Income Statement: Introduction to Taxation 235 Introduction • Taxable Profit • Tax Burden • Disclosure Requirements. Introduction • Income Statement • Balance Sheet • Cash Flow Statement • Solvency Ratios • Profitability • Cash Management • Investor's Ratios.

APPENDICES

WHO SHOULD READ THIS BOOK

THE STRUCTURE OF THE BOOK The book is divided into five parts

How to use this book

Other accounting issues – there are three chapters in this section which give the reader of accounts more information, or cover accounting issues that affect more

Appendices – there are two covering

INTRODUCTION TO

COMPANIES AND THEIR ACCOUNTS

1 Introduction

WHAT ARE THE ACCOUNTS?

JANUARY

Only the cost of items used in sales will be charged to the profit and loss account. This £700 is the cost of paint which will be charged to the profit and loss account.

FEBRUARY

Because the balance sheet is a snapshot of the company on a given day, we need to show the total profit, or in this case, loss, that the company has made since its inception. In each box of Table 1.5, the assets and liabilities are shown in the order in which they could be realized.

MARCH

The decorative materials used in the sale are still charged to the profit and loss account, even though they may not have been paid for. The materials used are charged to the profit and loss account, regardless of whether they have been paid for or not.

APRIL

THE PUBLISHED ACCOUNTS

The cash flow statement uses the total cash flow in the business and groups the company's cash flow into eight categories:. The cash flow statement shows the movement of cash during the period, and functionally looks at cash flow.

2 Accounting practice

INTRODUCTION

THE LEGAL AND REGULATORY FRAMEWORK

The ASB's accounting standards are called Financial Reporting Standards (FRS) and the draft standards are called Financial Reporting Exposure Drafts (FRED). Older accounting standards are called Statements of Standard Accounting Practice (SSAP); while the newer ones are called Financial Reporting Standards (FRS).

THE BASES USED IN PREPARING ACCOUNTS

Current cost accounts adjust historical cost accounts to show actual profit, assets, and liabilities for the year. An adjustment has been made to the current cost charges detailed above to reflect the benefit that comes from partially financing the business through borrowing.

THE ACCOUNTING PRINCIPLES

If a company has all the risks and rewards of owning something, it should be included in the financial statements, regardless of legal status. A good example of this is the way long-term leases (finance leases) are treated in the financial statements.

3 Companies

ALTERNATIVES TO STARTING A COMPANY

The management of the club's affairs is usually entrusted to a committee, which manages the club on behalf of its members. If the partnership runs into financial difficulties, each partner will usually be personally liable for the debts of the business.

COMPANIES

The Partnership Act of 1890 defines a partnership as 'the relationship existing between persons carrying on business for profit'. This includes all rules and regulations relating to the internal management of the company.

DIFFERENT TYPES OF COMPANY

A private company is defined as small or medium if it does not pass more than one of the following criteria presented in table 3.1. Accounting and filing criteria for small private companies. As long as you don't want this access to the capital markets, private companies offer more flexibility than public companies.

GETTING A LISTING ON THE STOCK EXCHANGE

The placement is usually arranged by the company's broker, and most of the shares are likely to be placed with his clients. Shares are sold privately to investors, usually by the company's broker placing the shares directly with its clients.

THE ALTERNATIVE INVESTMENT MARKET (AIM)

Public company A company with a minimum share capital of £50,000 (of which at least 25 per cent has been fully paid up), at least two shareholders and directors (unless incorporated before 1 November 1929) and a qualified company secretary. The price (ask price) will be the one that ensures that all shares have been sold.

4 Introduction to the accounts

THE CHAIRMAN’S STATEMENT

THE DIRECTORS’ REPORT

THE OPERATING AND FINANCIAL REVIEW

The components of the tax levy, if the total tax levy is 'significantly different from a standard tax levy'.

THE FINANCIAL STATEMENTS

The capital structure of the company:. the maturity profile of debts; the types of capital instruments used in the business; the control of treasury activities; the currency in which loans are made and cash and deposits are held; the size of the fixed-interest loans; the use of financial instruments for hedging; the extent to which net investments in foreign currencies are hedged by currency loans and other hedging instruments. You can always spot a company that deals with creative accounting – the money is gone.

THE AUDITORS’ REPORT

It recommends that directors should clarify their responsibility for the preparation of financial statements, and auditors' reports should contain a clear statement of the auditors' responsibilities. When forming the opinion, we also assessed the general appropriateness of the presentation of information in the financial statements.

