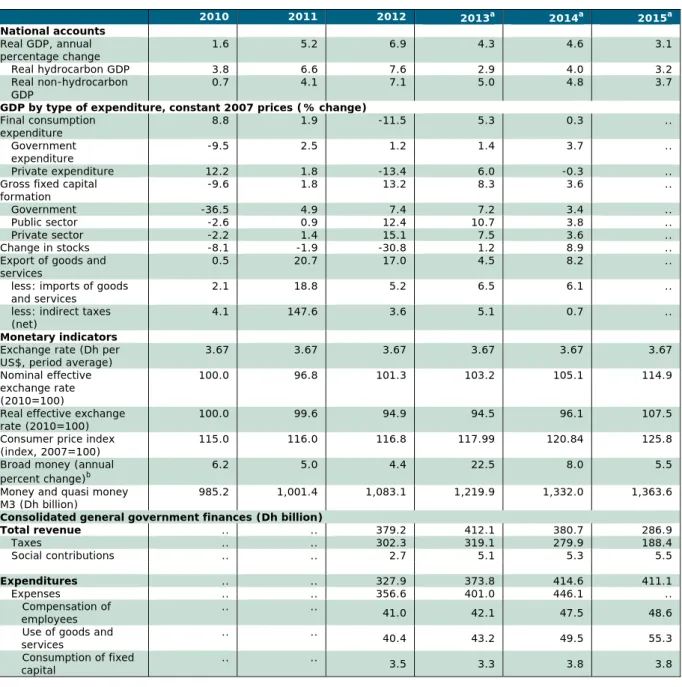

Free zones and economic specialized zones are important facets of the UAE economy and the government's growth strategy. In the wake of the global financial crisis, the UAE economy has proven resilient.

Fiscal Policy

In this regard, the Government has started to implement initiatives in alternative energy, Islamic economy and space and aviation. In this regard, progress has been made in SME financing through the issuance of a new SME Act and the establishment of financial infrastructure, such as a credit bureau and credit register.

Monetary and Exchange Policy

Therefore, the CBUAE must maintain sufficient reserves to maintain the peg of the currency to the US 10 of 1980 with regard to the central bank, the monetary system and the organization of the banking system. and as a financial advisor to the government.

Balance of Payments

The United Arab Emirates has a fixed exchange rate regime, where the local currency, the United Arab Emirates dirham (Dh), is pegged (since November 1997) to the US. During the review period, the CBUAE maintained an accommodative monetary policy, while customer deposits in banks continued to grow thanks to available liquidity and increased non-resident deposits.

Developments in Trade

Composition of trade

Shares of machinery, transport equipment and chemical products rose, while gems and metals and base metals fell. Shares of machinery and chemicals rose, while gems and metals and base metals fell.

