Biogas offers multifaceted benefits to the end user, compared to other renewable energies such as wind, solar and hydroelectric (Hakawati et al., 2017)). These challenges are intensified in developing countries due to the absence of institutional policies (Lönnqvist, et al., 2018). Biofuel waste in the petrochemical industry offers multiple opportunities (Siddique, et al., 2015), but implementations are still limited (Hagman, et al., 2018).

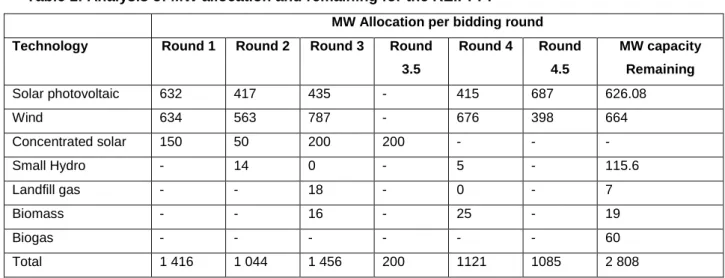

Given all the benefits of biogas and the need for expansion in the renewable energy sector in South Africa; there were no bids for biogas distribution in all rounds of the REIPPPPP (Qase et al., 2015).

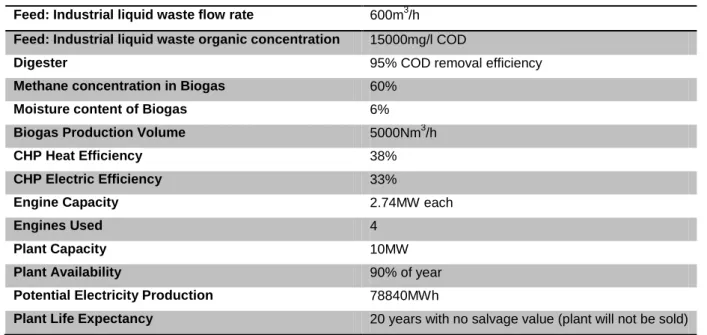

Revenue

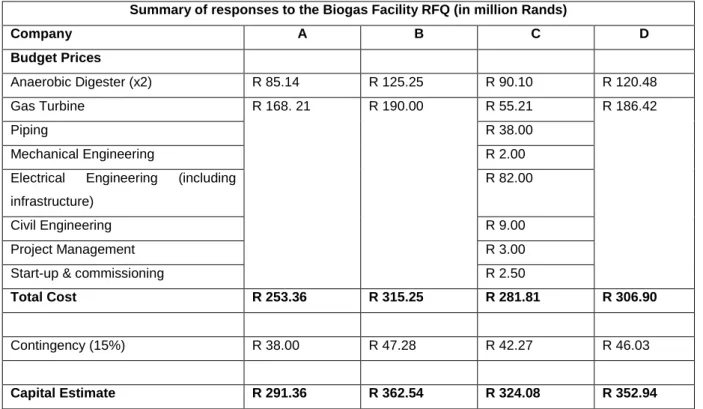

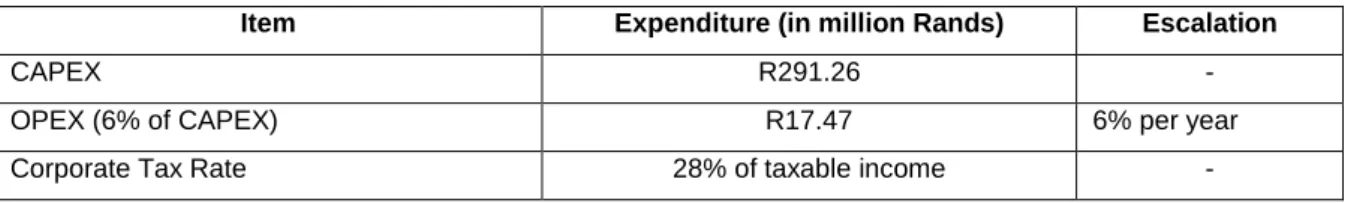

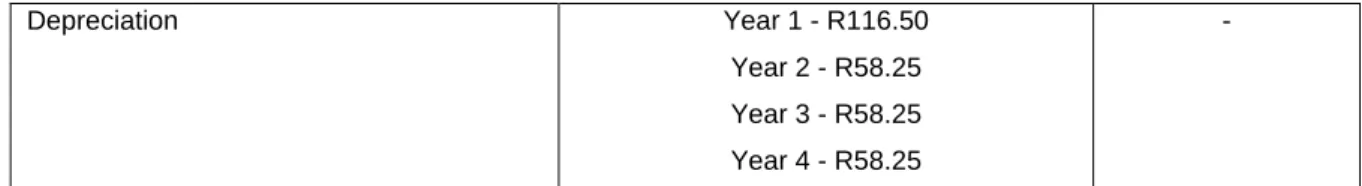

It can be seen that CAPEX values based on European experience (Hahn, 2011) tend to reduce the evidence of economies of scale in contrast to African cases that show diseconomies of scale (Amigun and Blottniz, 2007). Germany allows assets to be depreciated evenly over the entire useful life of the asset due to tax advantages (Deloitte, 2015). The revenue stream was therefore estimated in line with the Eskom megaflex tariff for large industry, R763.8MWh.

Although the annual escalation of electricity prices exceeded South Africa's inflation rate (Eskom, 2017), annual escalations were assumed to be that of inflation at 6% (Lehohla, 2016), due to the 20 year project evaluation term. Compensation is based on the sale of electricity within the context of the REIPPPP, including the sale of heat energy, which is priced according to the equivalent electricity costs for industry (as used in case 1) since no subsidies exist for the heat generated by CHP. For the purposes of this study, it is assumed that 80% of the heat energy is recovered.

