Many empirical studies attempt to measure the financial performance of different banks in order to gain better insight into Islamic banking. However, few studies have addressed the impact of Islamic financing on the financial performance of financial institutions, such as Islamic banks, which will be the focus of this study.

Overview on Islamic Banks and Conventional Banks

Past studies showed that the banking sector contributes to the growth of the economy and an effective and efficient banking system is important for long-term growth and is crucial for the development of the economy (Al Khathlan, Gaddam and Malik, 2009). Thus, measuring the factors that affect bank profitability is very important especially with the existence of instability in the global market due to the credit crunch and the subsequent banking crisis (Azira.

Overview on Islamic Financial Industry

Finally, to test the different effect of two financing modes of Islamic banks and conventional banks on profitability. Therefore, the study aims to assess the financial performance of Islamic banking and conventional banking operating in the GCC and investigate whether there are different effects of financing modes on banks' profitability.

Problem Statement

Research Objective

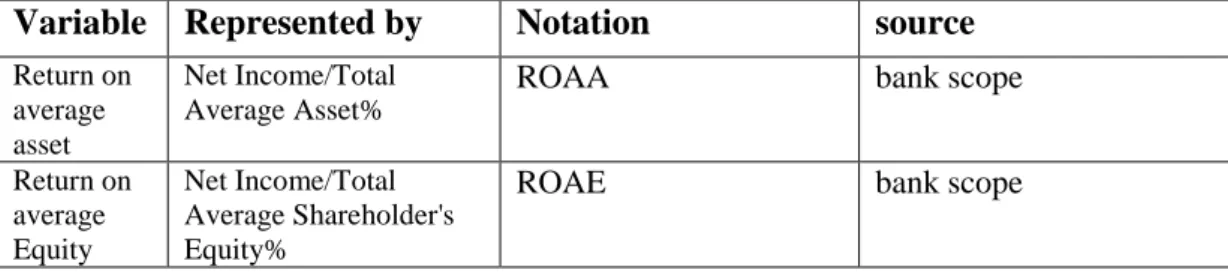

To examine the impact of Islamic lending on the return on average assets (ROAA) and return on average equity (ROAE) of Islamic banks in the GCC. To investigate whether there is a different effect of financing on the profitability of Islamic and conventional banks.

Research Question

To examine the impact of conventional loans on return on average assets (ROAA) and return on average equity (ROAE) of conventional banks in the GCC.

Contribution to the Study

This thesis is one of the few attempts to focus on the influence of the financing of both banking systems (Islamic banks and conventional banks) on the profitability, while investigating for the existence of different effect of this financing on bank profit in relation to bank type .

Organization of the Study

This section will introduce the Islamic banking system and what differentiates it from the conventional banking system, and an overview of the GCC banking sector. For example, the growth in Islamic banking is evident with the growth in assets held by Islamic banks and profitability in the industry.

GCC Banking sector

Of these figures, approximately 93% of total assets (approximately US$920 billion in 2015) were based on nine core markets consisting of Saudi Arabia, Bahrain, Qatar, Malaysia, Indonesia, United Arab Emirates, Pakistan, Kuwait and Turkey. (Ernst & Young, 2015). However, Islamic banking is also increasingly being adopted in non-Muslim countries to cater to Muslim customers in those countries, making Islamic banking a global phenomenon (Khan & Bhatti, 2008; Ernst & Young, 2015).

Islamic Banking Rules and Principles

The first of these is a risk-sharing component where the financial transactions are structured to reflect the distribution of risk and return among the participants in the transaction (El Hawaryet al., 2006; Khan, 2010). A third guideline is to avoid the exploitation of either party to the transaction, while a fourth guideline is the avoidance of financing sinful activities (haram) (El Hawary et al., 2006; Khan, 2010), for example the financing. for products such as alcohol that are prohibited in the Koran.

Islamic Banking Performance

For example, as evaluated by cost-to-income statistics, poor efficiency was noted in Islamic banks in Sudan, Indonesia and the Bahamas, where the ratio was above 100 percent (Brown, 2003). On the other hand, in countries such as Kuwait and Brunei, Islamic banks proved to be extremely efficient, with a cost-to-income ratio of about 30 percent.

Conventional Banking Performance

In the study, the authors noted that determinants of profitability can be either of an internal nature (bank-specific factors) or of an external nature, industry factors and macroeconomic factors (Petria et al., 2015). Such an effect of the economic environment was evident, for example, in a study by Djalilov and Piesse (2016), who assessed factors affecting the profitability of banks in transition countries in Central and Eastern Europe (CEE) and former Union of Soviet Socialist Republics (Soviet -Socialist Republics) influenced. USSR) from 2000 to 2013. Moreover, large banks were found to be more profitable compared to smaller banks while adverse economic environment such as increased inflation was found to decrease the profitability of the banks (Tariq et al., 2014).

