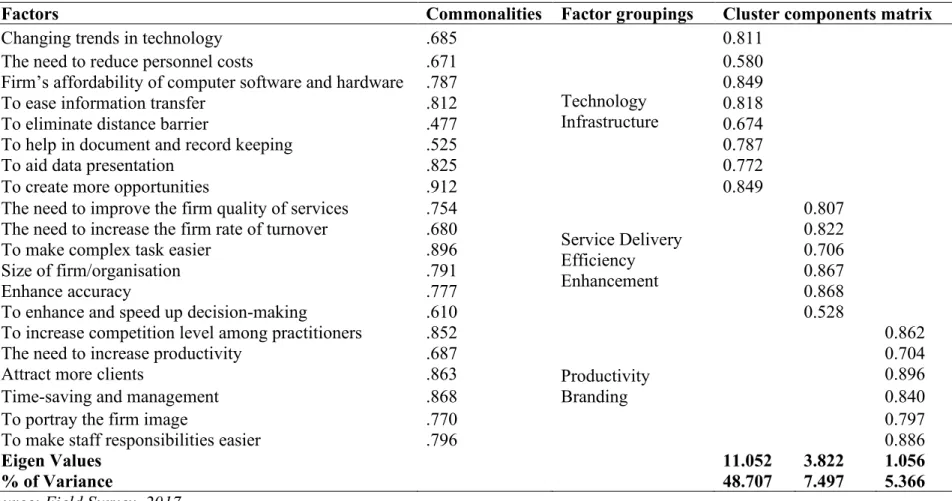

The advent of ICT has affected the business activities of real estate agents (Swanepool & Tuccilino, 2003; Kakulu, 2008; Babawale, 2012). 2015) investigated the motivating factors influencing the use of ICT in real estate practice in Minna, Nigeria.

Methodology

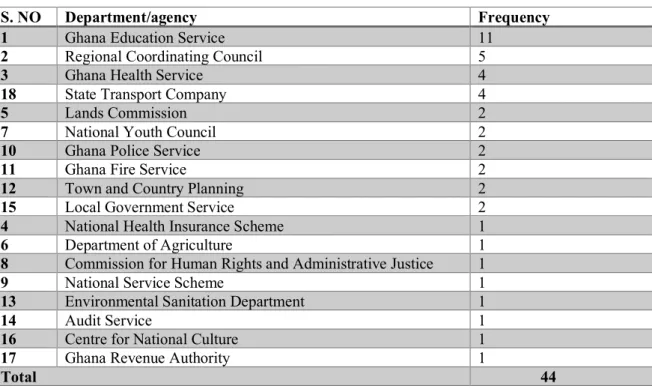

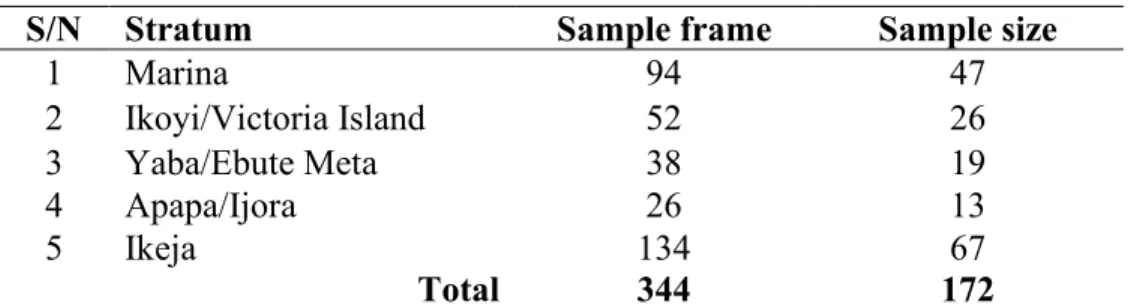

50% of real estate companies were purposefully selected to represent the sample size of respondents. Tabachnick and Fidell (2007) suggest that the sample size of a study should be between 150 and 300 before factor analysis can be considered.

