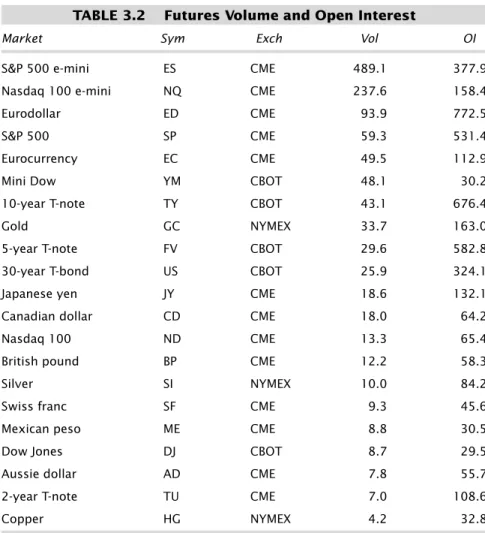

Currencies Trading Volume

S. Dollar Index

Dollar Index (ticker symbol =DX) is an open traded futures contract offered by the New York Board of Trade. If the Dollar Index is trending lower, it is very likely that a major currency that is a component of the Dollar Index is trading higher.

Currency Pairs

Major and Minor Currencies

Cross Currency

Base Currency

Quote Currency

Pips

Ticks

Margin

Leverage

Bid Price

Ask Price

Bid/Ask Spread

Quote Convention

Transaction Cost

Rollover

Putting It All Together

The Trader’s Nemesis

Caveat Emptor

Broker Services

Many traders offer a "paper trading" service, which allows a beginner to get used to the real market and risk-free "test" a certain trading strategy. Additionally, perusing the broker's new trader FAQ website will guide you through the services and options available.

Broker Policies

Check with the regulatory authorities in the country where the broker is based to see if the broker/dealer is regulated. But be careful: the person who answers you could be the broker or one of the broker's 'representatives'.

Avoiding Fraudulent Operations

It is very closely aligned with the FOREX interbank market, and is great if you have enough for their minimum account requirement. Two examples are www.hotspot.com and www.fxall.com. But once you've decided on a dealer, try to stick with it unless you realize you've made a really big mistake.

Account Types

Take time to make a decision you can live with: Don't rush and don't be afraid to ask lots and lots of questions. Also, most of the fraud in the FOREX game is seen in the arena of strikes and futures.

Registration

Account Activation

Identification Confirmation

Make sure you know what types of orders your broker/dealer accepts and build your trading system accordingly. Conversely, if your trading system requires complex order methodologies (hopefully not), make sure the broker you choose will be comfortable handling them.

Order Types

The stop loss order remains in effect until the position is liquidated or the customer cancels the stop loss order. Take profit orders. A take profit order is a limit order associated with a specific position with the purpose of capturing the accrued profit and liquidating the position.

Order Execution

Always read your broker's documentation for specific order information and to see if rollover fees will apply if a position is held longer than one day. Once you've decided what order types you need to trade (generally speaking, fewer are best), check the brokers on your list to see which ones can best accommodate you.

Order Confirmation

Transaction Exposure

Unless you are an experienced trader, you should not design a trading system that requires a large number of orders in the market at all times; stick to the basics first. We recommend that you don't even trade on paper until you are fully familiar with the pip values and calculate the profit and loss for pairs or crosses you plan to trade.

