One of the main factors identified was the reluctance of banks to provide loans to small businesses. The main objective of the study was to develop a value-based decision framework for small business lending.

Introduction

Given the poverty situation in South Africa, the promotion of small businesses has always been a primary focus of the government (Rogerson, 2018). While it is recognized that there are several challenges and barriers that could hamper the growth and development of small businesses in South Africa, the focus of this study is on the credit aspect, in particular how the position of access to credit for small businesses can will be improved.

South Africa’s economic conditions

Within seven months of its launch, the Banking Association South Africa reported that 600,000 accounts had been opened. Unfortunately, access to credit is one of the prohibitive factors for local companies to produce goods for export.

Application of value-based management

This state of affairs highlights the importance of restructuring financial aid, particularly lending, to improve the income potential of small businesses, which, it can be argued, will ultimately have a positive impact on wealth creation in South Africa's economy . The opportunity therefore exists for a company to expand and grow to a point where it can employ more people, thereby aiding in the government's job creation efforts.

Motivation for the focus of the study

The motivation for the study is therefore to explore a value-based small business lending decision framework for banks to use that optimizes government support initiatives to reduce banks' credit risk and allows for a more convenient service to small business customers. . Ultimately, the proposed value-based decision-making framework for small business lending should benefit small business customers, the bank, and promote small business growth in South Africa's economy.

Problem statement

It explores a methodology where the strategy of the banks and the government can be more effectively aligned to enable more access to credit for small businesses. A value-based management approach according to Young et al., (2000), focuses all decision-making on the fundamental drivers of value.

Objectives of the study

Identify any variables that may contribute to identifying credit risk in lending to small businesses. Based on the empirical study results, develop a proposed value-based decision-making framework for small business loans in order to achieve the primary objective of the study.

Research design and methodology

Creswell (2013) mentions that a mixed method allows an investigation of more complex issues/questions, as the different methods assess different phenomena to expand the scope of the study and address insufficient information. The exercise was carried out at the premises of the Small Enterprise Finance Agency (SEFA) using the existing commercial data of credit providers, after a non-disclosure agreement was signed.

Anticipated contributions of the study

Knowledge development contribution

The results of the research conducted will provide information that can help design an appropriate value-based decision-making framework for small business loans that will improve access to credit for small businesses, and provide clues that can hopefully be shared globally .

Practice and policy contribution

Limitations of the study

Layout of the study

This chapter focused on the impact of government initiatives on small business lending, particularly through government regulations and initiatives aimed at promoting access to credit for small business. This is followed by the proposed value-based decision framework for small business lending in South Africa, which is based on the results of the empirical research conducted.

