New public finance : responding to global challenges / edited by Inge Kaul and Pedro Conceição. This book provides one of the first systematic treatments of public finance for the new age of globalization – with the entirely appropriate title The New Public Finance. One of the most important issues in both old and new public finance is how to provide assistance.

O VERVIEW

In this rebalancing of markets and states, public and private finance converge and public-private partnerships are more common. Policymakers face a longer agenda of global challenges – from cross-border integration of national markets and communication and transport systems to global climate change, communicable diseases, terrorism, migration and poverty reduction.

T ODAY ?

W HAT T HIS B OOK I S A BOUT

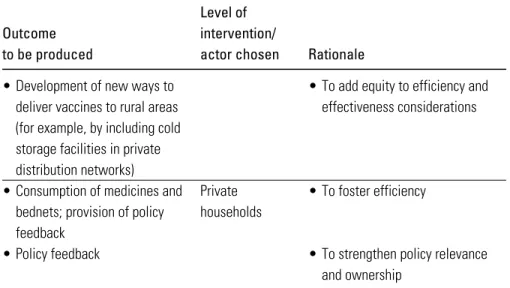

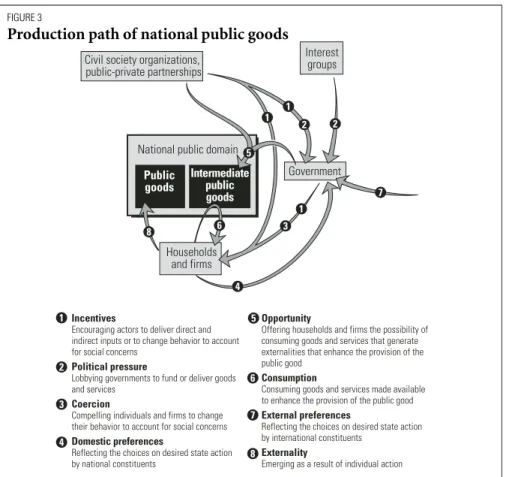

But one point seems clear: the policy approaches and tools of public finance tend to be concentrated near the intersections of the public-private and domestic-foreign policy axes. Consumption of goods and services available to improve the provision of a public good. External preferences. The rebalancing of markets and countries has resulted in an intertwining of the public and private sectors.

F INANCING G LOBAL C HALLENGES

NTERNATIONAL

C OOPERATION BEHIND AND BEYOND

B ORDERS

Subsequent chapters examine some of the more recent national public finance tasks arising from the state's role in blending foreign and domestic policy demands. More than 30 of the roughly 60 identified in his chapter were created in the past decade. The provision of public goods at the international level is being developed as a separate function – as the international arm of the public finance allocation branch.

Achieving a broader consensus on the state's role as an intermediary between external and domestic political demands. Some of the new public finance instruments may need further testing and adaptation to the conditions in the individual countries. At present, the "Samuelson condition" (Samuelson is the most important criterion that helps policy makers determine the efficient level of provision of public goods.

Thus, the challenge is how to improve the availability of information about the costs and benefits of the current delivery status of various global public goods and the net benefits that can be obtained from any improvement measures. The research findings on such questions may eventually lead to a comprehensive theory of the new public finance – a theory that combines international cooperation behind borders (the mix of domestic and external policy preferences) and international cooperation beyond national borders (the mix). economic and foreign policy goals). In these situations, bonds can be indexed to the price level of the key commodity (or basket of commodities).

For more details on the activities of the Multilateral Investment Guarantee Agency, see www.miga.org, and the International Finance Corporation, see www.ifc.org. Estimates of the benefits associated with the improved delivery of global public goods reported in Conceição and Mendoza describe courses of corrective action that do not necessarily explore the most effective tool for the purpose. The Governance of the International Monetary Fund." In Inge Kaul, Pedro Conceição, Katell Le Goulven, and Ronald U.

T AKING THE O UTSIDE W ORLD INTO A CCOUNT

D OMESTIC P OLICY D EMANDS

T HE R ISE OF THE I NTERMEDIARY

S TATE

During the twentieth century, the state in most parts of the world played a strong role that still resonates in much of public finance theory today. The role of the state in both theory and practice began to change markedly around the mid-1970s. Textbooks typically identify three essential elements of the state.2 First, the state is the aggregator of national policy preferences.

Although the problems have been recognized (Arrow 1963), this convergence of national policy demands is a recognized key role of the state. Assessment of the achievement of the Millennium Development Goals (United Nations Development Program and World Bank). Does this mean that the state is being captured by certain private or civil society interests?