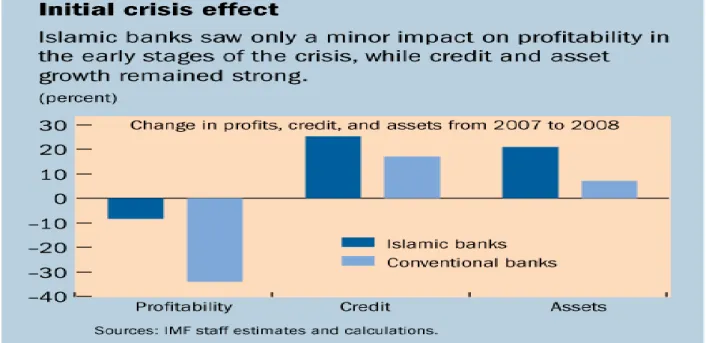

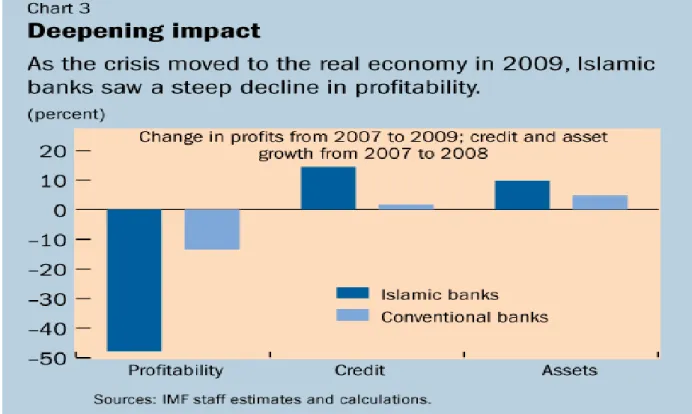

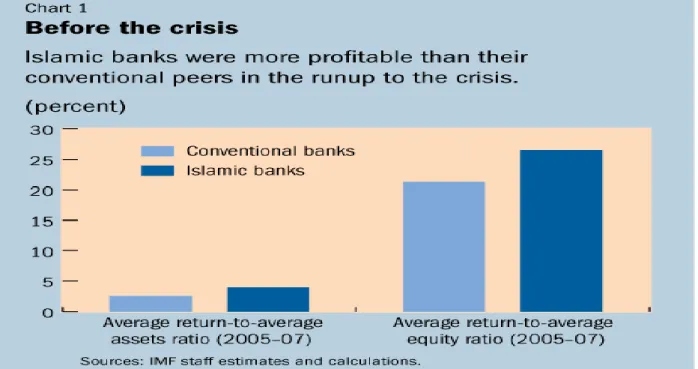

Performance comparison between Islamic and Conventional Banks during Financial

On the other hand, the profitability of Islamic banks decreased during the crisis due to the fall in the market value of assets. For example, some studies reported better performance of conventional banks (Rosly and Abu Bakar, 2003; Bintawim, 2011; Bamaas, 2013), while others reported better performance of Islamic banks compared to conventional banks (IMF, 2010). The study tries to determine the relationship between financing and profitability of selected banks.

The following regression model (1 and 2) is used to test the first two hypotheses of the study, the relationship between financing products and profitability of conventional banks and Islamic banks separately. The result showed that only 9% of the variance in ROAA of Islamic banks is explained by the variance (Islamic financing and GDP). In this chapter, we first compared the performance of Islamic banks and conventional banks in terms of dependent variables (ROAA and . ROAE) and independent variable (loans) through descriptive statistics.

Factors affecting banking sector performance in GCC countries: Islamic banks versus conventional banks (Msc. Thesis).