Introduction

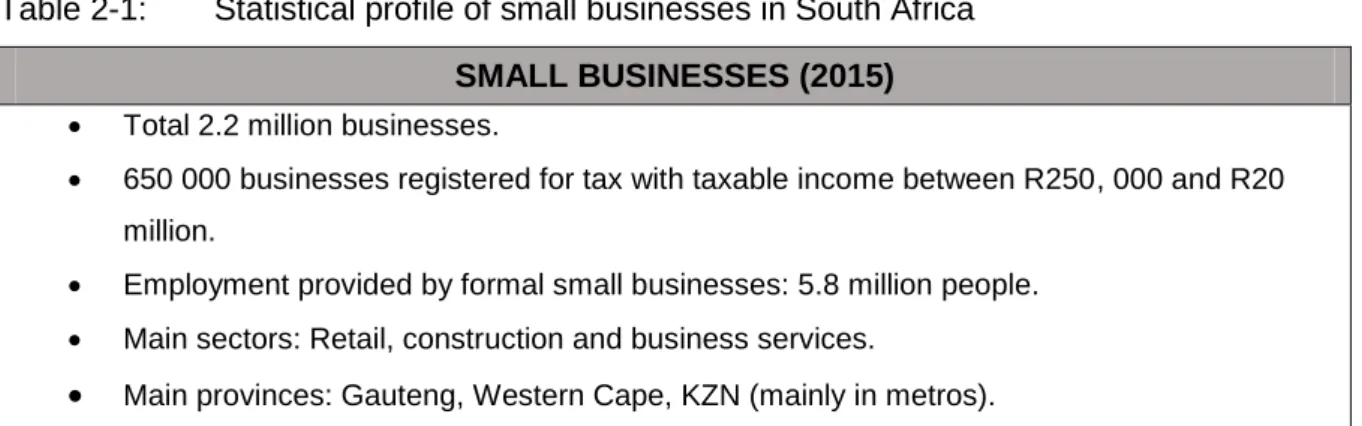

A general profile of small businesses in South Africa

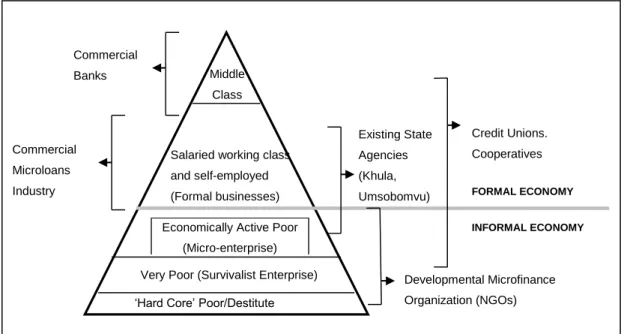

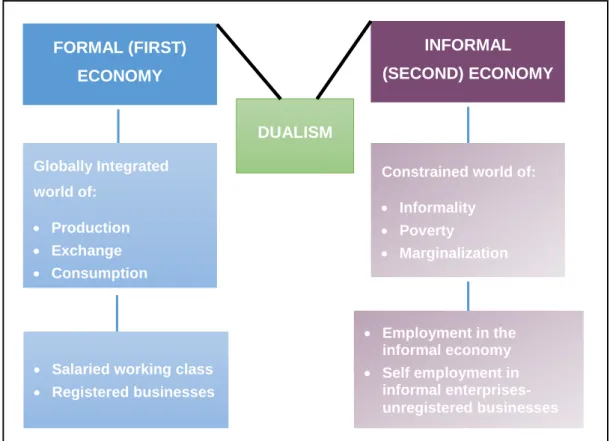

From the above it has been determined that small businesses include businesses that trade in the formal and informal economy of South Africa. The above provided a general profile of small businesses in South Africa, with a further distinction between formal and informal small businesses.

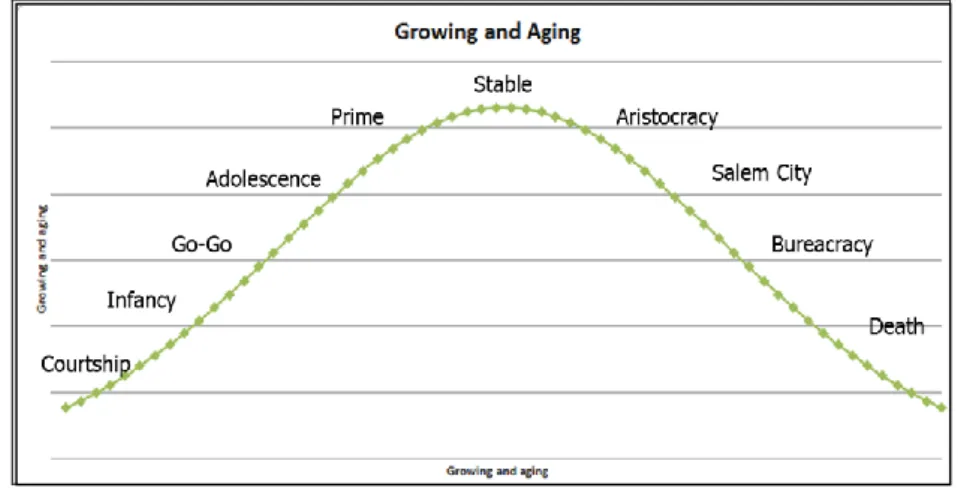

Business lifecycle stages

In the "go-go" stage, the company has a successful product and/or service and the company is booming. At the stage of "bureaucracy", the company cannot generate enough funds for its maintenance.

