No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted by Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the publisher or permission through payment of the appropriate fee per copy to Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA by fax or on the Internet at www.copyright .com. Limitation of Liability/Disclaimer of Warranty: Although the publisher and author have used their best efforts to prepare this book, they make no representations or warranties as to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranty of merchantability or fitness for a specific purpose.

A Brave New World of Investor Relations

We believe this is a direct result of the value proposition a group of former capital markets professionals can bring to the IR process. Our view of the world is that IR strategy that focuses on long-term equity value should be a force in all corporate communications decisions.”

A New Approach and Why It’s Important

Chances are the entertainment company's stock was already down and new management dealt with the problem transparently and quickly. They can take it in exchange for a piece of the company - that is, they can sell shares or ownership by giving the investor shares in the company.

INVESTOR RELATIONS, TAKE 1

On the other side of the equation, those who want to invest their money can do so, again generally, in both stocks, and there are usually specialists in each area. IR counsel, internal or external, not only administers disclosure responsibilities but, in a perfect world, works to preserve or increase the company's equity value.

STOCK PRICES

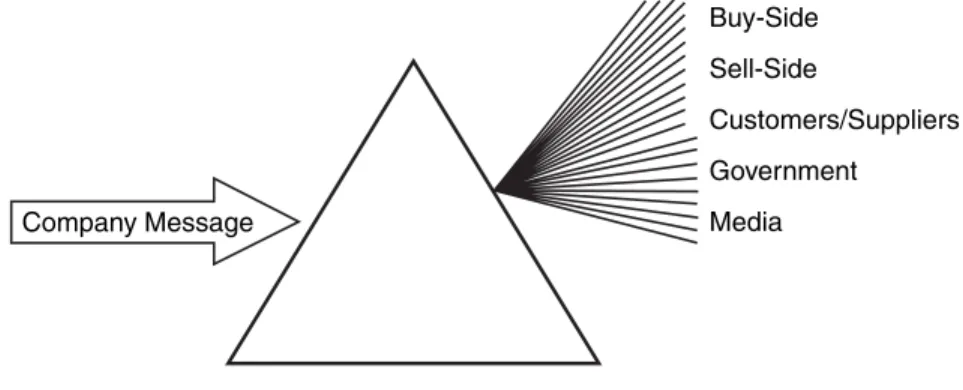

In most cases, the packaging and distribution of this information is the responsibility of investor relations, as IR is the filter through which all financial communications come out of the company. Exposing the company to a wider range of shareholders can also attract the sell-side, which from an investment banking perspective sees a high share price as an opportunity to acquire assets for stock rather than cash or sell more equity to the public. to raise cash for operations or debt reduction.

COST OF CAPITAL

Many investors focus only on large caps because they consider them to have less risk, less volatility and more liquidity, which allows large investors to buy and sell quickly without moving the market. Similarly, companies want institutional investors to buy stocks because they usually buy large quantities, which increases liquidity and modifies volatility.