Results and Discussion

The first group of factors accounted for 48.707% of the total importance of factors that requested the use of ICTs in real estate practice. All articles deal with the acquisition of technological factors necessary to achieve success in the use of ICT in real estate practice.

Conclusion and Recommendations

Factors influencing the use of information and communication technology in real estate practice in Minna. Information and communication technology in the real estate industry: Productivity, industry structure and market efficiency.

Introduction

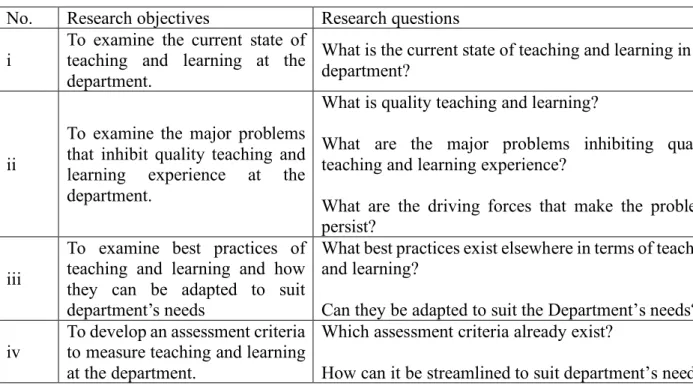

The need for improving teaching and learning has previously been underlined (Adams, 1993, Hanushek and Woessmann, 2007). To investigate the major problems inhibiting quality teaching and learning experience at the department.

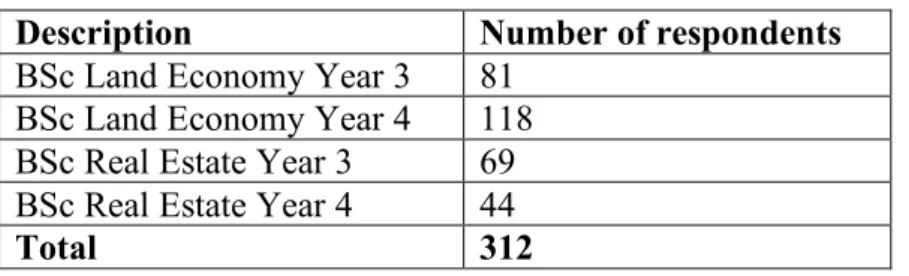

Methodology

Ramsden's (1991) questionnaire aimed to assess teaching effectiveness at the level of the entire course. A section in which feedback is requested on the perception of the quality of elements of the teaching and learning environment.

