Moreover, these firms also have optimal levels of working capital investment, and they strive to adjust to this optimal level. The study also found that working capital management plays an important role in mitigating the impact of financial constraints.

Introduction

However, different economic styles have different goals, so working capital management practices may differ. In general, there is a dearth of working capital management theory in academic research.

Background to the study and outline of the research problem

- Working capital, business failures and share price crashes

- The paradigm shift in working capital management

- Working capital financing in South Africa

- Working capital management and financial constraints

- The global financial crisis

- Research questions

- Research objectives

Good working capital management combats companies against a credit crisis and reduced access to external funds (Kesimli and Gunay, 2011). Does working capital management make a difference in easing financial constraints in South Africa among JSE listed companies?

Aim of the study

How did the global economic crisis affect the working capital financing and investment practices of JSE listed companies. Examine the impact of the global financial crisis on the working capital financing and investment practices of JSE listed companies.

Problem statement

Significance of the study

A literature search found only three studies of working capital management and profitability (Erasmus, 2010, Smith and Begemann, 1997, Ngwenya, 2012). Furthermore, given the South African financial landscape, there is a need to analyze the determinants of working capital financing.

Context of the study

This study uses the partial adjustment model because the process of adjustment to the real or desired goal of working capital management involves time and cost. The highly integrative nature of working capital management means that the regression analysis must take into account the endogeneity problem.

The JSE

It involves a trade-off between disequilibrium and the cost of target adaptation. From a methodological point of view, this study contributes to the discourse on short-term financial management by using a dynamic approach and uses the generalized method of moments (GMM) as a way of controlling for potential endogeneity problems.

Assumptions of the study

Limitations of the study

Organisation of the study

Introduction

The history of working capital management

The work of Adam Smith (1776) distinguishing between circulating and fixed capital was among the early work to contribute to the development of working capital management theory. The merchandise of the merchant yields him no income or profit until he sells it for money, and the money yields so little until it is again exchanged for goods.

The origins of the term working capital

His capital is constantly going away from him in one form and returning to him in another, and it is only through such circulation or successive exchanges that it can yield him any profit.

The evolution of working capital management

There was increasing emphasis on financial ratios, especially the current and quick ratios – these were widely used as a measure of working capital adequacy. Beranek (1988) argues that the commercial banking sector also contributed to working capital management as they largely promoted working capital loans before 1920.

The development of working capital management theory

He studied the effect of the level of working capital on the return on investment in nine industries for 1961 and found that the two factors were inversely related. This was a glorious period in the development of the theory of working capital management, although at that time models were developed on individual elements of working capital.

The concept of working capital

According to Mongrut et al. 2007) the modern literature on working capital seems to have lost the glamor that the subject created in the 1960s and 1970s. A further concept of working capital asserts that working capital should be considered to include both short-term assets and other non-capital expenditures related to the operations of a business.

Definition of working capital

It determines whether the company will be able to survive a depression or meet the company's contingent needs. This study defines working capital from the gross concept; that is, working capital represents the company's investment in current assets, and net working capital is the difference between current assets and current liabilities.

Definition of working capital management

Measures of corporate liquidity

The static view

Quick Ratio / Acid Test Ratio = (Current Assets – Inventory) / Current Liabilities Cash Ratio = Cash + Marketable Securities / Current Liabilities. Furthermore, the liquidation of current assets to pay current liabilities will disrupt the operating cycle of the firm unless the firm is liquidated.

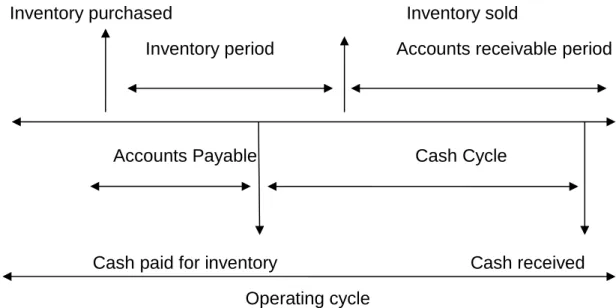

The dynamic view

They designed a modified version of the CCC that they called the Weighted Cash Conversion Cycle (WCCC). Shin and Soenen (1998) questioned the suitability of the CCC to measure the efficiency of firms' working capital management on the grounds that its calculation involves adding ratios of different denominations.

Working capital requirements and net liquid balance

NTC measures the number of "sales days" a company has to pay for its working capital. For example, accelerated debt collection increases available cash; reduces the need for working capital and improves the company's net liquidity position.

