No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States States Copyright Act, without the prior written permission of the publisher, or authorization by payment of the applicable fee per copy to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA, facsimile or on the Internet at www.copyright . com. Technical Analysis of the Foreign Exchange Market: Classic Techniques for Profiting from Market Fluctuations and Trading Sentiment / Boris Schlossberg.

Technical

Analysis of the Currency Market

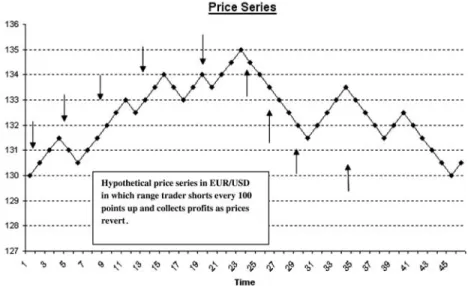

Regardless of how it is used, leverage is a crucial aspect of currency trading and leads us to a discussion of the most common trading strategy in the market: the carry trade. Still, trading in the opposite direction of the carry can also be very profitable.

Is It All

Just Random?

But a skilled observer will understand that these deviations are simply the result of the normal amount of chaos in Mr. Nevertheless, the greater the degree of expectation, the better the trader's lead and the greater the chance of eventual success.

The Secret to Trading

But because Britain's economy is roughly one-tenth the size of the US or the EU, liquidity in the pound could be a problem. EUR/JPY – one of the most active pairings in the currency world, as it is the primary hedging instrument for the huge volume of trade between Europe and Asia.

Show Me the Data!

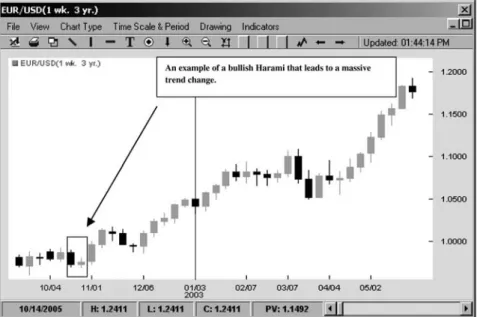

Prices take off the previous period lows and then significantly exceed the previous highs, ending near the top of the range. In shooting star or reverse hammer candlesticks, prices explore the upper end of the range and are quickly rejected.

Trend Is Your Friend?

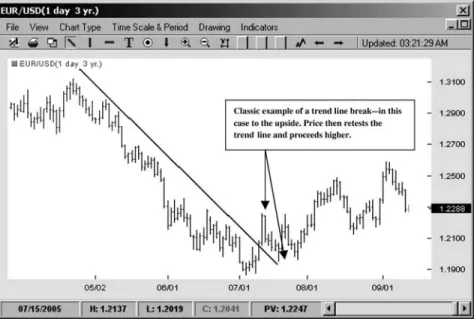

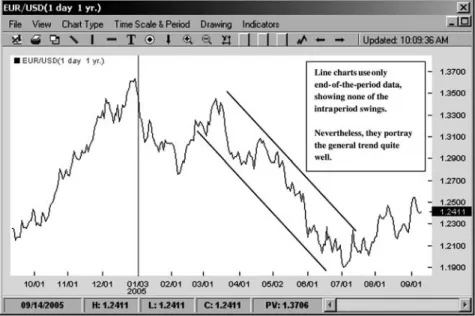

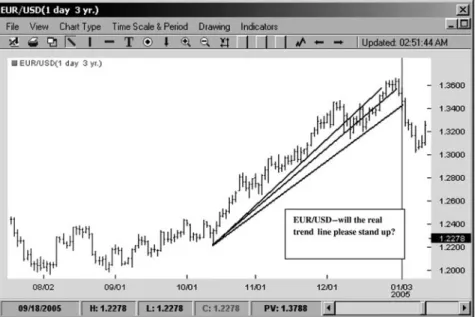

A more sophisticated use of the trend line is to form trend line channels that connect the lowest prices on one side and the highest prices on the other side (see Figure 5.2). First and foremost, careful speculators should clearly define what a trendline breakout is. Does a breakout of the line mean a breakout or does the price have to close through the trend line for it to be valid.

