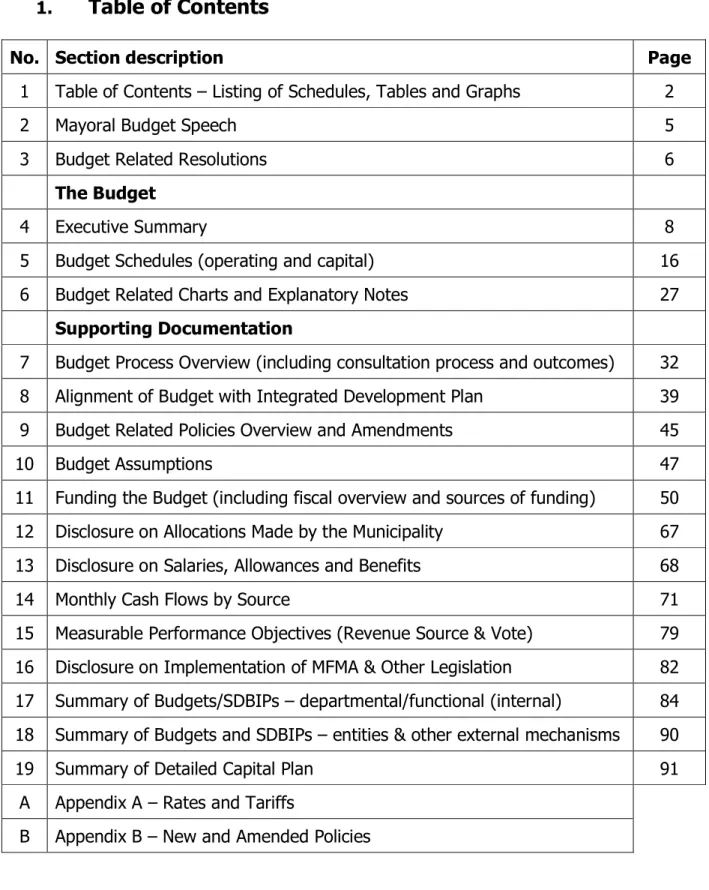

Council resolves that the measurable performance targets for revenue from each source reflected in Table 10 be approved for the budget year. Council resolves that the measurable performance targets for each vote reflected in section 17 be approved for the 2010/11 budget year. Emalahleni Municipal Council before the end of March for the financial year beginning July 1, 2010 and ending June.

There are many other format requirements for the budget that are too numerous to mention here, but a full list can be found in section 17 of the MFMA. These revised baseline budgets returned by the managers then formed the basis for the draft budget built on the key assumptions and decisions (see section 10 for a discussion of budget assumptions). As presented, the Budget for 2010/11 balances expenditure with income and available cash balances as required by the MFMA.

In addition, all positions are budgeted to be filled for the full year, except where agency workers are used in lieu of a vacancy. Council salaries are also budgeted to increase by 10%. The salary sum is 42.2% of the.

Other items in the operating budget

Conclusion

How the Total Operating Revenue Budget are funded (R101.6 million)

Rates 4.47%

Cash Carry Forward 4.05%

Sewer 2.83%

Water 2.51%

Refuse 2.52%

Elec 3.84%

Lic, Permits, Fines 0.00%

Agency 21.15%

Other 4.20%

Gen Exp 33.04%

Debt Payments 0.07%

Work Capital 0.00%

Bad Debts 6.07%

Maintenance 9.06%

All Salaries, Allow, Etc

Councillor Allowances

Small Equip

How the Total Budget Operating Expenditure are allocated (R99.1 million)

5.3 - Table A3 - Planned financial performance (revenues and expenses according to the municipal vote) 5.4 - Table A4 - Planned financial performance (revenues and expenses). These charts are related to the budget schedules presented above and are presented to illustrate the related numerical schedule.