The liquidity and profitability trade-off

Efficient working capital management means balancing the conflicting objectives of maximizing business value (profitability) and ensuring the survival of the business (liquidity).

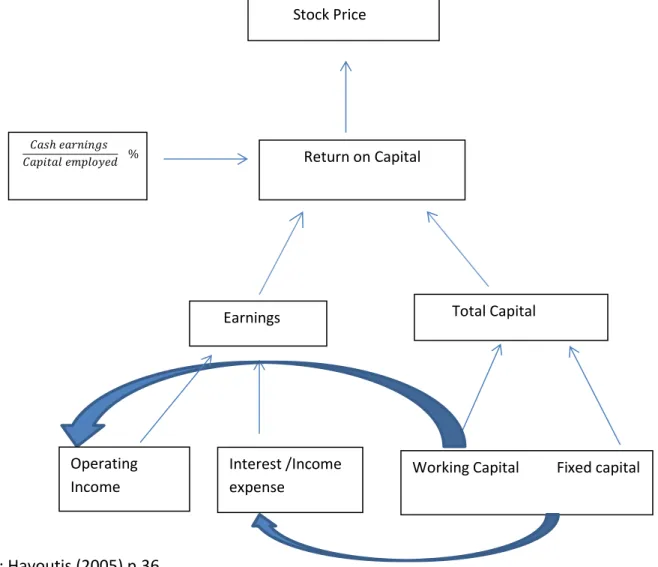

How working capital optimisation affects profitability

Working capital management and profitability empirical studies

Chapter summary

Introduction

Current assets (Working capital investments)

Fixed capital and working capital investments

Types of current assets (Working capital investments)

Cash and marketable securities

On the other hand, excessive cash holdings compromise returns because cash is a non-earning asset while marketable securities earn low returns on the market. The conflicting effects of excessive cash holdings and cash shortages mean that the firm must maintain an optimal cash balance that enables it to pay its debts as and when they fall due, while ensuring that it does not hold excessive cash levels.

Accounts receivable (Trade debtors)

Credit sales help the company increase sales in the short term and eliminate the need for customers to build up enough cash to purchase goods/services. When credit is extended, the company must finance inventory; there are opportunity costs for money tied up with debtors, the risk of non-payment by some customers and the costs of running a credit department (Gitman, 1997; Firer et al., 2012).

Inventory (Stock)

Selling on credit can stimulate sales, help a firm gain market share, prevent competition, and enable a firm to charge a higher price, thereby increasing both profit margins and sales in the short term (Nadiri, 1969, Smith, 1987, Schwartz, 1974). Maintaining high inventory levels allows the company to run production schedules smoothly and continuously and to meet any unexpected increases in sales demand.