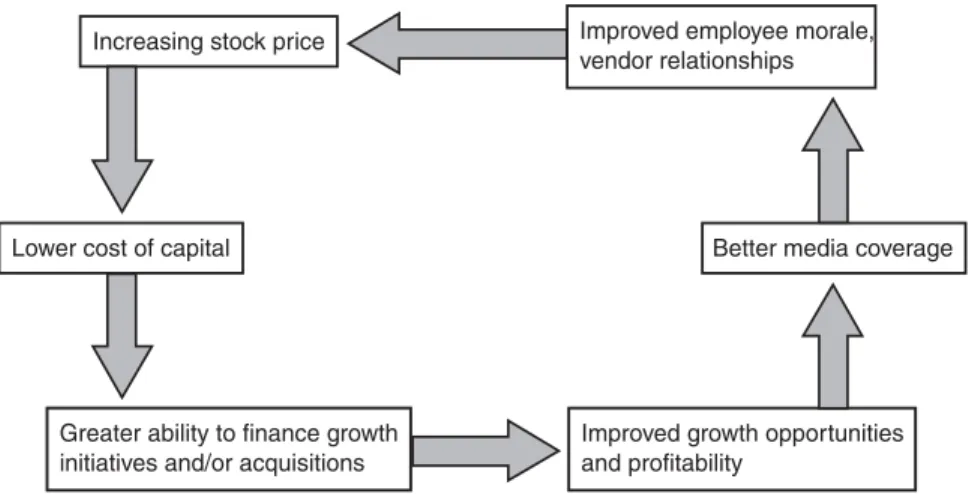

THE VIRTUOUS CYCLE OF A HIGH STOCK PRICE

VALUATION—THE OBVIOUS AND THE NOT-SO-OBVIOUS

This is basic information that can be easily gleaned from a company's financial records and should be included in income statements, cash flow statements, and balance sheets. The intangibles are the nuances of value, managing expectations and perceptions, and the ability to define, deliver, and create dialogue about a company's financial performance and position in its industry.

AIR TIME FOR THE PRIVATE COMPANY

The opinions of capital markets professionals, especially analysts but sometimes portfolio managers, are often cited by the media, and the media is an integral force in shaping public perception and shaping a company's reputation. So for private companies to have equal representation in the public eye, they must at least be a glimmer in the eye of the capital markets.

INVESTOR RELATIONS, TAKE 2

An IR strategy is of great value to the private company in putting the message out there. Privates can talk to the world, make predictions about themselves and the industry, and potentially influence their competition's perception and cost of capital, yet never be held to the regulatory accountability that comes with life as a public company.

GLOBAL IR

For those companies seeking capital, the sell-side has access to investors and the means and motivation to serve them. The sell-side's ability, through its analysts, to provide research on companies and recommend stocks underscores the analyst's importance in the capital markets.

THE SCOOP ON THE SELL-SIDE

Research and sales and trading, and the investment banking function of the business operate separately, with a figurative Chinese wall preventing information from passing between them. Finally, there are numerous independent research firms that only publish research and have no investment banking capabilities.

IR RELATIONSHIPS WITH THE SELL-SIDE

Directing the perception of the sales side is a very effective means of leveraging the company's message. The company's profile should also be attractive in terms of potential investment banking and trading fees, but given the new regulatory environment, this should not be a concern for analysts.

THE SELL-SIDE/BUY-SIDE RELATIONSHIP

Given these facts, IR professionals are essentially competing for shelf space in the analyst's mind, and the best way to get on the shelf is to think like analysts do and understand how they are compensated. The IR professional typically has a small window of opportunity to deliver the company story, and that story must immediately appeal to the analyst as a stock picker.

EQUITY RESEARCH

An analyst's goal is to perform a complete analysis of a company in order to estimate its value based on the current share price and then make a "useful" recommendation to investors. While the analyst strives to paint a comprehensive picture of the industry, the private company must convince the analyst that any portrait is incomplete without them.

ECONOMIC EVENTS

THE IR IMPERATIVE

The nice thing about institutional and retail investors is that their objective is the same as that of the company. If they believe in the company and management, then they are more likely to buy and hold, which can reduce volatility and keep the stock price at an even, rising level.

THE BUZZ ON THE BUY-SIDE

An investor who understands the long-term investment thesis is a valuable partner because this investor takes some supply out of the supply-demand equation, setting the table for a demand imbalance should the company's earnings increase. IR that helps management effectively deal with short-term fluctuations in inventory caused by these players is invaluable.

MANAGEMENT AND THE INVESTORS

IR RELATIONSHIPS WITH THE BUY-SIDE

It is paramount to have an IR effort that can identify short sellers, understand the situation and extract the emotion from the matter. Strategic advisors who have been in their seats understand investment objectives and the current issues that can cause short-term volatility.

THE STARTING TEAM

VERTICAL AND HORIZONTAL STAKEHOLDERS

THE COMPETITION

Companies want to disclose as much as they need to, but not too much, while investors and analysts demand more and more information. Getting this fine line right is important for all groups: regulators, investors and analysts.

THE GOVERNMENT—SEC, FASB, AND INDUSTRY REGULATORS

It can also influence public perception, which can then influence consumer behavior and ultimately have an impact on a company's business. Business and media relations efforts must follow the strategic goals of an IR program and pay close attention to the company's financial performance, its investment benefits, and the expectations Wall Street places on the company.