THE CADBURY COMMITTEE’S CODE OF BEST PRACTICE

This is given when the auditors believe that the information in the financial statements is seriously misleading. They will then state that in their opinion the accounts do not give a true and fair view.

GREENBURY

The stock exchange has adopted this in its listing rules, and companies now provide very detailed information about their board remuneration in the remuneration committee's report. The information in the report is always interesting, but often has little relevance for financial analysis.

THE NOTES TO THE ACCOUNTS

It specified best practice for remuneration committees, remuneration policy and service contracts and directors' compensation.

THE ACCOUNTS

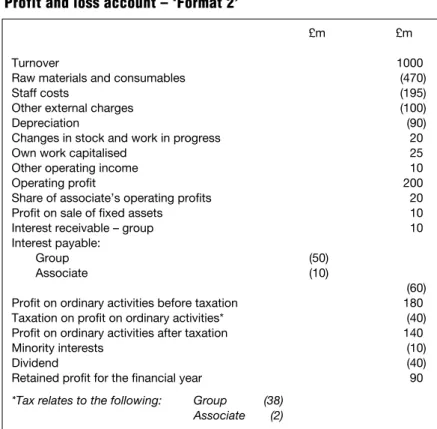

The profit and loss account: turnover to profit before tax 197

The profit and loss account: introduction to taxation

The profit and loss account: profit after tax to retained profit 258

5 The balance sheet

SHARE CAPITAL AND SHARE ISSUES

Many companies offer employees and directors the opportunity to buy shares in the company at a discounted price. The above is a summary of the Preference Shareholders' rights, but full details are contained in the Company's Articles of Association.

RESERVES

Indivisible reserves are allowed to be used as they are considered part of the company's capital base, and the transfer is from a reserve to the share capital. The company can then qualify for statutory share premium relief under s 131 of the Companies Act.

DEBT–EQUITY HYBRIDS

Bonus Issue/Scrip Issue/Capitalization Issue Some company reserves are converted into share capital. Employee Stock Ownership Plan (ESOP) A plan that offers employees the opportunity to purchase company stock at a discounted price.

6 The balance sheet: borrowings

HOW MUCH SHOULD A COMPANY BORROW?

Once we reach our break-even point and the fixed costs are paid, any sales above this point will generate 40 percent profit. The profit of the company with the higher contribution and fixed costs is much more susceptible to changes in sales.

HOW MUCH CAN A COMPANY BORROW?

WHAT SORT OF BORROWINGS DOES A COMPANY HAVE?

Some bonds increase interest during the duration of the bond (called step-down bonds), others decrease it (step-down bonds). 3) Repayment of the principal amount borrowed. If the company's stock price rises, the value of the bond will increase as the value of the conversion option increases.

THE LENDER’S PERSPECTIVE

If the company has a 'lottery' to determine repayment, the average life of the fund is used. The gross repayment yield on corporate loans will be higher than the benchmark government loans to reflect the increased risk.

MANAGING INTEREST RATE EXPOSURE

A company with a BBB credit rating collects short-term floating rate money and AAA fixed rate money. A company with a credit rating of AAA issues a bond with a fixed interest rate of 10 percent, and a company with a credit rating of BBB borrows at LIBOR + 3/4 percent.

ACCOUNTING TREATMENT

These must be shown separately as part of the debt, and their conversion should not be assumed. This means that the proceeds recognized as debt will be less than the face value of the bond.

FRED 13

This discount should be treated as a financing cost and allocated to the accounting periods, obtaining a constant percentage of the outstanding debt. This means that they should be treated in the same way as bonds with warrants, with the fair value of the option reflected as part of equity.

THE BORROWING RATIOS

The traditional way of calculating leverage measured long-term borrowings as a percentage of the long-term capital available to the company. Operational leverage A measure of the percentage change in profit for a 1 percent change in revenue.

7 The balance sheet

The accounting standard requires that purchased goodwill and purchased intangible assets should be recognized as assets on the balance sheet. Internally generated intangible assets should normally be charged to the profit and loss account, ensuring consistency with the accounting treatment for goodwill.

CAPITALISED RESEARCH AND DEVELOPMENT COSTS

Intangible assets that are believed to have an indefinite useful life should be reviewed annually to identify any impairment, which should then be expensed in the income statement. Both pure and applied research must always be included in the income statement.

PATENTS AND TRADE MARKS

Household products group Jeyes shows trademarks and other rights as intangible assets on its balance sheet. SmithKline Beecham shows licenses and patents as part of its intangible assets (it also shows goodwill and brands as intangible assets).