Direction of trade

Foreign Direct Investment

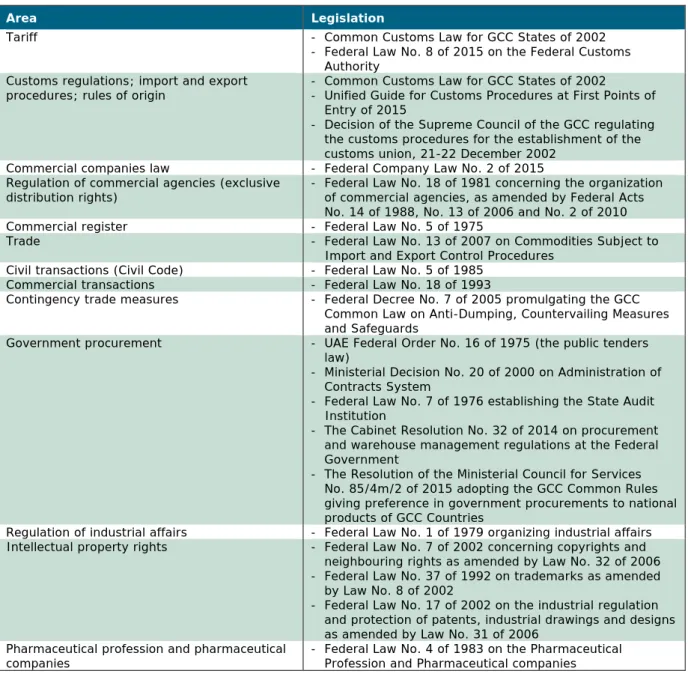

General Framework

Similar to the federal legal system, Dubai also has courts of first instance, courts of appeal and a court of cassation - which is the highest judicial body. Other emirates use the diwan – the ruler's office, through which the concerns of citizens are presented to their governments.

Trade Policy Objectives

Abu Dhabi, established a commercial court in May 2008 (the only one in the UAE) to meet the needs of the expanding business sector in the emirate.6. The Chambers' mission is to represent, support and protect the interests of business in the Emirates.

Trade Agreements and Arrangements

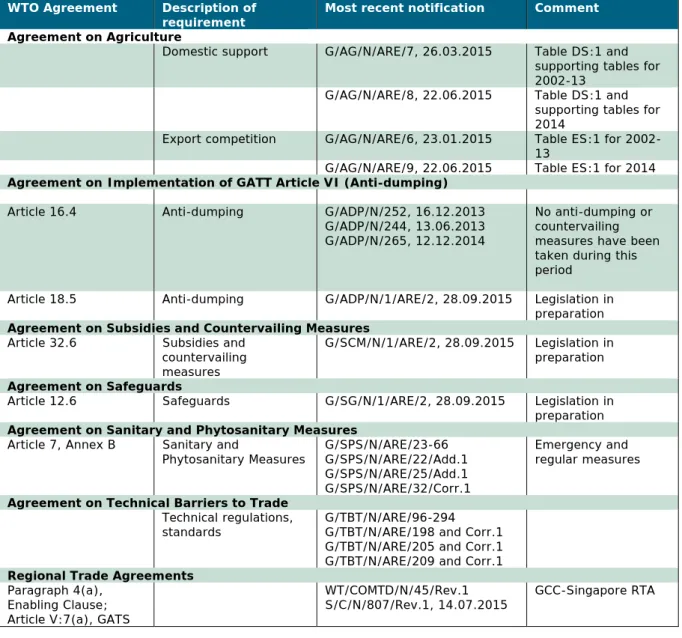

WTO

The institution responsible for emergency relief in the territory of the UAE is the Anti-dumping Directorate under the Ministry of Economy. The UAE Ministry of Economy is currently preparing a federal law on anti-dumping, countervailing and safeguard measures in accordance with the 2010 amendments to the GCC Common Law.

Regional and preferential agreements

- Cooperation Council for the Arab States of the Gulf

- Pan-Arab Free Trade Area Agreement (PAFTA)

To accelerate the liberalization process, on January 1, 2015, the elimination of all tariffs was enforced among PAFTA members, with the exception of some products, for reasons such as public health, safety and morale, and environmental protection. The implementation of the agreement is the responsibility of the Economic and Social Council of the League of Arab States, which coordinates its economic integration.

Other agreements and arrangements

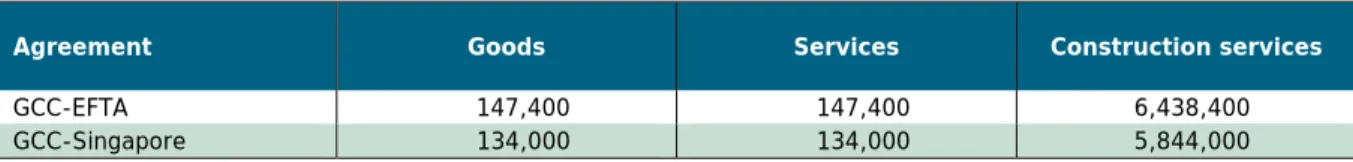

- EFTA-GCC Free Trade Agreement

- GCC-Singapore Free Trade Agreement (GSFTA)

- Negotiations

- Other preferential arrangements

They undertake to conclude negotiations on the annex related to intellectual property rights no later than two years after the entry into force of the agreement. Tariffs on the remaining 1% of imports originating in Singapore will be eliminated 5 years after the entry into force of the agreement.