All actors – states, business, civil society – contribute to the creation of the global pool of external political expectations. They can support an intergovernmental agreement to strengthen the state's political leverage at the national level. Globalisation, economic development and the role of the state. Penang and New York: Third World Network and Zed Books Ltd.

The state's role in fiscal theory." In Peter Birch Sørensen, ed., Public finances in a changing world.

E FFICIENCY P RESSURES

G LOBALIZATION , P UBLIC S PENDING ,

AND S OCIAL W ELFARE

Evaluation of public spending against the ability of governments to raise revenue (not just in terms of whether they are under pressure to increase or decrease budgets). The share of public spending in GDP in many of today's industrialized countries has been around 10 percent (Tanzi and Schuknecht 2000; Maddison 1997; and Lindert 2004). This phase lasted until the mid-1980s, when the current era of globalization began and the rate of growth in public spending slowed (table 2).

Later, when economic openness increased in developing countries between the 1980s and the late 1990s, public spending as a share of GDP fell (table 3). Smaller countries also tend to be more ethnically homogeneous, which has a positive impact on public spending (Alesina, Glaeser, and Sacerdote 2001; Alesina and La Ferrara 2003). As Garrett (2001) points out, scholars such as Rodrik (1998) did not really investigate how globalization affects public spending.

A comparison of peak public spending as a share of GDP for the 13 most open industrial countries and its level in 2002 shows that public spending is stagnating or declining, although economic openness clearly remains high (Table 7). . This finding is supported by a scatter diagram relating the change in trade openness over the period 1987–2002 to the change in public spending (Figure 1). A combination of public spending aimed at those at the bottom of the income distribution or, in the short term, those most exposed to economic risks.

First, many of the factors that have contributed to the growth in public spending over the past 150 years have not been related to globalization.

S PILLOVERS

P OLICY O PTIONS FOR A DDRESSING L ONG -T ERM F ISCAL C HALLENGES

The first step is to place budget analysis and decision-making in a long-term perspective. A long-term intergenerational report is also required, evaluating the long-term sustainability of current government policies over the 40 years following the release of the report. Dealing with long-term fiscal policy challenges must therefore also take into account the political economic issues that underpin policy-making.

The long-term implications of any new budget initiative must be quantified, including the likely time course of expenditures. The rules must be realistic in their long-term expectations of tax burdens and provision of expenditure. And they need to start doing these things now because the long term has already begun.

These steps will also improve the prospects for international cooperation, which is likely to be a critical step in addressing long-term fiscal challenges. The list of long-term fiscal challenges facing the countries is long and wide.1 Demographic challenges. A comprehensive list of possible sources of long-term fiscal pressures for different countries and regions is available in Heller (2003).

Coping with Aging Societies, Climate Change and Other Long-Term Fiscal Challenges.Washington, D.C.: International Monetary Fund.

E CONOMIES

T HE R OLE OF M ACRO M ARKETS

Making risk sharing part of the language of international agreements Why such agreements have not emerged. Part of the problem is that economic risks and their management through international risk sharing agreements have. Securities tied to a country's GDP would allow investors around the world to invest directly in the United States economy.

This person has placed a bet (probably unwittingly) on the future growth and economic prosperity of the economy. Their contract price represents the expected discounted present value of a country's long-term income stream. Most of the legal work to allow the creation of such securities has been completed.

The public does not seem to recognize the risk of a major change in the economic status of countries. The price of the contract would reflect the expected long-term future stream of national income. Then, dividends on the declining macro security will be lower, and the holder of the higher security will be rewarded with further dividends as the index rises.

In equilibrium, the price of the upside macro should reflect market valuation of a claim on the cash flow represented by the index.

AND C OORDINATION

N ATIONAL T AXATION IN A

G LOBALIZING W ORLD

It can apply its tax on foreign income net of the foreign tax, and treat the foreign tax as a deduction from taxable income. It may allow full or limited credit of the foreign tax, and treat the foreign tax as its own. National economic interests. The transfer of economic activity abroad can have a profound effect on the national economic interests of the country of residence.

The source country's tax claim is the product of the tax rate it applies and its claim to the tax base. International equity. The share of the tax base and the tax rate applied by source countries to income accruing to others should be seen as a matter of international equity, requiring international cooperation (Musgrave 2000b). Essentially, rules are needed to allocate equal shares to source countries in the revenues accruing to multinational corporations.

Therefore, cooperation is required from countries of residence in the interest of international welfare, just as cooperation is required from source countries in the interest of international equality. As mentioned, it is possible to take different views of the capital of individual taxpayers (as it applies to those receiving foreign income), each requiring different foreign tax treatment. This foreign tax treatment is similar to the central government's treatment of state and local taxes in the United States and other federal systems.

It also does not affect the right of the country of residence to impose income tax on all capital gains of its residents.