AN INTEGRATED PLAN

This knowledge is essential, because once a story leaves the company's doors, it's up to others to get it right. Because the company can no longer control how the story is told, the company must do everything in its power to make sure that those who control the story actually understand the story.

THE AUDIENCE

These functions should work closely together in communicating with all constituencies that influence the capital markets, especially the media. Just as public relations professionals should know how capital markets will react to key decisions, public relations professionals should anticipate media interpretation.

POSITIONED TO BE PROACTIVE

EXPOSURE AND EQUITY

These individuals were sensitive to hype and were unaware of the cyclical nature of the stock market and the risks associated with it. The source of excitement was not only technology, but also access to the affair.

THE ROCKY FOUNDATION FOR ANALYSTS

The strong economy created a perception of wealth and disposable income that drove new investors to the market. The punchline to the joke, however, and the reality for almost every investment professional on Wall Street, was that almost any rating other than Strong Buy was considered a sell.

MANAGEMENT’S MUDDLE

However, analysts were less to blame for these conditions than the upper management at the investment banks. At the very least, analysts who didn't fly the flag risked alienation by buy-side fund managers, potentially cutting off millions in commission business for the investment bank.

SNAPPING OUT OF IT

In 1934, Congress created the Securities and Exchange Commission to establish and enforce rules for the financial exchanges and corporations that would keep the capital markets fair and open. Material information is generally defined to mean anything that would affect the understanding and decision-making of an investor – that is, anything that would cause a rational investor to act.

MATERIAL INFORMATION

For the past 70 years, the SEC has regulated the markets and overseen corporate mergers, acquisitions, and financing activities to protect investors. Along with IR, however, management must also exercise some degree of restraint in releasing too much news to the financial wires.

TO ONE AS TO THE MANY

However, material information is not limited to these items, so management must be prepared, along with legal and IR, to determine materiality on an ongoing basis—in other words, what information or events should be disclosed to the investing public. Therefore, those who have access to the relevant information before others have a clear trading advantage.

PUBLIC TALK

To level the playing field, all participants must receive information at the same time, which the SEC tried to enforce with Reg FD. What the last few years have revealed is the fact that while companies may have disseminated material information to the markets, they may have selectively disseminated that information to some and not to all.

REGULATION FAIR DISCLOSURE, REG FD

This activity was standard operating procedure and the general public was left out in the cold in the form of delayed information. Once in the business of seeking additional information from management teams over dinner or in one-on-one meetings or conference calls, the analyst must now work with widely disclosed information.

THE SARBANES-OXLEY ACT

Being an "ax"—the most influential analyst on a particular stock—these days has less to do with a personal relationship with the CEO and more to do with traditional research. The government has taken steps to improve the transparency of these numbers and increase the accountability of the people behind them.

RISING TO THE OCCASION

After the pinprick, the market emptied, the government stepped in, and the communications landscape became even more complex. Although companies, analysts and investors agreed that practices needed to change, many of the new rules caused confusion and some CEOs responded by withdrawing from the market altogether.

SELL-SIDE IMPLICATIONS

Instead, the small firm typically looks for an undervalued and under-followed stock that the entire firm—including sales, trading and investment banking—can get behind. However, one of the biggest criteria for any sellable firm, whether large or small, is that the analyst must believe in management and its ability to manage the Street.

BUY-SIDE

Given this new world, where the wrong email or the wrong procedure can end a career, it's important to understand what kind of companies attract sales analysts. Analysts will only recommend companies whose executives they trust, executives with an established strategy and an understanding of how the Street will react to that strategy.

MANAGEMENT MUST LEAD

While Reg FD and Sarbanes-Oxley have made some CEOs disillusioned, any CEO who thinks it's better to stay silent—when bad news comes out—risks losing credibility with the investment community and key stakeholders. It's the difference of being proactive vs. reactive, the latter is always more difficult.

