BSC Budget Steering Committee MEC Member of the Executive Committee CBD Central Business District MFMA Municipal Financial Management Act CBO Community Organization MHDP Municipal Housing Plan CBP Community Projects MIG Municipal Infrastructure Grant. Motor Vehicle Registration Authority / Driving License Testing Center COO Chief Operating Officer NDP National Development Plan. SAPS South African Police Forces IBT Inclining Block Tariff SCOA Standard Calculation Chart ICT Information Communication.

ANNUAL BUDGET

M AYOR ’ S R EPORT

We have been given the responsibility of handling the public purse and we dare not betray the trust of our people. To date, we have produced doctors, journalists, pilots and many more in our quest to provide a better future for our people. We will continue to seek and use better and effective revenue enhancement strategies so that we can fast track what we have been mandated by the people.

C OUNCIL R ESOLUTIONS

In order to guide the implementation of the annual budget of the municipality, the Ekurhuleni City Council APPROVES the amended policies and by-laws set out in annex D of this document. That the copy of the IDP must be SUBMITTED to the MEC for Local Government and the relevant provincial department. That the MEC for Local Government be REQUESTED to approve the draft Ekurhuleni City EMP for 2020/21 as its Land Development Objectives as provided for in section 72a of the Development Facilitation Act.”.