Results

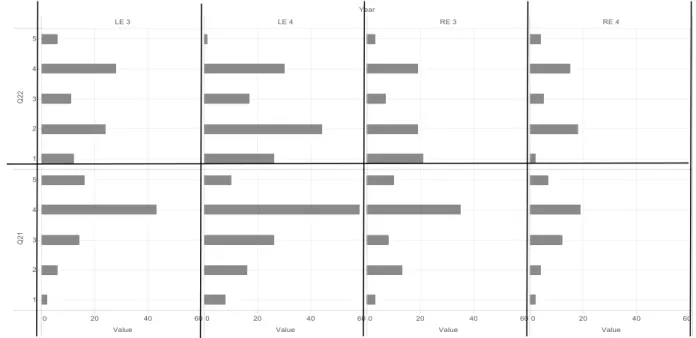

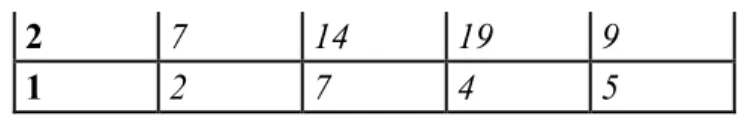

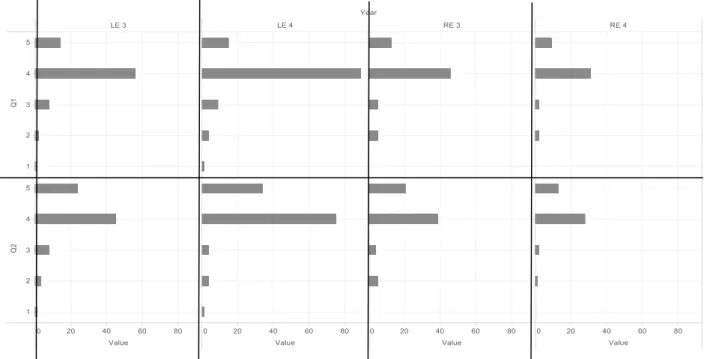

Figure 2 shows that a majority of students (more than 45% in each class) do not agree with the statement that they receive sufficient feedback on activities and assignments (question 22). The majority of the students were of the opinion that explanations from the teachers were useful.

Conclusion

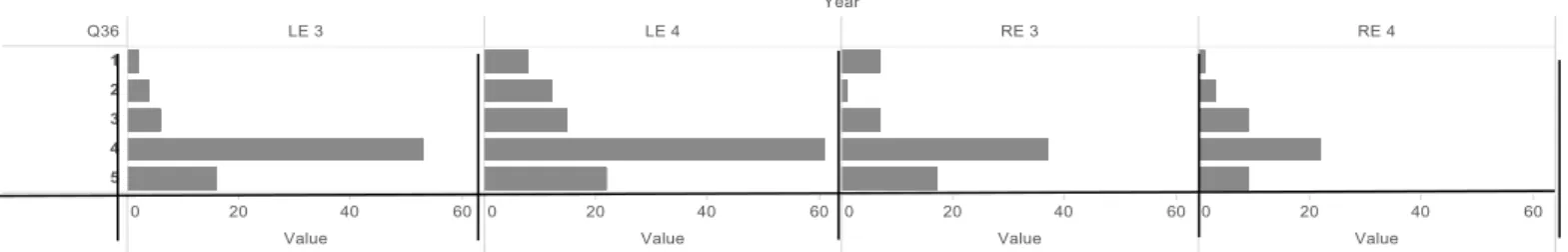

The last criterion considered in this research was to measure the overall quality of the program (see Figure 4). Finally, it can be a basis for further comprehensive assessment of the performance of the department in terms of teaching and learning.