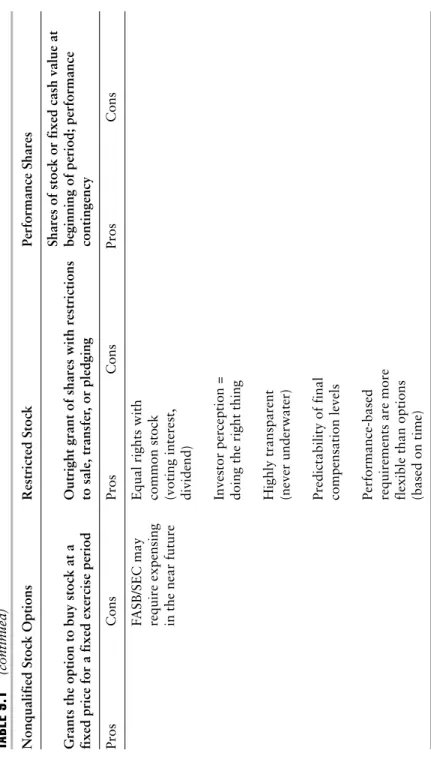

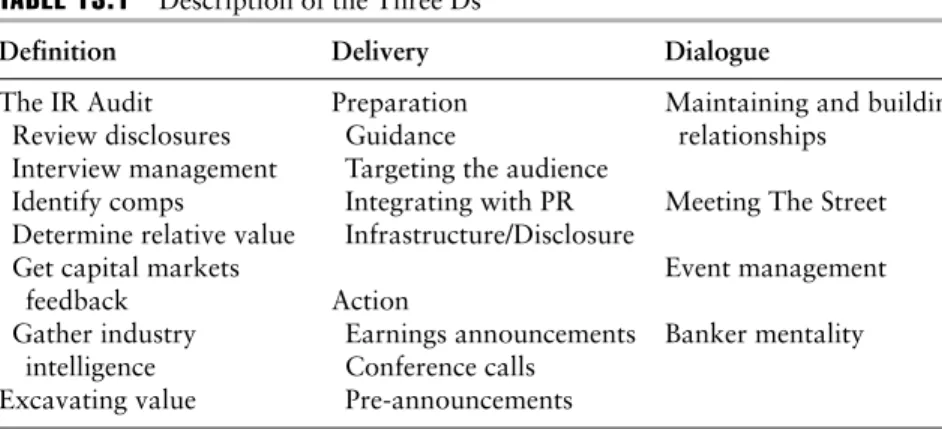

COMPENSATION

Sealed Air of Saddle Brook, New Jersey, issued restricted stock as part of four components: cash salary, benefits, performance-based restricted stock and a management-by-objectives program. Recipients of restricted stock paid $1 per share for stock certificates, which vested after three years.

IN THE BOARDROOM

Other companies that have switched to restricted stock or reduced stock options include Altria Group, Citigroup, Dell Computer and Cendant Corp. Analysts and investors examine these and many other questions to assess management accountability and the accuracy of a company's financial statements in calculating the credibility of disclosures, the feasibility of checks and balances policies, and the character of company management.

A TANGLE OF TRAPS

IR can manage the process by helping the board communicate the principles by which the company is run. Although Reg FD and Sarbanes-Oxley have increased requirements for companies, accountants, analysts and bankers, they serve to do much more than complicate the processes.

POST-BOOM IR

SEC filings are the raw materials of IR, and what one does with them can determine the success of financial communications. On the other hand, if a company goes out of its way to explain these rather dry documents and makes an effort to target and solicit the right investors at the right time, success can increase the organization's visibility and raise the company's profile. overall value.

THE ESSENTIALS: PUBLIC FILINGS AND MEETINGS

10-K: A fiscal year end report to the SEC that summarizes business and financial activities for that year. The 10-K is more comprehensive than the annual report. MD&A: Management's discussion and analysis is an important, mandatory part of the 10-K and 10-Q filings.

THE ESSENTIALS: DELIVERY VEHICLES

This is due to Reg FD as well as the quest to control the information that the buy and sell side digests. The conference call is also management's opportunity to define its business rather than waiting for the analyst to do so in writing.

ADDITIONAL IR TOOLS AND VEHICLES

Newsletters: Periodic newsletters to employees, partners and investors are a good way to keep stakeholders informed and capture the attention of key constituencies. The hope is to generate interest so that the buy side will buy and the sell side will publish.