E XECUTIVE S UMMARY

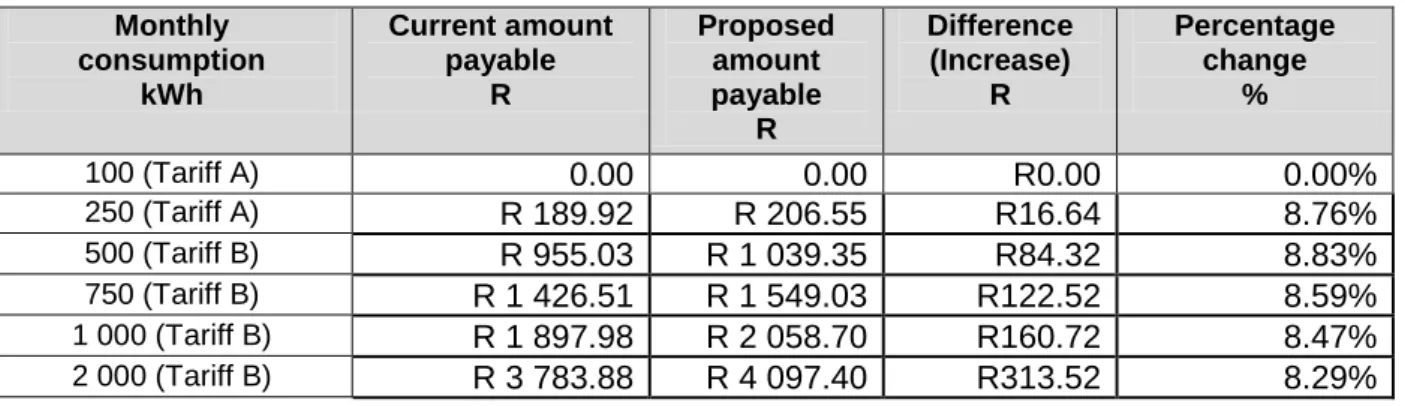

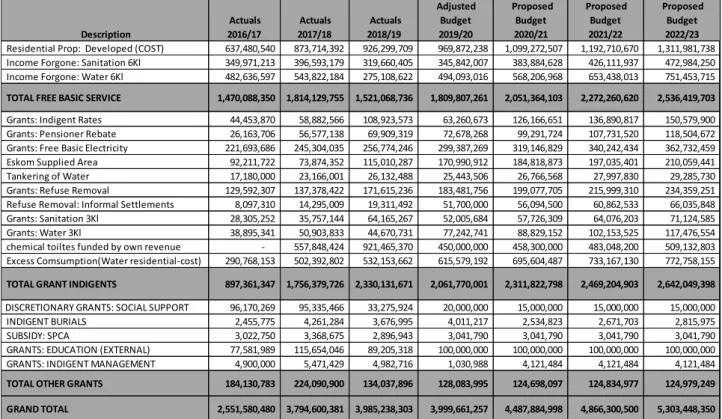

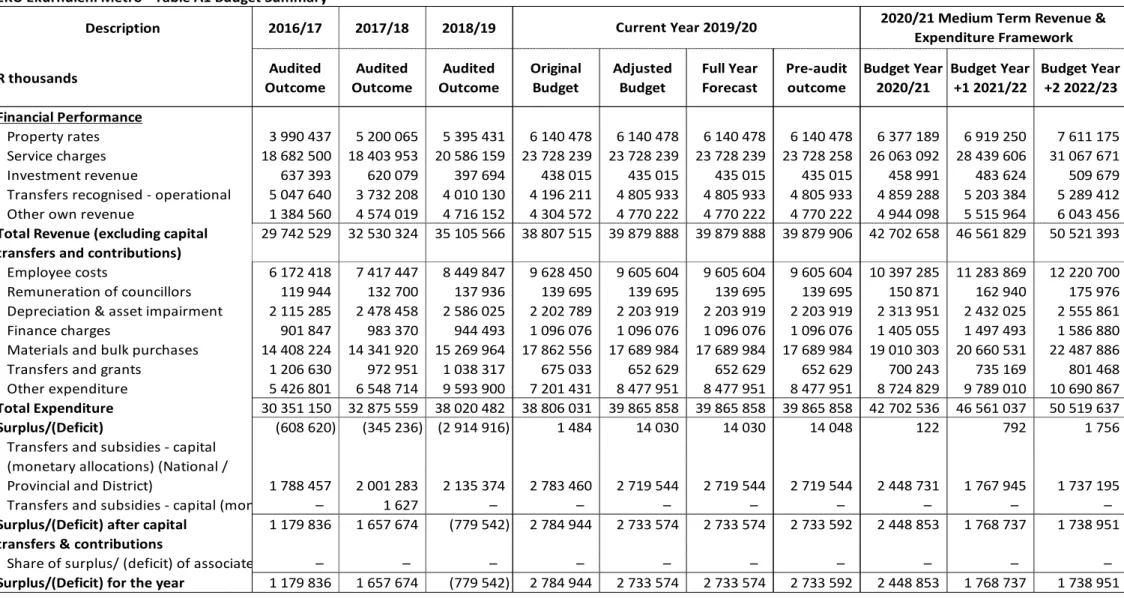

On 9 March 2020, the National Energy Regulator of South Africa (Nersa) considered the Eskom application for retail tariffs and structural adjustments. The proposed electricity tariff increases are based on NERSA's approval of Eskom's application. The financial sustainability of the 2019/20 MTREF is largely dependent on the collection level of billed revenue. The City will also provide an additional 3kI free basic water services to registered needy households as prescribed in the Council's approved Needy Policy. The total amount budgeted for free basic services and social grants to our community amounts to R4.8 billion compared to R4.

