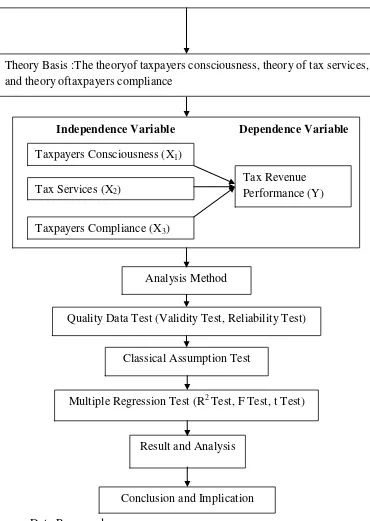

The Influence of Taxpayers Conciousness, Tax Sevices and Taxpayers Compliance on Tax Revenue Performance (Survey on The Individual Taxpayer in South Tangerang)

Teks penuh

Gambar

Dokumen terkait

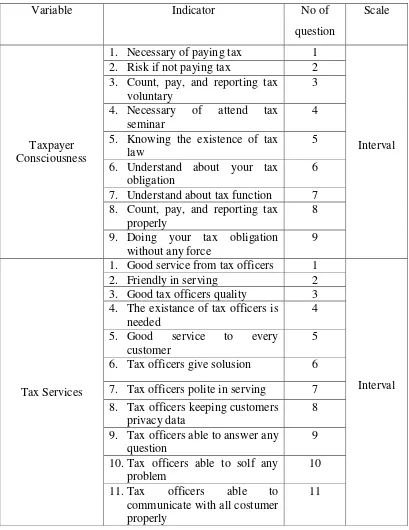

To investigate the effect of consciousness, the sanctions, the attitude of the tax authorities, environment, knowledge of tax regulations influence simultaneously on tax compliance

The re- sults of this study indicate that religion plays an important role in shaping individual’s attitude and behavior towards tax obligation.. Second, the higher the degree

Abstract. Generally Definition of Tax Amnesty is a government policy that is given to taxpayers about tax amnesty, and in exchange for the forgiveness of the taxpayer is required

Tujuan penelitian ini adalah untuk mengetahui pengetahuan perpajakan, sanksi perpajakan, dan fiskus terhadap kepatuhan wajib pajak dalam melaksanakan kewajiban

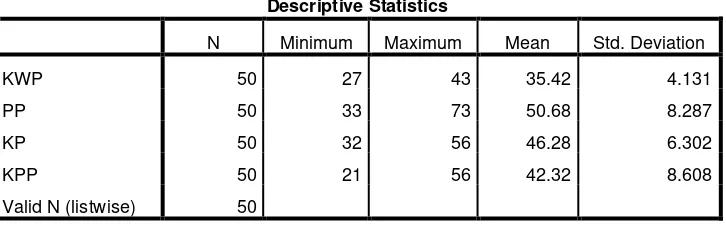

Based on this provision, the compliance variables in this paper are measured by the ratio of the number of reported income tax returns to the number of registered taxpayers for each

• Eksplorasi sifat bahan dan pemanfaatannya laporan rancangan pemecahan masalah laporan deskripsi proyek Perangkat presentasi dan perangkat berkarya (proyek berbasis

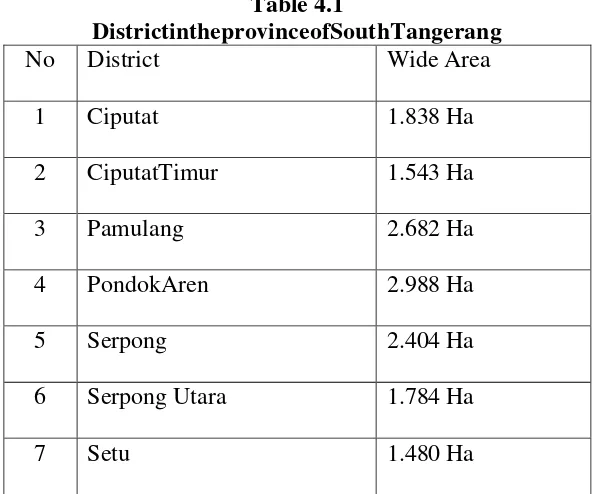

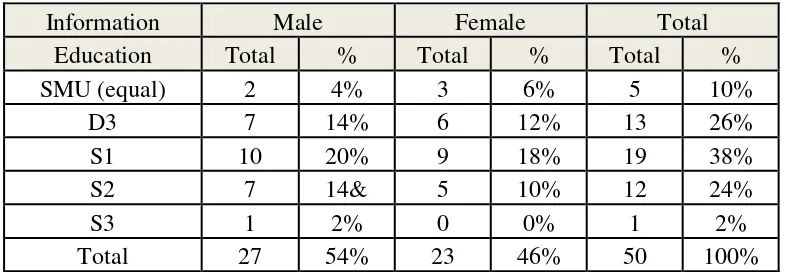

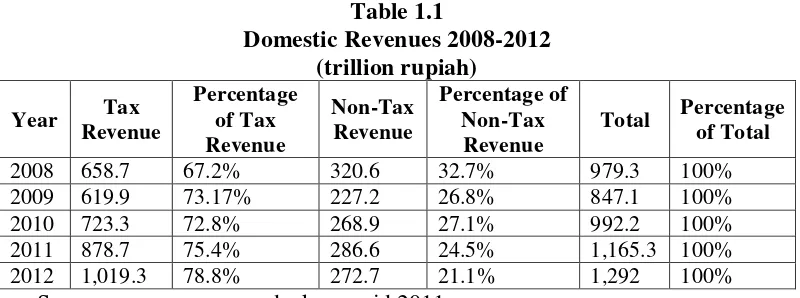

The purpose of this research was to find out whether the number of taxpayers, taxpayer compliance, and number of tax inspection have a significant influence

3 Abdur Rahman Al Juzairi. Fiqih Empat Madzhab.. Maka Allah menyesatkan, siapa yang Dia kehendaki, dan memberi petunjuk kepada siapa yang Dia kehendaki. dan Dia-lah