R'OOO

OPERATING REVENUE BY SOURCE

07/08 Aud

08/09 Aud

09/10 Bud

09/10 Adj

09/10 Est

10/11 Bud

11/12 Proj

12/13 Proj

OPERATING EXPENDITURE BY GFS FUNCTION

09/1 0 Est

CAPITAL EXPENDITURE BY VOTE

CAPITAL FUNDING BY SOURCE

In terms of the Municipal Systems Act, Chapter 5, Part 3, a Municipal Council must review its integrated development plan annually in accordance with the performance measures in section 41; and to the extent that changing circumstances require and may change its integrated development plan in accordance with a defined process.

Political Oversight

BUDGET

ACTORS ROLES AND RESPONSIBILITIES

MECHANISMS FOR ALIGNMENT

BINDING LEGISLATION

Legal and policy Framework

National Spatial Development Perspective (NSDP) 4. Promotion of Rural Livelihood Programme (RULIV)

Eastern Cape Integrated Sustainable Rural Development Strategy (EC- ISRDS) PHASE PARTICIPATION MECHANISM & PLANNING EVENTS

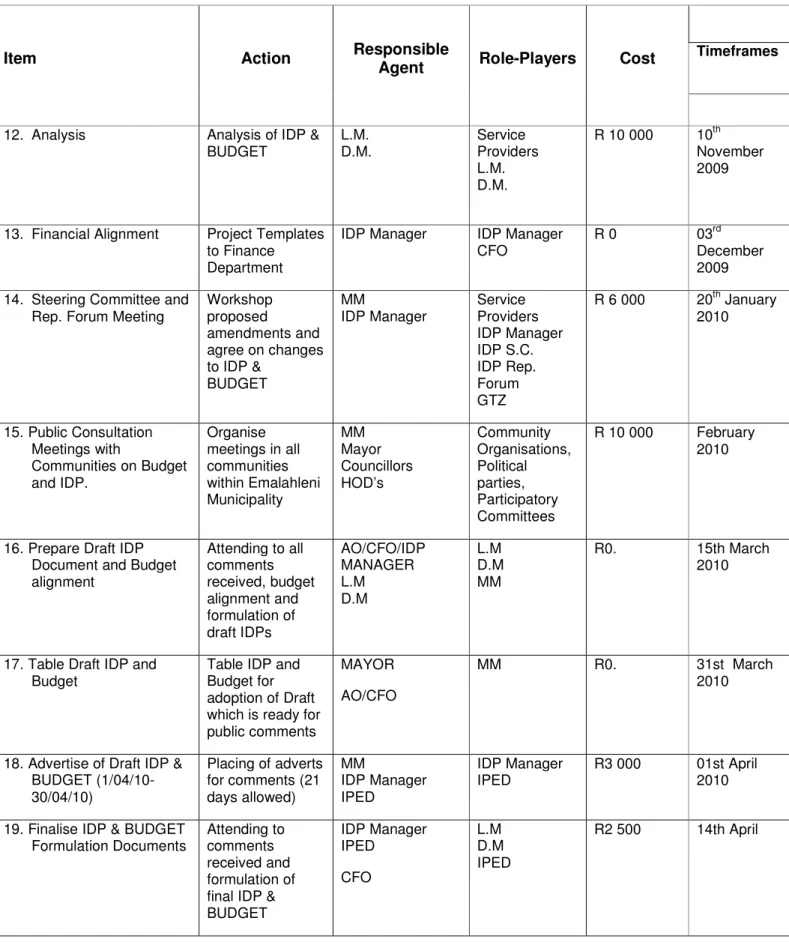

Item Action Responsible

Agent Role-Players Cost Timeframes

Prepare Draft Process Plan and District

IDP S.C

IDP Steering Committee

Adopt Process Plans Submit Process Plan to Council

Appointment of Service Providers

IDP Managers Meeting in CHDM (October and

Consultation with IDP Rep. Forum

GTZ IDP Rep

Publication of process plan

Sector Departments reminded of IDP &

IDP Steering Committee Meeting/Strategic

Sector Alignment • District Cluster

Steering Committee and

Analysis Analysis of IDP &

Financial Alignment Project Templates to Finance

Public Consultation Meetings with

MM Mayor

Prepare Draft IDP Document and Budget

AO/CFO/IDP MANAGER

Table Draft IDP and Budget

MAYOR AO/CFO

Advertise of Draft IDP &

BUDGET (1/04/10- 30/04/10)