Leverage and Margin Percent

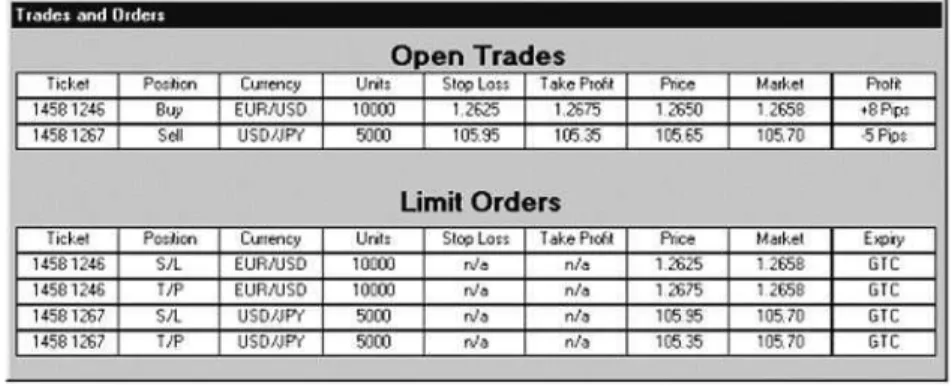

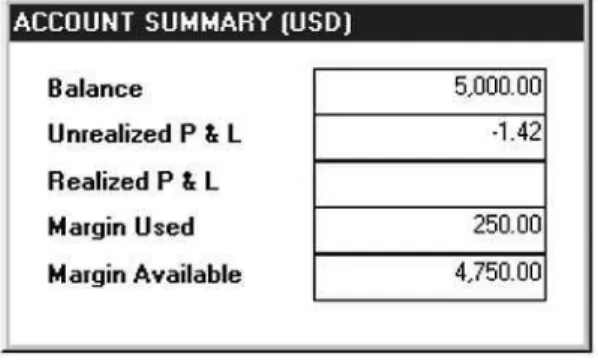

Profit and loss (P&L) for each open position is calculated in real-time on most brokers' trading platforms.

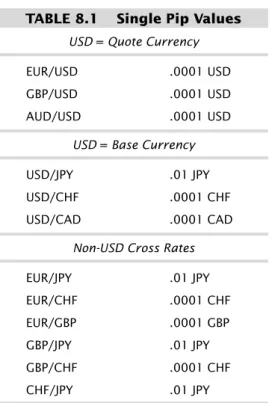

Pip Values

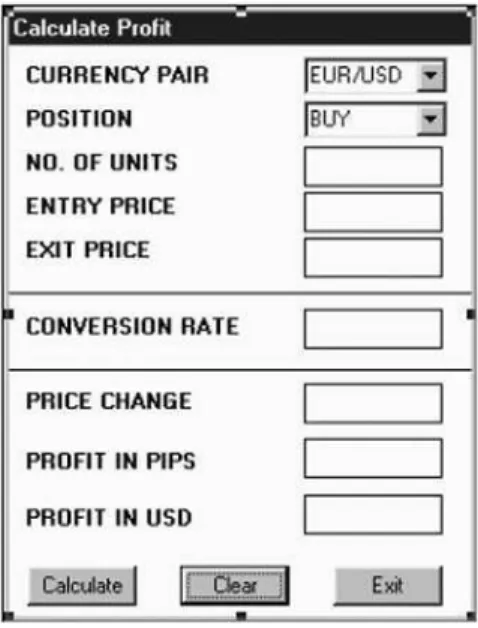

Calculating Profit and Loss

The conversion rate in Figure 8.7 is the current price of the GBP/USD pair. Please note that when USD is the quote currency of the conversion pair, you will need to multiply the rate.

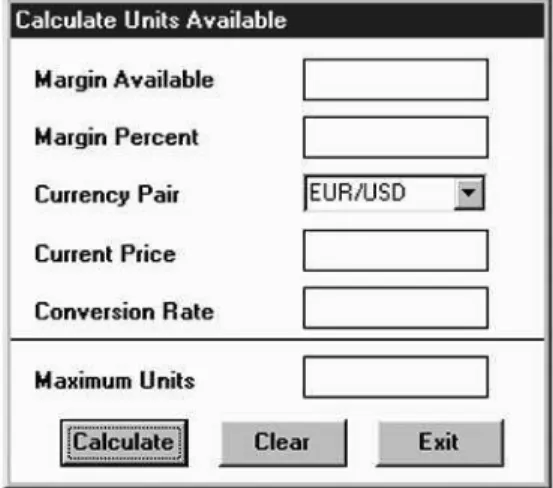

Calculating Units Available

Conversion ratio. If the quoted currency is in the selected USD currency pair, enter "1". Since the USD is the base currency in the USD/JPY pair, we need to enter the current price as the exchange rate.

Calculating Margin Requirements

In the next example (Figure 8.10), we calculate the available units for a currency pair where the base currency is USD. Cross rates can be handled in the same way by simply manipulating the conversion rate.