Permanent and temporary working capital

- Working capital investment policies

- Working capital investment and firm value relationship

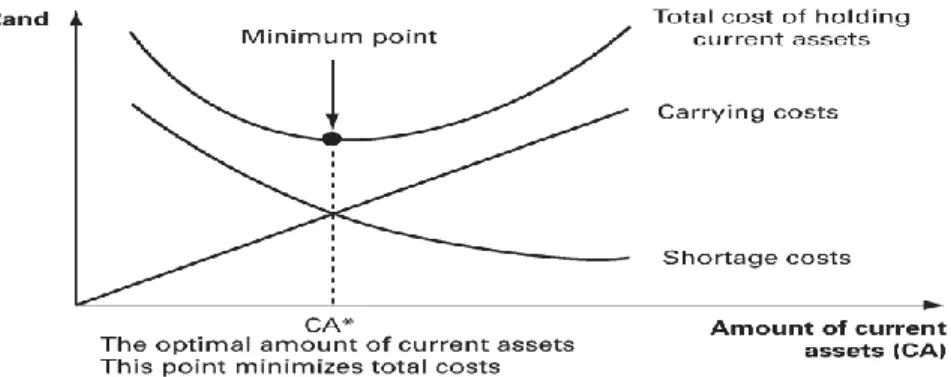

- The cost of holding current assets

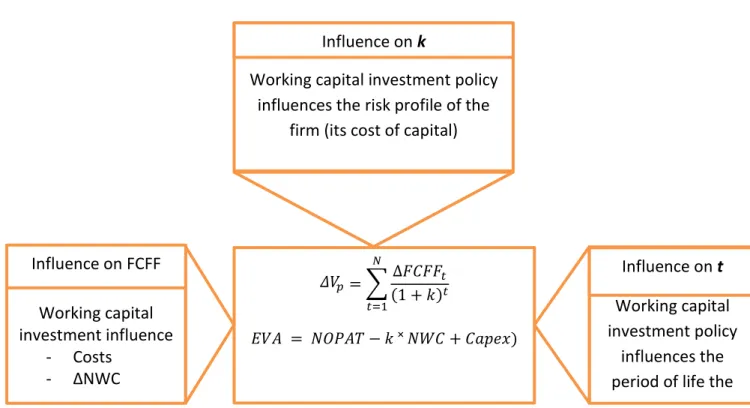

- How working capital investment influences firm value

- Empirical studies on working capital investment and firm value

- Factors influencing working capital investment

- Empirical studies on working capital investment

- Analysis of theoretical and empirical literature on working capital investment

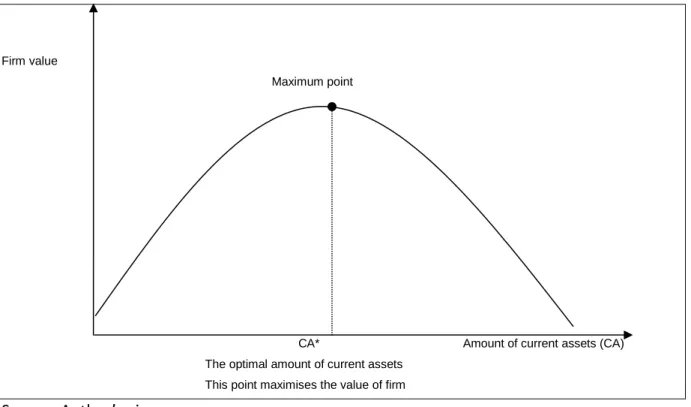

Pursuing a flexible working capital investment policy (maintaining a high level of current assets) can also increase a company's value and profitability. Having a high amount of working capital (mainly cash and marketable securities) allows a company to meet its obligations more easily, which reduces its liquidity and risk of default, increases its borrowing capacity, lowers the cost of capital and increases its value (Samiloglu and Demirgunes, 2008).

Working capital financing

Working capital finance and current liabilities

There are several qualitative factors affecting the firm's working capital investments that cannot be measured, most of which are beyond the firm's control. 64. investment) and current liabilities represents working capital financing obtained from long-term debt or equity.

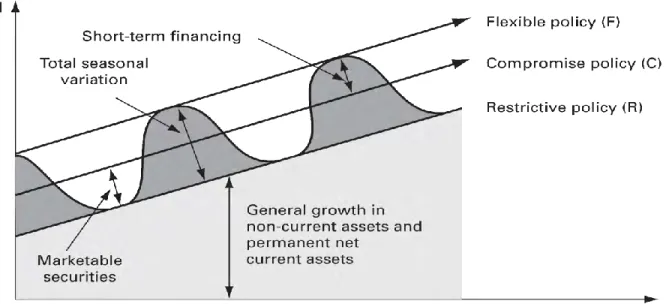

Working capital financing policies

Short-term loans are used to cover peak assets such as inventories, while long-term funds are used to support long-term assets and permanent working capital. The company has a liquidity reserve in the form of short-term marketable investments in the low season.

Working capital financing and risk

Sources of working capital finance

Long-term sources of working capital finance

Factoring increases financing and the borrowing capacity of the firm as it is off balance sheet financing. Consequently, factoring can provide room for the firm to access other forms of external financing despite having more debt.

Short-term sources of working capital finance

- Accruals

- Trade credit (Accounts payable)

- Trade credit theories

- Trade credit usage and its advantages

- Bank credit

- Bank credit versus trade credit

- Long-term debt and short-term debt

- Accounts receivable financing

- Inventory financing

- Public deposits

As the company increases (decreases) its production and purchases, accounts payable increase (decrease) and provide part of the funds needed to finance the increase in production (Danielson and Scott, 2004). The leverage ratio depends on the age and credit quality of the company's receivables.

Working capital financing empirical studies

The use of public deposits to finance working capital started in the 1930s, then declined in the 1950s before regaining prominence in the 1970s (Majumdar, 1996). But they expose the innocent investing public to the trap of unscrupulous deposit takers. 2010) found that the contribution of short-term financing to working capital was on an upward trend.

Factors influencing working capital financing

2010) found that the contribution of short-term financing to working capital showed an increasing trend. Companies with limited or no internal financial resources must finance their working capital needs from other sources.