Previous Studies done on Banks Performance

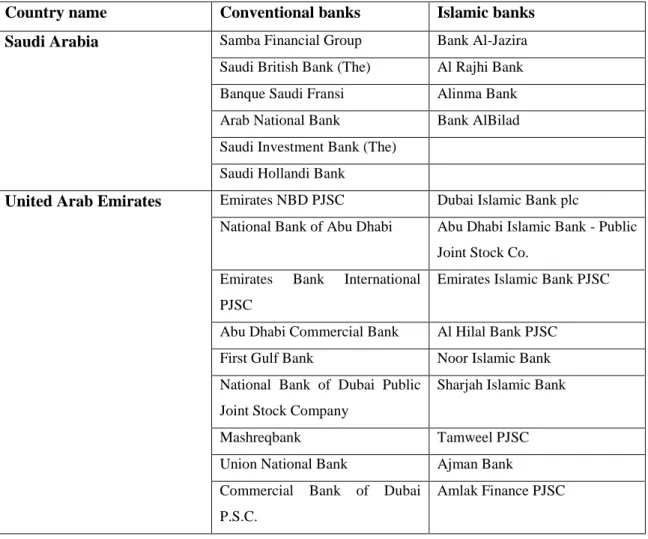

Data collection and sample

Abu Dhabi Commercial Bank Al Hilal Bank PJSC First Gulf Bank Noor Islamic Bank National Bank of Dubai Public. Qatar Qatar National Bank Qatar Islamic Bank SAQ COMERCIAL BANK OF QATAR Masraf Al Rayan (Q.S.C.) Doha Bank Qatar International Islamic Bank International Bank of Qatar. Gulf Bank KSC (The) Boubyan Bank KSC Burgan Bank SAK Kuwait International Bank Commercial Bank of Kuwait.

Data Analysis Technique

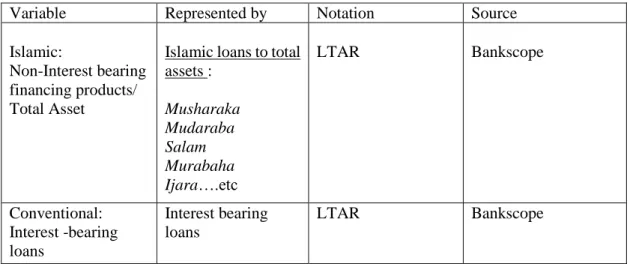

Measurement of Variables

Dependent variables

Independent variables

According to the Accounting and Auditing Organization for Islamic Financial Institution (AAOIFI), Islamic assets represent money and cash equivalents, receivables such as (Murabaha, Salam, &Istisna); investments (Musharakah & Mudarabah) as well as,. In addition, the reason for dividing total assets by loans in this study is that many researchers have found that bank size has a positive effect on bank performance. A study by Eichengreen and Gibson (2001) suggested that bank size had a positive effect on profitability up to a certain limit.

Control variables

For example, in the case of conventional banks, indicating that high inflation will increase loan rates and thus incomes will increase. While in the case of Islamic banks, inflation can positively affect profits when the banks engage heavily in direct investment, shareholding and/or other trading activities (Murabahah). However, studies also revealed that inflation can have a negative impact on banks' performance due to other internal variables such as wages and other costs (overhead) growing faster than inflation (Abdel-Hamid M. Bashir, 2003).

Model

Model Assumptions

As previously mentioned, the study uses a panel data set, as it enjoys some advantages over normal cross-sections and time series. The study tests each data series for stationary using: Panel unit root test such as (Levin, Lei & Chu (LLC), ImPersaran Shin (IPS), Wu and Fisher ADF) at level. As a result, according to the panel unit root test results, p-values for all variables are less than 0.05 and therefore the study can reject the null hypothesis (unit root); therefore, alternative hypothesis (stationary) cannot be rejected.

Empirical Model

Dummy variable is known as a design variable, when we assign the value 1 to it, it means that the coefficient intercepts or modifies the point of intersection. In the case of the value 0, this indicates that the variable coefficient plays no part in changing the point of intersection. Model (3) is a comprehensive model to test for different profitability behavior between Islamic banks and conventional banks, (Dis) the dummy variable is 1 for Islamic banks 0 otherwise;.

Hypothesis

In this sense, unbalanced panel data is used, which is common in banking, and because panel data has several advantages in which the bank and time-invariant effect can be controlled for in the regression analysis. In the next chapter, descriptive and correlational analysis and empirical results of regression models will be presented. This chapter will present a comprehensive analysis of the empirical results of testing the goals mentioned in the previous chapter.