Factors which contribute to small business success

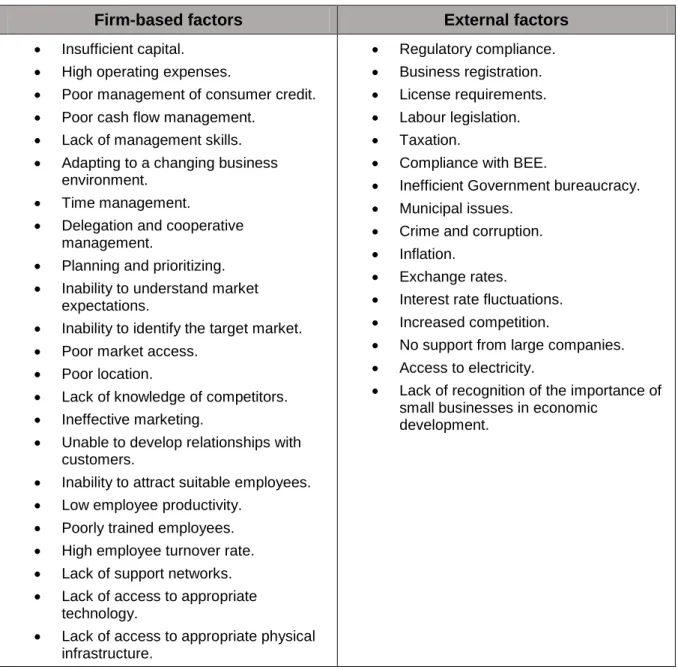

Firm-based factors

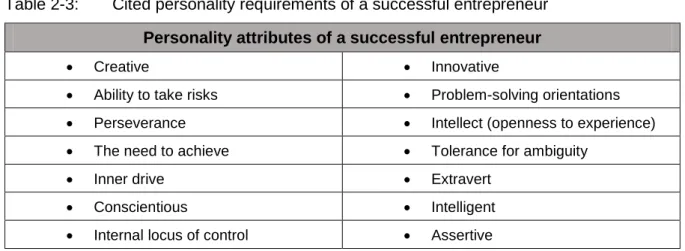

Business characteristics are characteristics specific to a firm that can positively or negatively impact firm performance. "Openness to experience" was cited as the most important, as it has a positive impact on both financial performance and business growth.

External factors

Other firm-based factors that may have a positive impact on firm performance include, but are not limited to, participation in business alliances and partnerships, larger size, longer period of existence, larger ownership structure, access to credit, proper staffing, positive capital inflows, and access to appropriate technology (Hyder. & Lussier, 2016).

Sources of capital

However, according to Fatoki (2014), new venture capital for small businesses is about R1.1 billion, which is only a fraction of the funds available. However, debt financing is limited for small firms, especially in the early stages of the business cycle, as previously identified (Fatoki, 2014a).

Challenges faced by small businesses

Challenges to obtaining credit from banks

The above highlights that collateral requirements, high interest rates and the absence of a lease are barriers to access to credit for small businesses in South Africa. The above provided an overview of the challenges small businesses face in obtaining credit.

General challenges faced by small businesses

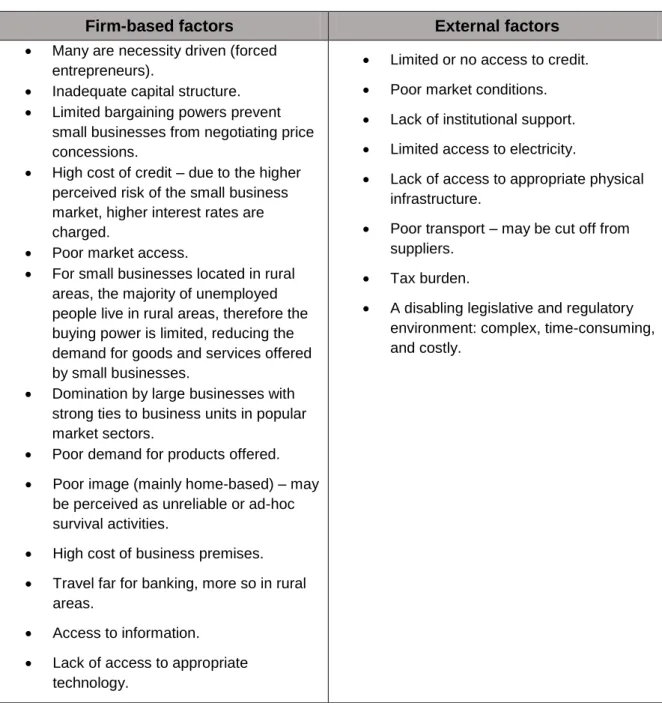

However, the challenges small businesses face are not limited to regulatory and criminal activity. The main reasons for the failure of small businesses in South Africa are further explored below.