Chapter summary

Introduction

According to Bernanke and Gertler (1989) the quality of the firm's balance sheet affects the agency costs of external finance. When its liquidity decreases or when the prospects of future sales deteriorate, the cost of external financing increases.

Cash flow Investment sensitivity

Guariglia (2008) explained that one of the main reasons for the different conclusions coming from studies on cash flow investment sensitivity is disagreement over how financial constraints are measured. Guariglia (2008) concluded that the degree of internal and external financial constraints has different effects on the sensitivity of cash flow investments.

Measures of financial constraints

Financially constrained firms are likely to borrow at high interest rates in foreign markets (Fazzari et al., 1988, de Almedia and Eid, 2013). Duration of business is another way to classify businesses as financially constrained or not.

Working capital, fixed investment and financial constraints

Fazzari and Petersen (1993) found that US firms used their working capital to offset investments in fixed assets. 2013) state that the effects of financial constraints on cash flow investment sensitivity can be mitigated by maintaining high levels of working capital.

Chapter summary

Luo (2011) presented an argument that financial constraints have a brighter side of influencing how managers spend money. In the same way, financial constraints force managers to set the optimal working capital at a level that is not too high.

Introduction

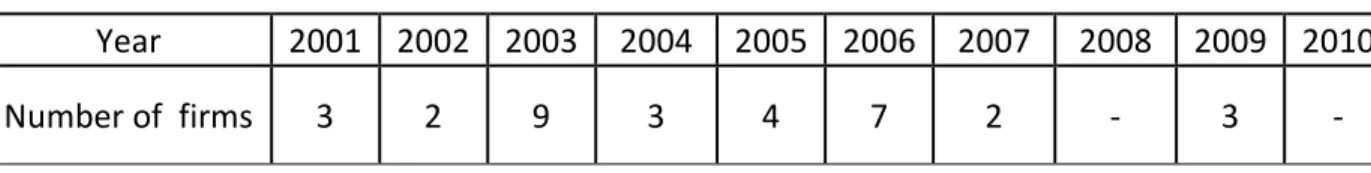

Data sources

Data collection

Third, panel data allows the researcher to analyze the adjustment process of the dependent variable in response to changes in the values of the independent variable. Fourth, panel data allows the researcher to solve a problem with omitted variables in the regression results.

Target population

Using panel data methodology, the study ascertains the importance of hypothetical variables that influence working capital financing and investment decisions. Second, panel data suggest that firms are heterogeneous, which enables the researcher to control for unobservable heterogeneity; on the other hand, enabling the elimination of biases arising from the existence of individual effects (Baltagi, 2008, Hsiao, 2003).

Data analysis

- Model specification

- The working capital investment model

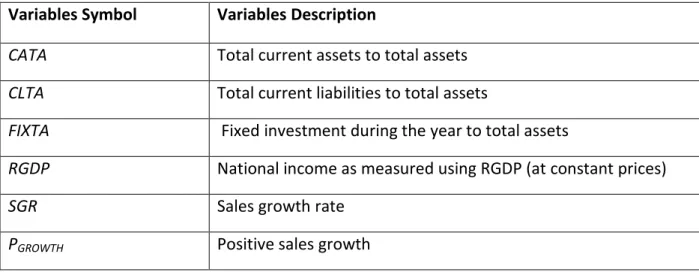

- Justification, construction and hypothesis of the variables

- The empirical model

- Econometric issues

Working Capital Investment (Current Assets) = 𝑓 (Short-Term Financing, Sales Growth, Operating Cash Flows, Fixed Investments, Size, Leverage, Market Strength, Business Cycle). The company's ability to raise external long-term funds therefore affects its working capital investment.