Literature Review

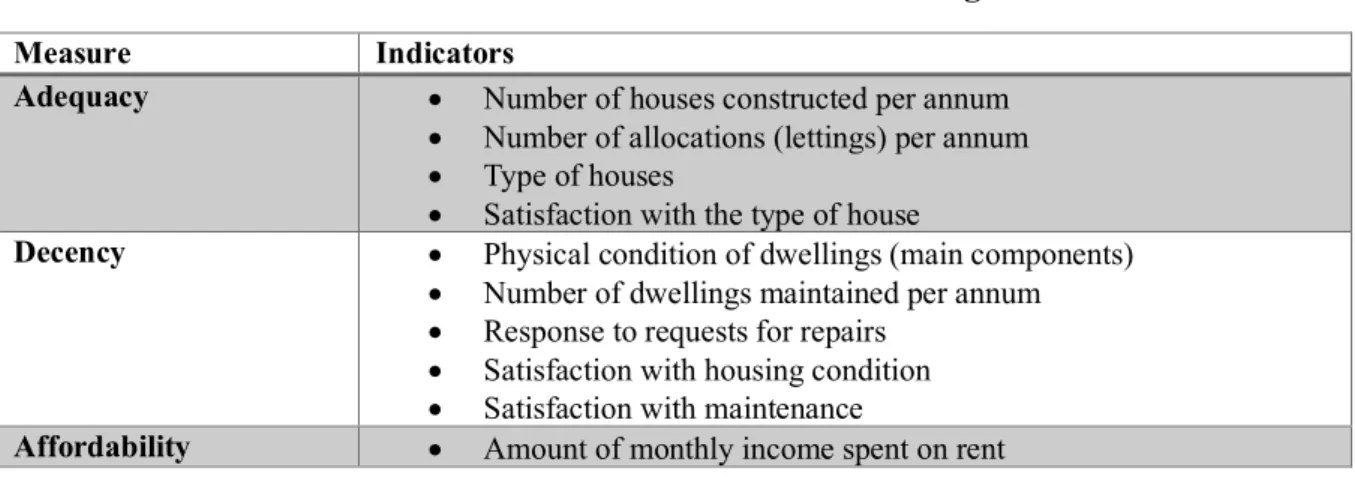

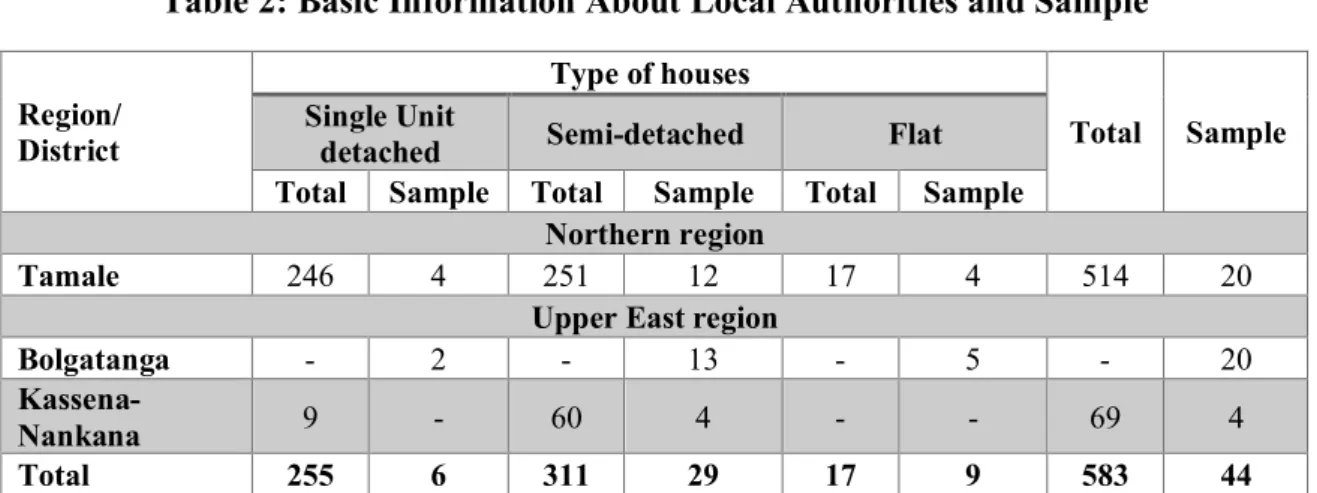

Therefore, this paper aims to assess the performance of LAs as managers of public housing in Ghana. The starting point for performance appraisal of local government managed public housing in Ghana is to identify the objective of public housing.

Methods

Furthermore, the main purpose of the study was to supplement the answers from the interviews. The survey was carried out to measure the tenants' perception of the condition of the houses and their satisfaction with the housing conditions.

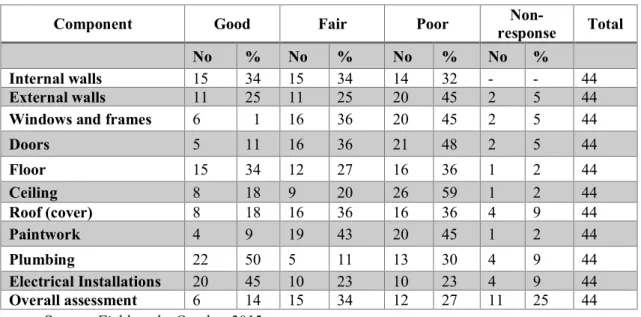

Findings

There are not enough rooms for tenants"; "The houses are not right for us in terms of the number of government workers";. Tenants were asked to express their satisfaction with the situation; general condition of their apartments, type of apartment and number of rooms (Table 6).