Reasons for the failure of small businesses in South Africa

High cost of credit – because of the higher perceived risk of the small business market, higher interest rates are charged. For small businesses in rural areas, the majority of the unemployed live in rural areas, which limits purchasing power, reducing the demand for goods and services offered by small businesses.

Conclusion

These challenges highlight a huge gap that should be taken into account when revising any policy aimed at the potential and growth of small businesses in South Africa.

Introduction

Evolution by credit providers in South Africa to provide credit to small

Informal organizations

However, if one of the members should default on a repayment, resulting in a shortfall in the total monthly payment, no further loans will be made to the group, affecting each individual member. According to Makina et al. 2015) loans from informal lenders drain the profits of a small business due to high interest rates.

Banks

Each month a different member receives money in the fund that has been collected during that period. Although all four banking groups were included in the first category, there was much less interest in the services of the self-employed operating smaller businesses (Schoombee, 2000).

Banks’ existing proposition for small businesses

In asset-based loans, the bank takes the asset it is financing as collateral, so there is a strong emphasis on the value of the asset. The term "cost of funds" refers to the amount a bank would pay to borrow funds in order to lend to potential customers.

Operational structure

Degree of decentralization

The study also revealed that while 45% of developed country banks' approval process is done only or primarily in branches, only 19% of banks operating in developing countries reported this option for small business loans. Similarly, 40% of developed country banks reported that risk management for small business lending is performed only or primarily in branches, compared to 8% of developing country banks.

Bank Credit Policy

By prescribing decision-making policies based on the 5Cs of credit or similar frameworks, banks would reasonably expect that two credit managers would come to the same conclusion regarding a loan for a particular applicant. Providing a credit policy that adheres to the guidelines of the 5Cs of credit is the best effort that can be made to ensure some consistency, as credit managers will determine credit risk.

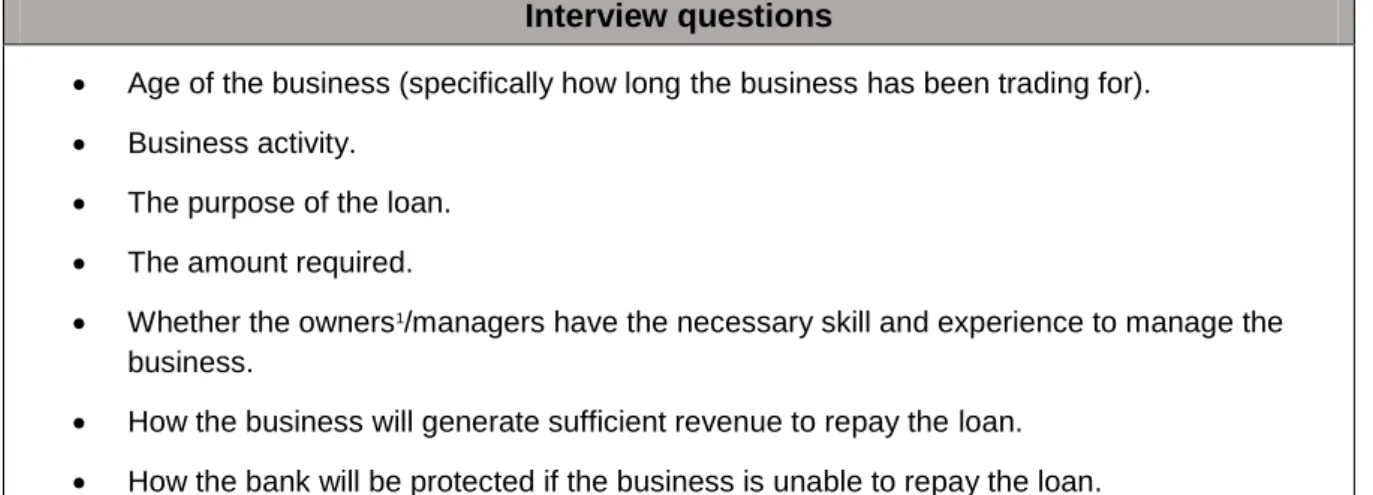

Credit application lifecycle stages

- Introduction of the customer to the bank

- Interview process

- Credit assessment process

- Credit approval process

How the bank will be protected if the business is unable to repay the loan. The ability of the business to repay short-term debt (payable within 12 months).

