This thesis is submitted as partial fulfillment of the requirements for the master's degree in mathematics. This work investigates the pricing of Asian options under a modified version of the pioneer model Black Scholes [3]. Several illustrations of the solution will be offered to demonstrate the effectiveness of the methods used.

I am also grateful to Dr. Adama Diene, Chair of the Mathematics Department, and all my professors in the department for their support.

Introduction

Financial Derivatives

Asian Options

Thesis Objective

To our knowledge, existing research on Asian options pricing does not consider a hybrid model that combines jumps and high volatility. This work examines the pricing of Asian options in a high-volatility market by leaps and bounds, using a modified version of the groundbreaking Black Scholes model. In this thesis it is proposed to model the underlying asset using a stochastic differential equation with jumps and high volatility.

The pricing problem will be addressed using stochastic calculus tools such as Ito's formula, and this assignment will use numerical techniques for finance to obtain a solution to the pricing problem. Previously, the goal was to solve equation (1.1) and then calculate the Asian options price given by the formula. Comparison of our results with existing models in the literature After this introductory chapter, the rest of the dissertation is structured as follows.

Other concepts such as Stochastic Differential Equations (SDE), Poisson process, the jump-diffusion process and the Itô formula for the jump-diffusion process which are also needed in our thesis can be found in this chapter. In this chapter, the Itô formula is used to obtain the solution of the SDE of the underlying model. Moreover, the derivation of the PDE of the Asian option under our model is discussed with the same methodology of [9].

Financial Products and Derivatives

Financial Markets and Products

- Financial Assets

- Financial Derivatives

The value of the financial asset depends on the type of contract or ownership claim. Stock is defined as the financial claim that shows the comparable ownership of the investor or the holder against the earnings and overall assets of the business for which the shares are issued. Different countries do have different currencies, but currently in the world one of the strongest currencies is the US dollar.

Silver and gold are the most common commodities traded in the commodity market over the years. The price for these derivatives can be derived from the fluctuations that occur in the underlying asset. A forward contract is a personal contract between two parties, for which the settlement takes place on a predetermined specific date in the future for a price that is settled today.

These are bilateral contracts and they are exposed to demand that one of the contracting parties does not fulfill the transactions and does not fulfill the contract. A futures contract is a type of contract between two parties where both parties (buyer and seller) agree on factors or sell the specified asset considering a specific quantity and a predetermined price on a date that is specified. in the future. In future contracts, at the beginning the exchange needs both parties for a nominal account which is part of the contract and is known as margin.

Types of Options Contract

- American Option Contract

- European Option Contract

The American option contract style allows the investor to profit at any time if the price rises, so you don't have to wait for the contract's expiration date. Usually, the last day to exercise a weekly American option is the Friday of the week in which the contract expires. Unlike the monthly American option, the third Friday of the month is the last day to execute the contract.

A European option is a type of option that limits the execution of the contract only at the time of expiration, unlike American options, this type of option does not allow the holder to execute the contract at any time before or at the option expiration time . The European index options stop trading when business closes on the Thursday before the third Friday of the expiration date. This gap in trading gives brokers the ability to price the assets of the underlying index.

All options contracts give the holder this right to exercise their right before or on the expiration date of the option contract at a specific price known as a strike price. Normally, the trading price of the underlying asset is compared to the strike price to calculate profitability, but with path-dependent options, the price used to determine profitability can vary. This price can be the highest or lowest trading price of the underlying asset, but it can also be a trigger event, such as the underlying asset hitting a specific price.

Asian Options

A path-dependent option is an exotic option whose value depends not only on the price of the underlying asset, but also on the path taken by the asset during the life of the option. The value of soft-dependent options is based on a single price event that occurred during the option's life. Some of these options take the average price, which is sampled at different time intervals.

Value of soft dependent options is based on a single price event that occurred during the option life. The average price of an asset observed over a specific period of time is known as the average price. This can be easily calculated by finding the simple arithmetic mean of closing prices for a specific time.

