Private project and structured finance has been identified as the most effective tool for providing the necessary infrastructure. The complexity, formidable risks and highly leveraged nature of project and structured finance transactions account for the disparity between the number of infrastructure finance transactions reaching financial close compared to the available pipeline.

Introduction to the Research Problem

The complexity of project financing itself creates an extraordinary set of risks for the parties involved. In addition to the risk aversion caused by the financial crisis, Basel III created additional obstacles for commercial banks providing project financing.

Purpose of the Study

Research Problem

This study seeks to understand the process applied by financiers during the due diligence phase for the financial close of projects, as well as the risk assessment processes during the different stages of the project life cycle.

Research Objectives

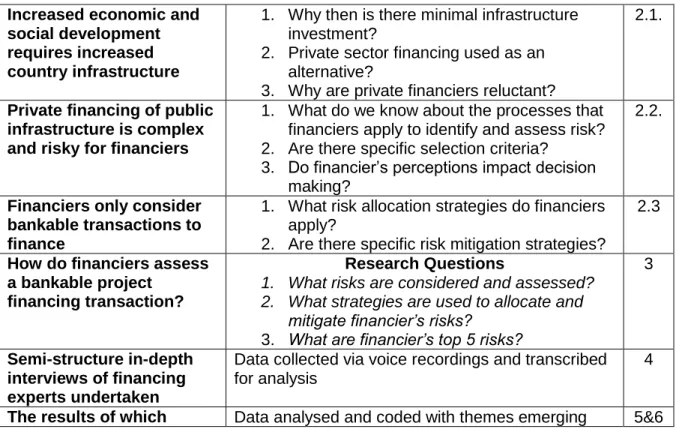

Conceptual Framework

Project Financing Arrangements

Defining Project Financing

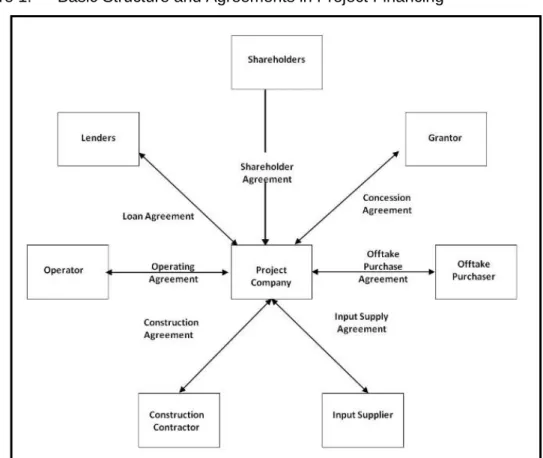

Structure and Principles of Project Finance

The concept of project financing stems from bundling different contracts, those of design, construction and operation, into one contract with one SPV or project company to influence investment efficiency (Hoppe, Kusterer, & Schmitz, 2013). Project finance arrangements have become the preferred mechanism for developing capital-intensive infrastructure as they are considered highly effective and cost-efficient (Torchia, Calabrò, & Morner, 2013).

Risk Identification and Assessment

Financier’s Risk Identification

In contrast, some risk management processes have been identified in the literature that employ a more simplified process, such as the Risk Management Process developed by the Project Management Institute (2008) and the Multi-Party Risk Management Process (Pipattanapiwong & Watanabe, 2000). Financiers apply complex and rigorous due diligence assessments to project financing arrangements and should be involved in the process early in the bidding phase (Dixon, Pottinger, & Jordan, 2005).

Project Selection Methods

Buscaino, Caselli, Corielli and Gatti (2012) investigated the ways in which banking institutions can remain active in the project finance arena with the stricter controls imposed on them by Basel III. The long-term nature of project finance requires more dynamic financial analysis methods of project selection than quantitative methods alone which may not account for the various risk factors present in long-term high-value project finance arrangements.

Risk Allocation and Mitigation

Methods of Risk Allocation

In this case, through complex contractual arrangements imposed by funders, risk sharing did not effectively allow the public sector to effectively transfer risk to the private sector (Reeves & Ryan, 2007). Are the risks in project financing properly allocated to the appropriate parties in the agreement in practice.