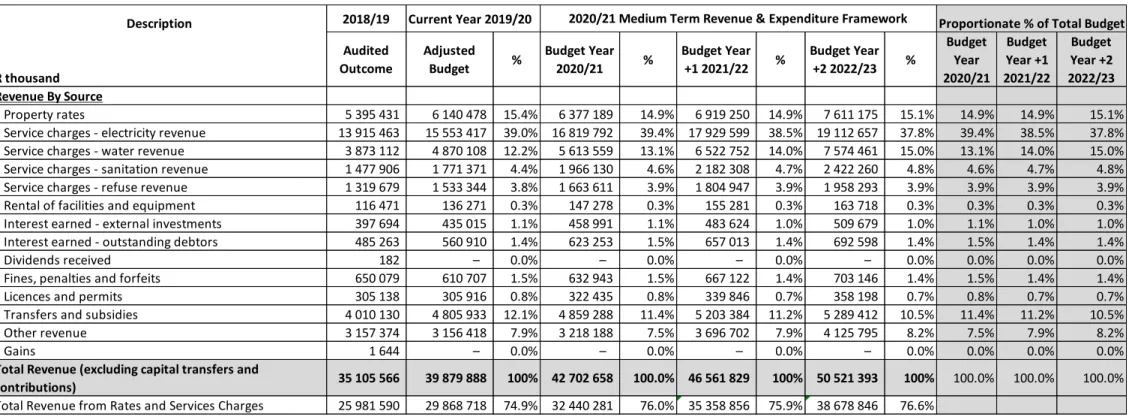

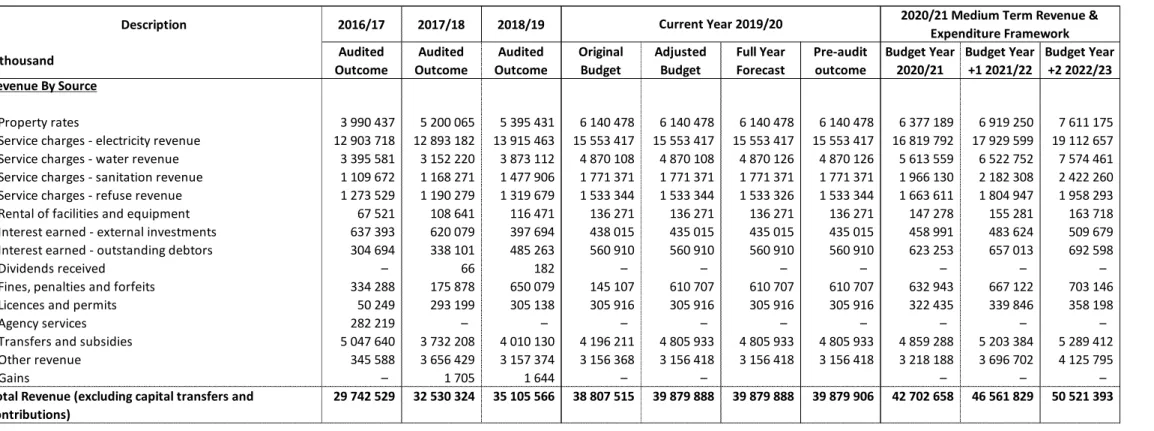

O PERATING R EVENUE F RAMEWORK

- Property Rates

- Sale of Water and Sanitation and Impact of Tariff Increases

- Sale of Electricity

- Waste Removal and Impact of Tariff Increases

- Other Tariff Increases

- Overall impact of tariff increases on households

The table below provides an overview of the various operating grants and subsidies allocated to the city over the medium term. The proposed fee increase for the provision of waste removal and disposal services is 7.5%. The proposed fee increase resulted in a total revenue increase of 8.5%. 5.2% 4.9% The increase is necessary to keep pace with inflation and rising maintenance costs. The cost of hiring facilities also allows for the generation of income for.