Investment Regime

The new law applies to commercial companies established in the UAE, as well as to branch offices of foreign companies operating in the UAE. According to the new law, companies established in the UAE must have a minimum of 51% national ownership from the UAE.

Measures Directly Affecting Imports

- Customs procedures and requirements

- Customs valuation

- Rules of origin

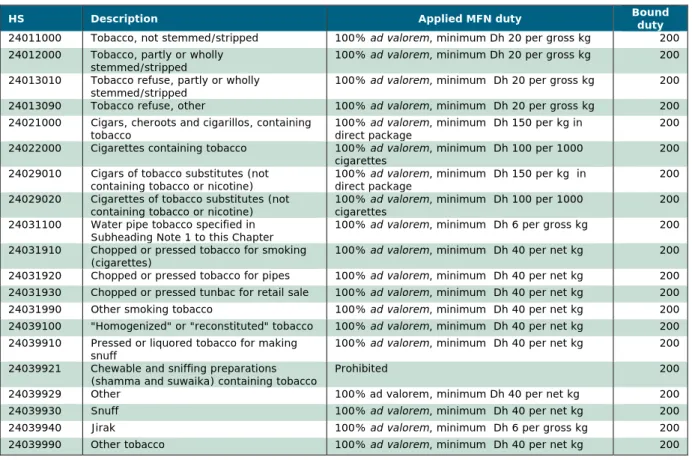

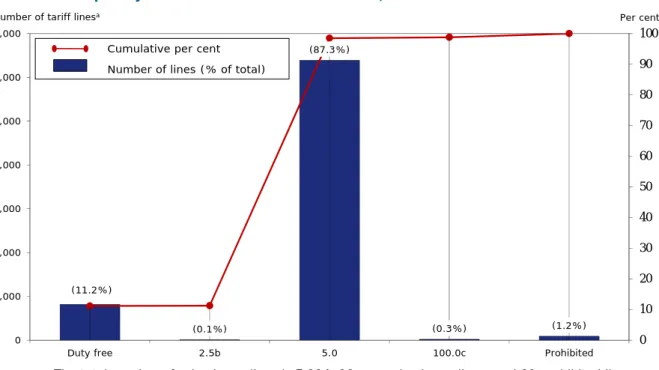

- Tariffs

- Applied MFN tariff

- Bound tariffs

- Preferential tariffs

- Other charges affecting imports

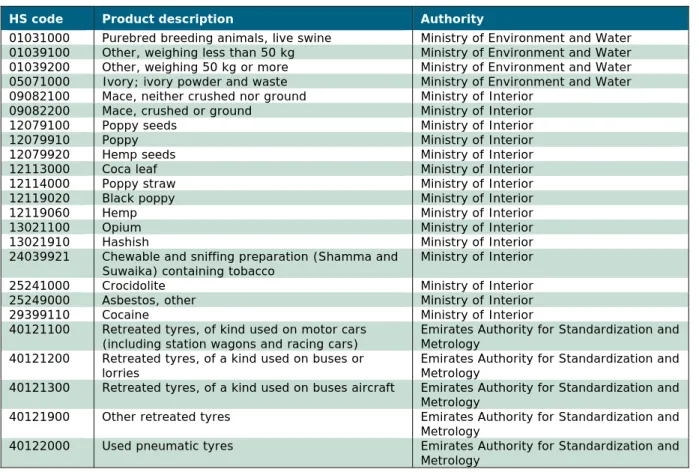

- Import prohibitions, restrictions, and licensing

- Anti-dumping, countervailing, and safeguard measures

No license is required to trade from or to the free zones.12 Goods imported into and exported from free zones follow the same procedures as goods imported into or exported from the customs territory of the UAE. Under the Common Customs Law of the GCC, natural and legal citizens of the GCC states have the right to exercise the profession of customs clearance upon obtaining a license from the customs administration of their state. The UAE applies the GCC Common External Tariff (CET) with most of the 7,231 tariff lines (8-digit level) subject to a 5% tariff and most of the remaining tariff lines duty free.

