Financial accounting provides the rules and structure for disseminating financial information about businesses (and other organizations). Answer: Many possible benefits can be gained by acquiring a strong knowledge of financial accounting and the means by which information is communicated about an organization.

Incorporation and the Trading of Capital Shares

Question: Buying equity shares is an extremely popular investment strategy among a wide range of the population. One of the great advantages of incorporation is the ease with which capital stock can usually be exchanged.

Using Financial Accounting for Wise Decision Making

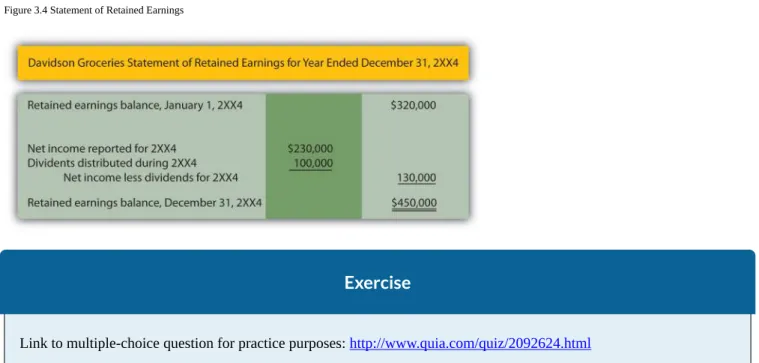

Answer: The financial information reported by and about an organization consists of data that can be measured in monetary terms. Financial accounting therefore provides financial information as well as explanatory verbal explanations to help users evaluate the financial health and potential of a particular organization.

Video Clip

End-of-Chapter Exercises

Which of the following would not be considered an example of a decision made using accounting information. Explain how each of the following can use the information from Nguyen Company's financial statements.

What Should Decision-makers Know So That Good Decisions Can Be Made about an Organization?

- Creating a Portrait of an Organization That Can Be Used by Decision Makers

- Dealing with Uncertainty

- The Need for Generally Accepted Accounting Principles

The availability of these authoritative guidelines played a central role in the growth of the US. Rob is the founder of the Philadelphia Chapter of ALPFA (the Association of Latino Professionals in Finance and Accounting).

Four Basic Terms Found in Financial Accounting

Sales arising from non-core parts of the company's operations (perhaps the disposal of a piece of land, for example) will be reported in a different way. A measure of the inflow or increase in net assets generated by the sales made by a company.

End-of-Chapter Exercises

Which of the following is not an example of an uncertainty that companies face in their financial reporting. Some are made for customers who have an account with Mike's Music and are billed at the end of the month.

In What Form Is Financial Information Actually Delivered to Decision Makers Such as Investors and

Creditors?

The Construction of an Income Statement

Understand that financial statements provide the structure for companies to report financial information to decision makers. Answer: Businesses and other organizations periodically produce financial statements that provide a formal structure for conveying financial information to decision makers.

Financial Statements and Accompanying Notes 2

Reported Profitability and the Principle of Conservatism

However, if neither scenario appears to be more likely, the cost is classified as an expense rather than an asset due to the principle of conservatism. The root cause of this accounting scandal, one of the largest in history, was a fraudulent decision by members of the company's management to record an expense of nearly $4 billion as an asset rather than an expense.

Increasing the Net Assets of a Company

The amount of net assets of a company is the excess of its assets over its liabilities. The source of a company's net assets (assets minus liabilities) is of interest to external decision makers.