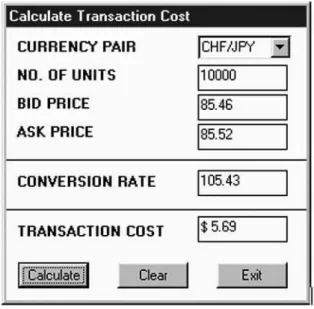

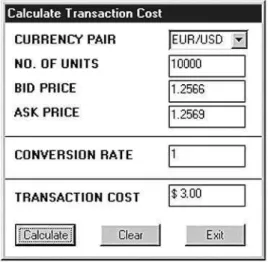

Calculating Transaction Cost

Remember that the bid price is used when the trader starts a new buy trade (long) and the offer price when the trader starts a new buy trade. When USD is the quote currency in the currency pair, the conversion rate is equal to 1, as seen in figure 8.12.

Calculating Account Summary Balance

Not only did you recoup the transaction costs (minus three pips), but you made a plus 10 pips of profit, as shown in Figure 8.17. Once your trade liquidation is recorded at the brokerage firm, your new account summary should look similar to what is shown in Figure 8.18.

In Review

It is generally accepted that there are two main schools of thought when formulating a trading strategy for any market, whether securities, futures or currencies. Naturally, the trader may choose to incorporate elements of both disciplines as he or she hones his or her personal trading strategy.

Supply and Demand

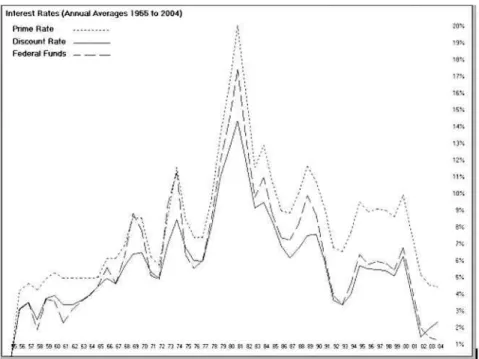

Interest rates and the overall strength of the economy are the two main factors that affect supply and demand. Therefore, they are responsible for changes based on supply and demand for a particular currency.

Interest Rates

Done alone, fundamental analysis can be stressful for traders who trade commodities, currencies and other "margin" products. Data related to interest rates and international trade are analyzed very carefully.

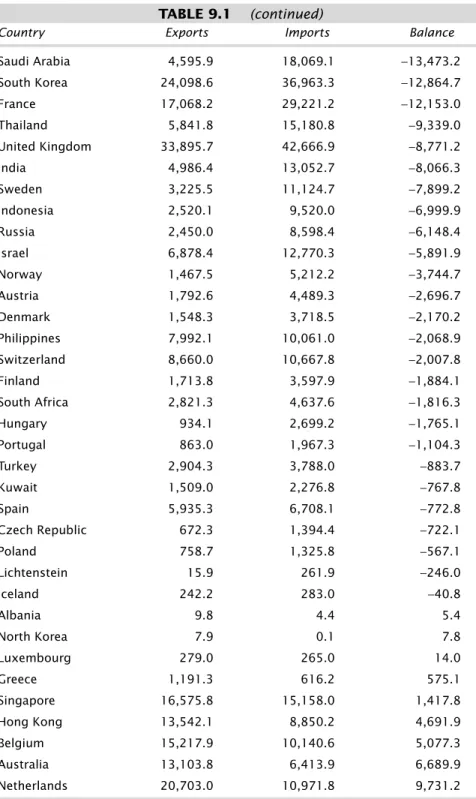

Balance of Trade

Conversely, if trade figures show an increase in exports, money will flow into the country and increase the value of the currency. A deficit is negative only if the deficit is greater than market expectations and therefore will cause a negative price movement.

Purchasing Power Parity

The simplest way to calculate purchasing power parity between two countries is to compare the price of a "standard" good that is, in fact, identical in all countries. One of the main problems in calculating a comprehensive PPP is that people in different countries consume very different sets of goods and services, making it difficult to compare purchasing power across countries.

Gross Domestic Product

The relative ranking of countries can vary dramatically depending on which approach is used: Using official exchange rates can often underestimate the relative effective domestic purchasing power of the average producer or consumer within a less developed economy by 50 to 60 percent, due to the weakness of local currencies on world markets. However, comparison based on official exchange rates can provide a better indication of a country's purchasing power on the international market for goods and services.

