No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Act on copyright, without either the prior written consent of the publisher, or authorization by payment of the applicable per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA by fax or on the web at www.copyright . com. Limitation of Liability/Disclaimer of Warranty: Although the publisher and author have used their best efforts to prepare this book, they make no representations or warranties as to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose.

PART THREE

PART FOUR

PART FIVE

Multinational finance takes the perspective of the financial manager of a multinational enterprise with investments or financial operations in more than one country. Thus, the purpose of this text is to provide "sufficient" knowledge in each of the most critical areas of multinational finance.

MEETING YOUR OBJECTIVES

Multinational Finance takes a market-oriented view of the multinational corporation, with separate chapters on international capital markets, portfolio diversification and asset pricing. These detailed and technical chapters provide a useful complement to the risk management chapters in Part III of the text.

KEY FEATURES

Chapters that expand on material from the first course begin with a brief review of the fundamentals. These specialized chapters are suitable for students who want an in-depth understanding of the financial tools available for currency risk management.

LEARNING AIDS

Market updates and applications that appear as boxed essays provide real-world examples and practical applications of conceptual material. More than 200 end-of-chapter concept questions summarize the main ideas in each chapter and allow readers to test their understanding of the material.

SUPPLEMENTS FOR THE INSTRUCTOR

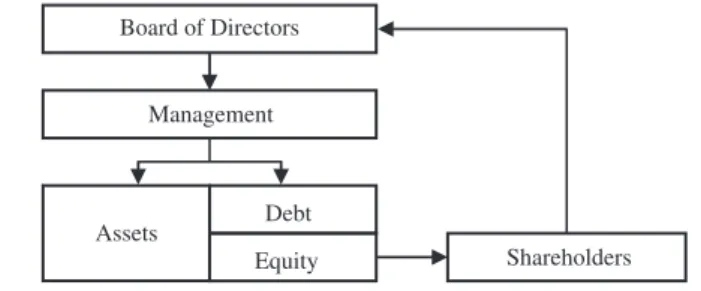

THE GOALS OF THE MULTINATIONAL CORPORATION

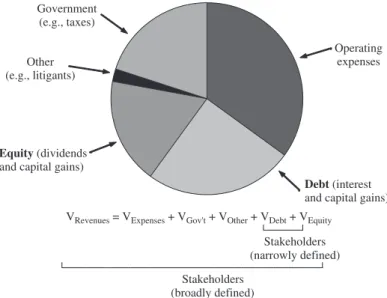

The value of these claims depends on the laws and conventions of the countries in which the MNC operates. As the remaining owners of the company, it is the shareholders who ultimately bear these agency costs.

THE CHALLENGES OF MULTINATIONAL OPERATIONS Recognizing and Overcoming Cultural Differences

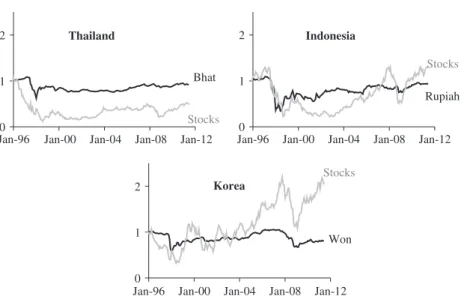

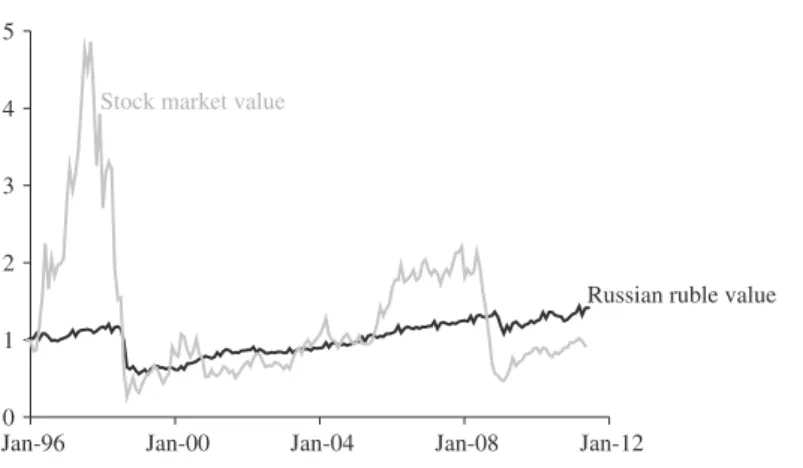

The MNC is exposed to currency risk - also called foreign exchange risk or currency risk - if unexpected changes in currency values affect the company's value. Volatility in world currency markets can cause the value of the MNC to fluctuate in unexpected ways.