With the traded volume adjusted, the (VWAP) volume weighted average price can be calculated on an intra-day basis. Compared to other options, Asian options generally have low volatility due to the averaging mechanism. Asian options are also generally cheaper than their standard counterparts, since the volatility of the average price is less than the volatility of the spot price.

Stochastic Tools

- Stochastic Processes

- Brownian Motion and Itô Formula

- Poisson Process

- Jump Diffusion Process and Ito Formula for a Jump-Diffusion Process

A stochastic process(Xt)t≥0 is known to be adapted to filtration(Ft)t≥0 if for each t ≥0 there is a random variableXt that is measurable with respect to Ft. It is observable that if the stochastic process (Xt)t≥0 is adapted to a filtration (Ft)t≥0 and also that ifF0 contains all the subsets of F that have zero probability, then each process(X˜t) t≥0 that satisfiesP(X˜t=Xt) =1,t≥0 is adjusted for filtration(Ft)t≥0. A stochastic process(Xt)t≥0 that is adapted to filtration(Ft)t≥0 is called progressively measurable with respect to the filtration(Ft)t≥0if for each≥0,.

However, the following theorem shows that a continuous and adjusted stochastic process is gradually measurable. If a continuous stochastic process (Xt)t≥0 is adjusted with respect to filtration (Ft)t≥0, then it is also progressively measurable with respect to it. Note that Brownian motion is a continuous time stochastic process that has stationary as well as independent Gaussian distributed steps and continuous paths.

It can be defined as a stochastic process that models the arrival of events over time, where the number of events occurring in a fixed-length time interval is a random variable following a Poisson distribution. It is most commonly used to model a random series of events that occur in a continuous time, such as the arrival of customers in a store, the number of earthquakes that occur in a region over a period of time, or the number of photons detected by a sensor in a certain time interval. Random events are taken into account. It is a generalization of standard Brownian motion, which is a continuous stochastic process, but with the added feature of allowing sudden, discontinuous jumps in the process.