Restricted goods are specific to the authority of each emirate's customs authority and, therefore, may vary from one emirate to another. The complainant must be notified within seven working days of the decision of the Standing Committee.

Measures Directly Affecting Exports

- Export procedures and requirements

- Export taxes, charges, and levies

- Export prohibitions, restrictions, and licensing

- Export support and promotion

- Export finance, insurance, guarantees

Eligible products are those that Dubai Exports agrees are of UAE origin with a minimum of 10% UAE value added. Grant payments can be up to one-third of the eligible costs.29 Dubai Exports also runs an export academy and an export resource center and provides assistance in participating in international exhibitions and trade missions. Emirates Industrial Bank (EIB) used to provide export credit with loans of up to 80% of the export contract value for UAE-based businesses with a minimum of 51%.

On 7 September 2011, the state-owned Emirates Development Bank took over the activities of the EIB and the Emirates Real Estate Bank to provide financing for housing, infrastructure and SMEs.30. The Export Credit Insurance Company of the Emirates (ECIE), owned by the Government of Dubai, provides a comprehensive short-term trade credit insurance policy to companies in the UAE engaged in manufacturing, value added trading and service exports.

Measures Affecting Production and Trade

- Standards and other technical requirements

- Sanitary and phytosanitary requirements

- State-owned enterprises and privatization

- Taxation and incentives

- Competition policy and price controls

- Competition policy

- Price controls

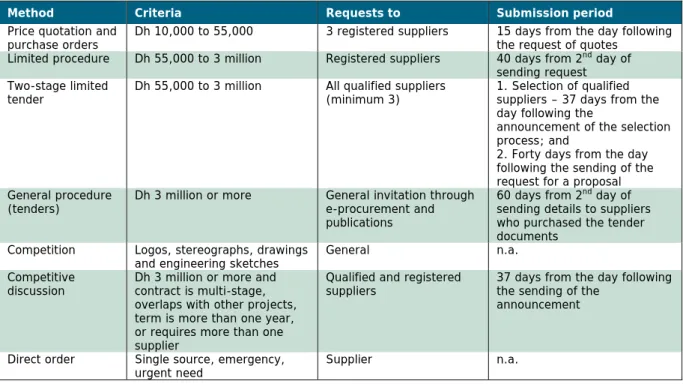

- Government procurement

- Intellectual property rights

- Overview

- Patents

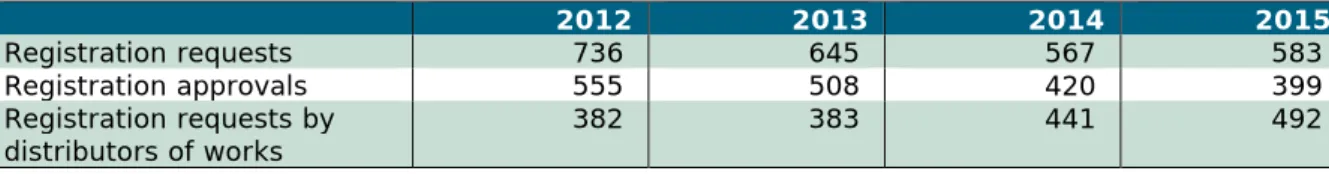

- Copyrights and related rights

- Trademarks

- Enforcement

During 2012-2015, the UAE made 207 notifications to the WTO's Committee on Technical Barriers to Trade under Article 10.6 of the TBT Agreement. ESMA/ENAS is currently a member of the International Laboratory Accreditation Cooperation (ILAC) and operates in accordance with the international standard for accreditation bodies (ISO/IEC 17011). Free zones play a significant role in the UAE economy, as two-thirds of non-oil products are exported from them, especially machinery and electronic devices.