Discussion

It is also vital for LAs to set out their maintenance responsibilities and those of tenants in their tenancy agreements. Until now, the main indicator of the performance of LAs is the housing situation.

Conclusion

These have been identified as the financial performance of residential real estate in South Africa, the nature of residential real estate and the maturity of the REITs sector in South Africa. The findings highlight key aspects of the South African REIT sector that contribute to the low inclusion of housing stock in REITs' portfolios. The structure of the article provides a brief discussion of the history of REITs from both a global and South African perspective.

Background to the Study

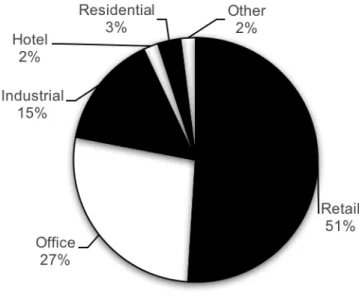

The listed property market in South Africa at the time of this study consisted of four types of property entities listed on the Johannesburg Stock Exchange (JSE). Over the past decade, the listed property sector in South Africa has experienced significant growth (De Klerk, 2013). The South African REIT market is the 9th largest of its kind globally (Ntuli & Akinsomi, 2017).

The South African Residential Property Sector

The residential market has seen a shift from freeholds to sectional title schemes and gated communities (Golding, 2016). The above highlights that there is indeed a great deal of potential for investors within the residential sector in urban South Africa. To this end, it is suggested that defining the factors that have led to the low investment in residential stock will enable a deeper understanding of what needs to be done to exploit the opportunities that exist in the residential real estate sector in South Africa. make.