Reporting a Balance Sheet and a Statement of Cash Flows

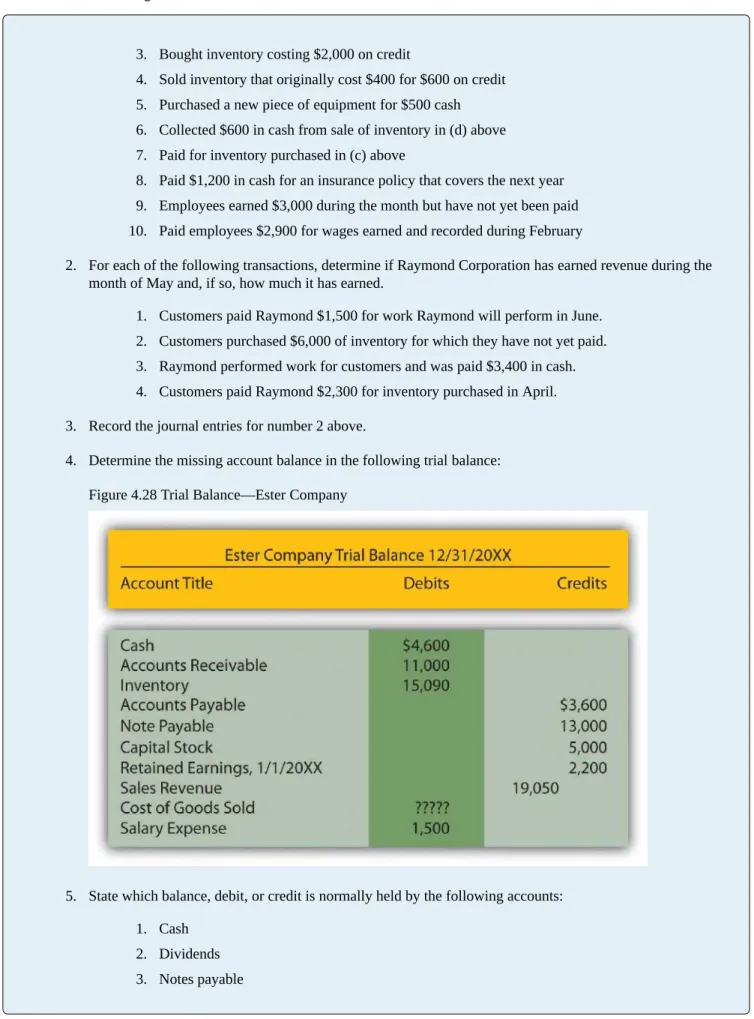

450,000 was calculated earlier in Figure 3.4 "Statement of Retained Earnings" and identifies the portion of the net assets generated by the company's own operations over the years. Question: In studying the statement of cash flows, a company's individual cash flows related to the sale of inventory, advertising, sale of land, purchase of a building, payment of dividends, and the like can be readily identified . Investing activities report cash flows from events that (1) are separate from the central or day-to-day operations of the business and (2) involve an asset.

The statement of cash flows explains how the company's cash balance changed during the year. This format shows the actual amount of cash flow created by individual operating activities such as sales to customers and purchases of inventory. This indirect method will be demonstrated in detail in Chapter 17 “In a Set of Financial Statements, what information is conveyed by the Statement of Cash Flows?”.

End-of-Chapter Exercises

The purpose of the balance sheet is to report the assets and liabilities of a company at a specific date. Unfortunately, Fisher has a lawsuit pending at the end of the year, which could result in the company having to pay a large sum of money. On which of the following statements would you find information about what a company has to help it generate income in the future and what the company owes to others.

Use the abbreviations below to indicate in which statement you would find each item below. Based on your knowledge of accounting so far, determine whether the following items should be recorded as an expense or an asset. On 10/1, Ramond paid $40,000 for insurance covering the company's property for the last quarter of the year.

How Does an Organization Accumulate and Organize the Information Necessary to Prepare Financial