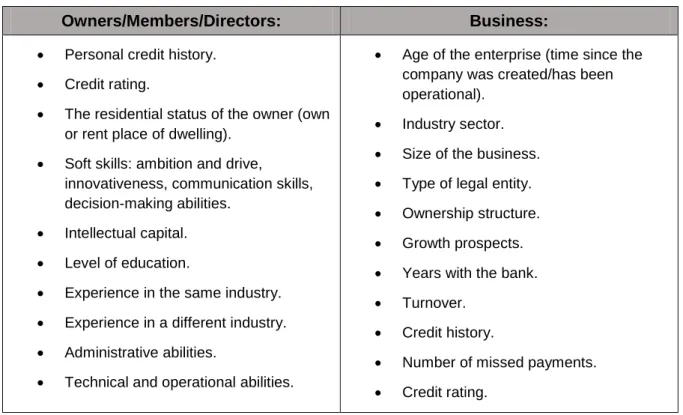

Credit scoring

- Credit scoring models

- How credit scoring works

- Choosing an appropriate scorecard

- Validation of scoring models

- Small business credit scorecard: variables

Since the focus of the study is on small business loans, possible variables that can be used in the design of a small business credit scoring model will now be further investigated. Furthermore, it is important that the scorecard is adapted to the specific local conditions of the country and the bank (Jayagopal, 2004).

Challenges for banks

Impact of the recession on small business lending

Different views have emerged about the reasons for the scarcity of credit to small businesses since the recession. The Federal Reserve's Survey of Small Business Finances also indicated that small business credit scores are lower now than before the Great Recession.

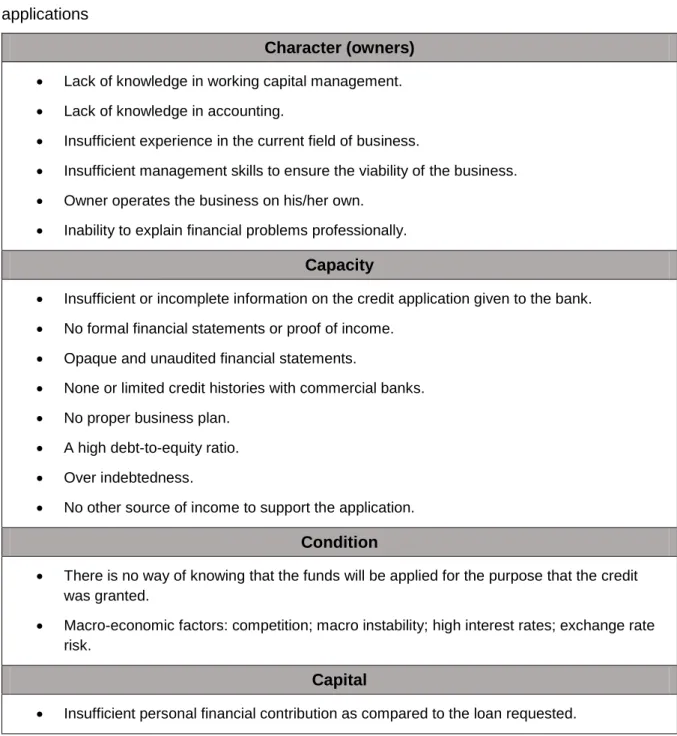

Challenges for credit managers when assessing small business credit

Information asymmetry once again in this case resulted in moral hazard due to the bank's lack of knowledge about the borrower's activities. It can be inferred that the challenges mentioned above may be similar to the reasons for the decline in loan applications for small businesses.

Reasons for the decline of credit applications

It is worrying that small firms may pay interest premiums that are not fully justified by additional risk (Jones, 2005:46). The above provided background information on the challenges credit managers face when reviewing small business loan applications.

Conclusion

Introduction

Evolution of government initiatives in support of SMMEs

There is no "after support". 2005) emphasize that the impact of government interventions on small business lending cannot be underestimated, especially since the 2008 Global Financial Crisis. In order to identify the impact of the NCA on small business loans, it is important to begin with an understanding of the NCA and why and how it came about.

History of microfinance regulation

The exemption applied to microloans defined (at that stage), as loans of less than R6000 granted for periods shorter than 36 months (Buma et al., 2010:36). Credit providers providing microcredit had to register with the QMFR and comply with its rules (Buma et al., 2010:38).