THE OPPORTUNITIES OF MULTINATIONAL OPERATIONS

For example, Nike promotes its corporate brand - the Nike swoosh - in various international markets and across its product line. Allocation efficiency – the basic objective of any financial market – is greatest when there is high liquidity and transaction volume in freely traded assets.

FINANCIAL MANAGEMENT OF THE MULTINATIONAL CORPORATION

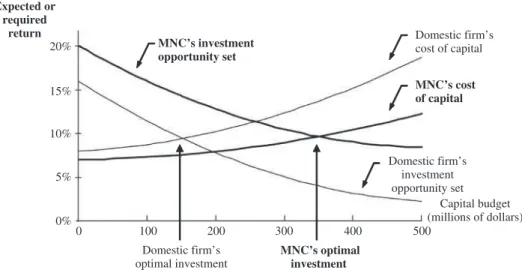

Firms draw on their lowest cost sources first, so the cost of capital is an increasing function of the capital budget. Multinational financial management requires a thorough knowledge of the international financial markets for equity securities, interest contracts, currencies, commodities and derivatives (futures, options and swaps).

SUMMARY

The multinational financial manager must be sensitive to these differences in the behavior of both professional and personal life. Today's multinational financial manager must be a jack of all trades as well as a master of finance.

KEY TERMS

CONCEPTUAL QUESTIONS

INTEGRATION OF THE WORLD’S MARKETS

WTO (www.wto.org) In 1994, 121 nations signed the Uruguay Round of the General Agreement on Tariffs and Trade (GATT). The global financial crisis of 2008 provides a striking example of the interdependence of the world's financial markets and reminds us that we all live on the same small planet.

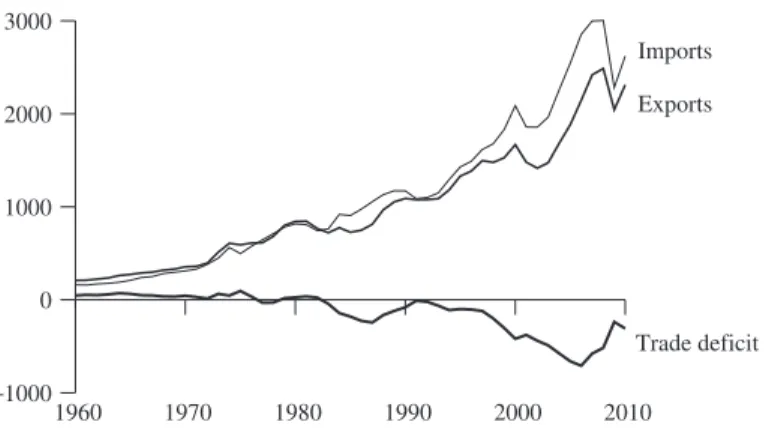

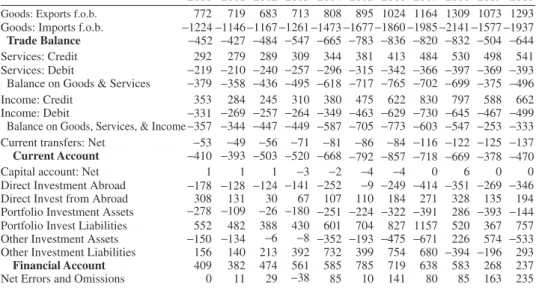

BALANCE-OF-PAYMENTS STATISTICS

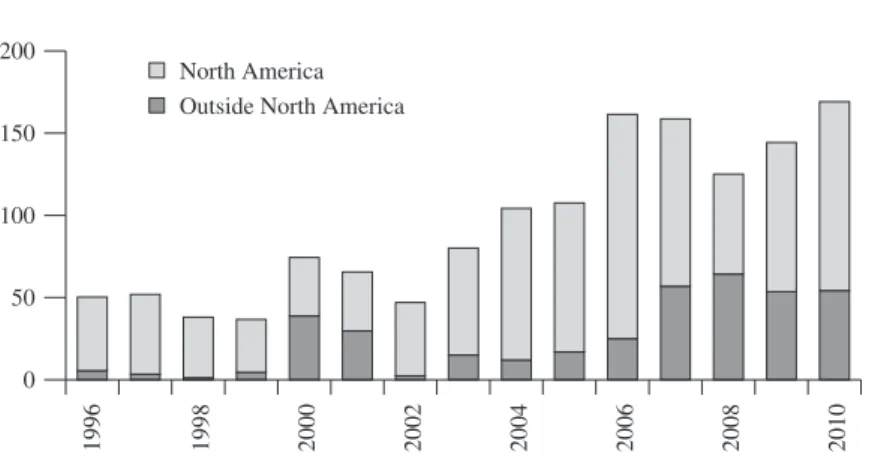

An increase in cross-border financing as multinational corporations (MNCs) raise capital in any market and currency that offers the most attractive rates (see Chapter 14). This bill is an attempt to divert cross-border activity from imbalances elsewhere in the BoP.