- The Connection of the Journal and the Ledger

- End-of-Chapter Exercises

- The Essential Role of Transaction Analysis

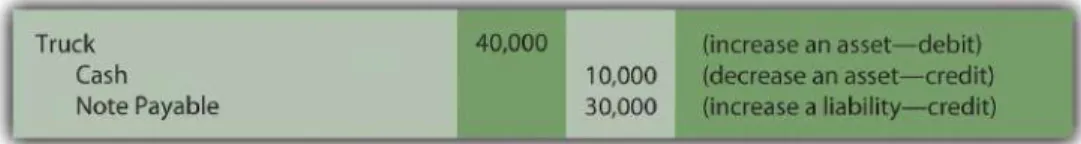

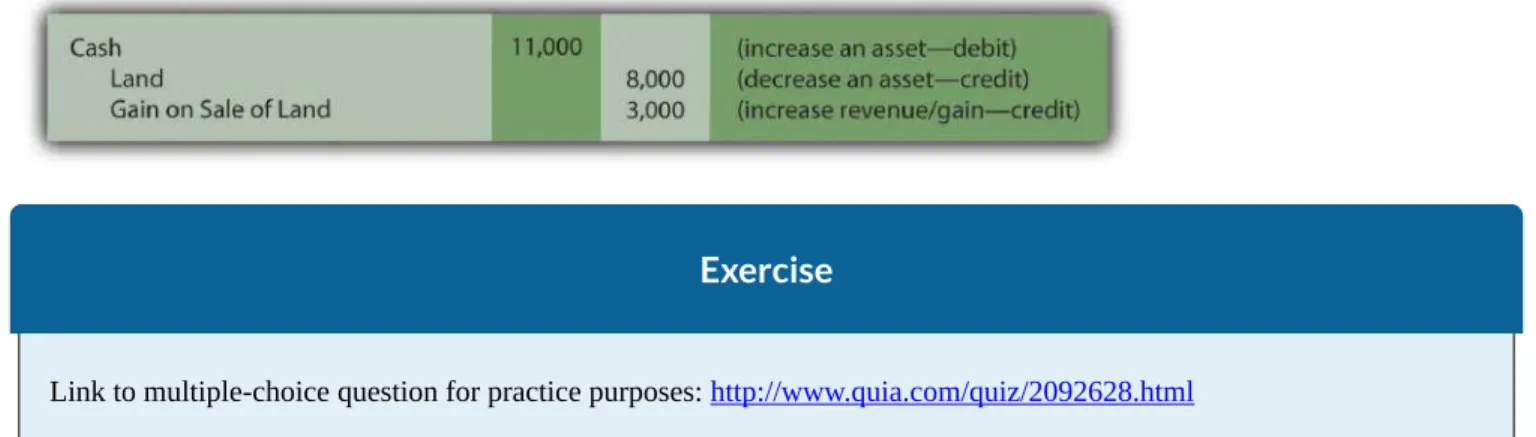

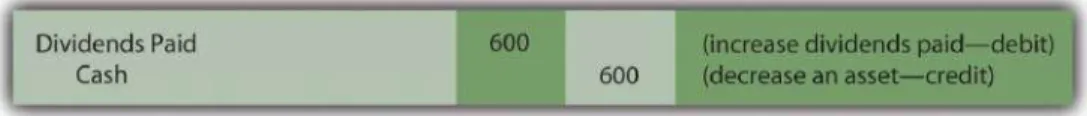

Question: Officials of the Lawndale Company decide to purchase a small piece of land by paying $8,000 in cash. An increase of $11,000 in cash is recorded along with the elimination of the $8,000 cost of the land transferred to the new buyer. Following the debit and credit rules, dividends paid are listed as one of the accounts that increase on a debit.

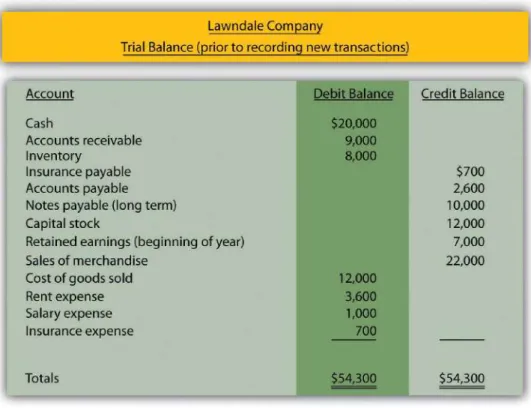

Each account includes the previous balance (BP) found in the trial balance shown in Figure 4.3 “Balances Taken from T-Accounts in the General Ledger” at the beginning of the illustrated transactions. Which of the following is the correct journal entry that Rollins should make when the $500 is received. Money was taken for twelve of the dresses, with customers owed for the remaining eight.

Transaction Analysis

The Effects Caused by Common Transactions

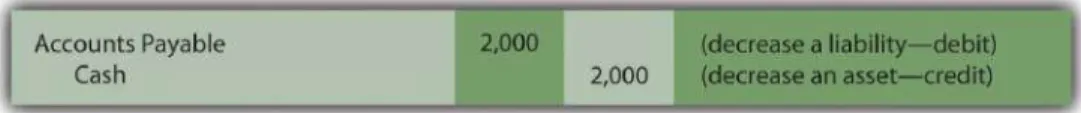

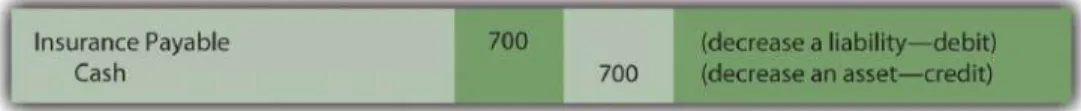

Question: Transaction 4—The inventory items purchased in Transaction 1 for $2,000 have now been sold. Question: Transaction 5—The reporting company pays $700 for insurance coverage related to the past few months. The amount was previously entered into the company's accounting system when the expense was incurred.

