The result of the study shows that lessons can be learned from Osun State Sukuk Ijarah in other states. In this regard, providing infrastructure in the education sector is one of the prerequisites for economic, social, political and technological growth and development of countries. Nigeria is the giant economy of Africa and one of the major players in the global economy.

Insufficient funding in the education sector is one of the major obstacles to sustaining comprehensive economic growth in Osun State and Nigeria in general. Therefore, the purpose of the article is to draw lessons from the Osun state of Sukuk Ijarah for other states. The issuer has no previous operating history or business and will not have any material obligations other than in connection with the issuance of the Sukuk.

It has not engaged in any material activities other than those related to the issuance of the Sukuk. The money received from the Sukuk holders would be used to build the schools, so the ownership of the school rests with the Sukuk holders. Any of the following risks could have a material adverse effect on the state's financial condition and ability to meet its financial obligations, including the Sukuk.

The Investors have the right to seek the opinion of their Shari'ah expert on the Shari'ah compliance of the Sukuk. In addition, the primary source of repayment of the Sukuk is the monthly deduction by ISPO from the Statutory Award of the State. This will ensure that the repayment of the financial obligation is adequately covered and is not affected by fluctuations in the state's IGR.

The amounts on the credit of the CDSA will be used to meet the lease obligations of the State. This fund will act as a buffer in the event of a default in the funding of the state's obligations. Foreign investors are sensitive to fluctuations in the exchange rate of the Naira against their domestic currency.

A decline in the value of the Naira relative to their domestic currency will result in diminishing real returns for the investor. Exchange rate fluctuations can also have a negative effect on the completion of the government's projects that require imports. The market price of the Sukuk may be subject to significant fluctuations in response to actual or anticipated variations in the Nigerian economic environment.

The boost of the Sukuk market is the result of its ability to offer long-term financing.

Methodology

What kind of encouragement can you give other states to show their commitment to adopting Sukuk as a resource/. Sukuk is a transparent financing instrument. Theme: Recommendation of the Sukuk instrument to other states to finance their infrastructure projects. LOTUS Yes, for some reason I will first recommend that Sukuk is a socially responsible way to access capital from the affordable sector to the sector that needs it.