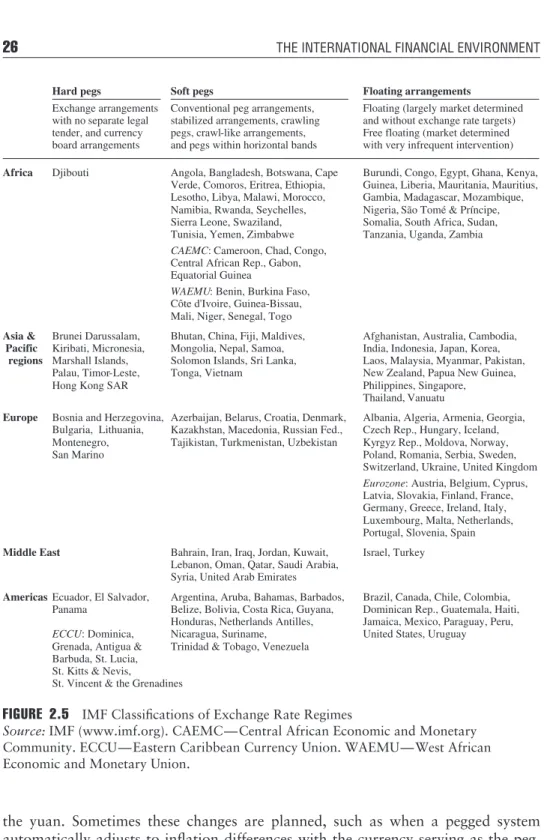

EXCHANGE RATE SYSTEMS

In this way, a system of fixed exchange rates links inflation differences between countries to wage levels and working conditions. Take a look at our earlier example of a fixed exchange rate system with higher inflation in China than in Indonesia.

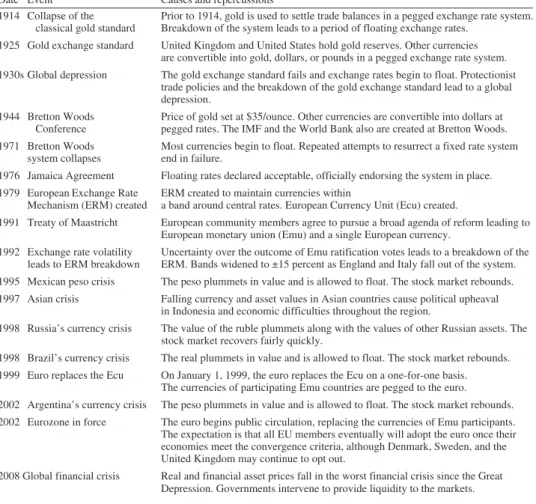

A BRIEF HISTORY OF THE INTERNATIONAL MONETARY SYSTEM

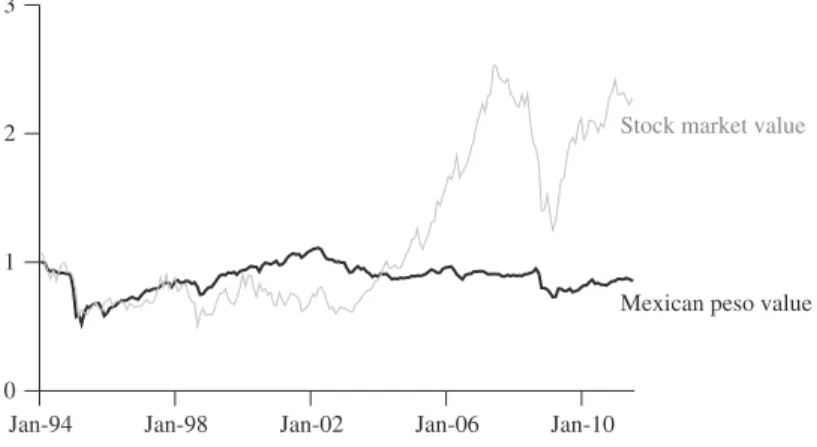

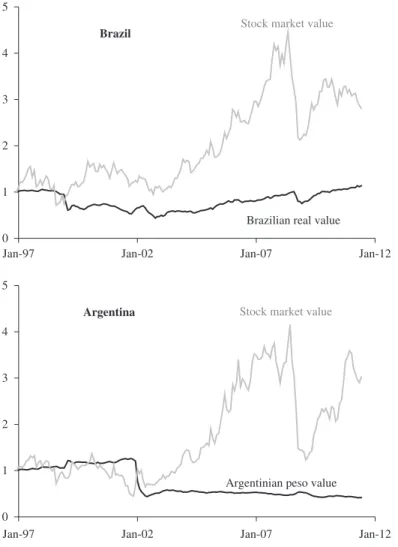

The combined effect of the peso's devaluation and the stock market crash was a 70 percent drop in the dollar value of Mexican stocks. At the heart of this debate from the perspective of the multinational financial manager is the notion of moral hazard - the risk that the existence of a contract will change the behavior of the parties to the contract.