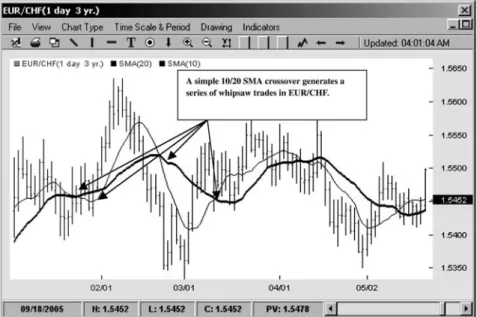

If prices are able to close above or below the main trend line, it is assumed that the market consensus may have changed materially. Beginning traders will often see a moving average crossover and perceive that the entry point is at the intersection of two moving averages. Seeing how price action often follows in the direction of the crossover, they assume this setup works well.

For the most part, the value of the SMA installation is simply an analysis tool. The main reason that makes this particular variant of the setup so attractive is that there is little risk involved in trading. Understanding the exit – the third rule of trading – can now be helpful in valuing the second rule, which is to only buy when the price recovers.

Gauging Range

George Lane claimed that one of the most useful ways to use stochastics is by spotting the divergence between price action and indicator readings. RSI, like stochastics, compares the strength of the currency pair with its price history. One of the most common methods of RSI trading is to spot divergence patterns.

Invented by Gerald Appel in 1978, the MACD is undoubtedly one of the top five most popular technical indicators in existence. The MACD is also plotted with its trigger line, which is simply the 9-period exponential moving average of the MACD itself. The MACD histogram is a very sensitive measure of price velocity and as such is a very useful tool in one of my favorite setups: the MACD turn.

One of the main principles of indicator trading is that the trader should stick with the logic of his setup. In the MACD pivot example, I would stop myself out of the trade only if the MACD value made a new swing low. Like the stochastic and RSI, the main focus of the CCI is to measure the deviation of the price of the tradable item from its statistical average.

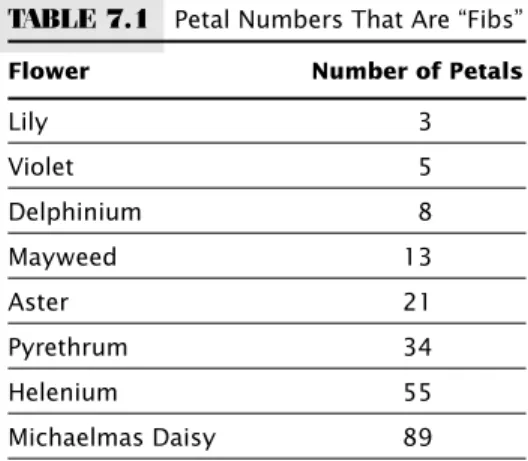

Fibs Don’t Fib

This ratio is often referred to as "phi." The other very interesting aspect of the Fibonacci sequence is that the reciprocal of that ratio is equal to 1.618 or 1 + phi. Essentially, he lowered his break-even point by two-thirds of the amplitude of the move. This is the first zone where traders caught on the wrong side of the move are able to exit their positions at breakeven or better.

If you are right and the price continues to move in your favor, you can add another quarter to 138.2 percent of the initial split move. Finally, if the trading momentum continues, you can add the final 25 percent of the position to 161.8 percent of the move. Imagine that the length of the exit candle is 100 pips and it closes at 1.3300 at the high.

First of all, it reduces risk by committing only half of your capital at the start of the trade. In the second scenario, you, the trader, can also afford to lose more than 50 percent of the time and still be profitable on the strategy. In the first example, the trader is vulnerable to a quick reversal if the price just reaches the 161.8 percent target level and then suddenly falls back through the original entry level which takes the trader out of the trade and then just as quickly pulls back to 1.3400.

Patterns and Antipatterns

Know Your Mark

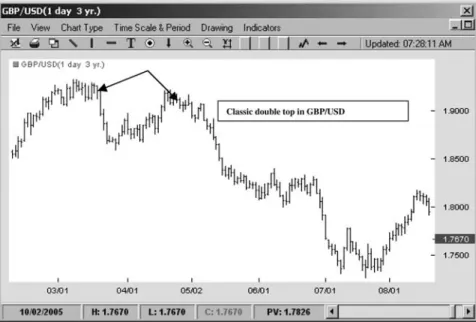

Again, there are different choices depending on the price action and the trader's temperament (see Figure 8-7). More aggressive traders may therefore choose to place their stops at the original low of the double bottom rather than the most recent low. A more unusual version of the double bottom occurs when the second bottom is lower than the first.

Therefore, it is crucial to keep a close eye on the price movement of the currency, even if the original point of support or resistance is broken. At the same time, bears provide consistent resistance at the upper level of the range. Instead, price ranges continue to narrow until the upper trend line of the wedge breaks up and the uptrend begins (see Figure 8.22).