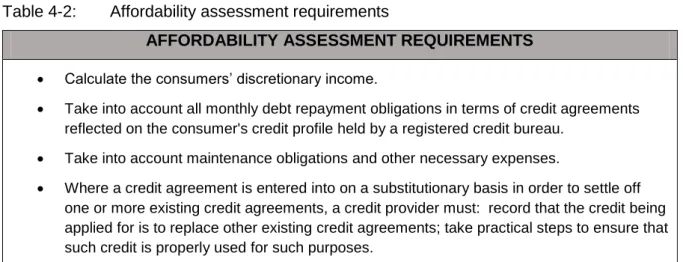

The National Credit Act

- Definition of the NCA

- Who needs to register with the NCA

- Credit transactions regulated by the NCA

- Rights and duties of consumers

- Rights and duties of Credit providers

- Influence of the NCA

Below, the sections of the NCA which relate to the rights and duties of credit providers will be explored. The above provided a brief description of the salient areas of NCA throughout the credit life cycle.

Khula Credit Guarantee Scheme

- Overview

- The aim of the Credit Guarantee Scheme (CGS)

- Categorization of Guarantees

- Models of Credit Guarantee Schemes

- Challenges

It is a requirement for banks to take judgment before they can claim from the Guarantee Scheme in the event of borrower default. However, Migro (2005:3) says that this is a major concern for the success of the Khula credit guarantee scheme, as the most important channel for the guarantee scheme is banks.

Conclusion

Introduction

Research paradigm

The critical theory paradigm is based on the belief that reality consists of the researcher's subjective view of the external world and therefore reality is socially constructed (Bhattacherjee, 2012). Constructivism, like the critical theory paradigm, is based on a transactional and subjectivist epistemology, and the methodology is hermeneutic and dialectical.

Research methodology

A decision was made to follow a combined research approach of both quantitative and qualitative analysis to obtain the data required for this study, as explained earlier in Chapter 1. Empirical study (A) consisted of a mixed method of both quantitative and qualitative analysis, and Empirical study (B) was based on quantitative analysis only.