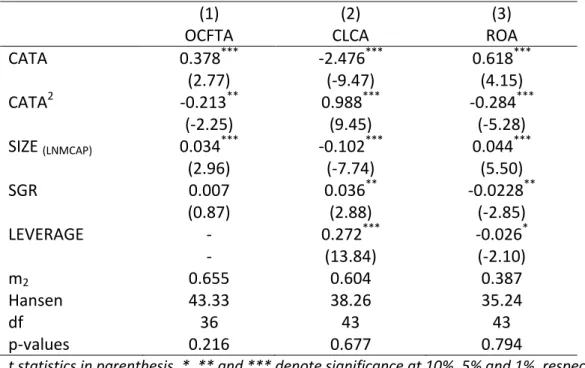

Working capital and firm value relationship estimation model

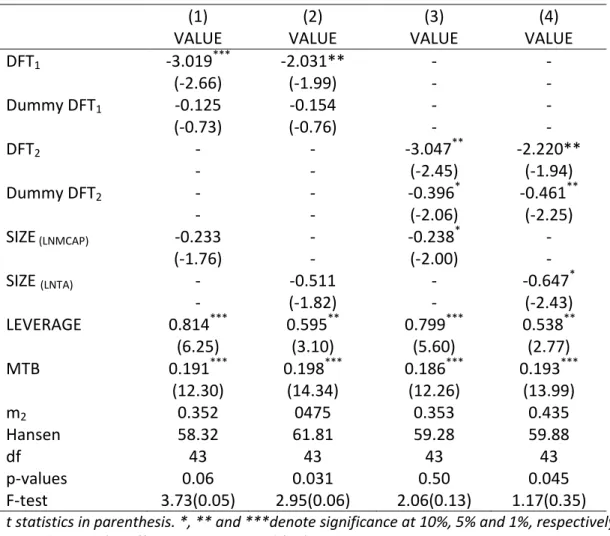

CATA2 was included in the regression model to test the quadratic relationship between the level of working capital investment and firm value. DFTit is the absolute value of the residuals of the estimation results of the revalued working capital investment equation in linear form.

The empirical working capital financing model

Where 𝑇𝐶𝑇𝐴𝑖𝑡 represents trade credit to total assets, 𝑂𝐶𝐹𝑇𝐴𝑖𝑡 is operating cash flow to total assets, 𝑆𝐼𝑍𝐸 𝑃𝐺𝑅𝑂𝑊𝑇𝐻𝑖𝑡 is positive sales growth, 𝑂𝑇𝐷b scaled to total assets represents long-term debt to total assets. ; 𝐿𝑁𝐴𝐺𝐸𝑖𝑡 is the natural logarithm of the number of years since foundation, 𝑃𝑈𝑅𝑇𝐴𝑖𝑡that is purchases to total assets; 𝑅𝐺𝐷𝑃𝑖𝑡 is real GDP growth and 𝐶𝐴𝑇𝐴𝑖𝑡 is investment in current assets. the company cannot control.

Financial constraints, working capital and fixed investment relationship

The sensitivity of working capital to cash flow fluctuations and the sensitivity of fixed capital to cash flow were tested after classifying firms into high and low working capital firms. Firms characterized by low working capital cannot use working capital to cushion the impact of cash flow shocks on fixed asset investment.

Specification tests

Chapter summary

Introduction

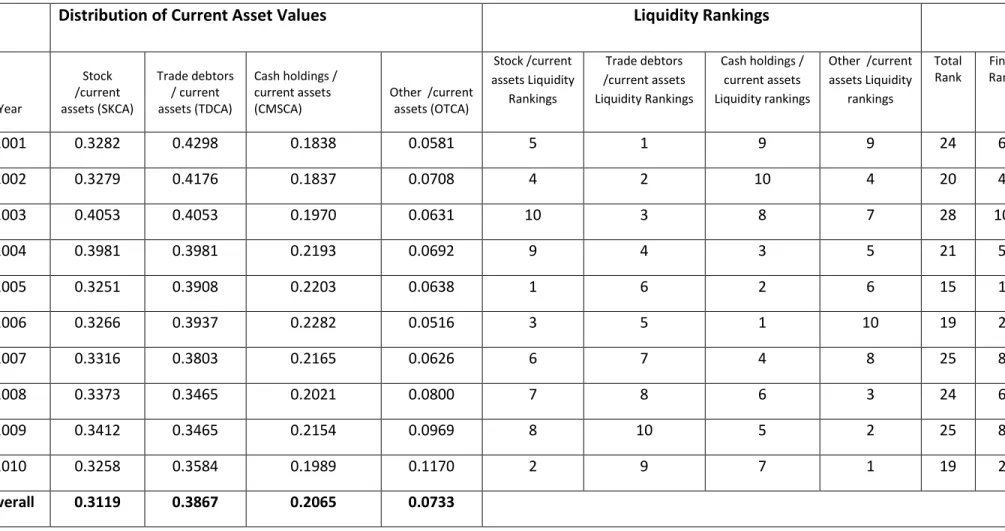

Working capital structure and liquidity rankings

- Distribution of current asset values

- Liquidity rankings

- Sectoral analysis of current assets

- Sectoral analysis: composition of current assets and liquidity rankings

The average current assets to total assets ratio (CATA) of the sample was 64%, as shown in Table 6. These studies found that current assets represented over 60% of the total assets of these companies.