Intervention

Other Economic Indicators

For example, you need to know which indicators measure the growth of the economy (GDP) versus those that measure inflation (PPI, CPI) or employment (non-farm payrolls). Other economic indicators are similar in that the headline figure is not watched nearly as closely as the finer points of the data.

Overview

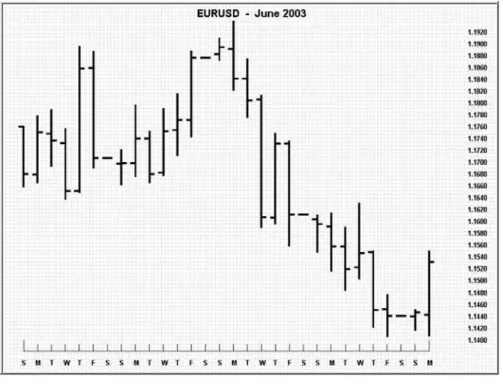

Bar Charts

An interesting variant of the standard OHLC bar chart was developed by author/trader Burton Pugh in the 1930s. Bar chart interpretation is one of the most interesting and well-studied topics in the field of technical analysis.

Trend Lines

Conversely, if the trendline for an uptrend passes through the most recent prices, a sell signal is generated.

Support and Resistance

Recognizing Chart Patterns

Reversal Patterns

Continuation Patterns

Gaps

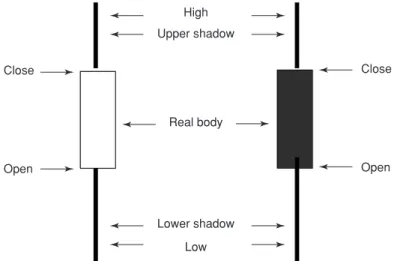

Candlestick Charts

Step 2—The body is depicted as a vertical column bounded by the opening price and the closing price. Step 3 – The shadows are just vertical lines: a line above the body to the high point of the day (the top shadow) and a line below the body to the low point of the day (the bottom shadow).

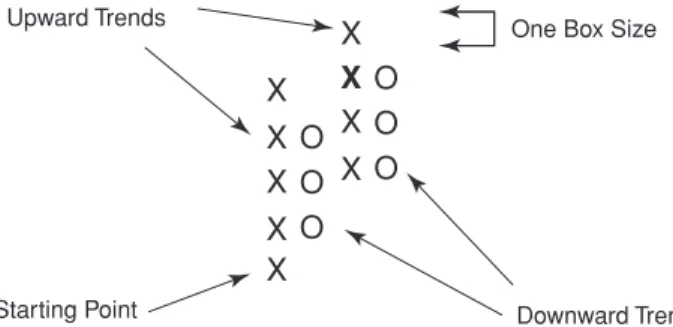

Point and Figure Charts

Two user-defined variables are required to plot a dot-figure plot, the first of which is called field size. Another user-defined parameter required for plotting a point-and-number plot is called the amount of inverted value.

Indicators and Oscillators

Relative Strength Indicator

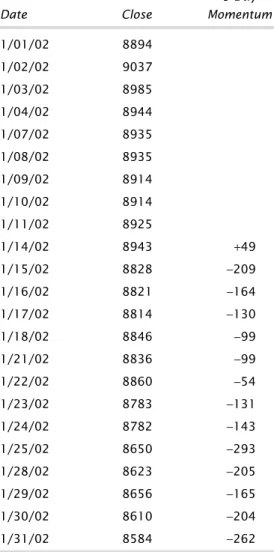

Momentum Analysis

The next example in Table 10.2 of momentum analysis uses the EUR/USD currency pair as the underlying asset. Momentum analysis should not be used as the sole criterion for the timing of market entry and exit, but in combination with other indicators and chart signals.