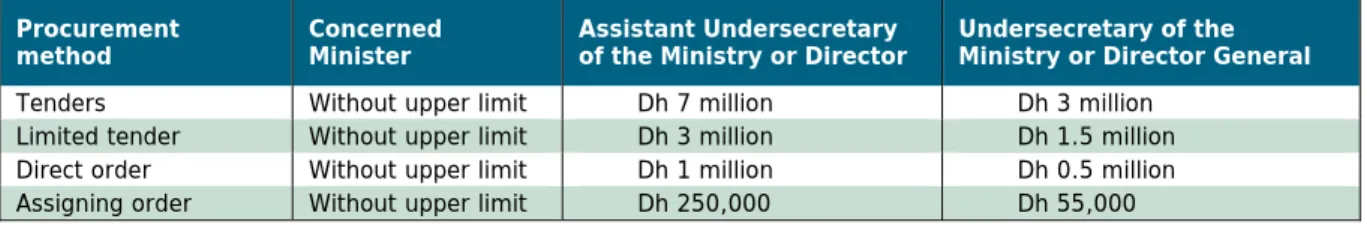

Procurement by the federal entity can be by one of several methods, depending on the value and nature of the procurement (Table 3.6). The Federal Customs Authority and the customs authorities of the emirates handle the enforcement of IPRs at the border.