THE GLOBAL FINANCIAL CRISIS OF 2008

While securitization has provided liquidity to the mortgage market, it has also boosted housing prices and investors' expectations of further real estate gains. The illiquidity of the subprime CDO market was the first and most visible symptom of the crisis.

SUMMARY

Efforts to limit exchange rate fluctuations through mechanisms such as ERM have had some success, although in the long run currency values are determined by market forces rather than government fiat. Other countries were added to the Eurozone (Cyprus, Estonia, Greece, Malta, Slovakia and Slovenia).

PROBLEMS

SUGGESTED READINGS

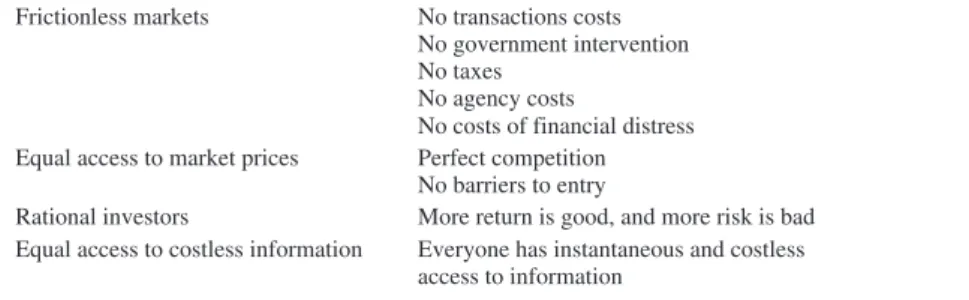

CHARACTERISTICS OF FINANCIAL MARKETS

Capital markets are markets for long-term financial assets and liabilities, usually with maturities of one year or more. For example, a 30-year government bond is a long-term financial asset and is traded on the capital market at the time of issue.

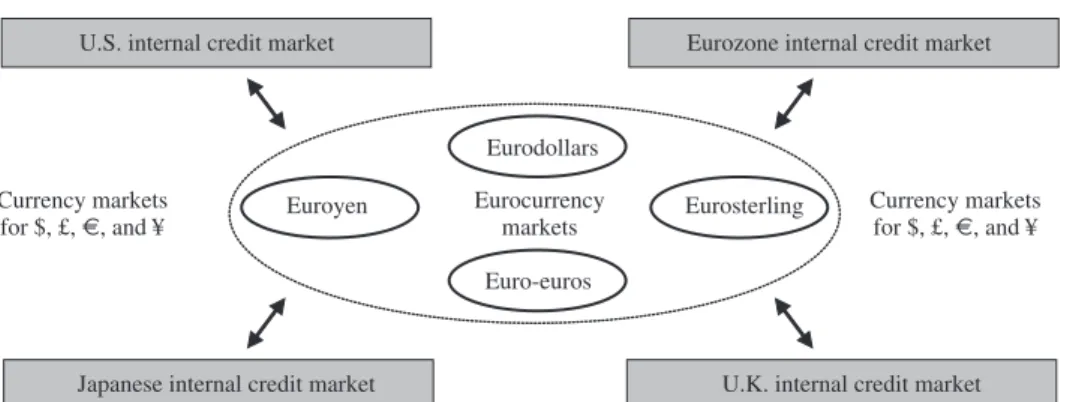

THE EUROCURRENCY MARKET

This results in the most distinctive feature of the euro currency market: an almost total absence of outside regulatory interference. The bank can charge 2.25 percent for large loans to business customers in the external euro currency market.

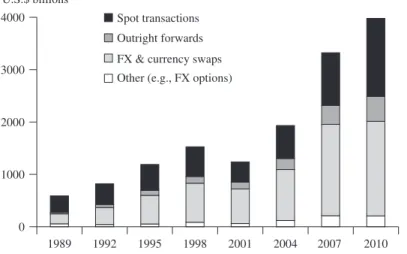

THE FOREIGN EXCHANGE MARKET

For large deposits (more than $1 million) in the external euro currency market, the bank may be willing to pay 1.75 percent. Commercial banks act as dealers or market makers in the foreign exchange market by bidding bid and ask (or ask) prices and earning their profit by buying against.