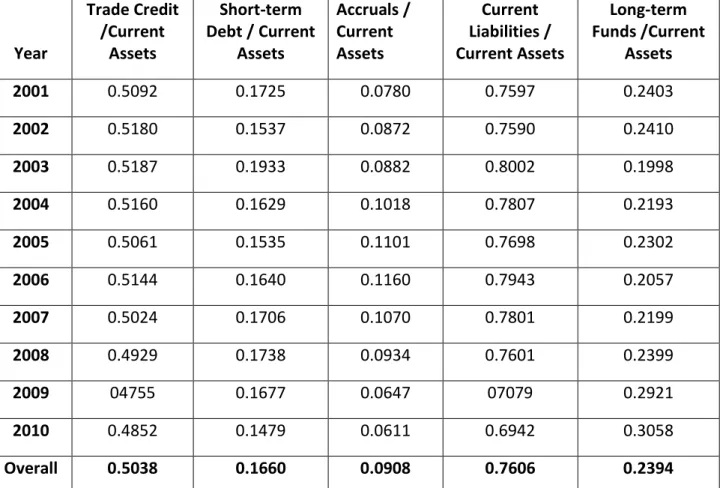

Composition of current liabilities

- Percentage composition of working capital finance

- Working capital financing policy

- Working capital financing patterns

- Trade credit and short-term financial debt as sources of finance

This suggests that these firms followed a more conservative working capital financing policy; financing current assets using more long-term funds than short-term funds. Overall, short-term debt financed less than a tenth and trade credit financed almost a third of the total assets held by these firms.

Chapter summary

Introduction

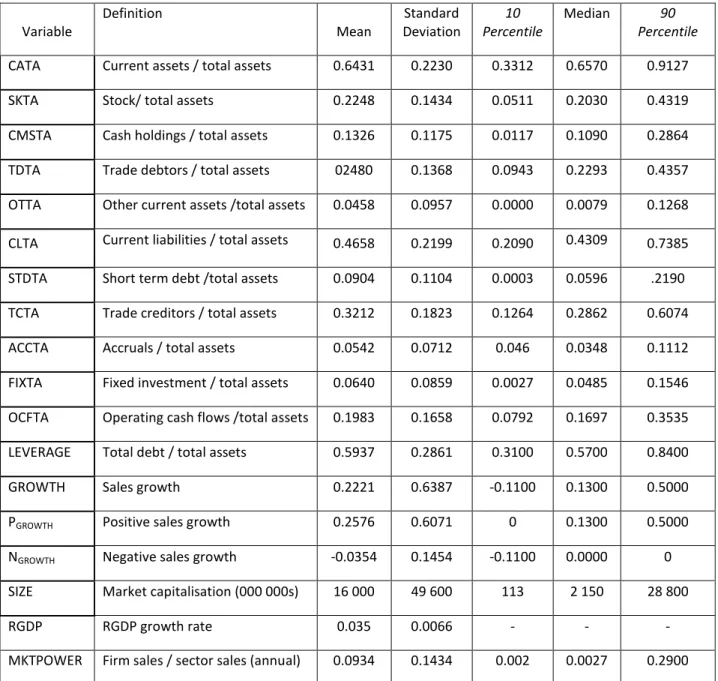

Working capital investment descriptive statistics

The proportion of trade creditors to total assets (TCTA) was 32% (and the average value was 29%), which means that almost a third of the total assets of the sample companies were financed by trade credits. The average STDTA was 9% (median value is 6%), which means that short-term debt finances less than a tenth of the total assets of the sample companies.