OTHER BASIC IR PRACTICES

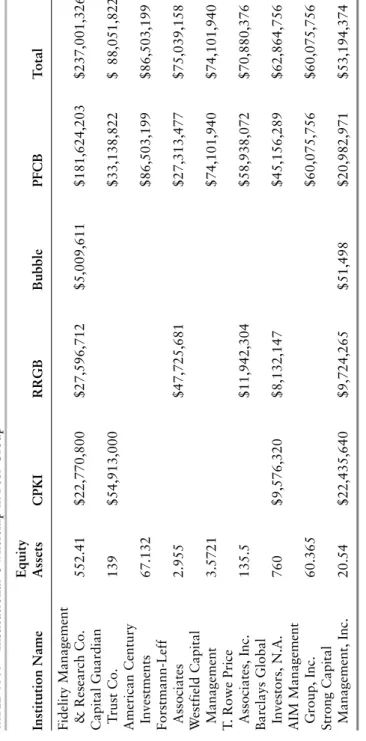

The composition of institutional ownership and the percentage of institutional ownership in relation to the whole is an indicator of a company's image in the eyes of the capital markets. IR should constantly research the capital markets to understand the sell-side and buy-side attitudes towards the company.

RESOURCES FOR TRADITIONAL IR

REVAMPED, RAMPED UP, AND REDEFINED

For example, it is best if management does not discuss valuation with analysts and portfolio managers. The disclosure of estimates by a company to The Street, guidance, is perhaps one of the most essential practices of IR that this book covers.

A BETTER APPROACH

In public companies, the IR function is either a department, a specific task for a professional or a need that is fully or partially outsourced to an external company. The backgrounds of professionals performing the IR task vary: PR, media relations, accounting, finance and law.

THE COLLABORATION

Like capital markets professionals, PR people know how to say what the media needs to hear, which contributes significantly to the IR strategy. As much as IR packages a financial product for consumption on Wall Street, PR professionals create an easily digestible package for the media and other constituents.

MAXIMIZING VALUE THROUGH AN INTEGRATED APPROACH

In addition, they undoubtedly have relationships with former colleagues in the markets, which is invaluable for monitoring current trends. Another essential component of an optimal IR team are public relations or corporate communications professionals.

ONE-TWO PUNCH

HIRING IR

Even after paying the inevitably high price to acquire these experts, new hires still have a lot of catching up to do with the company, its operations, metrics, industry, competition and market.

INTERNAL VS. EXTERNAL IR

ONWARD AND UPWARD

Another is industry, specifically strategic partners in the arena, who may have insight into competitors and consumers. The difference between traditional IR and this book's view of IR is the difference between hope and control.