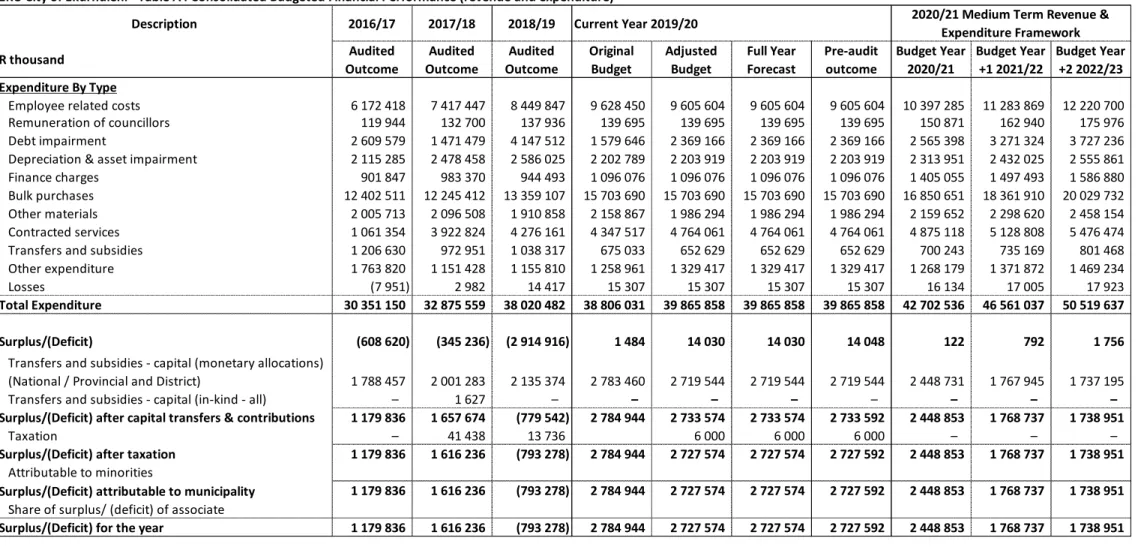

O PERATING E XPENDITURE F RAMEWORK

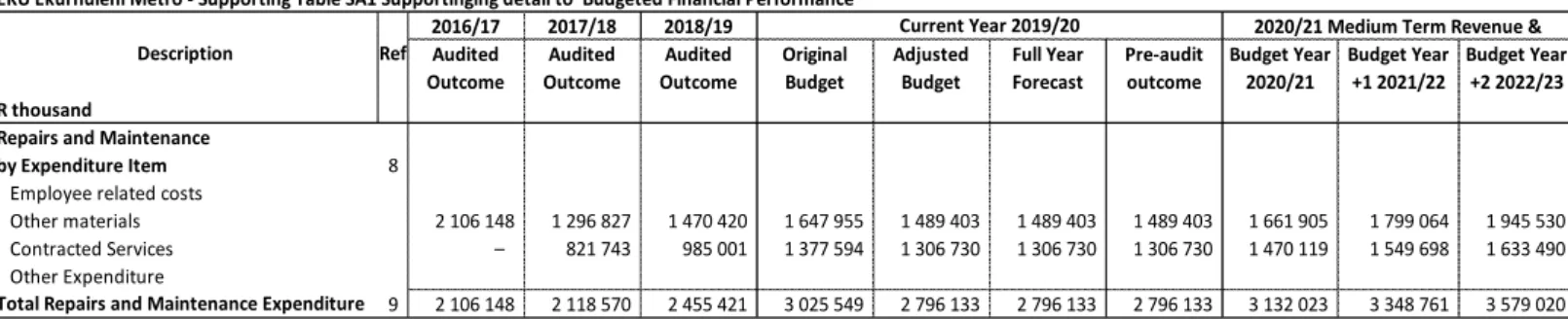

- Repairs and maintenance

- Free Basic Services: Basic Social Services Package

The costs relating to the remuneration of Councilors are determined by the Minister for Co-operative Government and Traditional Affairs in accordance with the Remuneration of Public Officers Act, 1998 (Act 20 of 1998). The latest executive order to this effect has been adopted. taken into account when preparing the municipality's budget. This is due to the Council's decision to borrow R2.5bn. in 2020/21 to fund the capital budget. The interest rate on the external loan is calculated based on the estimated interest rate of 10.5%. Large purchases are informed directly when purchasing electricity from Eskom and water from Rand Water. The annual price increases are included in the budget allocations and are directly included in the revenue regulations.