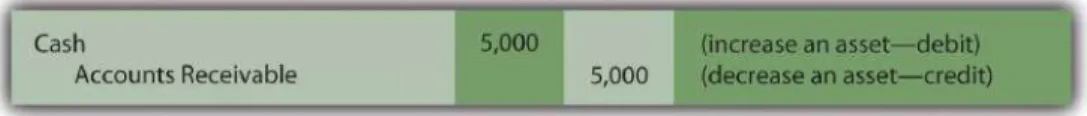

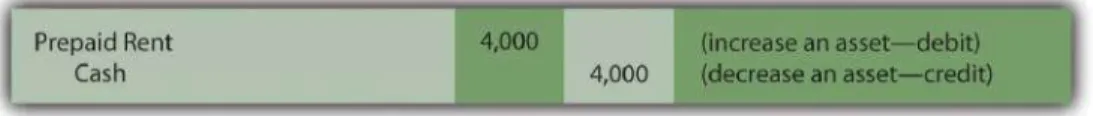

Instead, the accountant states that this increase in cash is caused by the decrease in the accounts receivable balance. Question: Transaction 10 – The company wants to rent a building for use for the next four months and pays the property owner $4,000 to cover these costs. In a perpetual system, cost of goods sold—the expense that measures the cost of inventory acquired by a company's customers—is recorded at the time of sale.

An Introduction to Double-Entry Bookkeeping

Answer: Advanced computers and other electronic devices are designed to refine and speed up the financial accounting process, but the same basic organizational procedures have been used now for hundreds of years. Fortunately, the vast majority of any company's transactions are repetitive, so many of the effects can be easily predicted. Regardless of time or place, a cash purchase of equipment increases the balance reported for equipment while reducing cash.

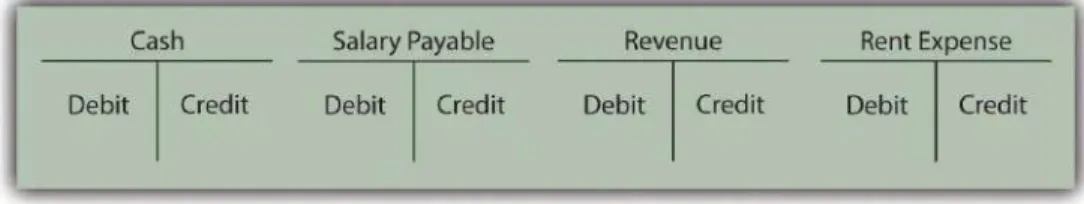

As shown above, this is recorded on the debit side of the specific asset's T account. A T-account is maintained for each of the accounts (such as cash, accounts payable, and rent expense) to be reported by a company. The left side of the T account is the debit side, and the right side is the credit.

Preparing Journal Entries

How is the acquisition of inventory on credit recorded in the form of a journal entry. Note that the word "inventory" is physically on the left side of the journal entry and the words "accounts payable". If no entry was previously recorded, which journal entry is appropriate when a salary payment is made.

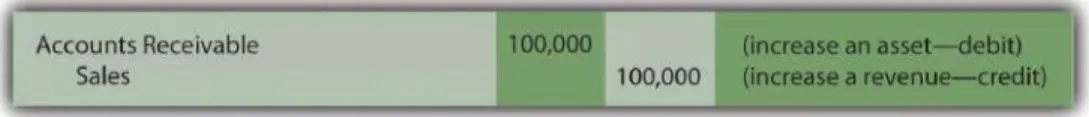

What kind of ledger does the company's accountant prepare to reflect the cash inflow received from the loan. As shown above in Journal 4A, revenue recognition is not directly linked to the receipt of cash. After analyzing the financial effects, the effect of each transaction is recorded in the company's accounting system through the journal entry.

Why Must Financial Information Be Adjusted Prior to the Production of Financial Statements?

- The Need for Adjusting Entries

- Preparing Various Adjusting Entries

- Preparing Financial Statements Based on Adjusted Balances

- Chapter Appendix

Each of the debits and credits is then posted to the corresponding T account located in the ledger. Explain the need for an adjusting entry in prepaid expense reporting and be able to prepare that adjustment. This adjustment leaves $3,000 in the asset (for the remaining three months of rent on the building) while $1,000 is now reported as an expense (for a previous month of rent).

To reconcile reported balances with accrual accounting rules, adjusting entries are created as a step in the preparation of financial statements. Explain the need for an adjusting entry in the reporting of unearned revenue and know how to prepare this adjustment. The final trial balance for Lawndale Company (including the four adjusting entries made above) is presented in the appendix to this chapter.