Diamonds are one of the rarest patterns and can be incredibly frustrating for a trader who gets caught inside one (see Figure 8.26). The head and shoulders pattern is one of the most common and well-known reversal patterns in all of technical analysis. From the low of the left shoulder, prices stage a massive rally that takes the currency pair to new highs.

Know Yourself, Know Your Setup

PERCENT SOLUTION

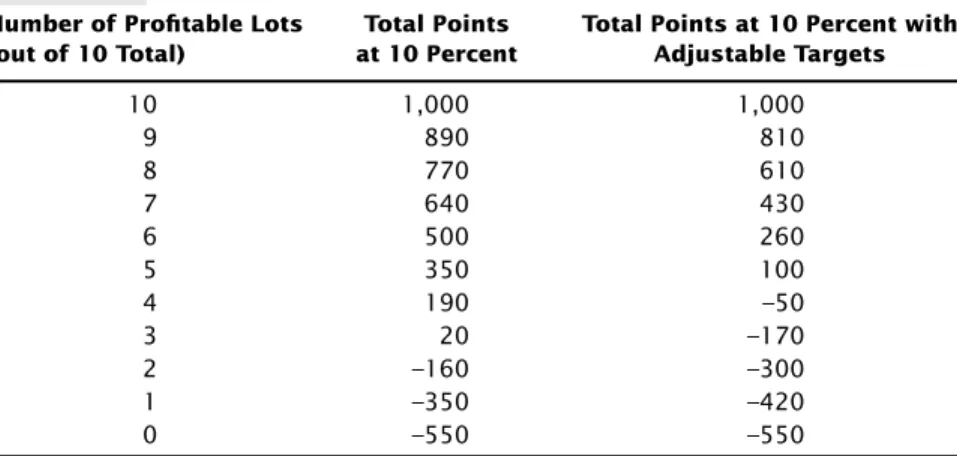

For the sake of simplicity, we are willing to risk 100 points and seek a 100-point target on the trade. Instead of stopping at 1.2600 with the entire position, we place stops at 10-point intervals for 10 percent of the position. So if the trade moves against us by 10 points, we would sell a mini lot, leaving us with nine mini lots (90,000 units) in the trade.

If the trade moves 20 pips against our entry, we would sell another mini lot, leaving us with 80,000 units – and so on until the price reaches our final stop-out of 1.2600, at which point we should liquidate just one more mini lot in our inventory. However, if the trade turned in our favor at any point before the eighth stop-out was reached, we could still take a profit. It automatically reduces risk if the trade moves against you, but allows the trader to partially stay in the trade until the last moment.

We don't need to scale out every 10 percent of the distance to the final stop. That's the only way to act!” I hope this chapter has convinced you of the fallacy of such thinking. Then pushing the trade by continuously adding a winning position could be the best strategy for you.

Setups!

Setups! Setups!

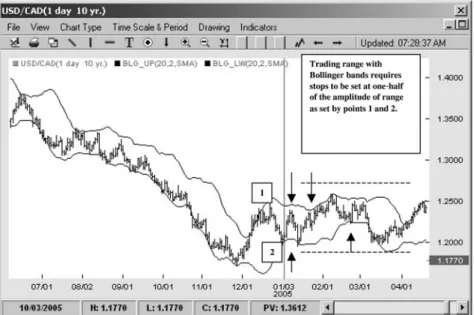

Liquidate one-third of the position when the price reaches the 20-period simple moving average (20 SMA). Liquidate one third of the position at the marker of the opposing 2 standard deviation Bollinger band. If the price decides to climb the Bollinger band channel, liquidate the last one-third of the position if the price bar closes outside the Bollinger band channel zone.

If the trade is moving against you, add the other half of the position at the next 2 standard deviation Bollinger band mark. The great value of the MACD reversal is that it prevents the trader from falling for this common bluff. If the price chart prints three consecutive bars with RSI readings of 70 or higher, short at the end of the third bar.

Measure from the bottom of the first bar to the top of the third bar. If the price chart prints three consecutive bars with an RSI value of 30 or less, go long at the end of the third bar. If the price moves 70 percent of your stop's value in your direction (that is, if you risked 100 points on the trade and it moved 70 points in your favor), take the full profit on the position.

Glossary

Average Directional Index (ADX) Unlike most oscillators, ADX does not attempt to measure the direction of the trend; instead, it works to measure the strength of the trend.