Directory UMM :Data Elmu:jurnal:J-a:Journal Of Economic Dynamics And Control:Vol24.Issue11-12.Oct2000:

Teks penuh

Gambar

Dokumen terkait

Unfortunately, nodule occupancy by the inoculated strains could not be studied by serol- ogy in the ®eld experiments, because of cross reactions among some of the strains used in

Fully factorial ANOVA was used to test the vertical distribution of 14 C-activity between the dierent layers in the peat for each decomposition period separately. Drainage status,

To follow the survival of an introduced bacteria in the contaminated soil, TBPZ was transformed with a plasmid carrying a gene for kanamycin resistance and the lux CDABE operon from

In a ®eld experiment on barley, the eects of soil application of phosphorus fertilizer and inoculum of Glomus mosseae on the mycorrhizal colonization of roots, crop yield and P

Balvers, R.J., Mitchell, D.W., E$cient gradualism in intertemporal portfolios 21 Barnett, W.A., Serletis, A., Martingales, nonlinearity, and chaos 703 Barucci, E., Exponentially

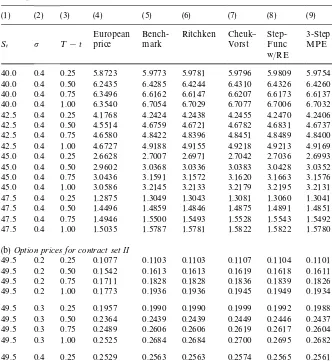

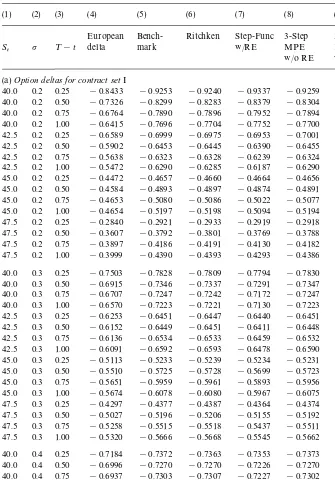

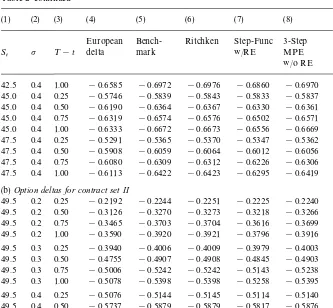

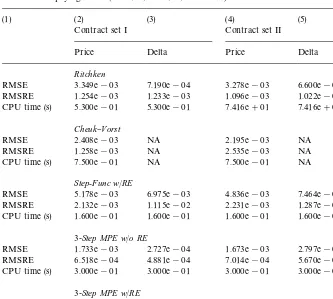

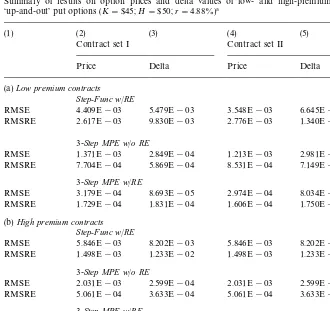

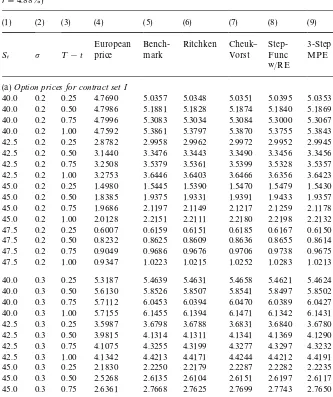

For ease of comparison, we report the ratio of the average standard errors from the crude Monte Carlo to the corresponding average standard errors obtained from the Monte Carlo

In Section 3, we introduce the lattice-subspace property of the asset span and show that it is necessary and su$cient for the minimum-cost portfolio insurance to be price independent

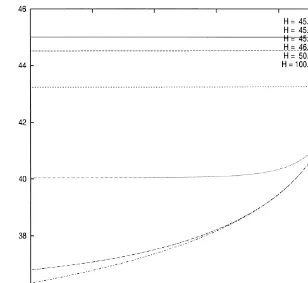

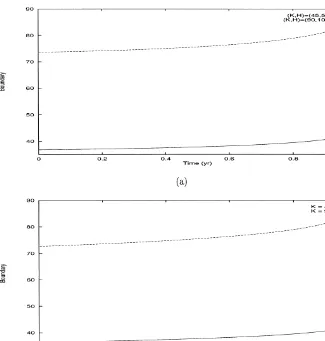

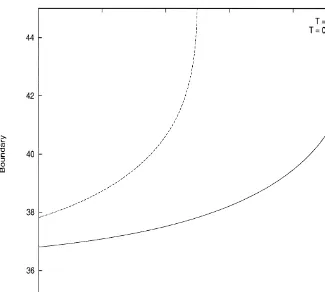

Hence, the value of the portfolio at any future time will depend on the stock (and bond) price at that time, but it will not depend on the path followed by the stock in reaching