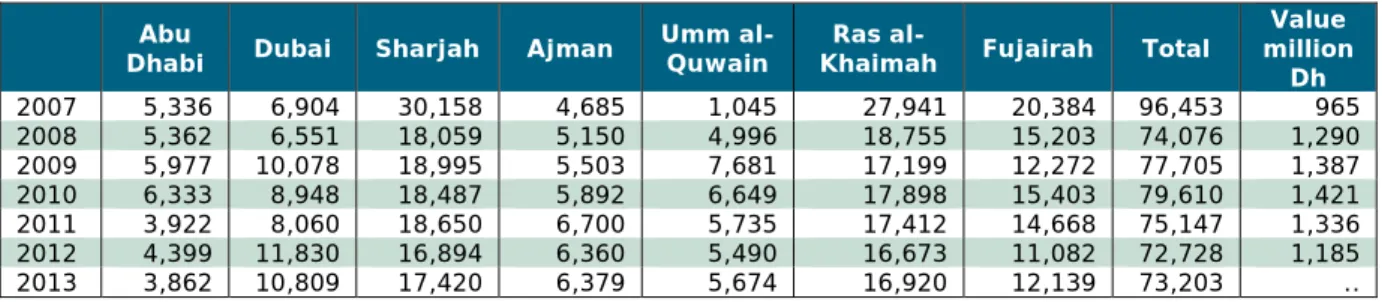

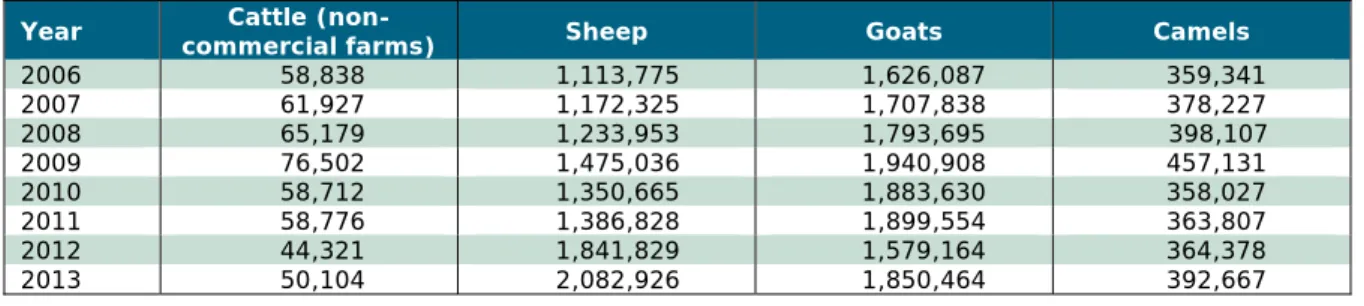

Agriculture and Fisheries

- Overview

- Trade

- Policies

- Fisheries

The UAE is a net importer of agricultural and fishery products, which accounted for around 9% of the value of total imports in 2014. There are 16,000 farmer members of the ADFSC, and in practice the ADFSC provides agricultural services to all 24,000 farmers in the emirate. 3 FAO (2012), Report of the FAO Technical Workshop on a Spatial Planning Development Program for Marine Capture Fisheries and Aquaculture, Cairo, the Arab Republic of Egypt, 25-27 November 2012, p.

8 FAO (2012), Report of the FAO Technical Workshop on a Spatial Planning Development Program for Marine Capture Fisheries and Aquaculture, Cairo, Arab Republic of Egypt, 25-27 November 2012, p. 23 of 1999 concerning the exploitation, protection and development of living aquatic resources in the waters of the State of the United Arab Emirates.

Industry

Hydrocarbon sector

- Regulation of the oil sector

- Regulation of the gas sector

Another important company in Abu Dhabi's natural gas sector is Abu Dhabi Gas Liquefaction Limited (ADGAS), which controls the production and export of liquefied natural gas (LNG) and liquefied petroleum gas (LPG) from Abu Dhabi. The third major player in Abu Dhabi's natural gas industry is Abu Dhabi Gas Development Company Limited (Al Hosn Gas), which is responsible for developing sour gas reservoirs in the emirate's large Shah field. Dubai's natural gas sector, run by the ENOC Group – a state-owned entity made up of dozens of subsidiaries – operates similarly to its counterpart in Abu Dhabi.

In addition to imports from Qatar, Dubai and Abu Dhabi are both involved in LNG trade; the former as importer and the latter as exporter. In Abu Dhabi, the tax is applied in accordance with the Abu Dhabi Income Tax Decree of 1965 and varies between 55% and 85% depending on production.