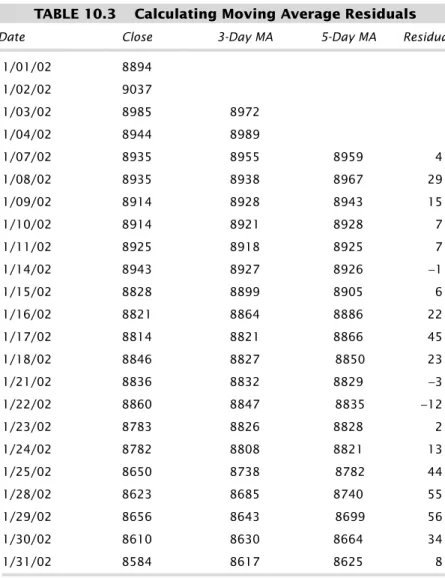

Moving Averages

Bollinger Bands

The central band is a simple arithmetic moving average of the daily closes using a trader-selected moving average index. The distinguishing feature of Bollinger bands is that the spacing between the bands varies based on the volatility of the prices.

Swing Analysis

So Bollinger Bands used by themselves do not provide everything technicians need to know, which is when to buy and sell. Elliott devoted their lives to interpreting these relationships and estimating the length of the next wave in the time series.

Advanced Studies

In his analysis of stocks in the 1920s and 1930s, Elliott was able to identify and categorize nine levels of cycles (that is, a sequence of successive waves) over the same time period for a single bar chart. This involved increasing the minimum reversal threshold in the filtering algorithm, creating fewer but longer waves with each new iteration.

Into the Future

The Technician’s Creed

The Trading Triangle

Money Management Factors

Risk/Reward Ratio

The risk/reward ratio can therefore be quantified as the quotient of the profit spread divided by the stop loss spread. Choosing a risk/reward ratio is highly subjective and is something the trader must decide carefully after considering many factors, including his or her trading style and trading methodology.

Ad Hoc Adjustment of Limit Orders

Early Liquidation

Let's also assume that our trader had enough equity in a margin account to execute the trade with a unit size of one lot (100,000 euros). If at any point the trader is overtaken by uncertainty (a polite word for fear), doubt and confusion, it is better to manually liquidate the trade with a small profit or loss than to wait sadly for a big loss.

More Ideas on Setting Stops

Trade Capital Allocation

Trading Psychology

Fear and Greed, Greed and Fear!

Welles Wilder in his book The Adam Theory of Markets: The first idea is one of emotion and attitude, namely that to be successful one must "surrender" to the market. If one stops worrying about what could happen or what should happen, then one is free to concentrate on what the market is doing, which is where the profit will be made.

Characteristics of Successful Traders

A trading style does not develop out of the blue, but will emerge as you make your first trades. Once you start trading, keep thinking about your trading style from time to time.

Trading Strategy

Market sentiment is what most of the market is perceived to feel about the market and therefore what it is doing or will do. You may have heard the phrase "the trend is your friend", meaning that if you are in the right direction with a strong trend, you will make successful trades.

Trading Tactics

The placement of the stop-loss and take-profit limits is highly subjective and is based on the trader's risk sensitivity. Either way, you are free to adjust the stop-loss and take-profit limit orders in an open position.

Eclectic Approach

The trader must always be aware of margin requirements and the amount remaining in his or her account.