Finalise IDP & BUDGET Formulation Documents

Align CHDM and LM IDP&BUDGET

Adoption by Council Adoption of new IDP & BUDGET

Submission of

Document to Dept. H and LG for comment

PIMMS CFO

Alignment of Budget with Integrated Development Plan

1 VISION

2 MISSION

3 DEVELOPMENT PRIORITIES FOR 2010/11

SERVICE DELIVERY

- FINANCIAL BY LAWS & POLICIES as adopted

The tables contained in the following pages attempt to harmonize the draft budget with the IDP. EC136 Emalahleni (Ec) - Support table SA5 Reconciliation of IDP strategic objectives and budget (operating expenses). EC136 Emalahleni (Ec) - Support table SA6 Reconciliation of IDP strategic objectives and budget (capital expenditure).

They will be available when the budget is submitted for consultation, presented for consideration for approval and finally approved. This section attempts to provide a broad overview of the budget policy framework and highlight the changed policies that must be approved by council decision. The Council has adopted a number of budget and finance related policies over the years and reviewed all the policies adopted by the Council during the budget process.

POLICY

The following policies were reviewed and are tabled for adoption

- Emalahleni Local Municipality Fraud Prevention Plan

- Emalahleni Local Municipality Fraud & Anti Corruption Policy 9.2.3 Emalahleni Local Municipality Risk Management Strategy

Charter

Emalahleni Local Municipality Disposal Policy as amended 9.2.6 Emalahleni Local Municipality Asset Management Policy as

Emalahleni Local Municipality Supply Chain Policy as amended

To prepare sensible budgets, assumptions must be made about internal and external factors that may affect the budget.

Budget Assumptions Table 2010/11

- Interest Rates

- Increases - Rates and Tariffs

- Billing Collection Rates

- Bulk Electricity Purchases

- Payment of all creditors within 30 days;

- using only realistically expected actual revenues and non-committed cash surpluses to fund the budget;

- ensuring that all required reserve funds are ‘cash backed’

This new costing model should then be used in the proposed tariffs for the municipality this year. A 28.9% increase in the price of large-scale electricity will see tariffs charged to customers increase by 20% this year, as set by NERSA. The municipality provides water supply and sanitation services under an agency contract with the Chris Hani District Municipality.

The municipality has continued to experience challenges in the implementation of property valuation within the municipality. The municipality has implemented an action plan to utilize internal resources to improve the collection of various billed services through a collection plan, but this needs to be reviewed and an action plan approved to increase the collection rate. After including advisers' allowances, salaries and related expenses account for over 40% of the operating budget.

Emalahleni Municipality has initiated a process to work towards a reform of its financial position and reporting systems to promote sustainability and compliance with the requirements of the MFMA. In recent years, the municipality has been obliged to make adjustments to accommodate the staff, deal with a high staff turnover, meet service deliveries from a. In recent years, the municipality has struggled to balance the budget and has had to cut back heavily on self-financed projects, resulting in delays in the delivery of services to ensure compliance with the MFMA's regulations.

However, the municipality needs to review its revenue collection base and strengthen its credit control and debt collection efforts. An evaluation of every aspect of its operation must be carried out to ensure that we conduct our business in an efficient and effective manner for the benefit of the community we serve. The Municipality must strengthen its commitment to prudent financial management of its resources and ensure that all services provided by related income and.

We must meet the challenge and meet the challenge to ensure the continued growth and financial stability of the Municipality. Credible budgets have realistic projections of revenues and expenditures, and their implementation improves the financial sustainability of the municipality. The municipality has followed these principles and the instructions presented in KT circulars 41 and 42 regarding the budget process and the financing of a municipal budget.