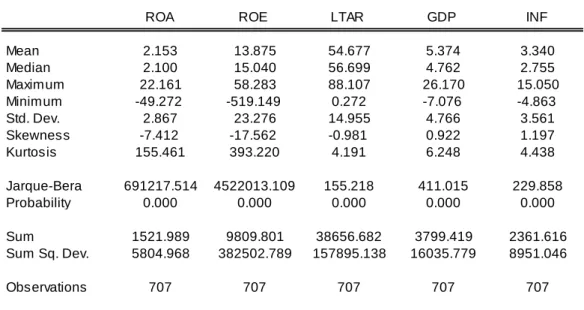

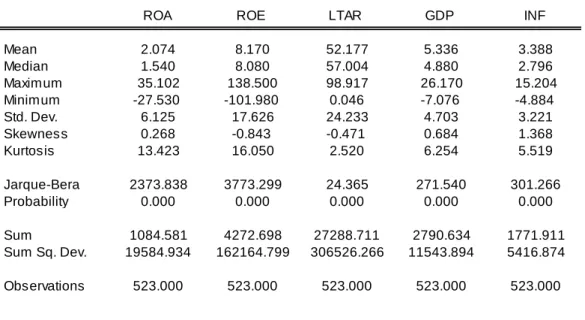

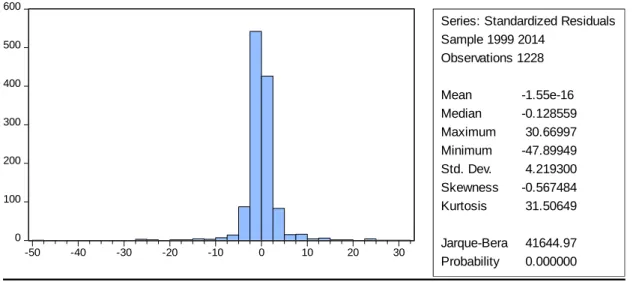

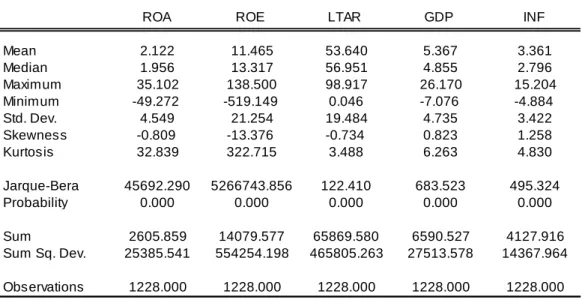

Descriptive Statistics

Coming to the independent variable (LTAR) in (Table 7), the average is 53.63%, which means that loans amount to approx. 53.63% of bank assets, reflecting the concentration of the entire sample in lending activities. Regarding both Islamic and conventional banks, the value of the skewness of (ROAA= -0.73; ROAE = -13.38; and LTAR= -0.74) is negative, indicating that the distribution is negatively skewed. This may be because Kurtosis has high values, which creates a problem in the normality distribution of the residuals.

Correlation analysis

Since most of the variables have a low correlation, this signals a weak relationship between the variables and therefore indicates the absence of multicollinearity problem. Furthermore, (LTAR), which represents the net loans to total assets, had positive correlation with ROAA & ROAE, supporting the expectation that it should have a positive relationship with profitability. Also, GDP has a positive correlation on both performance measures of banks (ROAA and ROAE); which means that as the economy grows, the banks' results are expected to increase.

Regression analysis

Empirical Results and Findings of Islamic banks

Which show that there is a positive relationship between GDP and return on assets of Islamic banks. The relationship between GDP and ROAE of Islamic banks resulted with coefficient = 1.65 and t-statistic= 4.15 significant at 1% level. Therefore, we can reject the null hypothesis and say that there is a positive relationship between GDP and ROAE of Islamic banks.

Empirical Results and Findings of Conventional banks

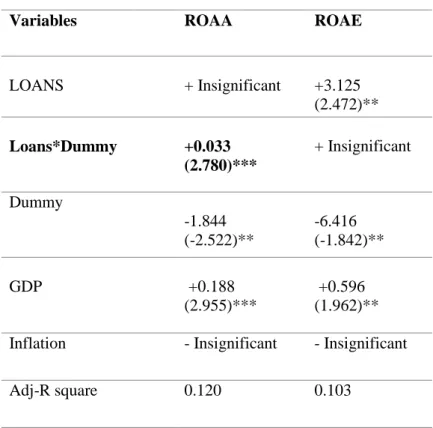

When it comes to testing the different effect of financing products between Islamic banks and conventional banks on average return on equity. The study aimed to apply the two-regression model to Islamic banks and conventional banks separately. Therefore, many researchers used this ratio to compare the liquidity management of Islamic banks and conventional banks in different countries.

Empirical Results and Findings of all banks

Conclusion

According to Rami (2012), the financial system in the GCC countries is controlled by the banking sector and is a crucial part of the GCC economy. He also stated that the banking sector in the GCC countries is strengthened by high profit and capital and that the GCC countries have the largest percentage of Islamic financial institutions and are the primary source of financing for Islamic banking activity (Rami Zeitun, 2012). . Therefore, the purpose of this study was to first test the relationship between the two banking systems' financing products and bank profitability separately in the GCC countries from the period 1999 to 2014.

Limitations &Future recommendation

Determinants of bank performance: Comparative analysis between conventional and Islamic banks from GCC countries. International Journal of Economics and Finance, 7(9), 169. SaifulAzharRosly, MohdAfandi Abu Bakar Performance of Islamic and Conventional Banks in Malaysia", International Journal of Social Economics, Vol. 2012).Comparative Study on the Performance of Islamic and Conventional Banks conventional in the GCC region.Determinants of Islamic and conventional bank performance in the GCC countries using panel data analysis.Global Economy and Finance Journal.