Empirical Study A

Research Design

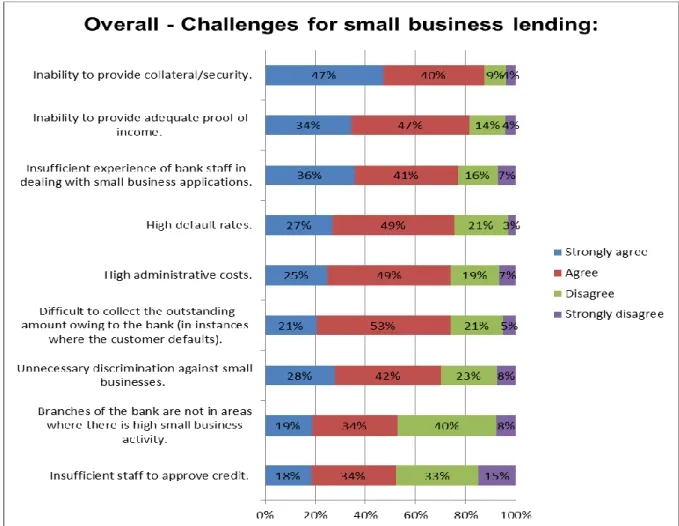

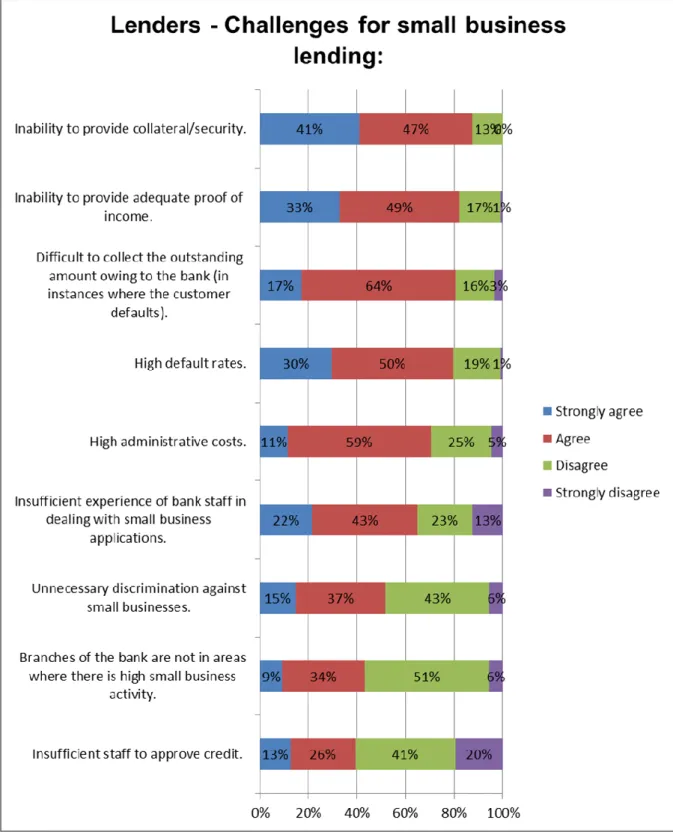

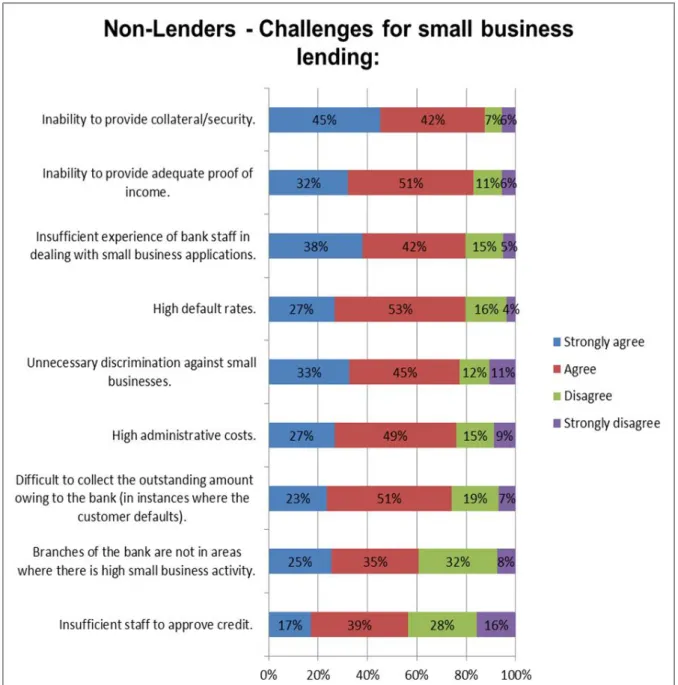

This section addressed views on appropriate lending policies for small business lending, based on participants' views on what methodology could be applied to reduce credit risk for the bank, thereby enabling greater access to credit for small businesses to make. . This section discussed the Khula Credit Guarantee Scheme, which aimed to promote growth in access to finance for SMEs in South Africa.

Research population and sample size

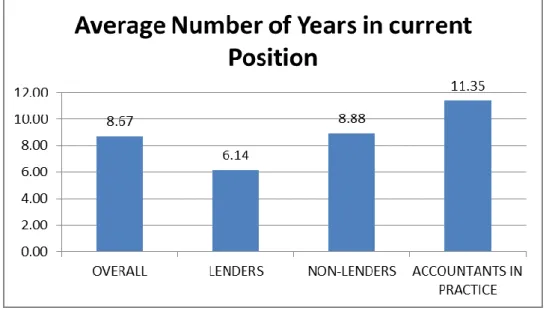

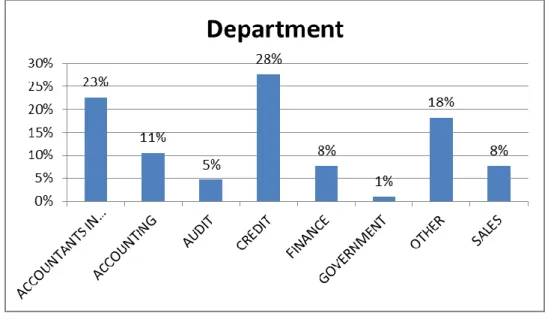

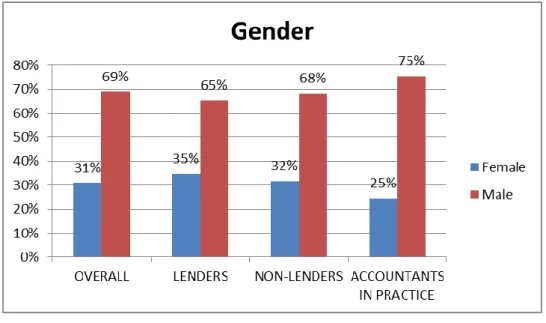

The rest of the banking population were the loan managers who make the loan decision. To obtain the information to form the categories "Lenders", "Non-lenders" and "Accountants in practice" the demographic characteristics in Figure 5-5 "Department" were used.