MFMA section Ref

Detailed lists of all proposed rates and rates for the 2010/11 financial year are contained in Appendix A. We will focus on the four main council rates together with property rates. These five sources of revenue will account for nearly R16.2 million in billed revenue for the municipality in 2010/11 and are estimated to represent R10.4 million in actual money collected.

The Municipality is in the process of finalizing our Valuation Roll as addressed by the appointed provider and addressing the various issues arising from the new role, including the identification of a number of plots still registered in the name of the State but occupied by private individuals. The municipality faced a vacuum as the vast majority of its taxable property portfolio was levied on old assessments and or no payment had been received on taxable property, which needed to be addressed. It is of critical importance for the municipality that the implementation of the general valuation for the municipality is reviewed and refined, the state ownership of land must be urgently resolved to ensure a certain broadened income base.

The second largest source of income for the municipality is the electricity tariff (R3.9 million next year). The vast majority of private users of the municipal electricity distribution system use a 'prepaid' meter system. Using this system, the municipality is able to collect the rate charge 'up front' and eliminate all losses on receivables.

Emalahleni provides water and waste water services in the role of District Municipality Representative Chris Hani. Garbage collection rates are usage-based fees based on factors such as customer category and number of pickups requested. In order to achieve this goal, the municipality will have to continue to seek savings and operational efficiency in municipal operations.

At the moment, the municipality has to place restrictions on the expenditure account in certain operational areas. The municipality also has plans to examine the abolition of certain areas and operations, which are not core functions of the municipality. Other areas of operation being explored include; implementation of the municipality's credit control and collection policy; and addressing a major issue regarding a huge amount of extremely old and very difficult to collect debtors on the active billing system.

MUNICIPAL INFRASTRUCTURE GRANT

NATIONAL ELECTRIFICATION PROGRAMME

MUNICIPAL SYSTEM IMPROVEMENT PROGRAMME

LOCAL GOVERNMENT FINANCIAL MANAGEMENT GRANT

The following is a list of grants included within the budget and a brief description of each. This grant is awarded to promote and support reforms to financial management and the implementation of the Municipal Financial Management Act. Conditions include the submission of a council resolution that aims to achieve multi-year budgets, accounting and reporting reforms.

Employing a qualified Chief Financial Officer and promoting an internship program in the area of financial management and continuous review, audit and submission of implementation plans to address deficiencies in financial management. The table on the next page contains a detailed list of funds that the municipality expects to receive.

Cash Carry Forward

Capital Grants Projects

Operating Grants Projects

Each year, when preparing the budget, consideration should be given to proposed future sources of revenue that could be introduced. The largest single potential source of revenue for the municipality is the collection of charged tariffs and rates. In addition, the effective implementation and introduction of property valuation in the municipality is crucial for its financial future.

Both of these points will be given top priority in the coming financial year in hopes of developing strategies and plans to implement improvements in the future. The table below shows that no expected loan payments will be made for the year.

TOTAL GRANTS TO ORGANISATIONS/GROUPS

Table 10 – Revenues by Source and Vote

Operating Revenue by Source & Vote 2010/11 Performance Objectives re MFMA 17 3 b

Refuse Removal 2 564 664 Fees for the removal of refuse The fee is for the removal of waste on the property. Most of the act's requirements took effect immediately; however, certain sections of the act were given varying delays based on the municipality's 'capacity' as determined by the National Treasury. All local municipalities were classified as high, medium or low capacity municipalities, with each level assigned different implementation dates for the different delayed sections.

With few exceptions, all sections of the MFMA had to be implemented by Emalahleni by July 1, 2008. Many of the major changes required by law have already been implemented by the municipality. Much of the implementation of the MFMA involves new and sometimes complex budgetary and financial reporting requirements.

The Mayor is required to make quarterly reports to the council on all aspects of budget implementation and any issues that need to be addressed. The summary of the SDBIP Directorate contained in the following pages provides the objectives and performance indicators for the year 2010/11.

SCHEDULE