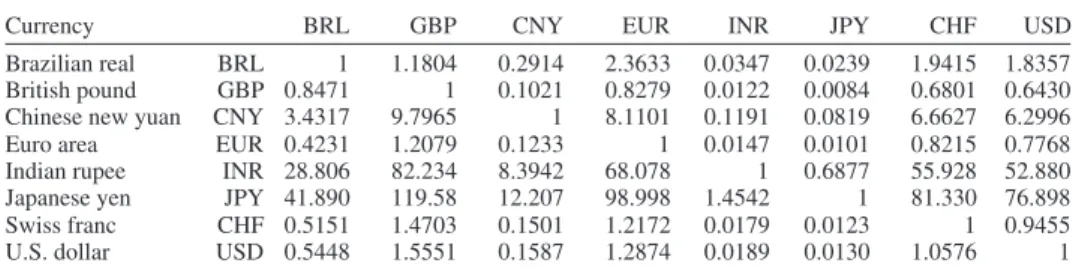

FOREIGN EXCHANGE RATES AND QUOTATIONS

Again, it is easiest to keep the reference currency in the denominator of the FX quote. The value of the currency in the denominator of a rate note changes according to the formula.

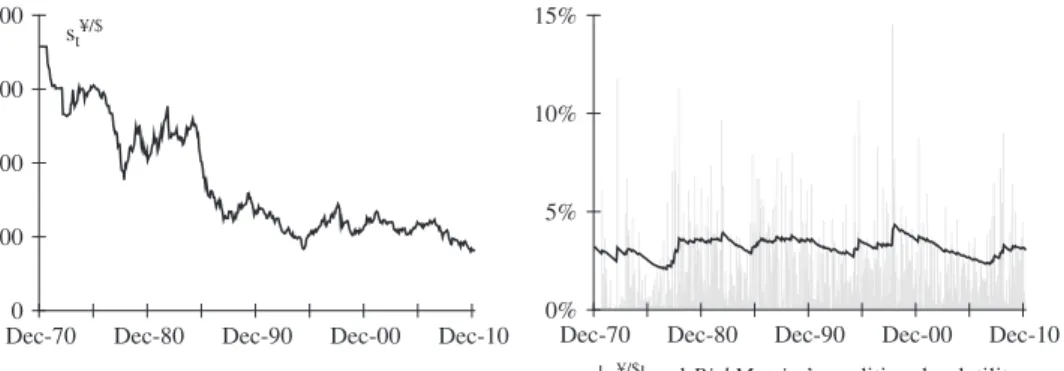

THE EMPIRICAL BEHAVIOR OF EXCHANGE RATES Changes in Exchange Rates

Alternatively, we can let (Sd/f1 /Sd/f0 )=(1+sd/f), where sd/f is the percentage change in the d-per-f spot rate during the period. The GARCH variance is called an autoregressive conditional variance because it depends on the last period's variance (σt−12) and the square of the most recent change in the spot rate (s . t−1 2).

SUMMARY

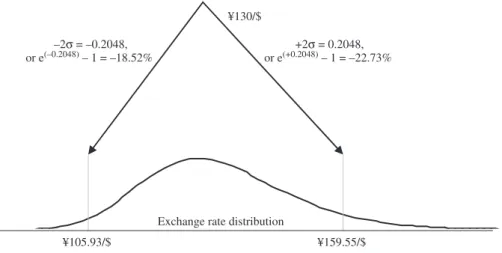

If the dollar in the denominator appreciates by 25 percent, then the yen must depreciate by 20 percent. Suppose you estimate a GARCH(1,1) model of monthly volatility in the value of the dollar and arrive at the following estimates:.

THE LAW OF ONE PRICE

The law of one price requires that the value of an asset be the same regardless of whether the value is measured in foreign or domestic currency. Transaction costs are relatively low for actively traded financial assets, such as currencies on the interbank market.

EXCHANGE RATE EQUILIBRIUM

This suggests that the winning arbitrage strategy should be to buy the currency in the denominator of any spot rate with the currency in the numerator. Of course, every time you sell the currency in the denominator, you are simultaneously buying the currency in the numerator.