Ethical considerations

All ethical standards for this research were met, and confidentiality was maintained by keeping the data confidential and not disclosing the respondents' identity, or from which institution the answers came when reporting the data for the study. The respondents were informed about the purpose of the study and the procedures that would be used to collect the data.

Data analysis

Owen (2014) notes that coding is not an exact science as it is based on the coder's interpretation. The coder's goal is to find repetitive action patterns and consistency within the data.

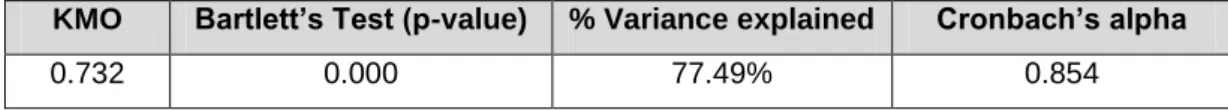

Data validity and reliability

The statistical analysis of the data included an assessment of the internal reliability of the measurement tool. A description of the questions that make up Parts 1 and 2 for “Loan Assessment: “Acceptable Proof of Income” and “Loan Assessment: Microeconomic Factors” can be found in Table 5-4.

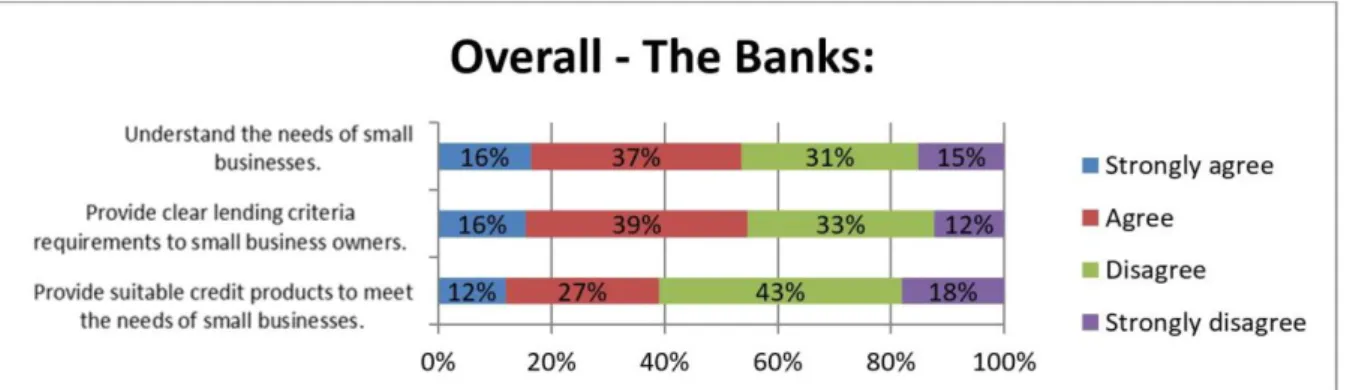

Questionnaire results

The participants were then asked structured questions about the banks' credit policy regarding lending to small businesses. A model that incorporates psychometric assessments that assess the applicant's knowledge of the business idea.

Empirical Study B

Data analysis

Results

Conclusion

Introduction

Objective summary results

Research objective: To obtain a general profile of small businesses in

Research objective: To identify the basis upon which banks typically grant

Research objective: Access to credit for small businesses: Challenges

Research objective: To identify the prominent reasons for the failure of

Research objective: To identify any variables which may contribute towards

Research objective: To determine the influence of the National Credit Act

Research objective: To determine the influence of the Khula Credit

Proposed Bank Guarantee Securitization Model

Value-based Decision Framework for Small Business Lending

Phase 1

Phase 2

Phase 3

Aftercare management

SBCC Outlets

Rewards Programme

Conclusion

Recommendations for further research