Measurement and Pricing of Risks

Keating (2004) argues that before the financial crisis the government in Australia was trying to shift increasing risk from the public sector to the private sector using project finance structures. Further support of this argument is provided by Demirag et al. 2010) who assert that due to the unwillingness of commercial and investment banks to accept the high risks associated with project financing, the public sector accepted more risks in an effort to facilitate the closing of project financing agreements.

Impact of Financiers Risk Perceptions

In the study conducted by Jupe (2011) of Metronet Infrastructure SPV in London, the author found that 95% of the debt financing was covered by the government, indicating the transfer of marginal risk to the private sector. Funders are one of the most important parties in project financing arrangements with their objectives being different from other parties to the arrangement (Broadbent, Gill, & Laughlin, 2004).

Conclusion

The financial crisis has shaped the lending criteria used by debt lenders in project finance contracts in such a way that the risk aversion for such high debt is accompanied by higher borrowing costs. Project finance is, at best, an art form practiced by finance experts from multidisciplinary fields.

Research Question 1

The literature review conducted in Chapter 2 highlights the lack of academic literature in the field of project finance. With the research approach, as discussed in chapter 4, the main objective was to identify the risk assessment, allocation and mitigation strategies applied by banking institutions to long-term and high-value project financing agreements, thus answering the research questions posed in this paper and translating the findings into a meaningful framework.

Research Question 2

The complexity, subjectivity and confidential nature of data in this area of study led the researcher to use an exploratory approach to understanding the risk management approach used by financiers.

Research Question 3

Introduction

The interviews were conducted through Microsoft Live Meeting due to the location of the experts distributed in different countries of the world. For quality assurance purposes, electronic recordings of the interviews were made with a combination of manual notes by the researcher.

Population

Unit of Analysis

Sampling Method and Size

To this end, purposive sampling is used to ensure that a high standard of relevant data is collected for analysis using expert criteria to achieve the objective of identifying a financial risk assessment framework for project finance (Struwig & Stead, 2001). Data saturation was reached when no new themes and concepts emerged from the interviews conducted (Saunders & Lewis, 2012).

Measurement Instrument

Pre-Test

Interview Process and Interview Guide

Additional questions were inserted by the researcher to explore further topics or themes raised in the interview where no specific question was listed in the semi-structured interview guide. An iterative data collection and management process was used to ensure that the appropriate topics were covered and that data saturation was achieved.

Analysis Approach

The quality of all transcripts was checked by the researcher by reading the transcript while listening to the recordings. Commonalities were tried to be identified at this early stage through the words, phrases used by the interviewee.

Limitations

A systematic content analysis approach was used to analyze the responses to the interviews conducted. Upon examination, any responses that were not conceptually relevant to the code or codes were recoded or removed from the analysis.