Pricing Asian Options in a Jump-Diffusion Model with High Volatility

- Introduction

- The Model

- Solution of the Underlying Asset Price SDE

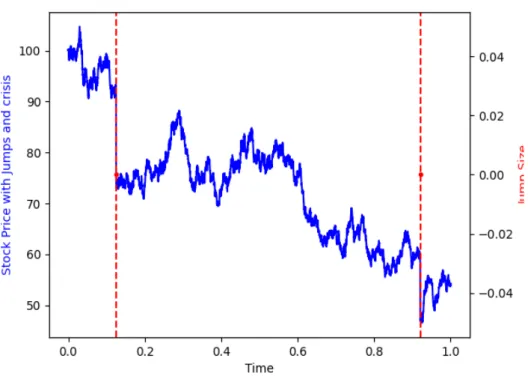

- Pricing Jump-Diffusion Model During Crisis

- Numerical Simulations

- Simulation of the Brownian Motion and the Poisson Process

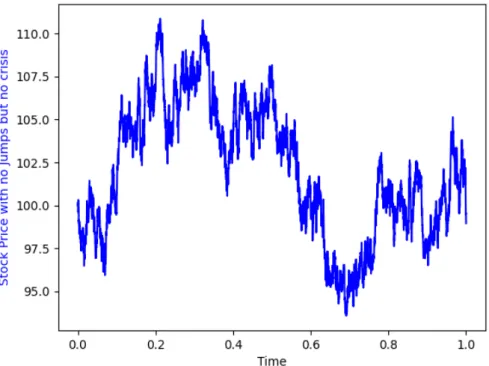

- Illustrations

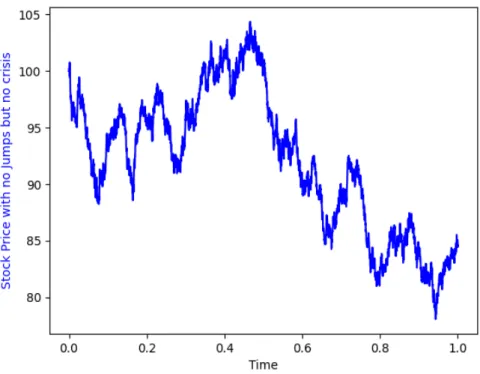

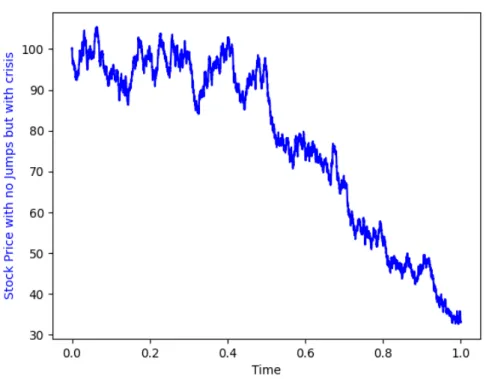

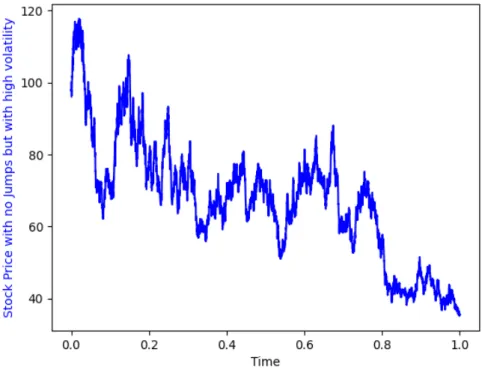

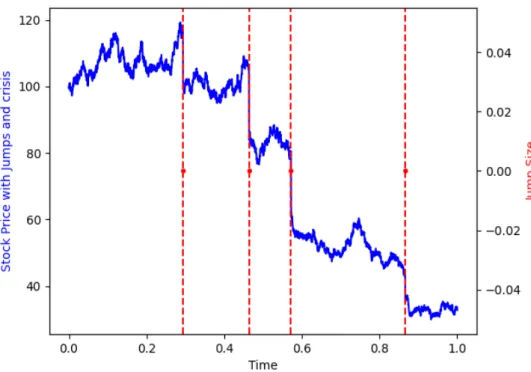

The parameter µ represents the yield of the underlying asset price and σ is its volatility when β =0. The aim was previously to solve Equation (4.3), and then derive the PDE of the price of Asian options under the proposed model. In the next lemma we provide the solution of the SDE of our model where the coefficients of the model r,σ,a,bandλ are all constant.

Note that the process (ξt)0⩽t⩽T given by (4.6) corresponds to the solution of the SDE resulting from the fundamental price of the asset, if β =0. This section discusses the Asian option pricing PDE with profit given by equation (1.2) under combination crisis and jumps. Using the European options PDE derivation methodologies in the existing literature, see for example, we obtain in the following proposition the PDE characterizing the Asian option price of our crisis with the jumps model.

If we assume that we invest the value of the option in a portfolio consisting of the underlying asset priceSt and a risk-free asset with a current interest rate. The market is incomplete and we aim to minimize the difference between the value of the portfolio V expressed in equation (4.14) and the price of the option as given by equation (4.12). The above equation can be reduced to the PDE for the Asian setting in the case of Geometric Brownian motion model when b=β =0.

We use the Euler scheme to discretize the SDE of the model given by equation (4.3). The details of the Brownian motion and Poisson process simulations are described in the following subsections.

Conclusion

Merton, "On the Pricing of Corporate Debt: The Risk Structure of Interest Rates," The Journal of Finance, vol. Heston, "A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options," The Review of Financial Studies, vol. Vecer, “A new pde approach for pricing arithmetic mean Asian options,” Journal of computational finance, vol.

Curran, "Valuing Asian and portfolio options by conditioning on the geometric mean price," Management science, vol. Al-Refai, "Option pricing in jump diffusion markets during financial crisis," Applied Mathematics & Information Sciences, vol. Bates, "Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche Mark options,” The Review of Financial Studies, vol.

Harmanani, “Option pricing in post-crash relaxation,” Physica A: Statistical Mechanics and Its Applications, vol. Al-Mdallal, “Numerical Simulations for Option Pricing in Jump Diffusion Markets,” Arab Journal of Mathematical Sciences, vol.