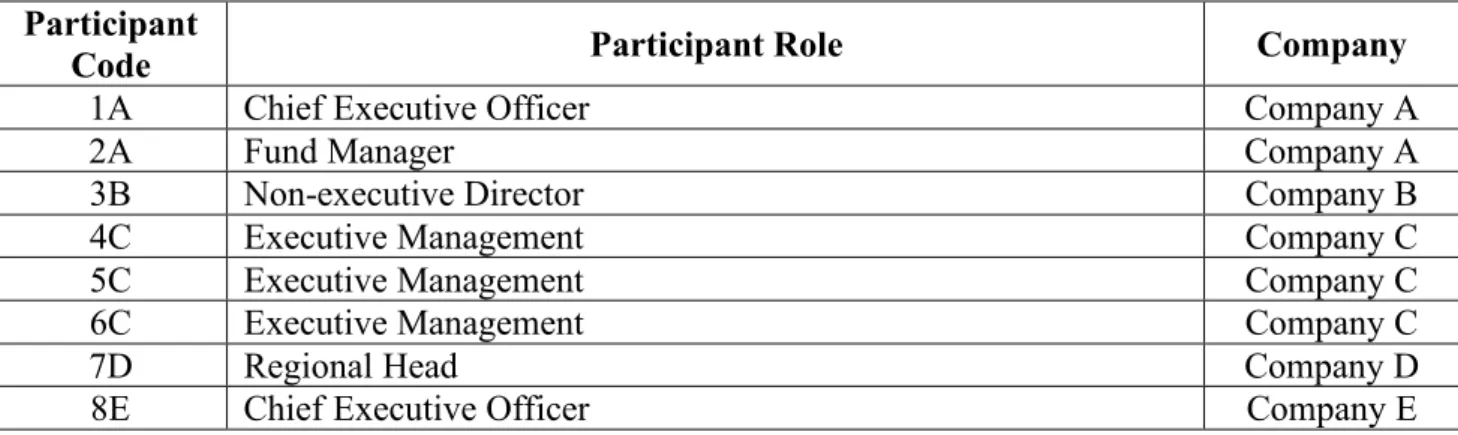

Research Method

With the research question and sampling methodology in mind, the approach therefore focused on semi-structured interviews with real estate professionals working in the South African listed real estate sector. The purpose of selecting this organization in the study is that they are experts in the REIT sector, but can also provide an objective assessment of the sector as they have no vested interest in any particular REIT portfolio or strategy. Their specialization is in retail real estate, with a focus on non-metropolitan hubs serving low LSM segments in the form of convenience, community and regional shopping centres, which are close to transport hubs.

Findings and Data Analysis

A significant trend developing in the South African REIT sector is an increasing exposure to offshore investments. According to 8E, the management intensity in the residential sector is far more complicated than the business sector. This is supported by 3B who suggested that there is a skills shortage in practitioners operating in the housing sector in South Africa and that specialized housing expertise is required to achieve attractive returns.

Discussion

Respondent 1A further mentions that the Residential Real Estate Trust attempted to list in the early 2000s. In turn, this is likely to lead to an increase in the use of housing stock in the listed sector. Current underdevelopment means that there is limited information and unclear understanding of the risks and opportunities presented by residential property in the listed sector (Anderson & Cloete, 2016).

Conclusion

50 Years of Real Estate Investment Trusts: An International Examination of REIT Growth and Performance. Available: https://www.accountancysa.org.za/analysis-reit-south-african-real-estate-investment-trust-structure-introduced/. Available: https://www.reit.com/data-research/data/us-reit-industry-equity-market-cap [Accessed August 2, 2017].

Introduction

Conclusion

Trends in the use of the Internet for the marketing of residential property in New Zealand. This paper provides an in-depth examination of various concepts related to forms and sources of uncertainty, as well as dealing with uncertainty in real estate development (RED). The problem of risk and uncertainty in RED is compounded by new developments in the real estate market, which have increased the sophistication of investors and the market itself (Olaleye, 2008).

Perspectives on Risk and Uncertainty

The study asserted that uncertainty relates to a lack of knowledge about possible outcomes, while risk refers to situations with known alternative outcomes and the associated level of probability associated with each outcome. Ward and Chapman's (2003) study asserted that uncertainty means lack of certainty and refers to variability related to cost, time or quality. It arises as a result of ignorance about the state of knowledge and/or lack of control (Kahneman & Tversky, 1982).

Forms and Sources of Uncertainty in Real Estate Development

The second is endogenous uncertainty, which is related to the unknown internal factors embedded in the RED. Endogenous uncertainty, the source of which is internal to the RED, can be further examined from two perspectives. The former, which is related to the macro level, arises as a result of decision-making in a dynamic and uncertain environment.

Management of Uncertainty in RED

It therefore assumes that the assumptions underlying the traditional models may lead to unreliability of the assessment estimates, due to their static one-time decision. Other studies, such as Throupe et al. 2014), confirms this assertion of the effectiveness of the real option approaches as a means of managing uncertainty in RED projects. The focus of the next section is to discuss the different options available in RED.

Types of Options in Real Estate Development

- Exit/Abandonment Options

- Learning Options

- Modify/Switching Options

Some waiver options allow the investor to dispose of the project and cash in on the salvage/resale value of previous capital investments in the project. However, in this case, the investor could check the suitability of the project by undertaking the initial phase development, perhaps at a low cost. Other types of options within the classification adopted for this study include the option to enter into a contract.

Real Option Models

A major disadvantage of this approach is that it can only value options with a limited lifespan. The Black-Scholes model is one of many models of the partial differential method. Masunaga (2007) noted that an advantage of the discrete and closed form approaches is that they are based on the risk-neutral framework.