Research Question 1

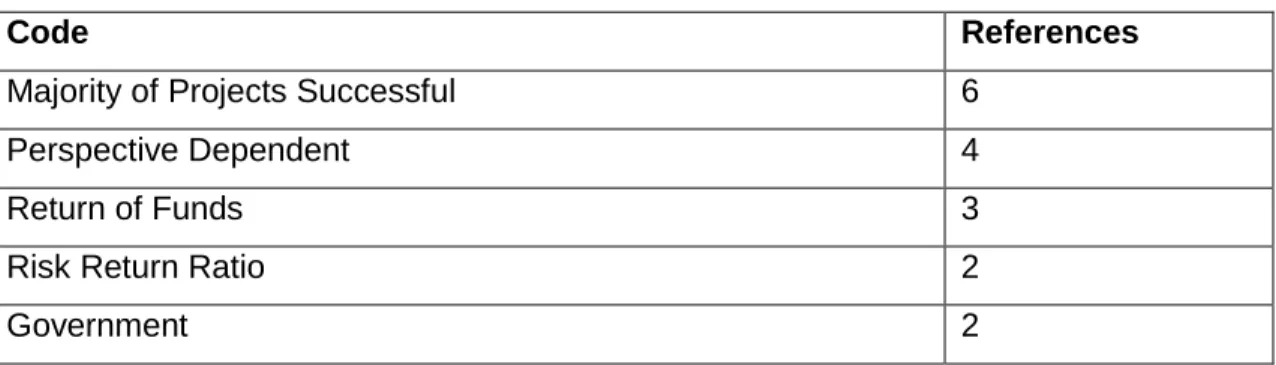

- Successfully Financed Projects

- Declined Project Financing

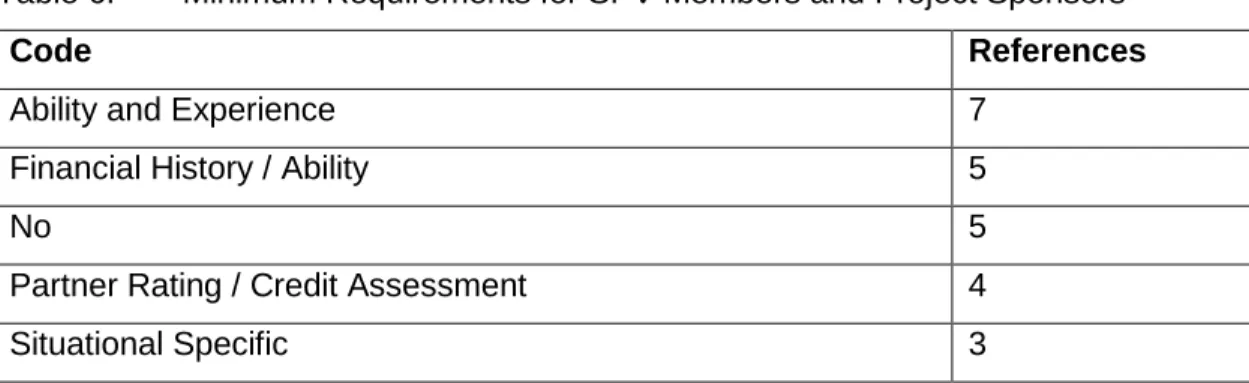

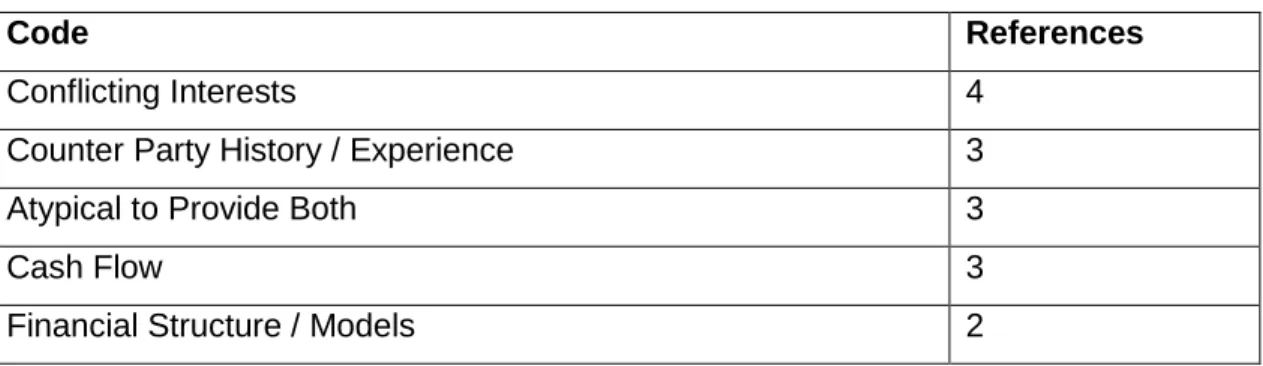

- Consortium and Project Sponsor Risk Factors

- Consortium and Project Sponsor Minimum Criteria

- SPV /Project Company Board Members

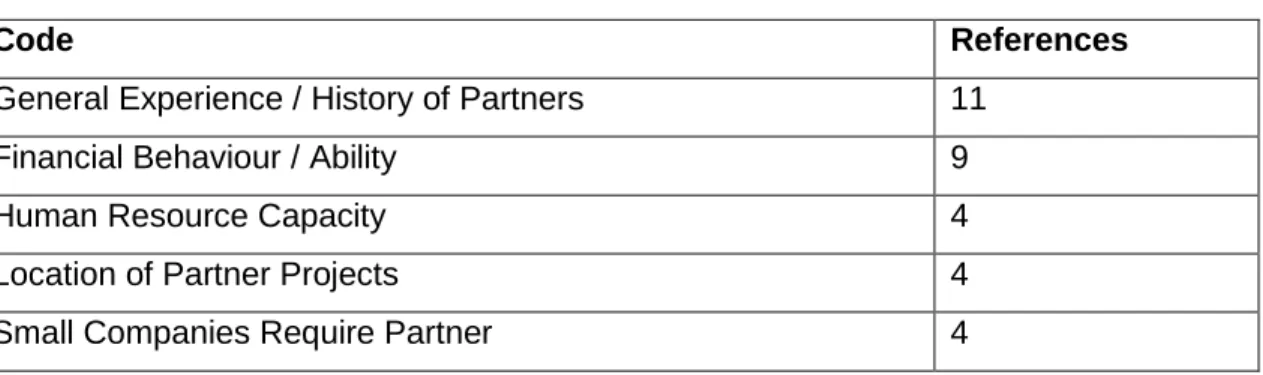

- Project Financing Minimum Criteria

- Greenfield vs. Brownfield Project Financing

The evaluation of project participants or project partners was described as an essential risk factor requiring attention, including the experience and previous success of the partners. For the most part, the actual board members themselves are not an important factor considered in the grand scheme of the project.