BRAND NAMES

Patents and trademarks are one of many rights that companies may choose to capitalize on. Copyrights obviously have a value and some companies choose to reflect them as intangible assets in their accounting.

GOODWILL

This will mean that there will still be differences between companies in the value of the reserves shown in the accounts. The impairment review compares the value of the acquisition with the present value of its future cash flows.

8 The balance sheet

When we do our personal balance sheets and look at our friends' fixed assets, we have a fair idea of what they are worth. When we look at the tangible assets on a company's balance sheet, we must always remember three things:.

IDENTIFYING THE COST OF AN ASSET

The FRED allows the capitalization of attributable financing costs, if the company's accounting policy is to capitalize financing costs. It is permitted, but uncommon outside the construction sector, in France, the Netherlands and Germany.

GOVERNMENT GRANTS

Prudence states that they should not appear in the profit and loss account until the company has met all the conditions that apply to the grant. Whereas in France grants are either treated as income when received, or appear as a separate component of equity and are amortized in the profit and loss account over the depreciable period of the asset.

DEPRECIATION OF ASSETS

Only permanent declines in the value of investment properties would be charged to the income statement in accordance with the FRED 9 proposals (Amendment to SSAP 19, Accounting for Investment Properties). Further impairments must be debited to the income statement in the usual way.

CHANGING THE BASIS OF DEPRECIATION

In the US, the life of assets must be reviewed annually and the annuity method is not acceptable. The impact of any material changes in asset lives and methods will need to be disclosed in the notes to the accounts.

OWNERSHIP OF ASSETS

So far we have assumed that the company we are analyzing is the company that leases the asset from the financing company, the lessee. Landlords must disclose the following:. the accounting policy for financial leases; the net investment in financial leases, split between investments within one year and more than one year; the total rental income from financial leases during the period; the cost of assets acquired for use in finance leases.

REVALUATION OF ASSETS

Any revaluation deficit that is believed to be permanent can be charged to the revaluation reserve only to the extent of any revaluation surplus related to those assets. Only part of their depreciation could be absorbed by reserves; the balance had to be debited to the profit and loss account.

FRED 17

If the property subsequently declines in value (as commercial property did in the UK during the late 1980s and early 1990s), it should be recognized in the accounts if the decline in value is believed to be permanent. As these gains and losses represent an impairment adjustment, they should be charged to operating profit in the same manner as depreciation.

DISPOSAL OF TANGIBLE ASSETS

INFORMATION DISCLOSED IN THE NOTES

THE FIXED ASSET RATIOS

Operating margins should improve if the company has justified its replacement of fixed assets through cost reduction. 8 The balance sheet: property, plant and equipment The annuity method A method of depreciation that produces a depreciation that reflects a.

9 The balance sheet

SUBSIDIARIES

The holding company is legally obliged to prepare consolidated accounts for the group, so subsidiaries will not be shown in the group's fixed asset investments, as their assets and liabilities are included in the group's accounts. However, they will appear as a fixed asset investment in the parent company's balance sheet (usually published with the group balance sheet).

PARTICIPATING INTERESTS

ASSOCIATED UNDERTAKINGS

The value of the investment shown in the predators' balance sheet will rise to £22,000 - the. The value of the investment shown on the balance sheet would therefore be £20,500 – the cost plus the predator's share of the post-acquisition retained profits.

OTHER INVESTMENTS

The group's share of the associated companies' total net assets is shown in the group balance sheet. The company reports its interests in the joint venture's income, expenses, assets and liabilities.

10 The balance sheet: stock

Consignment stock is covered by one of the accounting rules (IAS 5, Accounting for Transaction Substances). This means that the consignment stock should appear in the accounts of the party that has the risks and rewards of ownership.

VALUING STOCK

From our previous example, the ending stock on the balance sheet would be shown at £1000 and the cost of sales in the profit and loss account would be £10,465. In the US, stock is usually traded at the lower of inventory or market value.

THE STOCK RATIOS

Whether we use turnover or cost of sales, inventory turnover or inventory days, we can calculate the extra investment the company had to have in inventory. It tells us how many times during the period the company converted its inventory into sales.

11 The balance sheet

DEBTORS

If you recalculate the debtor days based on sales for the last quarter (multiplying by 91 - the number of days in the period), the debtor days have improved slightly, instead of getting worse x91 days = 47.3 days, compared to 47.4 days based on same period last year). The cost of factoring will be disclosed separately in the notes to the accounts.

BUSINESSES HELD FOR RESALE

INVESTMENTS