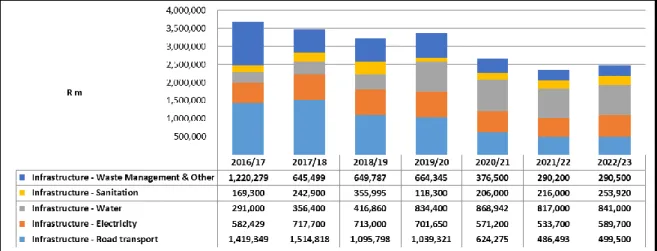

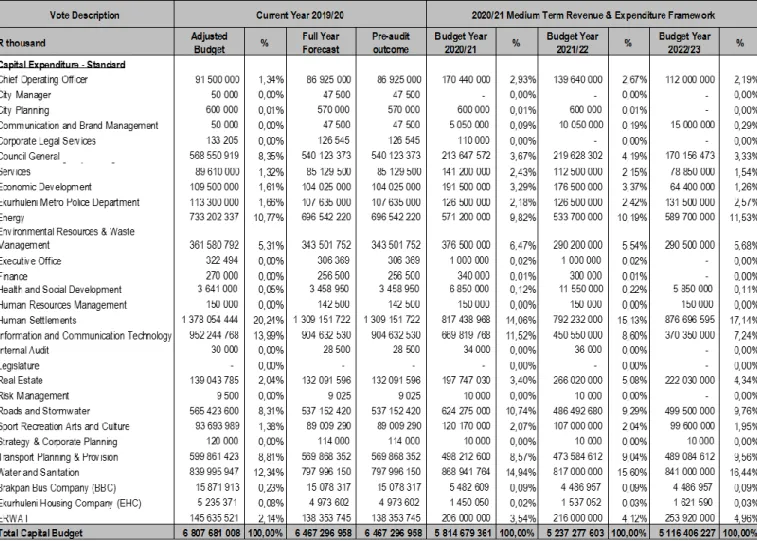

C APITAL EXPENDITURE

Other grant funding that will be used to finance social projects that will not necessarily generate income; External loans will be used to finance economic infrastructure that will stimulate economic growth and job creation; The chart below presents a breakdown of the Capital Budget that will be spent on infrastructure-related projects over the MTREF.

A NNUAL B UDGET T ABLES – C ONSOLIDATED

In addition to the MBRR Table A9, MBRR Tables SA34a,b,c provide a detailed breakdown of the capital program relating to new asset construction, capital asset renewal as well as operational repairs and maintenance by asset class. This requires the simultaneous assessment of the financial performance, financial position and cash flow budgets, together with the Capital Budget. This table facilitates the view of the budgeted operating performance in relation to the organizational structure of the city.