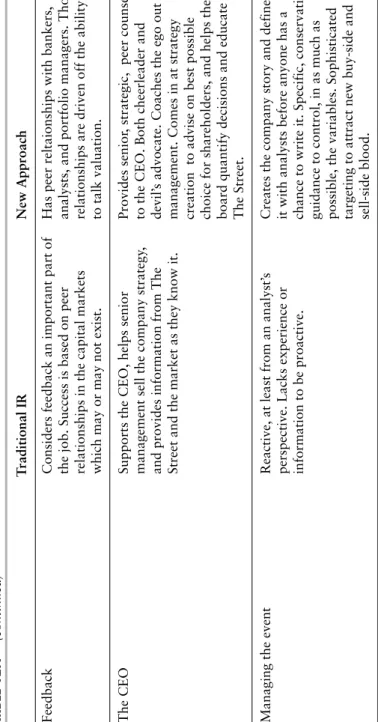

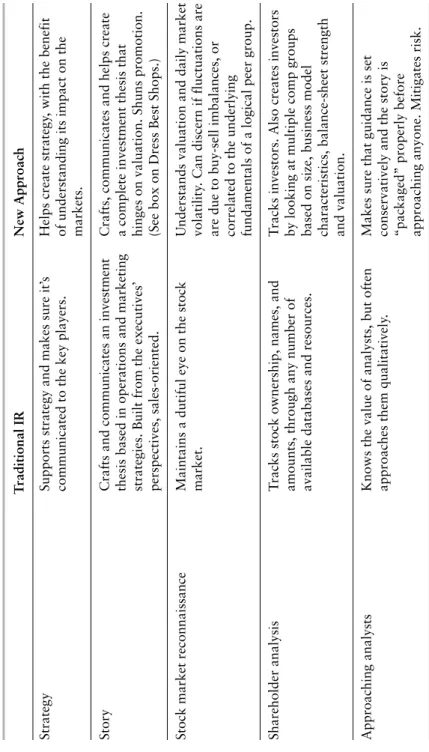

OUT WITH THE OLD

As a result, the cost of any IR effort, no matter how sophisticated, is nominal relative to the prospect of damaging the company's valuation by even one multiple point—a fine that would mean, for example. The CEO Supports the CEO, helps senior Provide senior, strategic peer management advice to sell the company strategy to the CEO.

TRANSFORMING IR

Capital markets and public relations professionals with experience on the other side of the table are a good place to start when implementing a new IR. The management team and the public company are the product, and IR packages are that product for Wall Street consumption.

STRATEGIC IR

These people should not only have communication skills, but should also have the ability to understand capital markets and value companies like an investor would. Capital markets professionals seem to have the best experience for this job, as they have a unique understanding of Wall Street and, in particular, how investment banks operate.

IR RESPONSIBILITIES AND OBJECTIVES

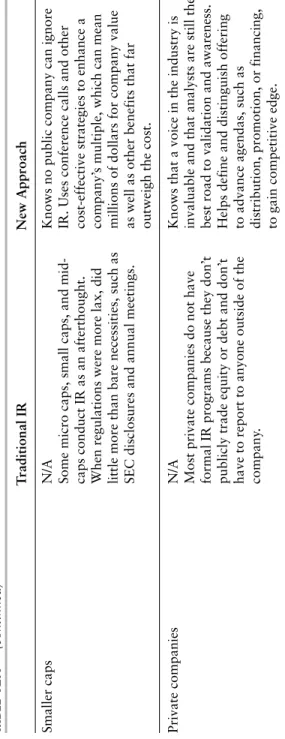

DEFINITION

A company that knows its peers and understands its value relative to those peers can do a better job of communicating its value story.

DELIVERY

DIALOGUE

MEGA CAPS

LARGE CAPS

SMALL CAPS

When the CEO or CFO takes on these corporate communication tasks, they almost always end up lower on the priority list. The primary duty of a CEO or CFO is to run the business and deliver the expected financial performance.

IPOS

The CFO divides the tasks, and this is usually done with the help of internal administrative support. This type of proactive communication planning is how companies garner a premium rating: the CEO's goal and all shareholders' goals.

HIGH YIELD

PRIVATE

INTERNATIONAL

THE APPROACH TO STRATEGIC IR

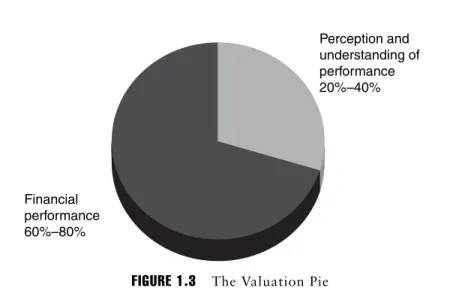

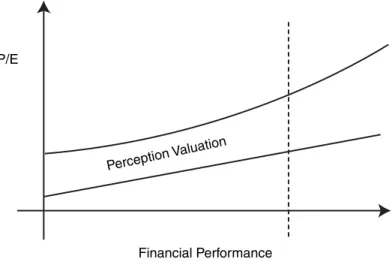

UNDERSTANDING THE ART AND SCIENCE OF VALUATION

The art element is how that financial performance is communicated (how, when, what, to whom and by whom) relative to expectations. We strongly believe that the art portion of valuation can account for anywhere from 20 to 40 percent of the total valuation at any given time.

THE MANAGEMENT PIECE OF VALUATION

However, before any interaction between The Street and the company can take place, a company must define its current position and future plans. The IR audit is the first step in self-realization for companies and the first step in sharpening their peer group.