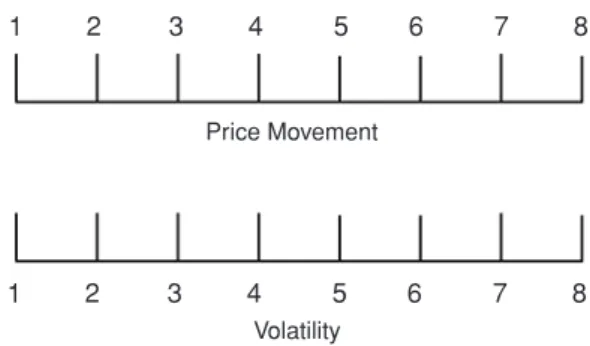

Selecting Markets to Trade

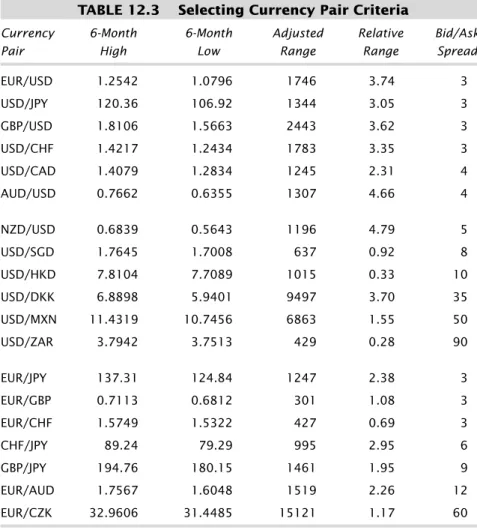

Currency pairs with a relative range value of less than 1.50 should probably be avoided due to a lack of volatility unless the trader knows how to profit from horizontal markets (this involves scalping small profits from numerous trades and incurs very high transaction costs included in the account statement). Although Table 12.3 took several thousand ticks to compile, it is in no way conclusive.

Selecting Trading Parameters

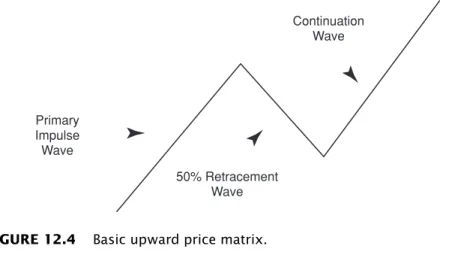

Trading Matrices

Typically, a minimum percentage of the previous leg must occur, or a minimum number of pips in the opposite direction will "trigger" a new leg, as shown in Figure 12.5. Scalpers are most associated with tick data, day traders with 1-minute and 5-minute data, and position traders with hourly data.

Dagger Entry Rule

Market Timing

Note that over the weekend, all currency pairs have an additional premium in transaction costs. As transaction costs return to normal at the end of the week, many pairs show high volatility due to the economic impacts that occurred over the weekend.

Evaluating Your Performance

Common Trading Mistakes

A fellow dealer once commented, "Supervising extended periods of whipsawing is like watching paint dry." We explained that the market is simply building energy to make a significant breakout. Simply reversing the market action (buy to sell or sell to buy) after a loss does not guarantee that the current trend will continue.

Correcting Errors

The two most common mistakes are entering the wrong action (buy or sell) and mistyping the number of units to trade. You may want to reduce the number of units traded (temporarily) just to re-inforce your trading confidence.

When to Say “Uncle”

You may need to increase or decrease the number of pips that you use to set the stop-loss and take-profit limit orders. There's also no reason why you can't trade any of the seven major USD currency pairs or even the cross rates of the EUR, JPY and GBP currencies once you've gained some trading experience.

Daily Trade Plan and Evaluation

We find it useful to keep daily and weekly records of our trading plans, thoughts and activities. You can add more to your daily and weekly summaries based on your specific trading program.

The Tax Man

Evaluations should include what went right and what went wrong, as well as a short text summary of the session.

Rollovers

Such rates of return are quoted in dollars and shown in the interest column of the FOREX trading system. Reversal credits or debits are reflected in the unrealized profit and loss column of the open position.

Hedging

However, rollovers will not affect traders who never hold a position overnight, as the rollover is exclusively a day-to-day phenomenon.

Options Trading

Arbitrage

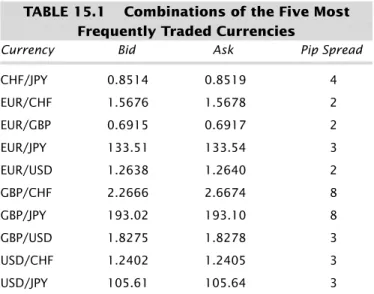

The fact that the USD is the base currency in two pairs (USD/CHF and USD/JPY) and the quoted currency in two other pairs (EUR/USD and GBP/USD) plays an important role in the arbitrage arithmetic. . Two USD Pairs and One Cross Pair (Split) Example 1 used the product of two USD currencies to calculate the cross rate.

Adding Complexity

Pros and Cons of Arbitrage

Further Studies

Guinée Bissau Banque centrale des États de l’Afrique de l’Ouest Autorité monétaire de Hong Kong. Togo Banque centrale des États de l'Afrique de l'Ouest Trinité-et-Tobago Banque centrale de Trinité-et-Tobago.

Periodicals

Books

Web Sites

This order remains open until the end of the trading day, which is usually 5 PMEST. Price changes in the currency pair are expressed in terms of the quote currency.