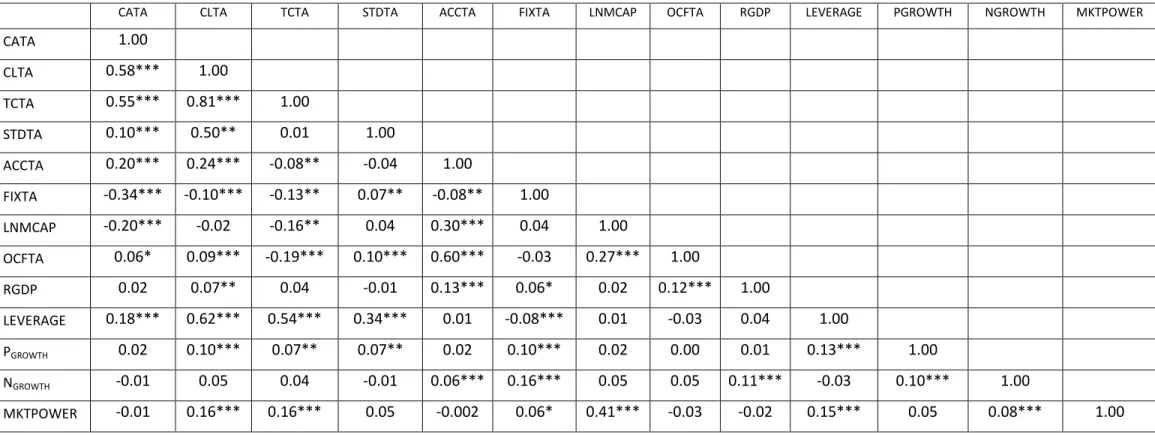

Working capital investment correlation matrix

On the other hand, short-term assets are used to pay off short-term debts. The decomposition of short-term financing into accounts payable, current liabilities and accruals shows statistically significant positive correlations with current assets.

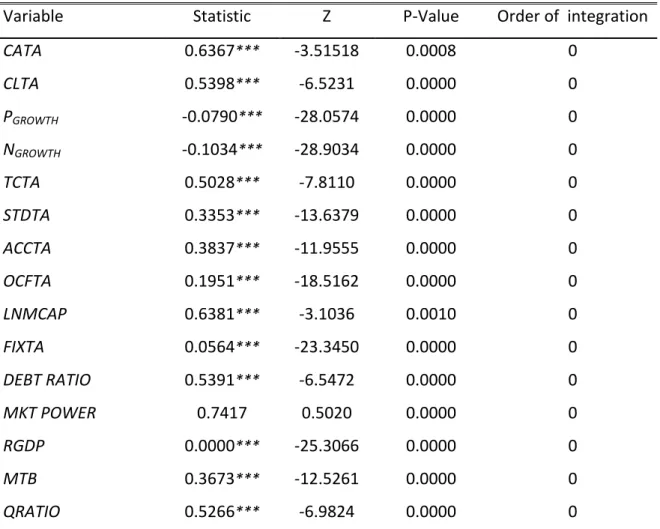

Working capital investment unit roots tests

The Harris-Tzavalis panel unit root test is designed for cases where N is relatively large. The results obtained from the Harris-Tzavalis procedure unit root test are presented in Table 16.

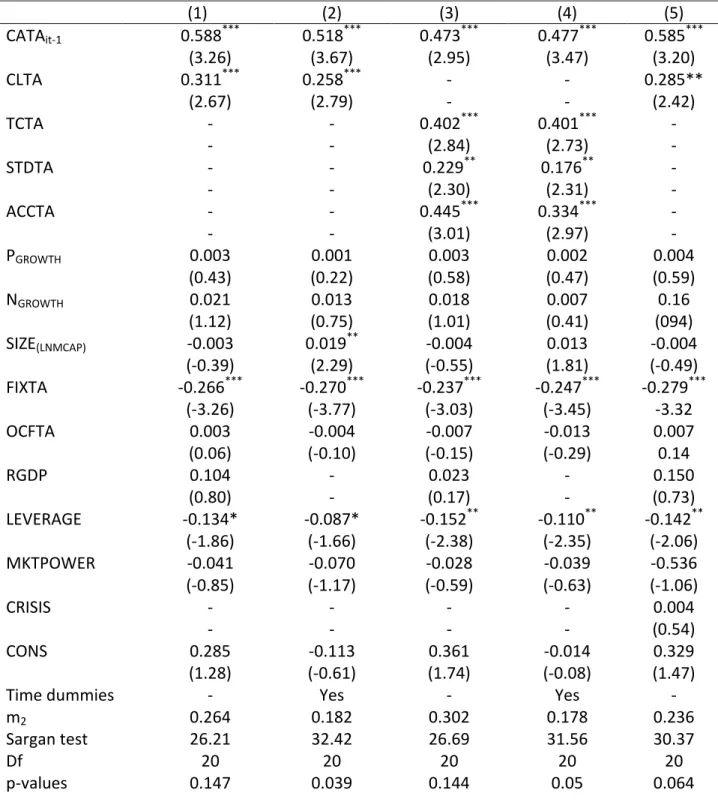

Determinants of working capital investment estimation results

Wrec= the receivables share of the working capital investment Srec = the speed of adjustment of receivables. Wcash= the share of the cash balance of the working capital investment Scash = the speed of adjustment of the cash balance.