STEP ONE: REVIEW DISCLOSURES, ANALYZE FINANCIALS

STEP TWO: INTERVIEW SENIOR MANAGEMENT

The interview process should bring the SEC disclosures to life and give IR a better idea of the overall company and competitive landscape. After the interview phase, the IR may decide that if the CEO comes along, his lack of immediacy with the numbers will require the CFO to come along to every meeting.

THE STAKEHOLDERS

STEP THREE: IDENTIFY COMPARABLES

The takeover and redefining of its tradeoff set repositioned the company to significantly increase shareholder value. Once the appropriate group is created, all company communications must be linked to the new comparables.

STEP FOUR: DETERMINE RELATIVE VALUE

Creating this new group was a great fresh start and a new perspective for the analysts and their sales forces. Had that repositioning exercise not been undertaken, The Street likely would have continued to define the company in a low-multiple industry.

STEP FIVE: GET CAPITAL MARKETS FEEDBACK

If a company is undervalued, it is because they are poor communicators or it is a negative opinion of management. Perhaps ultimately they think the company is inconsistent, lacking credibility, routinely over-promising and under-delivering.

STEP SIX: GATHER INDUSTRY INTELLIGENCE

The last step in an IR audit, before developing the company's story, is to inform the industry. IR should know how The Street measures the industry in order to discover and highlight relevant topics within the company.

THE RESULT OF THE IR AUDIT

These steps, initiated by the management and the ERO, should pay dividends in terms of closing the aforementioned valuation gap. With a focus on company knowledge, industry intelligence and relative valuation, IROs will find that when fully informed, they have the right tools to advise a busy CEO and the confidence to talk to even the most seasoned analyst. sophisticated.

EXCAVATING THE STORY: EXAMPLES

Third, The Street had always viewed one of the company's product lines as overly specialized with no growth potential. The company was actually very well diversified, minimizing risk in four different parts of the company.

FROM DEFINITION TO DELIVERY

The first part of the delivery phase is to ensure that all parts of the package are in place. This second part of the delivery phase is outreach, which includes providing the investment community with information and access to management through earnings releases, conference calls and, when appropriate, advance notices.

GUIDANCE

Delivery fits organically with all steps of IR and is anchored around the plans, disclosures and engagements a company has with the capital markets.

THE LINCHPIN OF EFFECTIVE IR

Especially in the case of no guidance, when management refuses to quantify the future, analysts are completely blind in developing forecasts. A good relationship with the sell-side can help the company and protect shareholder value in the long run.

GIVING GUIDANCE

If management advertises too much or gives no guidance at all, the credibility of the analysts is compromised, and these are the people the company needs most in the long run. The analyst is someone who wants to protect the company whenever possible, and protection in this case means conservative guidance based on conservative and transparent assumptions.

SHORT-TERM GUIDANCE VS

SHORTSIGHTED GUIDANCE

In the latter case, if lawyers simply dominate the debate and make the decision, management should be extremely careful about intra-quarter conversations with analysts and portfolio managers about the business.

THE NUANCES OF GIVING GUIDANCE

By that point, IR told the CEO that if Wall Street believed the $2.60 valuation, the stock would be at least $20 per share. In reality, this CEO was not receptive to IR advice and did not really understand the nuances of the stock market.

THE CONSENSUS NUMBER

THE CONSENSUS WITHOUT GUIDANCE

By comparison, during the fourth quarter of 2002, the company reported revenue of $25.8 million and earnings per share of $0.13. See the attached table entitled “Comparison of Pro Forma Diluted Earnings Per Share” for a tabular representation of the reconciliation.

NOT TO MENTION REG FD

These first call quarterly earnings targets are generated continuously, regardless of whether a company has issued guidance or not. Before the year begins, each company has the opportunity to influence the First Call consensus through a conservative, self-imposed bogey.

THE CONSERVATIVE TIGHTROPE

Additionally, we believe management has historically been conservative.” The leisure analyst rated the stock a Buy and called for a 25 percent upside in the report. In our view, conservative guidance can foster a powerful cycle where equity value is maximized, Wall Street benefits, and the entire organization becomes stronger.