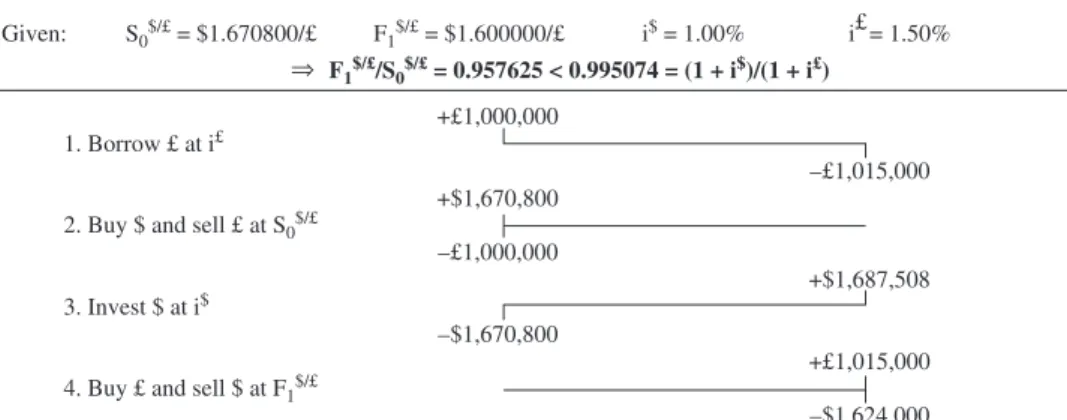

INTEREST RATE PARITY AND COVERED INTEREST ARBITRAGE

Assume Ftd/f/S0d/f > [(1 + id)/(1 + if)]t, so that domestic interest rates are too low and foreign interest rates are too high to justify the premium of next. Conversely, if Ftd/f/S0d/f < [(1 +id)/(1 + if)]t, then domestic interest rates are too high or foreign interest rates are too low to justify the premium next.

LESS RELIABLE INTERNATIONAL PARITY CONDITIONS

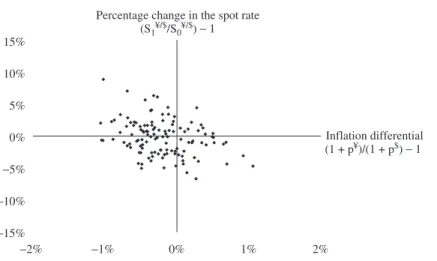

If forward parity holds, forward premiums should reflect the expected change in the spot rate according to If forward parity accurately predicts future spot rates, then the actual and predicted changes in the spot rate should lie along a 45-degree line.

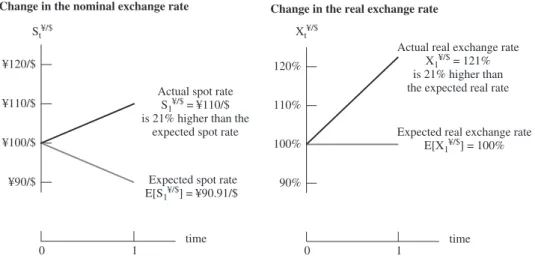

THE REAL EXCHANGE RATE

The formula for the percentage change of the real exchange rate over a single period is . In the international parity terms, the currency remains in the numerator (denominator) in the numerator (denominator) of interest rates and exchange rates.

EXCHANGE RATE FORECASTING

Technical Analysis Technical analysts believe that there are patterns in exchange rate movements and that these patterns allow for successful prediction of future exchange rates. Further, exchange rates may respond to fundamental variables with a lag, or only in the long run.

SUMMARY

Changes in exchange rates are difficult to predict as they are close to a random hike over daily or monthly intervals. What is the expected real exchange rate X1D/Fin one period with time zero as base.

APPENDIX 4A: CONTINUOUS COMPOUNDING

FINANCIAL FUTURES EXCHANGES

Futures exchanges trade various currency futures based on local currency price quotes. CME offers a wide range, including euro futures with prices in pounds sterling, yen and Swiss francs.

THE OPERATION OF FUTURES MARKETS

Louis and Billy Ray closed their position when the price reaches $29. Hopefully, this delay in trading would give the Duke brothers and the rest of the market a chance to incorporate the orange juice harvest information in a more informed way.

FUTURES CONTRACTS

A USDA report reads on TV: ''The cold winter apparently did not affect the orange harvest.'' While Louis and Billy Ray are short the orange juice futures contract, most traders (especially Dukes) are long. If the investor is unable to meet the cover call, the exchange clearing house cancels the contract and offsets its position in the futures market the next day.

FORWARD VERSUS FUTURES MARKET HEDGES

At the end of the contract, the forward price approximates the spot exchange rate. The size and timing of cash flows from a futures contract depends on the time path of the futures price, but the net profit or loss is the same as with a futures contract.

FUTURES HEDGES USING CROSS-EXCHANGE RATES

For example, a ¥/ futures hedge on the TFE (www.tfx.co.jp/en/) can be less expensive than a CME cross hedge, and just as effective. To execute this hedge, Watanabe will need to contact a futures broker (a ''trading member'' in Japan) authorized to trade futures on the TFE.