Robustness check

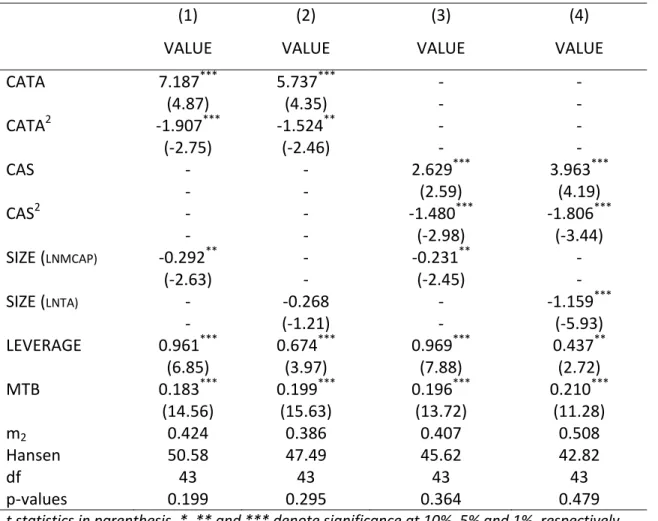

Working capital investment and firm value estimation results

Therefore, the concave firm value working capital investment hypothesized in this study is not rejected. Poor working capital investment (as shown by the longer CCC) was attributed to Kmart's eventual bankruptcy.

Robustness tests

The residuals obtained from the linear model of working capital investment are taken as deviations from the target level of working capital investment. The residuals were named DFT and were the absolute values of the residuals obtained from the linear estimation model of the working capital investment model in Equation 20.

Deviations from the optimal investment level

The proxy for size is not significant in Column 3. In agreement with Martínez-Sola et al. 2013a), both proxies for firm size have an inverse relationship with the value of the firm.

Positive and negative deviations from the optimal level

Indeed, the F-test reveals that the sum of these two coefficients is significant at a level higher than 5%, supporting the hypothesis that deviations on either side of the optimal working capital investment point reduce firm value. This finding implies that the value of South African listed companies can be increased by increasing working capital investment in circumstances where they are below the optimal level of working capital investment and by decreasing the level of working capital investment when it is above optimal.

Impact areas of working capital investment estimation results

Low levels of working capital investment create value because, as Damodaran (2001) notes, working capital investment affects cash flows. In cases where the negative effect on cash flows is greater than the positive effect on liquidity and operations, it is necessary to reduce investments in working capital.

Chapter summary

An increase in investments in working capital has a negative effect on cash flows, but a positive effect on liquidity and operations; managers should increase investments in working capital when the positive effect on liquidity and operations outweighs the negative effect on cash flows. Due to the interdependence of the effects of increasing or decreasing investments in working capital, the job of a financial manager is even more demanding (Poirters, 2004).

Introduction

Descriptive statistics

Working capital financing correlation matrix

Working capital financing unit root tests

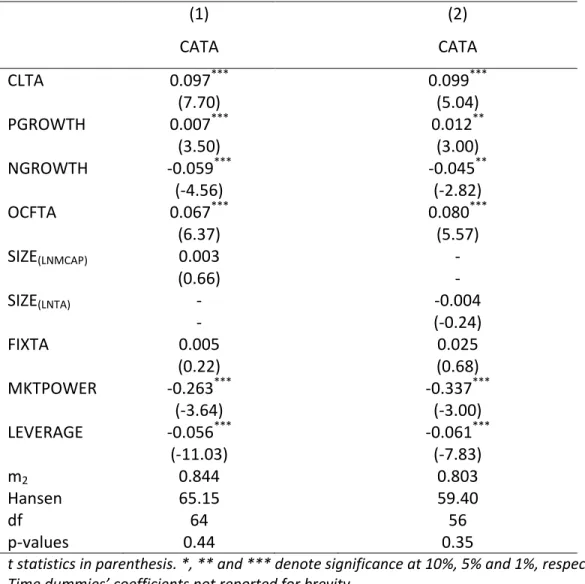

Determinants of trade credit estimation results

Determinants of short-term financial debt estimation results

Chapter summary

Introduction

Cash flow investment sensitivity estimation results

Cash flow investment sensitivity of high/low working capital firms

Working capital, profitability and cashflow

Working capital, profitability, cashflow and fixed investment

Robustness tests

Chapter summary

Introduction

Summary of the study