UNDERSTANDING THE STREET

TARGETING THE BUY-SIDE

With the company's message defined and the complex issues around guidance decided upon, it's time to target analysts and investors. Portfolio activity, specifically as it relates to the company's industry (are they buyers or sellers during any given quarter?).

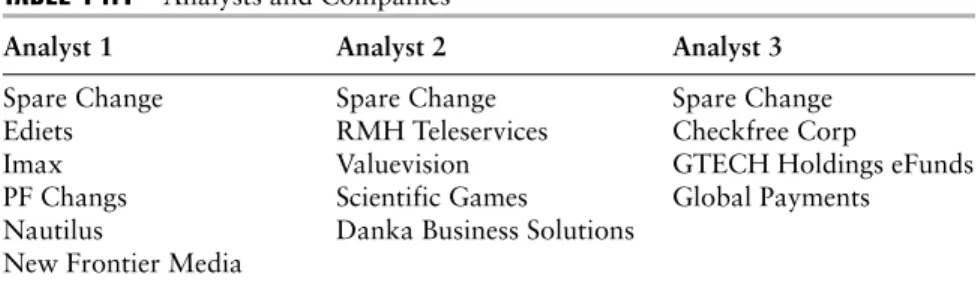

TARGETING THE ANALYSTS

After IR discovers the top shareholders of the company, a peer analysis must be performed and the top shareholders of the comp base identified. If an institution does not own shares of the company, but buys many other companies in the industry, there is an opportunity to target this institution as a potential buyer.

THE RESEARCH HURDLE

THE ANALYST’S MOTIVATION AND INCENTIVE

THE MIND, AND DAY, OF AN ANALYST

Integrated public relations and public relations efforts maximize the time and money spent on corporate communications and generally reduce a company's risk profile. PR can also increase a firm's equity if it contributes to the perceived value equation.

MEDIA MACHINATIONS

BASIC PR

PR AND IR

UNDERSTANDING THE AUDIENCE

PERSONALIZING THE PITCH

Most of the time the media is looking for something new, distinct, creative and exciting. Then IR and PR focused on the specific needs of the reporter who wanted the exclusive and considered the angles that would appeal to general media.

UNCOVERING THE ANGLE

When PR must make the choice of one outlet over another, they must weigh the importance of each channel over the long term. Similar to the way IR tunes in to the specific needs of investors, PR must tailor the story to meet the demands of each outlet.

STAYING AHEAD OF THE STORY

CLOSING THE LOOP

One of the company's customers shared an interesting story about how the company's software solutions attacked some problems it had and added value to the customer's bottom line. After placing this story on the software company's website and in media marketing materials, several journalists picked up on the angle of the difference a company can make, and the software provider received positive press.

PR AND GUIDANCE

It is clear that employees develop pride and satisfaction from the firm's solid financial performance. Providing conservative financial guidance sets the stage for an integrated public relations effort that can successfully feed the media, employees and suppliers, thereby raising the performance of the entire organization.

SUPPORTING IR

First Call is also the source for analyst research, and access to that research allows IR to scan Wall Street opinions for every company in the industry, which can be especially valuable around conference calls to gather intelligence about Wall Street's perception of any given quarter. This mitigates the example of leaks to Wall Street or the media and should make it clear that talking to analysts can be.

READY TO GO

Furthermore, if things are going to change materially from what is expected, these money managers want to know as soon as possible. Predictability is good, surprise is bad, and when it comes to performance, the pattern of delivery can sometimes be just as important as the actual results.

EARNINGS ANNOUNCEMENTS

However, if the more extensive guidance portion of the release hadn't been packaged as a subtitle, chances are the media may have ignored this highly material piece of information. For that reason, the release and the quotes are both templates for disclosure, so any direct word from the company should be considered and thought out.

THE CONFERENCE CALL

The voices on the conference call become the public voices of the company, and the public role of company executives should reflect their jobs. In other words, the announcement and subsequent analyst call were diluted in the turmoil of the day.

PRE-ANNOUNCEMENTS

If this is the case, getting the news out as soon as possible is even more important, but again not before management disagrees with the revised scope. If the company says no, then it's better not to reveal new information in the near future.