Support for and Supervise Operational Soundness of Constitutional Sharia Financial Institution

Teks penuh

Gambar

Dokumen terkait

According to Bank Indonesia Regulation Number 6/21/2004 dated August 3, 2004 concerning Minimum Reserve Requirement in Rupiah and Foreign Currency for commercial banks that

In reference to Article 3 of Bank Indonesia Regulation Number 6/11/PBI/2004 dated April 12, 2004 concerning Blanket Guarantee Interest Rate for Third Party Deposit and Interbank

Several provisions in Bank Indonesia Regulation Number 7/25/PBI/2005 concerning the Risk Management Certification for the Management and Officers of Commercial Banks (State Gazette

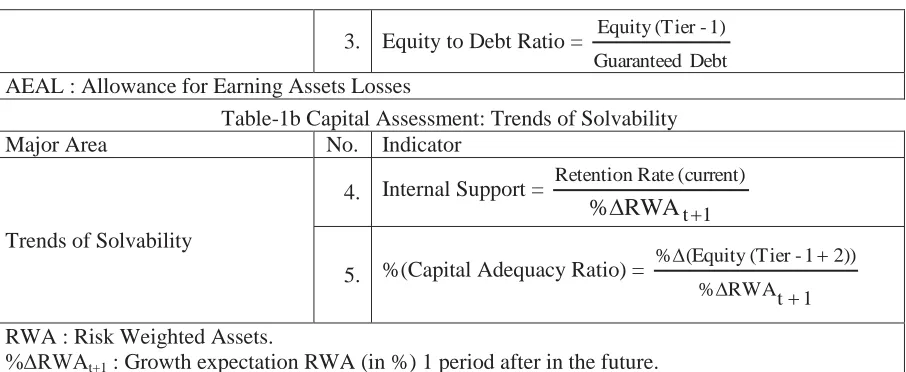

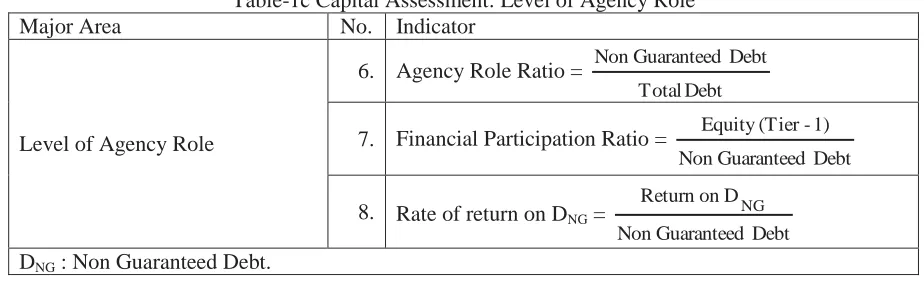

--- With the issuance of Bank Indonesia Regulation Number 3/21/PBI/2001 dated December 13, 2001 concerning Capital Adequacy Ratio for Commercial Banks, it is necessary to alter

he ownership of Indonesia shariah bank is loosely regulated by the central bank as written in the article 6 verse 2 of Bank Indonesia Regulation number 11/3/PBI/2009

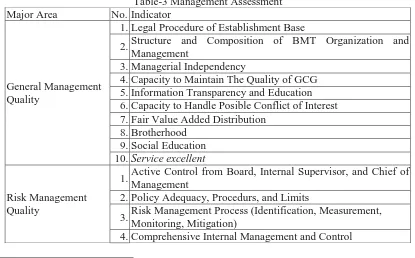

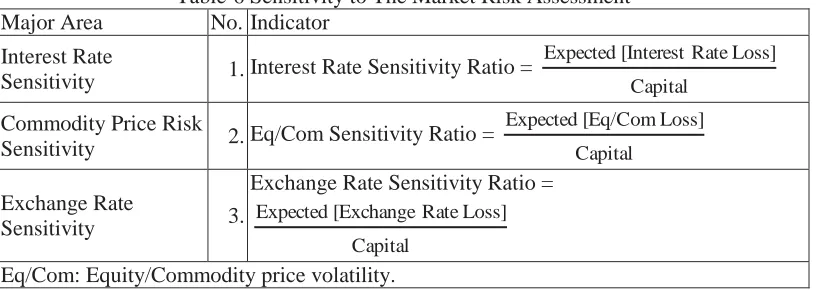

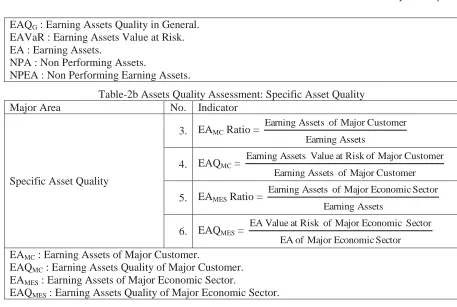

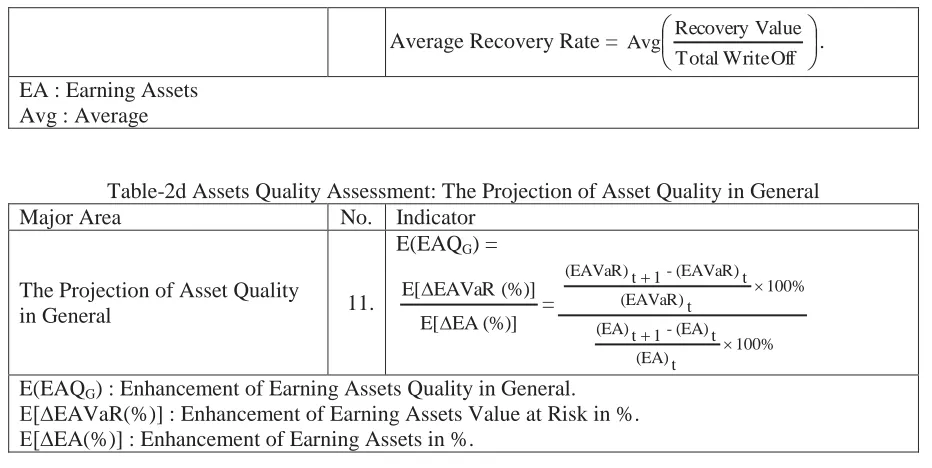

In assessing the health of banks, according to Bank Indonesia regulation number 6/10/PBI/2004 the CAMELS method consists of Capital, Asset Quality, Management, Earnings, Liquidity &

[4] Bank Indonesia Regulation Number 18/40/PBI/2016 concerning Implementation of Payment Transaction Processing [5] Bank Indonesia Regulation Number 20/6/PBI/2018 concerning Electronic

The method of assessing the soundness level of the State Savings Bank using the RGEC method in accordance with Bank Indonesia Regulation Number 13/1/PBI/2011 concerning the Rating of