Research Question 2

- Country Lending Limits

- Non-Financial Risk Assessment

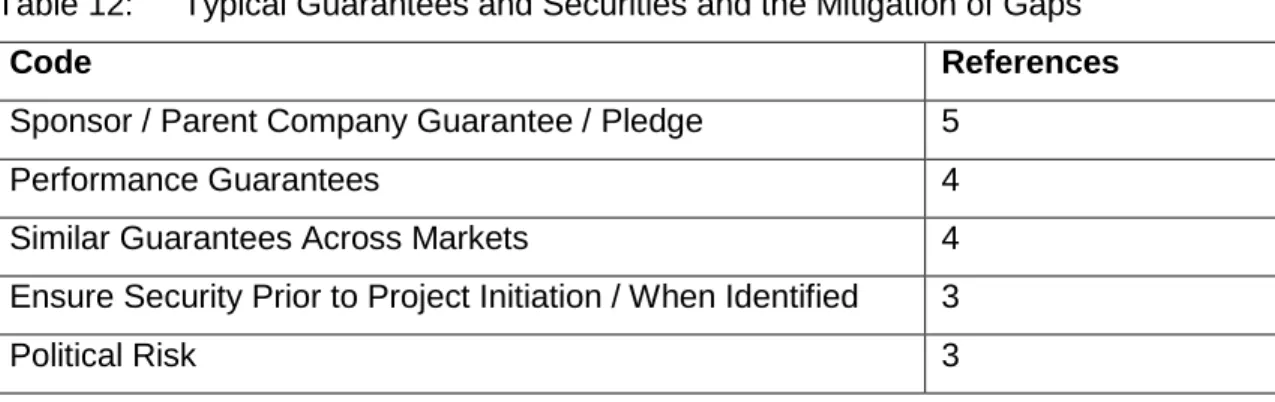

- Guarantees/Securities

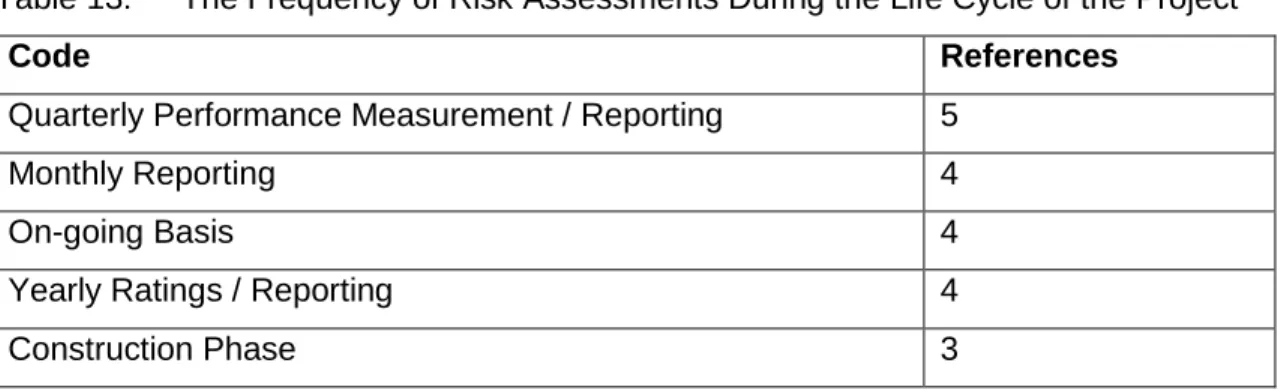

- Frequency of Risk Assessments

- Exit Strategies

- Risk Mitigation Strategies

- Newly Identified Project Risks

- Impact of Financiers’ Perceptions

You evaluate the performance of the design builder and the facility manager regularly throughout the project." Maybe the government is backing the project in some way, that the project is important to the country, so you can see the importance of the project.

Research Question 3

Top Five Project Financing Risks

I think we're talking about politics, so what's happening in the political environment, what's being done that could potentially affect the project. Construction risk is second and it's huge because you can't build it then you have nothing and there's a long story in the history of projects around the world that were great ideas but the technology just didn't work.

Conclusion

I always think it's the regulatory and legal risks all rolled into one, and the reason there's a high risk is that often in new markets there's no certainty around regulatory and legal requirements." The research findings discussed in this chapter are closely aligned with the research questions identified in Chapter 3 and are based on the findings presented in Chapter 5.

Research Question 1

- Successfully Financed Projects

- Declined Project Financing Transactions

- Consortium and Project Sponsor Risk Factors

- Consortium and Project Sponsor Minimum Criteria

- Project Financing Minimum Criteria

- Greenfield vs. Brownfield Investments

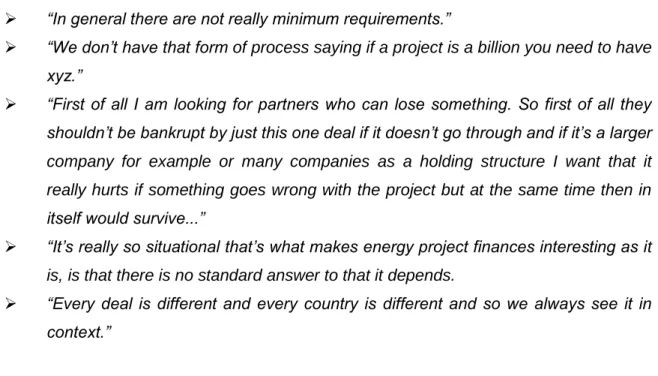

External consultants, corporate knowledge base of the financing institutions and industry experience guide this assessment. Minimum criteria are scenario specific and depend entirely on the context of the project financing transaction under consideration.

Research Question 2

- Country Lending Limits

- Non-Financial Risk Assessments

- Guarantees/Securities

- Frequency of Risk Assessments

- Exit Strategies

- Risk Mitigation Strategies

- Newly Identified Project Risks

- Impact of Financiers Perceptions

Seven of the 15 interviewees report that country credit limits are project-specific and depend on the importance of the project to the country's economy. The results in Table 17 indicate that 27% of respondents agree that project financing decisions are based on the lender's market experience.