The compensation was based on the sale of electricity under the German Renewable Energy Sources Act (Erneuerbare-Energien-Gesetz, EEG), at a price of 11.4. Sale of thermal energy that has been evaluated at the equivalent price of electricity according to German tariffs for industry. Thus, using the same amount of thermal energy produced in case 2, for a 10MW biogas plant with 90% annual availability, the annual revenue is

Carbon tax consideration

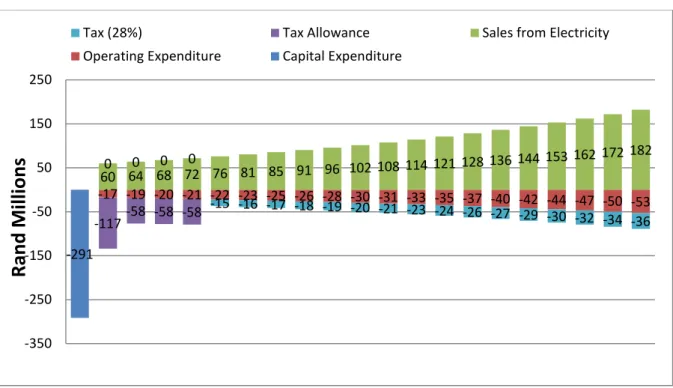

Cash flows

This was done to evaluate the feasibility of the German case with stricter viability criteria, as a lower cost of capital would make the project viable. The stricter criterion is imposed to evaluate whether the same project in Germany would be viable with a South African discount rate. The imposed higher discount rate will negatively affect the viability of investments in the German case, but is used to evaluate the impact that the discount rate can have on the carrying of the project.

The discount rate is used to calculate the net present value (NPV) of an investment's future cash flows, which must be greater than zero to ensure a present positive cash flow (Skae, 2014). Net present value (NPV) is defined as the sum of the present values of annual cash flows. Where NPV is the net present value of the project, CFn is the cash flow in year n and r is the discount rate.

The IRR allows the judgment of the future performance of the investment to compare the required rate of return (Agostini et al., 2016). The payback period of the investment should be less than two years to be economically viable. If lower than the discount rate is achieved, the investment will be considered non-viable.

Results

In general, the higher the IRR, the more desirable it is to undertake the project (Agostini et al., 2016). If the net present value is zero or more, the investment will be considered feasible, if the NPV is less than zero, the investment will not be feasible and will be rejected. If the achieved internal rate of return (IRR) is higher than the discount rate, the investment will be feasible and should be accepted based on the IRR decision rule.