Factors Influencing the Adoption of Real Option Models

However, it should be noted that the real options approach is not a panacea. There are inherent limitations to the approach. 2004) noted that there are tendencies towards miscalculations and misuse of the ROA, which could lead to incorrect estimates. It appears that some factors influence whether or not RED appraisers adopt ROA. Furthermore, Dyson and Oliveira (2007) argued that a disadvantage of ROA is its reliance on quantitative data.

Conclusion

Nigeria: an analysis of challenges and prospects in real estate development in Nigeria, retrieved from http://www.mondaq.com [April, 2016]. Modeling uncertainty and flexibility in the financial analysis of a real estate development project in Switzerland. The wide popularity of the HPM technique in the field of real estate has translated into its adoption in both practice and theory (Schwartz, 1995).

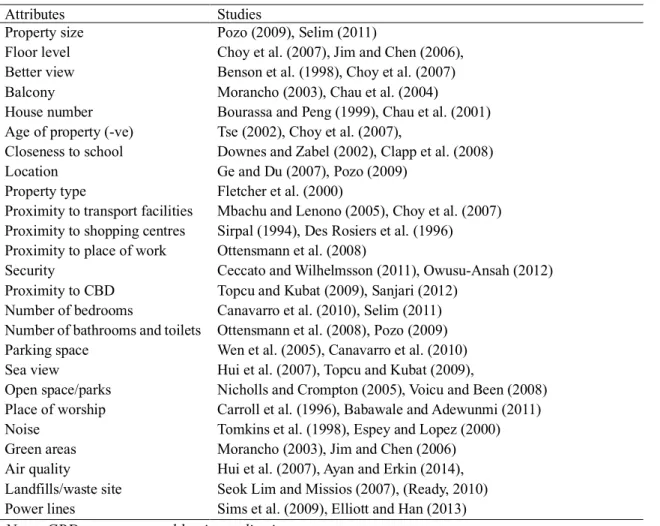

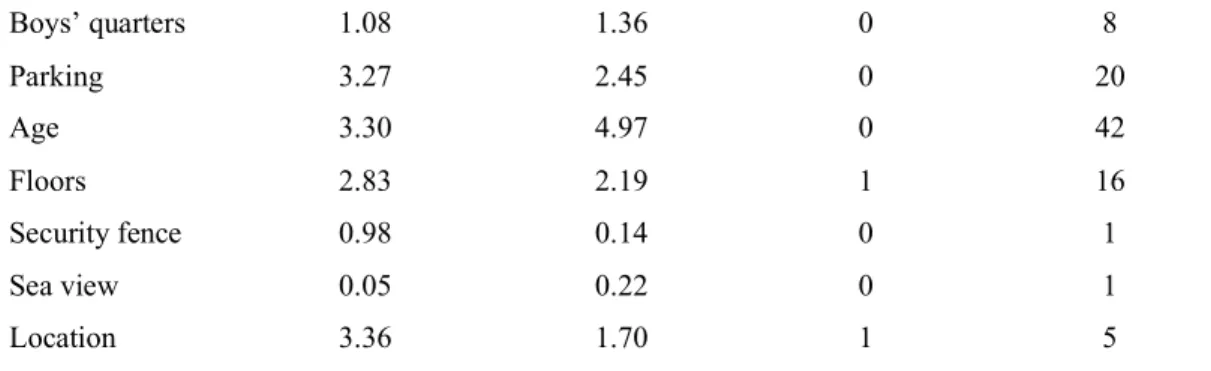

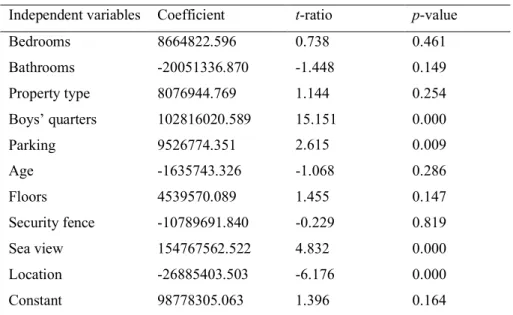

Research Method The Data

The selection of the variables to be included in the model began with testing for multicollinearity between the independent variables by estimating their partial correlation coefficients. 80% (256) of the samples were used to develop the HPM equation, while the remaining 20% (65) remaining samples were used for testing the model. The accuracy of the model was tested based on the r2, mean absolute percentage error (MAPE), mean absolute error (MAE), root means square error (RMSE) and finally the percentage of the predicted values that are close to the true property . values (residual samples).