Research Question 3

Top 5 Project Financing Risks

Forty percent of respondents indicated construction risk as the second highest priority from a funder's perspective. In the same context, foreign currency fluctuations have put a great strain on the stability of the country.

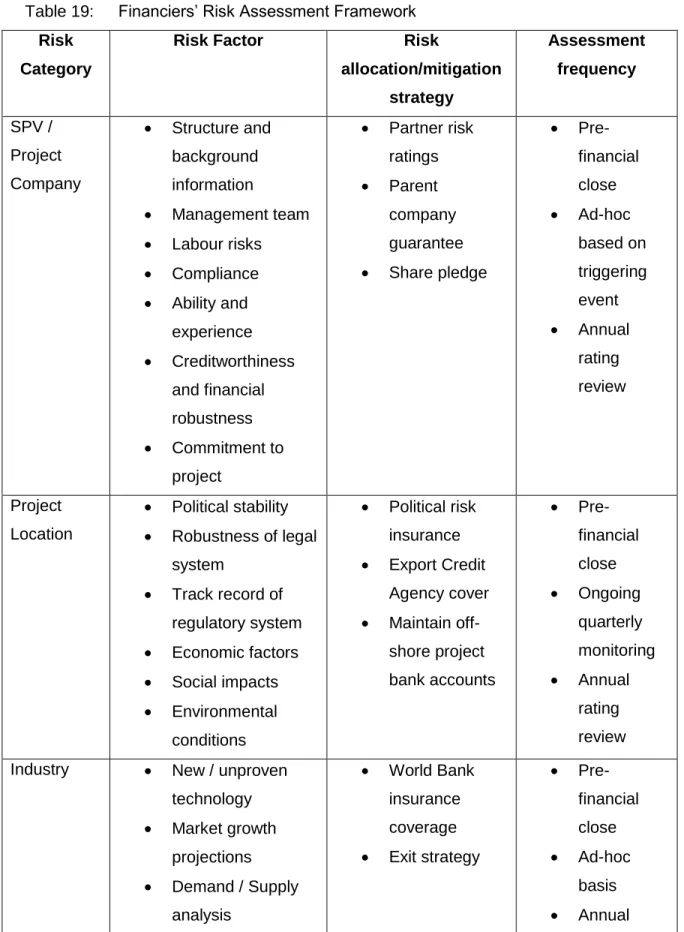

A Financier’s Assessment Framework

The country where the project is carried out will earn income in the local currency, but will be obliged to repay the loans in either EURO or US Dollars. Poor quality of legal documentation in the country, or a change in the legal framework during the life of the project finance transaction, can create inconsistencies or outdated contracts.

Introduction

Research Objectives and Findings

The main non-financial risks identified in this study that affect the financier's decision-making process during due diligence are the political, legal and regulatory risks in a country. The top 5 risks from a financier's point of view when performing due diligence on project and structured finance transactions were found in this study to be; political or governmental risk, construction risk, commodity and foreign exchange risk, legal and regulatory risks and the strength and validity of the closed contracts.

A Financier’s Assessment Framework

From all the information collected and analyzed and the results presented, the generalized financier risk assessment framework was created and presented in this research study.

Future Research Areas

Limitations of the Research

This research study focused on the broader definition and application of project finance in a wide variety of markets. The complexities and variations inherent in the different types of structured finance projects and transactions are endless.

Conclusion

Lessons from the private finance initiative in the UK: Benefits, problems and critical success factors. The role of public private partnerships to manage risks in public sector projects in Hong Kong.

Informed Consent Letter

Semi-Structured Interview Guide

List of Qualitative Analysis Codes

Historical cases of success of providing both financial history / Separate assessment of debt and equity of ability Reputation in the country dependent on the stability of the project. Similar losses across markets Confidence in developed markets depending on the experience of the members depending on the market experience of.

Ethical Clearance Letter