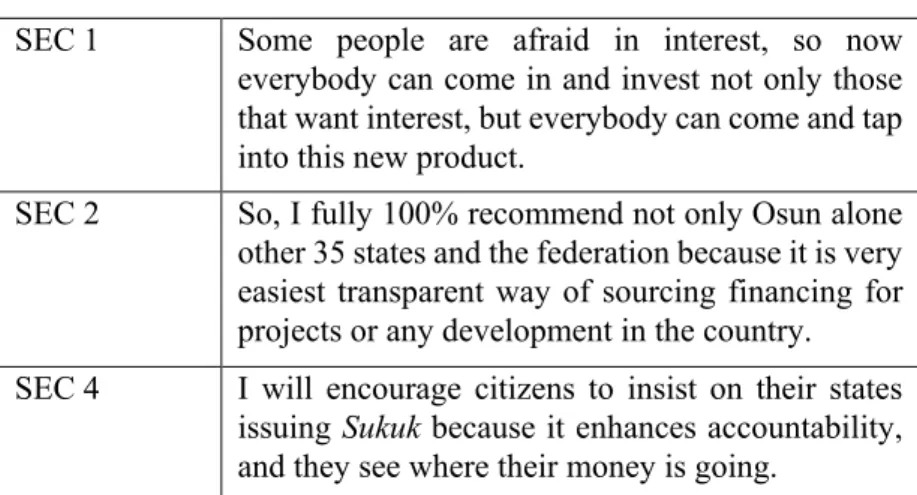

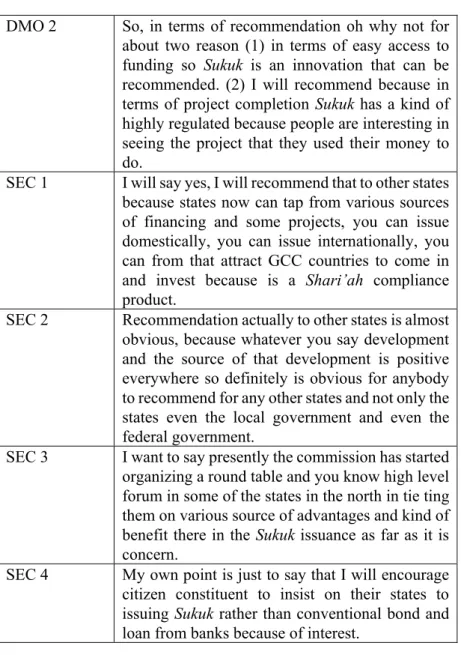

You cannot use Sukuk to finance anything that is not asset based so because of the assets when it was introduced to other states. LOTUS says she will recommend Sukuk financing to other states in the country for a number of reasons, firstly, Sukuk has an easy way of channeling funds from the payable sector to the deficit sector, secondly, it has a long-term contract and thirdly does it create job opportunities because Sukuk is always linked to another project, DMO 1 maintained that he will recommend Sukuk to other states just because its structure is an asset-based instrument that cannot be used to finance anything that is not a asset based while DMO 2 recommends Sukuk to other states for two reasons, firstly Sukuk is a new innovation that has easy access to finance projects and secondly it is highly regulated in terms of project completion and people will see where resources are used, SEC 1 believed that Sukuk can serve as another way of financing infrastructure projects and a new instrument in capital that can be used by market participants to finance projects, and Sukuk can be issued nationally and internationally, where foreign investors will participate, SEC 2 believes that Sukuk is a source of development so it can be recommended to other states and the federal government, SEC 3 states that the SEC is now organizing a round table that educates and enlightens the states in the north to issue Sukuk due to of the advantages and benefits of the product, based on which Sukuk is recommended to other states, and SEC 4 recommended other states to issue Sukuk instead of conventional bonds or loans from banks because of the interest. Sukuk is an instrument that one can encourage others to invest in and it has features for easy project delivery.

Projects implemented using the Sukuk instrument are not diverted to another aspect of the economy. Topic: Other countries can be encouraged to adopt Sukuk as a source of financing. As shown in Table 2.1 above, most of the respondents have a similar idea of encouraging other countries to engage in Sukuk financing, due to its features such as easy access to financing, easy project implementation, and long-term commitment. DMO 1 felt that it will encourage other countries to come and invest in Sukuk and use the Osun model as a case study. Being the first country to issue the instrument, DMO 2 agrees that Sukuk serves as a fast way of project implementation and an easy way to raise funds, while SEC 1 believes that other countries should go and see the mock-up of Osun and also see the amount, spent on the project, so they should take up Sukuk financing, SEC 2 talks about a kind of encouragement, education and warns that the SEC gives other countries to adopt Sukuk financing instead of conventional bonds because of the advantages associated with the Islamic instrument, and SEC 3 expresses its opinion that most countries have obtained Sukuk financing based on the benefits associated with the instrument and also considered that the use of an Islamic financial instrument for project financing is a concrete and reliable foundation.

Projects executed using the Sukuk instrument are not diverted to another aspect of the economy. As shown in Table 2.2, some of the respondents see Sukuk as a kind of instrument that cannot be diverted to another aspect of the economy that is not designed for that purpose.

Findings and Discussion

Shari'ah, the way funds are used, easy project delivery and must be asset-backed or asset-based, unlike the conventional bond. Sukuk is a new innovation and also a Sharia compliance product preferred over conventional bonds to provide an alternative to traditional investment channels that can encourage Muslims and non-Muslims to invest due to its transparency and accountability. Sukuk are essentially asset-backed instruments, which naturally support the construction of underlying assets and provide better risk participation and return than conventional credit-based bonds.

Sukuk can also be recommended for its transparency, which means that it cannot be diverted to other sectors of the economy, and the fixed assets will generate more profit than conventional bonds. We can also encourage other countries to adopt the Sukuk instrument to finance their budget deficit, as Sukuk provides investors with a high degree of certainty that their money will be used for this purpose. So if the Sukuk is structured to offer funds for a particular project, the money will not be diverted and used for another purpose.

Therefore, it is clear that other states are encouraged to invest in the Sukuk instrument, due to the features of easy project delivery and adequate use of the fund mobilized to Sukuk. In summary, Ijarah Sukuk is one of the most acceptable products of the Islamic capital market. It is an alternative source of finance that promotes socio-economic growth and development for both the private and public sectors.

Ijarah Sukuk serves as an ideal way of financing large infrastructure projects for public goods by the government. Thus, it has the advantage of complying with Sharia principles and raising the standard of living of the society's economies. Therefore, we can learn from Osun State Ijarah Sukuk to other states in Nigeria because of the benefits of channeling the fund to finance the huge infrastructural deficit.

From an economic point of view, Ijarah Sukuk allowed the issuer (federal, state or corporate) to build, rehabilitate their outdated infrastructure and avoid long and medium term financing through interest based investment loan. As a result, if other countries in Nigeria adopt Ijarah Sukuk, they can benefit from its pleasure and advantage of large infrastructure for the development of the society.

Conclusion and Recommendations

Challenges of Infrastructural Development in Nigeria: An Assessment of Pains and Gains.