Final Trial Balance and Financial Statements

End-of-Chapter Exercises

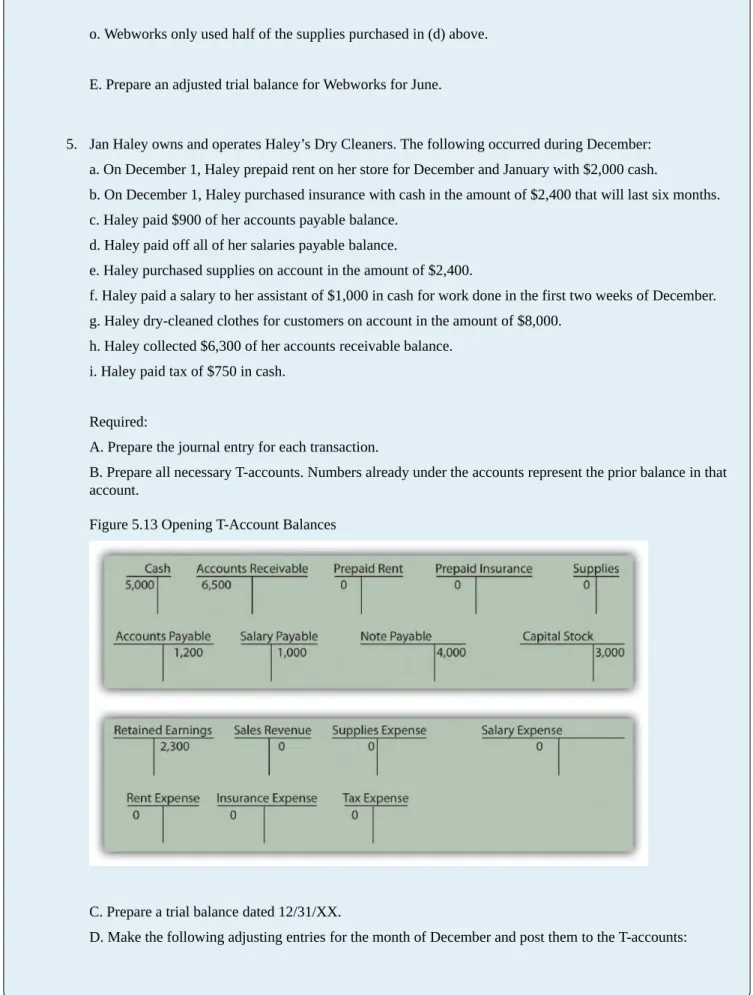

Which of the following accounts would be closed at the end of the accounting period. At the beginning of the month, Marlin agreed to perform services for the next three months for the Catsui Corporation for $30,000 per month. month. At the end of the month, Marlin owes its employees $480,000, but does not pay them until the following week.

At the beginning of the month, Marlin agreed to perform services for the Ryland Company for 127 Financial Accounting. KKCDK receives cash payment for 300 of the CDs and the student groups owe for the other 100 CDs. On the first day of the month, KKCDK pays $20 in advance for advertising in the local newspaper.

Why Should Decision Makers Trust Financial Statements?

- The Need for the Securities and Exchange Commission

- The Role of the Independent Auditor in Financial Reporting

- Performing an Audit

- The Need for Internal Control

- The Purpose and Content of an Independent Auditor’s Report

- End-of-Chapter Exercises

First, many numbers in any set of financial statements are no more than estimates. Describe the effect that the company's internal control has on the work of the independent auditor. Question: In previous discussions, the role of the independent auditor has been described as adding credibility to the financial statements.

When performing an audit, the work of the independent CPA is affected by the company's internal control. The independent auditor evaluates the quality of the internal control found in the various systems. The financial statements are identified and the second (scope) paragraph provides an explanation of the audit process.

In a Set of Financial Statements, What Information Is Conveyed about Receivables?

- End-of-Chapter Exercises

- Accounts Receivable and Net Realizable Value

- Accounting for Uncollectible Accounts

- The Problem with Estimations

- Estimating the Amount of Uncollectible Accounts

- Remeasuring Foreign Currency Balances

- A Company’s Vital Signs—Accounts Receivable

Know that net realizable value is an estimate of the amount of cash that will be collected from a particular asset. Accounts receivable are stated at net realizable value, the amount of cash expected to be collected. Then, whenever a specific account is considered bad, the balance is removed from both the accounts receivable and the allowance for doubtful accounts T-accounts.

For example, the balance in the allowance for doubtful accounts will be affected by credit sales made in the current year that turn out to be worthless by the end of the period. Here, the correct balance for the provision for doubtful accounts is determined based on the percentage of receivables that are presumed to be uncollectible. All other balances continue to be displayed at the exchange rate prevailing on the date of the original transaction.