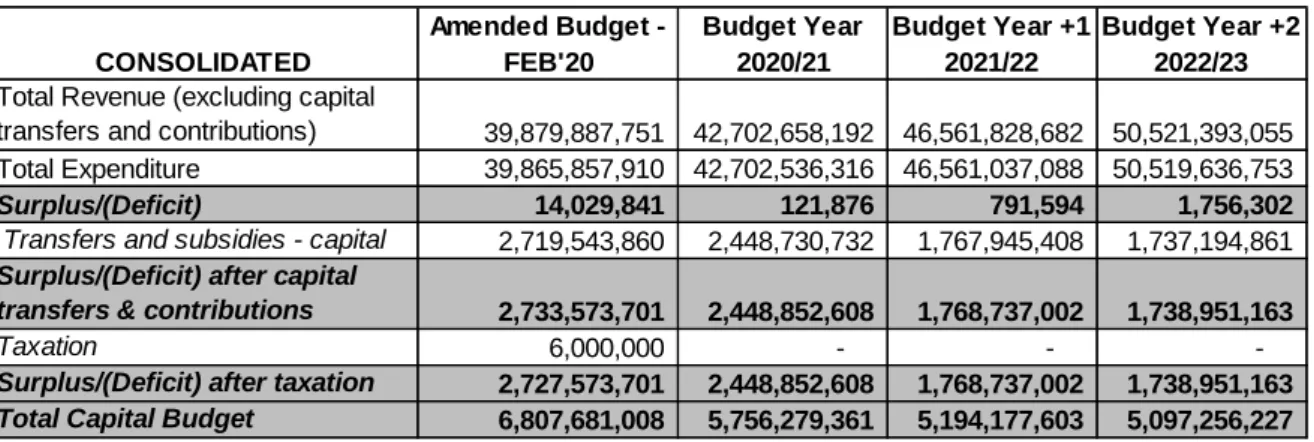

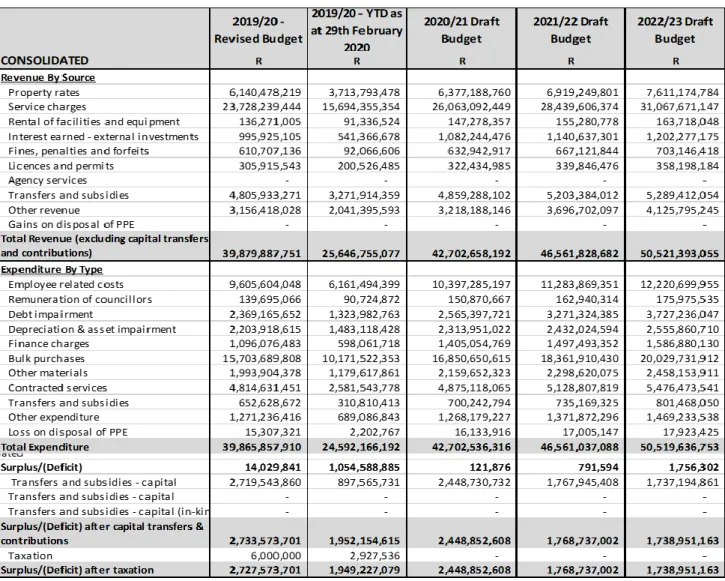

The table below is an analysis of the surplus or deficit for trading services of waste removal, electricity and water (including sewage). Revenues generated from tolls and service charges make up a significant percentage of the revenue basket for the city. The concern raised by the rating agency, Moody's, about the growth of the city's capital budget in recent years, which is unsustainable in the medium and long term;.

A significant portion of the capital budget will be funded through borrowing through the MTREF, with expected borrowings of R2.542 billion in 2020/21. The rationale is that the ownership and net assets of the municipality belong to the community. For example, the assumption of the collection rate will affect the cash position of the municipality and consequently determine the level of cash and cash equivalents at the end of the year.

The final objective of the medium-term framework is to ensure that the budget is financed and aligned with Article 18 of the MFMA.

SUPPORTING DOCUMENTATION

O VERVIEW OF THE ANNUAL BUDGET PROCESS

- Budget Process Overview

- IDP and Service Delivery and Budget Implementation Plan

- Financial Modelling and Key Planning Drivers

- Community Consultation

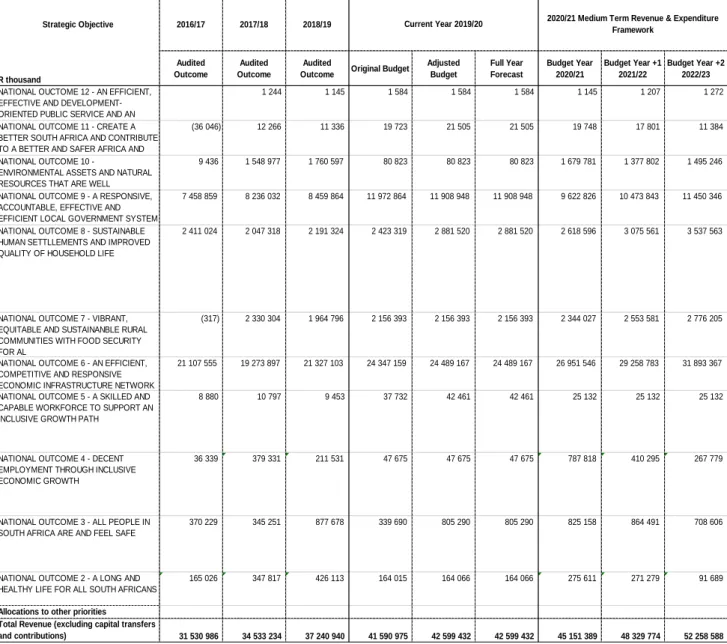

- Overview of alignment of annual budget with IDP

These fees have a significant impact on the city's revenue projections as they make up a significant portion of its own revenue. The Council then approved the presentation of the budget in March 2020, which is in accordance with Article 16(2) of the MFMA. The IDP must harmonize the resources and capacity of a municipality with its overall development goals and manage the municipality's budget.