HEDGING WITH CURRENCY FUTURES

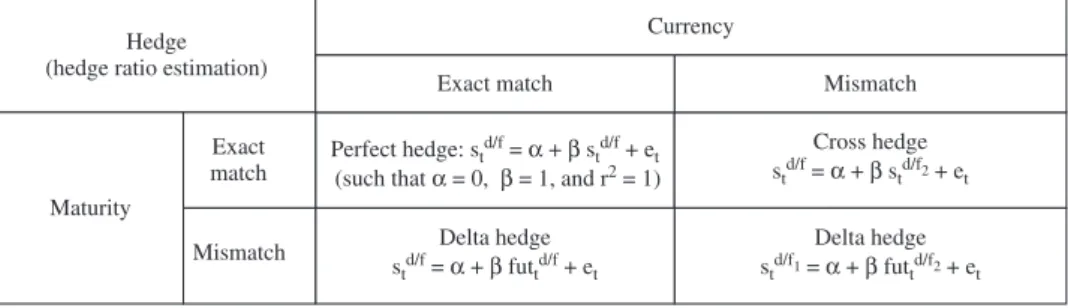

The remaining risk in futures hedging arises from underlying volatility - the risk that interest rates in one or both currencies will change unexpectedly. Futures Hedging As with futures contracts, most of the change in the value of a futures contract results from the change in the underlying spot rate.

SUMMARY

Changes in the std/f2 spot rate can be replaced by futtd/f2 because futures prices converge to spot prices at expiration and the maturity of the futures contract is the same as that of the underlying transaction exposure in the spot market. When both the term and currency match that of the underlying obligation, Equation 5.10 reduces to.

WHAT IS AN OPTION?

Currency options are derivative securities, as their value is derived from the value of the underlying exchange rate. Because early exercise options are rarely exercised, European and American currency options are almost equal in ability to hedge currency risk.1.

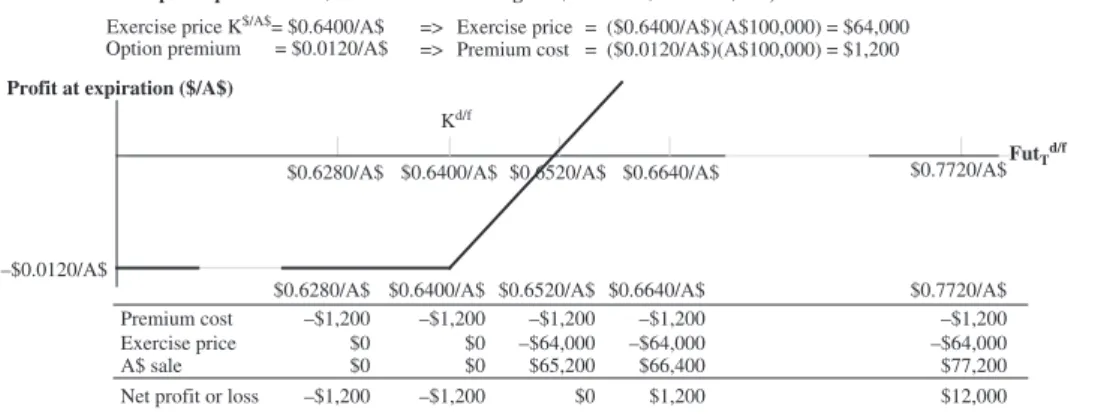

OPTION PAYOFF PROFILES

The premium depends on the writer's expected losses should the option expire in-the-money. On the other side of the contract, the option writer has an obligation to sell pounds and buy dollars.

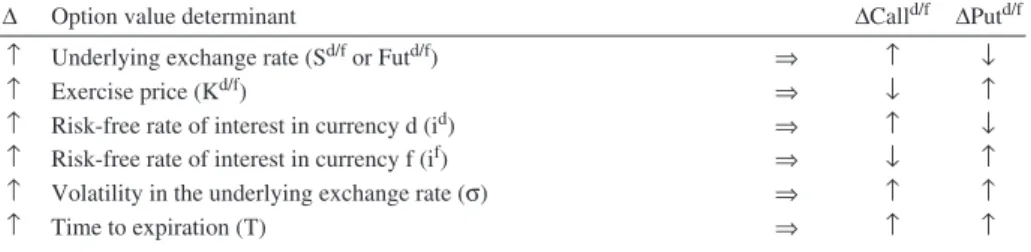

CURRENCY OPTION VALUES PRIOR TO EXPIRATION

If an option is in-the-money, its intrinsic value is equal to the difference between the exercise price and the value of the underlying asset. Volatility in the underlying (spot or futures) exchange rate determines how far in- or out-of-the-money an option is likely to expire.

HEDGING WITH CURRENCY OPTIONS

In-the-money call options therefore also benefit from higher volatility in the underlying asset. A small increase in the yen value of the dollar will result in a loss of value on the underlying term liability.