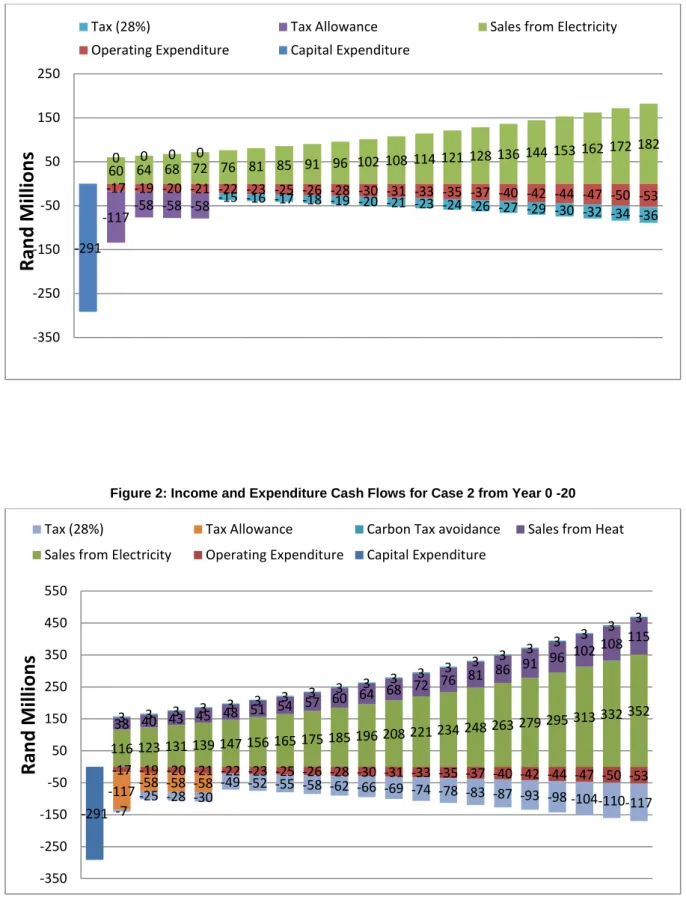

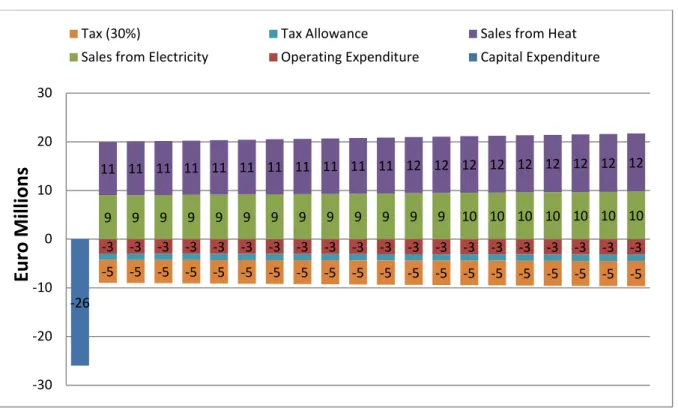

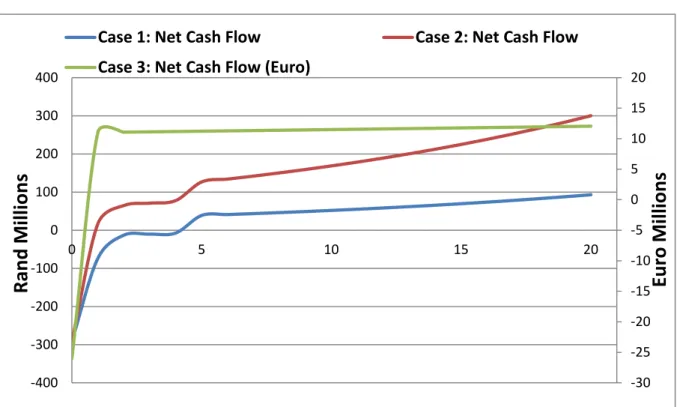

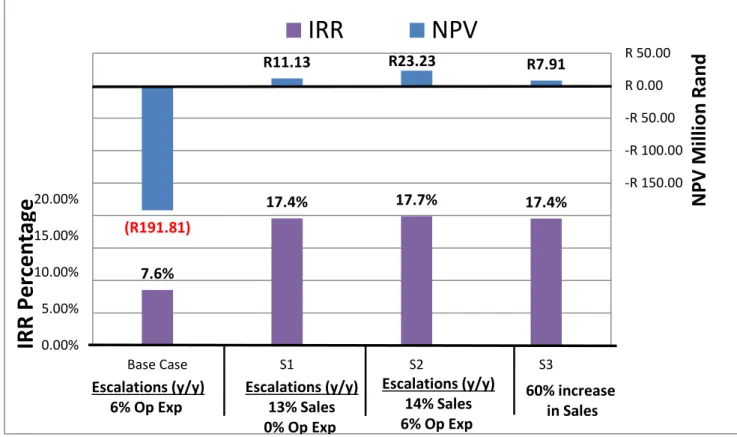

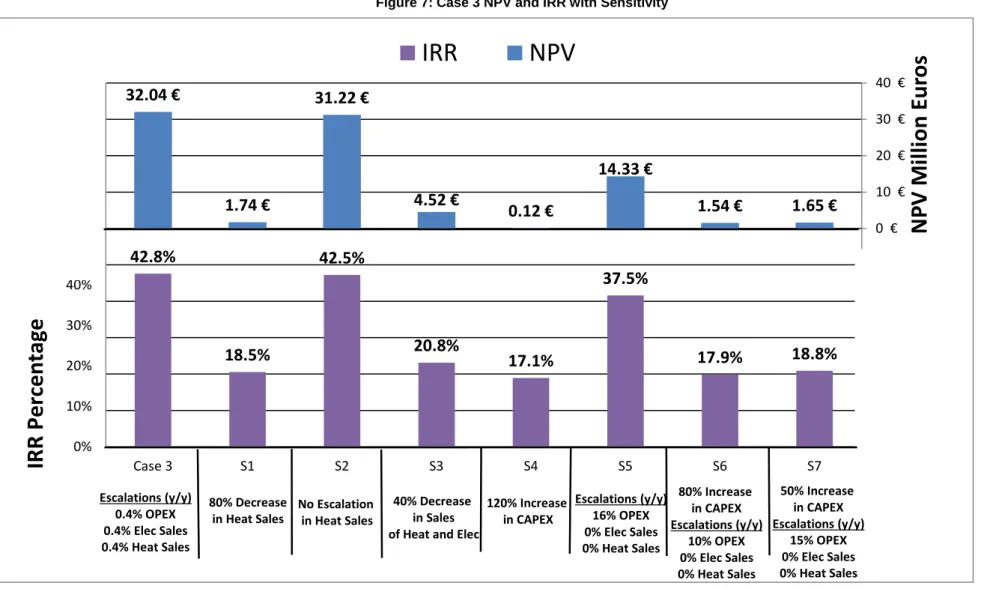

Tax (28%) Tax deductions Carbon Tax evasion Sales from heat Sales from electricity Business expenses Capital expenditure. Figures 5, 6 and 7 summarize the NPV and IRR for the respective cases, including the sensitivity indicators. Variations, through sensitivities (S1,S2...etc) in CAPEX, OPEX and sales were made to determine the income or expenses that affect the investment decision.

Net Cash Flow Case 2: Net Cash Flow Case 3: Net Cash Flow (Euro)

Analysis of Case 1

The IRR of 7.6% is lower than the petrochemical company's discount rate of 17% and together with the NPV which is negative, makes the investment unwise. The lower than discount rate IRR means that the company is better off paying its debtors as the company's cost of capital is 13%. The sensitivities, S1 and S2 indicate that a 13-14% or more annual escalation in sales must be maintained over the twenty year evaluation for the investment to be healthy.