The adaptation of the budget to the IDP has been achieved through the development of the city's IDP strategic goals, which are aligned with the city's long-term plan (GDS 2055). The chapter on the IDP performance scorecard has been amended to reflect the current delivery realities and expected results for the remainder of the period. The whole process was structured around supporting and working towards contributing to the achievement of the programs set out in GDS 2055.

Pursuant to section 34 of the Municipal Systems Act, 32 of 2000, the council must review its IDP annually in the form of a predetermined process. Focus on basic services in the form of eradication of the backlog and maintenance of existing infrastructure and community needs. All departments were part of the process of reviewing the IDP and SDBIP against the newly approved GDS 2055.

As part of the preparation of the 2020/21 MTREF, financial modeling was undertaken to ensure affordability and long-term financial sustainability.

M EASURABLE PERFORMANCE OBJECTIVES AND INDICATORS

- Performance indicators and benchmarks

- Free Basic Services: basic social services package for indigent

HS2.21 Percentage of taxable housing in the housing market with subsidy that enters the municipal valuation list. Cost of capital for business expenses is a measure of the cost of borrowing relative to business expenses. Cost of capital for own income is a measure of the cost of borrowing relative to own income.

The leverage ratio is a measure of the long-term borrowings (non-current) over funds and reserves. Current ratio is a measure of the city's ability to pay short-term liabilities with its short-term assets. Employee costs and compensation as a percentage of revenue (excluding capital o Revenue) remain steady over the MTREF period.

Repairs and maintenance as a percentage of revenue (excluding capital revenue) should be at an appropriate level to ensure that capital assets remain efficient and perform at an optimal level. Finance charges and depreciation as a percentage of income (excluding capital income) depend on borrowing, interest rate levels and the rate of depreciation of capital assets. The ratio of unpaid service debtors to revenue is an indicator of what percentage of revenue is in unpaid service debtors.

Cost recovery is an indication of the city's ability to cover fixed operating expenses with its cash and investment holdings. The higher the ratio, the higher the ability.

O VERVIEW OF BUDGET - RELATED POLICIES AND B Y -L AWS

Chief Financial Officer” means the person appointed by the Municipality as the Group Chief Financial Officer for the City of Ekurhuleni under section 56 of the Local Government: Municipal Systems Act, 2000 (Act 32 of 2000). Municipal Director - means the person appointed by the Municipality as Municipal Director for the Municipality. Chief Financial Officer - means the person appointed by the Municipality as Group Chief Financial Officer for the City of Ekurhuleni pursuant to section 56 of the Municipal Systems Act, 2000 (Act 32 of 2000).: Municipal Systems Act, 2000 ( Act 32 of 2000).

City Manager - means the person appointed by the Municipality as the City Manager of the City of Ekurhuleni in terms of section 82 of the Local. Payment will be determined from the date of last accurate reading of the meter prior to failure to register or error. The Board's estimate must be fair and reasonable and for the period from the date of the last accurate reading of the meter prior to the meter's repair or replacement.

It must be based on one or any applicable combination of the following: after the Council meter has been corrected. 6.2 (j) The applicant's constitution must provide that any assets remaining in the event of the dissolution of. 6.2(k) Existence of all applicants to be verified by the relevant Department in the specific sector (verification of the intended service must be carried out, etc.).

Ensure the safety of the municipal staff, the public and the users of the SSEG installations;.