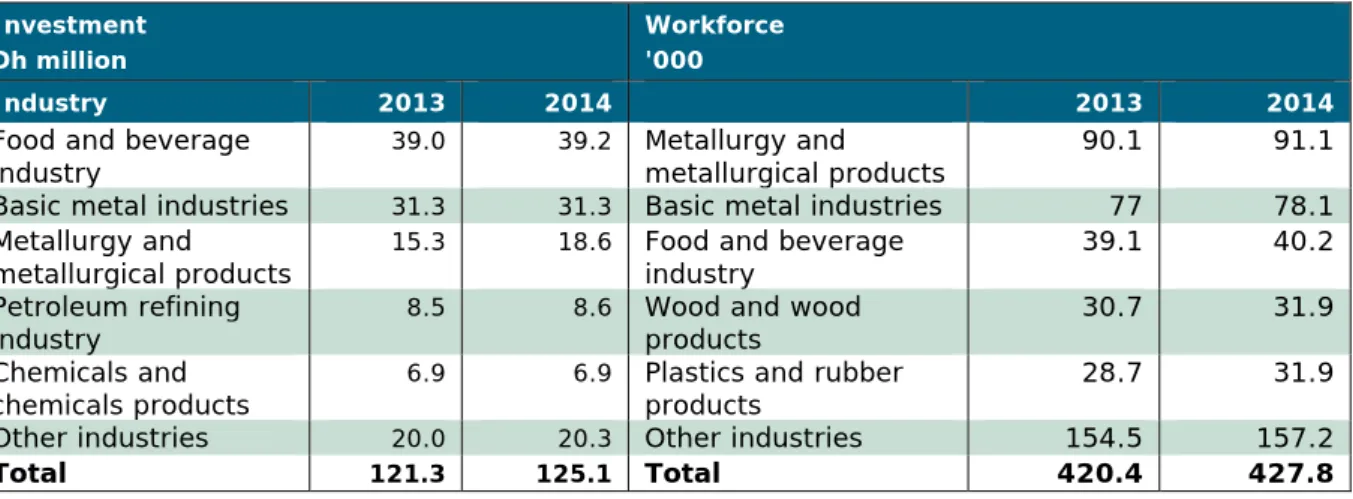

Non-hydrocarbon manufacturing sector

The main heavy industries in the UAE are related to hydrocarbons and activities are concentrated in the Jebel Ali Free Zone in the Emirate of Dubai and the Jebel Dhanna-Ruwais Industrial Zone, Abu Dhabi Industrial City and Al Ain Industrial City in the Emirate of Dubai. Abu Dhabi. The United Arab Emirates is known as an international trade center and the largest re-export center in the region. The largest industrial conglomerate of the United Arab Emirates is the state-owned SENAAT - General Holding Corporation (SENAAT-GHC), which is an important party in the implementation of Abu Dhabi's industrial diversification policy.

At the end of 2010, the first phase of the Khalifa Industrial Zone Abu Dhabi (KIZAD) project was launched by Abu Dhabi Ports Co. In November 2013, the government of Abu Dhabi enacted a local law establishing the Industrial Development Bureau (IDB) as a specialized entity to develop and regulate the industrial sector in line with the Emirate's industrial strategy.

Services

Financial services

- Banking

- Insurance

- Capital markets

Construction

- Overview

- WTO commitments

- Policies

Telecommunications

Transport

- Air transport

- Maritime transport

Tourism

Non-oil free zones trade by main HS sections, 2011 and 2014

Exports of oil, petroleum products and gas totaled approximately US$112 billion in 2014, up from nearly US$130 billion the previous year.

Non-oil direct trade by main origin and destination, 2011 and 2014

Non-oil free zones trade by main origin and destination, 2011 and 2014

The constitution gives each of the seven emirates the right to choose either to participate in the federal judicial system or to maintain its independent system. NC represents various dominant players in the country's economic and commercial sector.

Frequency distribution of MFN tariff rates, 2015

The Act provides for the formation of the Competition Regulation Committee in the Ministry of Economy with a mandate that includes responsibility to propose policy and legislation on competition, make recommendations on the implementation of the Act, and requests for reconsideration of decisions made by the Minister was taken, to investigate. . Forty days from the day after sending the request for a proposal General procedure. tenders). Authority to approve contracts rests with the federal entity and depends on the procurement method and the value of the contract (Table 3.7).

In addition, as a GCC member state, the UAE is a signatory to the GCC patent system.46 The UAE is not a member of the International Union for the Protection of New Varieties of Plants. Trademarks are registered with the UAE Trademark Office in one of the classes within the Standard International Classification of Goods and Services. Since 2006, the Ministry of Environment and Water (MOEW) has been responsible for federal policy and legislation on water safety, food safety, environmental protection and biosecurity.

The MOEW took over the functions and authorities of the Ministry of Agriculture and Fisheries, the Federal Environment Agency and the General Secretariat of Municipalities.

Domestic support to agriculture, 2014

According to the announcements, support for agriculture in the UAE has been exclusively in the green box since 2006. An industrial license, issued by the Ministry of Economy, is required to carry out any industrial activity in the UAE. Foreign banks operating in the UAE are also regulated by the central bank and must open branches in the UAE.

A minimum of 10% of the total staff employed by all banks in the UAE must be UAE nationals (excluding support staff) as per Central Bank regulations. Capital: The Central Bank is reviewing regulatory capital requirements for banks operating in the UAE. The GCAA was established in 1996 and is responsible for air transport in the United Arab Emirates.

Abu Dhabi International Airport is located in the Emirate of Abu Dhabi, the capital of the United Arab Emirates.