This annual escalation in sales is more than double the average inflation in South Africa over the past five years, making the investment decision even more questionable as double-digit inflation is highly unlikely. This is further supported by sensitivity, S3, which initially requires an additional 60% income to make the investment sound.

Analysis of Case 2

The analysis also indicates that the case is strongly dependent on the sale of heat, although the investment can be sustained with a 70% decrease in the sale of heat together with a 3% annual escalation. The impending carbon tax bill, in the form of carbon tax avoidance, appears to have a marginal impact on the investment decision, even with no grants granted. Overall case 2 investment indicators; proves to be much more robust than case 1, which sustains large increases in expenditure and smaller increases in income.

IRR NPV

Analysis of Case 3

A major difference between case 2 and case 3 is the large contribution of heat sales to the valuation. This was due to the fact that the price of electricity was higher than the price offered as part of the German Renewable Energy Sources Act (Sösemann, 2007). A noteworthy point in this case is that the annual escalations in expenses and revenues were marginal, as the country's average annual inflation rate was 0.4%. S2: The indicators for investment decisions decrease slightly because the sale of heat does not increase annually, but remains very favorable.

S6: The investment decision remains wise with an 80% increase in CAPEX and an annual escalation of 10% in OPEX and 0% in heat and electricity sales. S7: The investment decision remains wise with a 50% increase in CAPEX and an annual escalation of 15% in OPEX and 0% in heat and electricity sales. The sensitivities show that the NPV and IRR are highly dependent on heat sales, but are still applicable with an 80% reduction in heat sales.

The NPV and IRR are also sensitive to fluctuations in OPEX compared to case 2, due to OPEX contributing about 5%. A notable difference between cases 2 and 3 is the ability of case 3 to meet minimum investment criteria with a 120% increase in CAPEX, compared to 60% in case 2. This is again due to higher revenue streams in case 3 compared to case 2, due to the higher cost of electricity in Germany.

Discussion

It is also noteworthy to point out that as of 2013, the renewable energy tax in Germany contributed ~48% of the electricity price (Cox et al., 2014). The higher the electricity price, the higher the income streams and thus the more positive effect on the investment decision. Another reason why biogas technology is so widespread in Germany is because the country's renewable energy policy allows for small biogas installations (400kW), while South Africa's smallest within the REIPPPP framework is 1MW.

In addition to the lower capital costs, Germany has benefited from years of investment in biogas technology due to the government's renewable energy policy developed in 1991, compared to South Africa in 2001. The country's early adoption of a renewable energy strategy has given many years of development in policy and technology, which also makes an investment decision easier. In conclusion, although in the case of the petrochemical company, the project was deemed unviable primarily due to the high WACC (as shown in case 1), the extent of financial viability via REIPPPP still exists (as shown in case 2) based on certain existing conditions that would need to be changed.

These conditions will include the option to sell heat even at the current price of industrial electricity (R763,8/MWh) which will promote income streams for the participant. Additionally the option for smaller biogas capacity capping installations which will reduce capital costs, also confirmed by Amigun & Blottnitz (2007). Furthermore, South Africa's developing nation status, with greater perceived risk, attracts a higher cost of capital than that of Germany, and therefore requires a higher return (Moody's 2017).

Conclusion

Companies that want to invest in South African projects but are listed on developed markets or have diversified allocations may also be able to use lower borrowing costs (Investec, 2004). Future studies could consider the sensitivity of engine sizes as well as WACC variations as part of the financial evaluation. Further synergies exist with other industry sectors where CO2 production from the biogas plant can be captured and sold to the industrial food and beverage sector.

Economics of reducing greenhouse gas emissions via biogas production from sorghum, maize and dairy manure in the Po valley. Technical-economic assessment of upgrading biogas plants by adsorption of hydrogen sulphide on purified sewage sludge. The role of technology diffusion in a decarbonizing world to limit global warming to well below 2 °C: An assessment using the Global TIMES model.

Biomass Price Developments Impede Biofuel Investment and Research in Germany: The Decisive Future Role of High Yields. The role of biogas recirculation in increasing the treatment efficiency of petrochemical wastewater of continuously stirred tank reactor. The transformation of Germany's energy system: What is the role of biogas in the electricity market.