O VERVIEW OF BUDGET ASSUMPTIONS

- General inflation outlook and its impact on the municipal activities

- Credit rating outlook

- Interest rates for borrowing and investment of funds

- Collection rate for revenue services

- Growth or decline in tax base of the municipality

- Salary increases

- Impact of national, provincial and local policies

- Ability of the municipality to spend and deliver on the programmes . 127

- Medium-term Outlook: Operating Revenue

- Medium-term outlook: capital revenue

- Cash Flow Management

- Cash-backed Reserves/Accumulated Surplus Reconciliation

- Funding compliance measurement

What are the predicted cash and investments available at the end of the financial year. A shortfall (applications > cash and investments) indicates failure to comply with Article 18 of the MFMA requirement that the municipal budget must be 'financed'. National Treasury requires the municipality to assess its financial sustainability through 14 different measures that look at different aspects of the municipality's financial health.

All information comes directly from the annual budgeted statements of financial results, financial position and cash flows. The funding compliance measurement table essentially measures the extent to which the proposed budget complies with the funding requirements of the MFMA. The municipality's expected liquidity was discussed as part of the budgeted cash flow statement. A "positive" liquidity position for each year of the MTREF will generally be a minimum requirement, depending on the intended use of those funds, such as cash backing reserves and working capital requirements.

This measure is intended to analyze the underlying assumed collection rate for the MTREF to determine the relevance and credibility of the budget assumptions. This measure must be considered important within the context of the funding benchmarks criteria because a trend indicating insufficient funds exists. Details of the City's strategy in relation to asset management and repair and maintenance are contained in Table 89 MBRR SA34c - repair and maintenance expenditure by asset class on page 237.

A requirement of the detailed capital budget is that each capital project be categorized as a new asset or renovation/rehabilitation project.

E XPENDITURE ON GRANTS AND RECONCILIATIONS OF UNSPENT FUNDS

C OUNCILLOR AND EMPLOYEE BENEFITS

EKU Ekurhuleni Metro - Support Table SA22 Summary of Councilor and Employee Benefits Summary of Employee and Councilor. EKU Ekurhuleni Metro - Support Table SA23 Salaries, Allowances and Benefits (Political Office Holders/Council Members/Senior Managers).

A NNUAL BUDGETS AND SDBIP S – INTERNAL DEPARTMENTS

- CITY MANAGER

- CHIEF OPERATING OFFICER: DELIVERY CO-ORDINATION

- CITY PLANNING

- COMMUNICATION & BRANDING DEPARTMENT

- CORPORATE LEGAL SERVICES

- DISASTER AND EMERGENCY MANAGEMENT SERVICES

- ECONOMIC DEVELOPMENT

- CITY OF EKURHULENI METRO POLICE DEPARTMENT (EMPD)

- ENERGY

- ENVIRONMENTAL RESOURCE AND WASTE MANAGEMENT

- EXECUTIVE OFFICE

- FINANCE DEPARTMENT

- HEALTH AND SOCIAL DEVELOPMENT

- HUMAN RESOURCES MANAGEMENT AND DEVELOPMENT

- HUMAN SETTLEMENTS

- BUDGET OF EKURHULENI HOUSING COMPANY (EHC)

- INFORMATION COMMUNICATION TECHNOLOGY (ICT)

- INTERNAL AUDIT

- LEGISLATURE

- REAL ESTATE

- RISK MANAGEMENT

- ROADS AND STORM WATER

- SPORT, RECREATION, ARTS AND CULTURE (SRAC)

- STRATEGY & CORPORATE PLANNING

- TRANSPORT PLANNING AND PROVISION

- BUDGET FOR BRAKPAN BUS COMPANY (BBC)

- WATER AND SANITATION

- BUDGET OF ERWAT

C ONTRACTS HAVING FUTURE BUDGETARY IMPLICATIONS

C APITAL EXPENDITURE DETAILS

D ETAILED C APITAL B UDGET PER MUNICIPAL VOTE -

L EGISLATION COMPLIANCE STATUS

O THER SUPPORTING DOCUMENTS

I MPLEMENTATION OF M SCOA

M UNICIPAL M ANAGER ’ S QUALITY CERTIFICATE