EXCHANGE RATE VOLATILITY REVISITED (ADVANCED)

There are six determinants of a currency option value: (1) the spot rate Sd/f, (2) the exercise price Kd/f, (3) the domestic risk-free rate ID, (4) the foreign risk-free rate if, (5 ) time to expiration T, and (6) the volatility of the underlying assetσ. Implied volatility is actually a time-weighted average of the instantaneous variances that prevail over the life of the option.

SUMMARY

Use similar charts to show how volatility affects the time value of out-of-the-money, at-the-money, and in-the-money put options. What is the annual standard deviation of the S$/A$ exchange rate if continuously compounded exchange rate changes$/A$ i.i.d.

APPENDIX 6A: CURRENCY OPTION VALUATION

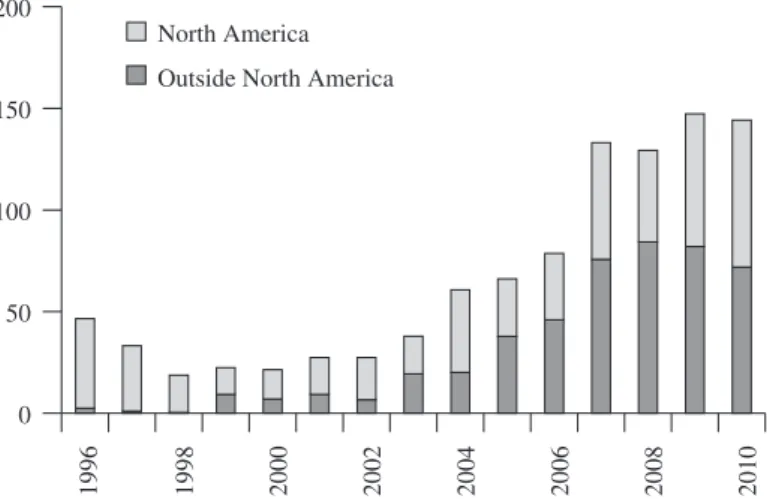

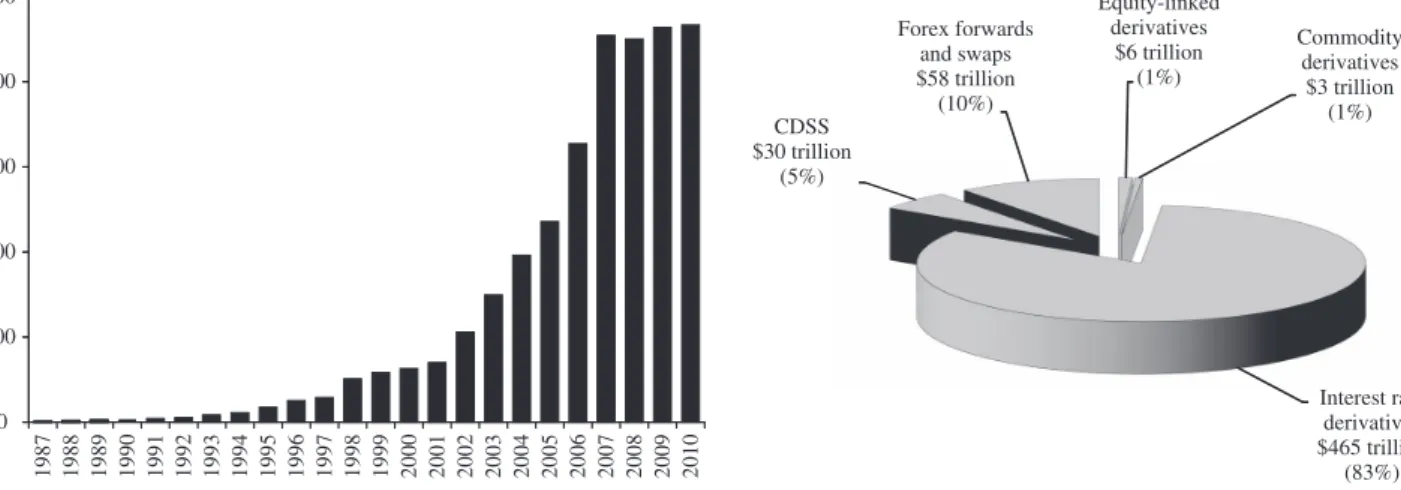

THE GROWTH OF THE SWAPS MARKET

Credit default swaps (CDSs) accounted for $30 trillion and are the fastest growing segment of the market. Equity derivatives have held a fairly stable share of the market for the past decade, accounting for $7 trillion in notional principal.

SWAPS AS PORTFOLIOS OF FORWARD CONTRACTS

Instead of exchanging the full amount of the interest payments, only the check for the difference should be exchanged. Thus, the default risk of a swap contract falls somewhere between the risk of a comparable future contract (which is negligible) and the risk of the future contract with the longest maturity in the swap contract.

CURRENCY SWAPS