Results and Discussion Empirical Results

Also, the positive impact of BQ room on property prices was reported in the study of Basu and Thibodeau (1998). The need to establish the predictive accuracy of the HPM technique for property valuation in a developing country necessitated this study. Estimation of hedonic price function for residential units (A case study of Hashtgerd New City, Iran).

The Research Context

There is a glaring gap in the literature and this research is essential to address the lingering problems of land registration in the country. The national law governing land registration in Nigeria is the Land Registration Act No. In Kaduna State, the relevant laws include the Kaduna State Land Registration Act, 1982, the Kaduna Geographical Information Service (KADGIS) Act, 2015 and the Kaduna Land Use Regulations, 1982. 2017.

Literature Review

Thontteh and Omirin (2015) investigated land registration reforms in Lagos State with the aim of determining the effectiveness of the electronic document management system (EDMS) used for land registration. In addition, Feder and Nishio (1999) reviewed the literature on empirical works on the benefits of land registration. Indications from the literature are that many countries have implemented different forms of land registration.

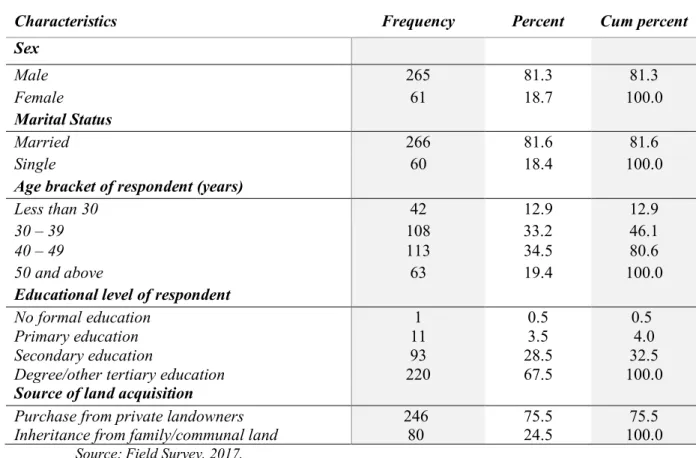

Materials and Methods

In the survey of the consultants, 62 firms of registered surveyors and valuers practicing property transaction consultancy were identified by the Kaduna State branch of the Nigerian Institution of Surveyors and Valuers (NIESV). The study population was then estimated from the updated figure of 1,451,280 households at 48.6%, the country's estimated proportion of urban population to the total in 2016 (United Nations, Department of Economic and Social Affairs, Population Division, 2014). Based on the observations, the guide was modified, and a final version was prepared and used in the study.

Results

- Respondents’ Demographic Characteristics

Respondents who registered their land had problems, the most important of which was the long duration of registration. It requires the applicant to submit two key documents as proof of ownership - a sales contract and a certificate of ownership of the applicant from the district head, village head and district head of the area where the land is located (M09SS). After registration of the contract of assignment, a certificate of use is processed and issued in the name of the transferee.

Discussion of Results

Similarly, factors that pose challenges to the land registration process include corruption (manifested in making informal payments to land registration officials) and inefficient registration process (manifested in poor record keeping, delays and long and cumbersome processes). Furthermore, the issues raised in the research are equally relevant to many African countries where land registration and land tenure insecurity have posed significant challenges to the development of land markets. Future researchers should consider investigating further measures to address land registration challenges in the state.